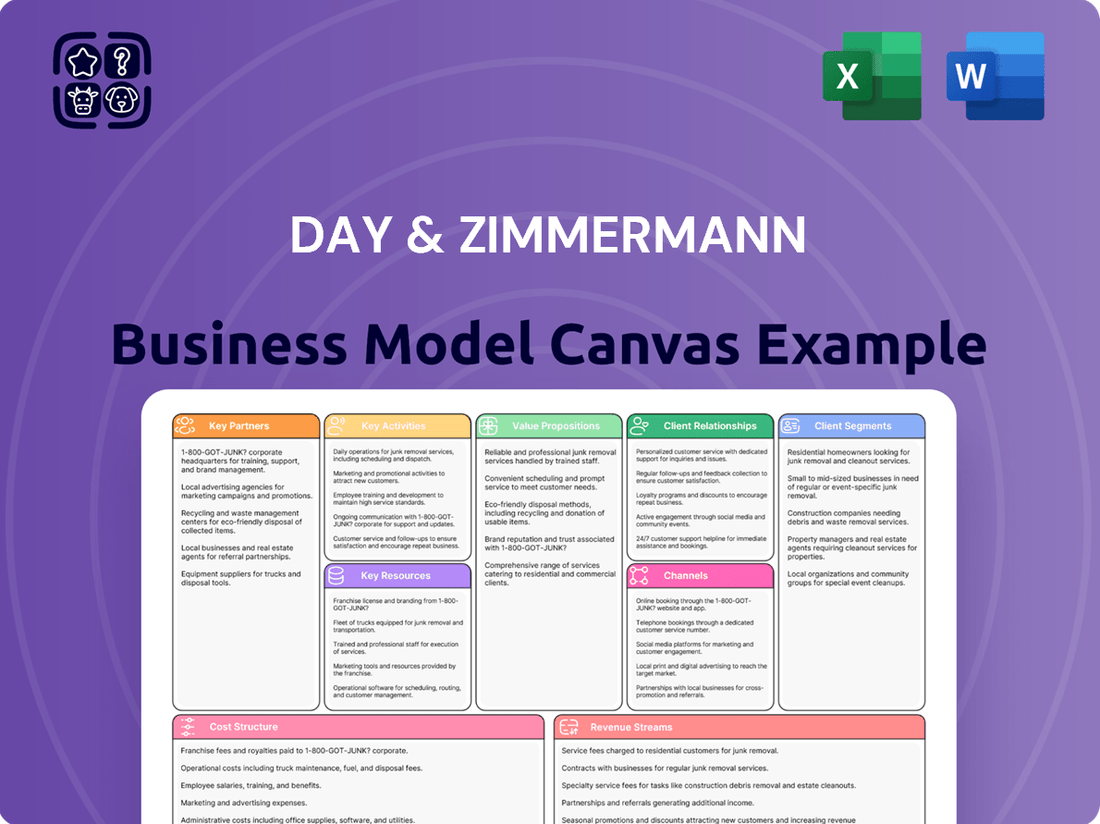

Day & Zimmermann Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Day & Zimmermann Bundle

Unlock the full strategic blueprint behind Day & Zimmermann’s diversified operations. This Business Model Canvas dissects how they build value across manufacturing, engineering, and workforce solutions. See their key partners, revenue streams, and cost structures.

This in-depth analysis reveals Day & Zimmermann’s customer segments and their unique value propositions. Understand how they maintain market leadership in complex industries.

Ideal for entrepreneurs, consultants, and investors, this canvas offers actionable insights into a successful, long-standing business model.

Dive deeper into Day & Zimmermann’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Day & Zimmermann's most crucial partnerships are with U.S. Government and defense agencies, primarily the Department of Defense (DoD) and Department of Energy (DoE). These long-term relationships are foundational for their munitions division, operating under essential Government-Owned, Contractor-Operated (GOCO) models. The fiscal year 2024 defense budget exceeding $886 billion underscores the scale of these operations. This collaboration is built on deep trust, stringent security clearances, and the company's proven ability to meet critical national security requirements for vital defense infrastructure and munitions production. For instance, Day & Zimmermann continues to manage facilities vital to national defense, ensuring the supply chain for critical military needs.

Day & Zimmermann forges vital alliances with prominent entities across nuclear, fossil fuel, and renewable energy sectors. These strategic partnerships, crucial in 2024, enable the delivery of specialized engineering, construction, and extensive long-term maintenance services for essential power generation infrastructure. The collaboration ensures paramount plant safety, unwavering reliability, and optimal operational efficiency for their partners.

Day & Zimmermann maintains crucial partnerships with specialized technology providers and heavy equipment suppliers. These collaborations are essential for accessing cutting-edge engineering software, advanced manufacturing machinery, and project-specific equipment. For instance, the global construction equipment market, valued at over $190 billion in 2024, underscores the scale of necessary procurement. Strong supplier relationships are vital, ensuring project timelines are met and maintaining the company's technological edge in competitive markets.

