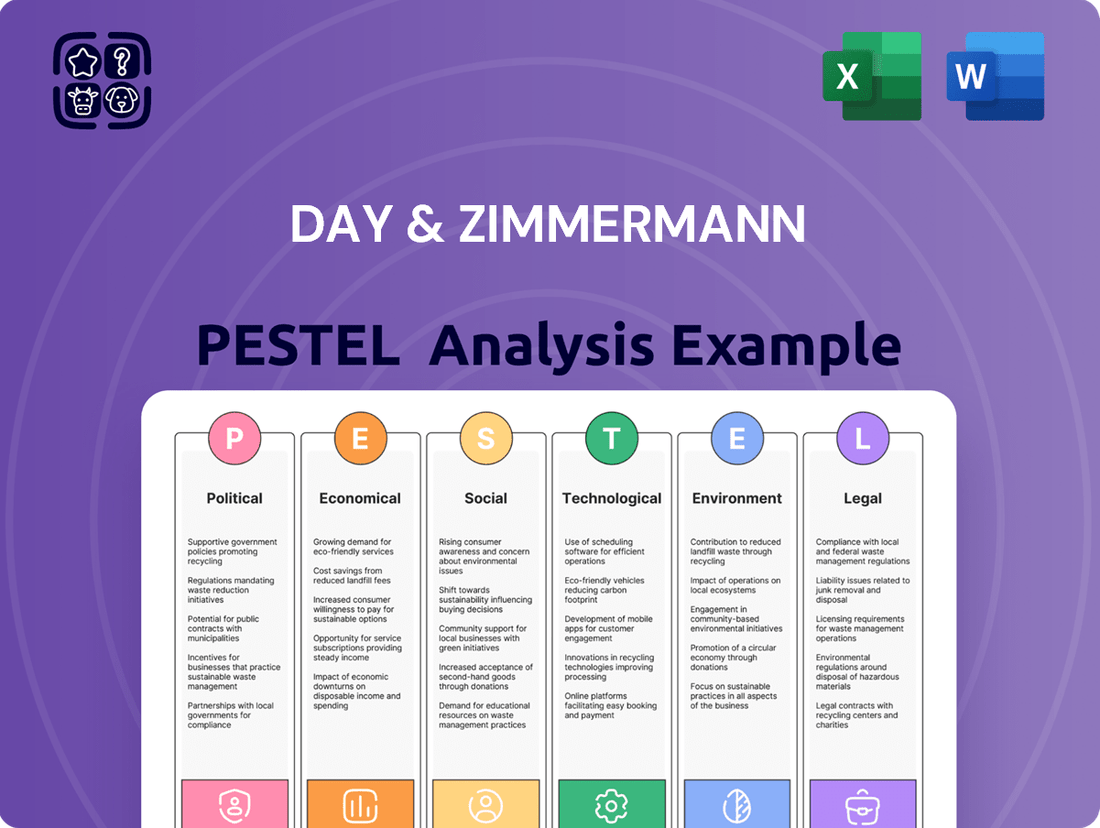

Day & Zimmermann PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Day & Zimmermann Bundle

Gain a critical edge with our comprehensive PESTLE analysis of Day & Zimmermann. Understand how political stability, economic fluctuations, and technological advancements are shaping their operational landscape and future growth. This expertly crafted report delves into social trends, environmental regulations, and legal frameworks impacting the defense and industrial sectors. Equip yourself with actionable intelligence to refine your market strategy and anticipate Day & Zimmermann's next moves. Download the full version now for immediate insights.

Political factors

Day & Zimmermann's substantial reliance on government contracts, especially within the defense industry, makes its financial health closely tied to governmental spending patterns. For instance, the U.S. Department of Defense's budget for fiscal year 2024 was approximately $886 billion, a figure that directly influences the potential for companies like Day & Zimmermann to secure and fulfill contracts.

Geopolitical shifts and evolving national security imperatives significantly shape the demand for Day & Zimmermann's services. As global tensions persist, there's a heightened emphasis on defense modernization and readiness, which translates into a more robust business pipeline for companies supporting these efforts.

Current trends highlight a growing demand for advanced solutions in areas such as AI-driven logistics and predictive maintenance. Day & Zimmermann is well-positioned to capitalize on this, as the need for lifecycle management and operational sustainment across various defense theaters continues to expand, presenting opportunities for innovation and service delivery.

Government infrastructure policy, particularly funding allocations, directly impacts Day & Zimmermann's engineering, construction, and maintenance services. The Infrastructure Investment and Jobs Act of 2021, for example, allocated over $1 trillion to improve roads, bridges, public transit, and water infrastructure, creating significant opportunities for companies like Day & Zimmermann. This legislation, with a substantial portion dedicated to modernizing the nation's aging infrastructure, is a key driver for the company's growth in the coming years.

