DFDS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFDS Bundle

DFDS operates in a dynamic ferry and logistics landscape, facing pressures from rivals, powerful buyers, and the constant threat of new entrants. Understanding these forces is crucial for navigating the industry's competitive currents.

The complete report reveals the real forces shaping DFDS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of marine fuel, primarily oil companies, wield considerable power. This stems from the indispensable nature of fuel for shipping operations and the inherent volatility of global oil prices. DFDS's operational expenses are directly impacted by these price swings, with fuel frequently representing a significant percentage of overall costs.

The increasing costs associated with environmental regulations, such as the EU Emissions Trading System (ETS), further amplify supplier leverage. For vessels operating within EU waters, the fuel cost component is projected to rise to 70% by 2025, underscoring the critical impact of fuel suppliers on DFDS's profitability and strategic planning.

Port operators and providers of port terminal services hold significant bargaining power, particularly in strategic locations crucial to DFDS's operations. The efficiency and availability of these services directly influence DFDS's ability to maintain its shipping schedules and optimize its complex logistics networks.

In 2024, DFDS continued its focus on enhancing port terminal efficiency through automation initiatives. For instance, the company has invested in upgrading equipment and implementing digital solutions at key terminals to streamline cargo handling and reduce turnaround times, thereby mitigating some of the supplier leverage.

The bargaining power of suppliers, particularly vessel manufacturers and maintenance providers, is a significant factor for DFDS. The highly specialized nature of shipbuilding and the critical need for ongoing fleet maintenance mean these suppliers hold considerable sway. DFDS's commitment to investing in new, greener ferries, with a goal of acquiring six by 2030, underscores this reliance, as these ventures represent substantial capital outlays and necessitate strong relationships with these key industry players.

Technology and Software Providers

As DFDS continues its digital transformation, the bargaining power of technology and software providers is on the rise. Companies offering specialized logistics software, AI-driven planning tools, and other advanced digital solutions are becoming increasingly crucial for optimizing DFDS's operations and supply chain. This reliance on cutting-edge, integrated platforms grants these suppliers significant leverage.

- Increased Dependence: DFDS's commitment to digitization means a growing reliance on sophisticated software for route optimization, fleet management, and customer interaction.

- Specialized Expertise: Providers of niche technologies, such as AI for predictive maintenance or advanced data analytics for demand forecasting, possess unique capabilities that are hard for DFDS to replicate internally.

- Switching Costs: Migrating to new software systems can be costly and disruptive, making DFDS hesitant to switch suppliers frequently, thereby strengthening the existing providers' position.

- Market Trends: The broader industry trend towards digital integration and the adoption of Industry 4.0 technologies further bolsters the bargaining power of leading technology vendors in the logistics sector.

Labor (Crew and Truck Drivers)

The bargaining power of labor, specifically maritime crew and truck drivers, significantly influences DFDS's operational efficiency and financial performance. A scarcity of skilled professionals in these critical roles, particularly evident in European road transport, grants unions and individual workers leverage. This can translate into upward pressure on wages and potential disruptions if demands aren't met.

The European logistics sector has been grappling with driver shortages. For instance, estimates in late 2023 and early 2024 suggested a deficit of tens of thousands of qualified truck drivers across the continent, directly impacting companies like DFDS that rely on road transport for their integrated ferry and logistics services. This imbalance amplifies the bargaining power of existing drivers.

- Labor Shortages: A persistent shortage of skilled truck drivers in Europe, estimated to be in the tens of thousands, strengthens their negotiating position.

- Wage Demands: Increased demand for drivers can lead to higher wage expectations and improved benefits packages, impacting DFDS's operating costs.

- Operational Constraints: Limited availability of qualified crew and drivers can restrict DFDS's ability to expand services or respond to fluctuating market demand, potentially causing delays.

- Union Influence: Stronger unions representing maritime and road transport workers can collectively bargain for better terms, further enhancing labor's bargaining power.

