Deckers Outdoor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deckers Outdoor Bundle

Deckers Outdoor's BCG Matrix reveals a dynamic portfolio, with brands like Hoka and UGG likely positioned as Stars or Cash Cows, driving significant growth and revenue. Understanding these placements is crucial for strategic resource allocation.

Unlock the full potential of Deckers Outdoor's portfolio by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of each brand's position, enabling you to make informed decisions about investment and future product development.

Stars

Hoka is a star performer for Deckers Outdoor, showcasing impressive revenue growth. In the first quarter of fiscal year 2026, Hoka's revenue surged by 20% to $653 million, following a robust 23.6% increase to $2.233 billion in fiscal year 2025. This strong financial trajectory highlights Hoka's significant contribution to Deckers' overall success.

The brand's international reach is expanding rapidly, with particularly strong performance noted in the EMEA and APAC regions. This global momentum is being further fueled by Deckers' strategic initiatives to broaden Hoka's wholesale distribution and increase the number of company-owned retail locations, aiming to capture even more market share.

Deckers Outdoor is actively pursuing international market expansion, a key strategic pillar. This focus is yielding significant results, with international sales experiencing a remarkable surge of 50% in the first quarter of fiscal year 2026.

These international efforts now represent a substantial 35% of Deckers' total revenue, highlighting the growing global importance of its brands.

This impressive growth is largely propelled by the strong performance of both Hoka and UGG, especially in rapidly expanding markets such as China and across Europe.

The robust international sales figures underscore a clear and increasing global appetite for Deckers' core product offerings.

Deckers' Direct-to-Consumer (DTC) channel experienced robust growth, with net sales climbing 26.5% in fiscal year 2024. This channel's increasing importance is highlighted by its projected contribution to 43% of total company revenue in fiscal year 2025.

This strategic focus on DTC allows Deckers to cultivate a more controlled and premium brand experience for consumers. It also directly enhances profitability by cutting out intermediaries, a key factor in strengthening the market presence of its flagship brands, Hoka and UGG.

Innovation in Product Pipeline

Deckers Outdoor’s product pipeline is a key driver of its success, particularly for its star brands, Hoka and UGG. Both benefit from a constant stream of new and updated products aimed at a global audience. This innovation is crucial for staying ahead in competitive markets.

Hoka, for instance, consistently refreshes popular lines like the Clifton, Bondi, and Arahi. This commitment to innovation ensures that consumers remain engaged and that the brand maintains its strong market position. For example, Hoka saw significant growth in its fiscal year 2024, with net sales increasing by 17.7% year-over-year, reaching $1.46 billion, reflecting the success of its product strategy.

- Hoka's Clifton series: Continual updates and new colorways keep this popular running shoe relevant.

- UGG's Classic Boot: While iconic, UGG also innovates with new materials, styles, and collaborations to attract new demographics.

- Fiscal Year 2024 Performance: Hoka's net sales reached $1.46 billion, a 17.7% increase, underscoring the impact of its product pipeline.

- Market Share: Consistent product innovation helps both Hoka and UGG defend and grow their market share against a crowded field of competitors.

Strong Brand Intangible Assets

Deckers' competitive advantage, or narrow moat, is built on the significant intangible assets of its brands, particularly UGG and Hoka. These brands have a powerful appeal, consistently delivering impressive sales growth. For instance, in the fiscal year ending March 31, 2024, Deckers reported net sales of $3.79 billion, with Hoka and UGG being major contributors. Hoka’s revenue saw a substantial increase of 32.4% year-over-year, reaching $1.43 billion, while UGG's revenue grew by 3.4% to $1.02 billion. This demonstrates the strong consumer loyalty and perceived value that allows Deckers to command premium pricing for its products.

