Deloitte & Touche LLP Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deloitte & Touche LLP Bundle

Deloitte & Touche LLP's Business Model Canvas lays out a powerful framework for professional services. It details how they attract diverse client segments with tailored value propositions, leveraging key partnerships and resources. This comprehensive view uncovers their revenue streams and cost structures, offering a strategic blueprint.

Want to understand the engine behind Deloitte & Touche LLP's success? Our full Business Model Canvas provides an in-depth look at their customer relationships, channels, and core activities. It's an essential tool for anyone looking to replicate their market dominance.

Unlock the strategic secrets of Deloitte & Touche LLP with our complete Business Model Canvas. This downloadable resource meticulously outlines their value creation, key resources, and competitive advantages, perfect for strategic analysis and business development.

Partnerships

Deloitte & Touche LLP strategically partners with major technology players such as Amazon Web Services (AWS), NVIDIA, Genesys, and CleverTap. These alliances are crucial for embedding cutting-edge capabilities, including Generative AI, advanced cloud infrastructure, and robust cybersecurity, directly into Deloitte's professional services. For example, in 2024, the demand for cloud migration services, a core offering enhanced by AWS partnerships, saw significant growth, with many enterprises accelerating their cloud adoption strategies to leverage scalability and innovation.

Deloitte & Touche LLP actively partners with academic and research institutions, fostering innovation and thought leadership. Collaborations with universities like the University of Michigan are crucial for developing cutting-edge insights and technologies, especially in rapidly evolving fields such as autonomous vehicles and talent mobility.

These partnerships are not just about research; they also help Deloitte stay at the forefront of emerging trends and acquire specialized knowledge. For instance, in 2024, Deloitte continued to invest in research initiatives focused on AI ethics and sustainable business practices, often drawing on academic expertise.

By engaging with universities, Deloitte gains access to a pipeline of future talent and fresh perspectives, which is vital for maintaining its competitive edge. This academic synergy directly supports Deloitte's commitment to delivering innovative solutions to its clients.

Deloitte actively partners with numerous industry associations, such as the Financial Accounting Standards Board (FASB) and the International Federation of Accountants (IFAC), to influence market trends and tackle sector-specific issues. This engagement allows Deloitte to remain ahead of shifting business environments and regulatory updates, ensuring their advisory services are always relevant.

Public Sector Entities and NGOs

Deloitte & Touche LLP actively collaborates with public sector entities and non-governmental organizations, such as the International Olympic Committee (IOC) and the International Paralympic Committee (IPC). These partnerships underscore Deloitte's dedication to societal impact and sustainability efforts.

Through these alliances, Deloitte leverages its consulting prowess to address complex challenges and drive positive outcomes for the broader public good. For instance, in 2023, Deloitte's work with various governments focused on digital transformation initiatives, aiming to improve public service delivery and efficiency.

- Public Sector Collaboration: Partnerships with governments to enhance public service delivery and efficiency through technology adoption.

- NGO Engagement: Working with NGOs on sustainability reporting and impact measurement frameworks.

- Societal Impact Focus: Applying consulting expertise to address critical societal challenges, often pro bono or at reduced rates.

- Event Support: Providing advisory services for major international sporting events, contributing to their operational success and legacy.

Niche Solution Providers and Start-ups

Deloitte actively partners with niche solution providers and innovative startups to enhance its offerings. For instance, collaborations with firms like Ardoq for enterprise architecture and May Mobility in the autonomous transportation sector demonstrate a strategic approach to integrating specialized expertise.

These alliances are crucial for Deloitte to broaden its service capabilities and effectively address the evolving, highly specific demands of its clientele. By leveraging the agility and innovation of these partners, Deloitte can deliver cutting-edge solutions that might otherwise be outside its core competencies.

- Integration of Specialized Technologies: Deloitte integrates technologies from partners like Ardoq to provide advanced enterprise architecture solutions.

- Addressing Emerging Markets: Collaborations, such as with May Mobility, allow Deloitte to offer expertise in rapidly developing fields like autonomous transportation.

- Portfolio Expansion: These partnerships enable Deloitte to expand its service portfolio, offering clients a more comprehensive suite of specialized services.

- Client-Centric Innovation: The focus is on bringing focused, innovative solutions to specific client challenges, driven by the unique strengths of each partnership.

Deloitte's key partnerships extend to financial institutions and regulatory bodies, ensuring compliance and shaping industry standards.

Collaborations with entities like the Securities and Exchange Commission (SEC) and various central banks are vital for staying abreast of financial regulations and market dynamics, as seen in Deloitte's 2024 advisory roles on evolving ESG reporting standards.

| Partner Type | Key Partners | Strategic Benefit | 2024 Focus Area |

|---|---|---|---|

| Technology Providers | AWS, NVIDIA, Genesys | Embedding advanced capabilities (AI, Cloud) | Accelerated cloud migration demand |

| Academic Institutions | University of Michigan | Innovation, thought leadership, talent pipeline | AI ethics and talent mobility research |

| Industry Associations | FASB, IFAC | Influencing trends, regulatory adherence | Adapting to shifting business environments |

| Public Sector/NGOs | IOC, IPC, Governments | Societal impact, digital transformation | Improving public service efficiency |

| Niche Solution Providers | Ardoq, May Mobility | Expanding service offerings, specialized expertise | Enterprise architecture, autonomous transport |

