DFDS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFDS Bundle

Navigate the complex currents affecting DFDS with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping the ferry and logistics giant. This expert-crafted report provides the critical intelligence you need to anticipate challenges and seize opportunities. Download the full version now for actionable insights to bolster your strategic planning.

Political factors

Geopolitical stability is a cornerstone for DFDS, an operator heavily reliant on predictable trade flows across Northern Europe and the Baltic. In 2024, ongoing tensions in Eastern Europe continue to influence shipping routes and insurance costs, impacting operational efficiency.

Shifting trade policies, such as potential adjustments to tariffs or new customs procedures in key markets like the UK post-Brexit, directly affect DFDS's freight volumes and the cost of doing business. For example, the company must remain agile to navigate varying import/export regulations that could emerge throughout 2025.

Disruptions stemming from regional conflicts or evolving international relations can reroute shipping demand. DFDS's strategic planning for 2024-2025 includes contingency measures for such geopolitical shifts, which could necessitate changes in service offerings or port calls to maintain consistent service delivery.

Government regulations significantly shape DFDS's operational landscape, encompassing maritime safety, security, and environmental standards. Compliance with evolving rules, such as the EU Emissions Trading System (ETS) and Fuel EU Maritime (FEUM), which saw increased stringency from 2024 through 2025, necessitates substantial capital expenditure and impacts pricing decisions.

These regulatory frameworks directly influence DFDS's cost structure and competitiveness. For instance, the push for lower emissions under FEUM requires investment in greener technologies and fuels, potentially increasing operational expenses in the short term but offering long-term sustainability benefits.

Conversely, favorable government policies, such as the 20-year Jersey ferry services contract secured by DFDS, offer considerable operational stability and clear avenues for revenue growth. Such concessions underscore the importance of navigating and leveraging the political and regulatory environment for strategic advantage.

Brexit continues to reshape DFDS's UK-EU operations, with ongoing adjustments to border protocols and customs impacting transit times. In 2023, the UK's trade with the EU saw significant shifts, with new customs declarations and checks adding layers of complexity that DFDS must navigate to maintain efficient freight and passenger services.

DFDS must remain agile, closely monitoring evolving UK-EU trade agreements and regulatory divergences to adapt its service offerings and infrastructure accordingly. For instance, the implementation of the Windsor Framework in early 2024 aimed to ease some trade friction, but the company still faces the challenge of adapting to these dynamic political landscapes.

Government Subsidies and Support for Green Shipping

Government initiatives and subsidies are crucial for DFDS's green shipping transition. For instance, the European Union's Fit for 55 package, aiming for a 55% emissions reduction by 2030, includes measures like the EU Emissions Trading System (ETS) for maritime transport, which incentivizes cleaner operations. These policies directly support DFDS's goal of becoming climate neutral by 2050.

Financial backing for alternative fuels and energy-efficient technologies significantly accelerates DFDS's fleet modernization. The Danish government, for example, has supported projects exploring green fuels like green methanol and ammonia through various funding schemes. This financial aid is instrumental in offsetting the higher upfront costs associated with these advanced technologies.

- EU Emissions Trading System (ETS): Implemented in 2024 for maritime, it puts a price on carbon emissions, encouraging DFDS to invest in lower-emission solutions.

- National Funding Programs: Denmark and other operating countries offer grants for green maritime technology, such as those supporting the development of methanol-powered ferries.

- Infrastructure Development Support: Governments are also investing in shore power and bunkering infrastructure for alternative fuels, which is essential for DFDS's operational changes.

International Relations and Bilateral Agreements

DFDS's strategic expansion is significantly influenced by bilateral agreements and international relations. The company's 2024 acquisition of FRS Iberia/Maroc and Ekol International Transport, for instance, bolstered its presence in key growth markets, a move facilitated by favorable trade relationships and nearshoring trends. These international partnerships directly enable DFDS to tap into new opportunities and optimize its operational network.

However, geopolitical tensions can pose considerable risks. Political disputes between nations where DFDS operates could result in trade barriers, increased customs duties, or even operational disruptions, directly impacting profitability and logistical efficiency. Maintaining strong diplomatic ties and navigating complex international regulations are therefore critical for sustained success.

- Strategic Acquisitions: DFDS's 2024 acquisitions in Spain, Morocco, and Turkey highlight the importance of positive bilateral relations for network expansion.

- Nearshoring Benefits: These acquisitions leverage nearshoring trends, indicating how supportive international policies can drive growth in new regions.

- Risk Mitigation: Political instability or disputes can lead to increased costs and operational complexities, underscoring the need for proactive international engagement.