The admiration for UGG and Hoka stems from their strategic positioning in the market. Hoka has capitalized on the booming running and athleisure trends, while UGG maintains its strong foothold in comfort and fashion. This dual strength in distinct consumer segments underscores the brand equity. In the first quarter of fiscal year 2025, Deckers announced net sales of $853.1 million, a 10.4% increase compared to the previous year, with Hoka and UGG continuing to lead the charge, highlighting their sustained market relevance and consumer demand.

- Brand Strength: UGG and Hoka possess significant brand equity, enabling premium pricing and fostering customer loyalty.

- Sales Growth Drivers: Both brands have consistently driven double-digit sales growth, as evidenced by fiscal year 2024 and Q1 fiscal year 2025 results.

- Market Positioning: Strategic positioning in growing segments like running (Hoka) and comfort/fashion (UGG) reinforces brand value.

- Financial Performance: Hoka's revenue grew 32.4% to $1.43 billion in FY24, and UGG's revenue rose 3.4% to $1.02 billion in FY24, showcasing their financial impact.

Hoka stands out as a star within Deckers Outdoor's portfolio, demonstrating exceptional revenue growth and expanding international presence. Its robust financial performance, marked by a 20% revenue increase to $653 million in Q1 FY2026, underscores its critical role in the company's success.

The brand's global momentum is further amplified by strategic investments in wholesale distribution and company-owned retail, particularly in high-growth regions like EMEA and APAC. This international push, contributing 35% of Deckers' total revenue in Q1 FY2026, highlights a strong global demand for Hoka's innovative products.

Hoka's commitment to product innovation, exemplified by continuous updates to popular lines like the Clifton, fuels its market leadership. This strategy, coupled with a strong Direct-to-Consumer channel that accounted for 43% of total company revenue in FY2025, solidifies Hoka's position as a key growth driver for Deckers.

| Brand | FY2024 Revenue | FY2024 Growth | Q1 FY2026 Revenue | Q1 FY2026 Growth |

