Daycoval Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daycoval Bank Bundle

Daycoval Bank operates within a dynamic environment shaped by political stability, economic fluctuations, and evolving social attitudes. Understanding these external forces is crucial for forecasting future performance and identifying strategic opportunities. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence to guide your decisions.

Uncover how regulatory changes, economic shifts, and technological advancements are impacting Daycoval Bank's competitive landscape. This expertly crafted PESTLE analysis provides the critical insights you need to anticipate challenges and capitalize on emerging trends. Download the full version now and gain a significant advantage.

Political factors

The stability of the Brazilian government and its policy direction are crucial for Daycoval Bank. Political shifts can introduce uncertainty, impacting investor confidence and the regulatory landscape. For instance, Brazil's presidential election cycles often bring periods of policy review, which can affect the banking sector's operational framework.

Government fiscal policies, encompassing public spending and debt management, significantly shape Brazil's economic landscape. For instance, in 2024, Brazil's fiscal deficit was projected to be around 1.1% of GDP, a figure that influences investor confidence and borrowing costs.

High government deficits and concerns about debt sustainability can pressure inflation and interest rates upward. This directly affects Daycoval Bank's cost of capital and the borrowing capacity of its clients, potentially dampening lending activity.

Conversely, a commitment to fiscal responsibility, as demonstrated by efforts to control public spending and manage debt effectively, fosters a more stable and predictable environment for financial institutions like Daycoval Bank and its customers, encouraging investment and credit expansion.

The Central Bank of Brazil's (BCB) autonomy is a cornerstone for effective monetary policy and financial system stability. This independence allows the BCB to make crucial decisions, like interest rate adjustments, without undue political pressure, fostering a more predictable economic landscape for institutions like Daycoval Bank.

In 2024, the BCB continued its cycle of interest rate adjustments, with the Selic rate being a key tool to combat inflation. For instance, by early 2024, the Selic rate had seen reductions, signaling a shift in monetary policy stance aimed at balancing inflation control with economic growth, directly impacting Daycoval's lending and funding costs.

Trade Policies and International Relations

Brazil's trade policies and international relations significantly shape foreign investment and its economic trajectory. For instance, in 2024, Brazil's efforts to strengthen ties with the European Union, particularly through discussions around the Mercosur-EU trade agreement, aim to boost trade and attract foreign capital. A stable geopolitical climate and favorable trade agreements can channel more investment into the financial sector, fostering growth in business activity and international banking operations.

Conversely, trade tensions or geopolitical instability can introduce considerable market uncertainty. For example, global trade disputes in 2023 and early 2024 have highlighted how disruptions in international relations can impact investor confidence and capital flows into emerging markets like Brazil. Daycoval Bank, like other financial institutions, must navigate these dynamics to manage risk and capitalize on opportunities.

- Mercosur-EU Trade Agreement: Ongoing negotiations in 2024 aim to create a more open market, potentially increasing foreign direct investment into Brazil's financial services sector.

- Geopolitical Stability: Brazil's active participation in international forums like the G20 in 2024 underscores its commitment to global cooperation, which can positively influence investor sentiment.

- Trade Disputes Impact: Global trade friction in 2023-2024 has demonstrated the sensitivity of emerging markets to international relations, impacting capital inflows and economic outlook.

Anti-Corruption and Governance Initiatives

Government initiatives aimed at combating corruption and bolstering corporate governance in Brazil are crucial for fostering a more transparent and trustworthy investment landscape. For Daycoval Bank, these efforts translate into a more appealing environment for investors and a reduction in potential operational risks.

A robust governance framework, coupled with a lower perceived level of corruption, directly impacts a financial institution's attractiveness. This is particularly relevant as Brazil continues to implement measures to align with global standards for financial sector integrity.

- Enhanced Investor Confidence: Improved governance and anti-corruption measures can boost foreign direct investment into Brazil's financial sector. For instance, in 2023, Brazil saw significant inflows of foreign capital, partly driven by perceived improvements in regulatory environments.

