Deloitte & Touche LLP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deloitte & Touche LLP Bundle

Gain a significant advantage with our meticulously crafted PESTLE Analysis for Deloitte & Touche LLP. Uncover how evolving political landscapes, economic fluctuations, and social shifts are redefining the consulting industry and impacting Deloitte's strategic trajectory. Don't get left behind; download the full analysis now to equip yourself with actionable intelligence and fortify your own market position.

Political factors

The stability of government policies and regulatory frameworks is crucial for Deloitte's operations worldwide. For instance, shifts in tax legislation, such as potential corporate tax rate changes in major economies like the United States, can significantly alter the financial planning landscape for Deloitte's clients. The predictability of these regulations directly influences the firm's ability to offer reliable advisory services.

Changes in trade policies also present both opportunities and challenges. As of early 2025, ongoing discussions around digital trade agreements and data localization requirements in regions like the European Union continue to shape how multinational corporations operate and require expert guidance, a core service area for Deloitte.

Political stability within key markets is paramount. A stable political environment, exemplified by consistent governance in countries like Germany or Singapore, fosters a predictable business climate. This predictability allows Deloitte and its clients to invest with greater confidence, knowing that the fundamental rules of engagement are unlikely to change abruptly.

Global trade agreements and the evolving geopolitical landscape directly shape Deloitte's international operations and client interactions. For instance, the continued evolution of trade pacts, such as potential adjustments to agreements like the USMCA or new frameworks emerging from BRICS+ discussions in 2024, can alter the economic footing of multinational clients, influencing their need for advisory services. Trade disputes, like those impacting critical supply chains in the tech or agricultural sectors, can create uncertainty, directly affecting demand for Deloitte's strategic consulting and risk management expertise.

Shifts in global alliances and the emergence of new trade blocs can create both opportunities and challenges for Deloitte's client base. For example, the increasing focus on regional trade agreements, potentially driven by broader geopolitical realignments observed through 2024 and into 2025, can reshape market access and investment flows. This necessitates Deloitte's ability to advise clients on navigating diverse regulatory environments and optimizing cross-border strategies to maintain their competitive edge.

The increasing global emphasis on anti-corruption and enhanced corporate governance significantly boosts demand for Deloitte's core audit and risk advisory services. Governments worldwide are enacting stricter regulations, such as the UK Bribery Act and the US Foreign Corrupt Practices Act, which necessitate robust compliance programs for businesses. For instance, in 2023, enforcement actions related to financial misconduct continued to rise, with penalties reaching billions of dollars, underscoring the critical need for assurance services.

This regulatory environment directly fuels the need for Deloitte's expertise in financial transparency and ethical business practices. Clients are actively seeking assurance on their internal controls and compliance frameworks to mitigate legal and reputational risks. The global fight against corruption, evidenced by organizations like Transparency International reporting persistent challenges in many regions, creates a sustained market for Deloitte's specialized services in fraud detection and prevention.

To maintain its competitive edge, Deloitte must continuously adapt its service offerings to align with evolving global governance standards and regulatory frameworks. Staying abreast of changes in international accounting standards and anti-money laundering directives is paramount. For example, the ongoing implementation of new ESG (Environmental, Social, and Governance) reporting requirements by bodies like the International Sustainability Standards Board (ISSB) presents both challenges and opportunities for advisory firms to guide clients through compliance.

Government Spending and Public Sector Consulting

Government spending priorities directly shape the market for Deloitte's public sector consulting. For instance, the 2024 US federal budget, with its significant allocations towards national defense and infrastructure projects, presents substantial opportunities for advisory services in these areas. Increased government investment in digital modernization, as seen in many G7 nations, also fuels demand for Deloitte's expertise in IT strategy and implementation within public agencies.

Conversely, shifts in fiscal policy can impact engagement levels. Austerity measures, like those implemented by some European governments in response to economic pressures, might lead to reduced public sector spending and, consequently, fewer consulting opportunities. The firm must remain agile, adapting its service offerings to align with evolving government budgetary allocations and strategic objectives.

Key areas of government spending influencing Deloitte's public sector consulting include:

- Infrastructure Development: Major national infrastructure plans, such as the Infrastructure Investment and Jobs Act in the US, drive demand for consulting on project management, financing, and execution.

- Digital Transformation: Government initiatives to modernize IT systems and enhance citizen services create opportunities for cybersecurity, cloud migration, and data analytics consulting.

- Healthcare and Public Health: Investments in public health preparedness and healthcare system improvements, particularly highlighted by recent global health events, open avenues for advisory services in these critical sectors.

- Defense and National Security: Increased defense budgets and evolving security landscapes often necessitate consulting on procurement, technology integration, and operational efficiency within defense ministries.

Political Risk in Emerging Markets

Operating within emerging markets inherently presents Deloitte and its clientele with elevated political risks. These can manifest as sudden policy shifts, governmental instability, or even the specter of asset nationalization, impacting business continuity and investment security. For instance, in 2024, several emerging economies experienced significant political realignments, leading to uncertainty for foreign investors.

Effectively assessing and proactively mitigating these political risks is absolutely crucial for Deloitte to ensure successful client engagements and to safeguard its own strategic interests and investments in these dynamic regions. Failure to do so can lead to significant financial and reputational damage.

A deep comprehension of the specific local political dynamics is paramount for fostering sustainable growth and achieving long-term success. This includes understanding election cycles, regulatory changes, and geopolitical influences that could shape the business environment.

- Geopolitical Instability: Emerging markets often face higher geopolitical tensions, which can disrupt supply chains and investment flows. In 2024, certain regions saw increased conflict, directly impacting business operations and investor confidence.

