DFDS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFDS Bundle

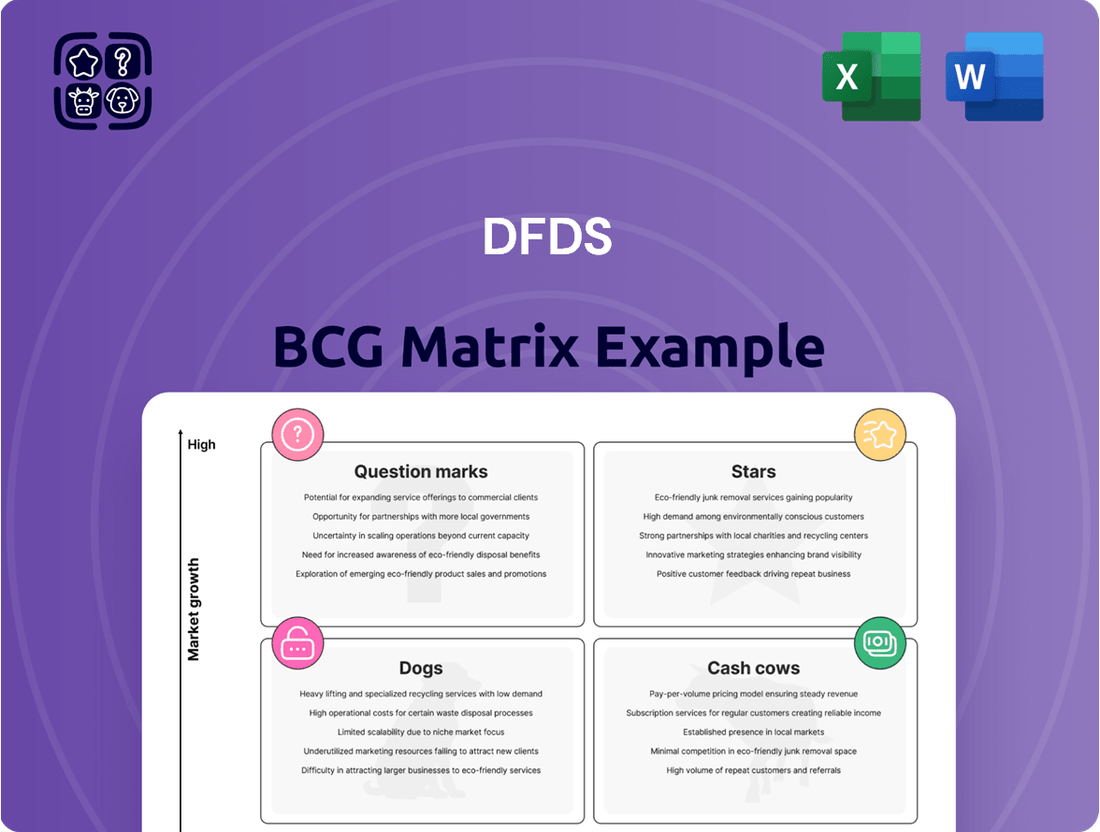

Curious about DFDS's strategic product positioning? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understand the foundational insights into their market share and growth potential.

To truly unlock the strategic advantage, dive into the full DFDS BCG Matrix. Gain a comprehensive understanding of each product's quadrant placement, enabling you to make informed decisions about resource allocation and future investments. Don't miss out on the complete picture for smarter business planning.

Stars

The Strait of Gibraltar ferry routes, significantly bolstered by DFDS's 2024 acquisition of FRS Iberia/Maroc, are a prime example of strategic growth. These newly integrated operations highlight DFDS's commitment to expanding its presence in a dynamic and increasingly important transit corridor.

DFDS has already commenced operations on these acquired routes, demonstrating a swift and effective integration that solidifies its market standing. This rapid operational start suggests a strong existing infrastructure and customer base inherited from FRS Iberia/Maroc.

By focusing on high-growth markets such as the Strait of Gibraltar, these ferry routes are positioned to become leaders within their specific segment. The strategic importance of this region, connecting Europe and Africa, offers substantial potential for increased passenger and freight traffic.

The Jersey Ferry Services concession, awarded to DFDS for a 20-year term commencing March 2025, positions the company as a dominant player in a niche, high-market-share segment. This long-term, exclusive agreement provides significant stability and a clear runway for sustained operations and potential expansion within this specific passenger and freight corridor.