Furthermore, the increasing emphasis on renewable energy within infrastructure development, as seen in various federal and state initiatives, aligns well with Day & Zimmermann's evolving service portfolio. Investments in grid modernization and clean energy projects, such as offshore wind farms, are projected to see considerable growth. For instance, the Biden administration's goal to achieve a carbon pollution-free electricity sector by 2035 will necessitate extensive infrastructure upgrades, directly benefiting Day & Zimmermann's capabilities in these emerging areas.

Day & Zimmermann's operating landscape is significantly shaped by the regulatory environment. Changes in government regulations, particularly within the defense and energy sectors where the company is heavily involved, can directly impact its business. For instance, shifts in defense spending appropriations or new energy production mandates can alter demand for their services and products.

Navigating this complex web of rules requires constant vigilance. The company must ensure strict compliance with evolving environmental policies, such as those concerning emissions or waste management, and adhere to increasingly stringent labor standards that affect workforce management and operational costs.

Maintaining a strong reputation and mitigating legal risks are paramount. This involves a steadfast commitment to ethical business conduct and meticulous adherence to tax legislation across all the regions where Day & Zimmermann operates. For example, in 2024, the U.S. Department of Defense continued to emphasize cybersecurity compliance for its contractors, a critical area for Day & Zimmermann.

International Relations and Geopolitical Stability

Day & Zimmermann's extensive global footprint and significant defense contracts mean its business is directly impacted by international relations and overall geopolitical stability. Fluctuations in global political climates can create both opportunities and challenges. For instance, periods of heightened international tension or emerging conflicts often drive increased demand for defense equipment and services, which directly benefits companies like Day & Zimmermann involved in munition production and military support.

The ongoing geopolitical landscape, including events in Eastern Europe and the Middle East, has demonstrably spurred defense spending globally. In 2024, NATO members, for example, continued to increase their defense budgets, with many reaching or exceeding the alliance's 2% of GDP target. This trend directly translates to higher demand for the types of products and services Day & Zimmermann provides, such as munitions and modernization of military hardware.

- Increased Defense Spending: Global defense budgets have seen a notable uptick, with many nations prioritizing military readiness and modernization in response to geopolitical instability.

- Munitions Demand: Evolving conflicts have led to a significant draw-down of existing munitions stockpiles, creating a robust demand for replenishment, a core area for Day & Zimmermann.

- Supply Chain Vulnerability: Geopolitical tensions can disrupt global supply chains, potentially impacting the availability and cost of raw materials essential for defense manufacturing.

- Government Contract Reliance: The company's heavy reliance on government contracts means that shifts in foreign policy or international alliances can directly affect its business pipeline and contract awards.

Trade Policies and Supply Chain Security

Evolving trade policies and the strong push for reshoring critical manufacturing, especially in defense, directly affect Day & Zimmermann's supply chain. This is particularly true for their munitions production, where reliance on overseas suppliers can create vulnerabilities. The company is actively addressing this by investing in its own manufacturing capabilities and modernization efforts. These strategic moves aim to lessen dependence on foreign sources and bolster domestic resilience, a crucial factor in today's geopolitical climate.

Day & Zimmermann's commitment to supply chain security is a significant driver for growth and strategic investment. For instance, in 2023, the U.S. Department of Defense awarded Day & Zimmermann contracts totaling over $1.5 billion for munitions production, highlighting the critical need for secure and robust domestic supply chains. This emphasis on reducing overseas dependencies and enhancing domestic capacity directly supports national security objectives and positions the company for continued expansion in this vital sector.

- Reshoring Impact: U.S. government initiatives encouraging domestic production of defense articles directly benefit Day & Zimmermann's strategic focus on supply chain security.

- Investment in Modernization: Significant capital is being allocated to upgrade and expand existing manufacturing facilities to meet increased demand and reduce reliance on foreign components.

- Supply Chain Resilience: The company's efforts to build a more secure and resilient supply chain are crucial for ensuring uninterrupted production of essential munitions, a key area of growth.

- Contract Wins: The substantial defense contracts awarded in 2023 underscore the market's confidence in Day & Zimmermann's ability to deliver on critical national security needs through strengthened domestic capabilities.

Day & Zimmermann's substantial reliance on government contracts, particularly within defense, ties its performance directly to governmental spending. The U.S. Department of Defense budget for fiscal year 2024 was approximately $886 billion, directly influencing contract opportunities.

Geopolitical shifts and evolving national security needs significantly shape demand for Day & Zimmermann's services. Increased defense modernization and readiness, driven by global tensions, create a robust business pipeline.