- Policy Volatility: Governments in emerging economies may enact rapid policy changes, affecting taxation, trade, and foreign investment rules. This unpredictability requires constant monitoring and adaptive strategies.

- Regulatory Uncertainty: The legal and regulatory frameworks in emerging markets can be less established or subject to frequent amendment, creating challenges for compliance and operational planning.

- Nationalization Risk: Although less common, the possibility of governments nationalizing key industries or assets remains a potential concern in some emerging markets, posing a significant threat to private enterprise.

Government policies and regulations are a cornerstone of Deloitte's operational landscape, directly influencing client advisory needs. For instance, changes in corporate tax rates, such as those debated in the US in 2024-2025, significantly impact financial planning. Similarly, evolving trade policies, like adjustments to USMCA or new BRICS+ frameworks, alter market access and demand for strategic consulting.

Political stability is paramount for predictable business environments. Consistent governance in countries like Germany or Singapore allows Deloitte and its clients to invest with confidence. Conversely, geopolitical instability in emerging markets, as seen with regional conflicts impacting supply chains in 2024, heightens political risk and necessitates robust risk management advisory.

Government spending priorities, such as infrastructure investment via the US Infrastructure Investment and Jobs Act, directly fuel Deloitte's public sector consulting. Digital transformation initiatives across G7 nations also create opportunities for IT strategy and cybersecurity services.

The global focus on anti-corruption and corporate governance, reinforced by stricter regulations like the UK Bribery Act, significantly boosts demand for Deloitte's audit and risk advisory services. Rising enforcement actions in 2023, totaling billions in penalties, underscore the critical need for assurance and compliance expertise.

What is included in the product

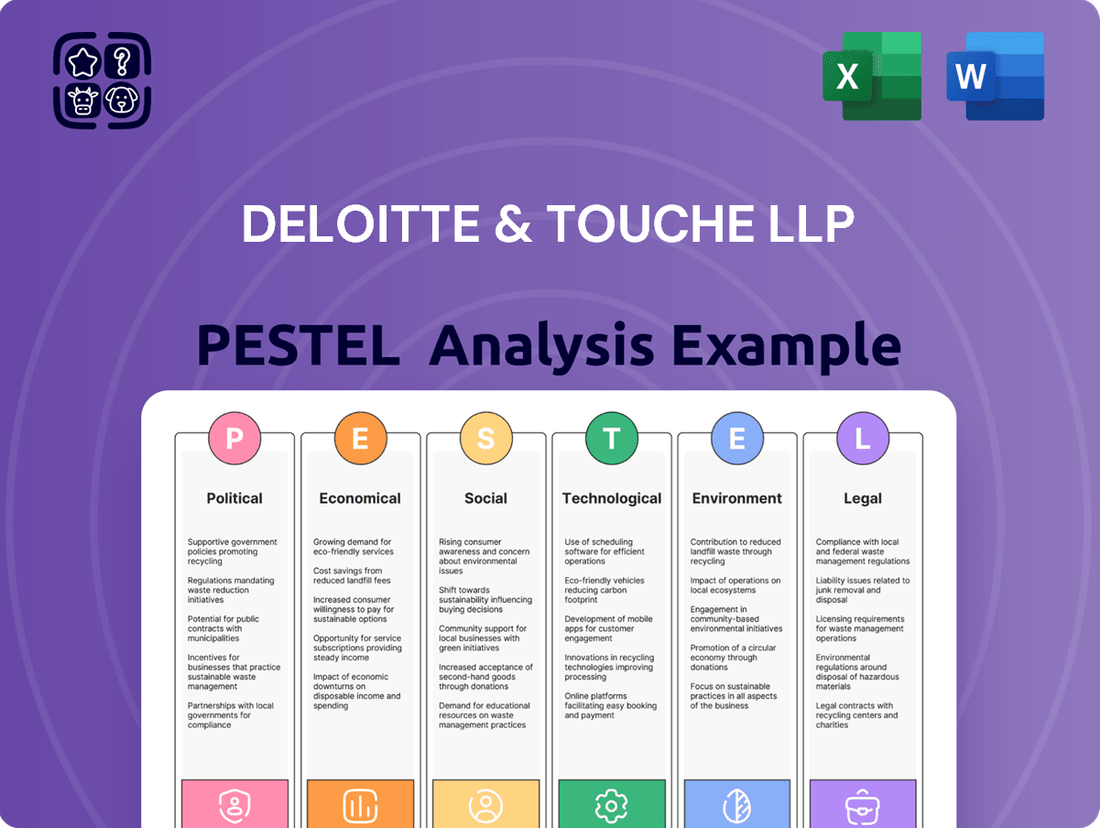

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Deloitte & Touche LLP, providing a comprehensive understanding of its external operating landscape.

Offers a structured framework that simplifies the complex external environment, turning overwhelming data into actionable insights for strategic decision-making.

Economic factors

The global economy's trajectory significantly impacts Deloitte's business. For 2024, the International Monetary Fund (IMF) projected global GDP growth at 3.2%, a slight slowdown from 2023's 3.5%. However, recession risks remain a concern, with some analysts pointing to persistent inflation and geopolitical instability as potential triggers.

Strong economic growth typically translates to increased client spending on consulting services, as businesses look to expand and innovate. For instance, during periods of robust expansion, demand for Deloitte's advisory and transformation services often rises. Conversely, economic downturns can lead to budget constraints and a deferral of non-critical projects, directly affecting revenue.

