Deckers Outdoor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deckers Outdoor Bundle

Deckers Outdoor faces a dynamic competitive landscape, with moderate bargaining power from suppliers and intense rivalry among established brands. The threat of new entrants is tempered by significant brand loyalty and distribution challenges, while the threat of substitutes is a constant consideration in the active lifestyle market.

The complete report reveals the real forces shaping Deckers Outdoor’s industry—from buyer power to the threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration significantly impacts Deckers Outdoor's bargaining power. If a limited number of suppliers provide critical materials like specialized leathers, performance textiles, and unique sole compounds, these suppliers gain leverage. This concentration can lead to higher input costs for Deckers, as they have fewer alternatives for essential components.

Switching costs for Deckers, the company behind popular brands like UGG and Hoka, represent a significant factor in the bargaining power of its suppliers. These costs are the financial and operational difficulties Deckers would encounter if it decided to change its current suppliers.

For instance, if Deckers relies on suppliers for highly specialized materials or components that require unique manufacturing processes or tooling, switching to a new supplier would necessitate substantial investment in new equipment and potentially extensive product redesign. This creates a strong incentive for Deckers to maintain relationships with existing suppliers, even if price increases are proposed, as the cost of finding and onboarding a new, equally capable supplier can be prohibitive.

Furthermore, long and complex supplier qualification processes, common in the footwear and apparel industries, add to these switching costs. A new supplier must often meet rigorous quality, ethical, and performance standards, which can take months or even years to validate. In 2023, Deckers reported a cost of goods sold of $1.6 billion, highlighting the scale of its supply chain operations and the potential impact of supplier disruptions or price hikes.

The bargaining power of suppliers for Deckers is significantly influenced by the unique and high-quality materials essential for brands like UGG and Hoka. For instance, the specific sheepskin used in UGG boots is a key differentiator, and if sourcing this material becomes difficult or expensive, it directly impacts Deckers' ability to maintain its premium brand image and pricing power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into manufacturing or distribution presents a potential challenge for Deckers Outdoor. If key material or component suppliers were to establish their own production lines or distribution channels for footwear and apparel, they could directly compete with Deckers, thereby increasing their bargaining power. This scenario, while less frequent in highly specialized manufacturing, could significantly alter the competitive landscape.

While specific instances of Deckers' suppliers integrating forward are not publicly detailed, the broader industry trend is worth noting. For example, in 2024, the global footwear market saw continued consolidation, with some vertically integrated players expanding their reach. This suggests that the potential for such a move exists, even if it's not an immediate or dominant threat for Deckers.

- Supplier Integration Risk: Suppliers moving into direct manufacturing or distribution poses a competitive threat to Deckers.

- Increased Leverage: Forward integration by suppliers would enhance their bargaining power and control over the value chain.

- Industry Context: While not a current major concern for Deckers, the footwear industry's consolidation in 2024 highlights the potential for vertical integration among players.

- Strategic Consideration: Deckers must remain vigilant regarding supplier capabilities and market dynamics that could facilitate forward integration.

Supplier's Dependence on Deckers

Supplier's dependence on Deckers is a critical factor in assessing their bargaining power. If Deckers accounts for a significant portion of a supplier's total revenue, that supplier will likely be hesitant to demand unfavorable terms. This is because losing Deckers as a major client could severely impact their own financial stability.

For instance, if a key component supplier relies on Deckers for over 20% of its sales, they have less leverage to push for higher prices or less favorable payment schedules. This dependence can therefore mitigate the supplier's ability to exert strong bargaining power.

- Supplier Revenue Dependence: If Deckers constitutes a large percentage of a supplier's annual sales, the supplier's bargaining power is diminished.

- Risk of Client Loss: Suppliers heavily reliant on Deckers are less likely to risk losing this business by making aggressive demands.

- Impact on Supplier Operations: A supplier's significant dependence might mean they are more accommodating to Deckers' needs to maintain the relationship.

The bargaining power of Deckers Outdoor's suppliers is moderate, influenced by the unique materials and components required for its popular brands. While some suppliers provide specialized inputs, Deckers' scale and brand strength offer some counter-leverage.