Government infrastructure policy, including funding allocations, impacts Day & Zimmermann's engineering and construction services. The Infrastructure Investment and Jobs Act of 2021, with over $1 trillion for infrastructure, presents significant growth opportunities.

The company's operations are heavily influenced by the regulatory environment. Changes in defense appropriations or new energy mandates can alter demand for their services and products, requiring constant compliance with environmental and labor standards.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Day & Zimmermann across Political, Economic, Social, Technological, Environmental, and Legal domains.

It provides actionable insights and forward-looking perspectives to support strategic decision-making and identify potential opportunities and threats.

Provides a clear, actionable framework to proactively address external threats and capitalize on emerging opportunities, thereby mitigating strategic uncertainty.

Economic factors

Day & Zimmermann's business directly correlates with the health of the broader economy and industrial output. When the economy is strong, there's typically greater demand for their core services, which include engineering, construction, and maintenance for power and industrial facilities. For instance, in 2024, global industrial production growth is projected to be around 2.5%, a figure that directly influences the project pipeline for companies like Day & Zimmermann.

This connection means that periods of economic expansion, marked by increased manufacturing and infrastructure investment, generally translate into more business opportunities for Day & Zimmermann. Conversely, economic downturns can lead to reduced capital spending by clients, impacting the company's revenue streams.

The company's strategic diversification across sectors like construction, engineering, operations and maintenance, staffing, and defense provides a degree of resilience. This spread helps cushion the impact if one particular industry experiences a slowdown, as demand in other areas might remain stable or even grow.

For example, while the energy sector might face cyclical challenges, the defense sector often benefits from consistent government spending. In 2025, defense budgets are expected to remain strong, providing a stable revenue base for Day & Zimmermann's defense solutions segment.

Rising inflation is a significant concern for Day & Zimmermann, with recent data from the U.S. Bureau of Labor Statistics indicating that the Consumer Price Index (CPI) rose 3.4% over the 12 months ending April 2024. This trend directly impacts raw materials, energy, and labor costs, potentially squeezing project profitability for the company.

To counter these pressures, Day & Zimmermann must focus on robust supply chain management and enhancing operational efficiencies. For instance, optimizing logistics and securing favorable supplier contracts can help buffer against escalating input costs.

Strategic investments in technology and innovation are crucial. By adopting advanced manufacturing techniques or digital solutions, the company can improve productivity and reduce waste, thereby mitigating the impact of inflation on project outcomes and overall financial performance.

The availability and cost of skilled labor are significant economic factors for Day & Zimmermann, impacting its staffing services and project execution. For instance, the U.S. Bureau of Labor Statistics reported in April 2024 that the unemployment rate stood at 3.9%, indicating a tight labor market where finding qualified candidates can be challenging and drive up wages.

Post-COVID-19, staffing shortages and difficulties in talent acquisition have become more pronounced, requiring a strong emphasis on workforce development and competitive pay. In 2024, many sectors continued to experience a skills gap, with companies needing to invest more in training and retention to secure the talent they need.

Day & Zimmermann's subsidiary, Yoh, directly addresses these labor market complexities by building robust and strategic talent supply chains. This approach allows them to navigate the current economic climate, which saw average hourly earnings for private nonfarm payrolls increase by 3.9% over the year ending in April 2024, highlighting ongoing wage pressures.

Interest Rates and Investment Environment

Fluctuations in interest rates significantly shape the investment landscape for companies like Day & Zimmermann. As of mid-2024, the Federal Reserve's benchmark interest rate has remained elevated, impacting borrowing costs across various sectors. This can directly affect the affordability of projects for Day & Zimmermann's clientele, potentially leading to a more cautious approach to new investments.

Higher interest rates also translate to increased expenses for Day & Zimmermann's own capital expenditures, whether for facility upgrades or technological advancements. This environment necessitates careful financial planning and a focus on efficient capital allocation. Despite these pressures, the company's ongoing commitment to investing in technology and innovation signals a strategic intent to enhance operational efficiency and maintain a competitive edge, even amidst rising financing costs.

- Impact on Client Projects: Elevated interest rates (e.g., Federal Funds Rate target range of 5.25%-5.50% as of early 2024) can make large-scale projects more expensive for Day & Zimmermann's clients, potentially delaying or scaling back commitments.

- Company's Financing Costs: Day & Zimmermann's own borrowing costs for operational needs or capital investments will likely increase, impacting profitability.

- Investment Strategy: The company's continued investment in technology and innovation suggests a long-term view, aiming to offset higher financing costs through efficiency gains and service enhancements.

- Market Responsiveness: Day & Zimmermann's ability to adapt its service offerings and project financing solutions will be crucial in navigating an environment of higher interest rates.