| Hoka | $1.46 billion | 17.7% | $653 million | 20% |

| UGG | $1.02 billion | 3.4% | N/A | N/A |

What is included in the product

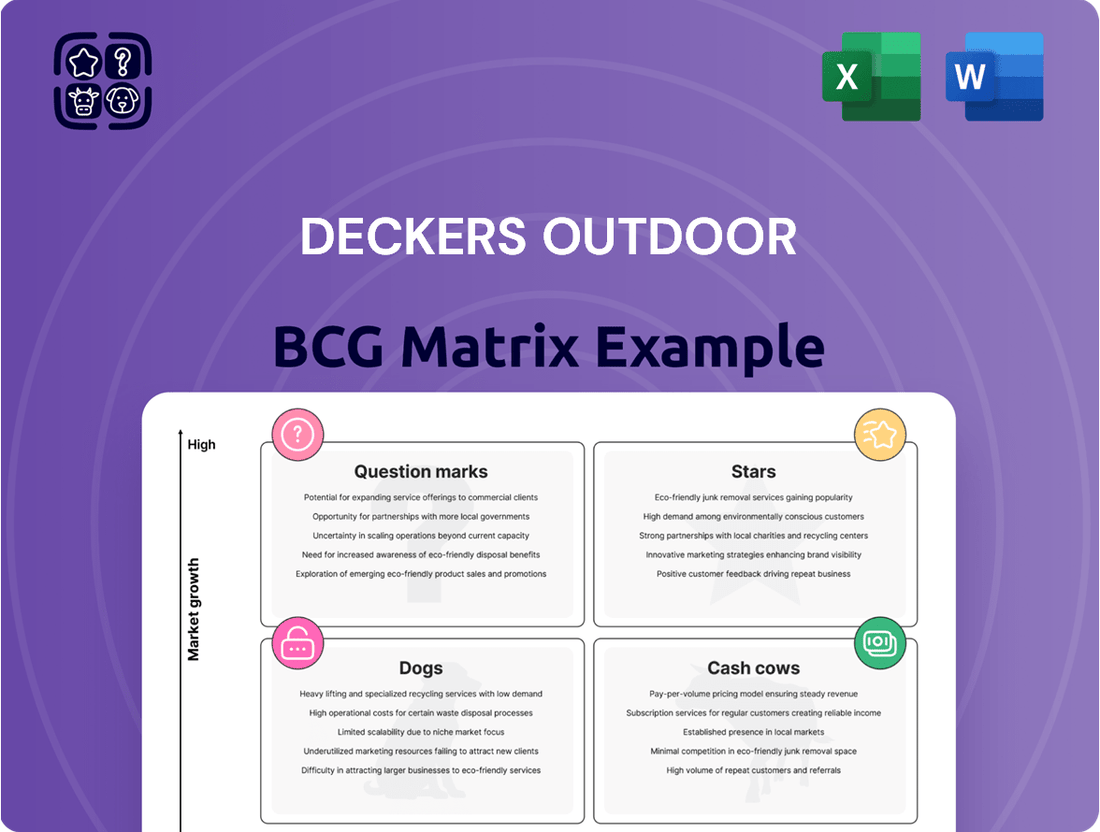

This BCG Matrix overview examines Deckers Outdoor's product portfolio, categorizing brands into Stars, Cash Cows, Question Marks, and Dogs.

Deckers Outdoor's BCG Matrix offers a clear, visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

UGG stands as Deckers Outdoor's dominant force, representing 51% of its fiscal 2025 sales. This brand exhibits a stable and highly profitable profile, solidifying its position as a cash cow.

In fiscal year 2025, UGG achieved $2.531 billion in sales, marking a substantial 13.1% growth. Despite a more mature growth trajectory compared to brands like Hoka, UGG's consistent revenue generation and strong profit margins underscore its reliable cash-generating capabilities.

Deckers' UGG brand is a prime example of a cash cow, demonstrating exceptional profitability. In fiscal 2025, UGG achieved a segment-level operating profit margin of 40%, showcasing its robust ability to generate substantial cash flow for the company.

Overall, Deckers Outdoor reported impressive financial health in fiscal 2025, with an operating margin nearing 24% and a gross margin of 57.88%. This strong performance underscores the company's effective management and the significant cash-generating power of its established brands like UGG.

UGG's position as a cash cow for Deckers Outdoor is undeniable, bolstered by its established market leadership. This brand commands a significant market share within its mature segment, consistently delivering high margins.

The brand's enduring consumer demand, even outside of peak seasons, solidifies its role as a reliable revenue generator for Deckers. For instance, in the fiscal year ending March 31, 2024, Deckers reported that UGG revenue reached $2.1 billion, a testament to its sustained popularity and profitability.

Reduced Need for Aggressive Promotion

UGG, as a Cash Cow for Deckers Outdoor, benefits from its strong brand equity and a dedicated customer following. This established presence significantly reduces the necessity for aggressive marketing campaigns and extensive distribution efforts.

Consequently, UGG enjoys higher profit retention because marketing expenditures can be controlled more effectively. For instance, in 2023, UGG's net sales reached $2.1 billion, contributing significantly to Deckers' overall revenue while requiring less incremental investment compared to newer or high-growth brands.

- Established Brand Recognition: UGG's iconic status minimizes the need for costly brand building initiatives.

- Loyal Customer Base: Repeat purchases from existing customers reduce customer acquisition costs.

- Efficient Marketing Spend: Marketing budgets can be optimized, leading to higher profit margins.

- Consistent Revenue Generation: UGG reliably generates substantial revenue with mature market positioning.

Consistent Cash Flow Generation

UGG stands as a prime example of a Cash Cow for Deckers Outdoor. It consistently generates more cash than it needs to operate and grow, providing a vital financial foundation.

This surplus cash is crucial, allowing Deckers to fund investments in other business segments, like emerging brands or new strategic ventures. UGG's robust financial performance underpins the company's overall stability and capacity for future expansion.