The concentration of suppliers for specialized materials, such as the unique sheepskin for UGG boots, can give those suppliers more power. However, Deckers' significant purchasing volume can mitigate this, especially if they secure long-term contracts. For example, in 2023, Deckers' cost of goods sold reached $1.6 billion, indicating substantial buying power.

Switching costs for Deckers are also a factor; finding and qualifying new suppliers for specialized components can be time-consuming and expensive, potentially involving new tooling and product redesigns. This can strengthen the position of existing suppliers.

Conversely, if Deckers represents a substantial portion of a supplier's revenue, that supplier's bargaining power is reduced, as they are less willing to risk losing a major client. The threat of suppliers integrating forward into manufacturing or distribution is a potential, though not currently dominant, concern, highlighted by industry consolidation trends observed in 2024.

| Factor | Impact on Supplier Bargaining Power | Deckers Outdoor Relevance |

|---|---|---|

| Supplier Concentration | Increases power for suppliers of specialized materials | High for unique UGG sheepskin and Hoka performance components |

| Switching Costs | Increases power for suppliers with specialized processes | Significant due to unique material requirements and qualification processes |

| Supplier Dependence on Deckers | Decreases power for suppliers reliant on Deckers' business | Varies; if Deckers is >20% of a supplier's sales, leverage is lower |

| Threat of Forward Integration | Increases power if suppliers become competitors | Low currently, but industry consolidation in 2024 suggests potential |

