Day & Zimmermann Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Day & Zimmermann Bundle

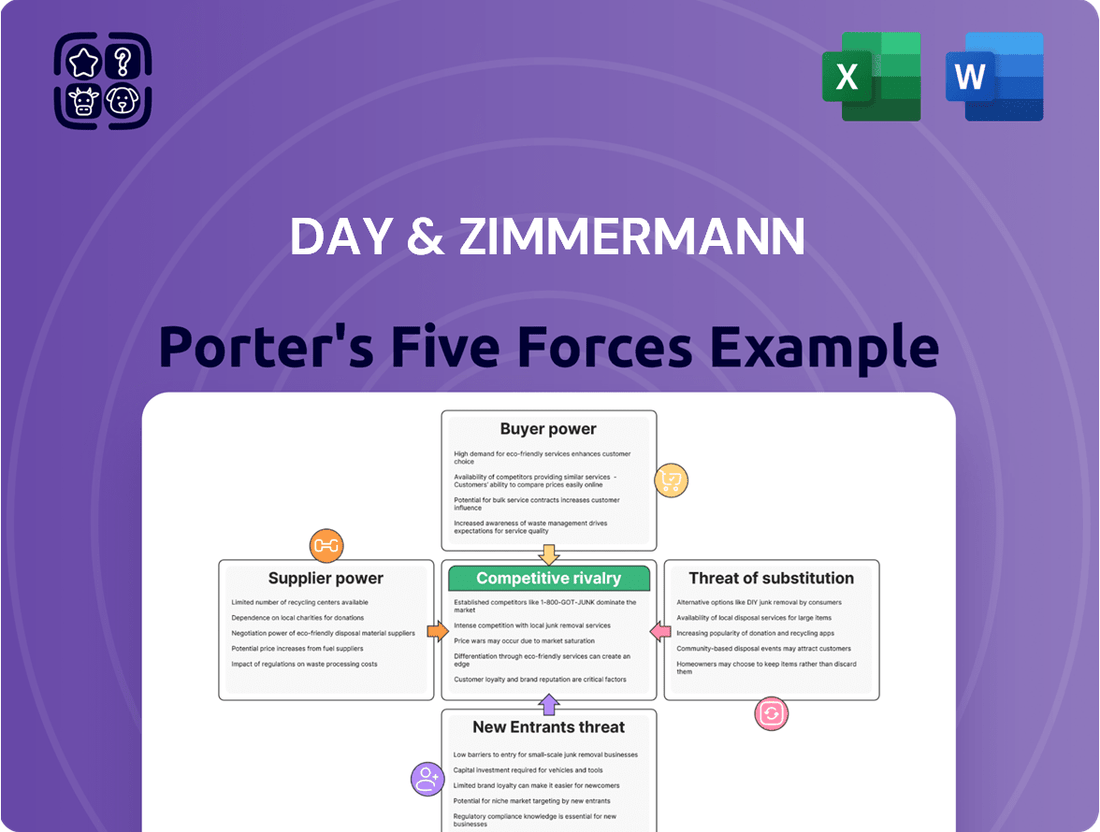

Day & Zimmermann operates in a complex industrial landscape shaped by several key competitive forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the danger posed by substitutes is crucial for strategic success. This brief overview only scratches the surface of these dynamics. Unlock the full Porter's Five Forces Analysis to explore Day & Zimmermann’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Day & Zimmermann's reliance on a highly skilled workforce, encompassing engineers, technicians, and specialized tradespeople, significantly influences supplier power. For intricate projects within power, industrial, and defense industries, the availability of this expertise is crucial. For example, the U.S. Bureau of Labor Statistics projected a 3% growth for mechanical engineers between 2022 and 2032, a field vital to many of Day & Zimmermann's operations, highlighting the ongoing demand for such specialized skills.

The scarcity of this specialized labor, particularly when security clearances are mandated for defense contracts, can empower these labor suppliers considerably. This scarcity translates into increased leverage for skilled workers and unions, potentially driving up labor costs. Indeed, in 2024, reports indicated continued wage growth in skilled trades, a trend that directly impacts companies like Day & Zimmermann who depend on this talent pool.

Day & Zimmermann's munitions production heavily relies on critical raw materials and components, some of which are sourced from a limited number of suppliers or are subject to geopolitical supply chain disruptions. This concentration means that if these materials are proprietary or their production is concentrated among a few vendors, those suppliers gain significant pricing power. For instance, in 2024, the global supply of certain specialized alloys and electronic components used in advanced munitions faced upward price pressure due to increased demand from defense sectors worldwide and ongoing logistical challenges.