What is included in the product

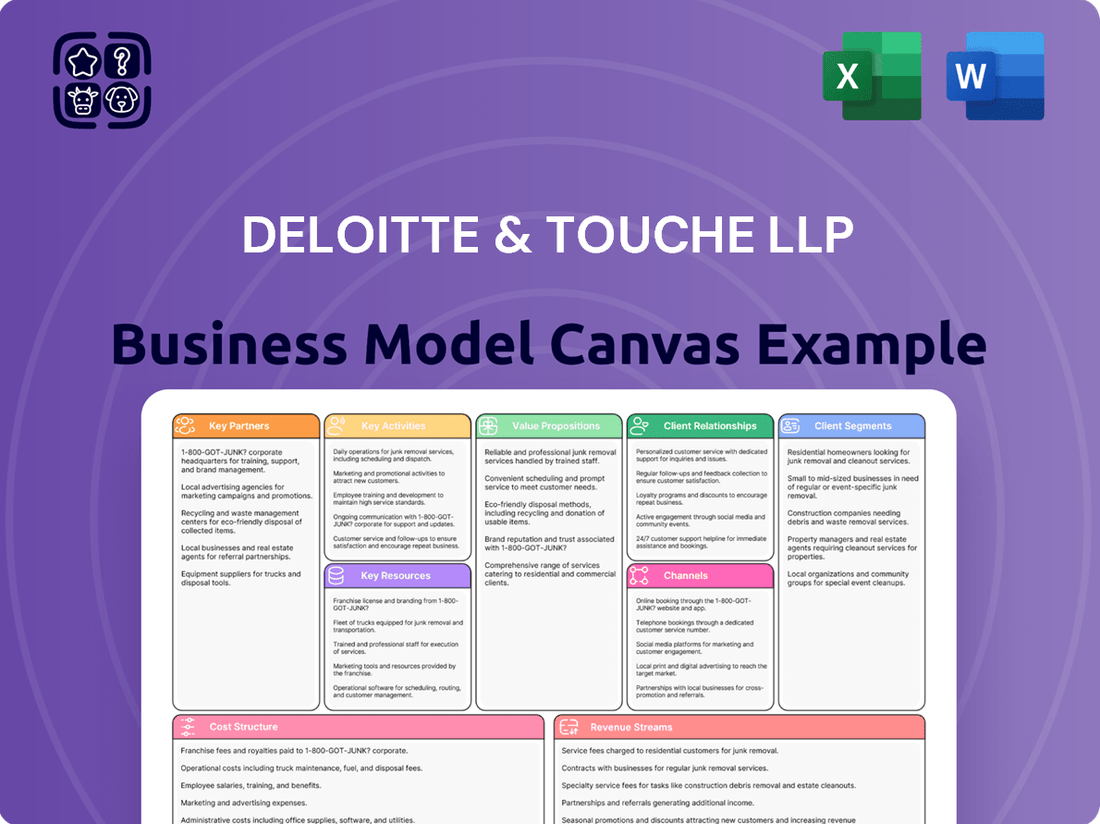

A detailed Deloitte & Touche LLP Business Model Canvas outlining their professional services across various customer segments, emphasizing their value propositions through diverse channels and revenue streams.

This model reflects Deloitte's operational strategy, showcasing key resources and activities that drive their competitive advantage in the consulting and assurance market.

Deloitte & Touche LLP's Business Model Canvas offers a structured, visual tool that simplifies complex strategic planning, alleviating the pain of disjointed or overwhelming business analysis for effective decision-making.

Activities

Deloitte's core activities revolve around delivering a comprehensive suite of professional services. These include meticulous audit and assurance, strategic consulting, insightful financial advisory, robust risk advisory, and expert tax and legal services.

These services are not siloed but are instead integrated through a multidisciplinary approach. This allows Deloitte to tackle multifaceted client challenges across a wide array of industries, offering holistic solutions.

For instance, in fiscal year 2023, Deloitte announced global revenues of $64.9 billion, underscoring the significant demand for its diverse service offerings. This growth reflects the firm's ability to adapt and provide value in a dynamic economic landscape.

The firm's commitment to addressing complex client needs is evident in its continued investment in technology and talent, ensuring the delivery of high-quality, impactful professional services that drive client success.

Deloitte & Touche LLP dedicates substantial resources to innovation and technology development. In 2024, the firm continued its significant investment in research and development, focusing on areas like Generative AI, advanced digital platforms, and robust cybersecurity solutions.

This commitment ensures Deloitte stays ahead of technological curves, enabling the creation of cutting-edge solutions for clients. Key digital platforms such as Deloitte Omnia, Deloitte Levvia, and Deloitte Ascend™ are central to this strategy, driving efficiency and new service offerings.

The emphasis on these technologies is crucial for maintaining a competitive edge. For instance, the firm's advancements in AI are designed to enhance audit quality, data analytics, and client advisory services, reflecting a strategic push into next-generation capabilities.

Deloitte & Touche LLP's key activities center on its people, with significant investment in talent acquisition, development, and retention. This includes robust recruitment efforts to bring in fresh perspectives and specialized skills. For instance, in fiscal year 2023, Deloitte globally hired over 100,000 people, underscoring its commitment to growth and talent pipeline development.

Upskilling is paramount, especially in emerging fields like Generative AI. Deloitte is actively training its professionals in these advanced technologies to ensure they can provide cutting-edge solutions to clients. This focus on continuous learning is crucial for maintaining a competitive edge in the rapidly evolving professional services landscape.

Fostering a supportive culture is equally vital. Deloitte emphasizes trust, well-being, and professional growth to retain its top talent. This commitment to employee well-being and development is a core strategy to ensure the firm possesses the highly skilled human capital necessary to deliver exceptional service quality and drive business success.

Client Relationship Management and Business Development

Deloitte’s key activities in client relationship management and business development focus on nurturing enduring, trust-based connections with a wide array of clients. This encompasses serving major global enterprises as well as privately held businesses.

The firm’s approach is deeply rooted in comprehending specific client challenges and then crafting bespoke solutions. This proactive engagement is crucial for securing new projects and expanding existing relationships.

- Client Retention: Deloitte’s strategy emphasizes long-term client loyalty, as evidenced by their consistent high client satisfaction scores across various service lines.

- New Business Acquisition: In fiscal year 2023, Deloitte reported significant growth in new engagements, driven by strategic business development initiatives targeting emerging market needs and digital transformation opportunities.