- Reduced Operational Risk: Stronger compliance and ethical standards, enforced by government initiatives, can mitigate risks such as fraud and reputational damage for banks like Daycoval.

- Alignment with International Standards: Adherence to global best practices in governance and anti-corruption is essential for banks operating in or seeking investment from international markets.

Political stability and consistent policy implementation are paramount for Daycoval Bank's operations in Brazil. Government efforts to manage the fiscal deficit, such as the projected deficit of 1.1% of GDP in 2024, directly influence investor confidence and borrowing costs.

The Central Bank of Brazil's autonomy in setting monetary policy, including interest rate adjustments like the Selic rate reductions seen in early 2024, creates a more predictable environment for lending and funding. Brazil's engagement in international trade agreements, like the ongoing Mercosur-EU discussions in 2024, aims to attract foreign capital and boost economic activity.

Furthermore, government initiatives to combat corruption and enhance corporate governance, which saw Brazil attract significant foreign capital in 2023, are vital for reducing operational risks and increasing the attractiveness of the financial sector to investors.

| Political Factor | Impact on Daycoval Bank | 2024/2025 Relevance |

|---|---|---|

| Fiscal Policy & Deficit | Influences borrowing costs and investor sentiment. | Projected 1.1% fiscal deficit in 2024 affects economic stability. |

| Monetary Policy (Selic Rate) | Directly impacts lending rates and funding costs. | BCB's rate adjustments in early 2024 signal policy direction. |

| Trade Agreements (Mercosur-EU) | Potential for increased foreign investment and business activity. | Ongoing negotiations in 2024 aim to open markets. |

| Governance & Anti-Corruption | Reduces operational risk and enhances investor attractiveness. | Brazil's efforts to improve regulatory environments attracted capital in 2023. |

