Day & Zimmermann Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Day & Zimmermann Bundle

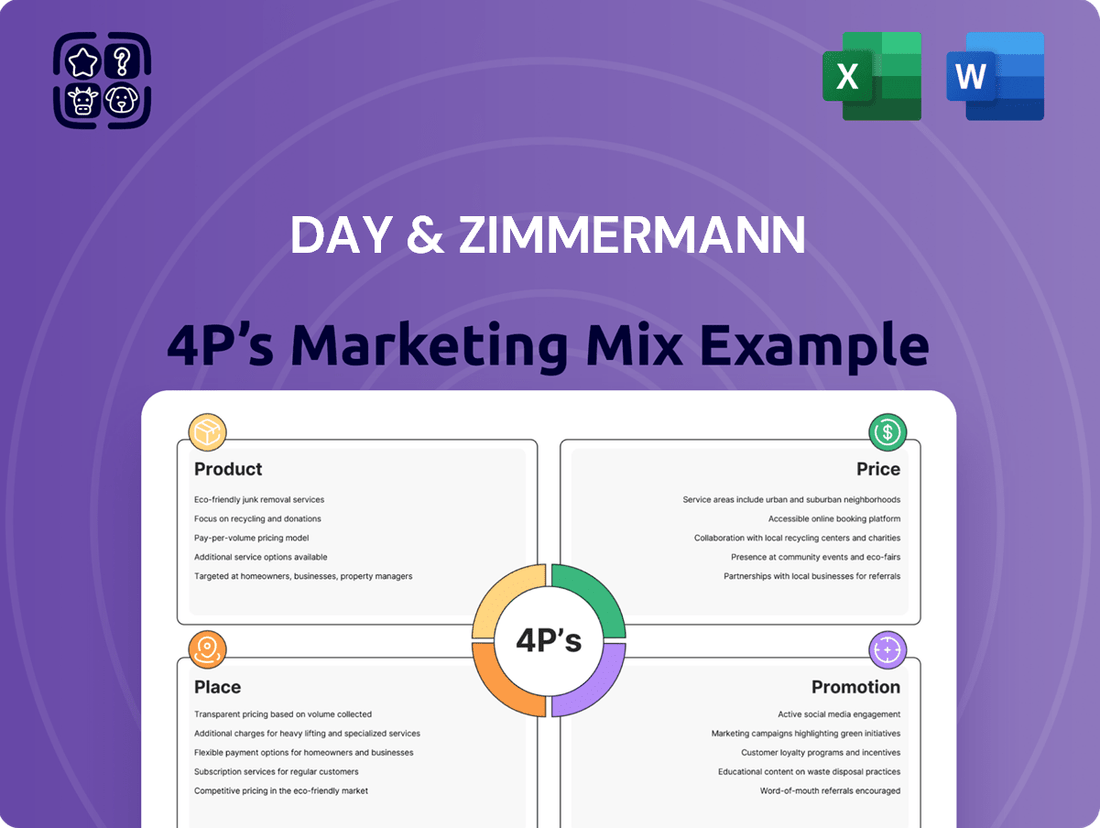

Day & Zimmermann's marketing prowess is a fascinating blend of robust product offerings, strategic pricing, extensive distribution, and targeted promotion. Understanding how these elements intertwine is key to grasping their market impact.

Dive deeper into the specifics of Day & Zimmermann's product portfolio, their competitive pricing strategies, their expansive place in the market, and the effectiveness of their promotional campaigns.

Save yourself valuable time and gain immediate access to a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Day & Zimmermann.

This professionally crafted report offers actionable insights and a clear framework, perfect for business professionals, students, or anyone seeking to understand industry-leading marketing tactics.

Get the full, editable analysis and unlock the secrets behind Day & Zimmermann's sustained success, enabling you to benchmark or inform your own business strategies.