Suppliers of essential components and services can exert significant influence over DFDS. This power is amplified by the specialized nature of maritime equipment and the critical need for reliable maintenance, which limits alternative sourcing options. DFDS's strategic investments in fleet renewal and upgrades, such as the planned acquisition of new ferries, directly increase its dependence on vessel manufacturers and maintenance providers, thereby strengthening their bargaining position.

The bargaining power of technology and software providers is growing as DFDS pursues digital transformation. Companies offering specialized logistics software, AI-driven planning tools, and advanced data analytics are becoming indispensable for optimizing operations. This reliance on unique, integrated platforms grants these technology suppliers considerable leverage, especially given the high switching costs associated with complex IT systems.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on DFDS |

|---|---|---|

| Marine Fuel Suppliers | Indispensable nature of fuel, oil price volatility, environmental regulations (e.g., EU ETS) | Direct impact on operational costs; fuel costs can represent a significant portion of expenses. |

| Port Operators & Terminal Services | Strategic location importance, efficiency of services | Influences DFDS's ability to maintain schedules and optimize logistics. |

| Vessel Manufacturers & Maintenance Providers | Specialized nature of shipbuilding, critical need for fleet maintenance | Substantial capital outlays for new vessels; reliance on ongoing maintenance services. |

| Technology & Software Providers | Need for specialized logistics software, AI tools, data analytics; high switching costs | Crucial for operational optimization and supply chain efficiency; grants significant leverage. |