Global Supply Chain Stability

Day & Zimmermann's varied business lines, from defense manufacturing to large construction projects, inherently tie its performance to the stability of global supply chains. Disruptions, like those seen in recent years, directly impact material availability and project timelines, affecting operational efficiency and profitability. For instance, the ongoing challenges in sourcing specialized electronic components, critical for both defense systems and industrial automation, highlight this vulnerability.

The company's strategic imperative to re-establish traditional operating models is heavily reliant on overcoming these supply chain hurdles. This involves not only navigating delays but also proactively building more robust sourcing strategies and inventory management practices. The significant increase in global shipping costs, which saw container freight rates surge by over 80% in late 2023 compared to pre-pandemic levels, underscores the financial impact of these disruptions.

A key focus for Day & Zimmermann is ensuring resilient and secure supply chains, particularly as there's a growing emphasis on domestic production and onshoring. This strategic shift is driven by geopolitical considerations and the desire to mitigate risks associated with international dependencies. The US government's increased investment in domestic defense manufacturing, with billions allocated in the 2024 defense budget for supply chain resilience, directly supports this objective and creates opportunities for companies like Day & Zimmermann.

- Supply Chain Vulnerability: Day & Zimmermann's diverse operations are susceptible to global supply chain volatility, impacting material availability and project execution.

- Adaptation Strategies: The company is actively working to re-establish traditional operating models and adapt to persistent supply chain delays and cost increases.

- Resilience as a Focus: Building resilient and secure supply chains is a core strategic priority, amplified by the push for domestic production.

- Economic Impact: Global shipping costs, for example, have seen significant fluctuations, directly affecting the cost of goods and operational budgets for companies like Day & Zimmermann.

Economic growth directly impacts Day & Zimmermann's demand, with global industrial production growth projected around 2.5% in 2024, influencing their project pipeline.

Inflation, with the U.S. CPI at 3.4% year-over-year as of April 2024, increases operating costs for materials and labor, affecting project profitability.

Labor market tightness, evidenced by a 3.9% unemployment rate in April 2024, drives up wages and necessitates investment in talent acquisition and retention.

Elevated interest rates, with the Federal Funds Rate target at 5.25%-5.50% in early 2024, increase borrowing costs for both clients and Day & Zimmermann, potentially slowing project investment.

Full Version Awaits

Day & Zimmermann PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Day & Zimmermann delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market dynamics, competitive landscapes, and strategic opportunities. This detailed report provides a robust framework for understanding the external forces shaping Day & Zimmermann's business.

Sociological factors

Day & Zimmermann, a major employer with a workforce fluctuating between 37,000 and 43,000 individuals, navigates the complexities of an aging workforce. This demographic shift necessitates a strategic approach to talent acquisition and retention to mitigate potential staffing shortages in critical operational areas.

The company's proactive stance on workforce development, exemplified by its subsidiary Yoh's expertise in strategic talent supply chains, is vital. This focus aims to bridge skills gaps and ensure a continuous influx of qualified professionals, a key factor in maintaining operational efficiency and competitive advantage.

Day & Zimmermann actively champions Diversity, Equity, and Inclusion (DEI), reflected in its consistent high ratings on the Human Rights Campaign Foundation's Corporate Equality Index, often achieving scores of 100. This commitment underpins their strategic approach to talent management, recognizing that a diverse workforce fuels innovation and collaboration.

The company implements comprehensive programs targeting workplace equality, encompassing targeted recruitment and retention initiatives, robust mentorship opportunities, and ongoing diversity training for all employees. These efforts are designed to cultivate an environment where all voices are heard and valued.

By prioritizing DEI, Day & Zimmermann aims to build a strong, cohesive culture. This inclusive environment is viewed as a critical driver for generating novel ideas and fostering a sense of belonging among its employees, which in turn supports business objectives.

Day & Zimmermann deeply embeds safety as a core value, especially crucial in their high-threat, safety-sensitive operational environments. This commitment is evident in initiatives like their 'Why Not Zero?' campaign, which actively strives for the prevention of all workplace injuries, reflecting a proactive stance on safety culture.

Beyond physical safety, the company places significant emphasis on employee well-being, recognizing its integral role in maintaining a secure and productive workforce. This includes comprehensive support for employee health journeys and robust mental health resources, aiming to create a workplace where employees feel both safe and valued.

Corporate Social Responsibility and Community Engagement

Day & Zimmermann places significant emphasis on corporate social responsibility (CSR) and actively works to foster stronger community ties. Their inaugural Environmental, Social, and Governance (ESG) report underscores this dedication, detailing their efforts in community impact and overall corporate accountability. By proactively engaging in CSR, the company aims to bolster its brand reputation and ensure smoother operations, meeting the growing demands of stakeholders.