What is included in the product

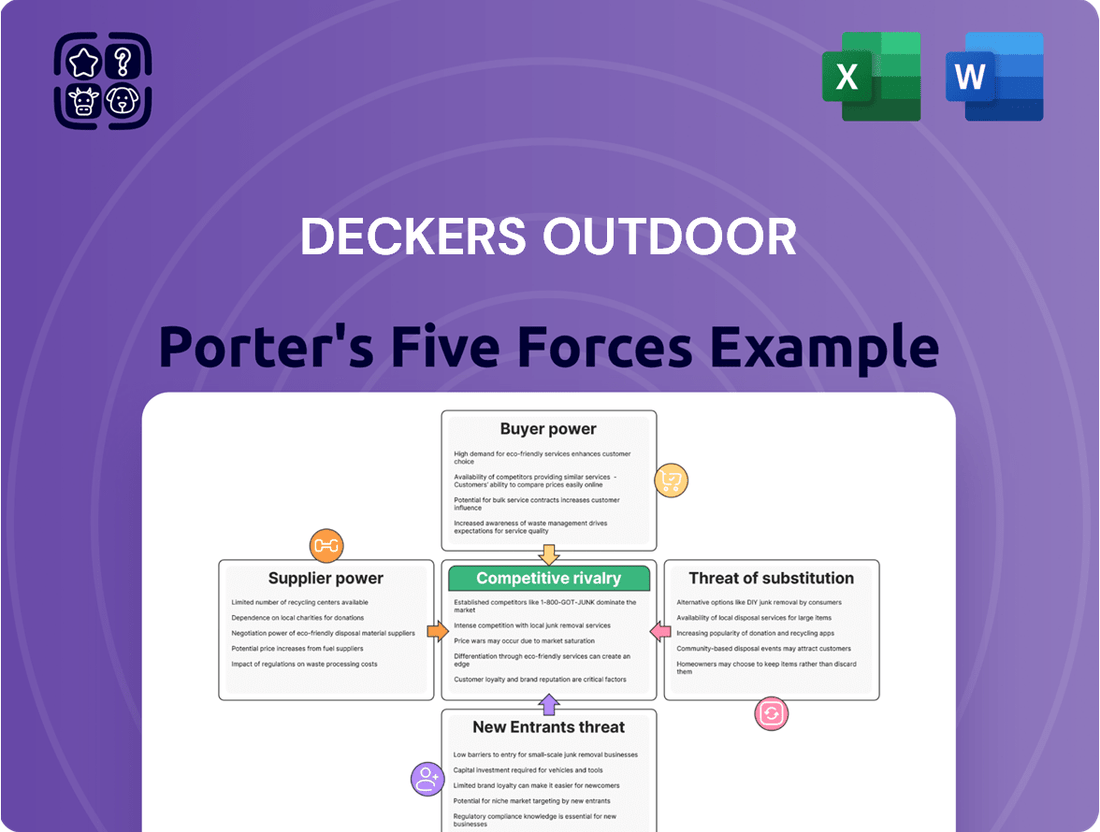

This analysis dissects the competitive landscape for Deckers Outdoor, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its brands.

Effortlessly identify and mitigate competitive threats by visualizing the impact of each Porter's Five Forces on Deckers Outdoor's market position.

Customers Bargaining Power

Customer price sensitivity is a key factor for Deckers Outdoor, influencing how both wholesale partners and direct consumers react to price adjustments. In 2023, Deckers reported a net sales increase of 5.7% to $3.97 billion, indicating that while demand remains strong, price points are carefully managed across its brands like Hoka and Ugg.

High price sensitivity in competitive footwear markets can pressure Deckers to offer discounts or promotions, potentially squeezing profit margins. For instance, while Hoka's performance running shoes command premium pricing, the broader casual footwear market, where Ugg operates, can be more susceptible to price competition from other brands.

The availability of substitute products is a major factor in customer bargaining power for Deckers Outdoor. Customers can easily find comparable footwear and apparel from many competing brands, from casual sneakers to high-performance hiking boots. This wide array of choices across different categories gives consumers significant leverage when making purchasing decisions.

Deckers Outdoor's reliance on a few major wholesale accounts significantly impacts its bargaining power with customers. For instance, if a handful of large sporting goods retailers or department stores account for a substantial percentage of Deckers' revenue, these buyers gain leverage.

In 2023, major retailers like Dick's Sporting Goods and Nordstrom were key partners for Deckers. When a few such large entities represent a significant portion of sales, they can negotiate for lower prices, extended payment terms, or greater marketing assistance, thereby squeezing Deckers' profit margins.

Customer Information and Transparency

Customers today are incredibly well-informed, thanks to the internet. They can easily compare prices, read reviews, and understand product quality across different brands. This transparency significantly boosts their bargaining power.

For instance, in the outdoor apparel market where Deckers Outdoor Corporation operates, consumers can quickly access detailed product specifications and pricing from competitors like Patagonia or The North Face. This accessibility means customers are less likely to overpay and more likely to switch if they don't feel they are getting the best value.

- Informed Purchasing Decisions: Online platforms provide extensive product comparisons and user reviews, empowering customers.

- Price Sensitivity: Easy access to competitor pricing allows customers to negotiate or seek better deals, impacting brands like Deckers.

- Brand Loyalty Factors: Transparency in quality and pricing can shift customer loyalty towards brands offering superior perceived value.

Threat of Backward Integration by Large Retailers

Large retail partners, such as major department stores or sporting goods chains, possess the potential to leverage their market presence and customer reach to develop their own private-label footwear or apparel lines. This strategic move would allow them to directly compete with Deckers' existing brands, potentially reducing their reliance on Deckers' offerings.

The bargaining power of these customers is amplified by this threat of backward integration. For instance, in 2024, major apparel retailers continued to expand their private-label assortments, with some reporting significant growth in these segments, directly impacting their purchasing decisions from established brands.

- Private Label Growth: Many large retailers are increasingly investing in and promoting their private-label brands, which often offer higher profit margins.

- Negotiating Leverage: The ability to create comparable products internally gives retailers greater leverage when negotiating terms, pricing, and exclusivity with external suppliers like Deckers.

- Market Share Impact: If a large retailer successfully launches a competitive private-label line, it could siphon market share away from Deckers' established brands, further strengthening the retailer's bargaining position.

Customers wield significant bargaining power when they can easily switch to alternatives or when their purchases represent a substantial portion of a supplier's revenue. For Deckers Outdoor, this is evident in the competitive footwear market where numerous brands offer similar products, allowing consumers to shop around for the best value.

