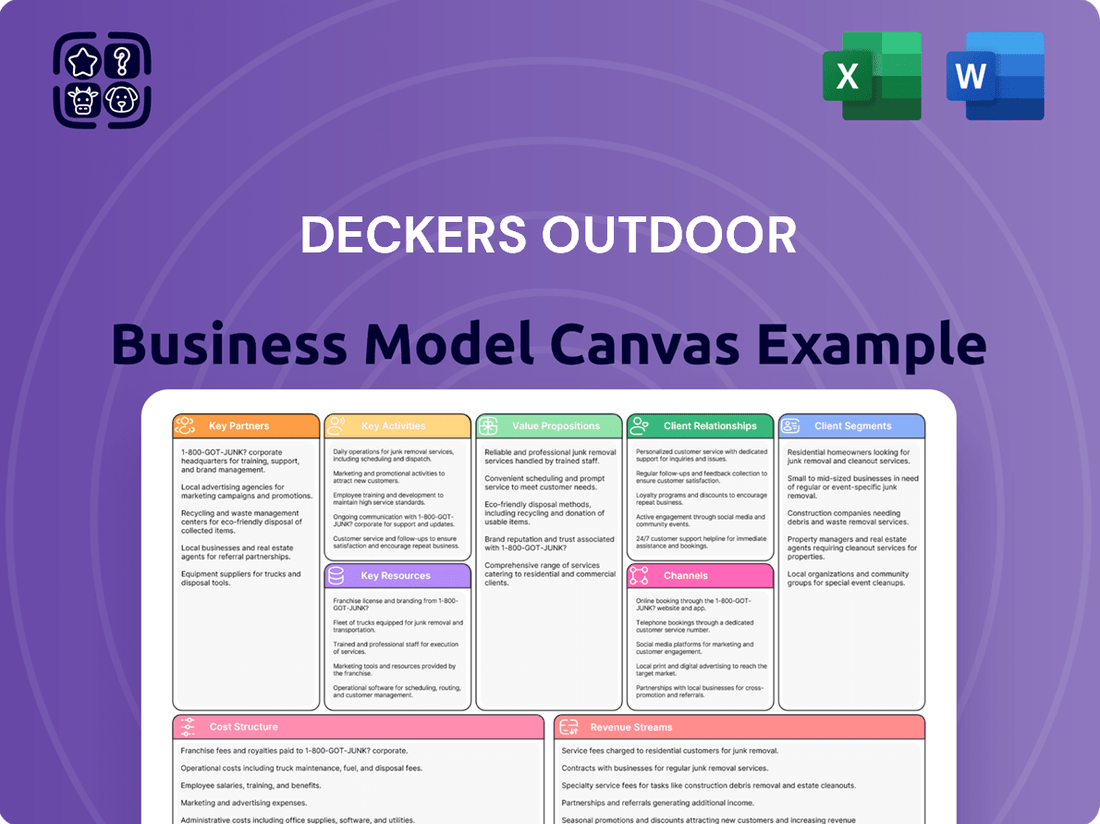

Deckers Outdoor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deckers Outdoor Bundle

Discover the strategic architecture of Deckers Outdoor's thriving business with our comprehensive Business Model Canvas. This in-depth analysis unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance.

Unlock the full strategic blueprint behind Deckers Outdoor's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Deckers Outdoor Corporation strategically partners with a wide array of domestic and international retailers, encompassing both major department stores and specialized shops. This broad wholesale network is crucial for extending market reach and making their products readily available to a larger customer base.

This wholesale approach effectively complements their direct-to-consumer (DTC) sales efforts, significantly boosting brand visibility and overall sales volume. For example, in 2024, Hoka’s strategic expansion into wholesale channels is evident through its partnerships with prominent retailers such as Dick's Sporting Goods and JD Sports, driving substantial growth.

Deckers Outdoor Corporation leans heavily on a worldwide web of manufacturing and supply partners. These are the folks who actually make their popular footwear, clothing, and accessories. Think of them as the backbone of getting products from idea to your feet.

Primarily, Deckers works with factory partners, known as Tier 1, and their suppliers, called Tier 2, in key production hubs like China, Vietnam, and Indonesia. This global footprint is essential for keeping production costs in check and ensuring they can meet demand. For instance, in 2023, Deckers reported that a significant portion of its cost of goods sold was tied to manufacturing and outsourcing, highlighting the critical nature of these relationships.

To keep a close eye on this intricate network, Deckers utilizes Sourcemap. This technology helps them map out their entire supply chain, bringing much-needed transparency to where and how their products are made. This focus on visibility is increasingly important for consumers and stakeholders alike, especially as companies aim for more responsible sourcing practices.

Deckers actively partners with technology and innovation firms to bolster its e-commerce capabilities and optimize internal operations. A prime example is their collaboration with Legion Technologies, a move designed to significantly enhance workforce management through data-driven insights and automation, ultimately boosting operational efficiency and customer satisfaction.

Marketing and Influencer Collaborations

Deckers leverages key partnerships, especially in marketing, to boost its brand presence. Both UGG and Hoka actively collaborate with fashion influencers and celebrities. These alliances are crucial for refreshing brand perception and connecting with younger consumers, particularly Gen-Z. For instance, UGG's 'Feels Like Ugg' campaign, developed with AKQA, highlights this strategy.

- Brand Reinvention: Collaborations with influencers help UGG and Hoka appeal to new demographics and keep their image fresh.

- Digital Amplification: These partnerships significantly enhance brand reach and messaging across social media and digital platforms.

- Targeted Reach: By working with relevant personalities, Deckers effectively targets specific consumer groups, driving engagement and sales.

- Campaign Success: The 'Feels Like Ugg' campaign demonstrates the power of these collaborations in creating buzz and reinforcing brand identity.

