DFDS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFDS Bundle

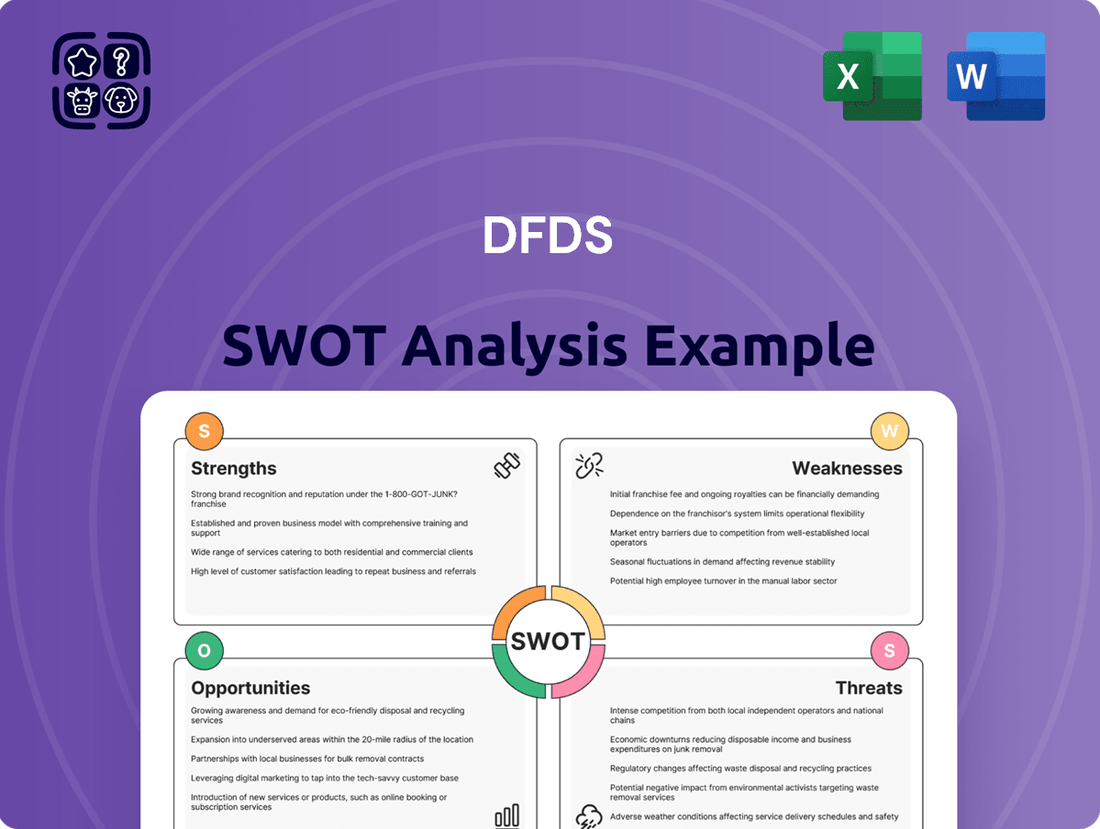

DFDS leverages its strong brand recognition and extensive ferry network as key strengths, while facing potential threats from fluctuating fuel prices and increasing competition. Want to understand how these factors shape their future?

Our comprehensive DFDS SWOT analysis provides a deep dive into their internal capabilities and external market forces, offering actionable insights for strategic decision-making.

Purchase the full SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning and research into this dynamic travel and logistics company.

Strengths

DFDS boasts an extensive network of ferry routes, predominantly serving Northern Europe and the Baltic Sea, which is a significant strength. This broad geographical reach allows them to connect key markets efficiently. In 2023, DFDS operated 50 vessels across 30 routes, demonstrating the scale of their network.

The company's integration of logistics services, such as road transport and warehousing, alongside their ferry operations, creates a powerful end-to-end solution. This synergy optimizes supply chains for their clients. For instance, their logistics division contributed to a substantial portion of their overall revenue, highlighting the importance of this integrated approach in their business model.

