Deloitte & Touche LLP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deloitte & Touche LLP Bundle

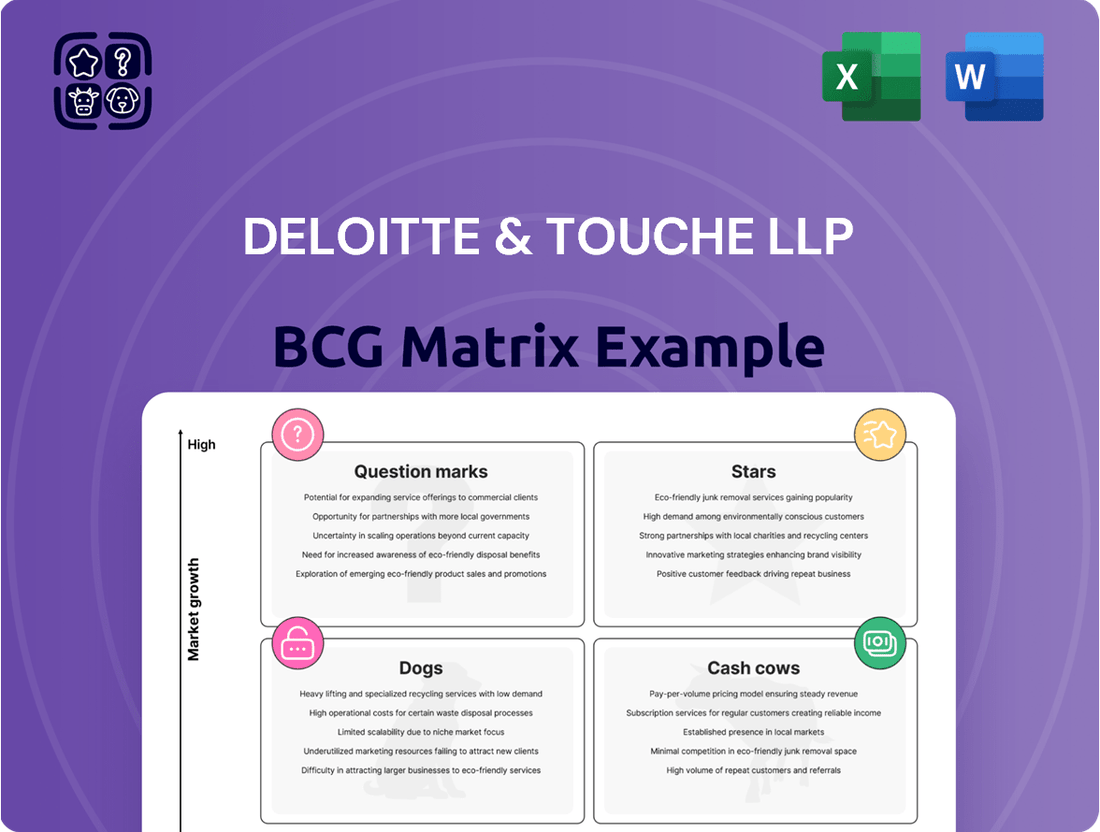

Curious about how Deloitte & Touche LLP strategically positions its diverse offerings? This glimpse into their BCG Matrix reveals how products are categorized as Stars, Cash Cows, Dogs, or Question Marks, offering a foundational understanding of their market performance.

Uncover the full strategic narrative behind Deloitte & Touche LLP's portfolio. The complete BCG Matrix provides a detailed breakdown of each product's quadrant placement, essential for understanding their current market standing and future potential.

This isn't just a classification; it's a roadmap. Purchasing the full BCG Matrix report will equip you with data-backed recommendations and actionable insights to optimize resource allocation and drive growth within Deloitte & Touche LLP's business units.

Gain a competitive edge by understanding precisely where Deloitte & Touche LLP stands in its respective markets. The full BCG Matrix offers quadrant-by-quadrant clarity and strategic takeaways, accelerating your own planning and decision-making processes.