Sustainability Initiatives and NGOs

Deckers Outdoor actively collaborates with environmental and social organizations to bolster its commitment to sustainability. A key partnership involves its membership in the Transparency Pledge, a commitment to enhancing supply chain visibility. For instance, in 2023, Deckers was among the brands that publicly committed to disclosing their Tier 1 and Tier 2 suppliers, aiming for greater accountability in their manufacturing processes.

These collaborations extend to direct support for communities within their supply chains. Deckers works on initiatives designed to uplift vulnerable families, ensuring a positive social impact alongside its environmental efforts. This focus on social responsibility is a growing area of importance for many consumers and investors, with ESG reporting becoming increasingly scrutinized.

Deckers' engagement with NGOs and sustainability initiatives underscores a strategic approach to managing its environmental and social governance (ESG) profile. This proactive stance is crucial in an era where corporate responsibility directly influences brand reputation and long-term viability.

Deckers Outdoor Corporation’s key partnerships are multifaceted, spanning retail distribution, manufacturing, technology, marketing, and sustainability initiatives. These collaborations are vital for market penetration, operational efficiency, brand building, and responsible business practices.

In 2024, Deckers continued to strengthen its retail partnerships, with brands like Hoka expanding their presence in major sporting goods chains such as Dick's Sporting Goods and JD Sports. This wholesale strategy complements their direct-to-consumer channels, significantly boosting sales and brand visibility. For instance, Deckers reported that wholesale revenue remained a substantial contributor to its overall financial performance in fiscal year 2024.

The company relies on a global network of manufacturing partners, primarily in Asia, to produce its footwear and apparel. These relationships, including those with Tier 1 and Tier 2 suppliers in countries like Vietnam and China, are critical for managing production costs and meeting global demand. In 2023, manufacturing and outsourcing costs represented a significant portion of Deckers’ cost of goods sold, underscoring the importance of these supply chain alliances.

Deckers also partners with technology firms, such as Legion Technologies, to enhance workforce management and operational efficiency through data analytics and automation. Marketing collaborations with influencers and celebrities, exemplified by UGG's 'Feels Like Ugg' campaign, are crucial for engaging younger demographics and refreshing brand image. Furthermore, Deckers actively engages with NGOs and participates in sustainability initiatives like the Transparency Pledge, demonstrating a commitment to supply chain visibility and social responsibility, with public commitments to supplier disclosure made in 2023.

| Partnership Type | Key Partners/Examples | Impact/Focus | Year Highlighted |

|---|---|---|---|

| Retail Distribution | Dick's Sporting Goods, JD Sports | Market reach, sales growth | 2024 |

| Manufacturing & Supply Chain | Tier 1 & Tier 2 suppliers (China, Vietnam, Indonesia) | Cost management, production capacity | 2023 |

| Technology & Operations | Legion Technologies | Workforce management, operational efficiency | Ongoing |

| Marketing & Brand Building | Fashion influencers, celebrities, AKQA | Brand perception, consumer engagement | Ongoing |

| Sustainability & Social Responsibility | Transparency Pledge, NGOs | Supply chain visibility, ESG profile | 2023 |

What is included in the product

Deckers Outdoor's Business Model Canvas focuses on delivering high-performance, lifestyle-oriented footwear and apparel to active consumers through direct-to-consumer and wholesale channels, leveraging brand loyalty and product innovation.

This model emphasizes premium customer relationships and efficient cost structures to support its diverse brand portfolio, including UGG and Hoka.

Deckers Outdoor's Business Model Canvas offers a clear, one-page snapshot, efficiently relieving the pain point of complex strategy by quickly identifying core components.

Activities

Deckers' core activities revolve around the relentless design, development, and innovation of footwear, apparel, and accessories. This spans its diverse brand portfolio, including UGG, Hoka, Teva, and Sanuk, ensuring a constant stream of new and improved offerings.

The company prioritizes creating products that are not only functional and fashion-forward but also cater to a wide range of lifestyle and performance demands. Examples like the Hoka Mach 6, known for its advanced cushioning, and UGG's popular Tasman and Ultra Mini styles highlight this commitment to meeting evolving consumer needs.

Deckers manages a complex global supply chain, sourcing materials and overseeing manufacturing across multiple countries. This involves ensuring ethical practices, like preventing forced or child labor through rigorous audits and employee training, and maintaining production efficiency.

In 2024, Deckers continued to navigate the intricate landscape of global manufacturing and supply chain management. The company's commitment to ethical sourcing remained a cornerstone, with ongoing efforts to mitigate risks associated with forced labor and child labor. This proactive approach is crucial for maintaining brand integrity and consumer trust in an increasingly scrutinized global marketplace.

Deckers Outdoor Corporation masterfully navigates a multi-channel distribution network, encompassing wholesale partnerships, a robust direct-to-consumer (DTC) e-commerce platform, and a growing portfolio of company-owned retail stores worldwide. This intricate system demands sophisticated management of logistics, inventory, and fulfillment to guarantee timely product delivery across diverse channels and geographies.

In 2024, Deckers continued to see significant traction in both its DTC and wholesale segments. The DTC channel, in particular, has been a key growth driver, reflecting strong consumer engagement with brands like Hoka and UGG directly through online and retail touchpoints.

Brand Building and Marketing

Deckers Outdoor Corporation dedicates significant resources to brand building and marketing to ensure the continued appeal and growth of its portfolio, which includes brands like Hoka and UGG. These efforts encompass a broad range of activities designed to connect with consumers and foster lasting loyalty.

The company actively engages in multimedia advertising campaigns, leveraging digital marketing channels and social media platforms to amplify brand messages. Strategic collaborations are also a key component, further enhancing brand visibility and resonance with target audiences. In 2023, Deckers reported a notable increase in marketing expenditures, reflecting a commitment to driving brand growth and market penetration.

- Brand Awareness: Extensive multimedia and digital marketing campaigns are central to maintaining and growing brand recognition.