The threat of backward integration by large retail partners further amplifies customer bargaining power. As of 2024, many major retailers are expanding their private-label offerings, creating direct competition for brands like Deckers and giving these retailers more leverage in negotiations.

In 2023, Deckers Outdoor saw its net sales climb to $3.97 billion, demonstrating continued demand. However, this growth occurs within a landscape where customers, armed with readily available price and product information online, can exert pressure on pricing and demand favorable terms.

| Factor | Impact on Deckers Outdoor | Evidence/Trend |

|---|---|---|

| Availability of Substitutes | High | Numerous competing brands in casual and performance footwear. |

| Customer Information | High | Online price comparison and reviews empower consumers. |

| Threat of Backward Integration | Moderate to High | Retailers expanding private-label lines (e.g., in 2024). |

| Price Sensitivity | Varies by Brand | Hoka's premium pricing vs. Ugg's broader market appeal. |

Preview the Actual Deliverable

Deckers Outdoor Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Deckers Outdoor's competitive landscape through Porter's Five Forces, covering threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products, and intensity of rivalry within the outdoor footwear and apparel industry.

Rivalry Among Competitors

The footwear and apparel market is incredibly crowded, featuring a vast array of global giants, well-known brands, and nimble startups. This fragmentation means Deckers Outdoor constantly contends with a diverse competitive landscape, spanning lifestyle, performance, and outdoor categories. For instance, in 2023, the global athletic footwear market alone was valued at over $90 billion, highlighting the sheer scale of players vying for market share.

The overall growth rate of the footwear and apparel market significantly influences competitive rivalry. In 2023, the global footwear market was valued at approximately $258.5 billion, with projections indicating continued expansion. When growth is robust, as it has been in certain athleisure and outdoor segments, companies can often expand without directly poaching each other's customers.

However, in slower-growing or mature segments of the footwear and apparel industry, competition intensifies as companies vie for existing market share. This often leads to more aggressive pricing, increased marketing spend, and a focus on product differentiation to capture a larger slice of a limited pie. For instance, while the overall market grows, specific niches might experience stagnation, forcing brands within those niches into fiercer competition.

Deckers Outdoor's competitive rivalry is significantly shaped by its product differentiation and the loyalty it cultivates for brands like UGG, Hoka, and Teva. The unique appeal and perceived quality of these offerings allow Deckers to command premium pricing, thereby mitigating intense price competition from rivals. For instance, Hoka's distinctive cushioning technology has fostered a dedicated following, contributing to its rapid sales growth, which reached $1.7 billion in the fiscal year ending March 31, 2024. This strong brand equity acts as a substantial barrier against competitors seeking to erode market share through price alone.

Exit Barriers for Competitors

Competitors in the footwear market, including those directly vying with Deckers Outdoor, face significant hurdles if they consider exiting. These exit barriers can include highly specialized manufacturing equipment, substantial investments in brand building and marketing, and long-term supply chain commitments. For instance, companies heavily invested in proprietary sole technologies or unique manufacturing processes would find it costly to repurpose or divest these assets.

These difficulties in leaving the market can trap less profitable firms, prolonging intense competition. This means that even struggling competitors might remain active, potentially driving down prices and margins for everyone, including Deckers. The presence of these barriers contributes to the overall competitive intensity within the broader footwear industry.

Consider these specific factors contributing to exit barriers:

- Specialized Assets: Footwear manufacturing often requires dedicated machinery and tooling for specific designs and materials, making them difficult to sell or repurpose for other industries.

- Contractual Obligations: Long-term leases on manufacturing facilities, supplier contracts, and distribution agreements can impose significant financial penalties for early termination.

- Brand Reputation and Goodwill: A significant portion of a footwear company's value lies in its brand recognition and customer loyalty, which are lost upon exit and difficult to recoup elsewhere.

- Emotional and Managerial Attachment: Founders and long-serving management teams may have deep emotional ties to their businesses, resisting closure even in the face of financial difficulties.

