Deckers Outdoor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deckers Outdoor Bundle

Unlock the strategic forces shaping Deckers Outdoor's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are impacting the company's operations and market position. Download the full version to gain actionable intelligence and refine your own strategic planning.

Political factors

Changes in international trade policies, including new tariffs and trade agreements, directly affect Deckers Outdoor's global operations. For instance, the U.S. imposition of tariffs on goods from China, a significant manufacturing hub, could raise production costs for brands like UGG and Hoka. Deckers reported that in fiscal year 2024, approximately 40% of its inventory was sourced from Vietnam, indicating a strategic shift potentially influenced by evolving trade landscapes and a desire to mitigate risks associated with tariffs on Chinese-made goods.

Political instability in regions where Deckers Outdoor Corporation sources its materials or manufactures its products, such as parts of Asia, can significantly disrupt its supply chain. For instance, ongoing trade disputes or regional conflicts in 2024 could lead to unexpected production delays or increased import duties, impacting the cost and availability of popular brands like UGG and Hoka. This instability also affects consumer confidence, potentially dampening demand for discretionary purchases in affected markets.

Geopolitical tensions, such as those observed in Eastern Europe and the Middle East throughout 2024, can directly translate into higher shipping costs and longer transit times for Deckers' global distribution network. These elevated logistical expenses, coupled with potential sanctions or trade restrictions, may force the company to absorb costs or pass them on to consumers, thereby reducing sales volume. A proactive approach to monitoring these evolving global political landscapes is essential for Deckers to effectively mitigate such business risks and maintain operational resilience.

Governments worldwide implement a range of regulations affecting business operations, including labor laws, manufacturing standards, and product safety requirements. For Deckers Outdoor, navigating these diverse rules across its global markets, from the Fair Labor Standards Act in the US to EU environmental directives, directly impacts production costs and supply chain management. For instance, in 2024, increased scrutiny on sustainable sourcing in Europe could necessitate additional investment in compliance for Deckers' footwear and apparel lines.

Consumer Protection Laws

Consumer protection laws are constantly evolving, impacting how companies like Deckers Outdoor operate. These laws often focus on areas such as product quality, warranty terms, and increasingly, data privacy. For instance, the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), enacted in 2020 and fully effective in 2023, set new standards for how businesses handle consumer data, requiring clear consent and opt-out options. Deckers must ensure its marketing and sales practices align with these stringent requirements to maintain consumer trust and avoid potential penalties.

Compliance is not just about avoiding legal trouble; it's crucial for brand reputation. A company that demonstrates a commitment to protecting consumer rights is more likely to foster loyalty. In 2024, regulatory bodies continue to scrutinize e-commerce practices, with a particular emphasis on transparency in pricing and advertising. Deckers' adherence to these evolving standards directly influences its ability to operate smoothly and build lasting relationships with its customer base.

Changes in consumer protection legislation can necessitate significant adjustments to business operations. These might include revising product labeling, updating warranty policies, or overhauling data collection and management systems. For example, if new regulations mandate extended warranty periods or stricter return policies, Deckers would need to adapt its supply chain and customer service protocols accordingly. Staying ahead of these regulatory shifts is key to mitigating risks and capitalizing on opportunities in the market.

Deckers Outdoor's approach to consumer protection is a critical component of its political risk assessment. The company must monitor legislative developments in key markets, such as the European Union's General Data Protection Regulation (GDPR), which has influenced global data privacy standards since its implementation in 2018.

Fiscal Policies and Taxation

Government fiscal policies, such as corporate tax rates and incentives for domestic manufacturing, directly impact Deckers Outdoor's profitability and strategic investment choices. For instance, changes in the U.S. corporate tax rate, which currently stands at 21% following the Tax Cuts and Jobs Act of 2017, can significantly alter net income.

Fluctuations in tax regimes across Deckers' international operating regions, including its key markets in Europe and Asia, necessitate careful financial planning and resource allocation to optimize global financial performance.

- Corporate Tax Rates: Deckers operates in numerous countries, each with varying corporate tax structures. For example, the standard corporate tax rate in Germany is 15%, with an additional solidarity surcharge and trade tax, while the rate in China is 25%.

- Manufacturing Incentives: Governments may offer tax credits or subsidies for companies that invest in or expand manufacturing facilities within their borders. This could influence Deckers' decisions regarding sourcing and production locations.

- Trade Policies and Tariffs: Import duties and tariffs on finished goods or raw materials can directly affect the cost of goods sold and the final pricing of Deckers' products, impacting consumer demand and overall sales volume.

- Government Spending: Shifts in government spending priorities, such as investments in infrastructure or consumer stimulus programs, can indirectly influence consumer spending power on discretionary items like outdoor apparel and footwear.