- Customer Loyalty: Social media engagement and strategic collaborations are employed to cultivate strong customer relationships and loyalty.

- Marketing Investment: Deckers has strategically increased its marketing spend to support the ongoing growth and development of its brands.

- Brand Portfolio: Key brands like Hoka and UGG benefit directly from these robust brand-building initiatives.

Customer Relationship Management and Engagement

Deckers Outdoor excels at nurturing customer connections through personalized experiences, like tailored product suggestions and direct communication channels. This strategy is designed to cultivate lasting customer loyalty and encourage brand advocacy, especially among younger demographics such as Gen-Z for their UGG brand.

The company actively engages its customer base by fostering online communities and offering exclusive content, which strengthens brand affinity. This approach is particularly evident in their efforts to connect with and understand the evolving preferences of key consumer groups.

- Personalized Recommendations: Utilizing data analytics to offer product suggestions aligned with individual customer preferences and past purchases.

- Targeted Communications: Employing email marketing and social media campaigns that speak directly to specific customer segments and their interests.

- Community Building: Creating platforms and events, both online and offline, where customers can connect with the brand and each other, fostering a sense of belonging.

- Loyalty Programs: Implementing reward systems that incentivize repeat purchases and encourage deeper engagement with the brand's offerings.

Deckers' key activities encompass the continuous design and development of innovative footwear and apparel across its portfolio, including Hoka and UGG. This involves meticulous product creation, ensuring both performance and fashion appeal to meet diverse consumer needs.

The company manages a complex global supply chain, focusing on ethical sourcing and efficient manufacturing. In 2024, Deckers reinforced its commitment to mitigating risks like forced or child labor through rigorous audits and training, maintaining brand integrity.

Deckers executes a multi-channel distribution strategy, leveraging wholesale, DTC e-commerce, and retail stores. This requires sophisticated logistics and inventory management to ensure timely product delivery. In 2024, DTC remained a significant growth driver for brands like Hoka.

Furthermore, Deckers invests heavily in brand building and marketing, utilizing digital channels, social media, and strategic collaborations to enhance brand visibility and customer loyalty. In 2023, marketing expenditures saw a notable increase to support brand growth.

Full Version Awaits

Business Model Canvas

The Deckers Outdoor Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited analysis of Deckers Outdoor's strategic framework, ensuring full transparency and no surprises. Once your order is confirmed, you'll gain immediate access to this exact, professionally formatted canvas, ready for your immediate use and adaptation.

Resources

Deckers Outdoor's robust brand portfolio, featuring UGG, Hoka, Teva, and Sanuk, is its most critical resource. These brands are globally recognized for their unique comfort, style, and performance characteristics, forming the bedrock of the company's market presence.

UGG and Hoka, in particular, are significant revenue drivers, commanding strong consumer loyalty and providing a substantial competitive advantage. For instance, in fiscal year 2024, Hoka experienced remarkable growth, with net sales increasing by 45.5% to $1.45 billion, underscoring its powerful market traction.

Deckers Outdoor Corporation holds significant intellectual property, including numerous design patents and trademarks that safeguard its distinctive product aesthetics and brand identities. This robust IP portfolio is crucial for protecting its innovative footwear technologies and unique visual appeal.

These protections are vital in combating counterfeiting and ensuring the integrity of its premium brands, which is essential for maintaining market position and customer trust. For instance, in 2023, Deckers continued to invest in R&D, a key driver for generating new IP.

Deckers Outdoor leverages a robust global supply chain, encompassing relationships with numerous Tier 1 and Tier 2 factory and supplier partners. This established network is fundamental for ensuring consistent production and maintaining product availability across its diverse brand portfolio.

This extensive manufacturing and distribution network enables Deckers to scale operations efficiently and reach consumers in various geographic regions. For instance, in fiscal year 2024, the company reported net sales of $3.4 billion, underscoring the capacity of its supply chain to support significant market demand.

Direct-to-Consumer (DTC) Infrastructure

Deckers Outdoor has significantly strengthened its direct-to-consumer (DTC) infrastructure, boasting robust e-commerce platforms and a growing network of company-owned retail stores. These channels are crucial for bypassing traditional wholesale models, enabling higher profit margins and more direct interaction with customers. In fiscal year 2024, DTC represented a substantial portion of Deckers' revenue, demonstrating the effectiveness of this strategy.

This investment in DTC infrastructure facilitates invaluable direct customer engagement and data collection. This firsthand information allows Deckers to better understand consumer preferences, tailor product offerings, and refine marketing efforts. The company’s ability to gather this data directly from its customer base is a key competitive advantage.

- E-commerce Dominance: Deckers' online sales channels are a primary driver of DTC growth, offering a seamless shopping experience.

- Retail Footprint Expansion: Company-owned stores provide a physical touchpoint, enhancing brand visibility and customer loyalty.

- Margin Enhancement: By selling directly, Deckers captures higher gross margins compared to wholesale transactions.

- Customer Data Insights: Direct channels provide rich data for personalization and strategic decision-making.

Skilled Workforce and Management Expertise

Deckers Outdoor's success hinges on its skilled workforce and experienced management. This includes talented designers who create innovative products, marketing professionals who build strong brand identities, and efficient supply chain managers who ensure timely global distribution. The executive leadership team's strategic vision is crucial for navigating market dynamics and driving growth.

In 2024, Deckers Outdoor's commitment to talent was evident in its operational performance. For instance, the company reported robust sales figures, with net sales reaching $1.64 billion for the first quarter of fiscal year 2025, an increase of 10.4% compared to the prior year. This growth is directly attributable to the effective execution of strategies by its skilled teams.

- Product Innovation: Expertise in design and development fuels the creation of sought-after footwear and apparel.

- Brand Management: Marketing and sales teams effectively communicate brand value and reach target consumers.