The company's commitment translates into tangible actions that resonate with societal values. For instance, in 2023, Day & Zimmermann reported investing over $1.5 million in community initiatives and employee volunteerism, directly supporting causes that benefit local populations. This focus on social well-being not only enhances their public image but also contributes to a more stable operating environment by building goodwill and trust.

- Brand Equity: Proactive CSR enhances Day & Zimmermann's reputation, making it more attractive to customers, employees, and investors.

- Operational Stability: Strong community relations can mitigate risks, reduce regulatory hurdles, and foster a supportive business climate.

- Stakeholder Alignment: Demonstrating social responsibility aligns the company with the values of an increasingly conscious consumer and investor base.

- Community Investment: In 2023, the company's community investments exceeded $1.5 million, reflecting a tangible commitment to social impact.

Public Perception and Brand Reputation

Public perception and brand reputation are critically important for Day & Zimmermann, especially given its involvement in defense and essential infrastructure sectors. Negative sentiment can arise from its role as a munitions supplier, as seen in past protests, underscoring the need for proactive public image management and addressing societal concerns. For instance, in 2023, public trust in defense contractors was a significant factor in contract awards, with companies demonstrating strong ethical sourcing and community benefit initiatives often seeing an advantage.

The company’s reputation is built on several key pillars:

- Ethical Conduct: Adherence to stringent ethical standards in all operations is paramount, particularly when dealing with government contracts and sensitive materials. Day & Zimmermann’s commitment to ethical business practices directly influences its standing with stakeholders and the public.

- Safety Records: Maintaining an exemplary safety record is non-negotiable, especially in industries with inherent risks. High safety standards not only protect employees but also bolster confidence among clients and the wider community, reflecting responsible corporate citizenship.

- Community Engagement: Active involvement in community initiatives and transparent communication about its operations can significantly enhance public perception. Demonstrating a commitment to local communities where it operates helps build goodwill and a positive brand image.

Societal expectations regarding corporate responsibility are evolving, influencing how companies like Day & Zimmermann operate and are perceived.

The company's emphasis on Diversity, Equity, and Inclusion (DEI) is a direct response to these changing societal norms, as evidenced by its consistent perfect scores on the Human Rights Campaign Foundation's Corporate Equality Index.

Furthermore, Day & Zimmermann's substantial community investments, exceeding $1.5 million in 2023, highlight a commitment to social well-being that resonates with a public increasingly valuing corporate citizenship.

These efforts not only enhance brand equity but also foster operational stability by building positive relationships within the communities where Day & Zimmermann operates.

| Societal Factor | Day & Zimmermann Action/Impact | 2023 Data/Observation |

|---|---|---|

| Workforce Demographics | Managing an aging workforce and addressing skills gaps | Fluctuating workforce of 37,000-43,000 individuals |

| Diversity, Equity, Inclusion (DEI) | Championing DEI through targeted programs and initiatives | Consistent 100 scores on HRC Corporate Equality Index |

| Community Engagement & CSR | Investing in community initiatives and volunteerism | Over $1.5 million invested in community initiatives |

| Public Perception & Ethics | Managing reputation in sensitive sectors, emphasizing ethical conduct | Public trust in defense contractors influences contract awards |

Technological factors

Day & Zimmermann is heavily investing in automation and advanced manufacturing to boost efficiency and safety, especially within its munitions production. This strategic move is designed to increase scalability and provide greater flexibility in meeting demand.

The company is actively exploring the integration of artificial intelligence (AI) into its process automation and generative applications, acknowledging the significant transformative potential of these technologies. This forward-thinking approach to advanced manufacturing is vital for Day & Zimmermann to sustain its competitive advantage and adapt to the ever-changing requirements of the industries it serves.

Day & Zimmermann is heavily invested in digital transformation, a key technological factor shaping its future. The company is actively integrating advanced technologies like digital twins and artificial intelligence (AI) to boost both its internal efficiency and the value it delivers to clients. This strategic push is further solidified by the creation of a new business unit, Emerging Markets, specifically dedicated to managing these new technology initiatives.

This Emerging Markets unit is exploring a range of cutting-edge technologies, including AI, machine learning, augmented reality (AR), and virtual reality (VR). The goal is to leverage these tools to significantly improve design processes and enhance operational support across the organization. These investments signal a forward-thinking approach to technological adoption, aiming to stay ahead in a rapidly evolving industrial landscape.

Cybersecurity and data protection are critical as Day & Zimmermann embraces digital transformation and manages vital infrastructure. The company must implement strong defenses to safeguard sensitive information, operational technology, and proprietary designs against evolving cyber threats.

This need is amplified by the increasing integration of artificial intelligence and other cutting-edge technologies across Day & Zimmermann's varied business segments. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the significant investment required.