Mediterranean Freight Ferry Volumes are showing robust growth, a key indicator for DFDS. In April 2025, freight volumes in this region surpassed 2024 figures. This surge is attributed to a notable shift from road transport to ferry services, coupled with enhanced capacity on the established Tunisia-France route.

Furthermore, the introduction of a new Egypt-Italy route has significantly contributed to this upward trend. These developments highlight a promising high-growth opportunity within the Mediterranean freight sector, an area where DFDS is strategically investing and actively increasing its market presence.

Green Transition Initiatives

Green Transition Initiatives represent DFDS's strategic push towards sustainability, aiming to significantly cut CO2 emissions. The company has set a target to reduce its CO2 emissions by 45% by 2030, with a long-term goal of achieving climate neutrality by 2050. This involves substantial investment in eco-friendly vessels and the adoption of cleaner energy sources for its operations.

The market for sustainable shipping is experiencing robust growth, driven by increasing environmental awareness and regulatory pressures. DFDS's early and significant investments in green technologies position it to capture a substantial share of this expanding market, establishing leadership in future green logistics solutions.

- CO2 Reduction Target: 45% by 2030.

- Climate Neutrality Goal: By 2050.

- Investment Focus: Green vessels and cleaner energy.

- Market Position: Aiming for leadership in sustainable shipping.

Integrated Logistics Solutions

DFDS's Integrated Logistics Solutions are a key growth driver, moving beyond traditional ferry operations to encompass road transport, warehousing, and port terminal services. This diversification targets the dynamic global logistics market, which saw significant growth in 2024 as companies increasingly focused on supply chain resilience and efficiency. The company's strategic investments in these areas are designed to capture market share in regions benefiting from nearshoring trends.

The expansion into comprehensive logistics services positions DFDS as a strong contender in a sector experiencing robust demand. For instance, the global third-party logistics (3PL) market was projected to reach over $1.3 trillion in 2024, highlighting the substantial opportunity. DFDS's integrated approach allows for greater control and optimization across the entire supply chain, offering a competitive edge.

- Focus on Supply Chain Optimization: DFDS is enhancing its offerings to include road freight, warehousing, and port operations, providing end-to-end logistics.

- High-Growth Market Potential: The logistics sector, particularly in areas influenced by nearshoring, presents significant opportunities for expansion and market penetration.

- Strategic Expansion: Investments in integrated solutions are aimed at capturing a larger share of a growing and evolving logistics landscape.

- Competitive Advantage: By offering a more complete suite of services, DFDS can provide greater efficiency and reliability to its clients.

Stars in the BCG Matrix represent high-growth, high-market-share business units. DFDS's Mediterranean Freight Ferry Volumes, particularly with the new Egypt-Italy route and strong performance on the Tunisia-France route, exemplify this. The Strait of Gibraltar routes, bolstered by the FRS Iberia/Maroc acquisition, also fit this category due to their strategic location and high traffic potential.

These operations are characterized by significant investment and strong potential for future revenue growth. The company's focus on expanding capacity and leveraging new routes in these high-demand areas positions them as Stars, requiring continued investment to maintain their growth trajectory and market leadership.

| Business Unit | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Mediterranean Freight Ferry Volumes | High | High | Star |

| Strait of Gibraltar Ferry Routes | High | High | Star |

What is included in the product

DFDS BCG Matrix analyzes its ferry and logistics services by market share and growth, guiding investment decisions.

DFDS BCG Matrix: A visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

North Sea freight routes are a classic example of DFDS's cash cows. These well-established operations consistently deliver strong revenue and profit, forming a stable foundation for the company.

Despite the mature nature of the market and occasional challenges, such as potential labor disruptions, DFDS maintains a commanding presence. This significant market share translates into predictable and reliable cash flow.

Evidence of their continued strength is clear, with freight volumes on these routes in May 2025 surpassing those recorded in 2024, underscoring their enduring profitability.

DFDS's Channel freight routes are a classic Cash Cow, boasting high volumes and a dominant market position in a well-established, mature sector. These routes are the backbone of the company's revenue generation, consistently delivering substantial financial contributions. For instance, in 2023, DFDS reported that its route between Dover and Calais handled a significant portion of its total freight volume, underscoring its importance.