Political stability and favorable government policies are crucial for DFDS's operations, particularly in its Northern European and Baltic routes. The company's 2024 expansion through acquisitions in Spain, Morocco, and Turkey demonstrates how positive bilateral relations facilitate market entry and network growth, leveraging nearshoring trends.

However, geopolitical tensions and evolving trade agreements, such as those impacting UK-EU trade post-Brexit, introduce complexities. DFDS must adapt to new customs procedures and regulatory divergences, as seen with the Windsor Framework implementation in early 2024, to maintain efficient services.

Government regulations, including the EU Emissions Trading System (ETS) and Fuel EU Maritime (FEUM), significantly influence DFDS's operational costs and investment in greener technologies. Financial support from national programs, like those in Denmark for green fuels, is vital for fleet modernization and achieving climate neutrality goals.

| Factor | Impact on DFDS | Example/Data (2024-2025) |

|---|---|---|

| Geopolitical Stability | Ensures predictable trade flows and stable insurance costs. | Ongoing tensions in Eastern Europe continue to affect shipping routes. |

| Trade Policies | Influences freight volumes and operational costs. | DFDS must adapt to potential adjustments in UK-EU customs procedures. |

| Environmental Regulations | Drives investment in greener technologies and impacts operational expenses. | EU ETS and FEUM compliance requires capital expenditure for emission reduction. |

| Government Support | Facilitates fleet modernization and green transition. | Danish government funding for green methanol and ammonia projects. |

| Bilateral Agreements | Enables strategic expansion and market access. | 2024 acquisitions in Spain, Morocco, and Turkey were facilitated by favorable trade relationships. |

What is included in the product

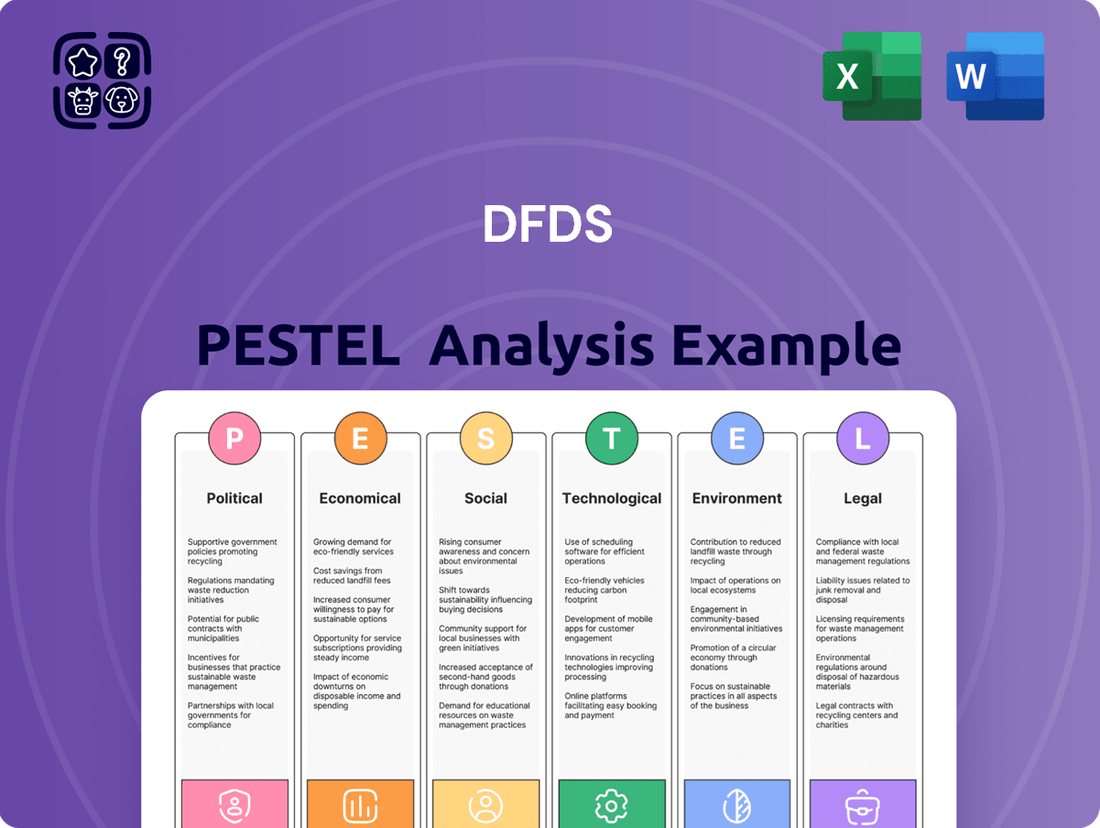

This DFDS PESTLE analysis dissects the influence of external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—on the company's operations and strategic positioning.