Deloitte's diversified portfolio of services, spanning audit, tax, consulting, and advisory, provides a degree of resilience against economic cycles. While certain sectors may contract, others, such as cybersecurity or risk management, might see sustained or even increased demand, helping to offset weaknesses elsewhere.

Looking ahead to 2025, projections suggest a modest uptick in global growth, with the IMF anticipating around 3.5%. Nevertheless, the global economic landscape remains dynamic, with ongoing debates about the sustainability of this growth and the potential for unforeseen shocks that could alter the outlook.

Rising inflation, as seen with the US Consumer Price Index (CPI) reaching 3.4% year-over-year in April 2024, directly increases Deloitte's operational expenses, from employee compensation to technology upgrades. Simultaneously, the Federal Reserve's monetary policy, including interest rate adjustments, significantly shapes client behavior. For instance, higher interest rates, which were maintained by the Fed through early 2024, can dampen corporate investment and M&A activity, potentially reducing demand for Deloitte's advisory services.

Fluctuating interest rates also affect the profitability of Deloitte's engagements by influencing clients' ability to fund projects and their overall financial health. A volatile economic environment characterized by persistent inflation and shifting interest rate landscapes can create uncertainty for clients, impacting their willingness to commit to large-scale financial advisory projects. Effectively navigating these economic pressures is crucial for Deloitte’s sustained performance and ability to deliver value.

Currency exchange rate volatility presents a significant challenge for Deloitte, a global professional services firm. Fluctuations in exchange rates directly impact the translation of revenues and expenses earned in foreign currencies into Deloitte's reporting currency, thereby affecting its reported profitability. For instance, a strengthening US dollar against currencies where Deloitte has substantial operations could lead to lower reported revenues when converted.

In 2024 and early 2025, many major currencies have experienced notable swings. The Euro has seen periods of weakness against the US dollar, and the British Pound has also faced headwinds. This makes it crucial for Deloitte to manage its international financial exposures carefully, as these currency movements can create unpredictable impacts on its financial statements.

Moreover, Deloitte's clients, many of whom operate across multiple jurisdictions, also grapple with currency risks. This often leads them to seek Deloitte's specialized advisory services in financial risk management, including hedging strategies and currency exposure analysis, creating a demand for these expert services.

The impact on reported earnings can be substantial; for example, if Deloitte earns a significant portion of its revenue in a currency that depreciates significantly against the dollar, the reported dollar value of that revenue will decrease, impacting overall financial performance metrics. This necessitates robust treasury and financial planning functions within Deloitte to mitigate such risks.

Market Demand for Professional Services

The demand for professional services like audit, consulting, and tax is closely tied to the health of the economy. When businesses are expanding or facing complex challenges, they tend to seek out expert advice. For instance, in 2024, many sectors are navigating inflation and evolving regulatory landscapes, which directly boosts the need for financial advisory and risk management services. This creates opportunities for firms like Deloitte to offer specialized solutions.

Industry-specific trends significantly shape the market for these services. High-growth sectors, such as technology and renewable energy, often require extensive consulting on digital transformation, cybersecurity, and sustainability initiatives. Conversely, industries undergoing disruption, like traditional retail facing e-commerce shifts, may see increased demand for restructuring and strategic planning advice. Deloitte's ability to cater to these varied needs is key to its market position.

Understanding these market dynamics is essential for Deloitte's strategic planning. By tracking economic indicators and sector performance, the firm can better allocate its resources and talent to areas with the highest demand. For example, if the global IT services market is projected to grow by 10% in 2025, as some analysts suggest, Deloitte would strategically invest in expanding its technology consulting capabilities.

The overall market for professional services is robust, with key segments showing strong growth.

- Global consulting market revenue was estimated to reach over $300 billion in 2023 and is projected to continue growing.

- The audit and assurance market remains stable, driven by regulatory compliance and corporate governance needs.

- Demand for digital transformation and cybersecurity consulting is particularly high, with many businesses investing heavily in these areas throughout 2024.

- Tax advisory services are also seeing consistent demand due to complex international tax laws and evolving domestic regulations.

Talent Market Competitiveness and Wage Inflation

The economic climate significantly shapes the talent market's competitiveness, especially for specialized roles crucial to Deloitte's operations. In 2024 and looking into 2025, many sectors are experiencing robust demand for skilled professionals, leading to increased competition for top talent.

Strong economic growth often correlates with rising wage inflation and potential talent shortages, directly impacting operational expenditures. For instance, the U.S. Bureau of Labor Statistics reported that wage growth for professional and business services continued to be a key driver of overall wage increases through early 2024.

- Talent Shortages: Critical skill gaps persist in areas like cybersecurity, data analytics, and AI, driving up demand and compensation for qualified individuals.

- Wage Inflation: Average hourly earnings in the U.S. private sector saw an increase of approximately 4.1% year-over-year by mid-2024, reflecting ongoing inflationary pressures.

- Global Competition: Deloitte faces international competition for talent, requiring competitive compensation packages to attract and retain employees across its global offices.

- Retention Costs: High turnover due to market competitiveness can significantly increase recruitment and training expenses, necessitating strategic investment in employee retention programs.

To effectively navigate this environment, Deloitte must implement strategic compensation and benefits strategies. This includes offering competitive salaries, robust benefits packages, and opportunities for professional development to secure and retain highly sought-after global talent.