Government fiscal policies, such as corporate tax rates and incentives for domestic manufacturing, directly impact Deckers Outdoor's profitability and strategic investment choices. For instance, changes in the U.S. corporate tax rate, which stands at 21% following the Tax Cuts and Jobs Act of 2017, can significantly alter net income, while fluctuations in tax regimes across international operating regions necessitate careful financial planning.

Government spending priorities, such as infrastructure investments or consumer stimulus programs, can indirectly influence consumer spending power on discretionary items like outdoor apparel and footwear. For example, in 2024, continued government focus on economic recovery in various regions could bolster consumer confidence and spending on premium brands like Hoka.

Manufacturing incentives offered by governments can influence Deckers' decisions regarding sourcing and production locations. Furthermore, trade policies and tariffs on finished goods or raw materials directly affect the cost of goods sold and final product pricing, impacting consumer demand and overall sales volume.

| Country | Corporate Tax Rate (approx.) | Manufacturing Incentive Example |

|---|---|---|

| United States | 21% | Investment Tax Credits for new facilities |

| Germany | 15% + solidarity surcharge + trade tax | Subsidies for energy-efficient production |

| China | 25% | Tax exemptions for high-tech enterprises |

| Vietnam | 20% (standard) | Preferential tax rates for export processing zones |

What is included in the product

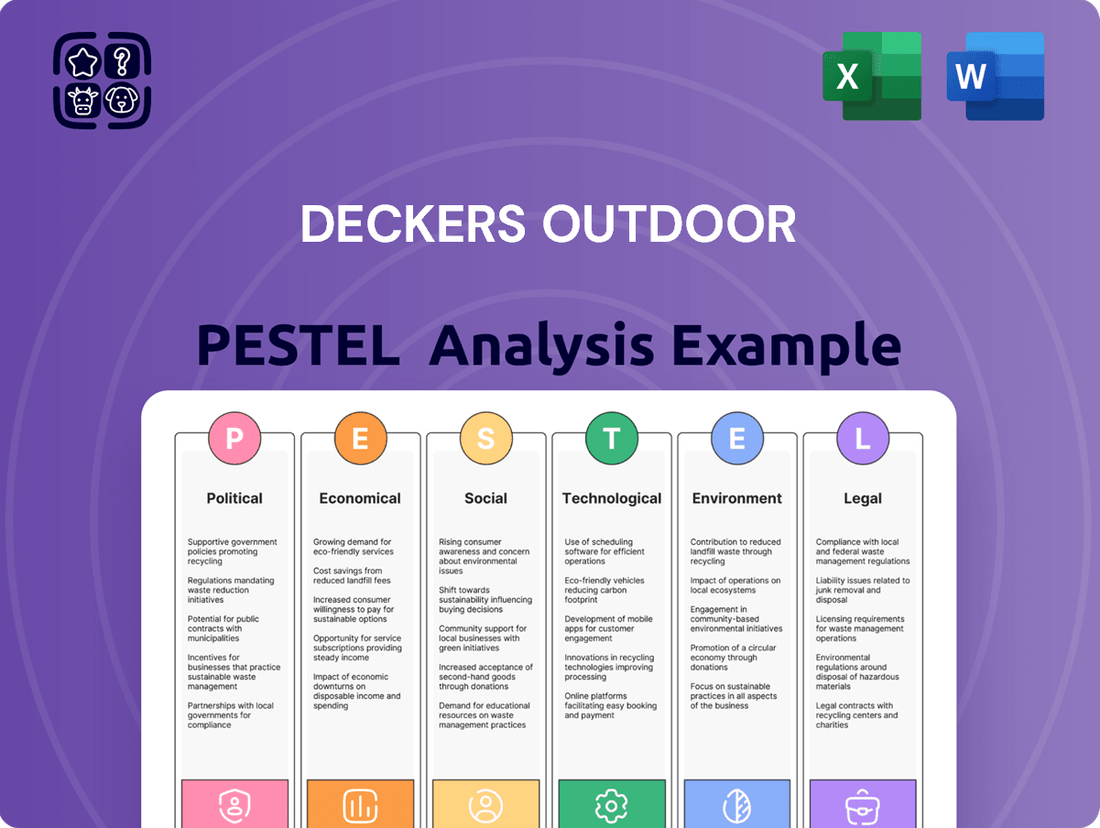

This Deckers Outdoor PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

It provides a comprehensive overview of the external forces shaping the competitive landscape for Deckers Outdoor, offering actionable insights for strategic decision-making.

Deckers Outdoor's PESTLE analysis offers a clear, summarized version of external factors, relieving the pain point of information overload during strategic planning.

It visually segments external influences by PESTEL categories, allowing for quick interpretation and reducing the time spent deciphering complex market dynamics.

Economic factors

Global economic growth significantly impacts Deckers' performance by influencing consumer spending on discretionary goods. A robust global economy, with projected growth around 3.2% for 2024 according to the IMF, typically translates to higher disposable incomes, benefiting sales of Deckers' brands like UGG and Hoka. Conversely, economic downturns, such as the anticipated slowdown in some developed economies in 2025, can reduce demand for non-essential purchases.