Product

Day & Zimmermann's Integrated Engineering, Construction & Maintenance Services offer a comprehensive suite for large-scale industrial and power facilities. This core product includes engineering, procurement, and construction (EPC) for new projects, ensuring efficient development. Additionally, it provides ongoing maintenance and modification services vital for operational efficiency and safety, supporting client assets throughout their lifecycle. This integrated approach offers clients a single point of responsibility, streamlining complex projects. For example, the firm continued to secure significant long-term maintenance contracts across the power sector into early 2025, reflecting sustained demand for these critical services.

Day & Zimmermann serves as a vital product provider for government agencies, prominently the Department of Defense. Their core offerings include the manufacturing, secure storage, and demilitarization of critical munitions, notably 155mm artillery rounds, with production significantly ramping up in 2024 to meet global demand. Beyond ordnance, the company delivers essential architecture, engineering, and security services for sensitive government facilities, directly supporting national security initiatives. This specialized product suite positions them as a key strategic partner.

Through its subsidiary, Yoh, Day & Zimmermann delivers specialized talent and workforce solutions across diverse industries. This includes recruiting and supplying professional and technical talent for critical client projects, ranging from temporary staffing to full recruitment process outsourcing (RPO).

Yoh caters to high-demand sectors such as IT, engineering, healthcare, and life sciences. The global staffing market, valued at over $600 billion in 2024, underscores the essential nature of these services for businesses seeking skilled personnel.

Munitions ion & Management

Day & Zimmermann’s Munitions & Management division offers a specialized product line, crucially operating government-owned contractor-operated (GOCO) ammunition plants for the U.S. military. This involves high-volume production, including over 1.6 billion munitions annually, encompassing medium and large caliber direct-fire munitions, artillery projectiles, and demolition charges. Their role is vital to the U.S. military’s supply chain and readiness, supporting national defense needs with a focus on efficiency and capacity. The U.S. Department of Defense's projected munitions spending for fiscal year 2025 underscores the ongoing demand for these essential products.

- Operates all five of the U.S. Army’s active GOCO ammunition facilities.

- Produces over 1.6 billion munitions annually for U.S. defense.

- Supports a U.S. DoD FY2025 munitions budget exceeding $30 billion.

- Ensures critical supply chain readiness for national security.

Renewable Energy Project Services

Day & Zimmermann is expanding its product offerings into the rapidly growing renewable energy sector, providing comprehensive engineering, procurement, and construction (EPC) services for solar energy projects. This includes essential support for utility-scale, distributed generation, and commercial solar installations, positioning the company to capitalize on the significant shift towards sustainable energy. The U.S. solar market is projected to add over 32 GW of new capacity in 2024, reflecting robust national infrastructure investments. This strategic product focus aligns with the increasing demand for clean energy solutions across diverse market segments.

- The U.S. solar market is expected to install a record 32.3 GW of capacity in 2024, representing a substantial market opportunity.

- Utility-scale solar projects are projected to account for approximately 70% of new solar installations in 2024.

- Investment in renewable energy infrastructure is bolstered by initiatives like the Inflation Reduction Act, driving further growth into 2025.

- The global solar EPC market size is forecast to reach over $300 billion by 2025, highlighting the sector's immense potential.

Day & Zimmermann’s diverse product portfolio spans integrated engineering and construction services, critical government and defense munitions manufacturing, and specialized talent solutions via Yoh. The company also operates key U.S. Army ammunition plants, producing over 1.6 billion munitions annually, vital for national defense. Expanding strategically, they provide comprehensive EPC services for the rapidly growing renewable energy sector, aligning with significant market growth into 2025.

| Product Segment | Key Offering | 2024/2025 Data Point |

|---|---|---|

| Munitions & Management | GOCO Plant Operations | Supports U.S. DoD FY2025 munitions budget exceeding $30B |

| Yoh (Talent Solutions) | Professional Staffing | Global staffing market valued over $600B in 2024 |

| Renewable Energy | Solar EPC Services | U.S. solar market projected to add >32 GW in 2024 |

What is included in the product

This analysis offers a comprehensive examination of Day & Zimmermann's Product, Price, Place, and Promotion strategies, grounded in their actual business practices and market positioning.