Competitor Strategies and Innovation

Rivals such as Nike and Adidas are aggressively vying for market share. They are doing this through a relentless focus on new product development, expansive marketing campaigns, and significant investments in technological advancements. This intense activity directly pressures Deckers Outdoor to adapt and respond to remain competitive.

To maintain its position, Deckers must engage in constant innovation. This includes not only product design but also exploring new materials and manufacturing processes. Strategic responses to competitor moves are crucial for preserving market share and profitability.

- Nike's 2024 revenue reached $51.2 billion, showcasing its substantial market presence and marketing power.

- Adidas reported revenues of €21.4 billion in 2023, demonstrating its significant global reach and product innovation efforts.

- Deckers' ability to differentiate its brands, particularly UGG and Hoka, through unique value propositions and targeted marketing is key to navigating this competitive landscape.

The competitive rivalry within the footwear and apparel sector is fierce, with major players like Nike and Adidas actively pursuing market dominance. These giants invest heavily in product innovation and extensive marketing, compelling Deckers Outdoor to continuously adapt. For example, Nike's 2024 revenue hit $51.2 billion, underscoring its significant market power.

Deckers differentiates itself through strong brands like UGG and Hoka, enabling premium pricing and mitigating direct price wars. Hoka's unique cushioning, for instance, fueled $1.7 billion in sales for the fiscal year ending March 31, 2024, demonstrating the strength of its brand equity against competitors relying solely on price.

| Competitor | 2023/2024 Revenue | Key Strategy |

| Nike | $51.2 billion (FY2024) | Product innovation, expansive marketing |

| Adidas | €21.4 billion (FY2023) | Global reach, product innovation |

| Deckers Outdoor (UGG, Hoka) | Hoka: $1.7 billion (FY2024) | Brand differentiation, premium pricing |

SSubstitutes Threaten

The threat of substitutes for Deckers Outdoor's products, particularly in its casual footwear segment, is significant. Consumers can easily opt for lower-priced, less specialized alternatives from mass-market brands that fulfill the basic need for footwear, even if they lack the performance or brand cachet of Deckers' offerings. For example, while UGG boots offer warmth and a distinct style, a consumer needing basic winter footwear might choose a less expensive, readily available option from a department store brand, representing a direct trade-off in price for perceived functionality.

Customer willingness to switch from Deckers' brands like UGG and Hoka to alternatives is a key concern. This propensity is influenced by evolving fashion, changing functional needs, and economic pressures. For instance, a shift towards minimalist footwear could reduce demand for UGG's iconic styles, impacting sales.

In 2023, the athleisure market, a significant segment for Deckers, saw continued growth with consumers seeking comfortable yet stylish options. However, the sheer variety of brands offering similar comfort-focused footwear means customers can easily pivot. This broad availability of substitutes, from large sportswear giants to niche direct-to-consumer brands, intensifies the threat.

The threat of substitutes is a significant factor for Deckers Outdoor. Consumers can often find alternative products that fulfill similar needs, even if they aren't direct competitors. For instance, individuals seeking comfortable casual footwear might opt for brands other than UGGs, or runners could choose general athletic shoes instead of specialized Hoka models.

This broad availability of alternatives means Deckers must continually innovate and differentiate its offerings. In 2023, the casual footwear market, where UGGs compete, saw robust growth, indicating a strong demand for comfortable options, but also highlighting the intense competition from a wide array of brands.

Switching Costs for Buyers to Substitutes

The threat of substitutes for Deckers Outdoor is amplified by generally low switching costs for consumers in the footwear market. Customers can readily explore alternative brands and styles without significant investment of time or money. This ease of transition means that if competitors offer compelling alternatives, Deckers faces a heightened risk of losing market share.

For instance, in the casual and athletic footwear segments where Deckers' brands like UGG and Hoka operate, consumers often make purchasing decisions based on immediate trends, comfort, and price. The lack of proprietary technology or unique design elements that are difficult to replicate in many footwear categories contributes to these low switching costs.