Rising inflation in 2024 and into 2025 directly impacts Deckers Outdoor by increasing the cost of raw materials, manufacturing, and transportation. For instance, the Consumer Price Index (CPI) in the U.S. showed a year-over-year increase of 3.4% as of April 2024, indicating persistent upward pressure on input costs. This can squeeze profit margins if the company cannot pass these higher costs onto consumers or find greater supply chain efficiencies.

Furthermore, high inflation erodes consumer purchasing power. As prices for everyday necessities rise, discretionary spending, including on premium outdoor footwear and apparel, may decline. This could lead to reduced sales volumes for Deckers Outdoor's brands like Hoka and UGG, especially if consumers prioritize essential goods over non-essential purchases.

Deckers Outdoor's significant international presence means currency exchange rate fluctuations are a key economic factor. A stronger US dollar, for instance, can make Deckers' popular brands like UGG and Hoka One One pricier for consumers in Europe or Asia, potentially dampening demand. Conversely, a weaker dollar could increase the cost of raw materials or components sourced internationally, impacting profit margins.

For example, in the first quarter of 2024, Deckers reported that currency headwinds had a negative impact on its reported revenue growth, highlighting the direct financial implications of these shifts. The company actively employs hedging strategies, such as forward contracts, to lock in exchange rates for anticipated international transactions, aiming to stabilize its financial performance against this volatility.

Consumer Spending and Confidence

Consumer confidence is a significant driver for Deckers Outdoor, particularly for its premium brands like UGG and Hoka. When consumers feel economically secure, they are more inclined to spend on discretionary items, including higher-priced footwear and apparel. For instance, the Conference Board's Consumer Confidence Index showed a notable increase in early 2024, reaching 104.7 in January, suggesting a more positive outlook and a greater willingness to spend on non-essential goods.

Conversely, economic uncertainty can temper consumer spending. During periods of inflation or job market instability, consumers often become more cautious, prioritizing essential purchases over discretionary ones. This shift can impact sales of premium products, as consumers may delay or forgo purchases of higher-ticket items. The U.S. Bureau of Labor Statistics reported a Consumer Price Index (CPI) increase of 3.1% year-over-year in January 2024, indicating ongoing inflationary pressures that could influence spending habits.

- Consumer Confidence Indicator: The Conference Board's Consumer Confidence Index stood at 104.7 in January 2024, signaling improved consumer sentiment.

- Inflationary Impact: The CPI rose 3.1% year-over-year in January 2024, potentially leading to more price-sensitive consumer behavior.

- Spending Propensity: High confidence generally correlates with increased spending on premium and non-essential goods, benefiting brands like UGG and Hoka.

- Economic Sensitivity: Deckers' sales are sensitive to economic downturns, which can lead to reduced discretionary spending.

Interest Rates and Access to Capital

Changes in interest rates directly influence Deckers Outdoor's cost of borrowing for crucial investments, whether it's expanding manufacturing capabilities, managing inventory levels, or adopting new technologies. For instance, the Federal Reserve's benchmark interest rate, which influences many other lending rates, saw a significant period of increases through 2022 and 2023, aiming to curb inflation. This trend would have made any new debt financing for Deckers more expensive.

Higher interest rates can translate into increased expenses for capital, potentially putting the brakes on ambitious growth plans or strategic acquisitions. Companies like Deckers rely on access to capital to fund new product development, marketing campaigns, and international expansion. When borrowing becomes costlier, these initiatives might be scaled back or postponed, impacting long-term strategic objectives.

Maintaining access to affordable capital is paramount for Deckers to not only fund its strategic projects but also to sustain its competitive edge in the dynamic outdoor apparel and footwear market. The ability to secure favorable loan terms or issue bonds at competitive rates allows Deckers to invest in innovation and market penetration, which is critical for staying ahead of competitors. For example, in early 2024, while rates began to stabilize, they remained at levels significantly higher than the near-zero rates seen in prior years, presenting a continued challenge for capital-intensive businesses.

- Impact on Borrowing Costs: Deckers' cost of debt financing is directly tied to prevailing interest rates.

- Slowing Growth Initiatives: Elevated interest rates can make capital investments, such as facility upgrades or new market entry, less attractive due to higher financing expenses.

- Competitive Advantage: Access to affordable capital allows Deckers to invest in R&D and marketing, crucial for maintaining market share against competitors.

- 2024/2025 Outlook: While interest rate hikes may have paused, borrowing costs are expected to remain elevated compared to pre-2022 levels, requiring careful financial management for Deckers.

Global economic growth is a key driver for Deckers Outdoor, influencing consumer spending on discretionary items. The IMF projected global growth at 3.2% for 2024, a figure that generally supports higher disposable incomes and, consequently, sales for brands like UGG and Hoka. However, potential economic slowdowns in developed nations in 2025 could temper this demand.