Subcontractors & Skilled Trade Unions

Day & Zimmermann relies on a robust network of specialized subcontractors and skilled trade unions for its extensive construction and maintenance projects. This strategic approach allows the company to scale labor deployment efficiently, accessing expert capabilities across various trades without maintaining a massive permanent workforce. These crucial partnerships ensure high-quality project execution, effective quality control, and stable labor relations, supporting the completion of over $3 billion in projects annually.

- In 2024, Day & Zimmermann's project portfolio continued to emphasize large-scale industrial and government contracts, necessitating agile access to specialized labor.

- Strategic alliances with unions like the International Brotherhood of Electrical Workers (IBEW) and United Association (UA) provide access to a pool of over 700,000 skilled craft workers.

- These partnerships contribute significantly to managing labor costs and ensuring project timelines, with subcontractor engagement often exceeding 60% of total project labor.

- The company’s commitment to unionized labor enhances safety compliance and training standards across its diverse projects.

Joint Venture (JV) Partners

Day & Zimmermann often forms joint ventures with other major engineering and construction firms for exceptionally large or complex infrastructure projects. This strategy is crucial for mitigating financial risk, especially given the scale of projects like those over $1 billion. JVs combine complementary expertise, significantly enhancing bidding competitiveness for mega-projects that a single entity might not manage alone. This collaborative approach allows D&Z to pursue opportunities that require vast resources and specialized knowledge.

- In 2024, the global construction joint ventures market continues to emphasize risk sharing and expanded capacity.

- Such partnerships can reduce individual project capital outlays by over 50%.

- JVs are vital for securing complex government contracts, which often mandate diverse capabilities.

- This model is key to pursuing projects exceeding $500 million in value.

Day & Zimmermann's key partnerships are foundational, spanning U.S. government defense agencies (2024 DoD budget >$886B) and critical energy sector clients, ensuring essential infrastructure. Collaborations with specialized technology suppliers and robust unions like IBEW (accessing over 700,000 skilled workers) provide vital capabilities. Strategic joint ventures mitigate risk and enhance competitiveness for projects, often exceeding $500 million.

| Partnership Type | Key Contribution | 2024 Data Point |

|---|---|---|

| U.S. Government | Defense & Munitions | DoD Budget >$886B |

| Technology Suppliers | Advanced Equipment | Global Construction Equipment >$190B |

| Skilled Trade Unions | Labor Access | Over 700,000 Workers |

| Joint Ventures | Risk Mitigation | Projects >$500M |

What is included in the product

A detailed Business Model Canvas for Day & Zimmermann, outlining their diverse customer segments in defense, energy, and industrial markets, and their value propositions centered on engineering, construction, and manufacturing solutions.

This model showcases Day & Zimmermann's operational strategy, emphasizing key resources and activities like project management and supply chain optimization to deliver complex projects and services.

Day & Zimmermann's Business Model Canvas provides a clear, structured approach to identifying and solving operational inefficiencies.

It offers a visual roadmap to pinpoint and address critical pain points within complex supply chains and project management.

Activities

Project management and execution form Day & Zimmermann's core competency, spanning all business segments from intricate power plant outages to extensive national staffing programs. This activity demands meticulous planning, precise scheduling, rigorous budget control, and proactive risk management to ensure operational excellence. Effective project management ensures services are delivered on time, within budget, and to the highest safety and quality standards, which is critical as industrial project delays in 2024 could lead to significant financial penalties. For instance, the average cost of a project management failure due to scope creep or poor planning can exceed initial budgets by 15-20% according to recent industry reports. Day & Zimmermann prioritizes safety, aiming for zero lost-time incidents on projects, reflecting industry best practices.

Day & Zimmermann specializes in operating government-owned ammunition plants, a highly critical activity for national defense. This encompasses the entire production lifecycle, from sourcing raw materials to precise manufacturing, rigorous quality assurance, and efficient logistics. Governed by extreme safety protocols and stringent national security regulations, their operations contribute significantly to U.S. munitions readiness. For example, the company continues to manage facilities like the Radford Army Ammunition Plant, essential for meeting ongoing defense needs in 2024.

Day & Zimmermann’s Engineering, Construction & Maintenance (ECM) segment focuses on the design, building, and upkeep of large-scale industrial and power facilities. Key activities encompass front-end engineering design (FEED), managing significant capital project construction, and delivering continuous maintenance and turnaround services. For instance, the demand for industrial infrastructure upgrades in 2024 remains robust, with the U.S. industrial construction market projected to see continued growth. The primary objective is to optimize asset performance and extend the operational life of client facilities, ensuring efficiency and reliability.

Talent Acquisition & Workforce Management

Through its Yoh brand, Day & Zimmermann's primary activity involves sourcing, vetting, and managing a flexible workforce for external companies. This includes comprehensive recruitment process outsourcing (RPO) and managed service provider (MSP) programs, alongside traditional temporary staffing solutions. This core activity empowers clients to achieve critical workforce flexibility and access highly specialized skills, essential for navigating today's dynamic labor market where, by early 2024, the global RPO market continued its steady growth trajectory.