Suppliers of highly specialized machinery, software, or proprietary technology crucial for Day & Zimmermann's operations in engineering, construction, and defense manufacturing can wield considerable bargaining power. For instance, companies providing advanced robotics for complex assembly or specialized simulation software for design processes often have limited competition, allowing them to dictate terms.

The high switching costs associated with adopting new technologies or integrating different equipment further solidify supplier leverage. Imagine the expense and disruption of replacing a core manufacturing system or retraining engineers on new software platforms; these barriers make it difficult for Day & Zimmermann to change suppliers. In 2024, the average cost for businesses to migrate enterprise resource planning (ERP) systems, which often include specialized manufacturing modules, can range from tens of thousands to millions of dollars.

Day & Zimmermann's strategic focus on internal innovation and the development of alternative solutions is key to mitigating this supplier power. By investing in research and development to create in-house capabilities or identify more readily available, yet still effective, technologies, the company can reduce its dependence on any single proprietary provider. This proactive approach ensures greater flexibility and cost control in its supply chain.

Limited Number of Qualified Subcontractors

In large engineering and construction projects, Day & Zimmermann frequently depends on specialized subcontractors. A limited number of qualified subcontractors for critical tasks, such as advanced welding or complex environmental cleanup, can significantly boost their leverage. This scarcity means these subcontractors can often command higher prices, directly impacting project budgets and timelines if key partners are not available or have capacity issues.

This situation can translate into increased operational costs for Day & Zimmermann. For instance, a report from the Construction Industry Association in late 2023 highlighted that specialized labor shortages had driven up subcontracting costs by an average of 8-12% on major infrastructure projects. This directly affects the profitability and competitiveness of firms like Day & Zimmermann.

- Limited Subcontractor Pool: A small number of highly skilled subcontractors for niche services grants them greater negotiation power.

- Increased Project Costs: Higher subcontracting fees directly inflate the overall project expenses for Day & Zimmermann.

- Potential for Delays: Unavailability of preferred subcontractors can lead to scheduling conflicts and project completion delays.

- Impact on Profitability: Rising subcontracting costs can squeeze profit margins if not adequately managed or passed on to clients.

Regulatory and Compliance-Dependent Suppliers

Suppliers in highly regulated industries, such as defense or nuclear power, possess significant bargaining power. These suppliers must meet rigorous compliance and certification requirements, which act as substantial barriers to entry for potential competitors. This limited supplier base means that companies like Day & Zimmermann have fewer options, increasing the leverage of existing, compliant vendors. For instance, in the defense sector, a 2024 report indicated that over 70% of prime contractors require their suppliers to hold specific government certifications, a process that can take years and substantial investment to achieve.

The necessity for Day & Zimmermann to verify and maintain these supplier certifications effectively concentrates its sourcing options. This dependency on a select group of qualified suppliers allows these vendors to command higher prices and more favorable terms. The complexity and cost associated with meeting these regulatory hurdles mean that only a handful of companies can reliably supply specialized components or services, thereby solidifying their market position and bargaining strength.

- Limited Supplier Pool: Stringent regulations create a natural barrier, reducing the number of eligible suppliers.

- High Compliance Costs: Meeting certifications is expensive and time-consuming, deterring new entrants.

- Increased Vendor Leverage: Fewer qualified suppliers mean existing ones can demand better terms.

- Strategic Sourcing Challenges: Companies like Day & Zimmermann face narrower sourcing options due to these requirements.

The bargaining power of suppliers for Day & Zimmermann is significantly influenced by the scarcity and specialization of labor, particularly in sectors like defense and advanced manufacturing. In 2024, continued wage growth in skilled trades underscored the leverage held by these workers, impacting labor costs for companies reliant on their expertise. This trend highlights the need for strategic workforce planning and talent acquisition to mitigate potential cost escalations driven by specialized skill shortages.

Moreover, the concentration of suppliers for critical raw materials and proprietary technology further amplifies supplier leverage. For instance, the global demand for specialized alloys in advanced munitions, coupled with logistical challenges in 2024, led to upward price pressures from a limited vendor base. Similarly, providers of advanced robotics or specialized simulation software often face minimal competition, allowing them to dictate terms and pricing, especially when switching costs are high.