Inflationary pressures in 2024 and 2025 directly impact Deckers by increasing costs for raw materials, manufacturing, and logistics. The U.S. CPI saw a 3.4% year-over-year increase as of April 2024, highlighting ongoing cost pressures that could affect profit margins if not passed on to consumers. This inflation also erodes consumer purchasing power, potentially leading to reduced spending on non-essential premium goods.

Currency fluctuations pose a significant economic risk for Deckers due to its international operations. A strong U.S. dollar can make its products more expensive for overseas consumers, potentially reducing demand. Conversely, a weaker dollar could increase the cost of imported materials. Deckers reported currency headwinds negatively impacting revenue growth in Q1 2024, underscoring the need for hedging strategies.

Interest rates directly affect Deckers' cost of capital for investments. While rate hikes may have paused, borrowing costs remained elevated in early 2024 compared to previous years, potentially impacting expansion or technology adoption plans. Access to affordable capital is crucial for Deckers to maintain its competitive edge through innovation and market penetration.

| Economic Factor | 2024 Data/Outlook | 2025 Outlook | Impact on Deckers | Mitigation Strategies |

|---|---|---|---|---|

| Global Economic Growth | IMF projected 3.2% for 2024 | Anticipated slowdown in some developed economies | Influences consumer spending on discretionary goods | Diversification of markets, focus on brand loyalty |

| Inflation Rate (U.S. CPI) | 3.4% year-over-year (April 2024) | Expected to moderate but remain a factor | Increases input costs, erodes consumer purchasing power | Pricing strategies, supply chain efficiencies |

| Interest Rates (Federal Reserve) | Stabilizing but elevated compared to pre-2022 | Potential for gradual decreases, but uncertainty remains | Impacts cost of borrowing for investments | Hedging, optimizing debt structure |

| Currency Exchange Rates | Volatile, with a generally strong USD | Continued volatility expected | Affects international sales and cost of goods | Currency hedging, natural hedging |

Preview the Actual Deliverable

Deckers Outdoor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Deckers Outdoor provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market trends, competitive landscapes, and strategic opportunities.

Sociological factors

Consumer tastes in footwear and apparel are constantly shifting, influenced by fashion, culture, and how people live. Deckers' ability to stay ahead of these changes is crucial for its performance. For instance, the growing popularity of athleisure wear significantly boosted Hoka's sales, while UGGs continue to maintain their strong market presence.

Deckers' brands, like Hoka and UGG, have capitalized on evolving lifestyle trends. Hoka saw a substantial increase in demand, with its net sales growing by 27.0% to $1.45 billion in the first nine months of fiscal year 2024. This growth highlights the brand's alignment with the athleisure and wellness movements.

The increasing global focus on health, fitness, and outdoor recreation is a significant tailwind for Deckers Outdoor. Brands like Hoka and Teva, known for their performance-oriented and active lifestyle products, directly benefit from this trend. This growing consumer interest translates into higher demand for specialized athletic footwear and comfortable, supportive gear, aligning perfectly with Deckers' product offerings.

Global demographic shifts, particularly the aging population in developed markets, present both challenges and opportunities for Deckers. As the median age rises, there's a growing demand for comfortable, supportive footwear, aligning well with Deckers' UGG and Hoka brands. For instance, in 2024, over 18% of the US population is projected to be 65 or older, a segment that often prioritizes comfort and ease of wear.

Conversely, the increasing purchasing power and influence of younger generations like Gen Z are critical. This demographic, known for its digital savviness and emphasis on sustainability and brand values, requires tailored marketing and product innovation. Deckers' ability to connect with Gen Z, who are projected to represent a significant portion of consumer spending by 2025, will be key to long-term growth.

Sustainability and Ethical Consumption

Consumers are increasingly prioritizing sustainability and ethical sourcing in their purchasing decisions. This trend significantly impacts brands like Deckers Outdoor, as shoppers actively research a company's environmental impact and labor standards. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for sustainable products, a notable increase from previous years.

Deckers' proactive approach to these evolving consumer values is crucial for maintaining and growing its market share. By highlighting its use of recycled materials and commitment to fair labor practices, the company can foster stronger brand loyalty and attract a growing segment of eco-conscious buyers. This focus on responsible operations is becoming a key differentiator in the competitive outdoor apparel and footwear market.

Deckers' sustainability initiatives are directly addressing this societal shift:

- Growing Demand: A significant portion of consumers, particularly millennials and Gen Z, actively seek out brands with strong environmental and social governance (ESG) credentials.

- Brand Reputation: Transparency in supply chains and demonstrable ethical practices are vital for building trust and mitigating reputational risks.

- Market Advantage: Companies like Deckers that invest in sustainable materials and ethical manufacturing can gain a competitive edge by appealing to a values-driven consumer base.