Don't miss the opportunity to own the complete Deloitte & Touche LLP BCG Matrix. It’s your key to unlocking strategic clarity, identifying investment opportunities, and navigating the complexities of their product landscape with confidence.

Stars

Cybersecurity Consulting Services, as a component of Deloitte & Touche LLP's portfolio, is positioned as a Star in the BCG Matrix. Deloitte holds the distinction of being the global leader in security services by revenue, indicating a substantial market share within this essential and expanding sector. For instance, in fiscal year 2023, Deloitte's global cybersecurity revenue surpassed $7.5 billion, reflecting its dominant market presence.

The firm's strategic focus on enhancing advanced AI capabilities, including its Managed Extended Detection and Response (MXDR) offerings and the CyberSphere platform, further solidifies its Star status. These investments are directly responsive to escalating client needs, fueled by the constant evolution of cyber threats and the pervasive nature of digital transformation across industries.

The AI and Generative AI solutions market is a rapidly expanding sector, with Deloitte demonstrating significant commitment through substantial investments and the introduction of innovative offerings. Their AI Factory as a Service and Zora AI™ agentic product platform are designed to assist businesses in leveraging new technologies for value creation across diverse industries.

Deloitte's strategic emphasis on AI is poised to secure a considerable portion of this burgeoning market. In 2023, the global AI market size was valued at approximately $200 billion, with projections indicating substantial growth in the coming years, driven by generative AI applications.

Deloitte & Touche LLP, a major player in the consulting world, is seeing robust demand for its digital transformation services. This area is a significant growth engine for the firm.

The company is actively guiding clients through crucial updates to their foundational systems, the adoption of cloud technologies, and the integration of artificial intelligence into their operations. For instance, Deloitte's recent reports highlight a substantial increase in client projects focused on AI-driven process automation.

Despite shifts in overall digital transformation spending patterns, Deloitte's extensive expertise and strategic emphasis on cutting-edge digital solutions position it for sustained high growth. Their broad service offerings in areas like cloud migration and cybersecurity are particularly strong.

In 2024, consulting revenue for the big four firms, including Deloitte, saw continued growth, with digital services being a primary contributor. Deloitte's investment in digital capabilities is designed to maintain its market leadership.

Sustainability & ESG Consulting

Sustainability and ESG consulting is a significant growth area for Deloitte, reflecting its strategic importance to C-suite leaders. This demand is fueled by increasing regulatory pressures and the desire to integrate sustainability into core business strategies. Deloitte's investment in this sector positions it to capture substantial market share by leveraging its existing client base and deep expertise.

The market for ESG advisory services is experiencing robust expansion. For instance, the global ESG consulting market was valued at approximately $10 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, reaching an estimated $25 billion. This rapid growth trajectory makes it a prime candidate for a Stars position in the BCG matrix.

- High Market Growth: The ESG consulting market is expanding rapidly, driven by regulatory changes and corporate demand.

- Deloitte's Strategic Focus: Deloitte is actively investing in and building its capabilities to meet this growing client need.

- Leveraging Existing Strengths: Deloitte can capitalize on its established client relationships and broad service portfolio to gain traction.

- Regulatory Tailwinds: New regulations globally are creating a consistent demand for ESG advisory services, supporting market expansion.

Cloud Transformation Services

Cloud Transformation Services represent a significant Star for Deloitte, driven by ongoing enterprise demand for digital modernization. Deloitte's expertise in migrating and optimizing cloud platforms is crucial for clients looking to leverage AI and other advanced technologies. This service line is well-positioned in a high-growth, dynamic market, reflecting continuous investment in modern IT infrastructure.

Key aspects of Deloitte's Cloud Transformation Services include:

- Cloud Migration Strategy & Execution: Assisting clients in moving workloads to public, private, or hybrid cloud environments.

- Cloud Optimization & Management: Enhancing cloud performance, cost-efficiency, and security post-migration.

- Cloud-Native Development: Building applications specifically for cloud environments to maximize scalability and agility.

- Hybrid and Multi-Cloud Solutions: Designing and implementing complex cloud strategies that integrate various cloud providers and on-premises systems.