It provides a comprehensive overview of how these forces create both challenges and avenues for growth, enabling informed strategic decision-making.

A concise DFDS PESTLE analysis that highlights key external factors, serving as a readily available reference to mitigate strategic blind spots and inform decision-making.

Economic factors

European economic growth is a critical driver for DFDS, directly impacting demand for both its freight and passenger services. A stronger economy typically translates to more goods being shipped and more people traveling, both of which are core to DFDS's business model.

Looking ahead to 2025, expectations for European economic growth are somewhat muted. This slowdown is anticipated to affect DFDS's earnings before interest and taxes (EBIT), underscoring the company's financial sensitivity to the broader economic climate. For instance, if GDP growth in key European markets slows by 1%, it could lead to a noticeable dip in freight volumes.

Conversely, periods of robust economic expansion across Europe would likely boost trade volumes and passenger numbers significantly. This would directly benefit DFDS through higher utilization of its ferry and logistics networks, leading to improved financial performance.

Fuel price volatility is a critical economic factor for DFDS, directly impacting its bottom line as fuel is a substantial operational expense. For instance, the price of Brent crude oil, a benchmark for many fuel types, experienced significant fluctuations throughout 2024, at times trading above $90 per barrel before dipping, creating an unpredictable cost environment.

While DFDS utilizes mechanisms like the Environmental, Social, and Governance (ESG) surcharge, previously known as the ETS surcharge, to help offset these rising costs, prolonged periods of high or erratic fuel prices necessitate continuous strategic adjustments. These adjustments can include optimizing vessel speeds, enhancing route planning, and potentially revising customer pricing to maintain profitability amidst these economic pressures.

DFDS navigates a highly competitive environment across its key operational areas. In the Mediterranean ferry sector, the company contends with established players and emerging threats, demanding constant vigilance in route planning and fare structures.

The Turkish logistics market, in particular, presents significant competitive pressures. The entry and aggressive expansion of competitors like Grimaldi in the Ro-Ro segment have demonstrably affected DFDS's profitability, compelling a strategic re-evaluation of pricing and operational efficiencies to maintain market share and earnings.

Exchange Rate Fluctuations

As a Danish company with extensive operations in Europe and beyond, DFDS is significantly impacted by exchange rate fluctuations. For instance, a stronger Danish Krone (DKK) relative to the Euro (EUR) or British Pound (GBP) would reduce the DKK value of revenues earned in those currencies. This exposure is a critical consideration for financial planning and risk management.

The volatility of currencies like the Turkish Lira (TRY) also presents challenges. For example, in early 2024, the TRY experienced significant depreciation against major currencies. Such movements directly affect DFDS's reported earnings and the cost of goods and services purchased in foreign markets, necessitating robust hedging strategies.

DFDS's financial performance in 2024 and projections for 2025 will be closely watched for their sensitivity to currency shifts. Management must actively monitor and manage these exposures to mitigate potential negative impacts on profitability and maintain competitive pricing across its diverse routes.

- Impact on Revenue: A weaker Euro or Pound against the Danish Krone directly reduces the reported DKK value of sales made in those countries.

- Cost Management: Fluctuations can increase the DKK cost of imported goods, fuel, or services procured in foreign currencies.

- Financial Reporting: Exchange rate volatility affects the translation of foreign subsidiary profits and assets into the consolidated financial statements.

- Hedging Strategies: DFDS likely employs financial instruments to hedge against adverse currency movements, aiming to stabilize financial results.

Consumer Spending and Travel Trends

Consumer spending habits and evolving travel trends are pivotal for DFDS's passenger ferry operations. Fluctuations in disposable income, shifts in consumer confidence, and the growing preference for sustainable or experience-based travel directly influence passenger volumes and revenue. For instance, in June 2025, DFDS reported a dip in adjusted passenger numbers, with a notable decrease observed on its Channel routes, reflecting these dynamic consumer behaviors.

Several factors are shaping these trends:

- Disposable Income: Higher disposable incomes generally correlate with increased leisure travel, benefiting ferry operators like DFDS. Economic uncertainty or inflation can lead consumers to reduce discretionary spending, impacting travel choices.

- Consumer Confidence: A positive outlook on the economy encourages consumers to plan and book holidays, boosting demand for ferry services. Conversely, low consumer confidence can lead to deferred travel plans.

- Travel Preferences: There's a growing interest in experiential travel and a potential shift away from short-haul flights towards more scenic or environmentally conscious modes of transport, which could favor ferry services. However, the convenience and speed of other options remain a significant competitive factor.

Economic growth across Europe directly influences DFDS's freight and passenger volumes. Projections for 2025 suggest a moderate economic slowdown, which could dampen demand. For example, a 1% decrease in GDP growth in key markets might lead to a reduction in freight shipments, impacting DFDS's revenue streams.