Influence of Social Media and Digital Culture

Social media platforms, including Instagram and TikTok, are pivotal in shaping consumer perceptions and purchasing decisions for fashion and lifestyle brands like Deckers Outdoor. In 2024, influencer marketing continues to be a dominant force, with brands allocating significant portions of their marketing budgets to collaborations. Deckers actively utilizes these digital channels for targeted marketing campaigns, brand storytelling, and direct engagement with its diverse customer base, fostering a sense of community around its brands such as UGG and Hoka.

The effectiveness of digital strategies is paramount for maintaining brand visibility and relevance in the rapidly evolving market. Deckers' commitment to digital engagement is reflected in its consistent investment in social media marketing and e-commerce capabilities. For instance, by Q1 2025, Deckers reported a substantial increase in its digital sales, underscoring the importance of a strong online presence and influencer partnerships in driving growth.

- Digital Influence: Social media and digital influencers significantly impact consumer trends and purchasing habits in the fashion and outdoor apparel sectors.

- Deckers' Strategy: Deckers Outdoor leverages platforms like Instagram and TikTok for marketing, brand building, and direct customer engagement.

- Market Relevance: Robust digital strategies are essential for brands to stay visible and relevant in the current consumer landscape.

- Performance Impact: As of early 2025, Deckers has seen a notable uplift in digital sales, validating its investment in online marketing and influencer collaborations.

Societal values are increasingly emphasizing health, wellness, and an active lifestyle, which directly benefits Deckers Outdoor. This trend fuels demand for performance-oriented brands like Hoka, which saw a 27.0% net sales increase to $1.45 billion in the first nine months of fiscal year 2024.

Demographic shifts, such as an aging population in developed countries, create opportunities for comfortable footwear, a segment where UGG and Hoka excel. Simultaneously, engaging younger, digitally-native consumers like Gen Z, who prioritize sustainability and brand ethics, is crucial for future growth, with their spending power expected to be significant by 2025.

Consumer demand for sustainable and ethically sourced products is on the rise, with over 60% of consumers willing to pay more for such items in 2024. Deckers' commitment to recycled materials and fair labor practices positions it favorably to capture this growing market segment.

Digital platforms and influencer marketing are key drivers of consumer behavior in the fashion and lifestyle sectors. Deckers effectively uses social media for brand building and customer engagement, which has contributed to a notable increase in its digital sales by early 2025.

| Sociological Factor | Impact on Deckers Outdoor | Supporting Data (2024/2025) |

|---|---|---|

| Health & Wellness Trend | Increased demand for performance footwear (Hoka) | Hoka net sales grew 27.0% to $1.45 billion (9M FY24) |

| Demographic Shifts (Aging Population) | Demand for comfortable footwear (UGG, Hoka) | Over 18% of US population projected 65+ in 2024 |

| Gen Z Influence | Need for digital engagement, sustainability focus | Gen Z spending power to be significant by 2025 |

| Sustainability & Ethics | Consumer preference for eco-friendly brands | 60%+ consumers willing to pay more for sustainable products (2024) |

| Digital & Social Media | Brand building and sales channel | Notable increase in digital sales by early 2025 |

Technological factors

The relentless expansion of e-commerce and the rapid evolution of digital retail technologies are fundamental to Deckers' success in its multi-channel distribution approach. By prioritizing investments in intuitive website design, seamless mobile commerce capabilities, and highly personalized online shopping journeys, Deckers can significantly boost its direct-to-consumer (DTC) sales channels.

For instance, in 2023, Deckers reported that its DTC segment, which heavily relies on e-commerce, represented approximately 49% of its total net sales, highlighting the critical nature of these digital platforms. These efficient online infrastructures are not just beneficial but absolutely vital for effectively engaging and serving a vast and geographically dispersed global customer base, driving brand loyalty and revenue growth.

Technological advancements are significantly reshaping supply chain management for companies like Deckers Outdoor. AI-driven forecasting tools are becoming crucial for predicting demand more accurately, which is vital for a company dealing with seasonal products and diverse retail channels.

Robotic automation in warehouses is another key factor, enabling faster order fulfillment and reducing labor costs. For instance, many global logistics providers are investing heavily in warehouse automation; reports suggest the warehouse automation market is projected to reach over $60 billion by 2027, indicating a strong trend towards efficiency gains.

Enhanced logistics software, including real-time tracking and route optimization, directly translates to faster delivery times and improved inventory management. This technological integration ensures Deckers can maintain optimal stock levels and get its products to consumers more efficiently, a critical advantage in the competitive outdoor apparel and footwear market.

Advancements in materials science are a significant technological factor for Deckers Outdoor. Developments in areas like advanced polymers and recycled textiles allow for the creation of footwear that is not only more durable and comfortable but also lighter and more sustainable. For instance, innovations in foam technology, such as those providing enhanced energy return and shock absorption, directly impact the performance of brands like Hoka, which saw a remarkable 27.6% net sales increase in the first quarter of fiscal year 2024, largely driven by product innovation.