- Low Switching Costs: Consumers can easily switch between different footwear brands and styles without incurring significant financial penalties or learning curves.

- Brand Loyalty vs. Accessibility: While Deckers has strong brand recognition, the accessibility of numerous competing brands means loyalty can be challenged by attractive alternatives.

- Impact on Pricing Power: Low switching costs can limit Deckers' ability to command premium pricing if substitutes offer comparable quality and style at a lower cost.

Technological Advancements Creating New Substitutes

Emerging technologies are a significant threat, potentially introducing entirely new categories of footwear or alternative solutions that could displace Deckers Outdoor's traditional products. For instance, advancements in 3D printing could allow for highly customized, on-demand footwear, bypassing traditional manufacturing and distribution channels.

Innovations in material science are also a key concern. Imagine lightweight, durable, and climate-adaptive materials that offer superior comfort and performance compared to current offerings, creating new substitute possibilities. By 2024, the global advanced materials market was valued at over $100 billion, highlighting the rapid pace of innovation in this sector.

Furthermore, the integration of wearable technology into apparel or even entirely new personal mobility solutions could present unforeseen substitute threats. Consider smart insoles that track gait and provide real-time feedback, or even advancements in personal transport that reduce the need for specific types of footwear for commuting or recreation.

- Material Science Innovations: Development of bio-based, self-healing, or temperature-regulating materials could offer superior alternatives.

- 3D Printing and Customization: On-demand manufacturing could reduce lead times and offer personalized fits, challenging mass-produced goods.

- Wearable Technology Integration: Smart footwear or integrated apparel could offer functionalities beyond traditional shoes, like health monitoring or enhanced performance tracking.

- Alternative Mobility Solutions: Innovations in personal transport might decrease reliance on specific footwear designed for certain activities.

The threat of substitutes for Deckers Outdoor is substantial, as consumers have numerous readily available alternatives for casual and athletic footwear. These substitutes often fulfill basic needs at lower price points, challenging Deckers' premium positioning. For instance, the broad athleisure market in 2023 was flooded with brands offering comfort-focused shoes, making it easy for consumers to switch from brands like UGG or Hoka if a competitor presents a more appealing value proposition.

Low switching costs further exacerbate this threat. Customers can easily move between brands without significant investment, especially since many footwear categories lack highly proprietary technology. This means Deckers must continuously innovate to maintain customer loyalty against a backdrop of accessible alternatives.

Emerging technologies, such as advanced materials and 3D printing, also present potential substitute threats. Innovations in material science, with the global advanced materials market exceeding $100 billion in 2024, could lead to superior comfort or performance alternatives, while 3D printing offers new avenues for customization that could disrupt traditional footwear manufacturing.

Entrants Threaten

Establishing a competitive footwear and apparel brand demands significant upfront capital. This includes substantial investments in product design and development, setting up or contracting manufacturing facilities, widespread marketing campaigns, and building a robust distribution network. For instance, launching a new footwear line in 2024 could easily require millions of dollars just for initial production runs and marketing, a figure that can be prohibitive for aspiring companies.

Deckers Outdoor Corporation benefits significantly from economies of scale, a major deterrent for new entrants. Its established global supply chain and high-volume production allow for lower per-unit manufacturing costs. For instance, in fiscal year 2024, Deckers reported net sales of $3.2 billion, reflecting the scale of its operations.

New companies entering the market would find it challenging to match these cost efficiencies. They would likely face higher initial production costs and less favorable terms with suppliers due to their smaller order volumes. This cost disadvantage makes it difficult for them to compete on price with established brands like UGG and Hoka.

Deckers Outdoor, with its flagship brands UGG and Hoka, benefits from deeply ingrained brand loyalty and a strong reputation built over decades. This makes it incredibly difficult for new players to gain traction. For instance, in 2023, UGG continued its strong performance, contributing significantly to Deckers' net sales, demonstrating the enduring consumer preference for its established products.

New entrants must overcome substantial hurdles in marketing expenditure and time to cultivate similar brand equity and capture consumer attention. The high cost of building brand awareness and trust in a competitive market like outdoor footwear and apparel presents a significant barrier, requiring substantial upfront investment and a long-term strategy to even approach the market share held by established names like UGG and Hoka.