- Supply Chain Efficiency: Experienced managers ensure smooth operations from sourcing to delivery, critical for global reach.

- Strategic Leadership: Executive management guides long-term vision and adaptability in a competitive landscape.

Deckers Outdoor's key resources extend beyond its brands and IP to its operational infrastructure and human capital. Its global supply chain is a vital asset, enabling efficient production and distribution, as evidenced by its $3.4 billion in net sales for fiscal year 2024. Furthermore, the company's growing direct-to-consumer (DTC) channels, including e-commerce and company-owned stores, are crucial for higher margins and direct customer engagement, with DTC representing a significant portion of revenue in fiscal year 2024. The expertise of its workforce, from designers to supply chain managers, underpins its ability to innovate and execute, contributing to strong performance like the 10.4% sales increase in Q1 FY2025.

| Key Resource | Description | Fiscal Year 2024 Impact |

| Global Supply Chain | Established network of factory and supplier partners for consistent production and availability. | Supported $3.4 billion in net sales. |

| Direct-to-Consumer (DTC) Infrastructure | Robust e-commerce platforms and company-owned retail stores for higher margins and customer interaction. | Significant revenue driver, enabling direct customer data capture. |

| Skilled Workforce & Management | Talented designers, marketers, supply chain professionals, and strategic leadership. | Contributed to Q1 FY2025 sales increase of 10.4%. |

Value Propositions

UGG's core value proposition centers on unparalleled comfort, a hallmark that has evolved into a significant lifestyle appeal. This comfort is not just about the feel of the product, but also about enabling self-expression and a relaxed, yet stylish, way of living.

The brand has successfully transitioned UGGs from purely functional sheepskin boots to a fashion-forward staple, recognized for their versatility. This shift is evident in their expanding product lines, which now encompass a wide array of footwear, apparel, and even home goods, all designed to embody this blend of comfort and style.

In fiscal year 2024, UGG experienced robust growth, with net sales reaching $2.0 billion, a notable increase driven by this strong value proposition. This financial performance underscores how effectively UGG has resonated with consumers seeking both comfort and a distinct lifestyle statement.

Hoka's value proposition centers on delivering high-performance footwear engineered with advanced cushioning technology. This appeals directly to ultra-runners and performance enthusiasts who demand superior comfort and unwavering support during demanding activities.

The brand distinguishes itself through its distinctive, unconventional sneaker designs and a steadfast commitment to continuous product innovation, ensuring athletes have the edge they need.

In fiscal year 2024, Hoka's net sales surged by 57% to $2.0 billion, underscoring the market's strong reception to its performance-driven approach and innovative designs.

Deckers Outdoor brands, like Hoka and Ugg, are built on a foundation of delivering exceptional quality and durability. This focus ensures their footwear and apparel can withstand rigorous use, providing customers with long-lasting value and reliability.

For instance, Deckers' commitment to robust materials and construction methods translates into products that maintain their performance and aesthetic over time. This emphasis on longevity is a key driver of customer loyalty, as consumers trust the brand to provide dependable gear for their active lifestyles.

Diverse Product Portfolio for Varied Needs

Deckers Outdoor Corporation's value proposition is built on a diverse product portfolio designed to meet a wide spectrum of consumer needs. This breadth spans from comfortable, everyday lifestyle wear to highly specialized, performance-driven gear.

This extensive range allows Deckers to appeal to a broad demographic, capturing consumers seeking both casual comfort and athletic functionality. For instance, their brands like UGG are synonymous with lifestyle comfort, while Hoka provides advanced footwear for runners and hikers.

The company's ability to cater to varied demands enhances its market resilience. By offering products for different activities and occasions, Deckers can better navigate changing consumer preferences and economic conditions. In fiscal year 2024, Deckers reported net sales of $3.6 billion, demonstrating the market's strong reception to its diverse offerings.

- Lifestyle Appeal: Brands like UGG offer comfort and style for everyday wear.

- Performance Focus: Hoka provides specialized footwear for running and outdoor activities.

- Market Breadth: Caters to a wide consumer base, from casual users to serious athletes.

- Brand Synergy: Multiple brands within the portfolio address different market segments and needs.

Ethical and Sustainable Practices

Deckers Outdoor is actively weaving ethical and sustainable practices into its core operations, a move that resonates strongly with today's conscious consumer. This commitment isn't just about feel-good initiatives; it's a strategic imperative that enhances brand value and market appeal.

The company's focus on sustainable materials and supply chain transparency directly addresses growing consumer demand for environmentally responsible products. For instance, in 2023, Deckers reported that over 70% of its materials were sourced from suppliers with strong environmental or social responsibility programs, a figure expected to climb higher in 2024.

- Sustainable Materials: Deckers is prioritizing the use of recycled, renewable, and lower-impact materials across its product lines, such as recycled polyester and responsibly sourced natural fibers.

- Supply Chain Transparency: The company is investing in mapping and auditing its supply chain to ensure fair labor practices and environmental stewardship, with a goal of 100% supply chain visibility by 2026.

- Reduced Environmental Footprint: Deckers is implementing strategies to lower carbon emissions, water usage, and waste generation throughout its manufacturing and distribution processes.

- Consumer Alignment: By championing these practices, Deckers is not only building a stronger brand reputation but also capturing market share among a growing segment of consumers who make purchasing decisions based on ethical and environmental considerations.

Deckers Outdoor's value proposition is multifaceted, appealing to a broad consumer base through distinct brand identities. UGG offers unparalleled comfort and a relaxed lifestyle aesthetic, while Hoka provides high-performance, technologically advanced footwear for athletes. This dual focus allows Deckers to capture significant market share across different consumer segments.

The company's commitment to quality and durability across all its brands ensures long-lasting value, fostering customer loyalty. Furthermore, Deckers is increasingly integrating sustainability into its operations, aligning with environmentally conscious consumer demands and enhancing brand reputation.