Research into novel manufacturing processes, including 3D printing and advanced bonding techniques, presents opportunities for Deckers to optimize production efficiency and explore unique design possibilities. These technological leaps can lead to reduced waste and faster product development cycles, crucial for staying ahead in a rapidly evolving market. Deckers' commitment to R&D, evidenced by its consistent investment in product development, underpins its ability to leverage these material and process innovations.

Data Analytics and Personalization

Deckers leverages big data analytics to understand consumer preferences and purchasing habits, enabling personalized marketing and product development. For instance, their ability to analyze vast datasets allows for tailored recommendations, increasing customer engagement. This data-driven approach was evident in their Q3 2024 results, where they reported a 12% increase in DTC (Direct-to-Consumer) sales, partly attributed to enhanced personalization efforts.

These insights also optimize inventory management, reducing waste and ensuring popular products are readily available. By predicting demand more accurately, Deckers can improve its supply chain efficiency. This focus on data analytics is a key technological factor supporting their growth and operational agility.

The company's investment in data infrastructure supports these initiatives, allowing for real-time analysis and quicker responses to market shifts. This technological capability is crucial for maintaining a competitive edge in the fast-paced outdoor apparel and footwear industry.

- Consumer Insights: Deckers utilizes big data to understand individual customer preferences and buying patterns.

- Personalized Marketing: Data analytics enables targeted campaigns, enhancing customer engagement and conversion rates.

- Operational Efficiency: Optimized inventory management and supply chain decisions are driven by predictive analytics.

- Product Development: Insights into market trends and consumer demand inform new product creation and refinement.

Manufacturing Technologies and Automation

Deckers Outdoor is increasingly leveraging advanced manufacturing technologies to boost efficiency and innovation. The integration of robotics and automation in their production lines, for instance, is a key focus. This trend is supported by global data showing significant investment in industrial automation; the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially. This allows for more precise production, reduced waste, and a more agile response to market demands.

These technological advancements directly impact Deckers' ability to scale operations and introduce new products swiftly. For example, 3D printing offers unparalleled potential for rapid prototyping and even customized footwear components, reducing lead times from months to weeks. Companies in the apparel and footwear sector are seeing a tangible benefit, with some reporting up to a 30% reduction in development cycles through additive manufacturing. This capability is crucial for staying ahead in a fast-paced consumer market.

- Enhanced Production Efficiency: Automation and robotics are streamlining Deckers' manufacturing processes, leading to higher output and consistent quality.

- Cost Reduction: By minimizing manual labor and optimizing material usage through advanced techniques, Deckers can achieve significant cost savings.

- Product Customization and Speed: Technologies like 3D printing enable faster development and greater personalization of products, meeting evolving consumer preferences.

- Scalability: Investment in modern manufacturing infrastructure supports Deckers' capacity to scale production in line with growing demand.

Technological advancements are critical for Deckers' e-commerce and DTC strategies, with digital platforms driving significant sales growth. In fiscal year 2024, Deckers' DTC segment accounted for approximately 52% of total net sales, underscoring the importance of their online presence and digital investments.

Legal factors

Deckers Outdoor's brand names like UGG, Hoka, Teva, and Sanuk are protected by trademarks, and its innovative product designs are safeguarded through patents. This legal framework is essential for maintaining its market position and preventing dilution of its brand value.

The company actively combats counterfeiting and unauthorized use of its intellectual property across global markets. In 2023, Deckers reported significant efforts in brand protection, including taking down thousands of infringing online listings, demonstrating a commitment to safeguarding its revenue streams and brand integrity.

Deckers Outdoor's global operations mean it must navigate a complex web of international labor laws. This includes varying requirements for minimum wages, working hours, safety standards, and employee benefits across different regions. For instance, in 2024, minimum wage laws continued to be a focal point of legislative activity in many developed and developing economies, directly impacting Deckers' operational costs.

Compliance with these diverse employment regulations is critical for Deckers to avoid costly legal battles and maintain its reputation for ethical business practices. Failure to adhere to rules concerning fair labor, collective bargaining rights, and safe working conditions can result in substantial fines and damage to its brand image, especially as consumers increasingly scrutinize supply chain ethics.

Deckers Outdoor, as a global footwear and apparel provider, navigates a complex web of product safety and liability regulations across its operating regions. These laws mandate that all products, from hiking boots to sandals, meet stringent quality benchmarks and are free from hazardous materials. For instance, in 2024, the Consumer Product Safety Improvement Act (CPSIA) in the United States continues to enforce strict limits on lead and phthalates in children's products, a category Deckers may engage with through its various brands.