- UGG's consistent profitability fuels Deckers' investment in high-growth potential brands.

- The brand's strong cash generation supports Deckers' overall financial health and strategic flexibility.

- In fiscal year 2024, Deckers reported net sales of $3.59 billion, with UGG being a significant contributor to this revenue.

UGG is Deckers Outdoor's undisputed cash cow, generating significant and stable profits. In fiscal year 2025, UGG accounted for 51% of Deckers' sales, reaching $2.531 billion with a 13.1% growth rate.

The brand's impressive fiscal 2025 segment-level operating profit margin of 40% highlights its strong cash-generating ability. This consistent profitability allows Deckers to reinvest in other areas of the business.

UGG's established market leadership and loyal customer base reduce the need for extensive marketing, further enhancing its profit retention. For instance, in fiscal year 2024, UGG's net sales were $2.1 billion, demonstrating its enduring appeal and financial contribution.

The brand's consistent revenue generation and high margins provide a stable financial foundation for Deckers Outdoor, enabling strategic flexibility and investment in growth opportunities.

| Brand | Fiscal 2025 Sales | Fiscal 2025 Operating Margin | Fiscal 2025 Sales Growth |

|---|---|---|---|

| UGG | $2.531 billion | 40% | 13.1% |

Full Transparency, Always

Deckers Outdoor BCG Matrix

The BCG Matrix for Deckers Outdoor you are currently previewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no altered content, and no surprises – just a professionally designed and analysis-ready report that you can immediately utilize for strategic planning and decision-making. You're not just seeing a sample; you're seeing the final product, ready to be integrated into your business insights.

Dogs

Sanuk, positioned as a 'Dog' in Deckers Outdoor's BCG Matrix, experienced a significant downturn in performance. Net sales for the brand saw a substantial decline, with a 39.1% drop in the fourth quarter of fiscal year 2024 and a 33.0% decrease for the entire fiscal year 2024.

This performance underscored Sanuk's low market share and limited growth potential within Deckers' overall strategy. Consequently, Deckers Outdoor made the strategic decision to divest the Sanuk brand in August 2024, reflecting its classification as a 'Dog' due to its poor market standing and prospects.

Teva, a well-established brand within Deckers Outdoor, has experienced significant sales headwinds. In the fourth quarter of fiscal year 2024, net sales for Teva saw a notable decrease of 15.6%. This downward trend continued for the full fiscal year 2024, with Teva's net sales declining by 18.9%, even with a reported increase in the second quarter of fiscal year 2025.

Despite Teva's brand recognition, these fluctuating and predominantly declining sales figures within Deckers' overall portfolio indicate potential struggles with market share and growth momentum. This performance profile strongly aligns with the characteristics of a 'Dog' in the BCG Matrix, suggesting it requires careful consideration regarding its future strategic direction.

Koolaburra, a significant part of Deckers Outdoor's 'Other brands' segment, experienced stagnant or declining net sales in recent fiscal periods. For instance, in the fiscal year ending March 31, 2024, the 'Other brands' category, which includes Koolaburra, contributed $116.6 million to Deckers' total net sales. This figure represents a slight decrease from the $118.5 million reported in the prior fiscal year, indicating a lack of significant growth.

This performance places Koolaburra squarely in the 'Dog' quadrant of the BCG Matrix. The brand's limited market share, coupled with its low growth trajectory, suggests it operates in a mature or declining market segment where it struggles to gain traction against more dominant competitors. Consequently, Koolaburra requires careful management to either revitalize its performance or consider a strategic divestment.

Limited Investment and Strategic Focus

Deckers Outdoor Corporation is strategically concentrating its resources on its most successful brands, Hoka and UGG. This means brands like Sanuk and Koolaburra are receiving less attention and investment. For instance, in the first quarter of fiscal 2024, Deckers reported a net sales increase of 7.1% to $625.6 million, driven by strong performance in Hoka and UGG, while other brands saw more modest growth or declines.