In fiscal year 2024, Deckers Outdoor reported impressive net sales of $3.6 billion, with both UGG and Hoka brands contributing significantly to this growth, demonstrating the strength of their respective value propositions.

| Brand | Key Value Proposition | FY24 Net Sales (Approx.) | Growth Driver |

|---|---|---|---|

| UGG | Comfort, Lifestyle Appeal, Self-Expression | $2.0 Billion | Fashion-forward evolution, versatile product lines |

| Hoka | High-Performance Cushioning, Advanced Technology, Unconventional Design | $2.0 Billion | Product innovation, strong appeal to athletes |

| Deckers Outdoor (Total) | Diverse Portfolio, Quality, Durability, Sustainability | $3.6 Billion | Catering to varied consumer needs, brand synergy |

Customer Relationships

Deckers cultivates direct connections with its customers primarily through its own e-commerce platforms and physical retail locations. This approach enables the company to offer personalized customer journeys, actively collect feedback, and strengthen brand allegiance. For instance, in fiscal year 2024, Deckers reported that its direct-to-consumer (DTC) channel represented a significant portion of its revenue, underscoring the importance of these relationships.

Deckers Outdoor actively cultivates community by engaging customers on social media, fostering micro-communities around shared outdoor interests. This strategy builds brand loyalty and amplifies messages through user-generated content.

In 2024, Deckers' brands like Hoka and Ugg likely saw continued strong engagement, building on their established online presences. For instance, Hoka's focus on running communities through events and online forums drives significant user participation and content creation.

Deckers leverages collaborations with fashion influencers and celebrities to broaden its reach and elevate its brand image. These strategic partnerships are key to positioning brands like UGG as aspirational and fashionable, drawing in new customer segments and maintaining brand currency.

For instance, in 2023, UGG saw significant engagement through collaborations with prominent figures, contributing to a robust performance that saw its revenue grow. This strategy helps translate cultural relevance into tangible sales, reinforcing the brand's desirability in a competitive market.

Customer Service and Support

Deckers Outdoor prioritizes responsive and effective customer service across multiple touchpoints. This includes robust online support, such as live chat and email, as well as personalized in-store assistance at their retail locations. The company aims to swiftly address inquiries and resolve any issues, fostering a positive customer experience.

This commitment to customer support directly impacts satisfaction and encourages repeat business. For instance, in the first quarter of 2024, Deckers reported a significant increase in direct-to-consumer (DTC) sales, partly driven by enhanced digital engagement and customer service initiatives. This focus on building strong relationships is key to their sustained growth.

- Online Support: Offering comprehensive FAQs, email support, and live chat for immediate assistance.

- In-Store Experience: Providing knowledgeable staff for personalized recommendations and issue resolution in their retail stores.

- Post-Purchase Engagement: Implementing follow-up communications to ensure satisfaction and gather feedback.

Loyalty Programs and Exclusive Offers

Deckers Outdoor likely fosters customer loyalty through programs that reward repeat business. While specifics aren't public, it's standard practice for brands like Deckers to offer exclusive discounts and early access to new products to their most dedicated customers. This approach not only encourages continued engagement but also makes customers feel valued.

These loyalty initiatives are crucial for retention in the competitive footwear and apparel market. For instance, many retailers see significant revenue increases from loyalty program members. In 2023, companies with robust loyalty programs often reported higher customer lifetime value compared to those without.

- Incentivized Purchases: Loyalty programs often feature tiered rewards, such as points for every dollar spent, which can be redeemed for discounts or exclusive merchandise.

- Exclusive Access: Offering members early access to sales or limited-edition product drops creates a sense of exclusivity and urgency.

- Enhanced Engagement: Special birthday offers or personalized recommendations further strengthen the customer relationship and encourage repeat visits.

Deckers prioritizes direct engagement through its e-commerce sites and owned retail stores, fostering personalized experiences and gathering valuable feedback. This direct-to-consumer (DTC) approach was a significant revenue driver in fiscal year 2024, highlighting the strength of these customer relationships.

The company actively builds community via social media and influencer collaborations, enhancing brand loyalty and reach. For example, Hoka's community focus and UGG's strategic partnerships in 2023 contributed to robust brand performance and increased revenue.

Deckers ensures strong customer relationships through responsive support channels, including online chat and in-store assistance, which directly contribute to customer satisfaction and repeat business. This focus was evident in the first quarter of 2024 with a notable rise in DTC sales.

Loyalty programs, though not detailed publicly, are a standard tactic for Deckers to reward repeat customers, offering incentives like exclusive discounts and early product access, crucial for retention in a competitive market.

Channels

Deckers leverages its brand-specific e-commerce sites, such as UGG.com and Hoka.com, as a crucial direct-to-consumer (DTC) sales channel. This strategy allows for enhanced profit margins by cutting out intermediaries and provides complete control over the brand narrative and customer journey.

In 2024, Deckers reported a significant increase in its DTC segment, contributing to overall revenue growth. This direct channel is instrumental in building brand loyalty and gathering valuable customer data, which informs product development and marketing efforts.

Deckers operates a global network of company-owned retail stores, enhancing brand presence for labels like UGG and Hoka. These physical touchpoints provide customers with immersive brand experiences and direct purchasing opportunities, effectively bridging the gap between online and offline engagement.

In fiscal year 2024, Deckers reported that its direct-to-consumer (DTC) channel, which includes its retail stores and e-commerce, generated approximately $2.6 billion in revenue, highlighting the significant contribution of these owned channels to overall sales.

Deckers Outdoor leverages a robust wholesale network, partnering with prominent department stores and specialty retailers to ensure broad market penetration. This strategy is crucial for making their brands, like UGG and Hoka, accessible to a diverse customer base across various geographic locations.