The global economic outlook for 2024 and 2025 indicates a mixed but generally positive trend, with projected global GDP growth around 3.2% for 2024, expected to modestly increase to 3.5% in 2025 according to the IMF. Despite this growth, persistent inflation, such as the US CPI at 3.4% in April 2024, and geopolitical tensions continue to pose risks, impacting operational costs and client investment decisions. Fluctuations in currency exchange rates, with notable movements in the Euro and British Pound against the US dollar in early 2025, also present challenges and opportunities for Deloitte's international operations and advisory services.

| Economic Indicator | 2024 Projection | Early 2025 Trend | Impact on Deloitte |

| Global GDP Growth | ~3.2% (IMF) | Projected ~3.5% (IMF) | Influences client spending on services. |

| Inflation (e.g., US CPI) | ~3.4% (April 2024) | Remains a concern, impacting operational costs. | Increases operating expenses, necessitates adjustments in pricing and compensation. |

| Interest Rates | Maintained by Fed through early 2024 | Subject to ongoing policy adjustments | Affects client investment, M&A activity, and project funding. |

| Currency Exchange Rates | Volatile (e.g., EUR, GBP vs USD) | Continued fluctuations observed | Impacts reported revenues and expenses from international operations; drives demand for risk management services. |

Full Version Awaits

Deloitte & Touche LLP PESTLE Analysis

The preview shown here is the exact Deloitte & Touche LLP PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Deloitte & Touche LLP. It provides critical insights to inform strategic decision-making and risk management. You can trust that the detailed information and structured layout you see are precisely what you'll be working with.

Sociological factors

Global demographic shifts are significantly reshaping the workforce. Developed countries are experiencing aging populations, with the average age in the OECD projected to reach 45 by 2050. Conversely, emerging markets like India have a median age of around 28, indicating a large, young workforce entering the job market. These trends directly influence how Deloitte & Touche LLP attracts and manages talent, necessitating strategies that accommodate a multi-generational workforce and address varying skill sets.

Deloitte's talent acquisition strategies must adapt to these demographic realities. For instance, attracting younger talent from emerging economies requires different approaches than retaining experienced professionals in mature markets. Understanding the needs and expectations of a diverse age range, from Gen Z to Baby Boomers, is crucial for building effective teams and fostering an inclusive environment. This also impacts the consulting services Deloitte offers, as clients increasingly seek guidance on managing their own evolving human capital.

Societal shifts are profoundly impacting how companies like Deloitte attract and retain talent, with employees increasingly prioritizing work-life balance and flexibility. A 2024 survey by McKinsey found that 60% of workers consider flexible work options a top priority when choosing an employer, a significant increase from previous years. This evolving expectation means Deloitte must continue to adapt its professional development programs and benefits to align with these demands.

The demand for purpose-driven work is also on the rise. According to a 2025 Deloitte Global Human Capital Trends report, 70% of millennials and Gen Z workers state that an organization's social and environmental impact is a key factor in their employment decisions. Consequently, Deloitte's ability to demonstrate its commitment to corporate social responsibility and ethical practices is crucial for engaging its workforce and attracting new talent.

Embracing hybrid and remote work models is no longer a novelty but a necessity. Research from Gartner in late 2024 indicated that organizations offering hybrid work arrangements saw a 15% higher employee retention rate compared to those with fully in-office policies. Deloitte’s strategic adoption of flexible work arrangements directly addresses these employee expectations, fostering a more engaged and productive professional environment.

Societal movements championing Diversity, Equity, and Inclusion (DEI) are profoundly shaping corporate landscapes, making a strong commitment to these principles essential for brand reputation and securing top talent. For Deloitte, this translates into actively fostering an inclusive internal culture and embedding DEI considerations into client advisory services. This focus is not merely ethical; it’s a strategic imperative.

Deloitte's own DEI efforts are central to its brand. For instance, in 2023, Deloitte reported that 57% of its US workforce identified as female, and 60% identified as racially or ethnically diverse, reflecting significant progress towards representation goals. These figures are vital for attracting and retaining employees who increasingly prioritize inclusive workplaces.

Furthermore, clients are actively seeking Deloitte's expertise to navigate and implement their own DEI strategies. This demand presents a substantial growth opportunity for the firm, as businesses recognize the link between DEI, innovation, and market competitiveness. Deloitte’s ability to provide actionable DEI solutions is a key differentiator in the consulting market, with many organizations investing heavily in this area to meet stakeholder expectations and drive business outcomes.

Consumer and Business Trust in Institutions

Societal trust in large corporations and professional service firms like Deloitte & Touche LLP is a cornerstone sociological factor. Recent surveys indicate a nuanced view; for instance, a 2024 Edelman Trust Barometer report found that while trust in business generally remains higher than in government, specific events can cause significant shifts. High-profile corporate scandals or ethical lapses, such as those seen in past financial reporting irregularities at various companies, can swiftly erode public confidence, directly impacting Deloitte's reputation and its ability to attract and retain clients.

Maintaining unwavering transparency, ethical conduct, and integrity is therefore not merely a best practice but an existential imperative for Deloitte. A 2025 study by PwC on stakeholder expectations highlighted that over 70% of investors consider a firm's ethical track record as a key factor in their investment decisions. This emphasis on trustworthiness underpins Deloitte's client relationships and its overall market standing.

The firm's commitment to these principles is crucial for its long-term success.

- Erosion of trust: Past corporate malfeasance can significantly damage public perception of professional services firms.

- Client relationships: Trust is a direct determinant of the strength and longevity of client engagements.

- Stakeholder expectations: Investors and the public increasingly prioritize ethical behavior and transparency.

- Reputational capital: Deloitte's brand value is intrinsically linked to its perceived integrity.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporations to actively engage in Corporate Social Responsibility (CSR) are significantly shaping how Deloitte & Touche LLP is perceived and interacts with its clients. There's a palpable shift towards valuing businesses that demonstrably contribute to societal well-being and environmental sustainability. For instance, in 2024, a significant majority of consumers, around 70%, indicated that they consider a company's CSR practices when making purchasing decisions, directly impacting brand loyalty and reputation.