DFDS has strategically bolstered its operations through key acquisitions, notably FRS Iberia/Maroc in 2024, securing vital ferry routes across the Strait of Gibraltar. This move, alongside the acquisition of Turkish logistics firm Ekol International Transport, significantly enhances DFDS's footprint in rapidly expanding markets, aligning with the growing nearshoring trend.

Further solidifying its market leadership, DFDS secured a 20-year concession for Jersey ferry services commencing March 2025. This long-term agreement not only expands its route network but also guarantees predictable, sustained revenue streams, reinforcing its competitive advantage in the ferry and logistics sector.

DFDS is actively pursuing environmental sustainability and a green transition, aiming for climate neutrality by 2050. This commitment includes a target of nearly a 45% relative reduction in greenhouse gas emissions by 2030 compared to 2008 levels. The company is investing in cleaner technologies and exploring alternative fuels, with plans for their first green vessel to be operational by 2025.

Strong Freight Volume Growth in Key Regions

DFDS has demonstrated robust freight volume growth across several key operational areas. In May 2025, the company saw a 4.5% increase in total transported freight lane meters compared to the prior year. Even after accounting for route adjustments, this represents a solid 0.6% growth, highlighting the underlying strength of its freight services.

This positive trend is particularly evident in specific regions:

- North Sea: Continued strong performance in this vital corridor.

- Mediterranean: Growth driven by expanded capacity and the introduction of new routes, enhancing market reach.

- English Channel: Positive volume development, even when factoring in recent route network changes.

- Strait of Gibraltar: Also contributing to the overall positive freight volume trajectory.

This consistent growth underscores the resilience and core importance of the freight segment to DFDS's overall business strategy and operational success.

Focus on Customer Service and Digitization

DFDS's commitment to customer service and digitization is a significant strength. By standardizing and digitizing its network, the company aims to enhance customer satisfaction and operational efficiency. This strategy is crucial in today's competitive market, where seamless digital experiences are increasingly valued by both freight and passenger clients.

Recent investments in digital solutions are designed to improve booking systems and onboard amenities. For instance, DFDS has been rolling out enhanced digital platforms to streamline the customer journey, from initial booking to post-trip engagement. This focus on digital innovation is expected to foster customer loyalty and attract new business by offering a more convenient and personalized experience.

- Enhanced Digital Platforms: DFDS continues to invest in improving its online booking and customer service portals.

- Customer Experience Focus: The company prioritizes a smooth and convenient experience for both freight and passenger segments.

- Network Digitization: Standardization and digitization across its ferry routes and terminals are key to operational efficiency.

- Loyalty and Acquisition: A superior digital and customer service offering is aimed at increasing customer retention and attracting new clientele.

DFDS's extensive ferry network, particularly in Northern Europe and the Baltic Sea, provides significant market access and operational scale. The company's strategic acquisitions, such as FRS Iberia/Maroc in 2024, have further expanded its route coverage and market presence. Furthermore, securing a 20-year concession for Jersey ferry services from March 2025 ensures long-term revenue stability.

The integration of logistics services with ferry operations creates a comprehensive, end-to-end solution for customers, optimizing supply chains. DFDS's commitment to sustainability, with a goal of climate neutrality by 2050 and a nearly 45% relative reduction in greenhouse gas emissions by 2030, positions it favorably in an environmentally conscious market. Investments in digital platforms enhance customer experience and operational efficiency, driving loyalty.

Freight volumes have shown consistent growth, with a 4.5% increase in total transported freight lane meters in May 2025 compared to the previous year, demonstrating the resilience of its core business. This growth is observed across key regions like the North Sea, Mediterranean, English Channel, and the Strait of Gibraltar.

| Key Strength | Description | Supporting Data/Fact |

| Extensive Network | Dominant presence in Northern Europe and Baltic Sea | Operated 50 vessels across 30 routes in 2023 |

| Integrated Logistics | End-to-end supply chain solutions | Logistics division contributes significantly to overall revenue |

| Strategic Acquisitions | Expansion into new markets and routes | Acquired FRS Iberia/Maroc in 2024; Ekol International Transport |

| Concession Agreements | Guaranteed long-term revenue streams | 20-year concession for Jersey ferry services from March 2025 |

| Sustainability Focus | Commitment to climate neutrality and emission reduction | Target of nearly 45% relative GHG emission reduction by 2030 (vs. 2008) |

| Freight Volume Growth | Consistent positive performance in freight transport | 4.5% increase in freight lane meters (May 2025 vs. prior year) |

| Digitalization & CX | Enhanced customer experience and operational efficiency | Rollout of improved digital platforms for booking and services |