The global cloud computing market continues its upward trajectory. For instance, the worldwide public cloud services market is projected to grow by 20.4% to reach $678.8 billion in 2024, according to Gartner. This sustained growth underscores the strategic importance and market demand for Deloitte's cloud transformation capabilities.

Deloitte's cybersecurity offerings are a clear Star in the BCG Matrix, evidenced by its global leadership in security services by revenue. The firm's strategic investments in AI-powered solutions, such as its MXDR and CyberSphere platform, directly address the increasing demand for advanced threat detection and response capabilities. In fiscal year 2023, Deloitte's cybersecurity revenue exceeded $7.5 billion, underscoring its significant market share in this high-growth sector.

Deloitte's AI and Generative AI solutions are positioned as Stars, capitalizing on the explosive growth in this market. The firm's commitment is demonstrated through offerings like its AI Factory as a Service and Zora AI™ agentic product platform, designed to drive value creation for clients. With the global AI market valued at approximately $200 billion in 2023 and projected to expand rapidly, Deloitte's strategic focus on AI is set to capture substantial market share.

Digital transformation services are a strong Star for Deloitte, fueled by consistent client demand for modernization. The firm actively assists clients with system upgrades, cloud adoption, and AI integration, with a noticeable increase in AI-driven process automation projects. This robust demand, coupled with Deloitte's extensive digital expertise, ensures sustained high growth in this critical area.

Sustainability and ESG consulting is another significant Star for Deloitte, reflecting its strategic importance to business leaders. This growth is driven by evolving regulatory landscapes and the corporate imperative to integrate sustainability. The global ESG consulting market, valued at roughly $10 billion in 2023 with a projected CAGR over 15%, offers substantial opportunity for Deloitte to leverage its client base and expertise.

Cloud Transformation Services are a key Star for Deloitte, driven by persistent enterprise demand for digital modernization. Deloitte's proficiency in cloud migration and optimization is vital for clients seeking to adopt advanced technologies like AI. With the global public cloud services market projected to grow 20.4% to $678.8 billion in 2024, these services are strategically vital.

| Service Line | BCG Matrix Category | Market Growth | Deloitte's Market Share/Position | Key Drivers |

|---|---|---|---|---|

| Cybersecurity Consulting | Star | High | Global Leader by Revenue | Increasing cyber threats, digital transformation |

| AI & Generative AI Solutions | Star | Very High | Significant Investments, Innovative Offerings | AI adoption, value creation across industries |

| Digital Transformation Services | Star | High | Robust Demand, Extensive Expertise | System modernization, cloud adoption, AI integration |

| Sustainability & ESG Consulting | Star | High | Growing Demand, Strategic Focus | Regulatory pressures, corporate sustainability goals |

| Cloud Transformation Services | Star | High | Strong Expertise, High Demand | Digital modernization, AI enablement, cloud adoption |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

The Deloitte & Touche LLP BCG Matrix offers a clear, one-page overview, relieving the pain of scattered business unit performance data.

Cash Cows

Deloitte's Traditional Audit & Assurance Services are a classic Cash Cow within its BCG Matrix. The firm commands a significant global market share, especially serving large public interest entities and FTSE 350 companies.

While the audit market is mature and experiences more stable, lower growth, it reliably produces substantial revenue. For instance, in fiscal year 2023, Deloitte reported global revenues of $64.9 billion, with audit and assurance continuing to be a bedrock of this figure.

The emphasis Deloitte places on audit quality and fostering trust solidifies its strong, foundational position in this segment. This consistent revenue stream provides the financial stability to invest in other growth areas.

Deloitte's Tax & Legal services emerged as a leading growth engine in FY2024, underscoring its robust market standing. This segment's impressive revenue expansion signals a strong, stable position within the competitive landscape.

Traditional tax compliance, a cornerstone of the firm's offerings, continues to be a reliable source of consistent cash flow. This service is indispensable for multinational corporations and businesses of all sizes, requiring minimal incremental investment for sustained revenue generation.