Deloitte's own engagement in sustainability, ethical sourcing, and community outreach directly influences its brand image. Clients are increasingly seeking advisory services not just on financial matters, but also on how to build and implement effective CSR strategies. This trend is amplified by the growing awareness of climate change and social equity issues, making robust CSR a competitive differentiator.

The demand for expert guidance in CSR is evident in the market. Deloitte's clients, particularly those in the Fortune 500, are allocating substantial budgets towards sustainability reporting and impact initiatives. Reports from 2024 indicate that over 85% of these large corporations now have dedicated CSR departments or teams, underscoring the need for specialized consulting services.

- Growing Consumer Demand: In 2024, approximately 70% of consumers reported that CSR practices influence their purchasing choices, highlighting its impact on brand perception.

- Client Advisory Needs: A significant portion of Deloitte's clients, especially large enterprises, are actively seeking assistance in developing and executing their CSR strategies.

- Sustainability Integration: The emphasis on sustainability and ethical operations is no longer optional; it's a core expectation influencing business partnerships and client selection.

- Market Trend: By mid-2025, it's projected that over 90% of large corporations will have formal CSR programs, increasing the demand for consulting in this area.

Societal expectations regarding work-life balance and flexibility continue to evolve, impacting talent attraction and retention strategies for firms like Deloitte. In 2024, a significant 60% of workers identified flexible work options as a top priority, a trend that necessitates ongoing adaptation of professional development and benefits packages. Furthermore, the drive for purpose-driven work is paramount, with Deloitte's 2025 Global Human Capital Trends report indicating that 70% of younger workers consider an organization's social and environmental impact when choosing an employer.

The increasing emphasis on Diversity, Equity, and Inclusion (DEI) is a critical sociological factor. Deloitte's commitment to DEI is not only ethical but strategic, with 2023 data showing 57% of its US workforce identifying as female and 60% as racially or ethnically diverse. This focus is crucial for attracting talent and meets a growing client demand for DEI advisory services, presenting a significant market opportunity.

Societal trust in professional services firms is directly linked to ethical conduct and transparency. A 2024 Edelman Trust Barometer report highlighted that while trust in business is generally high, specific events can cause rapid erosion. Consequently, Deloitte's adherence to integrity is vital, especially as a 2025 PwC study revealed that over 70% of investors consider a firm's ethical track record in their decisions.

Technological factors

The swift progress in Artificial Intelligence and automation is fundamentally reshaping how professional services, including those at Deloitte, are executed. This impacts everything from intricate data analysis in audits to sophisticated predictive modeling in consulting engagements.

Deloitte is actively integrating AI and automation to boost efficiency and accuracy, offering clients more profound insights. For instance, their Audit & Assurance practice utilizes AI-powered tools to analyze larger datasets more effectively, identifying anomalies that might escape human review.

These technological advancements not only improve existing service delivery but also open up entirely new avenues for business. Deloitte is developing new service lines focused on helping clients implement AI strategies and navigate the complexities of this evolving landscape.

By 2025, the global AI market is projected to reach hundreds of billions of dollars, highlighting the immense opportunity and necessity for firms like Deloitte to stay at the forefront of these innovations to maintain a competitive edge.

Cybersecurity threats are becoming increasingly sophisticated, demanding constant upgrades to protective technologies and skilled personnel. For Deloitte, safeguarding sensitive client information is paramount, requiring substantial and ongoing investment in advanced cybersecurity measures.

In 2023, global cybercrime costs were projected to reach $8 trillion annually, a figure expected to climb. Deloitte not only fortifies its own defenses but also guides clients through the complex landscape of data privacy regulations and cybersecurity best practices, turning a critical risk into a significant service revenue stream.

The pervasive adoption of cloud computing continues to reshape business operations, directly fueling demand for Deloitte's specialized advisory and implementation services. This digital transformation is no longer a niche trend but a fundamental shift impacting nearly every sector.

Deloitte not only utilizes cloud technologies internally to enhance its own operational efficiency but also actively guides clients through complex cloud migrations and optimization strategies. For instance, by mid-2024, a significant majority of companies surveyed by a leading tech analyst firm indicated that cloud migration was a top priority for their digital transformation efforts.

This ongoing digital evolution, characterized by increased reliance on cloud infrastructure, presents a robust opportunity for Deloitte to expand its market share in cloud consulting. The market for cloud computing services, estimated to reach over $1 trillion globally by 2025, underscores the immense potential and the critical role Deloitte plays in facilitating this transition for its clients.

Data Analytics and Business Intelligence Tools

The increasing availability of big data and sophisticated business intelligence tools significantly enhances Deloitte's capacity to deliver data-driven insights and strategic advice to its clients. These advancements allow for deeper analysis of complex datasets, leading to more precise and impactful recommendations.

Deloitte's commitment to investing in cutting-edge analytics platforms and nurturing data science expertise is paramount for its competitive positioning. For instance, the global market for business analytics and big data was projected to reach over $300 billion in 2024, underscoring the strategic importance of these capabilities. By leveraging these tools, Deloitte can offer more tailored and effective solutions, thereby maximizing client value.

- Enhanced Client Solutions: Advanced analytics enable Deloitte to uncover hidden patterns and trends, facilitating more targeted and effective business strategies for clients.

- Competitive Advantage: Investment in data science and analytics platforms allows Deloitte to differentiate its service offerings and maintain a leadership position in the consulting industry.