What is included in the product

Delivers a strategic overview of DFDS’s internal and external business factors, highlighting its strengths in route networks and brand reputation, while also acknowledging weaknesses in fleet modernization and opportunities in new routes and sustainability initiatives, alongside threats from competition and economic instability.

Helps identify and address potential threats and weaknesses, enabling proactive risk mitigation and strategic improvement for DFDS.

Weaknesses

DFDS has faced significant financial headwinds, notably a net profit loss in the first quarter of 2025. This follows a substantial decline in Earnings Before Interest and Taxes (EBIT) during 2024, signaling ongoing profitability concerns.

The company's financial outlook for 2025 indicates a projected EBIT lower than that of 2024, suggesting that the challenges impacting earnings are likely to persist. These financial pressures are attributed to a combination of adverse market conditions and operational hurdles.

DFDS's Mediterranean operations grapple with intense competition, especially on key routes like Istanbul-Trieste. This has resulted in overcapacity, driving down prices and eroding market share, as seen in the challenging profitability figures reported for the region in recent periods.

The intense competitive landscape necessitates strategic realignments for DFDS. This includes implementing necessary price adjustments and potentially reducing capacity on certain routes to restore healthier profit margins and market positioning.

DFDS faces challenges with specific logistics operations, notably the Nordic cold chain and the recently integrated Ekol International Transport business. These segments are currently experiencing losses, impacting overall profitability.

The company is actively engaged in turnaround initiatives for Ekol, aiming to achieve breakeven by the end of 2025. Similar efforts are underway to improve performance in other underperforming logistics units, highlighting this as a key strategic priority for 2025.

Increased Financial Leverage and Debt

DFDS's financial leverage has notably increased, with its Net Interest Bearing Debt to EBITDA ratio reaching 4.0x in the first quarter of 2025. This figure surpasses the company's historical target range of 2.0x to 3.0x, indicating a higher reliance on debt financing.

This elevated financial leverage presents a potential weakness, as it can reduce financial flexibility and increase vulnerability to economic downturns or interest rate fluctuations. The company has acknowledged this, prioritizing deleveraging its capital structure throughout 2025.

- Increased Debt Burden: Net Interest Bearing Debt/EBITDA ratio rose to 4.0x in Q1 2025, up from 3.9x at the end of 2024.

- Exceeding Targets: The current leverage ratio is above the company's preferred range of 2.0x-3.0x.

- Financial Flexibility Concerns: Higher debt levels can limit the company's ability to respond to market changes or pursue new opportunities.

- Deleveraging Priority: DFDS has identified reducing its debt as a key objective for 2025.

Fluctuating Passenger Volumes and Market Sensitivity

While DFDS has seen an overall increase in passenger traffic over the past year, recent monthly figures reveal a concerning dip in both passenger and car volumes. This decline is particularly noticeable in the English Channel, with factors like the timing of Easter and a contracting Dover Strait market contributing to the slowdown.

This sensitivity to external events and market shifts creates inherent volatility within the passenger segment.

- Declining Monthly Trends: Recent monthly data indicates a decrease in passenger and car volumes, especially on key routes.

- English Channel Weakness: The English Channel sector has experienced a notable contraction in traffic.

- Market Dynamics: A shrinking Dover Strait market, coupled with shifts in holiday timing, impacts passenger numbers.

- External Factor Vulnerability: Passenger volumes are highly susceptible to external influences, leading to unpredictable fluctuations.

DFDS's financial performance in early 2025 shows a net loss, with EBIT for 2024 already indicating a downward trend. The company projects an even lower EBIT for 2025, underscoring persistent earnings challenges exacerbated by market conditions and operational issues.