The company's reliance on subcontractors in complex projects also plays a role, with a limited pool of qualified specialists for niche services like advanced welding or environmental cleanup granting these subcontractors greater negotiation power. This can lead to increased project costs and potential delays if key partners are unavailable, as evidenced by reports in late 2023 indicating 8-12% cost increases for specialized subcontracting on major infrastructure projects due to labor shortages.

| Factor | Impact on Day & Zimmermann | 2024/Recent Data Point |

|---|---|---|

| Specialized Labor Scarcity | Increased labor costs, potential project delays | Projected 3% growth for mechanical engineers (2022-2032), continued wage growth in skilled trades (2024) |

| Limited Raw Material Suppliers | Higher material costs, supply chain vulnerability | Upward price pressure on specialized alloys and electronic components in advanced munitions (2024) |

| Proprietary Technology Dependence | Higher equipment/software costs, integration challenges | High switching costs for ERP systems (tens of thousands to millions of dollars) |

| Niche Subcontractor Pool | Increased subcontracting fees, potential for project delays | 8-12% rise in subcontracting costs for specialized labor on infrastructure projects (late 2023) |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Day & Zimmermann's diverse industrial and government services sectors.

Instantly understand strategic pressure with a powerful spider/radar chart that visualizes the interconnectedness of all five forces impacting Day & Zimmermann.

Customers Bargaining Power

Day & Zimmermann's customer base is a formidable force, featuring large governmental agencies, major industrial corporations, and significant commercial entities. These clients wield substantial purchasing power, often backed by sophisticated procurement departments and lengthy track records of complex deal-making.

Their informed nature means they routinely engage in competitive bidding, allowing them to negotiate aggressively for favorable pricing, stringent service level agreements, and customized solutions. This informed approach means Day & Zimmermann must continuously demonstrate value to retain these key relationships.

The sheer scale of projects undertaken by these customers directly translates into amplified individual influence. For instance, a single large defense contract, representing a significant portion of Day & Zimmermann's revenue, grants that governmental agency considerable leverage in ongoing negotiations.

For standardized services, like basic staffing or routine facility upkeep, customers often find it simple and inexpensive to switch to another provider. This low barrier means Day & Zimmermann must remain competitive on price and service quality to keep clients happy. For instance, in the general staffing sector, a client might only need to re-vet a new agency, a process that doesn't typically involve significant capital investment.

For Day & Zimmermann, many services are acquired on a project-by-project basis, especially in areas like engineering and construction. This approach means clients can re-evaluate their choices for each new undertaking, naturally creating a competitive landscape for companies like Day & Zimmermann.

This episodic procurement model empowers customers. They can use the fact that they aren't tied to long-term contracts to push for better terms on each new project. For instance, in 2024, the infrastructure spending boom, driven by initiatives like the Bipartisan Infrastructure Law in the US, created numerous discrete projects. This increased demand for specialized services meant many clients had a wider array of providers to choose from, amplifying their bargaining power.

Threat of Backward Integration by Customers

For certain services, particularly those that are not central to a customer's operations or are performed routinely, large clients may contemplate building their own internal capacities instead of relying on external providers. This is especially true if the cost of outsourcing becomes too high.

A prime example of this could be a substantial industrial enterprise deciding to bolster its in-house maintenance division if the fees charged by external service companies escalate beyond a certain threshold. This possibility of customers integrating backward serves to cap the prices Day & Zimmermann can command, especially for services that lack a high degree of specialization.

The threat of backward integration is a significant factor influencing pricing power. For instance, in 2024, the industrial services sector saw increased scrutiny on outsourcing costs, with some large manufacturing firms exploring internal solutions for non-critical functions like facility management and routine equipment upkeep. This trend suggests that companies like Day & Zimmermann must remain competitive on price for commoditized services to mitigate the risk of losing business to in-house operations.

- Potential for In-House Service Development: Large customers may develop their own capabilities for non-core or repetitive tasks.

- Cost-Driven Integration: Prohibitive external service costs can trigger customers to build internal departments.

- Price Ceiling Impact: Backward integration potential limits the prices Day & Zimmermann can charge for less specialized services.

- 2024 Trend Observation: Increased customer focus on outsourcing costs in industrial services sector noted in 2024.

Price Sensitivity and Budget Constraints

Customers, particularly government and large industrial clients, often face stringent budget limitations. This makes them highly attuned to price, directly influencing their purchasing decisions. For companies like Day & Zimmermann, this translates into a need for cost-effective solutions and competitive pricing strategies to secure contracts.

In sectors such as defense, where government funding dictates project feasibility, budget constraints are a primary driver. These allocations directly shape project scope and available capital, compelling service providers to maintain aggressive cost structures. For example, a significant reduction in a defense budget could force a prime contractor to seek lower-cost suppliers or renegotiate terms, increasing customer bargaining power.