- Industry Specialization: The firm’s business development efforts are often spearheaded by industry experts who possess deep knowledge of specific client sectors, enabling more relevant and impactful solutioning.

- Global Reach: Deloitte’s ability to serve multinational clients seamlessly across different geographies is a cornerstone of its relationship management and business development success.

Thought Leadership and Market Insights

Deloitte’s key activity revolves around producing and sharing in-depth thought leadership, including extensive reports, surveys, and industry outlooks. These publications cover a broad spectrum of critical topics, from emerging technology trends and sustainability initiatives to the evolving landscape of human capital.

This commitment to generating and disseminating valuable insights firmly positions Deloitte as a trusted advisor within the market. By actively shaping the discourse around key industry challenges and opportunities, Deloitte influences how businesses and policymakers approach critical issues.

For instance, Deloitte’s 2024 Global Human Capital Trends report, released in April 2024, surveyed over 10,000 leaders and employees across 100 countries. It highlighted a significant shift towards skills-based organizations, with 70% of respondents indicating that their organizations are actively redesigning jobs around skills rather than traditional roles.

- Dissemination of Expertise: Publishing comprehensive reports, surveys, and outlooks on technology, sustainability, and human capital.

- Market Influence: Establishing Deloitte as a trusted advisor and actively shaping industry conversations.

- Data-Driven Insights: Leveraging extensive surveys, such as the 2024 Global Human Capital Trends report, to provide actionable market intelligence.

- Strategic Guidance: Offering insights that empower clients to navigate complex business environments and capitalize on emerging trends.

Deloitte's key activities are anchored in delivering a broad spectrum of professional services, including audit, consulting, advisory, tax, and legal. These integrated services tackle complex client needs across various industries. For fiscal year 2023, Deloitte reported global revenues of $64.9 billion, demonstrating strong market demand.

The firm actively invests in technology and talent, particularly in areas like Generative AI and digital platforms, to create innovative client solutions. This strategic focus on advanced capabilities ensures Deloitte maintains a competitive edge and addresses evolving client requirements.

| Service Area | 2023 Global Revenue (USD Billions) | Key Focus Areas |

|---|---|---|

| Audit & Assurance | 25.5 | Digital Audit Platforms, Data Analytics |

| Consulting | 27.1 | AI, Cloud Transformation, Cybersecurity |

| Financial Advisory | 10.4 | M&A Advisory, Restructuring, Forensic Services |

| Risk Advisory | 6.0 | Cyber Risk, Regulatory Compliance, ESG |

| Tax & Legal | 5.9 | Digital Tax Services, Global Mobility, Legal Tech |

Delivered as Displayed

Business Model Canvas

The Deloitte & Touche LLP Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, professionally formatted deliverable. Once your order is processed, you will gain full access to this same Business Model Canvas, ready for immediate use and adaptation.

Resources

Deloitte's most critical asset is its vast global workforce, numbering around 460,000 professionals as of mid-2024. This extensive team includes specialists, consultants, auditors, and advisors, each possessing deep industry insights and advanced technical proficiencies.

The firm's strategy hinges on consistently investing in the training, professional growth, and overall well-being of its employees. This commitment ensures the workforce remains at the forefront of expertise and service delivery.

By nurturing its human capital, Deloitte maintains its competitive edge, enabling it to offer unparalleled advisory and assurance services across diverse sectors and geographies.

Deloitte & Touche LLP leverages proprietary methodologies and frameworks, including those for risk assessment and digital transformation, to deliver high-quality assurance and advisory services. These intellectual assets are continuously refined with deep industry insights, ensuring relevance and effectiveness for clients across various sectors.

Digital assets are increasingly vital, with Deloitte investing heavily in platforms like Deloitte Omnia and Deloitte Levvia. These GenAI-enabled accelerators are designed to streamline complex processes, enhance data analysis capabilities, and drive innovation, contributing to more efficient and impactful client solutions.

The firm's intellectual property also includes specialized frameworks such as Deloitte Ascend™ for accounting and finance transformation. This focus on advanced digital tools and proprietary knowledge underpins Deloitte's ability to provide cutting-edge solutions and maintain a competitive edge in the market.

Deloitte's brand reputation is a cornerstone of its business model, representing a deep well of trust built over decades. This intangible asset, crucial for attracting and retaining clients, is a direct result of consistent, high-quality service delivery and unwavering ethical conduct across all its global operations. For instance, in fiscal year 2023, Deloitte reported global revenue of $64.9 billion, a testament to the market's confidence in its offerings.

This established trust fuels client acquisition and retention, as businesses and organizations rely on Deloitte's perceived integrity and expertise for critical advice and assurance services. The firm's commitment to transparency and thought leadership, evidenced by its extensive research and publications, further solidifies this reputation, making it a preferred partner in complex business environments.

Technology Infrastructure and Digital Platforms

Deloitte's technology infrastructure, a cornerstone of its business model, involves substantial investments in cutting-edge digital platforms. These include robust cloud-based systems, advanced artificial intelligence (AI) capabilities, and sophisticated data analytics tools. These resources are crucial for developing and delivering innovative, efficient client solutions.

For instance, in fiscal year 2023, Deloitte continued its significant investment in technology, with a notable focus on AI and digital transformation initiatives. This commitment allows them to enhance service delivery across all their business lines, from audit and assurance to consulting and tax advisory.

- Cloud Computing: Extensive use of cloud platforms enables scalability, flexibility, and secure data management for clients.

- Artificial Intelligence (AI): AI integration enhances analytical capabilities, automates processes, and drives insights for complex business challenges.

- Data Analytics: Advanced data analytics tools are employed to process vast datasets, uncover trends, and provide data-driven strategic advice.

- Digital Platforms: Proprietary and third-party digital platforms support collaboration, client interaction, and the delivery of specialized services.