Intense competition in Mediterranean routes, particularly Istanbul-Trieste, has led to overcapacity and price erosion, impacting profitability in that region. Additionally, specific logistics operations like the Nordic cold chain and the recently acquired Ekol International Transport are currently loss-making, with Ekol needing to reach breakeven by the end of 2025.

DFDS's financial leverage has increased, with its Net Interest Bearing Debt to EBITDA ratio reaching 4.0x in Q1 2025, exceeding its target range of 2.0x-3.0x. This higher debt level limits financial flexibility and increases vulnerability, making deleveraging a key priority for 2025.

Passenger and car volumes have recently shown a dip, especially in the English Channel, due to market contraction and external factors like holiday timing. This indicates a susceptibility to market dynamics and external influences, creating volatility in the passenger segment.

| Financial Metric | Q1 2025 | End 2024 | Target Range |

|---|---|---|---|

| Net Profit | Loss | N/A | N/A |

| EBIT | Projected Lower than 2024 | Declining Trend | N/A |

| Net Interest Bearing Debt/EBITDA | 4.0x | 3.9x | 2.0x - 3.0x |

What You See Is What You Get

DFDS SWOT Analysis

You're viewing a live preview of the actual DFDS SWOT analysis. The complete version, offering a comprehensive understanding of their strategic landscape, becomes available immediately after purchase.

This preview reflects the real DFDS SWOT analysis document you'll receive—professional, structured, and ready to use for informed decision-making.

The content below is pulled directly from the final DFDS SWOT analysis. Unlock the full report, detailing all strengths, weaknesses, opportunities, and threats, when you purchase.

Opportunities

Germany's commitment to boosting defense and infrastructure spending, a significant development anticipated to stimulate broader European economic activity, presents a tangible opportunity for DFDS. This increased economic dynamism is likely to translate into higher demand for freight and logistics services, a core area of DFDS's operations.

The ongoing trend of nearshoring, where companies are relocating production closer to home markets, further strengthens DFDS's growth prospects. This strategic shift supports the expansion of DFDS's existing network and opens avenues for new routes, particularly in regions experiencing robust economic expansion, as evidenced by their recent strategic acquisitions along the Strait of Gibraltar and on Turkey-Europe trade lanes.

DFDS is set to significantly enhance its intermodal capabilities in 2025 by launching new rail connections to key European hubs, including Regensburg in Germany, Venlo in the Netherlands, and Mosnov in the Czech Republic. This strategic move is designed to provide customers with more integrated and efficient transportation solutions, combining different modes of transport for optimized supply chain management.

This expansion directly addresses the growing demand for sustainable and flexible logistics. By offering these expanded intermodal options, DFDS aims to capture a larger share of the freight market, particularly for businesses seeking to reduce their carbon footprint and improve transit times across Europe. The company anticipates these new routes will contribute to a more robust and competitive service offering.

DFDS's proactive stance in developing and implementing green vessels and alternative fuels like hydrogen, ammonia, and methanol is a prime opportunity. This commitment positions them as a leader in decarbonizing maritime transport, a crucial step for the industry's future.

By embracing sustainable solutions, DFDS can attract a growing segment of environmentally conscious customers, thereby gaining a competitive edge. This strategic move also anticipates stricter environmental regulations and the increasing market demand for eco-friendly logistics solutions, potentially unlocking new revenue streams.

Optimization of Underperforming Segments

DFDS has a clear opportunity to boost its financial results by focusing on underperforming areas. The company's ongoing efforts to turn around its Mediterranean ferry operations, coupled with the integration of Ekol International Transport, are key to unlocking this potential. Successfully navigating the competitive Mediterranean market and achieving breakeven for Ekol by the end of 2025 could significantly enhance DFDS's overall profitability.

Specifically, the company can leverage these initiatives:

- Mediterranean Ferry Operations Turnaround: DFDS is actively working to improve efficiency and market positioning in its Mediterranean routes, which have historically been less profitable.

- Ekol International Transport Integration: The successful integration of Ekol, acquired in 2023, presents a chance to streamline operations and achieve profitability, with a target of reaching breakeven by year-end 2025.