Deloitte is actively integrating advanced technologies, such as generative AI, to streamline and boost efficiency within its high-volume tax compliance operations. This strategic adoption of technology enhances service delivery and operational effectiveness.

Deloitte's established Enterprise Resource Planning (ERP) implementation services function as a classic Cash Cow within their business portfolio. The firm boasts a deep history and considerable market share in delivering and refining large-scale ERP systems.

While the overall ERP market growth has moderated, it continues to be a substantial and consistent revenue generator for Deloitte. This stability is a hallmark of a Cash Cow, providing reliable earnings.

These complex projects, often involving intricate integrations and extended client relationships, ensure a steady stream of cash. For instance, in 2024, Deloitte continued to secure major ERP transformation projects with Fortune 500 companies, indicative of its enduring market strength and the recurring nature of these service offerings.

General Management Consulting

Deloitte's General Management Consulting practice stands as a significant Cash Cow within their BCG Matrix. As the world's largest consulting firm by revenue, Deloitte leverages its extensive brand recognition and deep client relationships to maintain a dominant market share in this sector. These established services, while perhaps not experiencing hyper-growth, deliver substantial and reliable cash flow, underpinning the firm's overall financial strength.

In 2024, Deloitte reported robust revenues across its consulting segment, with management consulting forming a core component. This broad practice benefits from Deloitte's ability to offer integrated solutions across multiple disciplines, a key differentiator that fosters client loyalty and repeat business. The consistent demand for foundational management advisory services ensures a steady stream of earnings.

- Dominant Market Share: Deloitte consistently ranks as a leader in management consulting, capturing a significant portion of the market due to its established presence and comprehensive service offerings.

- Brand Equity and Client Relationships: The firm's strong brand name and long-standing client partnerships are critical drivers of consistent revenue generation in this mature service area.

- Multidisciplinary Approach: Deloitte's ability to integrate various consulting services, from strategy to operations, provides a holistic value proposition that commands high client retention and project value.

- Stable Cash Flow Generation: While not always the fastest-growing segment, general management consulting reliably produces substantial and predictable cash flow, supporting investments in other business areas.

Financial Advisory for Restructuring & Forensics

Within Deloitte & Touche LLP's Financial Advisory practice, services focused on restructuring and forensic investigations are considered cash cows. While the broader Financial Advisory segment experienced a revenue dip globally in fiscal year 2024, these specialized areas demonstrated resilience.

These essential services, including financial distress and turnaround support, along with forensic investigations, continue to be in high demand. This demand is driven by ongoing economic volatility and the increasing complexity of corporate and legal investigations.

Deloitte's established reputation and deep client relationships bolster the stability of these offerings. They are viewed as a consistent revenue stream, even if the growth trajectory is more measured compared to other, more volatile segments.

- Resilient Demand: Forensic and restructuring services show stable demand, unaffected by broader market downturns.

- Economic Uncertainty: These services are critical during periods of economic instability, ensuring critical support for clients.

- Expertise Leverage: Deloitte's established expertise and strong client trust are key differentiators in these areas.

- Stable Revenue: While not high-growth, these segments provide a reliable and consistent revenue base for the practice.

Deloitte's core Audit and Assurance services, particularly for large public interest entities, represent a significant Cash Cow. Despite a mature market, these services consistently generate substantial and stable revenue, forming a bedrock for the firm's overall financial performance.

In fiscal year 2023, Deloitte reported global revenues of $64.9 billion, with Audit and Assurance continuing to be a foundational element of this impressive figure, demonstrating its reliable cash-generating capability.

The firm’s Tax and Legal services, especially traditional tax compliance, are also strong Cash Cows. These indispensable services for businesses of all sizes provide a consistent cash flow with minimal incremental investment needed for sustained revenue generation, a testament to their stable market position.

Deloitte's established Enterprise Resource Planning (ERP) implementation services are another key Cash Cow. While market growth has moderated, these complex, long-term projects continue to deliver substantial and predictable earnings, reinforcing their status as a reliable revenue stream.