What is included in the product

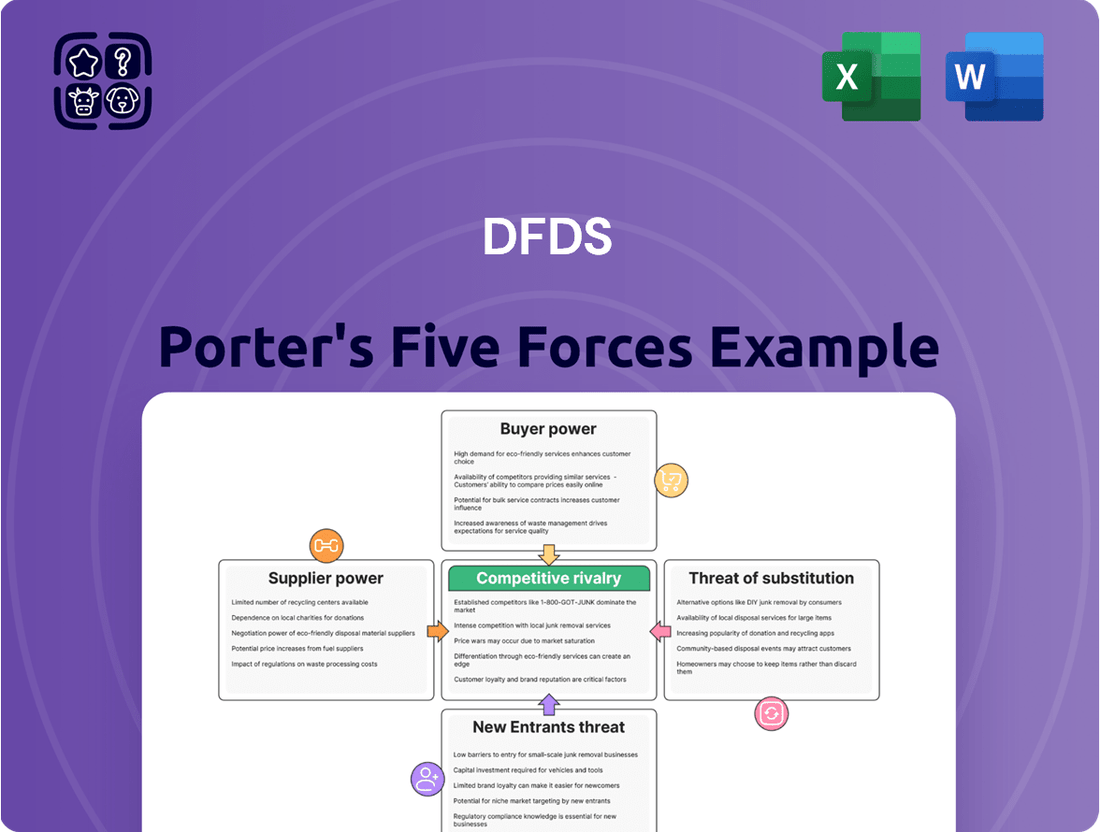

DFDS Porter's Five Forces Analysis reveals the competitive intensity and profitability potential within the ferry and logistics sectors. It dissects the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Quickly identify and address competitive threats with a visual breakdown of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

Large freight customers, especially those shipping substantial volumes or under long-term agreements, wield significant influence over DFDS. This power allows them to negotiate better pricing and insist on tailored service standards, such as comprehensive logistics packages and clear data reporting.

In 2024, the freight sector continued to see large clients demanding more value-added services. DFDS's strategy to counter this involves providing integrated transport and logistics solutions, aiming to lock in these key customers by offering a more complete and convenient service offering.

Individual passenger customers, or travelers, typically hold limited bargaining power with ferry operators like DFDS. This is largely because ferry services are often quite standardized, and the widespread availability of online booking and comparison websites makes it easy for customers to find the best prices. For instance, in 2024, a significant portion of ferry bookings are made through aggregators, increasing price transparency and reducing individual customer leverage.

Despite this, customer satisfaction is a critical factor for DFDS. A poor travel experience can quickly lead passengers to switch to competitors, indirectly increasing customer influence. Maintaining high service standards and positive customer reviews is therefore essential for DFDS to mitigate this potential power shift.

Logistics service buyers, particularly those requiring integrated road transport and warehousing solutions, exert significant bargaining power. Their focus on reliability, efficiency, and cost optimization in their supply chains means they can readily switch providers if better terms or service levels are offered elsewhere. The fragmented nature of the European logistics market, with numerous players vying for business, further amplifies this power.

In 2024, the European road freight market remained highly competitive, with an estimated over 100,000 road haulage companies operating across the continent. This sheer volume of providers means that large-scale logistics buyers, such as major retailers or manufacturers, can leverage their volume to negotiate favorable rates and service agreements, often seeking bundled solutions that encompass both transport and warehousing to streamline operations.

Price Sensitivity

DFDS faces significant customer price sensitivity in both its freight and passenger segments. For less urgent cargo or leisure travel, customers are more likely to shop around for the best deal, putting pressure on DFDS's pricing strategies. This sensitivity can intensify during economic slowdowns, as seen in the general consumer spending trends observed throughout 2024, where discretionary spending often tightens.

The competitive landscape directly influences this price sensitivity. When alternative transport options are readily available and competitively priced, customers have more power to demand lower fares or rates from DFDS. For instance, increased competition on key ferry routes can force DFDS to offer promotions, potentially impacting its profit margins if not managed strategically.

- Freight Customers: Price sensitivity is particularly high for non-time-critical freight, where cost savings can be substantial by choosing a slightly slower but cheaper option.

- Passenger Customers: Leisure travelers are often very price-conscious, especially during off-peak seasons or when booking in advance, leading to a demand for discounts and package deals.

- Economic Impact: In 2024, ongoing inflation and economic uncertainty have generally increased consumer and business price sensitivity across Europe, directly affecting DFDS's customer base.

- Competitive Response: DFDS must continually monitor competitor pricing to remain competitive, balancing the need to attract customers with the necessity of maintaining profitability on its routes.

Digitalization and Transparency

The increasing digitalization within the logistics and travel sectors significantly enhances customer bargaining power. With greater access to information, such as detailed pricing, service schedules, and peer reviews, customers can readily compare offerings. This transparency makes it simpler for them to identify the best value, thereby increasing their leverage when choosing providers. For instance, in 2024, online travel agencies and logistics comparison platforms continued to grow, giving consumers unprecedented visibility into market options.