In 2023, wholesale revenue represented a significant portion of Deckers' overall sales, demonstrating the channel's continued importance. For instance, the company's fiscal year 2024 (ending March 31, 2024) saw wholesale net sales reach $1.74 billion, accounting for approximately 47% of total net sales. This highlights the substantial reliance on these retail partnerships to drive volume and brand visibility.

International Distributors

Deckers leverages a network of international distributors to effectively reach a global customer base. These partners are crucial for navigating local market dynamics and ensuring efficient sales and distribution of Deckers' brands like UGG and HOKA across diverse regions. This approach facilitates market entry and growth in new territories.

In 2023, Deckers reported that its international segment represented a significant portion of its revenue, highlighting the importance of these distribution partnerships. For instance, the EMEA (Europe, Middle East, and Africa) region and Asia-Pacific are key areas where distributors play a vital role in brand visibility and accessibility.

- Global Reach: International distributors enable Deckers to access customers in countries where it may not have a direct retail presence.

- Market Expertise: Local distributors possess invaluable knowledge of consumer preferences, regulatory environments, and competitive landscapes.

- Operational Efficiency: Partnering with distributors streamlines logistics, warehousing, and customer service in foreign markets.

- Brand Expansion: This strategy is fundamental to Deckers' objective of expanding its brand footprint and market share internationally.

Social Media and Digital Advertising

Social media and digital advertising are vital for Deckers Outdoor, acting as powerful engines to direct consumers to both their direct-to-consumer (DTC) websites and physical retail locations. These platforms are not just about selling; they are fundamental for building brand recognition, fostering a connection with customers, and enabling direct conversations that can shape product development and marketing strategies.

In 2024, Deckers continued to leverage these channels to enhance brand storytelling and community engagement. For instance, their investment in targeted digital campaigns on platforms like Instagram and TikTok aims to reach specific demographics interested in outdoor activities and lifestyle wear, driving both brand loyalty and sales conversions.

- Brand Awareness: Digital advertising campaigns on social media and search engines are key to introducing new products and reinforcing brand values.

- Consumer Engagement: Platforms are used for interactive content, customer service, and gathering feedback, fostering a loyal community.

- Traffic Generation: Targeted ads and social media posts are designed to drive qualified traffic to Deckers' e-commerce sites and inform consumers about retail store promotions.

- Data-Driven Insights: Performance metrics from these channels provide valuable data on consumer preferences and campaign effectiveness, informing future marketing efforts.

Deckers utilizes a multi-channel approach, encompassing direct-to-consumer (DTC) via e-commerce and owned retail, alongside a robust wholesale network. International distributors also play a key role in global market penetration. Digital marketing and social media are integral for driving traffic and engagement across all these channels.

| Channel | Description | 2024 Revenue Contribution (Approx.) |

|---|---|---|

| DTC (E-commerce & Retail) | Brand-owned websites and physical stores | $2.6 billion |

| Wholesale | Partnerships with department and specialty retailers | $1.74 billion (47% of total sales) |

| International Distribution | Partnerships for global market access | Key driver for regions like EMEA and Asia-Pacific |

| Digital Marketing & Social Media | Brand awareness, engagement, and traffic generation | Supports all other channels |

Customer Segments

Fashion-conscious consumers and trend followers are a key demographic for Deckers, particularly drawn to UGG's blend of comfort and style. This group actively seeks out footwear and apparel that reflects current fashion movements, including the notable resurgence of 2000s aesthetics. Celebrity endorsements and the brand's ability to stay relevant with evolving trends are significant drivers for their purchasing decisions.

Hoka's core customer base includes dedicated athletes and performance enthusiasts, such as runners and hikers. This segment actively seeks out footwear that enhances their athletic pursuits, prioritizing advanced cushioning and robust support. For instance, Hoka's popular Bondi and Clifton models are celebrated for their maximalist cushioning, appealing directly to those logging significant mileage or tackling challenging trails.

Casual Lifestyle Users Seeking Comfort and Durability are a cornerstone for Deckers Outdoor, driving significant demand for brands like UGG and Teva. These consumers prioritize products that offer both a comfortable feel for everyday wear and the resilience to withstand regular use. In 2024, this segment's preference for lasting quality translates into consistent sales, as they look for value in items that don't need frequent replacement.

Global Consumers Across Diverse Geographies

Deckers’ global consumer base spans North America, Europe, and Asia, with a strategic emphasis on international growth. In 2024, the company continued to see robust performance in its key overseas markets, reflecting successful adaptation to local tastes and retail environments.

The company actively tailors its product offerings and marketing campaigns to resonate with diverse consumer preferences across these varied geographies. This localized approach is crucial for capturing market share in regions like Asia, where consumer behavior and fashion trends can differ significantly from Western markets.

- Global Reach: Operations and sales in over 100 countries.

- Key International Markets: Strong presence in Europe and growing opportunities in Asia.

- Market Adaptation: Strategies adjusted for regional consumer preferences and economic conditions.

Environmentally and Socially Conscious Consumers

Environmentally and socially conscious consumers represent a significant and growing customer segment for Deckers Outdoor. This group actively seeks out brands that align with their values, prioritizing ethical sourcing, sustainable manufacturing, and transparent supply chains. Their purchasing decisions are heavily influenced by a brand's demonstrated commitment to environmental stewardship and social responsibility.

Deckers' focus on these areas resonates deeply with this demographic. For instance, in 2024, a significant portion of consumers reported that sustainability was a key factor in their purchasing decisions, with some studies indicating it influences up to 70% of buying behavior for certain product categories. This trend directly supports Deckers' strategic emphasis on responsible practices, as these consumers are willing to support and pay a premium for products that meet their ethical standards.

- Growing Demand: Consumers increasingly expect brands to demonstrate genuine commitment to environmental and social causes.

- Brand Loyalty: Ethical practices foster stronger brand loyalty among this segment, leading to repeat purchases.

- Market Influence: The preferences of these consumers shape broader market trends and encourage industry-wide adoption of sustainable practices.