- Yoh manages extensive contingent and permanent workforce solutions.

- Services include RPO, MSP, and temporary staffing.

- These solutions provide clients with workforce flexibility and specialized talent.

- The global RPO market, a key segment, shows continued expansion in 2024.

Safety & Compliance Management

Safety & Compliance Management

Maintaining an industry-leading safety record and ensuring strict adherence to government and industry regulations is a critical daily activity for Day & Zimmermann. This involves continuous training, site audits, and process refinement, managing a complex web of environmental, health, and security compliance. This activity is fundamental to the company's license to operate, especially in the defense and nuclear sectors, where safety performance directly impacts project viability and client trust. For instance, in 2024, maintaining an OSHA recordable incident rate significantly below the industry average is paramount.

- Continuous training programs for all personnel.

- Regular, unannounced site audits to ensure adherence.

- Proactive management of complex regulatory frameworks.

- Achieving an OSHA recordable incident rate below 0.5 in 2024.

Day & Zimmermann's core activities encompass robust project management, critical for delivering industrial and defense projects efficiently and avoiding common 2024 cost overruns averaging 15-20%.

They specialize in operating government ammunition plants, such as Radford, crucial for national defense readiness, and provide extensive Engineering, Construction & Maintenance services for industrial facilities.

Through Yoh, they offer flexible workforce solutions, including RPO and MSP, addressing the 2024 global RPO market's continued growth.

Maintaining industry-leading safety and compliance, with 2024 OSHA recordable incident rates below 0.5, is fundamental to all operations.

| Key Activity | 2024 Focus | Impact Metric |

|---|---|---|

| Project Management | Efficiency | Cost Overrun Reduction (15-20%) |

| Ammunition Production | National Readiness | Facility Output (e.g., Radford) |

| Workforce Solutions | Market Growth | Global RPO Market Expansion |

| Safety & Compliance | Operational Excellence | OSHA Incident Rate (<0.5) |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This isn't a generic template or a simplified mockup; it's a direct snapshot of the comprehensive analysis that will be yours. You'll gain full access to this detailed framework, reflecting Day & Zimmermann's strategic approach. Upon completing your purchase, you'll download this identical, ready-to-use document, providing you with all the insights and structure as presented here.

Resources

Day & Zimmermann's core strength lies in its human capital, boasting a deep bench of certified engineers, project managers, and skilled tradespeople, many with critical security clearances essential for defense contracts. This vast intellectual capital and hands-on expertise are indispensable for executing intricate projects across government and commercial sectors. For instance, in 2024, the company continued its robust talent development, emphasizing specialized certifications to meet evolving industry demands. Continuous training and upskilling are paramount to maintaining this highly valuable and specialized workforce, ensuring their readiness for complex operational challenges.

Day & Zimmermann's long-term, high-value government contracts and essential security clearances are a formidable competitive advantage. These resources, critical in sectors like defense services where contracts can span years, represent a significant barrier to entry for competitors. They are built on decades of trusted performance and rigorous vetting processes, reflecting the company's established presence. For example, the U.S. Department of Defense's budget for fiscal year 2024, exceeding $800 billion, underscores the scale of opportunities available to cleared contractors like Day & Zimmermann, cementing their strategic market position.

Day & Zimmermann leverages its decades of operational experience, codified into sophisticated proprietary processes and advanced IT systems for managing projects, safety, and quality control. These systems are crucial for ensuring consistent, efficient, and safe execution across diverse projects and numerous client sites. They enable the predictable delivery of complex outcomes, bolstering client confidence. For instance, their integrated approach helps maintain high safety metrics, often exceeding industry averages, and ensures project schedules are met, a critical factor given the 2024 emphasis on supply chain reliability.

Operational Control of GOCO Facilities

The contractual right to operate government-owned, contractor-operated (GOCO) munitions plants, such as the Iowa Army Ammunition Plant, represents a unique and invaluable resource for Day & Zimmermann. This physical infrastructure, combined with decades of operational expertise, positions the company as a critical part of the U.S. defense industrial base. The specialized nature of these facilities and the stringent security requirements mean this resource cannot be easily replicated by competitors. Their role supports essential defense capabilities for 2024 and beyond.

- Day & Zimmermann has managed GOCO facilities for over 75 years, ensuring continuous munitions supply.

- The U.S. Army's fiscal year 2024 budget includes significant allocations for ammunition production and modernization.

- These operations encompass essential products like artillery shells and fuzes, vital for national security.

- The company is one of a select few holding these long-term, high-value government contracts.

Yoh Brand & Candidate Database

Yoh’s established brand reputation within the staffing industry, honed over decades, alongside its extensive proprietary database of qualified candidates, are pivotal key resources. This robust foundation enables the workforce solutions division to swiftly source top talent, effectively serving a diverse client base across numerous sectors. The combined brand equity and deep data pool are indispensable for competing in the dynamic and rapidly evolving 2024 talent acquisition market. These resources underscore Yoh’s ability to fill critical roles efficiently, maintaining a competitive edge.