Preview the Actual Deliverable

DFDS PESTLE Analysis

The DFDS PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting DFDS, providing actionable insights.

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying, offering a complete strategic overview.

Sociological factors

Shifting demographics are significantly impacting travel. For instance, in Europe, the proportion of individuals aged 65 and over is projected to reach 25% by 2050, a trend that could increase demand for accessible and comfortable ferry services. This aging population may favor shorter, more relaxed journeys.

Consumer preferences are also evolving, with a growing emphasis on sustainable travel options. Surveys in 2024 indicated that over 60% of European travelers consider environmental impact when booking trips, pushing companies like DFDS to highlight eco-friendly practices and potentially invest in greener fleet technologies to attract this segment.

Furthermore, there's a noticeable rise in demand for short-sea leisure trips, often driven by a desire for unique experiences and a break from traditional air travel. This aligns with DFDS's core offerings, but the company must continuously innovate its routes and onboard amenities to cater to these evolving leisure travel tastes.

Customers now demand effortless digital interactions for everything, from booking ferry tickets and managing their travel plans to staying connected while onboard. This shift means companies like DFDS must prioritize digital solutions to meet these evolving expectations.

DFDS is investing heavily in standardizing and digitizing its operations. For instance, their recent digital transformation initiatives aim to streamline the booking process and improve onboard services, directly addressing the growing need for seamless digital experiences. This focus on digital innovation is crucial for enhancing customer satisfaction and operational efficiency in the current market.

The maritime and logistics sectors are grappling with shifts in workforce demographics, raising concerns about potential skills gaps. DFDS, with its substantial workforce of 17,000 employees globally, must proactively address these trends.

Attracting, retaining, and developing a skilled workforce is paramount, especially as the industry embraces new technologies and greener operational practices. This necessitates specialized expertise in areas like digital navigation systems and sustainable fuel management, which may not be readily available in the current labor pool.

Public Perception and Corporate Social Responsibility

Public perception of shipping companies, particularly regarding their environmental impact, is a significant sociological factor. DFDS's commitment to Corporate Social Responsibility (CSR) and transparent communication about its sustainability initiatives, such as its climate action plan, directly shapes this perception. For instance, in 2023, DFDS reported a 10% reduction in CO2 emissions per cargo unit transported compared to 2022, a figure that resonates with environmentally conscious consumers and investors.

A positive public image, bolstered by strong ESG (Environmental, Social, and Governance) performance, can translate into tangible business benefits. This includes attracting and retaining customers who prioritize sustainable travel and logistics options, as well as fostering goodwill with regulatory bodies and local communities. DFDS's investment in greener ferry technologies, aiming for a 45% reduction in CO2 emissions by 2030, is a key element in building this favorable public perception.

- Growing consumer demand for sustainable travel options directly impacts shipping companies like DFDS.

- DFDS's 2023 ESG report highlighted a significant reduction in emissions, reinforcing its commitment to environmental stewardship.

- Stakeholder trust is enhanced through clear communication of climate action plans and CSR initiatives.

- Positive public perception can lead to a competitive advantage in attracting environmentally aware customers and investors.

Health and Safety Standards for Passengers and Employees

Maintaining robust health and safety standards for passengers and employees is a fundamental sociological consideration for DFDS. These standards directly influence public perception and trust in the company's operations. In 2023, DFDS reported a continued focus on enhancing safety protocols across its extensive ferry and logistics network, aiming to minimize incidents and ensure a secure environment for all stakeholders.

The company's commitment to employee well-being is also a key sociological driver. A safe working environment not only protects staff but also contributes to operational efficiency and reduces potential disruptions. DFDS actively invests in training and equipment to uphold these standards, recognizing their importance for both regulatory adherence and corporate reputation.

- Employee Safety Initiatives: DFDS has implemented enhanced safety training programs for its maritime and logistics personnel, with a reported 5% reduction in minor workplace incidents in the first half of 2024 compared to the same period in 2023.

- Passenger Well-being: The company maintains stringent hygiene protocols and emergency preparedness plans on all its vessels, a critical factor for attracting and retaining passengers, especially following the heightened awareness of public health concerns.

- Regulatory Compliance: Adherence to international maritime safety regulations, such as those set by the IMO, is paramount, ensuring DFDS meets societal expectations for safe travel and transport.

- Customer Trust: Demonstrating a strong commitment to health and safety is directly linked to customer loyalty and brand image, influencing passenger choices in an increasingly competitive travel market.