DFDS is actively responding to this trend by investing in enhanced self-service capabilities and improving overall transparency for its customers. This strategic move aims to meet evolving customer expectations for convenience and informed decision-making. By providing more direct access to information and control over bookings and services, DFDS can foster greater customer loyalty in a competitive digital landscape.

- Digitalization provides customers with extensive data on pricing and service quality.

- This transparency empowers customers to make more informed choices and negotiate better terms.

- DFDS is enhancing its digital platforms to offer more self-service options and transparency.

Customers, particularly large freight clients and logistics buyers, possess considerable bargaining power due to their volume and the competitive nature of the European logistics market. In 2024, this was evident as these clients demanded integrated solutions and favorable rates, leveraging the fragmented market of over 100,000 road haulage companies. DFDS counters this by offering comprehensive logistics packages to enhance customer retention.

While individual passenger customers have limited direct leverage, their collective satisfaction significantly influences DFDS's operations. Price sensitivity remains a key factor for both freight and passenger segments, exacerbated by economic conditions in 2024 that increased general price consciousness. Digitalization further amplifies customer power by providing easy access to comparative data.

| Customer Segment | Bargaining Power Drivers | DFDS's Strategic Response |

|---|---|---|

| Large Freight Customers | High volume, long-term agreements, demand for tailored services | Integrated transport and logistics solutions, value-added services |

| Logistics Service Buyers | Need for reliability, efficiency, cost optimization, ability to switch providers | Bundled solutions (transport & warehousing), competitive pricing |

| Individual Passenger Customers | Low individual power, but high impact of satisfaction/dissatisfaction | High service standards, positive reviews, digital self-service options |

Same Document Delivered

DFDS Porter's Five Forces Analysis

This preview showcases the complete DFDS Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape for the company. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate usability. You're looking at the actual, professionally formatted analysis, ready for your strategic planning needs without any hidden placeholders or alterations.

Rivalry Among Competitors

The European shipping and logistics arena is intensely competitive, featuring many established companies. DFDS navigates this landscape alongside rivals such as Color Line, P&O Ferries, and Stena Line, all of whom operate passenger and freight ferry services. Larger logistics providers like DHL and UPS also present competition, particularly for DFDS's integrated logistics offerings.

The European transportation and logistics sector is projected for modest growth. This slower expansion can heat up competition, as businesses fight harder for a larger piece of a less rapidly expanding market.

DFDS’s CEO has indicated that 2025 is anticipated to be a transitional period, marked by subdued expectations for economic expansion across Europe. This outlook suggests that the competitive landscape might become more challenging for companies like DFDS.

Companies in the ferry and logistics sector, including DFDS, face intense competition not solely on price but also on service quality. Factors like extensive network coverage, consistent service reliability, transit speed, and the provision of integrated logistics solutions are key differentiators. For instance, in 2023, DFDS reported a revenue of DKK 23.4 billion, demonstrating the scale of operations within this competitive landscape.

DFDS actively differentiates itself by focusing on its role in connecting industries and people through dependable maritime and land-based services. The company's strategic emphasis on standardizing and digitizing its network is aimed at elevating the customer experience, moving beyond basic transportation to offer seamless, technology-driven solutions.

Exit Barriers

High fixed costs are a significant factor in the ferry industry, creating substantial exit barriers. These costs include the ownership and maintenance of vessels, as well as investments in port infrastructure and complex logistics networks. This financial commitment means that companies often find it more viable to continue operating, even during periods of lower profitability, rather than incurring further losses by ceasing operations. This persistence inherently intensifies competitive rivalry as all players remain in the market.

The ferry sector's capital-intensive nature means that exiting the market is not a simple decision. Companies must consider the substantial resale value or depreciation of their assets, alongside any contractual obligations. These factors contribute to a situation where companies are more inclined to weather economic downturns rather than divest, thereby prolonging competitive pressures.