This focused approach, while boosting core brands, inherently limits the growth potential for those with reduced strategic emphasis. The lack of significant capital allocation to brands like Sanuk, which has faced challenges, makes a substantial turnaround or expansion difficult to achieve in the near term. This is a classic characteristic of 'Dogs' in the BCG matrix – brands with low market share and low growth prospects.

- Reduced Investment: Brands like Sanuk and Koolaburra are seeing diminished capital allocation as Deckers prioritizes Hoka and UGG.

- Limited Growth Potential: The lack of substantial investment hinders the ability of these brands to gain market share or expand their reach.

- Strategic Reallocation: Deckers' Q1 FY24 results highlight a clear trend of prioritizing high-performing segments, impacting the focus on other brands.

- BCG Matrix Classification: Sanuk and Koolaburra, with their current market position and growth trajectory, fit the 'Dog' category within Deckers' portfolio.

Candidate for Divestiture or Wind-Down

Deckers Outdoor's strategic pruning of underperforming assets is evident in its 2024 actions. The divestiture of the Sanuk brand and the discontinuation of Koolaburra exemplify a deliberate move to shed businesses that were not contributing substantially to operating profit or fitting the company's forward-looking vision. This aligns directly with the strategic imperative for brands situated in the 'Dogs' quadrant of the Boston Consulting Group (BCG) matrix, which typically advises divestiture or wind-down to reallocate resources to more promising ventures.

These decisions underscore a commitment to financial health and strategic focus. For instance, Sanuk, acquired in 2017 for $120 million, represented a significant investment that, by 2024, was deemed no longer central to Deckers' growth trajectory. Similarly, Koolaburra, a brand that struggled to gain significant market traction, was also identified for discontinuation. Such moves are critical for optimizing the overall portfolio and enhancing shareholder value by concentrating on brands like Hoka and Ugg, which continue to demonstrate robust performance and growth potential.

- Sanuk Divestiture: Deckers completed the sale of Sanuk in 2024, signaling a clear exit from a brand that was not meeting performance expectations.

- Koolaburra Wind-Down: The discontinuation of Koolaburra further illustrates Deckers' strategy to streamline its brand portfolio by phasing out less profitable or strategically misaligned businesses.

- BCG Matrix Alignment: These actions directly reflect the 'Dogs' quadrant strategy within the BCG matrix, advocating for the disposal of low-growth, low-market-share entities.

- Resource Reallocation: By divesting or discontinuing these brands, Deckers frees up capital and management attention to invest in higher-performing segments of its business.

Brands like Sanuk and Koolaburra are classified as 'Dogs' in Deckers Outdoor's BCG Matrix due to their low market share and limited growth prospects. Sanuk's net sales plummeted by 39.1% in Q4 FY2024 and 33.0% for the full fiscal year, leading to its divestiture in August 2024.

Koolaburra, part of the 'Other brands' segment, saw its contribution to net sales slightly decrease to $116.6 million in FY2024 from $118.5 million in the prior year, indicating a lack of growth momentum.

Deckers is strategically focusing investments on high-performing brands like Hoka and UGG, leading to reduced capital allocation for brands in the 'Dog' category, thereby limiting their potential for significant turnaround or expansion.

| Brand | BCG Category | FY2024 Net Sales Change | Strategic Action |

| Sanuk | Dog | -33.0% (Full Year) | Divested August 2024 |

| Koolaburra | Dog | Slight Decrease (part of 'Other brands') | Discontinued |

| Teva | Potential Dog/Question Mark | -18.9% (Full Year) | Requires strategic review |

Question Marks

Hoka's foray into new product lines, such as trail running accessories or expanded apparel offerings, and UGG's introduction of more fashion-forward or sustainable collections, represent potential Stars or Question Marks. These ventures, while leveraging established brand equity, demand substantial marketing investment to capture significant market share and achieve scale.