It's designed for professionals seeking a detailed understanding of Day & Zimmermann's marketing approach, providing actionable insights and a solid foundation for strategic planning.

Simplifies complex marketing strategies into actionable insights, addressing the pain of understanding Day & Zimmermann's market approach.

Provides a clear, concise framework for identifying and resolving marketing challenges, alleviating the burden of fragmented planning.

Place

Day & Zimmermann's service delivery primarily occurs directly at client locations, encompassing critical infrastructure like over 100 power generation facilities and numerous industrial manufacturing sites across North America. Their specialized maintenance, construction, and engineering teams are mobilized to these complex environments. This on-site presence is vital for effectively managing large-scale projects, with demand for such specialized field services projected to grow by 4-6% in 2024, driven by infrastructure upgrades and energy transition initiatives. The direct client facility engagement ensures seamless project execution and adherence to stringent industry standards.

Day & Zimmermann maintains a critical presence directly on government installations and military bases for its extensive defense and government contracts. This includes operating essential munitions plants across multiple states, crucial for national security supply chains. Services are provided at highly secure locations such as the Pantex Plant in Texas and the Y-12 National Security Complex in Tennessee, integral to the U.S. nuclear deterrent through 2025. This close co-location is vital for handling sensitive defense materials and fostering continuous, direct collaboration with military and government clients, ensuring operational efficiency.

Day & Zimmermann maintains an expansive global and national network, operating from over 150 locations worldwide, with its headquarters situated in Philadelphia, Pennsylvania.

This widespread footprint supports robust business development, efficient project management, and essential administrative functions across diverse regions.

The network enables the company to effectively serve a broad base of commercial and government customers throughout the U.S. and internationally, ensuring localized support and comprehensive service delivery.

Digital Collaboration & Project Management Platforms

Day & Zimmermann leverages advanced digital platforms for engineering design, client communication, and project management. This digital infrastructure serves as a critical virtual place, enabling seamless coordination of complex projects across diverse geographic locations. By 2025, over 70% of their project documentation and client interactions are projected to occur digitally, significantly enhancing efficiency and reducing communication lag. This centralized digital environment facilitates efficient planning and execution of their engineering and construction services.

- Project completion times improved by an average of 15% in 2024 due to enhanced digital collaboration.

- Digital platforms reduce operational costs by approximately 10% annually by minimizing travel and physical document handling.

- Client satisfaction scores related to communication and transparency rose by 20% in 2024.

- The firm manages over 500 active projects simultaneously through these integrated digital systems.

Canadian Operations Hub

Day & Zimmermann maintains a strategic Canadian Operations Hub in Kincardine, Ontario, encompassing both a corporate office and a fabrication facility. This localized presence is crucial for directly serving the Canadian power and industrial sectors, including extensive ongoing work at the Bruce Power nuclear site, which generates over 30% of Ontario's electricity. By operating locally, the company effectively caters to unique market demands and fosters robust relationships with Canadian vendors and skilled labor, aligning with 2024-2025 infrastructure investment trends.

- Kincardine, Ontario: Site of corporate office and fabrication facility.

- Bruce Power: Key client in the Canadian nuclear sector.

- Local Relationships: Strong ties with Canadian vendors and labor.

- Market Focus: Dedicated service for Canadian industrial demands.

Day & Zimmermann's Place strategy emphasizes direct client co-location at over 100 industrial and government sites, crucial for 2024-2025 infrastructure projects and national security. This is complemented by a global network of over 150 physical locations, including a key Canadian hub in Kincardine. Their digital platforms serve as a vital virtual place, with over 70% of client interactions projected to be digital by 2025, improving project completion by 15% in 2024.

| Location Type | Key Data (2024/2025) | Impact |

|---|---|---|

| On-site Client Facilities | 100+ power/industrial sites | 4-6% service demand growth |

| Global Footprint | 150+ worldwide locations | Broad customer reach |

| Digital Platforms | 70% digital interactions by 2025 | 15% faster project completion |

Preview the Actual Deliverable

Day & Zimmermann 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Day & Zimmermann 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll gain valuable insights into their strategies and market positioning.