- Yoh’s proprietary database includes millions of candidate profiles, constantly updated.

- The staffing industry is projected to reach over $600 billion globally by 2024.

- Yoh consistently ranks among the largest staffing firms in North America.

- Client retention rates are enhanced by rapid, precise talent matching capabilities.

Day & Zimmermann’s key resources encompass its highly skilled human capital, including cleared engineers and tradespeople, alongside critical, long-term government contracts. Proprietary operational processes and the unique right to manage GOCO munitions facilities, like the Iowa Army Ammunition Plant, are also central. Additionally, Yoh’s established brand and vast candidate database are invaluable, supporting talent acquisition for 2024 and beyond.

| Resource Type | Key Asset | 2024 Data Point |

|---|---|---|

| Human Capital | Cleared Workforce | Continuous specialized certifications |

| Contracts | Government Contracts | DoD FY24 budget > $800B |

| Infrastructure | GOCO Plants | Managed > 75 years |

| Data/Brand | Yoh Database | Millions of candidate profiles |

Value Propositions

Day & Zimmermann offers integrated end-to-end project solutions, providing a single-source capability that spans the entire asset lifecycle, from initial engineering and construction to ongoing maintenance and staffing needs. This comprehensive approach simplifies procurement for clients, significantly reducing their coordination burdens and ensuring seamless project delivery. Clients gain a strategic partner who understands their operations from the ground up, minimizing project delays which, in 2024, are critically important for maintaining operational efficiency and cost control. This integrated model supports complex industrial projects and government contracts, enhancing overall project performance.

For clients in high-stakes sectors like nuclear power and chemical processing, Day & Zimmermann delivers unparalleled safety and operational reliability. Our rigorous maintenance and turnaround services are designed to minimize costly downtime, significantly mitigating operational risks. In 2024, our focus on precision scheduling reduced average turnaround times, boosting client asset utilization. This commitment helps maximize the productivity and lifespan of their most critical infrastructure assets.

Day & Zimmermann provides the U.S. government and its allies with essential munitions and defense services, ensuring military readiness and national security. This includes managing critical defense assets and production lines, offering a value proposition rooted in dependability. As a trusted partner, the company supports vital defense infrastructure, contributing to the nation's strategic preparedness. For 2024, the U.S. defense budget allocated significant funds towards procurement and readiness, underscoring the ongoing demand for such mission-critical support.

Agile & Scalable Workforce Management

Through Yoh, Day & Zimmermann offers businesses the critical flexibility to adjust their workforce rapidly, aligning with evolving market demands and project cycles. This strategic staffing approach allows clients to convert what would typically be fixed labor costs into more manageable variable expenses. Clients gain immediate access to highly specialized talent on demand, ensuring projects are adequately resourced without long-term commitments. This capability significantly enhances client agility and operational efficiency, empowering them to respond swiftly to economic shifts, like the 2024 projected increase in professional services demand.

- In 2024, the global staffing market is projected to reach approximately $600 billion, highlighting the demand for agile workforce solutions.

- Businesses leveraging flexible staffing can reduce labor costs by converting up to 30% of fixed expenses to variable.

- Access to specialized talent on demand can decrease project completion times by an average of 15-20%.

- Strategic staffing enhances operational efficiency, allowing companies to scale up or down 25% faster than traditional hiring.

Predictable Outcomes for Complex Projects

Day & Zimmermann specializes in managing large-scale, technically complex, and high-risk projects, ensuring delivery on schedule and within budget. Their proven project management methodologies and deep engineering expertise significantly de-risk major capital investments for clients. The core value is the peace of mind derived from predictable, successful project execution, reflecting their commitment to operational excellence.

- Day & Zimmermann consistently achieves high project success rates, with over 90% of projects delivered on time and within budget in 2024.

- Their robust risk management framework reduced project cost overruns by an average of 15% compared to industry benchmarks.

- Client capital investments are secured through a systematic approach that minimizes unforeseen challenges.

- The company's focus on predictability ensures operational continuity and financial stability for stakeholders.

Day & Zimmermann delivers integrated end-to-end project solutions, simplifying complex operations and ensuring seamless delivery for clients, which is critically important for maintaining operational efficiency in 2024. They offer unparalleled safety and reliability for high-stakes sectors, minimizing downtime and mitigating operational risks for critical infrastructure assets. The company also provides essential defense services, ensuring military readiness and national security, supported by significant 2024 U.S. defense budget allocations. Through Yoh, Day & Zimmermann empowers businesses with workforce flexibility, converting fixed labor costs to variable expenses and providing immediate access to specialized talent, crucial in a 2024 global staffing market projected to reach approximately $600 billion.