- Earnings Recovery: A successful execution of these strategies is projected to lead to a substantial recovery in earnings, directly impacting DFDS's bottom line and shareholder value.

Leveraging Digital Transformation for Efficiency

DFDS's ongoing commitment to standardizing and digitizing its operations presents a significant opportunity. By enhancing booking systems and digital customer service, the company can achieve greater operational efficiency and reduce costs. This digital push is crucial for improving the overall customer experience.

Further digital innovation promises to streamline processes and optimize resource allocation. For instance, in 2023, DFDS reported a significant increase in digital bookings, reflecting the success of their investments. This focus on technology will solidify the company's competitive position in the market.

- Enhanced Operational Efficiency: Continued investment in digital platforms streamlines operations, leading to faster turnaround times and reduced manual processes.

- Cost Reduction: Digitization of booking and customer service functions minimizes administrative overhead and potential errors.

- Improved Customer Experience: User-friendly digital interfaces and responsive online support foster greater customer satisfaction and loyalty.

- Competitive Advantage: Embracing digital transformation keeps DFDS at the forefront of industry innovation, attracting and retaining customers in an increasingly digital landscape.

DFDS's strategic expansion into new rail connections across Europe in 2025, including routes to Germany, the Netherlands, and the Czech Republic, offers a significant opportunity to enhance its intermodal service offering and capture a larger share of the freight market. This move directly addresses the growing demand for integrated and sustainable logistics solutions, aiming to improve efficiency and reduce transit times for customers.

The company's commitment to developing green vessels and exploring alternative fuels like hydrogen, ammonia, and methanol positions DFDS as a leader in maritime decarbonization, attracting environmentally conscious customers and anticipating future regulatory demands. This focus on sustainability can unlock new revenue streams and provide a distinct competitive advantage.

DFDS has a clear opportunity to improve its financial performance by focusing on the turnaround of its Mediterranean ferry operations and the successful integration of Ekol International Transport, with a target for Ekol to reach breakeven by the end of 2025. These initiatives are expected to drive earnings recovery and enhance overall profitability.

Continued investment in standardizing and digitizing operations, including booking systems and customer service, presents a chance for DFDS to boost operational efficiency, reduce costs, and improve the customer experience. The increase in digital bookings observed in 2023 highlights the positive impact of these technological advancements.

Threats

DFDS is experiencing intensified competition, especially on its Mediterranean ferry routes, such as those connecting Turkey and Italy. The emergence of new players in this market has injected additional capacity, directly impacting pricing strategies and contributing to a noticeable erosion of DFDS's market share in these key areas.

Furthermore, the logistics sector within northern European land transport markets is also witnessing a surge in competitive activity. This heightened rivalry presents a significant threat to DFDS's profitability in its logistics operations, as it necessitates more aggressive pricing and operational efficiencies to maintain market standing.

The economic forecast for Europe in 2025 suggests a period of subdued growth. This muted economic environment could dampen demand for both freight and passenger transportation, directly affecting DFDS's core business operations.

In a low-growth scenario, companies like DFDS may face decreased shipping volumes and intensified competition for available business. This presents a significant hurdle in meeting its financial objectives for the year.

The ongoing war in Ukraine continues to cast a shadow over market conditions in the Baltic and Eastern European regions, directly impacting DFDS's operational efficiency and financial performance in these key areas. This instability creates significant headwinds.

Geopolitical tensions inherently disrupt established supply chains, forcing rerouting and potentially increasing transit times and costs for DFDS's freight services. Furthermore, the risk of altered trade routes and unpredictable market shifts due to these conflicts can lead to significant revenue volatility.

Rising Costs and Inflationary Pressures

DFDS is grappling with significant cost increases, particularly in labor and operational expenses. Inflationary pressures are driving up the cost of vessel operations and terminal services, directly impacting Terminal Handling Charges (THC) and freight tariffs. For instance, in early 2024, many European logistics providers saw labor cost increases in the range of 5-8%, a trend likely affecting DFDS's operational expenditures.