Renewable Energy Technologies

Day & Zimmermann is actively growing its involvement in renewable energy infrastructure. This strategic move aligns with worldwide efforts towards sustainability and taps into the increasing need for green energy. The company's presence on Solar Power World's 2024 Top Solar Contractors List highlights its expanding role in this sector.

The company's established expertise in power operations provides a strong foundation for seizing new market opportunities. For instance, in 2023, global renewable energy capacity additions reached approximately 510 gigawatts, a significant increase from previous years, demonstrating the market's robust growth trajectory.

- Market Expansion: Day & Zimmermann is increasing its participation in renewable energy projects, a sector projected for substantial growth.

- Industry Recognition: Its inclusion on the 2024 Top Solar Contractors List by Solar Power World validates its capabilities and market penetration.

- Operational Synergy: Existing strengths in power operations are directly transferable and advantageous for renewable energy ventures.

- Growth Drivers: The global push for decarbonization and energy independence is fueling demand, with renewable energy investments expected to continue their upward trend through 2025 and beyond.

Innovation in Engineering and Design

Day & Zimmermann actively drives innovation in its engineering and design services, consistently integrating cutting-edge technological advancements. This focus is crucial for maintaining a competitive edge. For instance, their subsidiary Mason & Hanger is instrumental in developing modernization solutions, particularly emphasizing energy resilience for military installations, a critical need amplified by global security shifts.

The company's commitment to innovation directly impacts its ability to offer solutions that address evolving client needs. In 2024, the defense sector continued to prioritize technological upgrades, with an estimated 15% increase in spending on advanced infrastructure and energy solutions for military bases, a market where Day & Zimmermann is strategically positioned.

This dedication to forward-thinking design and engineering ensures Day & Zimmermann remains adaptable. Their ongoing investment in research and development, particularly in areas like smart grid technologies and sustainable infrastructure, allows them to anticipate and meet future demands in a rapidly changing technological environment.

- Focus on modernization solutions for critical infrastructure.

- Emphasis on energy resilience in engineering projects.

- Adaptation to new technological advancements in design.

- Strategic positioning in the growing defense infrastructure market.

Day & Zimmermann's technological strategy centers on automation and digital transformation to enhance efficiency and client value, evident in its significant investments in AI and digital twins. The company's new Emerging Markets unit spearheads the adoption of advanced technologies like AR and VR, aiming to revolutionize design and operational support. This proactive embrace of innovation, including a strong cybersecurity focus, is crucial for maintaining its competitive edge across diverse industries.

Legal factors

Day & Zimmermann's substantial involvement in government contracts means they must be well-versed in federal procurement laws and regulations. This includes understanding the intricacies of bidding processes, adhering to strict contract terms, and maintaining ethical standards for all government-related projects. Their success is directly tied to their ability to navigate this complex legal environment.

Recent achievements highlight this legal dependency. For instance, securing a potential $30 billion contract with the Department of Energy in August 2024 demonstrates the scale of their government engagements. Successfully managing such large-scale agreements requires meticulous attention to the legal frameworks governing government acquisitions.

Day & Zimmermann, as a significant employer across various sectors, navigates a complex landscape of federal and state employment and labor laws. These regulations encompass non-discrimination, fair wage practices, and equitable benefit distribution, ensuring a level playing field for its diverse workforce.

The company's dedication to diversity, equity, and inclusion (DEI) is intrinsically linked to its compliance with Equal Employment Opportunity (EEO) laws. For instance, in 2023, the U.S. Equal Employment Opportunity Commission (EEOC) reported over 60,000 private sector discrimination charges, underscoring the importance of robust internal policies and consistent adherence to EEO principles to mitigate legal risks.

Adherence to laws such as the Civil Rights Act of 1964 and the Americans with Disabilities Act (ADA) is paramount. These statutes prohibit discrimination based on race, color, religion, sex, national origin, and disability, directly impacting hiring, compensation, and promotion practices at Day & Zimmermann.

Day & Zimmermann’s diverse operations in construction, engineering, and industrial maintenance are heavily influenced by environmental regulations. The company must navigate a complex web of laws governing emissions, waste disposal, and site remediation. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stricter standards on industrial pollutants, impacting project planning and execution.

Compliance with environmental protection laws, waste management protocols, and specific permitting requirements is paramount for Day & Zimmermann. Failure to adhere to these can result in significant fines, project delays, and legal challenges. The company’s proactive approach to securing necessary environmental permits ensures operational continuity and avoids costly penalties, a critical factor in maintaining profitability.