What is included in the product

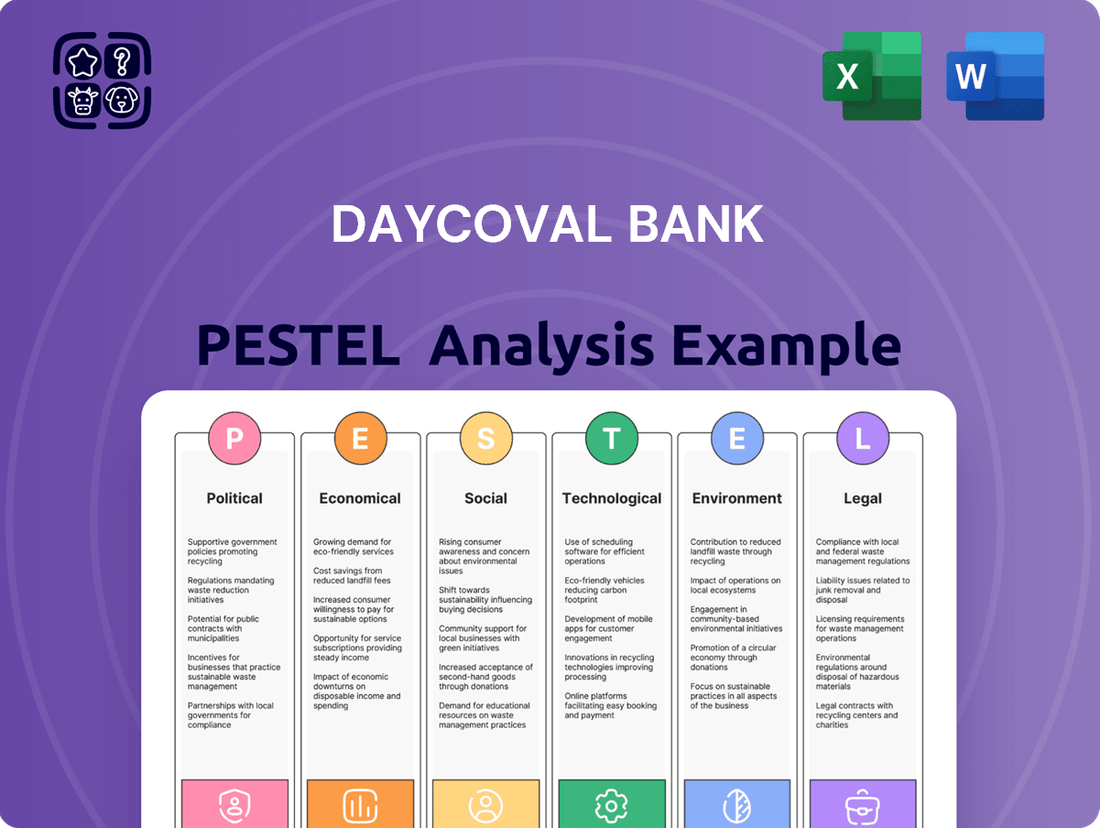

This PESTLE analysis of Daycoval Bank examines how Political, Economic, Social, Technological, Environmental, and Legal factors create unique challenges and opportunities for the bank.

It provides actionable insights for strategic decision-making by detailing current trends and their specific impact on Daycoval Bank's operations and market position.

This Daycoval Bank PESTLE Analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, effectively reliving the pain of sifting through extensive data.

Economic factors

Inflation and interest rates are paramount economic considerations for a financial institution like Daycoval Bank. Elevated inflation diminishes purchasing power and can escalate operational expenses, while increasing interest rates, such as the Selic rate, directly influence borrowing costs for both businesses and consumers.

The Central Bank of Brazil has been implementing rate hikes to combat persistent inflation, a move that can significantly impact Daycoval's loan book and overall profitability. For instance, Brazil's IPCA inflation rate was reported at 4.62% in the twelve months ending May 2024, a slight decrease from previous months but still a key factor influencing monetary policy.

The Selic rate, Brazil's benchmark interest rate, stood at 10.50% as of May 2024. This rate directly affects the cost of funding for banks and the interest charged on loans, creating a dynamic environment for Daycoval's lending operations and net interest margin.

Brazil's Gross Domestic Product (GDP) growth is a key indicator for Daycoval Bank. In 2024, Brazil experienced a robust economic expansion, with forecasts suggesting a growth rate around 2.5% to 3%. This heightened economic activity typically translates into increased demand for credit and financial services, benefiting Daycoval's core lending operations.

Looking ahead to 2025, projections indicate a moderation in Brazil's GDP growth, with estimates hovering between 1.5% and 2%. While this slowdown is a consideration, the underlying economic momentum from 2024 should still support a stable market for corporate and retail banking, Daycoval's primary business areas.

The unemployment rate and real wage growth are crucial economic indicators that directly influence consumer spending and, consequently, a bank's loan repayment performance. A low unemployment rate, coupled with robust wage increases, generally translates to higher disposable income, enabling individuals to meet their financial obligations more readily. For Daycoval Bank, this scenario is particularly beneficial for its retail banking products, such as personal loans and payroll-deductible loans, as it can lead to lower delinquency rates.

As of early 2024, Brazil's unemployment rate has shown a downward trend, hovering around 7.8% in the first quarter of 2024, down from 8.5% in the same period of 2023, indicating a strengthening labor market. Real wage growth, while still recovering, has seen positive movement, with average real wages increasing by approximately 2.5% year-over-year by the end of 2023. This environment supports consumer confidence and their capacity to manage debt effectively.

Exchange Rate Fluctuations

Fluctuations in the Brazilian Real's exchange rate significantly impact Daycoval Bank. For its corporate clients, a weaker Real can make imports more expensive, potentially increasing inflation. This inflationary pressure might lead the Central Bank of Brazil to raise interest rates, affecting borrowing costs and investment decisions across the economy.