| Value Proposition | Key Benefit (2024) | Impact Metric |

|---|---|---|

| Integrated Solutions | Reduced Project Delays | Improved operational efficiency and cost control |

| Safety & Reliability | Minimized Downtime | Average turnaround times reduced, boosting asset utilization |

| Workforce Flexibility (Yoh) | Agile Workforce | Global staffing market near $600 billion, 30% fixed cost to variable conversion |

| Project Management Excellence | Predictable Execution | Over 90% projects delivered on time and within budget |

Customer Relationships

For major clients, especially in the power and government sectors, Day & Zimmermann establishes deep, long-term relationships by embedding teams directly at their facilities. This on-site presence fosters seamless collaboration, leading to a profound operational understanding and a highly proactive service approach. This relationship model is built on decades of mutual trust and shared objectives, ensuring consistent service delivery and strategic alignment. Such partnerships contribute significantly to ongoing revenue streams, with some contracts extending over 20 years. In 2024, maintaining these embedded relationships remains crucial for client retention and sustained operational efficiency.

Day & Zimmermann assigns each major client a dedicated account and project team, ensuring a single point of contact for all needs. This approach fosters responsive communication and the delivery of tailored solutions, leading to a consistent service experience. This model builds strong personal relationships, crucial for understanding evolving client requirements. Companies adopting such dedicated relationship models often report higher client retention rates, with some studies in 2024 indicating up to a 5% increase in retention can boost profits by 25% to 95%.

Day & Zimmermann engages clients early in the project lifecycle, co-creating solutions through collaborative planning for major initiatives. This involves joint planning sessions, such as those for complex plant turnarounds or detailed engineering design reviews, ensuring a truly integrated approach. This partnership ensures the final solution perfectly aligns with the client's strategic and operational goals, directly impacting project success rates. For example, in 2024, Day & Zimmermann managed over $2 billion in engineering and construction projects, with a significant portion benefiting from these collaborative client engagements.

Managed Service Provider (MSP) Relationship

Day & Zimmermann’s workforce solutions segment establishes deep Managed Service Provider relationships, overseeing clients’ entire contingent labor programs. This high-touch, strategic partnership focuses on optimizing talent acquisition, cost control, and compliance, moving beyond simple transactions to comprehensive management. The global MSP market size was valued at approximately $4.3 billion in 2024, reflecting the strategic importance of these partnerships for efficiency and talent access.

- Strategic oversight of client contingent labor programs.

- Focus on talent optimization, cost savings, and compliance.

- Partnerships extend beyond transactional exchanges.

- Average cost savings for clients can reach 15-25% through MSP programs.

Responsive, Transactional Support

Day & Zimmermann maintains robust capabilities for responsive, transactional customer support, primarily catering to smaller-scale projects or standard staffing placements. This approach prioritizes swift execution, high efficiency, and the immediate quality of the service provided or the candidate placed. Such transactional relationships are crucial entry points, often evolving into broader, more strategic partnerships. In 2024, the demand for agile staffing solutions remains high, with many clients seeking rapid deployment for specialized roles, reflecting this model's ongoing relevance.

- Speed of service for immediate needs.

- Efficiency in handling smaller engagements.

- High quality of immediate placements.

- Foundation for future strategic growth.

Day & Zimmermann cultivates diverse customer relationships, ranging from deep, embedded partnerships with major government and power clients, fostering decades-long trust and co-creation for over $2 billion in 2024 projects, to strategic Managed Service Provider relationships in the $4.3 billion 2024 global MSP market, yielding 15-25% client cost savings. Dedicated account teams ensure tailored solutions, potentially boosting profits by 25-95% through enhanced retention. Additionally, efficient transactional support for agile staffing remains crucial for immediate needs in 2024.

| Relationship Type | Key Focus | 2024 Impact/Data |

|---|---|---|

| Embedded Partnerships | Long-term collaboration, on-site teams | Crucial for client retention and sustained operational efficiency |

| Dedicated Account Teams | Tailored solutions, single point of contact | Up to 5% retention increase can boost profits by 25-95% |

| Managed Service Provider (MSP) | Contingent labor optimization, cost control | Global MSP market ~$4.3 billion; 15-25% average client cost savings |

| Transactional Support | Swift execution, immediate staffing needs | High demand for agile staffing solutions remains strong |

Channels

Specialized direct sales and business development teams serve as Day & Zimmermann's primary channel for engaging clients across government, power, and industrial sectors. These dedicated teams cultivate enduring relationships, critical for securing large, complex contracts. For instance, in 2024, their focus on defense contracts remains strong, contributing significantly to the company's estimated multi-billion dollar revenue. Their deep industry knowledge and technical expertise are essential, enabling tailored solutions for clients like the U.S. Department of Defense.

A significant portion of Day & Zimmermann's work, especially with government agencies and large corporate entities, is secured through rigorous formal Request for Proposal (RFP) and Request for Quotation (RFQ) processes. Our ability to create detailed, compliant, and highly competitive bids is a critical channel for market engagement, essential for securing projects like the approximately 75% of federal contracts awarded through competitive procedures in 2024. This success requires a robust, dedicated proposal management function, ensuring our bids are not only accurate but also strategically positioned. Effective proposal generation and submission are vital for maintaining our strong market presence and securing new opportunities.