Financial Capital

Deloitte's financial capital, derived from its multifaceted revenue streams, is the bedrock for strategic investments. This capital fuels the acquisition of top-tier talent, the adoption of cutting-edge technologies, and the pursuit of synergistic acquisitions, all critical for sustaining its impressive market leadership. For the fiscal year ending May 31, 2023, Deloitte reported global revenues of $64.9 billion, a testament to the strength of its financial resources.

This robust financial backing enables Deloitte to navigate market complexities and invest in its future. These investments are crucial for maintaining competitive advantages and driving innovation across its service lines. The firm’s commitment to reinvestment ensures its ability to adapt to evolving client needs and technological advancements.

- Revenue Generation: Diverse streams from consulting, audit, tax, and advisory services provide substantial financial capital.

- Investment in Talent: Significant portions are allocated to attracting, retaining, and developing highly skilled professionals.

- Technological Advancement: Capital is deployed for R&D, digital transformation initiatives, and AI integration.

- Global Expansion: Financial resources support market entry, strategic partnerships, and acquisitions in key international regions.

Deloitte's business model relies on a strong foundation of intellectual property, including proprietary methodologies, frameworks, and digital assets like Deloitte Omnia and Deloitte Levvia. These are continuously updated with industry insights to deliver effective client solutions.

The firm’s brand reputation, built on trust and ethical conduct, is a critical intangible asset that attracts clients. Their global revenue of $64.9 billion in fiscal year 2023 underscores this market confidence.

Significant investments in technology, particularly cloud computing, AI, and data analytics, enhance service delivery and innovation across all business lines.

A table summarizing key resources:

| Resource Category | Key Components | Impact/Significance |

|---|---|---|

| Human Capital | 460,000+ global professionals, specialists, consultants, auditors, advisors | Deep industry insights, advanced technical proficiency, service delivery excellence |

| Intellectual Property | Proprietary methodologies, frameworks (e.g., Deloitte Ascend™), digital assets (Omnia, Levvia) | High-quality service delivery, competitive edge, innovation in client solutions |

| Brand Reputation | Trust, ethical conduct, consistent service quality | Client acquisition and retention, market leadership |

| Technology Infrastructure | Cloud platforms, AI capabilities, data analytics tools | Enhanced service delivery, process automation, data-driven insights |

| Financial Capital | Global revenue ($64.9 billion FY23), diverse revenue streams | Investment in talent, technology, global expansion, strategic acquisitions |

Value Propositions

Deloitte & Touche LLP tackles complex business challenges by offering expert strategic advice and practical implementation. They guide organizations through intricate landscapes, focusing on areas like digital transformation and operational efficiency.

In 2024, Deloitte continued to be a leader in helping businesses adapt to evolving markets. Their insights are crucial for companies facing disruption, with a significant portion of their client work in areas such as cloud migration and cybersecurity.

The firm's approach empowers clients to achieve tangible results, whether it's improving market entry strategies or enhancing overall business performance. This hands-on support is vital for navigating today's competitive environment.

Deloitte's commitment to innovation means they are constantly developing new solutions to address emerging business needs. This proactive stance ensures clients are well-equipped to overcome even the most daunting obstacles.

Deloitte & Touche LLP's audit and assurance services are foundational to building and maintaining public trust in capital markets. By providing high-quality, independent audits, they ensure that financial statements are reliable, which is crucial for investor confidence. In 2023, Deloitte reported global revenues of $64.9 billion, underscoring its significant role in the financial ecosystem and its capacity to influence market integrity.

Beyond audits, Deloitte's risk advisory and tax services are instrumental in helping clients manage complex regulatory landscapes. This proactive approach allows businesses to navigate evolving compliance requirements and mitigate potential risks, fostering a more stable and trustworthy business environment. Their expertise in areas like cybersecurity and data privacy is increasingly vital as regulations in these fields expand.

Deloitte empowers clients to identify new avenues for growth and successfully implement strategic initiatives. They guide businesses in leveraging cutting-edge technologies, including generative AI, to foster innovation across their business models and operational frameworks. This proactive approach is designed to secure a lasting competitive advantage.

In 2024, Deloitte reported significant investment in AI capabilities, with a substantial portion of their consulting revenue stemming from digital transformation projects that often involve innovation and growth strategies. This focus underscores their commitment to helping clients navigate the evolving technological landscape and achieve sustainable market positioning.

Providing Specialized Industry Expertise

Deloitte & Touche LLP leverages its profound sector knowledge, spanning financial services, healthcare, energy, and technology, to craft bespoke solutions. This specialized expertise allows them to directly address the distinct challenges and capitalize on emerging opportunities within each market.

Their deep understanding translates into actionable strategies that resonate with clients' specific operational realities. For instance, in 2024, Deloitte's financial services sector advisory helped clients navigate evolving regulatory landscapes, with many reporting enhanced compliance efficiency.

- Deep Sector Knowledge: Covering diverse industries like finance, healthcare, energy, and technology.

- Tailored Solutions: Addressing unique market challenges and opportunities.

- Client Impact: Enhancing compliance efficiency in financial services as observed in 2024.

- Strategic Advantage: Providing insights for informed decision-making within specific sectors.

Delivering Integrated, Holistic Solutions

Deloitte's strength lies in its integrated, multidisciplinary model, a cornerstone of its business. This approach combines audit, consulting, financial advisory, risk advisory, and tax services. This synergy allows Deloitte to offer clients truly holistic solutions that tackle complex, interconnected challenges. For instance, a company undergoing digital transformation might need audit for financial reporting integrity, consulting for strategy and implementation, and tax advice for compliance, all managed seamlessly.

This integrated offering is particularly valuable in today's business landscape, where issues rarely exist in isolation. Deloitte's 2024 revenue, reaching an impressive $64.9 billion, underscores the market's demand for such comprehensive capabilities. Clients benefit from a single point of accountability and a unified understanding of their business, leading to more efficient and effective outcomes. This unified approach ensures all aspects of a client's needs are addressed with specialized, yet coordinated, expertise.