General Management Consulting is a prominent Cash Cow for Deloitte, leveraging its largest-in-class revenue and deep client relationships. These foundational advisory services reliably produce significant cash flow, supporting the firm's strategic investments in other growth areas.

Delivered as Shown

Deloitte & Touche LLP BCG Matrix

The Deloitte & Touche LLP BCG Matrix document you're previewing is the complete, unwatermarked, and fully formatted report you will receive immediately after purchase. This is not a demo or a mockup; it's the actual strategic tool, ready for immediate download and application in your business planning and analysis.

Dogs

Highly commoditized IT staff augmentation, focusing solely on providing generic IT personnel without specialized skills or bundled solutions, operates in a fiercely competitive landscape. This intense price pressure results in low profit margins, as businesses prioritize cost savings over unique value propositions. Such services offer limited long-term strategic benefit, consuming resources with minimal potential for significant growth.

Deloitte may retain a presence in these commoditized segments, but this is typically driven by established client relationships rather than new strategic initiatives. In 2024, the IT staffing market saw an average profit margin of around 15% for purely commoditized roles, a stark contrast to the 30%+ margins seen in specialized or managed IT services. This highlights the challenge of generating substantial revenue from undifferentiated IT talent provision.

Maintaining legacy systems and providing non-strategic support often falls into the Dogs quadrant of the BCG Matrix. These activities, while essential for some clients, represent low growth and require significant operational overhead with minimal strategic value. For instance, in 2024, many organizations continued to allocate substantial IT budgets towards maintaining aging infrastructure, with estimates suggesting that up to 70% of IT spending in some sectors was directed towards keeping existing systems running rather than innovation.

Deloitte, like other professional services firms, recognizes that these services offer limited opportunities for market share expansion or significant revenue growth. The focus remains on efficient delivery to existing clients rather than pursuing new ventures in this space. The strategic imperative is to transition clients away from these cost-intensive, low-return activities towards more transformative, high-value solutions.

Basic, non-specialized data entry and processing, often referred to as commoditized services, are characterized by manual or rudimentary data handling. These tasks typically lack sophisticated analytics or advanced automation, making them highly susceptible to intense price competition and outsourcing. In 2024, the demand for these services remains, but top-tier firms like Deloitte are increasingly focusing on internal automation or divesting these functions.

The profit margins for such basic data processing are extremely low, often in the single digits, and the growth potential is severely limited. For instance, the global market for business process outsourcing (BPO), which often includes these types of tasks, saw continued pressure on pricing, with average margins for data entry services hovering around 5-8% in 2024, according to industry reports.

Outdated Compliance Reporting (non-regulatory tech driven)

Compliance services that rely on outdated methods, failing to adopt new regulatory technology or adapt to increasingly complex rules, are at risk of becoming commoditized. This means their value decreases as more providers offer similar, basic services.

Without integrating these compliance functions with strategic risk advisory or advanced tax technology solutions, growth potential becomes limited. This often leads to reduced profitability because these services require substantial effort for increasingly smaller returns, a common characteristic of a question mark in the BCG matrix.

- Diminishing Returns: Traditional compliance reporting, especially when not enhanced by technology, often yields less profit for the effort invested. For instance, manual data reconciliation for regulatory filings can be time-consuming and error-prone.

- Lack of Differentiation: When compliance reporting is purely transactional and doesn't offer strategic insights or leverage advanced tools, it becomes difficult to stand out in the market, leading to price-based competition.

- Limited Growth Prospects: Firms that don't invest in RegTech or integrate compliance with broader risk management strategies are likely to see stagnant growth in this service area. The global RegTech market, however, is projected to grow significantly, indicating a shift towards technologically advanced solutions. For example, the market was valued at approximately $11.5 billion in 2023 and is expected to reach over $34 billion by 2028, growing at a CAGR of over 24%. This highlights the opportunity cost for those not keeping pace.

- Integration Gap: The failure to connect compliance reporting with strategic risk advisory or advanced tax technology creates a disconnect, preventing the realization of synergistic benefits and higher-value client engagements.