DFDS's strategic decision to divest its Oslo route in 2024 serves as a notable, albeit exceptional, instance. This move, while aligning with a broader strategic reassessment, underscores the general reluctance to exit due to the aforementioned high exit barriers. The market typically sees players committed to their operational footprint.

The implications of these high exit barriers for competitive rivalry are clear:

- Entrenched Competition: Companies are less likely to exit, leading to a more crowded and competitive market for extended periods.

- Price Sensitivity: With many operators staying in the market, price competition can become more aggressive to capture market share.

- Strategic Persistence: Investments in assets and infrastructure foster a long-term competitive outlook among existing players.

- Limited New Entrants: The high capital requirements also act as a barrier to new companies entering the market, further solidifying the position of established operators.

Strategic Acquisitions and Partnerships

Consolidation through strategic acquisitions and partnerships significantly intensifies competitive rivalry in the ferry sector. DFDS's 2024 acquisitions, including FRS Iberia/Maroc and Ekol International Transport, exemplify this trend. These moves not only expand DFDS's operational footprint but also present formidable challenges to existing competitors by integrating new routes and customer bases.

These strategic alliances can lead to:

- Increased Market Share: Companies that successfully acquire rivals or form alliances gain immediate access to larger customer pools and more extensive route networks.

- Enhanced Network Synergies: Integration of acquired operations can unlock cost efficiencies and service improvements, creating a more competitive offering.

- Shifted Competitive Dynamics: Such large-scale M&A activity can redefine market leadership and force smaller or less agile players to reconsider their strategies or risk becoming irrelevant.

Competitive rivalry within the European ferry and logistics sector is robust, driven by numerous established players and the presence of larger global logistics firms. The sector faces a landscape where modest market growth in 2024 and 2025 necessitates aggressive competition for market share. DFDS, with its 2023 revenue of DKK 23.4 billion, operates within this dynamic environment, differentiating itself through service quality, network reach, and integrated logistics solutions.

High fixed costs, such as vessel ownership and port infrastructure, create significant exit barriers, keeping many companies committed to the market and intensifying rivalry. This persistence, coupled with strategic consolidation like DFDS's 2024 acquisitions of FRS Iberia/Maroc and Ekol International Transport, reshapes competitive dynamics by increasing market share and network synergies for the acquiring entities.

| Competitor | Primary Services | 2023 Revenue (Approximate, if available) |

|---|---|---|

| Color Line | Passenger & Freight Ferries | Not publicly disclosed in a comparable format |

| P&O Ferries | Passenger & Freight Ferries | Not publicly disclosed in a comparable format |

| Stena Line | Passenger & Freight Ferries | Not publicly disclosed in a comparable format |

| DHL | Global Logistics, Express Delivery | €24.9 billion (2023) |

| UPS | Global Logistics, Express Delivery | $91.0 billion (2023) |

SSubstitutes Threaten

For freight transport, the threat of substitutes is moderate. Direct road transport via tunnels or bridges, especially for shorter hauls, presents a direct alternative to ferry services, impacting DFDS's market. For instance, the Øresund Bridge connecting Denmark and Sweden offers a continuous road link, bypassing ferry routes.

While road congestion and infrastructure limitations can sometimes hinder road transport's efficiency, it remains a competitive option. In 2023, the total freight volume transported by road in the EU reached approximately 1.7 trillion tonne-kilometres, underscoring its significant role and competitive presence against other modes like ferries.

Rail transport presents a significant threat of substitution for freight, particularly for long-haul routes across Europe. Its growing appeal stems from environmental advantages and cost-effectiveness over longer distances compared to road freight. For instance, in 2023, rail freight accounted for approximately 17% of total freight transport in the EU, highlighting its substantial market presence.