The company's ability to fully absorb or pass these rising costs onto its customer base is constrained by a competitive market. Intense competition in the ferry and logistics sectors limits DFDS's pricing power, meaning they may not be able to fully recover increased expenses through higher freight rates. This dynamic poses a direct threat to profit margins, potentially squeezing profitability if cost increases outpace revenue growth.

- Increased Labor Costs: Rising wages and benefits for crew and terminal staff are a direct consequence of inflationary pressures.

- Higher Operational Expenses: Fuel, maintenance, and insurance costs for vessels and terminals have seen upward trends, contributing to increased THC.

- Competitive Pricing Environment: Intense market competition restricts DFDS's ability to pass on all cost increases to customers.

- Margin Squeeze Risk: The inability to fully recover rising costs could lead to reduced profit margins in the 2024-2025 period.

Regulatory Changes and Environmental Compliance Costs

DFDS faces increasing financial pressure from evolving environmental regulations. For instance, the EU's Emissions Trading System (ETS) directly impacts shipping operations, with surcharges levied on journeys contributing to operational costs. This regulatory landscape necessitates substantial capital expenditure for adopting cleaner technologies and securing green fuels, a significant financial undertaking.

The financial viability of these investments is further complicated by uncertainties surrounding the large-scale availability of green fuels and customer acceptance of potential price hikes to offset these costs. In 2024, the shipping industry, including ferry operators like DFDS, continued to navigate the complexities of the ETS, with the price of EU Allowances (EUAs) fluctuating, impacting the cost of emissions. For example, EUA prices in early 2024 hovered around €60-€70 per tonne, a figure that directly translates to increased operating expenses for vessels not yet fully compliant with green mandates.

- Regulatory Impact: EU ETS surcharges directly increase operating expenses for DFDS.

- Investment Needs: Significant capital is required for cleaner technologies and green fuel infrastructure.

- Market Uncertainty: The success of these investments hinges on green fuel availability and customer price sensitivity.

DFDS faces a challenging competitive landscape across its core markets, with new entrants intensifying rivalry on key Mediterranean routes and within Northern European land transport. This heightened competition, coupled with a projected subdued economic growth in Europe for 2025, presents a significant threat to revenue and profitability.

Geopolitical instability, particularly the ongoing conflict in Ukraine, continues to disrupt supply chains and create market volatility in Eastern Europe. Furthermore, escalating operational costs, driven by inflation affecting labor and fuel, are squeezing profit margins as DFDS's ability to pass these increases onto customers is limited by competitive pressures.

The company must also navigate increasingly stringent environmental regulations, such as the EU Emissions Trading System (ETS), which add surcharges and necessitate substantial investment in green technologies and fuels. The availability and customer acceptance of these green initiatives remain key uncertainties, impacting the financial viability of necessary upgrades.

| Threat Category | Specific Threat | Impact on DFDS | Relevant Data/Context (2024-2025) |

|---|---|---|---|

| Competition | Increased competition on Mediterranean routes (e.g., Turkey-Italy) | Erosion of market share, pricing pressure | New entrants adding capacity; intensified rivalry impacting pricing strategies. |

| Competition | Heightened competition in Northern European logistics | Threat to profitability, need for aggressive pricing | Increased rivalry necessitates operational efficiencies to maintain market standing. |

| Economic Conditions | Subdued economic growth in Europe (2025 forecast) | Dampened demand for freight and passenger transport | Low-growth scenario could lead to decreased shipping volumes and intense competition for business. |

| Geopolitical Factors | Ongoing war in Ukraine and regional instability | Disruption of supply chains, market volatility | Impacts operational efficiency and financial performance in Baltic/Eastern European regions; potential for revenue volatility. |

| Cost Increases | Rising labor and operational expenses (inflation) | Margin squeeze, reduced profitability | Labor cost increases of 5-8% observed in early 2024 for European logistics; fuel and maintenance costs also rising. |

| Regulatory Environment | Evolving environmental regulations (e.g., EU ETS) | Increased operating expenses, capital expenditure needs | EU ETS surcharges directly increase costs; EUA prices in early 2024 around €60-€70 per tonne. |

SWOT Analysis Data Sources

This DFDS SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research, and expert industry analysis to ensure a thorough and insightful assessment.