Sociological factors significantly shape DFDS's operational landscape, influencing everything from customer expectations to workforce dynamics. The aging European population, projected to constitute 25% of individuals aged 65 and over by 2050, presents an opportunity for DFDS to cater to demand for accessible, comfortable, and shorter ferry journeys.

Consumer preferences are increasingly leaning towards sustainability, with over 60% of European travelers in 2024 considering environmental impact. DFDS's proactive investment in greener fleet technologies and its reported 10% CO2 emission reduction per cargo unit in 2023 directly address this trend, enhancing brand appeal and stakeholder trust.

The demand for seamless digital interactions is paramount, driving DFDS's digital transformation initiatives to streamline booking and onboard services. Furthermore, a strong emphasis on health and safety, evidenced by a 5% reduction in minor workplace incidents in early 2024, builds customer trust and operational resilience.

| Sociological Factor | Impact on DFDS | Supporting Data/Trend |

|---|---|---|

| Demographics | Increased demand for accessible, shorter journeys | Europe's 65+ population projected to reach 25% by 2050 |

| Consumer Preferences | Growing demand for sustainable travel | 60%+ European travelers consider environmental impact (2024) |

| Digitalization | Need for seamless online experiences | DFDS's digital transformation initiatives |

| Health & Safety | Enhanced customer trust and operational efficiency | 5% reduction in minor workplace incidents (H1 2024 vs H1 2023) |

Technological factors

DFDS is actively digitizing and standardizing its operations to boost customer service and efficiency. This involves creating self-service portals for customers and automating port terminal processes, reflecting a strong commitment to technological advancement for smoother operations.

In 2023, DFDS continued its investment in digital solutions, aiming to reduce manual touchpoints and improve data flow across its ferry and logistics network. The company is also focusing on providing customers with access to green data, enabling them to make more informed and sustainable choices.

The push for green vessel technologies, including those utilizing hydrogen, ammonia, or methanol, is paramount for DFDS's ambitious decarbonization targets. DFDS is actively working towards launching its inaugural green vessel by 2025, underscoring its commitment through significant investments in research and strategic collaborations.

DFDS is increasingly leveraging advanced data analytics and AI to refine its planning and forecasting for both sea and land transport operations. This technological integration aims to provide a more accurate prediction of demand, vessel schedules, and resource allocation, crucial for navigating the complexities of the 2024-2025 shipping landscape.

By applying AI-driven insights, DFDS can optimize shipping routes and improve capacity utilization across its ferry and logistics network. For instance, predictive analytics can anticipate potential disruptions, allowing for proactive rerouting and minimizing delays, thereby enhancing overall operational efficiency and customer satisfaction.

The company's investment in these technologies is expected to yield tangible benefits, such as reduced fuel consumption through optimized routes and better management of empty container repositioning. In 2024, the global logistics market saw significant growth in AI adoption, with reports indicating a substantial increase in efficiency gains for companies that effectively implemented these solutions.

Enhanced Onboard Connectivity and Customer Experience Technologies

Technological advancements are significantly improving the onboard experience for DFDS passengers. Enhanced connectivity, including better Wi-Fi, is becoming a standard expectation for modern travelers. DFDS is investing in these areas to meet these evolving demands.

DFDS is also leveraging data analytics to offer more personalized customer experiences. This includes tailoring services and offers based on passenger preferences and travel history. For instance, by analyzing booking patterns, DFDS can proactively suggest relevant onboard amenities or future travel destinations.

- Improved Wi-Fi: DFDS aims to upgrade onboard Wi-Fi to provide faster and more reliable internet access, crucial for passengers who need to stay connected for work or leisure.

- Data-Driven Personalization: Utilizing customer data allows for customized offers and services, enhancing overall passenger satisfaction and loyalty.

- Digital Service Integration: Technologies like mobile apps for booking, check-in, and onboard services streamline the travel process, making it more convenient for customers.

Cybersecurity in Maritime and Logistics

The increasing digitalization across the maritime and logistics sectors elevates cybersecurity to a crucial technological consideration. Protecting sensitive customer data, vital operational systems, and intricate supply chain information from evolving cyber threats is no longer optional; it's essential for maintaining trust, ensuring uninterrupted business operations, and adhering to stringent data protection regulations. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the significant financial risks involved.

DFDS, like all players in this space, must invest in and maintain robust cybersecurity measures to safeguard its extensive digital infrastructure. This includes protecting against ransomware attacks, data breaches, and disruptions to critical shipping and logistics operations. A 2024 report indicated that the maritime industry experienced a 400% increase in cyberattacks in the preceding year, underscoring the immediate need for enhanced defenses.

Key technological factors influencing DFDS's cybersecurity approach include:

- Data Protection: Implementing advanced encryption and access controls to secure customer information and proprietary business data.