Small, Non-Integrated Legacy Advisory Offerings

Within Deloitte & Touche LLP's BCG Matrix, small, non-integrated legacy advisory offerings often fall into the 'Dogs' category. These are typically niche services, perhaps acquired through past mergers or created for markets that are now contracting. For instance, a specialized regulatory compliance service for a now-obsolete industry might fit this description.

These offerings might have limited market share and minimal growth prospects. Their strategic alignment with Deloitte's current core business objectives might also be weak. While they may still serve a small base of loyal, existing clients, they generally receive little to no new investment or active business development.

In 2024, such offerings represent a challenge in optimizing resource allocation. For example, if a legacy IT integration service, once vital, now only serves a handful of clients in a declining technology sector, it would likely be classified as a dog. These services often contribute minimal revenue and profit, requiring oversight but not strategic expansion.

- Limited Market Share: These services typically serve a small, often declining, client base.

- Low Growth Potential: The markets these services cater to are generally not expanding.

- Non-Core Strategic Alignment: They may not align with Deloitte's current high-priority growth areas.

- Resource Drain: While not actively invested in, they still require operational management and support.

Services falling into the 'Dogs' category of the BCG Matrix are characterized by low market share and low growth potential. These often include highly commoditized offerings or legacy services for declining industries, such as basic IT staff augmentation or specialized advisory for obsolete sectors. In 2024, these segments typically yield minimal profit margins, often in the single digits for data processing, and require operational oversight without strategic investment.

Deloitte, like other professional services firms, aims to manage or divest these 'Dog' business units efficiently. The focus is on minimizing resource drain and transitioning clients towards higher-growth, more profitable services. For instance, while legacy system maintenance might still be performed, the strategic imperative is to migrate clients to cloud-based or modern solutions, thereby phasing out these low-return activities.

The challenge with 'Dogs' lies in their continued drain on resources, albeit often at a lower level than 'Question Marks'. While some may continue to serve a small, loyal client base, they do not contribute significantly to overall growth or market leadership. The strategic goal is to either divest these units or find ways to make them more efficient, freeing up capital for investment in 'Stars' or 'Cash Cows'.

In 2024, the IT staffing market for generic roles saw profit margins around 15%, a clear indicator of the commoditized nature of these 'Dog' services. This contrasts sharply with specialized IT services that can command margins exceeding 30%, underscoring the strategic decision to move away from low-value, high-competition offerings.

Question Marks

Deloitte's Advanced Blockchain & Digital Asset Advisory likely falls into the Question Mark category of the BCG Matrix. This sector boasts significant growth potential as the digital asset landscape expands, encompassing everything from cryptocurrencies to tokenized securities and NFTs.

While Deloitte is a major player in consulting, its market share in highly specialized, cutting-edge blockchain applications is still being established. The firm's revenue in this niche area might be growing, but it's likely not yet a market leader compared to more focused fintech disruptors.

Achieving a dominant position requires substantial investment in specialized blockchain talent and advanced technological infrastructure. The competitive landscape is fierce, with many agile, tech-native firms vying for market share in this rapidly evolving domain.

For instance, the global blockchain market size was valued at USD 11.19 billion in 2023 and is projected to grow significantly, with some estimates reaching over USD 120 billion by 2028, indicating the high growth potential Deloitte aims to capture.

Quantum computing consulting, within Deloitte's BCG Matrix, would likely be positioned as a Question Mark. This is due to its high growth potential but currently low market share, reflecting its nascent stage of development and adoption.

Deloitte is actively investing in quantum capabilities, aiming to establish leadership in this emerging technology. However, the overall market for quantum computing services is still developing, necessitating significant, forward-looking investments without guaranteed immediate returns.

By 2024, while specific market share data for quantum consulting within Deloitte remains proprietary, the broader quantum computing market is projected for substantial growth. Analysts forecast the global quantum computing market to reach tens of billions of dollars by the late 2020s, indicating the long-term strategic importance of building expertise now.

The challenge for Deloitte, and others in this space, is to nurture this nascent capability, balancing speculative investment with the development of practical applications and client demand. Successful navigation of this Question Mark phase is crucial for future market leadership.