Hoka and UGG are exploring emerging markets like India and parts of Southeast Asia, where brand awareness is still developing. These regions present significant growth potential, but require tailored strategies. For instance, in India, the athleisure trend is gaining traction, creating an opportunity for Hoka, while UGG could tap into the growing demand for comfortable, premium footwear.

Strategic acquisitions of smaller, innovative footwear or apparel brands in high-growth niches would initially place Deckers Outdoor in the question marks category of the BCG matrix. These ventures into new markets or product categories carry uncertain market share but possess high growth potential, demanding significant investment to scale effectively. For instance, a hypothetical acquisition in the rapidly expanding sustainable athleisure market could represent such a strategic move.

Unproven Marketing Initiatives

Unproven marketing initiatives, such as experimental digital campaigns or the exploration of novel distribution channels, represent potential '?' for Deckers Outdoor. These ventures often demand substantial upfront investment with outcomes that are not yet guaranteed. For instance, a new influencer marketing strategy targeting a niche demographic might incur significant costs for content creation and platform fees, but its effectiveness in driving sales remains to be seen.

These initiatives carry inherent risks due to their unproven nature. Deckers Outdoor must carefully weigh the potential rewards against the financial outlay and the possibility of resource misallocation. A key consideration is the ability to pivot or discontinue these efforts if early data suggests they are not yielding the desired impact, ensuring that capital is not tied up in unproductive ventures.

- High Initial Investment: Experimental marketing can require significant upfront spending on new technologies, creative content, and platform access.

- Uncertain ROI: The return on investment for unproven initiatives is difficult to predict, making them a gamble.

- Resource Allocation Risk: Funds and personnel dedicated to these efforts could be diverted from more established, profitable activities.

- Need for Agile Monitoring: Continuous tracking of key performance indicators (KPIs) is crucial to assess viability and make timely adjustments.

Fashion-Forward or Niche Collaborations

Collaborations with designers or other brands that push Hoka or UGG into more fashion-forward or niche segments could be classified as Question Marks in the BCG Matrix. These ventures, while potentially offering high growth, depend heavily on strong market adoption and might necessitate significant promotional investment to achieve widespread appeal.

For instance, Hoka's collaboration with Kith in early 2024 introduced limited-edition models, targeting a more fashion-conscious consumer. While specific sales figures for these niche collaborations are not publicly disclosed, Deckers Outdoor's overall revenue for the fiscal year ended March 31, 2024, reached $3.59 billion, a 5.1% increase year-over-year, indicating a broad market acceptance of their brands.

- Potential for High Growth: Niche fashion collaborations can tap into emerging trends and attract new customer segments, driving significant revenue increases if successful.

- Market Adoption Dependency: The success of these ventures hinges on whether the target audience embraces the new aesthetic and positioning, which can be unpredictable.

- Substantial Promotional Needs: Gaining traction in fashion-forward or niche markets often requires dedicated marketing campaigns and influencer partnerships, increasing operational costs.

- Strategic Brand Extension: These collaborations allow Deckers to test new market territories and potentially elevate brand perception beyond their core outdoor and comfort offerings.

Question Marks represent new ventures or product lines with high growth potential but low market share. These are areas where Deckers Outdoor is investing but has not yet established a dominant position. Success here requires significant investment and strategic focus to convert them into Stars.

Examples include Hoka's expansion into new international markets or UGG's development of innovative, sustainable product lines. These initiatives are crucial for future growth but carry inherent risks due to market uncertainty and competitive pressures.

Deckers Outdoor's fiscal year 2024 revenue reached $3.59 billion, a 5.1% increase year-over-year. This growth demonstrates the company's ability to expand its market presence, even in areas that might initially be classified as Question Marks.

The company must carefully manage these Question Marks, allocating resources effectively and monitoring performance closely to identify those with the greatest potential to become market leaders.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Deckers Outdoor's annual reports, investor presentations, and market research reports to analyze product performance and market share.