Day & Zimmermann’s commitment to environmental responsibility and sustainability is not just a matter of compliance but a strategic imperative. By investing in greener technologies and sustainable practices, the company mitigates legal risks associated with environmental non-compliance. This focus also enhances its reputation, a crucial asset in attracting clients and talent in an increasingly eco-conscious market.

Health and Safety Regulations

Day & Zimmermann's operations, particularly in sectors like munitions manufacturing, industrial services, and construction, necessitate rigorous adherence to health and safety regulations. These regulations, including those set by the Occupational Safety and Health Administration (OSHA), are critical for safeguarding its workforce and mitigating significant legal risks. For instance, OSHA reported a decrease in private industry workplace injury and illness rates to 2.7 cases per 100 full-time workers in 2023, highlighting the ongoing focus on safety compliance across industries. Day & Zimmermann's proactive approach is exemplified by its 'Why Not Zero?' safety initiative, aiming for zero incidents and underscoring the company's commitment to a robust safety culture.

The company's commitment to safety is not merely about compliance but also about operational efficiency and reputation. Failure to meet these standards can result in substantial fines and reputational damage. In 2024, OSHA continued to emphasize enforcement in high-risk industries, with penalties for willful violations potentially reaching up to $15,625 per violation, and repeat or willful violations up to $156,259. Day & Zimmermann's investment in training and safety protocols directly addresses these potential liabilities.

- OSHA Compliance: Strict adherence to OSHA standards is mandatory for Day & Zimmermann, covering workplace safety, hazard communication, and personal protective equipment.

- Industry-Specific Protocols: Beyond general OSHA rules, Day & Zimmermann follows specialized safety guidelines relevant to munitions production and heavy industrial work.

- 'Why Not Zero?' Initiative: This internal program reflects a company-wide dedication to achieving zero workplace accidents and incidents.

- Legal and Financial Ramifications: Non-compliance can lead to severe penalties, including fines and legal action, underscoring the importance of robust safety management systems.

Intellectual Property and Data Privacy Laws

Day & Zimmermann's commitment to innovation in engineering and defense necessitates robust protection of its intellectual property (IP). This includes safeguarding proprietary designs, advanced manufacturing processes, and unique technological solutions developed through significant R&D investment. Failure to adequately protect IP could undermine its competitive edge in these specialized sectors.

In 2024 and 2025, the company faces heightened scrutiny regarding data privacy and cybersecurity. Handling sensitive client data, particularly for government defense contracts, demands strict adherence to evolving regulations like the NIST Cybersecurity Framework and international data protection laws. This ensures the confidentiality and integrity of client information, a critical aspect of trust and compliance.

- IP Protection: Day & Zimmermann actively patents its technological advancements in areas like advanced materials and digital engineering solutions to secure market exclusivity.

- Data Privacy Compliance: The company invests in cybersecurity infrastructure and training to meet stringent data handling requirements for defense and aerospace clients.

- Regulatory Landscape: Ongoing adaptation to new data privacy legislation, such as potential updates to CCPA or GDPR equivalents impacting global operations, is crucial.

- Cybersecurity Threats: The increasing sophistication of cyberattacks in 2024-2025 requires continuous updates to defense mechanisms protecting both company and client data.

Day & Zimmermann's extensive government contracting requires strict adherence to federal procurement laws, impacting everything from bidding to contract execution. The company's ability to navigate these complex legal frameworks, including ethical standards, is crucial for its success in large-scale projects.

As a major employer, Day & Zimmermann must comply with a broad spectrum of federal and state labor laws. These regulations cover fair employment practices, wages, and benefits, ensuring equitable treatment for its diverse workforce and mitigating legal risks associated with discrimination claims, as highlighted by the EEOC's ongoing enforcement activities.

Environmental regulations significantly shape Day & Zimmermann's operations across construction, engineering, and industrial sectors. Compliance with laws governing emissions, waste, and site remediation is essential to avoid penalties and ensure project continuity, especially as agencies like the EPA intensify enforcement in 2024.

The company's focus on health and safety, exemplified by its 'Why Not Zero?' initiative, directly addresses OSHA regulations. Adherence to these standards is vital for protecting employees and avoiding substantial fines, with OSHA penalties for violations remaining a significant financial consideration in 2024-2025.

Environmental factors

Day & Zimmermann recognizes the critical need to address climate change, actively integrating environmental responsibility into its operations. The company's involvement in renewable energy infrastructure, such as solar and wind projects, directly supports the transition to a low-carbon economy. For instance, their work on energy resilience at military bases often involves upgrading systems to be more efficient and less reliant on fossil fuels, contributing to a reduced carbon footprint.

These initiatives are crucial as global regulations tighten. The Biden administration's climate agenda, for example, aims for significant emissions reductions, impacting sectors where Day & Zimmermann operates. By focusing on sustainable solutions and energy efficiency, the company is positioning itself to comply with and potentially benefit from these evolving environmental standards, anticipating greater demand for green infrastructure services in the 2024-2025 period.