The strategy for these Cash Cow segments is straightforward: maximize efficiency and milking the existing infrastructure for steady, reliable cash flow. While growth might be modest, the emphasis is on cost control and operational excellence to ensure continued profitability. DFDS continues to invest in modernizing its fleet on these key routes, aiming to improve fuel efficiency and capacity utilization, thereby safeguarding its cash-generating power.

DFDS's established port terminal operations function as classic Cash Cows within their business portfolio. These are mature, well-established assets that generate consistent, high-margin profits with minimal need for further investment.

These terminals are critical infrastructure, supporting the substantial volumes of freight and passenger traffic that DFDS manages. Their foundational role means they don't require significant promotional spending to maintain their market position.

In 2024, DFDS reported strong performance across its ferry and logistics divisions, with port operations being a key contributor to this stability. The company's focus on operational efficiency at its terminals ensures continued robust cash generation.

Baltic Sea Freight Routes

Baltic Sea freight routes represent a classic cash cow for DFDS, reflecting a mature market with consistent demand. In June 2025, freight volumes across these routes held steady, mirroring the performance seen in 2024, which underscores the stability of this segment.

DFDS’s established position in the Baltic Sea signifies a substantial market share. This strong presence translates into reliable and significant cash flow generation, characteristic of a cash cow, though future growth is expected to be modest.

- Stable Freight Volumes: Baltic Sea freight volumes in June 2025 were comparable to 2024 levels, indicating market maturity.

- High Market Share: DFDS benefits from a solid market presence in this region.

- Steady Cash Flow: The mature nature of the routes ensures consistent cash generation for the company.

- Low Growth Prospects: While profitable, these routes are not anticipated to experience significant expansion.

Core European Road Transport Network

DFDS’s core European road transport network is a prime example of a cash cow. This mature and extensive operation consistently generates significant revenue through high-volume, established services across the continent.

Benefiting from economies of scale and long-standing customer relationships, these road transport activities provide a stable and reliable income stream for DFDS. For instance, DFDS reported that its road transport division, which includes its extensive network, contributed significantly to its overall financial performance in 2023, with revenues in the logistics segment showing robust growth.

- Established Network: DFDS operates a mature and extensive road transport network across Europe, facilitating consistent, high-volume services.

- Reliable Cash Generation: This network acts as a dependable cash generator within the company's broader logistics operations.

- Economies of Scale: Operations benefit from significant economies of scale, enhancing profitability.

- Customer Loyalty: Established customer relationships further solidify its position and revenue streams.

DFDS's passenger ferry services, particularly on established routes like Copenhagen-Oslo, function as cash cows. These operations benefit from consistent demand and a mature market, generating predictable revenue streams.

While passenger growth might be modest, the focus is on optimizing capacity and managing costs to ensure sustained profitability. The company's strong brand recognition on these routes further solidifies their cash-generating ability.

In 2024, DFDS saw a steady return of passenger traffic on its key routes, with the Copenhagen-Oslo service demonstrating resilience and consistent financial contribution.

The consistent performance of these passenger routes is crucial, providing a stable base of cash flow that can be reinvested in other areas of the business or returned to shareholders.

| Route | Market Status | Cash Flow Generation | Growth Outlook |

|---|---|---|---|

| North Sea Freight | Mature, High Share | Strong & Stable | Modest |

| Channel Freight | Mature, Dominant | Substantial & Consistent | Low |

| Baltic Sea Freight | Mature, Established | Steady & Reliable | Limited |

| European Road Transport | Mature, Extensive | Significant & Dependable | Moderate |

| Copenhagen-Oslo Passenger | Mature, Consistent Demand | Predictable & Stable | Modest |

Full Transparency, Always

DFDS BCG Matrix

The DFDS BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks or demo content, ensuring you get a professional and ready-to-use strategic tool for analyzing DFDS's business portfolio. You can confidently expect this exact report, meticulously prepared for clarity and actionable insights, to be delivered upon completion of your transaction.

Dogs

The divestment of the Oslo-Frederikshavn-Copenhagen route by DFDS in late 2025 strongly suggests it was classified as a 'Dog' within their BCG Matrix. This strategic exit highlights a situation where the route likely held a minimal market share within a mature or declining market segment, thus no longer fitting DFDS's core growth strategy.

DFDS identified subdued activity in its Logistics Division during Q1 2025, with specific challenges in the Nordic and Continent regions. These operations are currently undergoing turnaround projects, suggesting they may be Dogs in the BCG matrix.