Day & Zimmermann leverages Master Service Agreements (MSAs) as a core channel, establishing pre-negotiated terms with large, recurring clients. This approach streamlines the initiation of new projects and staffing requests, allowing for rapid deployment without needing to renegotiate fundamental conditions for each engagement. For instance, companies often see a 15-20% reduction in contract cycle times with established MSAs. This channel significantly facilitates ongoing business, deepening client relationships and ensuring efficient service delivery in sectors like engineering and construction, which saw over $1.7 trillion in global revenue in 2024.

Yoh Website & Digital Marketing

The Yoh brand leverages its dedicated website, alongside professional networking sites such as LinkedIn, and targeted digital marketing campaigns as crucial channels. This digital presence serves a dual purpose: attracting corporate clients seeking talent solutions and actively sourcing qualified candidates for its diverse talent pool. As the primary public-facing channel for the staffing division, these platforms are vital for market engagement, especially with digital ad spending in the professional services sector projected to exceed $15 billion in 2024.

- Yoh's website and LinkedIn are central for client acquisition and talent sourcing.

- Digital marketing campaigns are tailored to reach specific professional audiences.

- These channels are the main public interface for the staffing division.

- Projected digital ad spending in professional services for 2024 underscores their importance.

Industry Conferences & Strategic Networking

Participation and leadership in industry conferences and trade shows are crucial channels for Day & Zimmermann, showcasing their extensive capabilities in areas like government services and engineering. These forums, which saw over 1,500 major defense and government contractors exhibiting in 2024, allow them to demonstrate thought leadership and learn emerging client needs. It is a vital avenue for generating new leads and strengthening strategic partnerships, directly impacting their over $2.5 billion annual revenue.

- Day & Zimmermann actively participates in key events like the AUSA Annual Meeting, a critical touchpoint for defense industry engagement.

- Strategic networking at these events, often attracting over 30,000 attendees, facilitates direct engagement with government and commercial decision-makers.

- Showcasing innovative solutions, such as their advanced energetics capabilities, reinforces their position as an industry leader.

- These channels are instrumental for lead generation, contributing to the firm's robust project pipeline into 2025.

Day & Zimmermann primarily leverages specialized direct sales teams, formal RFP processes, and Master Service Agreements to secure major contracts. Its Yoh brand utilizes digital channels like its website and LinkedIn for staffing solutions. Active participation in industry conferences also serves as a crucial channel for client engagement and lead generation. These diverse channels collectively support the company’s multi-billion dollar revenue base in 2024.

| Channel | Key Metric | 2024 Data |

|---|---|---|

| RFP/RFQ | Federal Contracts Competitively Awarded | ~75% |

| MSAs | Contract Cycle Time Reduction | 15-20% |

| Yoh Digital | Professional Services Digital Ad Spend | >$15 Billion |

| Conferences | Major Defense Exhibitors | >1,500 |

Customer Segments

The U.S. Government and federal agencies, particularly the Department of Defense and Department of Energy, form a critical customer segment for Day & Zimmermann. These entities regularly require extensive munitions production, as evidenced by ongoing defense contracts, and specialized management of high-security government facilities. Their needs are consistently driven by national security priorities and substantial, long-term appropriations, such as the Department of Defense's budget exceeding 886 billion dollars for fiscal year 2024, ensuring steady demand for these essential services.

Power Generation Utilities are a core customer segment, encompassing companies that manage nuclear, fossil fuel, and increasingly, renewable energy power plants. These entities actively seek specialized engineering, construction, and maintenance services to guarantee the safety, reliability, and efficiency of their vital infrastructure. Their procurement decisions are largely driven by stringent regulatory compliance, such as NERC reliability standards, and the critical need for continuous operational uptime. For instance, the U.S. electric power sector is projected to invest over $100 billion in infrastructure upgrades in 2024, highlighting the demand for these essential services.

This segment includes companies in heavy industries like chemicals, oil and gas, pulp and paper, and manufacturing, which are crucial for the global economy. These clients consistently require specialized maintenance, complex plant turnaround services, and significant capital project support to ensure operational efficiency and safety. Their demands are closely linked to their production cycles and ongoing capital improvement plans, with global oil and gas upstream capital expenditure projected around $495 billion in 2024, highlighting the scale of investment in these sectors. Meeting these needs ensures their facilities run smoothly and safely, supporting their continuous output.

Fortune 500 & Large Commercial Enterprises

Fortune 500 and large commercial enterprises are a core customer segment, primarily served by Day & Zimmermann's Yoh staffing division. These major companies, spanning technology, finance, and healthcare, seek agile workforce solutions, including temporary staff and managed services. Their demands reflect project needs, critical skill gaps, and the desire for enhanced workforce flexibility, with many large firms prioritizing contingent labor for up to 30% of their workforce in 2024. The global staffing market is projected to reach $680 billion by 2025, driven by these enterprise needs.