- Operational Resilience: Deploying intrusion detection systems and regular vulnerability assessments to prevent operational disruptions.

- Supply Chain Security: Ensuring secure data exchange protocols with partners to protect the integrity of the entire supply chain.

- Regulatory Compliance: Staying abreast of and adhering to evolving data privacy laws such as GDPR and other international maritime cybersecurity standards.

DFDS is heavily investing in digital transformation, focusing on self-service portals and automated port operations to enhance efficiency and customer experience. The company's 2023 efforts included digitizing operations to reduce manual processes and improve data flow across its network, alongside providing customers with access to green data for sustainable choices.

The development of green vessel technologies, such as those powered by hydrogen, ammonia, or methanol, is critical for DFDS's 2025 decarbonization goals, with significant R&D investment and collaborations underway. Furthermore, DFDS is leveraging advanced data analytics and AI to optimize route planning, demand forecasting, and resource allocation for its 2024-2025 shipping operations, aiming for improved capacity utilization and reduced fuel consumption.

Enhanced onboard connectivity, particularly improved Wi-Fi, is a key focus to meet modern passenger expectations, alongside data-driven personalization for tailored services and offers. Cybersecurity is paramount, with DFDS needing to protect its digital infrastructure against increasing threats; the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, and the maritime industry saw a 400% increase in cyberattacks in the year prior to 2024.

| Technology Focus | DFDS Initiative/Impact | Data/Projection |

|---|---|---|

| Digitalization & Automation | Self-service portals, automated port terminals | Reducing manual touchpoints |

| Green Technology | Hydrogen, ammonia, methanol vessels | Targeting inaugural green vessel by 2025 |

| Data Analytics & AI | Route optimization, demand forecasting | Improving efficiency and capacity utilization |

| Cybersecurity | Protecting data and operations | Global cybercrime cost to reach $10.5 trillion by 2025 |

Legal factors

The EU Emissions Trading System (ETS) will cover 70% of DFDS's reported emissions starting January 1, 2025, directly increasing compliance costs. This expansion means DFDS must purchase more emission allowances, impacting its operational expenses.

Furthermore, the new Fuel EU Maritime (FEUM) regulations, also commencing in 2025, mandate a progressive reduction in the greenhouse gas intensity of maritime fuels. This will likely compel DFDS to invest in cleaner, more expensive fuels or alternative technologies, adding to its financial burden and requiring significant strategic adjustments.

The Import Control System 2 (ICS2) regulation, progressively implemented through 2025, mandates that carriers transporting goods into the European Union submit more comprehensive data through an Entry Summary Declaration (ENS) prior to arrival. This new requirement will necessitate substantial adjustments in data gathering and submission procedures for DFDS, directly affecting its freight operations.

Compliance with ICS2 will require DFDS to enhance its data management systems and potentially invest in new technologies to accurately capture and transmit the detailed information mandated by the EU. This also means customers will need to provide more specific cargo details to ensure smooth transit and avoid delays.

DFDS's strategic moves, including its acquisitions like the FRS Iberia/Maroc and Ekol International Transport deals, are closely scrutinized under EU competition law and similar regulations globally. These frameworks aim to prevent market dominance and ensure fair play, impacting how DFDS can grow and operate.

Non-compliance with these stringent regulations can lead to significant penalties, potentially disrupting operations and damaging the company's reputation. Therefore, DFDS must diligently navigate these legal landscapes to safeguard its expansion strategies and maintain its competitive standing.

Maritime Safety and Security Legislation

DFDS operates under a stringent framework of international and national maritime safety and security legislation. This includes regulations set forth by the International Maritime Organization (IMO), such as the International Ship and Port Facility Security (ISPS) Code, and national laws governing vessel operations, crew qualifications, and passenger safety. Compliance is paramount, necessitating ongoing investment in areas like advanced navigation systems and regular safety drills. For instance, the IMO's SOLAS (Safety of Life at Sea) convention mandates specific safety equipment and procedures on all vessels, directly impacting DFDS's operational costs and protocols.

Adherence to these legal requirements is not optional and demands continuous vigilance. DFDS must ensure its fleet undergoes regular inspections, its crew receives up-to-date training on emergency response and security measures, and its port facilities meet rigorous security standards. Failure to comply can result in significant fines, operational disruptions, and reputational damage. In 2023, the European Maritime Safety Agency (EMSA) reported a high compliance rate among EU-flagged vessels, underscoring the industry's focus on these critical legal obligations.

Key legal factors impacting DFDS include:

- International Maritime Organization (IMO) Conventions: Adherence to SOLAS, MARPOL (Marine Pollution), and STCW (Standards of Training, Certification and Watchkeeping for Seafarers) is fundamental.