This classification implies that these logistics activities likely possess both low market share and low market growth. Consequently, they are consuming valuable resources without generating satisfactory returns for DFDS.

The Tarifa-Tanger Ville route, a former segment for DFDS, was exited in early June 2025. This decision followed the company losing a crucial tender to continue operations on this particular ferry service.

This strategic move places the Tarifa-Tanger Ville route firmly in the Dogs category of the BCG Matrix. It signifies a business unit with a declining or stagnant market share within a low-growth industry.

The exit indicates that DFDS faced intense competition and was unable to secure the necessary contracts to sustain operations, reflecting a challenging market dynamic.

Passenger Ferry Operations (Overall Adjusted Decline)

While specific profitable passenger routes exist, the overall passenger segment for DFDS experienced adjusted declines in volumes during May and June 2025. Year-to-date figures similarly indicated negative growth, painting a picture of a low-growth market for these services.

This trend suggests that DFDS may be facing challenges in either maintaining or expanding its market share across its passenger ferry operations. The adjusted decline, accounting for any route adjustments, points to a broader market dynamic impacting the company's performance in this area.

- Passenger Volume Trend: Adjusted decline in May and June 2025, with negative year-to-date growth.

- Market Growth: Indicates a low-growth environment for passenger ferry services.

- Market Share: Potential struggles for DFDS to maintain or increase its presence.

- Strategic Implication: Suggests a need to re-evaluate passenger route strategy or focus on cost optimization.

Mediterranean Ferry Operations Facing New Competition

DFDS's Mediterranean ferry operations are currently facing a challenging market. Intensified competition, particularly from Grimaldi, has put significant pressure on earnings. This has resulted in negative earnings for Q4 2024 and Q1 2025, indicating a potential shift towards a 'Dog' category within the BCG matrix if corrective actions are not effective.

The competitive landscape has led to strategic adjustments, including capacity reductions on certain routes. This is a direct consequence of market share erosion, a key indicator of underperformance. The financial impact is stark, with the segment's profitability suffering due to these market dynamics.

- Negative Earnings: Q4 2024 and Q1 2025 saw substantial negative earnings for DFDS's Mediterranean ferry segment.

- Increased Competition: Grimaldi has emerged as a significant competitor, altering the market's dynamics.

- Capacity Reductions: To adapt to the competitive pressures, capacity has been reduced on some Mediterranean routes.

- Market Share Loss: The segment has experienced a loss of market share, a critical factor in its potential 'Dog' classification.

Dogs represent business units with low market share in low-growth markets. DFDS has identified several operations that fit this profile, leading to strategic divestments or intense restructuring efforts. These segments consume resources without yielding significant returns.

The divestment of the Oslo-Frederikshavn-Copenhagen route in late 2025, the exit from the Tarifa-Tanger Ville route in early June 2025, and the ongoing turnaround projects in the Logistics Division all point to DFDS classifying these as Dogs. These areas likely face declining demand or intense competition, making them unattractive for further investment.

The Mediterranean ferry segment, experiencing negative earnings in Q4 2024 and Q1 2025 due to increased competition from Grimaldi, also shows characteristics of a Dog. Capacity reductions and market share erosion are clear indicators of this challenging position.

Similarly, the overall passenger segment saw adjusted declines in volumes during May and June 2025, with negative year-to-date growth, suggesting a low-growth market where maintaining market share is proving difficult.

| Business Unit | Market Share | Market Growth | Strategic Action | Financial Indicator |

|---|---|---|---|---|

| Oslo-Frederikshavn-Copenhagen Route | Low | Declining/Low | Divested (late 2025) | N/A (Divested) |

| Tarifa-Tanger Ville Route | Low | Low | Exited (early June 2025) | N/A (Exited) |

| Nordic & Continent Logistics | Low | Low | Turnaround Project | Subdued Activity (Q1 2025) |

| Mediterranean Ferries | Low | Low | Capacity Reductions | Negative Earnings (Q4 2024, Q1 2025) |

| Overall Passenger Segment | Potentially Low | Low | Re-evaluation/Cost Optimization | Adjusted Decline (May-June 2025) |

Question Marks

Ekol International Transport, now part of DFDS's portfolio, is positioned as a potential Star within the BCG matrix. This segment operates in a high-growth area influenced by nearshoring, a trend that saw significant acceleration in 2024 as companies sought to diversify supply chains. While the acquisition represents a substantial investment in a promising market, the business currently faces a significant negative earnings impact.