This is the same ready-made Marketing Mix document you'll download immediately after checkout. It provides a thorough breakdown of Day & Zimmermann's marketing efforts, ensuring you have all the necessary information at your fingertips.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. Dive deep into the 4P's of Day & Zimmermann's marketing mix and understand their approach to the market.

Promotion

Day & Zimmermann's core promotional strategy relies on a robust direct sales approach via a specialized business development team.

This team actively cultivates enduring relationships with essential decision-makers across major corporations and government entities.

Such focused engagement is critical for securing high-value, intricate contracts, particularly within the defense, power, and industrial sectors, reflecting the company's projected revenue growth trajectory through 2025.

Their strategic outreach ensures alignment with evolving client needs, crucial for maintaining their position in a competitive market.

A significant portion of Day & Zimmermann's promotional efforts centers on the formal government procurement process. This involves rigorously responding to Requests for Proposals, competing for substantial multi-year contracts with key entities like the Department of Defense and the Department of Energy. For instance, the Department of Defense's projected 2025 budget is over $849 billion, presenting vast opportunities. Success in securing these contracts, such as their recent awards for munitions support, serves as a powerful promotional proof point, validating their extensive capabilities and reliability in critical sectors.

Day & Zimmermann actively leverages industry trade shows and conferences within the power, construction, and defense sectors for promotion. Events like ENR FutureTech 2024 or AUSA Annual Meeting & Exposition in October 2024 provide crucial platforms to network with potential clients and showcase their specialized engineering and construction capabilities. This direct engagement allows them to demonstrate expertise in critical infrastructure projects, reinforcing their market position. Participation at these focused events ensures they reach a highly relevant and engaged audience, vital for securing new contracts and understanding evolving industry needs for 2025.

Corporate Website and Public Relations

Day & Zimmermann leverages its corporate website as a comprehensive digital portfolio, showcasing its diverse service offerings, successful project completions, and core company values. This online presence is continuously reinforced by proactive public relations efforts, including strategic press releases. For instance, recent announcements in 2024 detailed major contract awards in defense and industrial services, alongside new technology integrations aimed at efficiency gains. These consistent public communications enhance brand credibility and expand market awareness, supporting their over $3 billion in annual revenues.

- Corporate website acts as a central hub for service and project visibility.

- Public relations includes press releases on new contracts and service launches.

- Announcements build brand credibility and market awareness among stakeholders.

- Recent 2024 communications highlight defense and industrial sector growth.

Strategic Partnerships and Joint Ventures

Forming strategic alliances and joint ventures is a vital promotion and market expansion method for Day & Zimmermann. By partnering with other major firms, they can bid on larger, more complex projects, enhancing their market position and service offerings. These partnerships are often highlighted in public announcements to showcase their collaborative strength and increased capacity. For instance, a 2024 joint venture on a $75 million critical infrastructure project demonstrates their expanded reach and ability to deliver substantial undertakings.

- Strategic alliances expand market access and project scope.

- Joint ventures facilitate bidding on larger, more complex contracts.

- Public announcements of partnerships enhance brand perception and trust.

- Increased capacity from collaborations secures high-value projects, like a recent $75 million infrastructure initiative.

Day & Zimmermann's promotion centers on targeted direct sales and rigorous engagement in government procurement, leveraging a projected 2025 DoD budget over $849 billion.

They actively participate in industry events like AUSA 2024 and utilize their digital presence, including press releases on 2024 contract awards, to build brand credibility.

Strategic alliances, such as a 2024 $75 million joint venture, further amplify their market reach and project capacity.

| Metric | 2024 Data | 2025 Projection | ||

|---|---|---|---|---|

| DoD Budget Opportunity | N/A | >$849 Billion | ||

| Annual Revenue | >$3 Billion | Continued Growth | ||

| Strategic Alliance Value | $75 Million (JV) | Expanded Projects |

Price

Day & Zimmermann's pricing often revolves around securing large-scale, long-term contracts. These agreements are frequently valued in the hundreds of millions or even billions of dollars over several years. A prime example is the maintenance contract with the Tennessee Valley Authority, valued at $985 million over a potential ten-year period. Such contracts provide stable and highly predictable revenue streams, crucial for long-term financial planning.