DFDS, a major player in the logistics sector, recognizes this threat by offering integrated services that often include rail transport. This strategic inclusion demonstrates an understanding that rail can serve as a viable alternative to their core sea and road offerings, especially for certain cargo types and routes where it offers a competitive edge in terms of both cost and sustainability.

For high-value or time-sensitive freight, air transport presents a significant threat of substitution. While typically more costly than sea or road transport, air cargo offers unparalleled speed, making it a compelling option for customers where delivery time is paramount. For instance, in 2024, the global air cargo market continued its recovery, with volumes showing an upward trend, indicating its sustained relevance for specific segments.

Fixed Links (Bridges and Tunnels)

The threat of substitutes for ferry services, particularly from fixed links like bridges and tunnels, is a significant consideration. These alternatives offer a direct and often faster alternative for crossing water bodies, potentially diverting passengers and freight. For instance, the opening of new bridges or the expansion of tunnel networks can directly compete with existing ferry routes.

The impact of these substitutes can be substantial. For example, the Øresund Bridge connecting Denmark and Sweden, which opened in 2000, significantly altered the landscape for ferry services between Copenhagen and Malmö. Similarly, ongoing discussions and potential future projects for fixed links in various regions could present long-term challenges for ferry operators.

- Bridges and tunnels offer speed and reliability advantages over ferries, especially for time-sensitive cargo and passengers.

- The development of new fixed links can directly siphon demand from established ferry routes, impacting revenue and market share.

- Infrastructure investments in bridges and tunnels represent a substantial capital commitment, indicating a strong belief in their long-term viability as transport solutions.

- The cost-effectiveness of substitutes, factoring in travel time and potential toll costs versus ferry fares, is a key determinant of their competitive threat.

Direct Passenger Flights

For passenger travel, especially for longer distances across Europe, direct flights present a compelling alternative to ferry services. The speed advantage of air travel is undeniable for passengers prioritizing efficiency.

While ferries provide a unique experience, such as the convenience of bringing a vehicle or the opportunity for overnight travel, air travel remains a potent substitute for those who value time above all else. In 2024, the European airline industry saw continued recovery, with passenger numbers approaching pre-pandemic levels, underscoring the strength of this substitute.

- Speed: Flights are significantly faster for inter-city or cross-border journeys.

- Convenience: For travelers without cars or those prioritizing quick transit, flights are often more direct.

- Cost Competitiveness: Budget airlines can sometimes offer fares comparable to or even lower than ferry tickets on certain routes, especially when factoring in the value of time saved.

The threat of substitutes for DFDS's services is a dynamic factor, influenced by infrastructure development and evolving consumer preferences. Fixed transport links like bridges and tunnels directly compete with ferry routes, offering faster transit times for both passengers and freight. For example, the Øresund Bridge has significantly impacted ferry traffic between Denmark and Sweden.

Rail and air transport also pose substantial substitution threats. Rail is increasingly competitive for long-haul freight due to its cost-effectiveness and environmental benefits, with EU rail freight accounting for around 17% of total freight in 2023. Air travel, while costlier, offers speed for time-sensitive passengers and cargo, with the global air cargo market showing an upward trend in 2024.

| Substitute Type | Key Advantages | Impact on DFDS | 2023/2024 Data Point |

|---|---|---|---|

| Bridges & Tunnels | Speed, Reliability | Direct competition for passengers and freight | Øresund Bridge example |

| Rail Freight | Cost-effectiveness (long-haul), Environmental | Alternative for certain freight segments | 17% of EU freight transport (2023) |

| Air Travel | Speed | Alternative for time-sensitive passengers/cargo | Global air cargo market recovery (2024) |

Entrants Threaten

Entering the shipping and logistics sector, particularly to compete with an established player like DFDS, demands immense upfront capital. New companies need to acquire or lease vessels, invest in port facilities, and build out extensive logistics networks. For instance, the cost of a single large ferry can run into hundreds of millions of euros, making it a prohibitive expense for many potential new entrants.