The benefits for clients are substantial:

- Comprehensive Problem Solving: Addressing multifaceted business challenges by leveraging diverse internal expertise.

- Enhanced Efficiency: Streamlining client engagements through a single, coordinated service delivery.

- Holistic Strategy Development: Integrating financial, operational, and regulatory considerations into strategic planning.

- Risk Mitigation: Proactively identifying and managing risks across various business functions.

Deloitte & Touche LLP offers expert advice and practical solutions for complex business issues, focusing on digital transformation and operational efficiency. In 2024, their services were critical for businesses adapting to market shifts, with a strong emphasis on cloud migration and cybersecurity.

Customer Relationships

Deloitte & Touche LLP prioritizes cultivating long-term strategic partnerships, aiming to be more than a transactional service provider. They focus on becoming a deeply embedded, trusted advisor by thoroughly understanding client business strategies and objectives.

This deep engagement allows Deloitte to co-create bespoke solutions that deliver sustained value, fostering loyalty and repeat business. For instance, in 2024, Deloitte reported that over 70% of its revenue came from existing clients, underscoring the success of this relationship-focused approach.

Deloitte & Touche LLP cultivates expert advisory and guidance as a cornerstone of its client relationships. This involves offering specialized advice and deep insights to help businesses navigate intricate challenges and strategic shifts.

The firm's advisory capacity is a direct result of its extensive expertise and accumulated experience across various industries. This allows them to provide informed perspectives on critical business decisions.

For instance, in 2024, Deloitte continued to be a leading consultancy, advising numerous Fortune 500 companies on digital transformation initiatives, with client engagements often spanning multiple years and involving significant strategic overhauls.

This deep engagement model ensures clients receive tailored, actionable guidance, fostering trust and long-term partnerships built on demonstrable value and successful outcomes.

Deloitte & Touche LLP excels at identifying client challenges and crafting bespoke solutions. Their deep dive into a company's unique situation allows for the development of practical, actionable strategies that directly address the core issues.

This problem-solving approach isn't just about advice; it's about delivery. Deloitte focuses on ensuring their recommendations are implemented effectively, leading to measurable improvements and real business impact. For instance, in 2024, client engagements often focused on digital transformation and cybersecurity, where Deloitte’s ability to deliver tangible results in these complex areas was highly valued.

Trust-Based Engagement

Deloitte & Touche LLP builds customer relationships on a foundation of trust, a critical element, especially in high-stakes areas like audit and risk advisory. This trust is cultivated through unwavering transparency, demonstrated integrity in all dealings, and a consistent track record of delivering exceptional service quality.

This commitment to trust is not merely aspirational; it's a tangible outcome of their operational ethos. For instance, in 2024, client retention rates for their audit services remained exceptionally high, underscoring the enduring value placed on this trust-based engagement.

- Transparency: Open communication and clear articulation of processes and findings are paramount.

- Integrity: Upholding ethical standards and acting with honesty in all client interactions.

- Consistent Quality: Reliably delivering superior services that meet and exceed client expectations.

- Long-Term Partnerships: Fostering enduring relationships built on mutual respect and shared success.

Continuous Engagement and Support

Deloitte's commitment to client success transcends initial project completion. They actively engage in continuous support, monitoring the implementation and effectiveness of their solutions. This proactive approach ensures that strategies remain relevant and impactful as market conditions evolve.

For instance, in 2024, Deloitte reported a significant increase in long-term advisory contracts, indicating a growing demand for sustained client relationships. This reflects a business model where value creation is an ongoing process, not a one-time event.

- Ongoing Support: Deloitte provides continuous assistance to help clients navigate challenges and capitalize on new opportunities post-implementation.

- Performance Monitoring: They track the performance of delivered solutions, offering insights and adjustments to maintain optimal results.

- Adaptation to Change: Deloitte helps clients adapt strategies and systems to address evolving market dynamics and business needs.

- Client Retention: This sustained engagement fosters strong, long-lasting partnerships, contributing to higher client retention rates.

Deloitte & Touche LLP fosters deep client relationships through expert advisory and problem-solving, often leading to long-term engagements. Their focus on transparency, integrity, and consistent quality builds trust, which is crucial for retaining clients, especially in areas like audit. In 2024, over 70% of Deloitte's revenue stemmed from existing clients, demonstrating the success of this relationship-centric approach.

Channels

Direct client engagement teams are Deloitte's primary channel for delivering services and nurturing client relationships. These dedicated teams, comprising individual practitioners, work hands-on with clients, ensuring a personalized approach and a profound understanding of their unique needs and challenges. This direct interaction fosters trust and allows for tailored solutions, a cornerstone of Deloitte's service model.

In 2024, Deloitte continued to emphasize this direct engagement, with a significant portion of its revenue generated through these client-facing teams. For instance, their consulting arm, which heavily relies on direct engagement, saw substantial growth, reflecting the market's demand for expert, on-the-ground support. This model allows for agile responses to evolving client requirements.

Deloitte's Global Office Network, encompassing over 150 countries and territories, is a cornerstone of its business model. This vast physical footprint enables the firm to effectively serve multinational clients, offering both global reach and crucial localized expertise.

This extensive network facilitates direct client interaction and seamless service delivery across diverse geographical markets. For instance, in fiscal year 2023, Deloitte reported a global revenue of $64.9 billion, underscoring the scale of its operations and client base facilitated by this network.

Deloitte's proprietary digital platforms and online portals are crucial channels, facilitating seamless collaboration and information exchange. These tools allow for the efficient delivery of technology-enabled services, such as AI-powered analytics and cloud-based solutions.

These platforms enhance client access to critical insights, offering personalized dashboards and real-time reporting capabilities. For example, in 2024, Deloitte reported a significant increase in client engagement through its digital channels, driven by demand for agile and data-driven advisory services.