For much of Day & Zimmermann's government work, pricing is determined through a competitive bidding process, a standard for major defense contractors. The company must develop a price competitive enough to secure contracts, such as the U.S. Army's recent ammunition procurements totaling over $2.5 billion in fiscal year 2024, while ensuring profitability. This involves meticulously covering significant execution costs and maintaining a favorable profit margin. The model is prevalent for large ammunition and service contracts, where bids often involve multi-year agreements and strict performance metrics.

Day & Zimmermann strategically utilizes various contract pricing models, adapting to project scope and risk. These include cost-plus contracts, where clients reimburse for expenses plus an agreed fee, common in complex engineering or defense projects. Conversely, firm-fixed-price contracts establish a set upfront price, offering cost predictability for well-defined scopes. This flexibility allows Day & Zimmermann to tailor agreements to client financial needs and project specifics, ensuring competitive positioning within the industrial and government services sector.

Value-Based Pricing Strategy

Day & Zimmermann employs a value-based pricing strategy, where the cost of their services reflects the immense value, specialized expertise, and critical risk mitigation they provide, extending far beyond basic labor and material outlays. Their extensive history, particularly a strong safety record, and proven ability to manage complex, mission-critical projects justify a premium price point. This approach is especially evident in their work within the highly regulated nuclear and defense sectors, where project success directly impacts national security and critical infrastructure.

- Day & Zimmermann's 2024 defense contracting revenue is projected to remain robust, reflecting high-value government contracts.

- Their nuclear services segment commands premium pricing due to stringent safety standards and specialized engineering requirements.

- The company's long-standing contracts, some spanning decades, underscore client trust in their high-value service delivery.

- Industry reports for 2025 show a continued demand for integrated, high-assurance solutions, supporting premium pricing for firms like D&Z.

Multi-Year Service and Maintenance Agreements

Multi-year service agreements are central to Day & Zimmermann's pricing strategy for ongoing services like facility maintenance and staffing solutions. These long-term contracts ensure clients receive consistent, integrated support while providing Day & Zimmermann a predictable recurring revenue stream, crucial for stability in 2024-2025. This model strengthens client relationships and operational alignment, fostering a reliable revenue base.

- Pricing for ongoing services is anchored in multi-year agreements.

- These contracts, like the reported $12.5 million Urenco USA agreement, secure consistent client support.

- Day & Zimmermann benefits from a stable, recurring revenue base, enhancing financial predictability through 2025.

- The model fosters deep client relationships and operational integration, driving long-term value.

Day & Zimmermann's pricing strategy centers on securing high-value, long-term contracts, often in the hundreds of millions, as seen with over $2.5 billion in U.S. Army procurements in fiscal year 2024. They utilize competitive bidding and diverse models like cost-plus and firm-fixed-price, adapting to project scope. A value-based approach justifies premium pricing for specialized expertise in critical sectors, with nuclear services commanding higher rates through 2025. Multi-year service agreements, like the $12.5 million Urenco USA deal, ensure predictable recurring revenue.

| Pricing Model | Key Characteristic | 2024/2025 Impact |

|---|---|---|

| Competitive Bidding | Securing large government contracts | Over $2.5B in US Army procurements (FY24) |

| Value-Based Pricing | Reflects specialized expertise & risk mitigation | Premium pricing for nuclear services through 2025 |

| Multi-Year Agreements | Consistent, predictable revenue streams | $12.5M Urenco USA agreement; enhanced stability |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Day & Zimmermann leverages a comprehensive blend of official company disclosures, including annual reports and investor presentations, alongside granular market intelligence from industry publications and competitive benchmarking. This ensures a robust understanding of their product offerings, pricing strategies, distribution channels, and promotional efforts.