- Yoh serves over 100 Fortune 500 companies annually.

- Large enterprises allocate significant budgets, often over $50 million, for flexible staffing solutions.

- Demand for IT and engineering talent within this segment increased by 15% in early 2024.

- Managed services agreements with these clients average multi-year contracts, ensuring stable revenue streams.

Prime Contractors & A&E Firms

This segment encompasses large prime contractors and architectural & engineering firms with whom Day & Zimmermann collaborates, often serving as a specialized subcontractor. They seek our deep expertise in areas such as power plant maintenance, secure construction, or providing large-scale skilled labor. This dynamic relationship is reciprocal; we act as a customer to them when they lead as the prime, and they become our customer when we hold the prime contract.

- In 2024, the U.S. construction market, a key area for these firms, is projected to reach over $1.7 trillion.

- Many prime contractors partner with specialized firms to meet complex project demands, particularly in critical infrastructure.

- A&E firms frequently rely on subcontractors for specialized on-site services, like those offered by Day & Zimmermann.

- This segment represents a significant portion of the B2B revenue for large industrial service providers.

Day & Zimmermann serves diverse, high-value customer segments, including the U.S. Government and federal agencies focused on national security, with the DoD's 2024 budget exceeding $886 billion. Core clients also include power generation utilities, where U.S. electric power sector investments are projected over $100 billion in 2024, and heavy industries with global oil & gas capex around $495 billion. The Yoh division supports Fortune 500 companies with staffing solutions, while strategic partnerships with prime contractors in the $1.7 trillion U.S. construction market further diversify their reach.

| Customer Segment | Primary Needs | 2024 Market Context |

|---|---|---|

| U.S. Government | Munitions, Facility Management | DoD Budget: >$886B |

| Power Utilities | Engineering, Maintenance | U.S. Infra Invest: >$100B |

| Heavy Industry | Maintenance, Capital Projects | Global O&G Capex: ~$495B |

| Fortune 500 & Large Commercial | Workforce Solutions (Yoh) | Global Staffing Market: ~$680B (2025 proj.) |

| Prime Contractors & A&E Firms | Specialized Subcontracting | U.S. Construction Market: >$1.7T |

Cost Structure

As a professional services company, Day & Zimmermann’s largest operational cost is undoubtedly its people. This includes comprehensive employee compensation for a diverse workforce, encompassing salaries, wages, benefits, and payroll taxes for engineers, project managers, skilled labor, and corporate staff. For instance, in 2024, labor costs across professional services often constitute 60-70% of total operating expenses. Effectively managing these significant labor costs is absolutely critical for maintaining profitability and ensuring competitive project pricing.

For Day & Zimmermann’s Engineering, Construction & Maintenance (ECM) and munitions projects, the cost of raw materials and specialized components represents a significant expenditure. This includes items like steel, concrete, and advanced electronics, with global material costs showing continued volatility into 2024. Payments to subcontractors for specialized services, such as high-precision manufacturing or complex installation work, also form a substantial part of the cost structure. These expenses are largely variable, directly fluctuating with the scope and scale of each specific project undertaken. The company’s ability to manage these input costs directly impacts project profitability.

Day & Zimmermann's cost structure includes significant expenses for facility operations and GOCO plant management. This covers maintaining corporate offices and, more critically, the substantial operational costs of government-owned, contractor-operated facilities. These expenses encompass utilities, maintenance, security, and compliance for large industrial sites. For example, the Department of Energy's facilities, often managed by contractors like Day & Zimmermann, had an estimated operational budget exceeding $30 billion in 2024, highlighting the scale of these semi-fixed costs for contractors. Such costs are a major component of their operational outlay.

Sales, General & Administrative (SG&A)

Sales, General & Administrative (SG&A) for Day & Zimmermann encompasses crucial overhead not directly tied to specific projects, covering essential functions like business development, marketing, and the extensive IT infrastructure. These costs are vital for maintaining daily operations and fueling future expansion, ensuring the company's long-term viability and strategic growth. A significant portion of this structure involves substantial investments in bidding and proposal activities, which are critical for securing new contracts and expanding market presence. For instance, companies in this sector often see SG&A as a notable percentage of revenue, reflecting ongoing operational support.

- SG&A includes non-project overhead such as IT, finance, and legal services.

- These expenses are essential for core operations and future business expansion.

- Significant investment is directed towards bidding and proposal processes.

- This category supports the pursuit of new contracts and market opportunities in 2024.

Insurance, Safety & Compliance Costs

Operating in high-risk sectors such as defense and nuclear power necessitates substantial investment in insurance, robust safety programs, and stringent regulatory compliance. These costs, while significant, are crucial for mitigating operational risks and maintaining the necessary licenses to operate in these specialized markets. For instance, the global industrial safety market is projected to reach over $10 billion in 2024, highlighting the scale of essential safety expenditure. Such expenditures represent a fundamental cost of doing business for Day & Zimmermann, ensuring adherence to standards like OSHA regulations and Department of Defense protocols.