The strategic goal for Ekol International Transport is to achieve breakeven by the end of 2025. This objective is crucial given that DFDS is still building its market share in this region. Successfully navigating this transition will be key to unlocking the full potential of this high-growth opportunity.

The new Spain-Netherlands freight route, launched in May 2025, connects Vilagarcía and Rotterdam weekly. This service is designed for industrial clients and project cargo, positioning it as a Question Mark within DFDS's portfolio. While the market shows promise for expansion, the route's current market share is minimal, necessitating significant investment to build awareness and operational capacity.

DFDS's advanced digital innovation initiatives, encompassing investments in new technologies, improved onboard internet, and intelligent operational systems, place it firmly in the question mark category of the BCG matrix. These are areas with high growth potential, yet they currently demand significant capital investment, similar to a company investing heavily in R&D for a new product line. For instance, DFDS has been actively upgrading its ferry fleets with enhanced connectivity solutions, aiming to provide passengers with better internet services, a move that aligns with the growing demand for digital experiences during travel.

Development of Green Vessel Technology and Infrastructure

DFDS's investment in green vessel technology and infrastructure aligns with its ambitious decarbonization goals, positioning these initiatives as high-investment, high-growth opportunities. While immediate returns are uncertain, these pioneering efforts are crucial for building future capabilities and market share in sustainable shipping.

The company is actively developing and deploying new green vessels, such as the recently delivered electric ferry, Flora, which operates on the Copenhagen-Ballebro route. This is complemented by investments in shore power infrastructure at key ports, enabling zero-emission operations at berth. For instance, DFDS has been upgrading its facilities in Copenhagen to accommodate these new technologies.

- High Investment, Uncertain Returns: The development of new green vessel technologies, like battery-electric or methanol-powered ferries, requires substantial capital outlay. For example, the construction of a single large battery-electric ferry can cost tens of millions of euros.

- High Growth Potential: The global push for decarbonization in shipping creates a significant growth market for sustainable solutions. By 2030, the International Maritime Organization (IMO) aims to reduce greenhouse gas emissions from international shipping by at least 20%, driving demand for green technologies.

- Capability Building: DFDS is investing in research and development, as well as partnerships, to acquire expertise in areas like battery management systems, alternative fuel integration, and charging infrastructure. This builds a competitive advantage in a nascent market.

- Market Share in Future Solutions: Early adoption and successful implementation of green technologies allow DFDS to establish a strong market presence and brand reputation in the future of sustainable maritime transport. This can lead to securing long-term contracts and preferential treatment from environmentally conscious customers.

Expansion into New Untapped Geographic Markets

Expansion into new, untapped geographic markets for DFDS aligns with the 'Question Marks' category of the BCG Matrix. This strategy involves venturing into emerging regions where the company is establishing its initial footprint, aiming to secure market share in potentially lucrative but unproven territories.

DFDS's strategic objective is to broaden its operational reach and strengthen its transport network across both established and new European corridors, as well as exploring opportunities beyond the continent. This proactive approach necessitates substantial capital allocation to cultivate demand and establish a competitive advantage in these nascent markets.

- Market Exploration: DFDS actively investigates and enters new geographic regions with the goal of establishing a presence and building routes.

- Investment Requirement: Significant investment is required to penetrate these new markets and build brand recognition and operational capacity.

- Growth Potential: These markets represent potential high-growth opportunities, but their success is not yet guaranteed, reflecting the inherent risk of Question Marks.

- Connectivity Enhancement: The strategy aims to improve overall connectivity by integrating these new markets into DFDS's existing European and international network.

Question Marks in DFDS's portfolio represent areas with high growth potential but currently low market share, requiring significant investment to develop. The new Spain-Netherlands freight route, launched in May 2025, exemplifies this, connecting key industrial hubs but needing substantial investment to build awareness and capacity. Similarly, DFDS's digital innovation initiatives, like enhanced onboard internet, are high-investment, high-potential areas where market share is still being established.

BCG Matrix Data Sources

Our DFDS BCG Matrix is built on comprehensive data, encompassing internal financial reports, customer feedback, operational statistics, and market research to provide a holistic view.