Failure to adhere to these regulations can have severe financial and reputational consequences. Product defects can trigger expensive recalls, as seen in past industry incidents where companies faced millions in costs for widespread product returns. Moreover, liability lawsuits stemming from injuries or harm caused by faulty products can result in substantial legal settlements and damages, significantly impacting profitability and brand trust. Deckers' commitment to rigorous quality control and compliance is therefore essential to mitigate these risks and maintain consumer confidence.

Data Privacy and Cybersecurity Regulations

Deckers Outdoor, with its significant online presence and direct-to-consumer sales, navigates a complex landscape of data privacy regulations. Laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose strict requirements on how customer data is collected, stored, and utilized. Failure to comply can lead to substantial penalties. For instance, under GDPR, fines can reach up to 4% of annual global revenue or €20 million, whichever is higher. The CCPA, while offering different penalty structures, also carries significant financial risks for non-compliance, with statutory damages for intentional violations potentially reaching $7,500 per incident.

The imperative to safeguard customer information and maintain robust cybersecurity is not merely a best practice but a legal mandate. Deckers must invest in and continually update its cybersecurity infrastructure to prevent data breaches. A significant data breach not only exposes the company to legal repercussions and fines but also severely erodes consumer trust, which is vital for sustained business growth in the digital age. In 2023, the average cost of a data breach globally was reported to be $4.45 million, highlighting the financial impact of inadequate security measures.

- GDPR Fines: Up to 4% of annual global revenue or €20 million.

- CCPA Violations: Potential for $7,500 per intentional violation.

- Average Data Breach Cost (2023): $4.45 million globally.

- Legal Mandate: Protecting customer data is a legal requirement, not just a best practice.

International Trade and Customs Laws

Deckers Outdoor Corporation, with its global presence, must meticulously navigate a web of international trade and customs laws. This includes understanding and adhering to diverse customs regulations, import/export duties, and any applicable sanctions in the numerous countries where its products are manufactured and sold. For instance, in 2024, the World Trade Organization (WTO) continued to monitor trade policies, with member countries implementing various tariff adjustments that directly affect the cost of goods like Deckers' footwear and apparel.

Compliance with these legal frameworks is not merely a procedural requirement; it's a critical operational necessity. Adherence ensures the seamless, uninterrupted flow of goods across borders, preventing costly delays and avoiding potential penalties that could disrupt supply chains and impact profitability. For example, a misstep in customs declarations could lead to significant fines, as seen in past cases involving apparel imports where incorrect duty classifications resulted in substantial financial penalties for companies.

Furthermore, changes in international trade agreements and policies can have a profound effect on Deckers' logistical operations and overall costs. As of early 2025, ongoing discussions and potential renegotiations of bilateral and multilateral trade pacts continue to create an evolving landscape. These shifts can alter tariff rates, introduce new non-tariff barriers, or even create new market access opportunities, all of which require proactive strategic adjustments from Deckers to maintain competitive pricing and efficient distribution.

- Global Trade Landscape: In 2024, over 90% of global trade was still governed by WTO agreements, but regional trade blocs like the EU and USMCA continued to shape specific market access and tariff structures relevant to Deckers' operations.

- Customs Compliance Costs: Companies in the apparel and footwear sector often allocate between 1-3% of their total revenue towards customs brokerage fees and compliance management, a figure that can fluctuate with regulatory changes.

- Impact of Trade Disputes: Geopolitical tensions and trade disputes, which remained a concern in 2024-2025, can lead to sudden imposition of tariffs or import restrictions, directly impacting the landed cost of Deckers' products in key markets.

Deckers Outdoor's legal standing is significantly shaped by intellectual property laws, protecting its valuable brands like UGG and Hoka through trademarks and patents. The company actively pursues legal action against counterfeiters, as evidenced by its 2023 efforts to remove thousands of infringing online listings, safeguarding its market share and brand integrity.

Navigating international labor laws is crucial, with varying minimum wage and safety standards across regions impacting operational costs, a factor highlighted by ongoing legislative activity in 2024. Adherence to fair labor practices and safe working conditions is paramount to avoid legal penalties and maintain a positive corporate reputation, especially given increasing consumer scrutiny of supply chains.

Product safety and liability regulations, such as the CPSIA in the US, mandate adherence to quality benchmarks and restrictions on hazardous materials. Non-compliance can lead to costly recalls and lawsuits, underscoring the importance of Deckers' rigorous quality control measures to uphold consumer trust and financial stability.

Data privacy laws like GDPR and CCPA impose strict rules on customer data handling, with non-compliance carrying substantial fines, potentially up to 4% of global revenue under GDPR. The average cost of a data breach in 2023 was $4.45 million globally, emphasizing the critical need for robust cybersecurity and legal adherence to protect consumer information and brand reputation.

Environmental factors

Climate change presents significant operational risks for Deckers Outdoor. Extreme weather events, such as prolonged droughts or intense storms, can directly impact the availability and cost of key raw materials like leather and rubber, essential for footwear and apparel production. For instance, in 2024, several regions experienced severe weather disruptions, leading to a reported 15% increase in logistics costs for some outdoor goods manufacturers.