- Data-Driven Decision Making: The proliferation of these tools empowers both Deloitte and its clients to make more informed, evidence-based decisions.

- Market Growth: The significant growth in the business analytics market indicates a strong demand for the data-centric services Deloitte provides.

Emerging Technologies (e.g., Blockchain, IoT, Quantum Computing)

Deloitte's ability to monitor and understand emerging technologies such as blockchain, the Internet of Things (IoT), and quantum computing is crucial for anticipating evolving client needs and crafting forward-thinking service solutions. While many of these technologies are still in their early stages, their potential to reshape industries necessitates diligent research and development efforts. This proactive approach ensures Deloitte can effectively guide clients in future-proofing their operations and maintaining a competitive edge.

The firm's investment in understanding these technological shifts positions it as a key innovator, capable of advising clients on the strategic integration of advanced technologies. For example, the global IoT market was projected to reach over $1.1 trillion in 2024, highlighting the significant opportunities and challenges for businesses across sectors. Deloitte’s expertise in this area allows them to help clients navigate the complexities of data management, security, and analytics inherent in IoT deployments.

- Blockchain Adoption: Deloitte’s 2023 Global Blockchain Survey indicated that 73% of executives believe blockchain will be a critical technology for their organization in the next three years, signaling a strong demand for related advisory services.

- IoT Market Growth: The global IoT market is expected to grow substantially, with an estimated 29.7 billion connected devices by 2030, presenting a vast landscape for Deloitte to offer consulting on strategy, implementation, and security.

- Quantum Computing Potential: While still nascent, quantum computing promises to revolutionize areas like drug discovery and financial modeling. Deloitte's early engagement in this field is vital for advising clients on potential future disruptions and opportunities.

- Digital Transformation Services: Deloitte's ability to integrate insights from these emerging technologies into its digital transformation services provides clients with a comprehensive roadmap for innovation and competitive advantage.

The rapid integration of AI and automation is transforming professional services, with Deloitte leveraging these technologies for enhanced data analysis and predictive modeling, boosting efficiency and client insights.

The escalating sophistication of cybersecurity threats necessitates continuous technological upgrades and skilled personnel, driving substantial investment in advanced protective measures for Deloitte and its clients.

Cloud computing's widespread adoption fuels demand for Deloitte's advisory services, as businesses prioritize cloud migration for digital transformation, with the cloud market poised for significant growth.

The availability of big data and business intelligence tools empowers Deloitte to deliver data-driven insights, capitalizing on a market projected for substantial expansion.

| Technological Factor | 2024/2025 Data/Projection | Impact on Deloitte |

| AI & Automation Market | Projected to reach hundreds of billions of dollars globally. | Enhances service delivery, creates new business lines. |

| Global Cybercrime Costs | Projected to reach $8 trillion annually (and climbing). | Drives investment in cybersecurity, creates service revenue. |

| Cloud Computing Services Market | Estimated to exceed $1 trillion globally by 2025. | Expands market share in cloud consulting. |

| Business Analytics & Big Data Market | Projected to exceed $300 billion in 2024. | Strengthens data-driven insights and strategic advice. |

| Global IoT Market | Projected to exceed $1.1 trillion in 2024. | Facilitates consulting on IoT strategy, implementation, and security. |

Legal factors

Deloitte & Touche LLP, like all major accounting firms, operates under a stringent and constantly evolving legal landscape. Regulations such as the Sarbanes-Oxley Act of 2002 (SOX) in the US, International Financial Reporting Standards (IFRS), and various local Generally Accepted Accounting Principles (GAAP) are the bedrock of their audit and assurance services. For instance, in 2023, the PCAOB, which oversees audits of public companies in the US, continued to emphasize robust internal controls and auditor independence, reflecting the ongoing impact of SOX.

Adherence to these complex rules isn't merely a formality; it's a critical business imperative. Failure to comply can result in significant financial penalties, legal sanctions, and, perhaps more damagingly, a severe blow to the firm's reputation and client trust. The need for continuous adaptation means Deloitte must invest heavily in updating its auditing methodologies and providing ongoing training to its professionals to ensure they are current with the latest standards and interpretations.

The expanding web of global data privacy laws, like the EU's GDPR and California's CCPA, directly shapes how Deloitte manages sensitive client and employee information. These regulations, with GDPR imposing fines up to 4% of global annual turnover for breaches, necessitate robust data protection strategies.

Deloitte's commitment to legal compliance in this domain is paramount, influencing its internal operations and service delivery. The firm actively assists clients in understanding and meeting their own complex data privacy responsibilities.

Navigating these evolving legal requirements, including upcoming privacy legislation in various jurisdictions throughout 2024 and 2025, represents a significant operational and strategic focus for Deloitte's advisory services.

Tax laws are intricate and constantly shifting. For Deloitte, this means staying ahead of changes is crucial, especially with international tax reform like the Base Erosion and Profit Shifting (BEPS) 2.0 initiative. These reforms, impacting global corporate structures and profit allocation, directly shape the demand for Deloitte's tax advisory services.

In 2024, the complexity of tax regulations, including evolving digital services taxes and transfer pricing rules, presents both challenges and opportunities for firms like Deloitte. Companies are actively seeking guidance to navigate these complexities, ensuring compliance and optimizing their tax positions across various jurisdictions. Deloitte’s tax practice, a significant revenue generator, thrives on this need for expert interpretation and strategic planning.