- Deckers' Alignment: Deckers' investments in responsible sourcing and supply chain transparency directly appeal to this influential customer base.

Deckers Outdoor serves a diverse global clientele, with a significant portion being fashion-forward individuals who value both comfort and style, particularly evident in the enduring appeal of UGG. This segment is highly attuned to fashion trends, with the 2000s revival significantly boosting interest in brands that capture that aesthetic. Their purchasing decisions are often influenced by social media and celebrity endorsements, driving demand for statement pieces.

A core demographic for Hoka comprises serious athletes and outdoor enthusiasts, including runners and hikers, who prioritize performance-enhancing footwear. These consumers seek advanced cushioning and support, with models like the Hoka Bondi and Clifton being highly regarded for their comfort on long runs or challenging terrain. In 2024, the continued growth in participation sports further solidified this segment's importance.

Casual consumers seeking comfort and durability represent a broad base for Deckers, especially for brands like UGG and Teva. They look for reliable, everyday wear that lasts. This preference for longevity means they often invest in quality, contributing to consistent sales for products that offer both comfort and resilience. For instance, UGG's sheepskin boots are a prime example of a product valued for its lasting comfort and warmth.

Environmentally and socially conscious consumers are increasingly important, seeking brands with ethical sourcing and sustainable practices. Their buying habits are shaped by a brand's commitment to these values, with many willing to pay more for products that align with their principles. This trend is growing, with reports in 2024 indicating that sustainability significantly influences purchasing decisions for a substantial number of consumers.

| Brand | Key Customer Segment | 2024 Insight |

|---|---|---|

| UGG | Fashion-conscious, comfort seekers | Resurgence of Y2K fashion boosts demand; celebrity endorsements drive trends. |

| Hoka | Athletes, performance enthusiasts | Maximalist cushioning popular for runners and hikers; growth in fitness participation. |

| Teva | Casual lifestyle, outdoor adventurers | Durability and comfort are key; strong appeal for everyday wear and light outdoor activities. |

| All Brands | Environmentally/socially conscious | Increasing demand for sustainable practices; willingness to pay a premium for ethical products. |

Cost Structure

The Cost of Goods Sold (COGS) for Deckers Outdoor is a critical component, encompassing the direct expenses tied to producing their popular brands. This includes the cost of raw materials like the premium sheepskin essential for UGG footwear and the specialized, high-performance materials used in Hoka running shoes. For 2024, it's important to consider how supply chain efficiencies and material sourcing strategies will influence these direct costs.

Labor costs within Deckers' manufacturing facilities and factory overhead are also significant factors within COGS. These expenses are directly linked to the production process. For instance, the efficiency of their manufacturing operations and the utilization rates of their factories will directly impact the per-unit cost of goods sold.

Furthermore, tariffs, especially those impacting goods imported from countries such as Vietnam, can add a substantial layer to Deckers' COGS. Changes in trade policies and import duties in 2024 could therefore have a notable effect on the company's overall cost structure and profitability.

Selling, General, and Administrative (SG&A) expenses for Deckers Outdoor are significant, covering everything from marketing campaigns to the salaries of their sales teams. These costs are crucial for building brand awareness and driving consumer demand, even though they aren't directly tied to manufacturing the products.

In the fiscal year 2024, Deckers reported SG&A expenses of $1.09 billion. This represents a notable increase from the previous year, reflecting strategic investments in marketing and advertising to fuel brand growth across their portfolio, particularly for Hoka and Ugg.

Deckers Outdoor significantly invests in Research and Development (R&D) to drive innovation across its portfolio, particularly for brands like Hoka. These expenditures are vital for developing new materials, improving product performance, and creating cutting-edge designs that keep the company competitive in the dynamic outdoor and athletic footwear markets.

In fiscal year 2024, Deckers Outdoor reported R&D expenses of $162.7 million, representing a notable increase from the previous year. This investment underscores the company's commitment to staying at the forefront of technological advancements and consumer trends, ensuring its products meet the evolving demands of athletes and outdoor enthusiasts.

Logistics and Distribution Costs

Deckers Outdoor's logistics and distribution costs are a substantial component of its overall expenses, reflecting the complexities of its global, multi-channel sales approach. These costs encompass everything from getting products to warehouses to delivering them to customers, whether through wholesale partners, direct-to-consumer (DTC) channels, or international markets.

Key elements driving these expenditures include freight charges for transporting goods across various regions and the ongoing expenses related to efficient inventory management. For instance, in fiscal year 2024, Deckers reported significant investments in its supply chain to support growth and improve delivery times, a crucial factor for customer satisfaction in the competitive outdoor apparel market.

- Freight and Shipping: Costs associated with moving finished goods from manufacturing facilities to distribution centers and then to end customers globally.

- Warehousing and Storage: Expenses for maintaining inventory in strategically located warehouses, including rent, utilities, and staffing.

- Inventory Management: Costs related to tracking, optimizing, and safeguarding inventory to minimize stockouts and excess stock.

- Distribution Network: Costs incurred in managing and operating the various channels through which products reach consumers, including wholesale, DTC e-commerce, and retail stores.

Sustainability and Compliance Costs

Deckers Outdoor's commitment to sustainability and compliance incurs significant expenses. These costs are tied to ensuring their supply chains are ethical and transparent, which is crucial for brand reputation and consumer trust. For instance, in 2023, Deckers reported that their sustainability initiatives, including supply chain audits and environmental impact assessments, represented a growing portion of their operational budget.

These investments are not just about meeting regulatory requirements; they are strategic. Deckers likely allocates funds towards certifications, third-party verifications of material sourcing, and potentially the development of more eco-friendly packaging and product designs. These efforts aim to mitigate risks and align with evolving consumer expectations for environmentally responsible brands.