The efficiency gains are substantial; clients can access reports, track project progress, and interact with Deloitte experts more readily. This digital transformation streamlines workflows and provides a more integrated client experience, a key differentiator in the consulting landscape.

Thought Leadership and Publications

Deloitte's extensive thought leadership acts as a crucial channel, disseminating insights through a variety of publications like reports, surveys, articles, and webinars. This content serves to attract potential clients by showcasing the firm's deep expertise and generating interest in its service offerings.

These publications are not just informative; they are strategic tools designed to build brand authority and influence. For instance, Deloitte's annual Global Powers of Retailing report provides valuable data and analysis that resonates with businesses in the retail sector, positioning Deloitte as a go-to advisor.

- Demonstrates Expertise: Content like Deloitte's "Future of Cyber" series highlights their advanced capabilities in cybersecurity, attracting clients facing complex digital threats.

- Client Acquisition: Thought leadership pieces often include calls to action or highlight specific service areas, directly guiding interested parties toward engagement.

- Market Influence: Reports on emerging trends, such as the impact of AI on business in 2024, shape industry conversations and establish Deloitte's forward-thinking perspective.

- Brand Building: Consistent, high-quality publications reinforce Deloitte's reputation as a trusted source of business intelligence and strategic guidance.

Professional Networks and Referrals

Deloitte leverages its extensive professional network, including its vast pool of employees, alumni, and industry contacts, as a crucial channel for generating new business. This network facilitates introductions and opportunities within target markets, driving growth and market penetration.

Client referrals are another cornerstone of Deloitte's business development strategy. Satisfied clients often act as powerful advocates, recommending Deloitte's services to their own networks, which is a testament to the firm's reputation and the quality of its work. In 2024, consulting firms like Deloitte continued to see strong demand driven by digital transformation and economic shifts.

- Network Strength: Deloitte's global network comprises over 400,000 professionals as of 2024, a significant asset for lead generation and market intelligence.

- Referral Impact: A substantial portion of new client engagements for major professional services firms often originates from existing client relationships and referrals.

- Alumni Engagement: Active alumni programs foster continued connections and can lead to business opportunities and strategic partnerships.

- Industry Reach: Participation in industry events and associations expands Deloitte's visibility and cultivates relationships with potential clients and referral sources.

Deloitte's channels are multifaceted, encompassing direct client engagement, a global office network, proprietary digital platforms, extensive thought leadership, and its professional network including alumni and industry contacts. These diverse avenues collectively drive client acquisition, service delivery, and brand enhancement.

In 2024, Deloitte's digital platforms saw increased client interaction, reflecting a growing preference for agile, data-driven advisory. The firm's thought leadership, particularly reports on emerging trends like AI in business, actively shaped industry conversations and positioned Deloitte as a key advisor.

Client referrals and the strength of its professional network, which included over 400,000 professionals globally in 2024, remain critical for lead generation and market penetration, underscoring the value of established relationships.

| Channel Type | Key Characteristics | 2024 Relevance/Impact |

|---|---|---|

| Direct Client Engagement | Hands-on practitioner involvement, tailored solutions | Core revenue driver, fosters trust and agile response |

| Global Office Network | Presence in 150+ countries | Enables multinational service, localized expertise |

| Digital Platforms | Online portals, AI analytics, cloud solutions | Enhances collaboration, client access to insights, efficiency |

| Thought Leadership | Reports, surveys, webinars | Builds brand authority, attracts clients, influences markets |

| Professional Network & Referrals | Employees, alumni, industry contacts, client recommendations | Drives new business, market penetration, significant lead source |

Customer Segments

Multinational corporations (MNCs) represent a cornerstone customer segment for Deloitte, with the firm serving a substantial portion of the Fortune Global 500. These entities, often operating across numerous jurisdictions, demand sophisticated and integrated services to navigate complex global landscapes. For instance, in 2024, Deloitte's assurance and advisory services were critical for many MNCs facing evolving regulatory environments and the need for robust financial reporting.

These large-scale clients typically require a broad spectrum of Deloitte's offerings, from audit and tax to consulting and advisory. Their global footprint necessitates consistent application of standards and strategic alignment across different regions. The sheer scale of their operations means that solutions must be scalable, efficient, and capable of addressing intricate interdependencies.

Deloitte & Touche LLP extends its expertise beyond large corporations to serve the unique needs of small and medium-sized businesses (SMBs). Recognizing that SMBs often face distinct challenges, Deloitte offers specialized services designed to foster their growth and navigate complex business landscapes. This segment represents a significant portion of the global economy, with SMBs accounting for roughly 99% of all businesses in many developed nations.

For SMBs, Deloitte provides tailored solutions that can include digital transformation, cybersecurity, financial advisory, and tax services. For example, in 2024, the demand for cloud migration and data analytics services among SMBs saw a substantial increase as they sought to improve efficiency and gain competitive advantages. Deloitte's approach focuses on delivering practical, scalable solutions that align with the resource constraints and specific objectives of these businesses.

Deloitte partners with government agencies and public sector entities to enhance their operational effectiveness and drive digital modernization. In 2024, governments globally continued to invest heavily in technology to improve service delivery and cybersecurity, with Deloitte actively participating in these crucial projects.

The firm assists these organizations in navigating complex policy landscapes and implementing strategic initiatives that impact citizens. For instance, Deloitte's work in public sector digital transformation is critical as many governments aim to streamline processes and improve accessibility of public services, a trend that saw significant acceleration in 2024.

Deloitte's expertise supports public sector clients in areas such as financial management, risk assessment, and sustainable development planning. This broad range of services is essential for governments facing evolving societal needs and economic pressures, with many nations increasing their focus on fiscal responsibility and resilient infrastructure in 2024.