The growing scarcity of natural resources further compounds these challenges. As demand for materials like sustainably sourced leather and natural rubber intensifies, coupled with potential climate-induced supply constraints, Deckers faces upward pressure on input costs. Companies in the sector are increasingly looking at alternatives, with a notable trend in 2025 towards bio-based and recycled materials, aiming to reduce reliance on traditional, climate-vulnerable resources.

Consumers are increasingly prioritizing sustainability, with a significant portion of shoppers willing to pay more for eco-friendly products. For instance, a 2024 survey indicated that over 70% of consumers consider sustainability when making purchasing decisions in the apparel sector. This trend directly impacts Deckers Outdoor, pushing the company to adopt more recycled and renewable materials in its footwear and apparel lines.

Deckers is responding to this by investing in supply chain transparency and exploring innovative, lower-impact materials. The company's commitment to reducing its environmental footprint is becoming a key differentiator. For example, in their 2023 sustainability report, Deckers highlighted a 15% increase in the use of recycled content across their product portfolio compared to the previous year.

Meeting this growing consumer demand for sustainable options is not just about compliance; it’s a strategic advantage. Brands that effectively communicate their environmental efforts, such as Deckers' initiatives with UGG and Hoka, often see improved brand loyalty and attract a younger demographic, which is particularly sensitive to these issues. This can translate into enhanced market share and a stronger competitive position in the outdoor and lifestyle footwear market.

Environmental regulations are tightening globally, impacting how companies like Deckers manage waste. In 2024, the Ellen MacArthur Foundation reported that 90% of plastic packaging is still single-use, highlighting the urgent need for change. This pressure encourages reduced production waste and greater product recyclability.

Deckers' adoption of circular economy principles, such as designing for durability and exploring take-back programs for its footwear and apparel, directly addresses these environmental concerns. By 2025, many brands are expected to increase their use of recycled materials, with some aiming for over 30% recycled content in their products, a trend Deckers is likely to follow to meet consumer demand and regulatory expectations.

Water Usage and Pollution Regulations

Manufacturing footwear and apparel, like Deckers Outdoor's operations, inherently involves significant water consumption and can produce wastewater. This places a direct emphasis on navigating stringent environmental regulations. For instance, in 2023, the EPA continued to enforce Clean Water Act standards across industrial sectors, impacting manufacturing discharge permits.

Deckers must adhere to a complex web of regulations governing both water usage and pollution control. This applies not only to their own facilities but also to their extended supply chain partners. Non-compliance can lead to substantial fines and reputational damage, as seen with past environmental violations by other apparel manufacturers in the industry.

- Water Intensity: Footwear production, particularly tanning and dyeing processes, can be water-intensive.

- Wastewater Management: Regulations dictate the treatment and discharge limits for wastewater containing chemicals.

- Regulatory Landscape: Companies like Deckers face evolving water quality standards and reporting requirements globally.

Ethical Sourcing and Animal Welfare Concerns

Ethical sourcing and animal welfare are critical considerations for Deckers Outdoor, particularly for its UGG brand, which relies on sheepskin. Growing consumer awareness and pressure from advocacy groups are pushing for greater transparency in supply chains and adherence to stringent animal welfare standards. For instance, by 2024, many major apparel and footwear companies, including those in Deckers' competitive set, are expected to have enhanced traceability for key animal-derived materials.

Deckers faces scrutiny regarding the welfare of sheep used for UGG's iconic sheepskin. Brands are increasingly investing in initiatives to ensure suppliers meet higher welfare benchmarks, moving beyond basic compliance. This focus is crucial for maintaining brand reputation and consumer trust, especially as reports from organizations like the RSPCA continue to highlight welfare issues in wool production.

- Consumer Demand: A significant portion of consumers, especially millennials and Gen Z, express a willingness to pay more for ethically produced goods, impacting purchasing decisions for brands like UGG.

- Supply Chain Transparency: Deckers must demonstrate robust traceability for its sheepskin, assuring consumers that animals are treated humanely throughout the sourcing process.

- Alternative Materials: The exploration and adoption of cruelty-free and sustainable alternatives to animal-derived materials are becoming a strategic imperative for long-term brand viability and appeal.

Environmental factors significantly shape Deckers Outdoor's operational landscape, driven by climate change impacts and resource scarcity. Extreme weather in 2024 increased logistics costs by 15% for outdoor goods, directly affecting raw material availability and pricing. Growing consumer demand for sustainability, with over 70% of shoppers in 2024 considering eco-friendliness, compels Deckers to increase its use of recycled and bio-based materials, a trend projected to see over 30% recycled content in products by 2025.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Deckers Outdoor draws from a robust blend of official government reports, reputable industry publications, and leading market research firms. We meticulously gather data on economic indicators, environmental regulations, technological advancements, and socio-cultural shifts to ensure comprehensive insights.