Economic fluctuations and evolving government spending priorities can significantly intensify price sensitivity. Shifts in focus, such as increased investment in cybersecurity or a reduction in traditional hardware procurement, can leave companies like Day & Zimmermann vulnerable if they cannot adapt their pricing or offerings. This pressure on margins is a constant consideration.

- Price Sensitivity: Government and industrial customers are highly price-sensitive due to budget constraints.

- Defense Sector Impact: Budget allocations in defense directly influence project scope and funding, demanding cost competitiveness.

- Economic Volatility: Downturns and shifting government spending priorities amplify price sensitivity.

- Margin Pressure: These factors collectively place considerable pressure on the profit margins of companies like Day & Zimmermann.

Day & Zimmermann's customers, especially large government agencies and industrial giants, hold significant bargaining power. Their ability to switch providers for many services is often easy and inexpensive, forcing Day & Zimmermann to focus on competitive pricing and excellent service. This is amplified when projects are procured on a case-by-case basis, allowing clients to renegotiate terms for each new undertaking. In 2024, the surge in infrastructure projects meant more choices for clients, increasing their leverage.

The potential for customers to develop their own in-house capabilities, particularly for routine tasks, acts as a cap on pricing for less specialized services. For instance, in 2024, some large manufacturers explored bringing facility management in-house due to rising outsourcing costs. This backward integration threat necessitates that Day & Zimmermann remain cost-competitive to retain business.

Price sensitivity is a major factor for Day & Zimmermann's clients, driven by budget limitations, especially within the defense sector. Economic shifts and changing government priorities in 2024 further heightened this price consciousness, putting pressure on profit margins for service providers.

| Factor | Impact on Day & Zimmermann | 2024 Context |

| Customer Scale & Sophistication | High leverage in negotiations; demand for customization. | Large projects in infrastructure and defense sectors provided clients with more options. |

| Ease of Switching (Commoditized Services) | Low switching costs for routine services necessitate competitive pricing. | General staffing and facility upkeep remain competitive markets. |

| Backward Integration Threat | Limits pricing power for non-specialized services. | Industrial clients considered internalizing facility management due to cost concerns. |

| Budget Constraints & Price Sensitivity | Directly impacts purchasing decisions; requires cost-effective solutions. | Defense budget allocations and economic volatility increased client focus on price. |

Full Version Awaits

Day & Zimmermann Porter's Five Forces Analysis

This preview shows the exact Day & Zimmermann Porter's Five Forces Analysis document you'll receive immediately after purchase. It provides a comprehensive evaluation of the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. This professionally formatted analysis is ready for your immediate use, offering deep insights into the strategic positioning of Day & Zimmermann without any surprises or placeholders.

Rivalry Among Competitors

The intensity of competitive rivalry for Day & Zimmermann fluctuates dramatically across its varied business segments. In areas like staffing, the market is often fragmented, featuring numerous local and specialized firms. This fragmentation typically fuels aggressive price competition as companies vie for market share.

However, in specialized sectors such as engineering and construction for critical infrastructure like power plants or defense manufacturing, the competitive landscape is far more concentrated. Here, rivalry shifts from price to factors like advanced technical proficiency, a proven track record in safety, and the ability to execute complex projects reliably. For instance, in the defense sector, a limited number of highly specialized contractors often compete for substantial government contracts, where technical capability is paramount.

Industries such as heavy construction and defense manufacturing are characterized by substantial fixed costs. These include investments in specialized machinery, extensive facilities, and a highly skilled workforce. For instance, the U.S. construction industry alone saw capital expenditures exceeding $350 billion in 2023, a testament to these high upfront investments.

When demand falters or existing capacity outstrips project requirements, companies are often compelled to engage in aggressive pricing strategies. The objective is to secure contracts and, crucially, to ensure that their substantial fixed overheads are covered. This intense price competition directly impacts profitability across the sector.

In 2024, the defense sector, for example, faced fluctuating government spending, leading some prime contractors to bid exceptionally low on certain projects to maintain operational levels. This dynamic pressures smaller suppliers to accept tighter margins to remain competitive within the supply chain.

While some of Day & Zimmermann's services, like certain manufacturing or staffing functions, can lean towards commoditization, its true competitive strength lies in its deep technical expertise and a proven track record. This includes a strong emphasis on safety and the capacity to manage intricate, large-scale projects that many competitors shy away from. For instance, in 2024, the company continued its involvement in critical infrastructure projects, showcasing its specialized capabilities.