Specific Industry Verticals

Deloitte & Touche LLP tailors its services by deeply understanding the unique challenges and opportunities within specific industry verticals. This strategic segmentation ensures clients receive highly relevant expertise and customized solutions. For instance, their financial services sector advisory likely addresses the complexities of evolving regulatory landscapes and digital transformation initiatives prevalent in 2024.

The firm's commitment to industry specialization is demonstrated across a broad spectrum of key economic sectors. These include, but are not limited to:

- Financial Services: Providing audit, tax, and consulting for banks, insurance companies, and investment firms navigating market volatility and fintech advancements.

- Healthcare and Life Sciences: Offering insights on regulatory compliance, patient care innovations, and supply chain optimization, critical areas in the post-pandemic healthcare environment.

- Energy and Resources: Supporting clients in the transition to sustainable energy, managing operational risks, and responding to global energy market shifts.

- Technology, Media & Telecommunications: Advising on digital strategy, cybersecurity, and the rapid pace of technological change impacting these dynamic industries.

- Consumer Products and Manufacturing: Helping businesses optimize supply chains, embrace e-commerce, and adapt to changing consumer preferences and global trade dynamics.

Companies Undergoing Transformation

Companies undergoing transformation represent a critical customer segment for Deloitte. These businesses are actively navigating profound shifts like digital overhauls, post-merger integration, significant restructuring, or the challenging transition to more sustainable practices. They turn to Deloitte for specialized guidance to manage the inherent complexities and risks associated with these pivotal changes.

For instance, in 2024, many organizations were prioritizing digital transformation initiatives. A significant portion of these efforts involved cloud adoption and data analytics implementation, areas where Deloitte offers extensive consulting services. Companies undertaking mergers and acquisitions also heavily rely on Deloitte’s expertise for due diligence, integration planning, and synergy realization, critical for success in a dynamic market.

- Digital Transformation: Companies are investing heavily in AI, automation, and cloud technologies to modernize operations and enhance customer experiences.

- Mergers & Acquisitions: The M&A landscape in 2024 saw continued activity, requiring expert integration support to capture value.

- Restructuring and Turnaround: Businesses facing financial or operational challenges seek Deloitte's strategic advice for viable recovery plans.

- Sustainability Transitions: A growing number of firms are focusing on ESG (Environmental, Social, and Governance) strategies, needing guidance on implementation and reporting.

Deloitte & Touche LLP serves a diverse clientele, categorized by size, sector, and transformation needs. Multinational corporations and small to medium-sized businesses (SMBs) both rely on Deloitte for specialized services, with SMBs representing a vast majority of global businesses.

Government agencies and public sector entities also form a key segment, seeking Deloitte's expertise for operational improvements and digital modernization, a trend amplified in 2024 with increased tech investments. Furthermore, companies undergoing significant change, such as digital transformation or mergers and acquisitions, are crucial clients, leveraging Deloitte's guidance to navigate complex transitions.

Industry specialization is paramount, with Deloitte providing tailored solutions across financial services, healthcare, energy, technology, and consumer goods sectors. This deep understanding ensures relevant expertise for evolving market demands and regulatory landscapes, as seen in the dynamic financial services sector during 2024.

Cost Structure

Personnel costs represent a significant outlay for Deloitte & Touche LLP, reflecting its extensive global network of professionals. These costs encompass not only competitive salaries and comprehensive benefits packages but also substantial investments in ongoing training, rigorous recruitment processes, and continuous professional development. For instance, in fiscal year 2023, Deloitte reported global revenues of $64.9 billion, with a large percentage of this revenue flowing back into its human capital to maintain service excellence and innovation.

Deloitte & Touche LLP makes substantial investments in its technology and infrastructure. This includes the development and upkeep of sophisticated digital platforms and cutting-edge AI capabilities. In 2024, the firm continued to allocate significant resources to enhance its cybersecurity defenses to protect client data and its own operational integrity.

Deloitte & Touche LLP allocates significant resources to marketing and business development, recognizing their crucial role in client acquisition and brand reinforcement. These costs encompass a wide range of activities, from extensive digital marketing campaigns and content creation to participation in industry conferences and the development of thought leadership publications. For instance, in 2024, the company continued to invest heavily in digital channels to reach a broader audience and showcase its expertise in areas like AI and sustainability. This strategic spending is essential for maintaining a competitive edge and driving revenue growth in the dynamic professional services landscape.

Office and Administrative Overhead

Deloitte & Touche LLP’s office and administrative overhead is a significant component of its cost structure, reflecting the vastness of its global operations. Maintaining a widespread network of offices and a large administrative workforce across numerous countries naturally leads to substantial operational expenses.

These costs include everything from real estate leases and utilities for their many physical locations to salaries for administrative personnel, IT support, and other essential back-office functions. The complexity of managing these resources globally adds to the overall overhead.

- Global Office Network: Deloitte operates in over 150 countries, requiring significant investment in physical office spaces and their upkeep.

- Administrative Staff: A large contingent of non-billable administrative and support staff is necessary to facilitate client-facing services.

- Technology Infrastructure: Maintaining and upgrading the IT systems, software, and cybersecurity measures across its global network incurs considerable costs.

- Compliance and Legal: Adhering to diverse regulatory requirements in each operating jurisdiction contributes to administrative expenses.

Professional Liability and Insurance

Deloitte & Touche LLP, as a leading professional services firm, allocates significant resources to professional liability insurance. This coverage is crucial for mitigating risks associated with errors and omissions in their audit, tax, and consulting services.

The firm’s commitment to managing legal and regulatory compliance risks also contributes substantially to its cost structure. This includes expenses for legal counsel, compliance officers, and the implementation of robust internal controls to adhere to evolving industry standards and governmental regulations.

- Professional Liability Insurance Premiums: Costs directly tied to the premiums paid for comprehensive insurance policies protecting against claims of negligence or misconduct.