The Real's volatility also influences the value of Daycoval's foreign currency transactions. For example, if the bank holds assets denominated in US dollars and the Real depreciates, those assets become worth more in local currency terms. Conversely, a stronger Real would decrease their local currency value.

- Impact on Corporate Clients: A depreciated Real can increase the cost of imported goods for Daycoval's business customers, potentially squeezing profit margins.

- Inflationary Pressures: Higher import costs due to a weaker currency can contribute to broader inflation in Brazil.

- Monetary Policy Response: Increased inflation often prompts the Central Bank of Brazil to increase its benchmark interest rate, the Selic rate, which affects lending and investment. As of early 2024, the Selic rate has seen reductions, but the potential for hikes remains a factor in exchange rate volatility.

- Foreign Currency Operations: Daycoval's financial performance can be directly affected by the translation of foreign currency assets and liabilities into Brazilian Reals.

Credit Market Conditions and Delinquency Rates

The overall health of Brazil's credit market is a significant factor for Daycoval Bank. While the banking system is showing signs of recovery from a downturn, persistent high delinquency rates and elevated household indebtedness continue to pose challenges, potentially tightening credit conditions.

For instance, Brazil's Central Bank data indicated that the average delinquency rate for loans to individuals reached approximately 5.5% in early 2024, a slight decrease from the previous year but still a concern. This level of indebtedness can limit consumer spending and increase the risk for lenders.

- Delinquency Rates: While showing a slight downward trend in early 2024, delinquency rates for Brazilian consumers remain a key indicator of credit market health, impacting loan loss provisions.

- Household Indebtedness: High levels of household debt continue to be a constraint, potentially reducing demand for new credit and increasing the risk of defaults.

- Operating Environment: As Brazil's economy stabilizes, Daycoval Bank anticipates an improvement in its asset quality, benefiting from a more favorable credit cycle.

Brazil's economic trajectory, marked by projected GDP growth of 2.5-3% in 2024 and a moderated 1.5-2% in 2025, directly impacts credit demand for Daycoval Bank. The Central Bank's monetary policy, evidenced by the Selic rate at 10.50% in May 2024 and efforts to curb the 4.62% IPCA inflation (May 2024), shapes borrowing costs and profitability. A strengthening labor market, with unemployment around 7.8% in Q1 2024 and positive real wage growth, supports consumer spending and loan repayment capacity.

| Economic Factor | Value/Trend (2024/2025) | Implication for Daycoval Bank |

|---|---|---|

| GDP Growth (Brazil) | 2.5-3% (2024), 1.5-2% (2025) | Increased demand for credit and financial services. |

| Selic Rate | 10.50% (May 2024) | Influences borrowing costs and net interest margin. |

| IPCA Inflation | 4.62% (12 months ending May 2024) | Impacts purchasing power and may trigger interest rate adjustments. |

| Unemployment Rate | ~7.8% (Q1 2024) | Supports consumer spending and loan repayment. |

Same Document Delivered

Daycoval Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis of Daycoval Bank.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Daycoval Bank.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into the strategic landscape for Daycoval Bank.

Sociological factors

A substantial segment of Brazil's population, estimated at around 25% as of late 2023, still lacks full access to formal banking services. This presents Daycoval with a significant avenue for growth, particularly in its retail banking operations.

Daycoval can capitalize on this unmet demand by offering tailored financial products, such as accessible personal loans and payroll-deductible loans, which are particularly attractive to the unbanked or underbanked population seeking reliable credit solutions.

Consumer behavior in Brazil is rapidly shifting towards digital channels. By the end of 2024, it's projected that over 80% of Brazilians will be actively using smartphones for daily tasks, including financial management. This trend directly influences how banks like Daycoval must operate, pushing for enhanced mobile banking platforms and digital payment solutions to meet evolving customer expectations.

The widespread adoption of instant payment systems, such as Pix, has fundamentally changed transaction habits. As of early 2025, Pix transactions are consistently exceeding 100 million per day, demonstrating a clear preference for speed and convenience. This necessitates banks to integrate and optimize their offerings around such real-time payment infrastructures to remain competitive.