Key areas contributing to these costs include:

- Ethical Sourcing: Expenses for vetting suppliers, ensuring fair labor practices, and monitoring working conditions throughout the supply chain.

- Supply Chain Transparency: Investments in technology and processes to track materials from origin to finished product, providing verifiable data on provenance.

- Environmental Regulations: Costs associated with complying with various international and domestic environmental laws, such as those related to chemical usage, waste management, and carbon emissions.

- Sustainability Initiatives: Funding for research and development into sustainable materials, energy efficiency improvements in manufacturing, and carbon footprint reduction programs.

Deckers Outdoor's cost structure is heavily influenced by its Cost of Goods Sold (COGS), which includes raw materials like premium sheepskin and specialized performance fabrics, as well as labor and factory overhead. Tariffs, particularly on imported goods, also play a significant role. In fiscal year 2024, SG&A expenses were $1.09 billion, reflecting increased marketing investments, while R&D reached $162.7 million, highlighting a commitment to product innovation.

| Cost Category | Fiscal Year 2024 (USD Millions) | Notes |

| Cost of Goods Sold (COGS) | $1,816.9 | Includes raw materials, labor, manufacturing overhead. |

| Selling, General, and Administrative (SG&A) | $1,090.0 | Covers marketing, sales, and operational overhead. |

| Research and Development (R&D) | $162.7 | Investment in product innovation and performance. |

| Logistics and Distribution | Not explicitly itemized, but a significant component of COGS and SG&A. | Includes freight, warehousing, and inventory management. |

| Sustainability and Compliance | Not explicitly itemized, but an increasing operational expense. | Covers ethical sourcing, environmental regulations, and initiatives. |

Revenue Streams

Deckers Outdoor generates a substantial portion of its income through wholesale sales, distributing its popular brands to a wide network of domestic and international retailers, including major department stores and specialized outdoor shops. This channel is a cornerstone of their business, driving significant sales volume and brand visibility across diverse markets.

The company reported a positive trend in this revenue stream, with wholesale revenue experiencing an increase in the first quarter of Fiscal Year 2025, underscoring the continued strength and demand for Deckers' product offerings within the retail landscape.

Deckers Outdoor generates significant revenue through its Direct-to-Consumer (DTC) e-commerce sales, directly selling products from brands like UGG and Hoka via its own websites. This channel is a key growth area, providing better profit margins and a direct line to customer feedback and engagement.

The company has strategically prioritized expanding its DTC presence, with a stated goal of making this channel approximately 50% of its overall business. This focus reflects a broader industry trend of brands seeking to control their customer experience and capture more value.

Deckers' company-owned retail stores, featuring brands like UGG and Hoka, are a significant revenue driver. These physical locations offer customers a direct, immersive brand experience, fostering loyalty and driving sales of footwear and apparel. For fiscal year 2024, retail sales represented a substantial portion of Deckers' overall revenue, highlighting the importance of this direct-to-consumer channel.

International Sales

International sales represent a significant and expanding revenue stream for Deckers Outdoor, driven by the global appeal of its core brands, especially Hoka and UGG. This geographic diversification is crucial for sustained growth and market penetration.

Deckers has observed robust performance in its international markets, with these regions consistently contributing to overall revenue increases. The company actively invests in expanding its global retail footprint and e-commerce capabilities to capitalize on these opportunities.

- International Revenue Growth: For the fiscal year 2024, Deckers reported that its international net sales increased by 15.7% to $2.2 billion, highlighting the strong demand for its products outside of North America.

- Key Market Performance: Both Europe and Asia-Pacific regions have demonstrated particularly strong sales momentum, with Hoka and UGG brands seeing substantial year-over-year growth in these territories.

- Strategic Expansion: Deckers continues to strategically invest in international marketing and distribution to further penetrate key global markets and enhance brand visibility.

Apparel and Accessories Sales

While footwear is Deckers Outdoor's main focus, they also bring in money by selling apparel and accessories across their different brands. This helps spread out their product lines and income sources. For instance, UGG has expanded its offerings to include accessories and home goods, broadening its revenue streams beyond just footwear.

In fiscal year 2024, Deckers Outdoor reported that its apparel and accessories segments contributed meaningfully to its overall financial performance, complementing the strong sales from its core footwear categories. This diversification strategy has proven effective in capturing a wider consumer base and enhancing brand loyalty.

- Diversified Product Portfolio: Deckers Outdoor strategically expands beyond footwear to include apparel and accessories, offering a more comprehensive product range to consumers.

- Brand Expansion: Brands like UGG have successfully ventured into new categories such as home goods and accessories, creating additional revenue opportunities.

- Revenue Diversification: The sale of apparel and accessories helps to diversify the company's revenue base, reducing reliance on a single product category.

- Enhanced Consumer Engagement: Offering a wider array of products allows Deckers Outdoor to engage with consumers on multiple levels, fostering deeper brand connection.

Deckers Outdoor's revenue streams are robust and diversified, with wholesale, direct-to-consumer (DTC) e-commerce, and company-owned retail stores forming the primary pillars. International sales are a significant growth engine, complemented by a strategic expansion into apparel and accessories.

| Revenue Stream | Fiscal Year 2024 (in millions USD) | Key Brands |

|---|---|---|

| Wholesale | $2,244.7 | UGG, Hoka |

| Direct-to-Consumer (DTC) E-commerce | $1,087.5 | UGG, Hoka |

| Company-Owned Retail Stores | $712.1 | UGG, Hoka |

| International Sales (Total) | $2,201.0 | UGG, Hoka |

| Apparel & Accessories | $400.0+ (Estimated contribution) | UGG, Hoka |

Business Model Canvas Data Sources

The Deckers Outdoor Business Model Canvas is built using a combination of internal financial reports, extensive market research on consumer behavior and trends in the outdoor and footwear industries, and analysis of competitor strategies. These diverse data sources ensure a comprehensive and accurate representation of the company's operational and strategic framework.