The global tax landscape continues to evolve, with a growing emphasis on transparency and fair taxation. Deloitte's ability to offer cutting-edge advice on international tax reforms, such as the OECD's Pillar Two rules which aim for a global minimum tax rate of 15%, directly impacts its client relationships and service offerings. This area remains a core strength and a key driver of growth.

Professional Liability and Litigation Risks

Deloitte & Touche LLP, like all major professional services firms, navigates significant professional liability and litigation risks. These arise from the nature of its advisory and assurance services, where errors or perceived negligence can lead to substantial claims. For instance, in 2023, the financial services sector saw continued scrutiny on audit quality, with regulatory bodies like the PCAOB issuing reports highlighting deficiencies. While specific litigation figures for Deloitte are not publicly itemized in detail, the broader accounting industry faces billions in potential claims annually.

To mitigate these exposures, Deloitte implements comprehensive risk management strategies and adheres strictly to evolving professional standards set by bodies like the AICPA and the International Auditing and Assurance Standards Board (IAASB). The firm also maintains substantial professional indemnity insurance coverage, a common practice in the industry to protect against financial fallout from legal actions. In 2024, the focus on corporate governance and ESG reporting is likely to introduce new areas of potential litigation if advisory services in these domains are found to be inadequate.

- Audit quality remains a key focus for regulators, with potential for claims arising from perceived failures in identifying financial misstatements.

- The increasing complexity of financial instruments and transactions heightens the risk of litigation stemming from advisory services.

- Professional indemnity insurance is critical, with premiums reflecting the overall litigation landscape for large accounting firms.

- New regulatory requirements, such as those related to data privacy and cybersecurity, introduce novel areas of professional liability.

Anti-Trust and Competition Laws

Deloitte & Touche LLP, as a major player in the professional services sector, operates under stringent anti-trust and competition laws across all its global markets. These regulations are designed to foster a level playing field, preventing monopolistic practices and ensuring that market dynamics are driven by genuine competition rather than undue influence. For Deloitte, this means careful navigation of rules concerning market share, pricing strategies, and potential mergers or acquisitions to avoid antitrust scrutiny.

Compliance with these laws is not merely a legal obligation but a strategic imperative. Failure to adhere can result in significant fines, reputational damage, and operational disruptions. For instance, the European Union's competition authorities have historically scrutinized large professional services firms for potential anticompetitive behavior. In 2024, the ongoing regulatory focus on market concentration in professional services highlights the critical need for firms like Deloitte to demonstrate fair competition in their service offerings and market expansion strategies.

- Regulatory Scrutiny: Competition authorities worldwide, including the US Federal Trade Commission (FTC) and the European Commission, actively monitor the professional services market for potential antitrust violations.

- Merger Control: Deloitte's proposed acquisitions or mergers must undergo rigorous review to ensure they do not substantially lessen competition or create a dominant market position.

- Service Bundling: Practices related to how Deloitte bundles its audit, consulting, and advisory services are subject to competition law to prevent leveraging dominance in one area to gain an unfair advantage in another.

- Market Share Impact: Given Deloitte's significant global market share, its business practices are under constant observation to ensure they do not stifle smaller competitors or limit consumer choice.

The legal framework governing Deloitte & Touche LLP is extensive, encompassing audit regulations like the Sarbanes-Oxley Act and global accounting standards such as IFRS. Data privacy laws, including GDPR and CCPA, are critical, with GDPR fines potentially reaching 4% of global annual turnover, influencing how Deloitte handles sensitive data in 2024 and beyond.

Tax legislation, particularly international reforms like BEPS 2.0 and the OECD's Pillar Two initiative for a 15% global minimum tax, significantly impacts Deloitte's advisory services. Staying abreast of evolving digital services taxes and transfer pricing rules is essential for compliance and client guidance.

Professional liability is a constant concern, with regulatory bodies like the PCAOB scrutinizing audit quality. New areas of liability are emerging from ESG reporting and cybersecurity advisory services, necessitating robust risk management and professional indemnity insurance.

Antitrust and competition laws worldwide dictate how Deloitte operates, particularly concerning market share, pricing, and mergers. Regulatory bodies actively monitor the professional services market to prevent anticompetitive practices, ensuring fair competition in 2024.

Environmental factors

The escalating global focus on climate change compels Deloitte to actively manage and reduce its carbon footprint. This involves scrutinizing emissions from essential business travel and daily office operations, aiming for significant reductions by 2025.

Companies like Deloitte are increasingly expected by clients and the public to showcase genuine commitment to environmental sustainability. This commitment is not just about corporate responsibility; it's becoming a core business driver.

This emphasis on sustainability directly fuels demand for Deloitte's expertise. Clients are actively seeking advisory services to navigate climate-related risks and develop effective decarbonization strategies, creating a significant market opportunity.

For instance, the global market for climate change consulting services was projected to reach $13.1 billion in 2024 and is expected to grow to $21.1 billion by 2029, highlighting the immense potential for firms like Deloitte.

The push for detailed Environmental, Social, and Governance (ESG) reporting is intensifying, affecting how companies like Deloitte operate and the services they offer clients. This growing demand for transparency in ESG practices means more businesses need help understanding and implementing these disclosures.

New regulations, such as the EU's Corporate Sustainability Reporting Directive (CSRD), which fully applies from 2024 for large companies, and the SEC's proposed climate disclosure rules, are creating a significant market for assurance and advisory services. For instance, a 2024 report indicated that over 70% of investors consider ESG factors in their investment decisions.

Deloitte's ability to provide expert guidance on navigating these evolving ESG frameworks, including standards from the International Sustainability Standards Board (ISSB), is therefore critical. Keeping pace with these changes ensures Deloitte can effectively support clients in meeting their sustainability reporting obligations and investor expectations.