- National Maritime Laws: Compliance with specific regulations in countries where DFDS operates, such as those set by the Danish Maritime Authority or the UK's Maritime and Coastguard Agency.

- Port Security Regulations: Meeting ISPS Code requirements for all ports of call, including access control and cargo screening.

- Environmental Protection Laws: Strict adherence to regulations concerning emissions, waste disposal, and ballast water management to prevent pollution.

Labor Laws and Employment Regulations

DFDS, as a major employer with around 17,000 staff globally, navigates a complex web of international labor laws. These regulations dictate everything from minimum wage requirements and working hours to employee benefits and dismissal procedures, directly impacting operational costs and HR strategies.

Compliance with these diverse legal frameworks is crucial. For instance, in 2024, the European Union continued to emphasize fair working conditions and the rights of gig economy workers, potentially influencing DFDS's employment models. Similarly, varying national regulations on collective bargaining can affect wage negotiations and employee relations across different operating regions.

- Global Compliance Burden: DFDS must adhere to labor laws in numerous countries, each with unique stipulations on wages, benefits, and working conditions.

- Impact on Costs: Adherence to minimum wage laws, social security contributions, and employee protection mandates directly influences DFDS's overall labor expenditure.

- Employee Rights and Relations: Regulations concerning employee rights, unionization, and collective bargaining agreements shape how DFDS manages its workforce and industrial relations.

- Evolving Regulations: Ongoing legislative changes, such as those concerning remote work or platform worker rights in 2024-2025, require continuous adaptation of HR policies.

DFDS faces increasing legal obligations related to environmental protection, particularly concerning emissions and fuel usage. The EU ETS expansion from January 1, 2025, covering 70% of emissions, and the FuelEU Maritime regulations from 2025, mandating GHG intensity reductions, will directly increase compliance costs and necessitate investment in cleaner fuels or technologies.

The company must also navigate new data submission requirements under the Import Control System 2 (ICS2), progressively implemented through 2025, impacting freight operations and requiring enhanced data management systems. Furthermore, DFDS's growth through acquisitions is subject to global competition laws, ensuring fair market practices.

DFDS's commitment to safety and security is governed by stringent international and national maritime laws, including IMO conventions like SOLAS and ISPS, requiring continuous investment in safety equipment and crew training. In 2023, the European Maritime Safety Agency (EMSA) noted high compliance rates among EU vessels, highlighting industry adherence to these critical legal mandates.

Labor laws globally also significantly impact DFDS, with around 17,000 staff, affecting operational costs and HR strategies. Evolving regulations, such as those concerning fair working conditions and platform worker rights in 2024-2025, demand continuous adaptation of HR policies.

| Regulation | Effective Date | Impact on DFDS |

| EU Emissions Trading System (ETS) Expansion | January 1, 2025 | Increased compliance costs due to coverage of 70% of emissions; need to purchase more emission allowances. |

| Fuel EU Maritime (FEUM) | 2025 | Mandatory reduction in GHG intensity of maritime fuels; potential investment in cleaner, more expensive fuels or technologies. |

| Import Control System 2 (ICS2) | Progressive implementation through 2025 | New data submission requirements for goods entering the EU; necessitates adjustments in data gathering and submission procedures. |

Environmental factors

DFDS is actively pursuing a climate-neutral goal by 2050, a significant undertaking that requires substantial capital allocation. This ambition is underpinned by a concrete target to slash greenhouse gas emissions by nearly 45% between 2008 and 2030, demonstrating a clear, phased approach to decarbonization.

These environmental objectives translate directly into considerable investments in innovative solutions. DFDS is channeling resources into the development and adoption of sustainable fuels, the retrofitting of vessels for enhanced energy efficiency, and the electrification of its shore-based infrastructure, all crucial steps in achieving its climate targets.

The EU's Emissions Trading System (ETS) and the upcoming FuelEU Maritime (FEUM) regulation are significant environmental factors for DFDS. The ETS, which prices carbon emissions, directly increases operational expenses for the company's vessels. For instance, in 2023, the price of EU ETS allowances fluctuated, with average prices around €90 per tonne of CO2, impacting fuel costs for ships exceeding certain emission thresholds.

FuelEU Maritime, set to be fully implemented in 2025, will further compel DFDS to adopt cleaner energy sources. This regulation mandates a gradual increase in the use of renewable or low-carbon fuels for ships calling at EU ports, potentially requiring substantial investment in new technologies and fuel bunkering infrastructure. Failure to comply could result in penalties and reputational damage.

DFDS actively pursues pollution reduction and robust waste management as key environmental priorities, extending their commitment beyond carbon emissions. This focus is evident in onboard initiatives like phasing out single-use plastics, a significant step in curbing marine pollution. Furthermore, efforts to minimize food waste across their diverse itineraries showcase a comprehensive approach to environmental stewardship.