Deloitte's specialized IoT and edge computing solutions are currently positioned as question marks within the BCG matrix. While the broader IoT market is substantial, specific high-growth niches within industrial IoT and edge computing are still in their formative stages of development and market penetration.

Deloitte possesses established capabilities in IoT, yet achieving a commanding market position in highly specialized or emerging industrial IoT applications requires strategic focus and dedicated investment. This suggests a need for further development and market cultivation to transform these nascent areas into stars.

The global IoT market was valued at an estimated $1.1 trillion in 2023 and is projected to reach $2.5 trillion by 2028, demonstrating significant growth potential. Within this, industrial IoT (IIoT) is a key driver, with spending expected to exceed $200 billion in 2024, highlighting the opportunity for specialized solutions.

To elevate these offerings from question marks to stars, Deloitte must prioritize targeted investments in research and development, strategic partnerships, and market-specific go-to-market strategies. This will be crucial for scaling these specialized solutions and capturing significant market share in these evolving sectors.

AI-Powered Legal Contract Automation & Analytics

The application of AI in legal services, specifically for contract automation and analytics, represents a dynamic and rapidly expanding sector within the legal industry. Deloitte's strategic integration of Generative AI (GenAI) into its legal and tax offerings positions it within this burgeoning market. However, achieving substantial market share in this niche legal technology space, particularly when competing with established legal tech specialists, necessitates dedicated and substantial investment. For instance, the global legal tech market was projected to reach $25.67 billion in 2023 and is expected to grow significantly, indicating the immense potential but also the competitive landscape.

- Market Growth: The legal AI market is experiencing robust expansion, driven by demand for efficiency and cost reduction in legal processes.

- Deloitte's Approach: Deloitte is leveraging GenAI to enhance its legal and tax service delivery.

- Competitive Landscape: Gaining significant market share requires overcoming competition from specialized legal tech firms.

- Investment Needs: Focused investment is crucial for Deloitte to establish a strong position in AI-powered legal contract automation and analytics.

New Market Penetration for Emerging Services (e.g., Tier 2 cities)

Deloitte's expansion into Tier 2 Indian cities for consulting and risk advisory services positions these offerings as potential stars. The goal is to capture high growth in these developing markets.

While the opportunity in Tier 2 cities is substantial, Deloitte's current market share for these emerging services in these specific new territories is relatively low. This is characteristic of a question mark in the BCG matrix.

Significant investment will be necessary to build brand awareness and tailor service offerings to the unique needs of Tier 2 cities. For instance, in 2023, India's Tier 2 and Tier 3 cities accounted for approximately 35% of the country's digital economy, highlighting the untapped potential.

- Market Share: Initially low in new Tier 2 city markets.

- Growth Rate: High potential for growth in these emerging service areas.

- Investment: Requires substantial investment in localization and talent acquisition.

- Objective: To convert potential into a dominant market share.

Deloitte's cybersecurity services in emerging markets, particularly in regions with rapidly increasing digital adoption but still developing cybersecurity frameworks, would likely be classified as Question Marks. These areas exhibit high growth potential due to rising cyber threats and a greater awareness of digital security needs.

While Deloitte is a global leader in cybersecurity, its market share in these specific, nascent geographic markets is still being established. The firm is investing to build presence and tailor its offerings, aiming to capture future demand before it becomes saturated.

The global cybersecurity market itself is projected for continued strong growth. For instance, the market was estimated to be around $200 billion in 2023 and is expected to expand significantly in the coming years, with specific growth rates varying by region.

For these emerging market cybersecurity services to transition from Question Marks to Stars, Deloitte will need to focus on localized strategies, talent development, and demonstrating tangible value to clients in these developing economies.

| Deloitte Service Offering | BCG Matrix Category | Rationale | Key Considerations |

|---|---|---|---|

| Emerging Market Cybersecurity | Question Mark | High market growth potential, currently low market share for Deloitte in these specific regions. | Requires significant investment in localization, talent, and market penetration strategies to build share. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.