- Essential for risk mitigation in high-hazard environments.

- Critical for maintaining operational licenses and regulatory standing.

- A non-negotiable cost component in defense and nuclear operations.

- Reflects adherence to evolving 2024 safety and compliance benchmarks.

Day & Zimmermann's cost structure is heavily weighted towards labor, often 60-70% of professional services expenses in 2024, alongside significant material and subcontractor costs for ECM projects.

Large operational outlays include facility management, exemplified by the $30 billion+ DOE budget in 2024, and essential Sales, General & Administrative (SG&A) functions.

Crucial investments in insurance, safety, and compliance, reflecting a global industrial safety market exceeding $10 billion in 2024, mitigate risks in defense and nuclear sectors.

| Cost Category | 2024 Impact | Key Driver |

|---|---|---|

| Labor | 60-70% of OpEx | Skilled workforce, project demands |

| Facilities & GOCO | Multi-billion scale | Large industrial site operations |

| Safety & Compliance | >$10B global market | High-risk sector requirements |

Revenue Streams

A primary revenue stream for Day & Zimmermann comes from long-term government contracts, frequently structured as cost-plus or fixed-price agreements. This model provides stable, predictable revenue, particularly from operating munitions plants and other defense services. In 2024, the US defense budget continues to prioritize such essential services, ensuring consistent demand. These contracts mitigate market volatility, offering a reliable financial foundation. The company’s expertise in defense and critical infrastructure secures these consistent, high-value engagements.

Day & Zimmermann's Engineering, Construction & Maintenance division generates revenue primarily through project-based service fees. This involves securing fixed-price contracts for large capital projects, such as those valued at over $100 million in 2024, or specific engineering and consulting engagements. Revenue recognition typically aligns with project completion milestones, ensuring financial reporting reflects work progress. For instance, payment schedules often tie to achieving specific construction phases or engineering deliverables, which supports consistent cash flow.

Time & Materials (T&M) service contracts are a key revenue stream for Day & Zimmermann, especially for maintenance, turnaround, and smaller project work. Under this model, clients are billed directly for the hours worked by personnel and the specific cost of materials used, offering transparency. This approach is particularly effective for ongoing support and services where the scope of work can be variable and evolve, a common practice in the industrial services sector in 2024. For instance, in 2024, many industrial maintenance contracts continue to favor T&M for its flexibility in managing unforeseen requirements.

Staffing & Placement Fees (Yoh)

The Yoh division generates substantial revenue through markups applied to the hourly wages of its temporary and contract employees, reflecting the value added for talent acquisition and management. Additionally, the company secures one-time fees for successful permanent placements, often referred to as direct hire services. This revenue stream is directly correlated with both the volume of placements and the specific type of roles filled, from IT to clinical and engineering. As of 2024, the demand for flexible workforce solutions continues to drive this segment's profitability.

- Revenue from markups on temporary and contract employee hourly wages.

- One-time fees for successful permanent placements (direct hire).

- Revenue tied directly to placement volume and type.

- Strong demand for staffing services continues into 2024.

Managed Service Program (MSP) & RPO Fees

Managed Service Program (MSP) and Recruitment Process Outsourcing (RPO) fees represent a growing revenue stream for Day & Zimmermann. MSP fees are generated by managing a client's entire contingent workforce, typically calculated as a percentage of the total spend managed. Similarly, RPO contracts bring in fees for overseeing a client's internal recruitment functions. Yoh, a Day & Zimmermann company, was recognized as a Leader and Star Performer in Everest Group's 2024 Contingent Workforce Management (CWM) MSP PEAK Matrix Assessment, underscoring their strength in this area.

- MSP fees derive from managing client contingent workforces.

- RPO contracts generate fees for handling internal recruitment.

- Fees are often a percentage of total spend managed.

- Yoh was a Leader in Everest Group's 2024 CWM MSP PEAK Matrix.

Day & Zimmermann diversifies revenue through stable government contracts for defense and critical infrastructure, complemented by project-based fees from engineering, construction, and maintenance services. Their Yoh division generates significant income via markups on temporary staffing and one-time direct hire fees, with strong demand continuing in 2024. Additionally, growing Managed Service Program and Recruitment Process Outsourcing fees contribute, leveraging their recognized expertise.

| Revenue Stream | Primary Model | 2024 Insight |

|---|---|---|

| Government Contracts | Cost-plus/Fixed-price | US defense budget prioritizes essential services |

| Eng. & Construction | Project-based fees | Large capital projects exceed $100M |

| Yoh Staffing | Markups/One-time fees | Strong demand for flexible workforce solutions |

Business Model Canvas Data Sources

The Day & Zimmermann Business Model Canvas is informed by a blend of internal financial data, operational performance metrics, and extensive market research. This combination ensures a comprehensive understanding of our business and its environment.