Companies that successfully differentiate their services through innovative solutions, exceptional project execution, or specialized accreditations experience reduced direct price competition. Conversely, a lack of distinctiveness in offerings can intensify rivalry, forcing businesses to compete primarily on cost. Day & Zimmermann's focus on these specialized areas helps it stand out in a crowded marketplace.

Government Contracting and Relationship-Based Competition

In the government contracting arena, competition is less about direct price wars and more about cultivating deep-seated relationships and demonstrating unwavering past performance. Companies like Day & Zimmermann thrive by building trust with government agencies, a process that takes years and involves navigating complex procurement regulations. This reliance on established connections and a proven ability to deliver reliably means that new entrants face significant hurdles.

Winning these lucrative, long-term prime contracts is often contingent on possessing the necessary security clearances and a thorough understanding of the intricate government acquisition lifecycle. For instance, the U.S. Department of Defense, a major client for many government contractors, emphasizes a contractor's ability to meet rigorous compliance standards and deliver mission-critical support. This environment fosters a unique competitive dynamic where reliability and adherence to strict protocols are paramount.

- Relationship Strength: Competition hinges on established trust and a history of successful contract fulfillment with government entities.

- Regulatory Compliance: Adherence to stringent government regulations and acquisition processes is a critical differentiator.

- Past Performance: A proven track record and demonstrated reliability are often more influential than price alone in securing contracts.

- Security Clearances: Possessing the requisite security clearances for personnel and operations is a fundamental requirement for participation.

Exit Barriers and Industry Consolidation

Day & Zimmermann faces significant competitive rivalry due to high exit barriers. Specialized assets like munition manufacturing facilities or large-scale construction equipment are often ill-suited for other industries, making it costly for companies to leave the market even when unprofitable. This immobility of capital keeps a larger number of competitors in play than might otherwise exist.

The need to retain specialized labor further compounds these exit barriers. Skilled workers in areas such as defense manufacturing or complex engineering projects are not easily transferable, creating a disincentive for firms to cease operations. Consequently, firms may continue to operate at reduced profitability, directly impacting the competitive intensity within the industry.

While mergers and acquisitions (M&A) do occur, the sheer number of remaining players, often due to the aforementioned barriers, prevents a substantial reduction in competitive pressures. For instance, in the defense contracting sector, a segment where Day & Zimmermann operates, the landscape remains fragmented despite ongoing consolidation efforts. This persistent rivalry necessitates continuous innovation and operational efficiency to maintain market share.

- Specialized Assets: Many facilities, particularly in defense and infrastructure, have limited alternative uses, increasing the cost of exit.

- Specialized Labor: A highly skilled workforce in niche areas makes it difficult and expensive for companies to wind down operations without significant severance costs.

- Market Fragmentation: Despite M&A trends, the presence of numerous smaller or specialized players, often entrenched by exit barriers, sustains intense competition.

- Innovation Pressure: The inability of some firms to exit forces all market participants to constantly improve products and processes to stay competitive.

Competitive rivalry for Day & Zimmermann is intense, particularly in its core sectors like defense and infrastructure engineering, where high fixed costs and specialized assets create significant exit barriers. This means companies, even when facing lower profitability, tend to stay in the market, intensifying competition. The need to cover these substantial overheads often leads to aggressive pricing, especially when demand softens, as seen in the U.S. construction sector's $350 billion in capital expenditures in 2023, which requires consistent project flow.

In government contracting, winning bids relies more on a proven track record, security clearances, and regulatory compliance than on price alone. This dynamic favors established players like Day & Zimmermann, who have cultivated strong relationships and demonstrated past performance, making it difficult for new entrants. For instance, the U.S. Department of Defense prioritizes reliability and compliance in its procurement processes.

The fragmentation within certain segments, like staffing, also fuels price-based competition. However, Day & Zimmermann's specialization in complex, high-stakes projects allows it to differentiate beyond price, leveraging its technical expertise and safety record. This focus is crucial as the defense sector, a key area for the company, experienced fluctuating government spending in 2024, forcing some contractors to bid aggressively to maintain operations.

| Key Factor | Impact on Rivalry | Example for Day & Zimmermann |

| High Fixed Costs | Intensifies rivalry as firms must cover overheads, leading to price competition. | Investments in specialized defense manufacturing facilities require continuous project acquisition. |

| Specialized Assets & Labor | High exit barriers keep competitors in the market, sustaining rivalry. | Facilities for munition production cannot be easily repurposed, preventing companies from leaving. |

| Government Contracting Dynamics | Rivalry based on relationships, past performance, and compliance, not just price. | Strong track record with the U.S. Department of Defense is a significant competitive advantage. |

| Market Fragmentation | Presence of numerous players, especially in less specialized segments, fuels competition. | The staffing division faces numerous smaller, localized competitors. |

SSubstitutes Threaten

Many large industrial and government clients can develop their own maintenance, basic engineering, or staffing departments. This internal capacity directly substitutes for outsourcing to firms like Day & Zimmermann.