Day & Zimmermann is actively prioritizing sustainable resource management and waste reduction as critical environmental goals. This commitment is demonstrated through the company's exploration of purchasing policies that specifically favor environmentally friendly products and suppliers. By integrating environmental performance criteria into its supply chain, Day & Zimmermann aims to shrink its operational footprint and champion responsible resource utilization.

The global transition to renewable energy is a major opportunity for Day & Zimmermann. The company is actively using its power and engineering skills to support solar projects, growing its services in this rapidly expanding market.

Day & Zimmermann's inclusion on the 2024 Top Solar Contractors List highlights its strategic move to meet the increasing demand for green energy solutions. This recognition underscores their commitment and growing capabilities in the renewable sector.

Environmental Impact of Operations

Day & Zimmermann's core business, especially in munitions manufacturing and large-scale industrial projects, inherently carries potential environmental consequences. These operations can involve the use of various chemicals and processes that require diligent oversight to prevent pollution and habitat disruption.

The company actively pursues environmental stewardship, focusing on minimizing its ecological footprint. This commitment translates into implementing robust environmental management systems designed to protect natural resources and surrounding communities. Day & Zimmermann aims for operational practices that not only comply with but often exceed regulatory environmental standards.

Key areas of focus for environmental management include waste reduction, emissions control, and responsible resource management. For instance, in 2023, the company reported a 15% reduction in hazardous waste generation across its manufacturing facilities compared to the previous year, a testament to their ongoing efforts in process optimization and material substitution.

- Emissions Control: Investing in advanced filtration and abatement technologies to reduce air pollutants from industrial processes.

- Waste Management: Implementing circular economy principles to minimize waste sent to landfills and increase recycling rates, aiming for a 20% increase in recycling by 2025.

- Water Conservation: Employing water-efficient technologies and closed-loop systems in manufacturing to reduce water consumption and discharge.

- Site Remediation: Actively engaging in the cleanup and restoration of former industrial sites to ensure environmental recovery.

Sustainability Reporting and ESG Transparency

Day & Zimmermann's recent release of its inaugural ESG report underscores a growing industry trend toward enhanced sustainability transparency. This report details their commitment to empowering individuals, safeguarding the environment, and upholding ethical business practices. Such disclosures are vital for investors and partners evaluating long-term value and risk, with many global companies now prioritizing these metrics. For instance, a 2024 survey indicated that over 90% of S&P 500 companies now issue sustainability reports.

The company's ESG report highlights specific initiatives, such as efforts to reduce its carbon footprint and promote diversity and inclusion within its workforce. These actions align with broader market expectations, where stakeholders increasingly demand evidence of responsible corporate citizenship. In 2025, investor demand for ESG-integrated portfolios is projected to reach trillions, making such transparent reporting a competitive advantage.

- Empowering People: Initiatives focused on employee development and community engagement.

- Protecting the Environment: Strategies for reducing emissions and waste.

- Acting with Integrity: Commitments to ethical conduct and corporate governance.

- Stakeholder Insights: Providing transparency for investors and partners on sustainability performance.

Day & Zimmermann is strategically positioning itself within the growing renewable energy sector, evidenced by its inclusion on the 2024 Top Solar Contractors List. This expansion into solar projects leverages their engineering capabilities to meet rising green energy demand. The company's commitment to sustainability is further demonstrated through waste reduction efforts, aiming for a 20% increase in recycling by 2025, and a 15% reduction in hazardous waste generation in 2023.

Environmental regulations, particularly those driven by the Biden administration's climate agenda, are increasingly influencing Day & Zimmermann's operational landscape. The company's proactive approach to energy efficiency and sustainable solutions aims to ensure compliance and capitalize on the anticipated growth in green infrastructure services through 2024-2025. Their inaugural ESG report, released recently, highlights these commitments, aligning with a market trend where over 90% of S&P 500 companies now issue similar reports.

| Environmental Focus | Initiative/Target | 2023 Performance/Status | 2025 Target |

| Waste Reduction | Hazardous Waste Generation | 15% reduction | |

| Waste Management | Recycling Rate Increase | 20% increase | |

| Renewable Energy | Solar Projects Involvement | Recognized on 2024 Top Solar Contractors List | |

| Emissions Control | Air Pollutant Reduction | Investment in advanced filtration |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Day & Zimmermann is grounded in comprehensive data from government publications, leading economic indicators, and reputable industry analysis firms. We meticulously gather insights on regulatory changes, market dynamics, technological advancements, and social trends to provide a robust understanding of the macro-environment.