Biodiversity and Marine Ecosystem Protection

DFDS operates in sensitive marine environments, necessitating a strong commitment to protecting biodiversity and marine ecosystems. This commitment translates into concrete actions aimed at minimizing their operational footprint.

Key initiatives include stringent measures to prevent oil spills and reduce underwater noise pollution, which can significantly impact marine life. For instance, DFDS has been actively involved in collaborations like the one with ReSea, an organization dedicated to cleaning up the oceans. In 2023, ReSea reported removing over 10,000 tons of plastic from waterways, a testament to the impact of such partnerships.

- Preventing Pollution: Implementing advanced technologies and protocols to avoid accidental spills of oil and other harmful substances into the sea.

- Reducing Underwater Noise: Employing quieter ship designs and operational practices to minimize disturbance to marine mammals and other sensitive species.

- Ocean Cleanup Initiatives: Partnering with organizations like ReSea, contributing to tangible efforts to remove plastic waste and protect marine habitats.

- Sustainable Vessel Operations: Focusing on fuel efficiency and waste management to lessen the overall environmental impact of maritime transport.

Renewable Energy Adoption in Ports and Terminals

DFDS is actively pursuing renewable energy solutions, notably through the installation of solar panels on its warehouses and terminals. This strategic move aligns with global trends in decarbonization and aims to reduce the company's reliance on fossil fuels for its land-based operations.

The company's commitment extends to electrifying its fleet, including e-trucks, reach stackers, and cranes. This electrification strategy is a key component in DFDS's broader effort to lower its carbon footprint, with the maritime sector facing increasing pressure to adopt greener technologies. For instance, the European Union's Fit for 55 package aims for a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels, influencing port infrastructure and logistics.

The adoption of renewable energy sources in port operations is becoming a critical factor for efficiency and sustainability.

- Solar Power Growth: Global solar power capacity is projected to reach over 2,000 GW by the end of 2024, demonstrating a significant shift towards renewable energy generation.

- Electrification in Logistics: The electric truck market is rapidly expanding, with major manufacturers introducing new models and increasing production volumes to meet demand for cleaner freight transport.

- Port Sustainability Initiatives: Many major ports worldwide are investing in green technologies, including shore power facilities and renewable energy projects, to reduce emissions and improve air quality.

DFDS's environmental strategy centers on achieving climate neutrality by 2050, with a near-term goal of reducing greenhouse gas emissions by almost 45% by 2030 compared to 2008 levels. This involves significant investments in sustainable fuels, vessel retrofitting, and shore-based electrification.

Regulatory pressures like the EU Emissions Trading System (ETS) and FuelEU Maritime (FEUM) directly impact DFDS's operational costs and require a transition to cleaner fuels. For instance, 2023 saw average EU ETS allowance prices around €90 per tonne of CO2, increasing expenses for emissions-heavy operations.

DFDS also prioritizes pollution reduction, including phasing out single-use plastics and minimizing food waste, and actively works to protect marine ecosystems through initiatives like preventing oil spills and reducing underwater noise pollution.

| Environmental Factor | DFDS Action/Impact | Relevant Data/Context |

|---|---|---|

| Climate Neutrality Goal | Targeting climate neutrality by 2050 | Commitment to reducing emissions aligns with global climate targets. |

| Emissions Reduction | Aiming for ~45% reduction by 2030 (vs. 2008) | Demonstrates a concrete, phased approach to decarbonization. |

| Sustainable Fuels | Investment in development and adoption | Essential for meeting FEUM mandates and reducing operational emissions. |

| EU ETS | Increased operational expenses | Average EU ETS allowance prices around €90/tonne CO2 in 2023 impacted fuel costs. |

| FuelEU Maritime (FEUM) | Mandates increased use of low-carbon fuels | Full implementation in 2025 requires investment in new technologies and infrastructure. |

| Pollution Reduction | Phasing out single-use plastics, waste management | Contributes to minimizing marine pollution and environmental impact. |

| Marine Ecosystem Protection | Preventing oil spills, reducing underwater noise | Partnerships like ReSea aim to clean up oceans; ReSea removed over 10,000 tons of plastic in 2023. |

| Renewable Energy | Solar panels on warehouses, electrification of fleet (e-trucks, cranes) | Global solar capacity projected to exceed 2,000 GW by end of 2024; growing electric truck market. |

PESTLE Analysis Data Sources

Our DFDS PESTLE analysis draws on a comprehensive blend of official government publications, reputable industry reports, and global economic data. This ensures that each factor, from political stability to technological advancements, is grounded in current and reliable information.