The choice to keep services in-house versus outsourcing often depends on whether a client can achieve better cost-effectiveness, access specialized expertise, or if the function aligns with their core strategic priorities. For example, in 2024, many large defense contractors continued to invest in their internal maintenance, repair, and overhaul (MRO) capabilities to ensure operational readiness and control costs, acting as a direct substitute for third-party providers.

Technological advancements present a significant threat of substitutes for Day & Zimmermann's core services. Innovations like advanced composite materials that require less frequent maintenance or AI-powered predictive maintenance systems could diminish the demand for traditional engineering and field services. For instance, the global market for predictive maintenance is projected to reach $28.1 billion by 2030, indicating a substantial shift towards technologically driven solutions.

The rise of modular construction and prefabrication also offers a viable alternative to traditional on-site building methods, potentially reducing the need for extensive labor and project management services that Day & Zimmermann provides. Companies adopting these methods can often achieve faster project completion times and cost savings. The modular construction market alone was valued at over $100 billion globally in 2023 and is expected to grow substantially.

Furthermore, the increasing availability of sophisticated digital tools for design, simulation, and project management can empower clients to manage certain aspects of their projects internally or through specialized software providers, bypassing the need for full-service engineering and construction firms. This trend necessitates that Day & Zimmermann continuously invests in and adapts its offerings to integrate these emerging technologies, ensuring its value proposition remains strong against these evolving substitutes.

The defense industry's evolving procurement models pose a significant threat of substitution for Day & Zimmermann. As governments prioritize non-lethal technologies, cyber warfare capabilities, and advanced electronic systems over traditional munitions, demand for Day & Zimmermann's core products could decline. For instance, the U.S. Department of Defense's increased investment in artificial intelligence and autonomous systems, projected to grow substantially in the coming years, signals a shift away from conventional ordnance.

Standardized Software Solutions for Project Management

The threat of substitutes for project management services is growing, especially for routine or less complex tasks. Off-the-shelf software and emerging AI platforms can now handle a significant portion of what previously required human input in project management and basic engineering. This means that for simpler projects, clients might opt for these technological solutions instead of engaging external consulting or design firms.

For instance, the global project management software market was valued at approximately $6.1 billion in 2023 and is projected to reach $12.9 billion by 2028, indicating substantial growth and adoption of these tools. This trend suggests a tangible shift towards digital solutions that can automate and streamline project workflows, potentially reducing the demand for certain human-centric services.

Day & Zimmermann must consider how these evolving software capabilities impact their service offerings. The company has a strategic choice: either integrate these advanced tools into their own service delivery to maintain competitiveness and offer enhanced efficiency, or risk seeing their market share erode for more standardized project management needs. Failing to adapt could lead to a reduction in demand for their simpler, more commoditized services.

- Market Shift: Project management software market growth indicates a strong move towards automated solutions.

- AI Integration: AI-driven platforms are increasingly capable of substituting human effort in basic engineering and design.

- Competitive Response: Day & Zimmermann needs to adapt by integrating these tools or face declining demand for routine tasks.

- Strategic Imperative: Proactive adoption of new technologies is crucial to mitigate the threat of substitutes.

Economic Downturns Leading to Reduced Outsourcing

Economic downturns present a significant threat of substitutes for companies like Day & Zimmermann. During periods of economic contraction, businesses often look for ways to reduce expenses. This can lead them to insource activities that were previously outsourced, effectively substituting external service providers with internal capabilities.

For instance, if a company needs specialized engineering support, an economic slowdown might prompt them to hire full-time engineers rather than engaging an external firm. This shift directly replaces the need for Day & Zimmermann's services with an internal alternative. The pressure to conserve capital during recessions makes this substitution particularly appealing to clients.