The maritime and logistics industries, including companies like DFDS, face significant regulatory hurdles that act as a barrier to entry. New companies must grapple with a complex web of international shipping laws, stringent safety protocols, and increasingly demanding environmental standards. For instance, the EU Emissions Trading System (ETS) for maritime transport, implemented in 2024, and the upcoming FuelEU Maritime regulation, set to take effect in 2025, impose substantial compliance costs and operational adjustments.

DFDS leverages its vast, established network of ferry routes and logistics operations, particularly across Northern Europe and the Baltic Sea. This extensive infrastructure provides significant economies of scale, making it challenging for newcomers to match the cost efficiencies and integrated service offerings that DFDS already provides.

Brand Recognition and Customer Loyalty

DFDS benefits from substantial brand recognition and deeply ingrained customer loyalty, cultivated over a long operational history. This established trust acts as a significant barrier for potential new entrants. For instance, DFDS has been recognized as the 'World's Leading Ferry Operator' on multiple occasions, underscoring its market standing and customer preference.

New companies would need to invest considerable time and financial resources to build a comparable level of brand awareness and secure customer allegiance. This makes it challenging for newcomers to directly compete on the basis of established reputation and customer relationships that DFDS already commands.

- Established Brand Equity: DFDS's repeated 'World's Leading Ferry Operator' awards highlight its strong global reputation.

- Customer Loyalty: Decades of service have fostered a loyal customer base, less likely to switch to unproven competitors.

- High Entry Costs: Replicating DFDS's brand trust and loyalty requires substantial marketing investment and time, creating a high barrier.

Access to Distribution Channels and Port Slots

Newcomers face significant hurdles in securing favorable port slots and efficient terminal operations. Established shipping companies often possess long-standing agreements and preferential access, making it difficult for new entrants to gain a foothold.

For instance, in 2024, major European ports like Rotterdam and Antwerp continued to see high utilization rates, with limited availability for new, unestablished carriers seeking dedicated terminal capacity. This scarcity directly impacts a new entrant's ability to offer competitive transit times and reliable service, as delays in port operations can quickly erode customer confidence.

Furthermore, building robust distribution channels for both freight and passenger services requires substantial investment and time. Existing players have cultivated extensive networks and customer relationships over years, creating a barrier to entry that new companies must overcome through strategic partnerships or by offering significantly differentiated services.

- Port Slot Scarcity: Major European ports in 2024 reported average vessel waiting times of 12-24 hours, impacting new entrants' schedule reliability.

- Terminal Operations: Existing players often have exclusive or long-term contracts for terminal services, limiting new entrants' access to efficient handling.

- Distribution Network: Establishing a comprehensive freight and passenger distribution network, as seen with DFDS's extensive route coverage, takes years of relationship building and infrastructure investment.

The threat of new entrants for DFDS is moderate, primarily due to the substantial capital required for fleet acquisition and infrastructure development. Regulatory compliance, especially with evolving environmental standards like FuelEU Maritime by 2025, adds significant cost and complexity.

DFDS's established brand loyalty and extensive route network, particularly in Northern Europe, present a formidable challenge for newcomers. Securing favorable port access and building comparable distribution channels also requires considerable time and investment, further deterring potential competitors.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Acquiring vessels and port infrastructure costs hundreds of millions of euros. | Very High |

| Regulatory Hurdles | Compliance with EU ETS (2024) and FuelEU Maritime (2025) increases operational costs. | High |

| Brand Loyalty & Network | DFDS's established reputation and extensive routes are difficult to replicate. | High |

| Port Access | Limited availability of port slots in major hubs like Rotterdam in 2024. | Moderate to High |

Porter's Five Forces Analysis Data Sources

Our DFDS Porter's Five Forces analysis is built upon a foundation of diverse data sources, including DFDS's own annual reports, industry-specific market research from firms like Euromonitor, and regulatory filings from maritime authorities. We also incorporate macroeconomic data from sources such as Eurostat to understand broader economic influences.