Access to Distribution Channels

New competitors entering the outdoor footwear and apparel market face substantial challenges in establishing robust distribution channels. Deckers Outdoor Corporation, for instance, leverages a sophisticated multi-channel approach encompassing wholesale partnerships, a growing direct-to-consumer (DTC) e-commerce platform, and a network of company-owned retail stores. This established infrastructure creates a significant barrier for newcomers seeking to gain access to key retail partners or to build equally efficient and widespread distribution networks.

Securing prime shelf space with established retailers, a critical component of market penetration, is exceptionally difficult for new entrants. Major retailers often prioritize brands with proven sales records and established customer loyalty, making it challenging for emerging companies to gain visibility. Furthermore, developing a cost-effective and far-reaching DTC distribution network, capable of competing with Deckers' existing capabilities, requires substantial investment in logistics, warehousing, and online infrastructure.

- Wholesale Challenges: New brands struggle to secure placement with major sporting goods retailers and department stores, which are crucial for broad market reach.

- DTC Investment: Building a competitive direct-to-consumer e-commerce and logistics operation demands significant capital and expertise, mirroring Deckers' established infrastructure.

- Brand Recognition: Without established brand recognition, new entrants find it harder to attract wholesale partners and drive direct consumer demand.

Intellectual Property and Regulatory Barriers

The threat of new entrants for Deckers Outdoor is significantly mitigated by intellectual property and stringent regulatory hurdles. Deckers holds numerous patents covering its innovative footwear technologies and design trademarks, particularly for brands like Hoka and UGG. For instance, Hoka's signature maximalist cushioning technology is a key differentiator protected by patents, making it difficult for rivals to replicate without infringement.

Navigating the complex web of international trade regulations, product safety standards, and environmental compliance also presents a substantial barrier. New companies entering the market must allocate considerable resources to legal teams and compliance departments to ensure adherence to global standards, a cost that can deter smaller or less-resourced competitors.

- Intellectual Property Protection: Deckers' extensive patent portfolio for footwear technology and design trademarks creates a significant barrier to entry.

- Regulatory Compliance Costs: New entrants face substantial investment requirements for navigating international trade laws, product safety standards, and environmental regulations.

- Brand Reputation and Established Trust: Decades of building brand loyalty and consumer trust for brands like UGG and Hoka are difficult for new players to overcome.

The threat of new entrants into the outdoor footwear and apparel market is considerably low for Deckers Outdoor. High capital requirements for product development, manufacturing, and marketing, estimated in the millions for a 2024 launch, act as a significant barrier. Furthermore, Deckers' established economies of scale, evident in its $3.2 billion in net sales for fiscal year 2024, allow for cost efficiencies that new players struggle to match.

Brand loyalty and recognition, especially for UGG and Hoka, represent another formidable hurdle, requiring substantial marketing investment and time for new companies to build comparable equity. Deckers also benefits from robust distribution channels, including wholesale, DTC e-commerce, and retail stores, which are difficult and costly for newcomers to replicate. Finally, intellectual property protection and complex regulatory compliance add further layers of difficulty for potential competitors.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for design, manufacturing, marketing, and distribution. | Prohibitive for many aspiring companies. |

| Economies of Scale | Lower per-unit costs due to high-volume production and supply chain efficiency. | Makes it difficult to compete on price with established brands. |

| Brand Loyalty & Recognition | Decades of building trust and consumer preference. | Requires significant marketing investment and time to overcome. |

| Distribution Channels | Established wholesale, DTC, and retail networks. | Challenging for new entrants to gain access and build comparable infrastructure. |

| Intellectual Property & Regulations | Patents on technology and design, plus complex compliance. | Adds legal and operational costs, deterring smaller competitors. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Deckers Outdoor leverages a comprehensive data strategy, drawing from Deckers' own SEC filings and investor relations materials, alongside industry-specific market research reports from firms like NPD Group and Statista.