While Day & Zimmermann's presence in sectors like defense offers some insulation, their commercial and industrial divisions are more susceptible. In 2023, global GDP growth slowed to an estimated 3.1% according to the IMF, a figure expected to remain modest in 2024. This environment heightens the risk of clients bringing outsourced functions in-house to manage costs.

- Cost-Cutting Measures: Economic recessions often trigger a prioritization of cost reduction, leading clients to insource services previously provided by external firms.

- Deferred Projects: Non-essential projects that might require outsourcing services could be postponed or canceled, reducing demand for external providers.

- Internal Capacity Building: Companies may invest in developing internal expertise and resources to handle tasks formerly outsourced, creating a substitute.

- Sectoral Vulnerability: While defense contracts provide stability, commercial and industrial segments of Day & Zimmermann's business are more exposed to economic pressures that drive insourcing.

Clients' growing ability to perform tasks internally, driven by technological advancements and cost-saving imperatives, poses a significant threat of substitutes for Day & Zimmermann. Many large industrial and government clients can develop their own maintenance, basic engineering, or staffing departments, effectively substituting for outsourced services. For instance, in 2024, many defense contractors continued to bolster their internal maintenance, repair, and overhaul (MRO) capabilities to control costs and ensure readiness.

Technological innovations like AI-powered predictive maintenance and advanced composite materials are diminishing the need for traditional field services. The global predictive maintenance market is projected to reach $28.1 billion by 2030, highlighting this shift. Similarly, modular construction, valued over $100 billion globally in 2023, offers an alternative to traditional on-site building, reducing demand for extensive labor and project management.

The rise of sophisticated digital tools for design and project management also allows clients to manage aspects internally or through software providers. The project management software market, valued at approximately $6.1 billion in 2023, is expected to grow substantially, indicating a trend towards digital solutions that can streamline workflows and potentially reduce demand for human-centric services.

Economic downturns exacerbate this threat, as businesses look to cut expenses by insourcing previously outsourced activities. During economic contractions, hiring full-time engineers instead of engaging external firms becomes a more appealing cost-saving measure. The IMF's projected modest global GDP growth for 2024 suggests this pressure to conserve capital will continue, making internal alternatives more attractive.

Entrants Threaten

Entering segments like power plant construction, large-scale industrial maintenance, or munitions production for companies like Day & Zimmermann demands significant capital. We're talking about substantial investments in specialized equipment, advanced facilities, and cutting-edge technology, easily running into hundreds of millions of dollars. For instance, building a new manufacturing plant for defense components could cost upwards of $500 million.

This considerable financial hurdle acts as a powerful deterrent, effectively keeping many potential new entrants out of the market. The sheer scale of upfront investment required means only well-capitalized firms can even consider competing.

Day & Zimmermann's existing, extensive infrastructure, built over decades, offers a significant competitive advantage. This established foundation is something any newcomer would struggle to replicate, especially in the short term.

The defense, nuclear, and heavy industrial sectors, where Day & Zimmermann operates, are characterized by extensive regulatory hurdles and stringent certification requirements. These sectors demand numerous licenses and adherence to rigorous safety and quality standards, making entry costly and time-consuming. For instance, companies seeking to work on U.S. Department of Defense contracts must navigate complex acquisition regulations and often require specific security clearances and quality system certifications, such as those mandated by ISO 9001 or AS9100.

Obtaining these necessary approvals is a significant investment of both time and capital. New entrants face substantial upfront costs associated with compliance, testing, and auditing. Day & Zimmermann's decades-long track record of successful compliance and its established portfolio of certifications represent a critical competitive advantage, effectively deterring less prepared or capitalized newcomers from entering these specialized markets.

Day & Zimmermann operates in sectors like engineering, project management, and defense manufacturing, all of which demand deeply specialized technical skills and a workforce with significant experience. For instance, their work in advanced aerospace and defense projects often requires engineers with specific knowledge in areas like composite materials or advanced propulsion systems. New companies entering these fields would face a substantial hurdle in recruiting and training personnel to this level of proficiency.

Developing such a specialized talent pool is not only difficult but also incredibly expensive and time-consuming. It can take years to cultivate the necessary expertise. This human capital barrier significantly impedes new entrants' ability to gain credibility and effectively undertake complex projects, as they lack the proven track record and established skilled teams that Day & Zimmermann possesses.

Established Client Relationships and Track Record

In the demanding sectors of government and large industrial contracting, securing new business hinges heavily on deeply rooted client relationships and a demonstrated history of successful project execution. Newcomers face a significant hurdle as they lack this essential background. They must commit substantial resources to cultivate trust and prove their capabilities, a process that inherently takes considerable time.