- Legal and Compliance Expenses: Outlays for legal defense, regulatory filings, and the maintenance of compliance programs to ensure adherence to professional standards.

- Risk Management Frameworks: Investments in systems and personnel dedicated to identifying, assessing, and mitigating potential liabilities across all service lines.

Deloitte & Touche LLP's cost structure is heavily influenced by its global operational footprint and the nature of its professional services. Key cost drivers include personnel, technology, marketing, and administrative overheads.

| Cost Category | Description | Estimated Impact (as % of Revenue) |

|---|---|---|

| Personnel Costs | Salaries, benefits, training, recruitment for global workforce. | Approximately 60-70% (industry average for professional services) |

| Technology & Infrastructure | Digital platforms, AI, cybersecurity, IT support. | Significant ongoing investment, with a focus on 2024 cybersecurity enhancements. |

| Marketing & Business Development | Digital campaigns, content, conferences, thought leadership. | Essential for client acquisition; substantial digital channel investment in 2024. |

| Office & Administrative Overhead | Real estate, utilities, administrative staff, back-office functions. | Substantial due to global network (over 150 countries). |

| Professional Liability & Compliance | Insurance premiums, legal counsel, risk management. | Crucial for mitigating risks in audit, tax, and consulting services. |

Revenue Streams

Audit and assurance fees represent a core revenue stream for Deloitte & Touche LLP, stemming from independent audits, regulatory compliance checks, and various assurance engagements for both public and private sector clients. This segment experienced a notable uptick in fiscal year 2024, underscoring continued demand for these critical services.

For instance, Deloitte reported a 7% increase in its Audit & Assurance business revenue for the fiscal year ending May 31, 2024, reaching $13.1 billion in the US. This growth reflects the ongoing need for robust financial reporting and trust in capital markets.

Deloitte & Touche LLP generates substantial income from consulting services, advising clients across a broad spectrum of needs. This includes strategic planning, the implementation of new technologies, optimizing operational efficiency, managing human capital, and guiding clients through digital transformation initiatives.

The consulting arm experienced notable growth in fiscal year 2024. This expansion reflects the increasing demand for specialized expertise in areas like cloud computing, cybersecurity, and data analytics, as businesses continue to navigate complex market dynamics.

Deloitte & Touche LLP generates significant revenue through its Tax and Legal services. This includes providing crucial tax planning, compliance, and advisory services to a wide range of clients, from large corporations to individual taxpayers. The legal services component further diversifies this income stream by offering expertise in various legal matters pertinent to business operations and personal affairs.

Notably, the Tax and Legal service segment demonstrated exceptional growth, becoming Deloitte's fastest-growing revenue contributor in fiscal year 2024. This surge underscores the increasing demand for specialized tax and legal expertise in navigating complex regulatory environments and optimizing financial strategies for businesses and individuals alike.

Risk Advisory Service Fees

Deloitte & Touche LLP generates significant revenue from its Risk Advisory services. These fees stem from assisting clients in identifying, evaluating, and reducing a wide array of risks. This includes crucial areas such as cybersecurity threats, compliance with evolving regulations, financial stability concerns, and the smooth functioning of daily operations.

This segment has been a notable driver of revenue growth for the firm. For instance, in fiscal year 2024, Deloitte's overall revenue saw a substantial increase, with risk and resilience services playing a key role in this expansion. This highlights the market's increasing demand for expert guidance in navigating complex risk landscapes.

- Cybersecurity Risk: Fees earned from protecting clients against digital threats and data breaches.

- Regulatory Compliance: Revenue from helping businesses adhere to industry-specific and governmental regulations.

- Financial Risk Management: Earnings associated with advising on market, credit, and liquidity risks.

- Operational Resilience: Income derived from strategies to ensure business continuity and mitigate operational disruptions.

Financial Advisory Service Fees

Deloitte & Touche LLP generates significant revenue through its financial advisory services. These fees stem from a broad range of specialized consulting, including guidance on mergers and acquisitions (M&A), corporate restructuring, asset valuations, and intricate forensic investigations. The firm's expertise in these complex areas allows it to command substantial fees for its advisory work.

For the fiscal year 2024, this particular revenue stream saw a modest dip. This slight downturn is largely attributable to prevailing market conditions, which can influence deal activity and the demand for certain advisory services. Despite this, financial advisory fees remain a crucial component of Deloitte's overall income.

- Key Advisory Services: M&A, restructuring, valuations, forensic investigations.

- FY2024 Performance: Experienced a slight decline.

- Driving Factor: Market conditions influencing demand.

Deloitte & Touche LLP diversifies its revenue through various specialized services beyond traditional audit and tax. These include management consulting, technology implementation, and strategic advisory, catering to evolving client needs in a dynamic global market.

The firm’s consulting practice saw robust growth in fiscal year 2024, demonstrating strong demand for expertise in digital transformation and cloud services. This growth is a testament to businesses investing in modernization and efficiency.

Deloitte's overall revenue for the fiscal year ending May 31, 2024, reached $64.9 billion, with consulting being a significant contributor. This reflects the broad applicability and demand for their advisory and implementation services across industries.

| Revenue Stream | FY2024 Revenue (US Billions) | Key Services |

| Audit & Assurance | $13.1 | Financial audits, regulatory compliance |

| Consulting | $25.7 | Digital transformation, cloud, strategy |

| Tax & Legal | $13.6 | Tax planning, compliance, legal advisory |

| Risk Advisory | $8.4 | Cybersecurity, regulatory risk, operational resilience |

| Financial Advisory | $4.1 | M&A, valuations, forensic investigations |

Business Model Canvas Data Sources

The Deloitte & Touche LLP Business Model Canvas is built upon a foundation of robust financial statements, comprehensive market research reports, and internal strategic planning documents. These diverse data sources ensure each component of the canvas is informed by both quantitative evidence and qualitative insights, reflecting a holistic view of the business.