Growing concerns over the availability of essential resources like water and critical minerals are fundamentally reshaping business strategies. This scarcity is driving a significant shift towards circular economy principles, where businesses aim to reuse and regenerate materials rather than relying on linear consumption models. For instance, the global demand for critical minerals, vital for technologies like electric vehicles and renewable energy, is projected to increase significantly; by 2030, demand for lithium could surge by over 400%, and cobalt by over 60% compared to 2020 levels, according to the International Energy Agency.

Deloitte actively guides its clients through this transition, focusing on optimizing resource utilization and building more resilient supply chains. This includes advising on the adoption of circular business models that minimize waste and maximize the value of products and materials throughout their lifecycle. Internally, Deloitte is also committed to reducing its own environmental footprint, implementing measures to minimize resource consumption across its global operations.

Environmental Compliance and Risk Management

Environmental compliance and risk management are increasingly critical for businesses, driving demand for specialized advisory services. Deloitte assists clients in understanding and adhering to stringent environmental regulations, a trend that saw global spending on environmental consulting services reach an estimated $50 billion in 2024, a figure projected to grow by 5-7% annually through 2027.

Deloitte's role involves helping organizations identify and manage environmental liabilities, such as contaminated land or emissions violations, and developing strategies to mitigate these risks. This focus reflects a broader market shift where sustainability and environmental stewardship are becoming core to business operations and investor relations.

- Regulatory Landscape: Businesses face evolving environmental laws concerning carbon emissions, waste management, and water usage, necessitating expert guidance.

- Risk Assessment: Deloitte aids in evaluating potential environmental hazards and their financial implications, including fines, remediation costs, and reputational damage.

- Strategic Mitigation: The firm develops tailored strategies for clients to improve environmental performance, ensure compliance, and build resilience against environmental shocks.

- Growing Demand: The environmental advisory segment is a significant growth area for professional services firms like Deloitte, reflecting its strategic importance to corporate clients.

Stakeholder Pressure for Corporate Environmental Responsibility

Stakeholder pressure is significantly shaping corporate environmental responsibility, influencing how companies like Deloitte operate. Investors, increasingly focused on Environmental, Social, and Governance (ESG) criteria, are driving demand for sustainable practices. For instance, in early 2024, sustainable investment funds continued to see robust inflows, with global sustainable fund assets projected to surpass $50 trillion by 2025, according to various market analyses. This financial leverage means companies must demonstrate genuine commitment to environmental stewardship to attract and retain capital.

Employees and customers are also vocal advocates for environmental action. A 2024 survey indicated that over 70% of consumers consider a company's environmental impact when making purchasing decisions. Similarly, a significant portion of the workforce, especially younger generations, prioritizes working for organizations with strong environmental values. This sentiment directly impacts Deloitte's ability to attract top talent and maintain strong client relationships, as its brand is intrinsically linked to its perceived commitment to sustainability.

Public perception of Deloitte's environmental stewardship is a critical factor. Proactive environmental initiatives, such as reducing its carbon footprint and investing in renewable energy, not only mitigate environmental risks but also bolster its reputation. Companies that actively engage in environmental responsibility often see improved brand loyalty and a competitive edge. For example, many leading professional services firms are setting ambitious net-zero targets, with some aiming for 2030 or earlier, a trend Deloitte is likely aligning with to meet stakeholder expectations.

The impact of stakeholder pressure can be seen in several key areas:

- Investor Demand: Growing ESG investment mandates mean companies must report transparently on environmental performance to secure funding.

- Consumer Behavior: A majority of consumers now factor environmental considerations into their purchasing choices, impacting brand loyalty and market share.

- Talent Acquisition: A strong environmental record is becoming a significant differentiator in attracting and retaining skilled employees.

- Reputation Management: Demonstrating environmental responsibility enhances a company's brand image and builds trust with the public and clients.

Environmental factors are increasingly shaping business strategies, driven by escalating climate concerns and resource scarcity. Deloitte is actively engaged in guiding clients through these shifts, focusing on decarbonization and circular economy principles, which are creating significant market opportunities for its advisory services.

The demand for ESG reporting and compliance with new regulations like the EU's CSRD is creating a substantial market for Deloitte's expertise. These environmental pressures necessitate expert guidance, driving growth in environmental consulting services, which saw global spending reach an estimated $50 billion in 2024.

Stakeholder pressure, particularly from investors and consumers prioritizing sustainability, is a key driver for corporate environmental responsibility. This trend influences brand loyalty, talent acquisition, and the need for transparent reporting on environmental performance, making proactive environmental initiatives crucial for firms like Deloitte.

| Area | 2024 Data/Projections | Impact on Deloitte |

|---|---|---|

| Climate Change Consulting Market | Projected $13.1 billion in 2024, growing to $21.1 billion by 2029 | Direct revenue growth opportunity for advisory services |

| Environmental Consulting Services Spending | Estimated $50 billion in 2024, with 5-7% annual growth through 2027 | Increased demand for compliance and risk management advisory |

| Sustainable Investment Assets | Projected to surpass $50 trillion by 2025 | Drives client need for robust ESG reporting and strategy |

| Consumer Prioritization of Environmental Impact | Over 70% consider environmental impact in purchasing decisions (2024 survey) | Enhances brand value for Deloitte through strong sustainability commitment |

PESTLE Analysis Data Sources

Our PESTLE Analysis is grounded in comprehensive data from respected global organizations like the World Bank and IMF, alongside national government publications and leading market research firms. This ensures a robust understanding of political, economic, social, technological, environmental, and legal landscapes.