Day & Zimmermann leverages its advantage of decades of built-up client trust and a consistent stream of repeat business. This established reputation acts as a substantial barrier to entry for potential competitors. For instance, in 2024, Day & Zimmermann continued to secure major contracts based on their long-standing performance, demonstrating the tangible value of their track record.

- Established Client Relationships: Decades of trust are a formidable barrier.

- Proven Track Record: Successful project delivery builds invaluable credibility.

- High Switching Costs for Clients: Moving from a trusted, proven provider is complex and risky.

- Demonstrated Competence: New entrants must invest heavily to prove their capabilities, a slow and costly endeavor.

Economies of Scale and Scope

Day & Zimmermann's ability to leverage economies of scale and scope significantly deters new entrants. By operating across a broad spectrum of services and undertaking large-scale projects, the company achieves cost advantages that are difficult for smaller, newer competitors to replicate. For instance, in 2024, their integrated solutions often involve managing complex supply chains and extensive workforces, driving down per-unit costs in areas like government contracting and engineering services.

Newcomers typically begin with a much smaller operational footprint, making it challenging to match the cost-effectiveness and breadth of services that Day & Zimmermann provides. This scale advantage allows for more efficient resource allocation, from procurement to workforce management, enabling more competitive pricing. In 2024, large defense contracts, where Day & Zimmermann is a major player, often require substantial upfront investment and operational capacity, creating a high barrier for nascent firms.

- Economies of Scale: Day & Zimmermann's large-scale operations, particularly in sectors like aerospace and defense manufacturing, allow for bulk purchasing and optimized production processes, reducing per-unit costs.

- Economies of Scope: By offering a diverse range of services, from engineering and construction to workforce solutions and government support, the company can cross-sell and achieve efficiencies by sharing resources and expertise across different business units.

- Barriers to Entry: New entrants face significant hurdles in matching the capital investment, established infrastructure, and experienced personnel that Day & Zimmermann possesses, especially for large, complex projects.

- Competitive Pricing: The cost efficiencies gained through scale enable Day & Zimmermann to offer competitive pricing, making it difficult for smaller, less integrated competitors to win bids and gain market share.

The threat of new entrants for Day & Zimmermann is generally low due to substantial capital requirements, with new plant constructions easily exceeding hundreds of millions of dollars. For instance, establishing defense component manufacturing facilities in 2024 could cost upwards of $500 million. This financial barrier limits competition to only well-capitalized firms. Furthermore, stringent regulatory and certification demands in sectors like defense and nuclear industries add significant time and cost for compliance, making it difficult for newcomers to meet necessary standards and gain approvals. For example, U.S. Department of Defense contracts require adherence to complex acquisition regulations and specific quality certifications like ISO 9001.

The need for highly specialized technical skills and experienced personnel presents another significant barrier. Attracting and training a workforce with expertise in advanced aerospace or composite materials, for example, is both expensive and time-consuming, often taking years to develop. Day & Zimmermann's established reputation and decades of successful project execution also create a strong deterrent. In 2024, securing major contracts relied heavily on this proven track record and built-up client trust, which new entrants lack and must invest heavily to replicate.

Economies of scale and scope further solidify Day & Zimmermann's competitive position, enabling cost advantages that are difficult for smaller firms to match. Their integrated solutions in 2024, managing complex supply chains and large workforces, drive down per-unit costs in government contracting and engineering services. New entrants struggle to achieve the same level of operational efficiency and competitive pricing that Day & Zimmermann leverages through its broad service offerings and substantial capacity, particularly in large defense contracts.

| Barrier Type | Description | Example Data (2024) |

|---|---|---|

| Capital Requirements | High upfront investment for facilities and technology. | New defense manufacturing plant construction: >$500 million. |

| Regulatory Hurdles | Extensive licenses and certifications in defense and nuclear sectors. | Compliance with ISO 9001 or AS9100 for defense contracts. |

| Specialized Workforce | Need for highly skilled and experienced personnel. | Expertise in advanced aerospace materials or propulsion systems. |

| Established Relationships | Decades of client trust and repeat business. | Securing major contracts based on long-standing performance. |

| Economies of Scale/Scope | Cost efficiencies from large-scale operations and diverse services. | Reduced per-unit costs in government contracting and engineering services. |

Porter's Five Forces Analysis Data Sources

Our Day & Zimmermann Porter's Five Forces analysis is built upon a foundation of robust data, incorporating insights from company annual reports, industry-specific market research, and relevant government regulatory filings.