Demographic shifts, particularly the aging population, significantly impact financial services. As more individuals enter retirement, there's a growing demand for products like retirement planning, annuities, and long-term care insurance. For instance, in Brazil, the proportion of the population aged 65 and over is projected to increase substantially, reaching an estimated 14.3% by 2025, up from around 10.8% in 2020, presenting both opportunities and challenges for financial institutions like Daycoval Bank.

Income Inequality and Social Mobility

High income inequality in Brazil, where Daycoval Bank operates, can significantly shape demand for financial products. For instance, a widening gap between the rich and poor might increase the need for specialized wealth management services for high-net-worth individuals, while simultaneously boosting demand for accessible credit and savings products from lower-income segments. This dynamic directly impacts a bank's credit risk profile, as different income brackets exhibit varying repayment capacities and default probabilities.

The potential for payroll-deductible loans, a common product in Brazil, is also influenced by income distribution. In 2024, Brazil's Gini coefficient, a measure of income inequality, remained a concern, indicating a substantial disparity in wealth. This means that while payroll-deductible loans might be attractive to a broad segment of the employed population, the actual uptake and risk associated with them will vary considerably based on the borrower's income level and job security.

- Brazil's Gini coefficient in 2024 indicated persistent income inequality, affecting demand for diverse financial products.

- Banks need strategies to cater to both high-net-worth and lower-income segments, influencing lending portfolios.

- Income disparity impacts the credit risk associated with different client groups, particularly for payroll-deductible loans.

- Daycoval Bank must consider these sociological factors to tailor its product offerings and manage risk effectively.

Public Trust and Reputation of Financial Institutions

Public trust is the bedrock of any financial institution's success, directly influencing customer acquisition and retention. In Brazil, where Daycoval operates, consumer confidence in banks can be swayed by memories of past economic instability and concerns about ethical practices. A recent survey in late 2023 indicated that while overall trust in Brazilian banks is recovering, transparency in fees and loan processes remains a key area of focus for customers. Daycoval's ability to consistently demonstrate reliability and prioritize customer service is therefore paramount to its sustained growth in a dynamic financial landscape.

Maintaining a sterling reputation is not just about avoiding negative press; it's about actively cultivating a perception of integrity and fairness. For Daycoval, this means transparent communication regarding its services and a commitment to ethical conduct in all its dealings. In 2024, Brazilian regulators have continued to emphasize consumer protection, making adherence to these standards even more critical. Banks that proactively address customer concerns and demonstrate a genuine commitment to their well-being are better positioned to build enduring trust.

The perceived fairness of banking practices significantly shapes public opinion. Daycoval must ensure its product offerings and customer interactions are viewed as equitable and beneficial. For instance, the interest rates offered on loans and the clarity of contract terms are frequently scrutinized by consumers. By focusing on clear communication and competitive, transparent pricing, Daycoval can solidify its reputation as a trustworthy financial partner.

Sociological factors significantly influence Daycoval Bank's operational landscape in Brazil. The banking sector's reputation is crucial, with consumer trust directly impacting customer acquisition and retention. In late 2023, surveys showed that while trust in Brazilian banks is improving, transparency in fees and loan processes remains a primary concern for customers.

Daycoval's commitment to ethical conduct and transparent communication is vital for building and maintaining this trust. By adhering to evolving consumer protection regulations, which intensified in 2024, the bank can solidify its image as a reliable financial partner. Perceived fairness in pricing and contract clarity are key drivers of this perception.

The demographic shift towards an aging population presents a growing demand for retirement planning and long-term financial products. By 2025, the proportion of Brazilians aged 65 and over is projected to reach approximately 14.3%, highlighting a significant market opportunity for Daycoval to develop specialized offerings.

| Sociological Factor | Impact on Daycoval | 2024/2025 Data Point |

|---|---|---|

| Consumer Trust & Reputation | Affects customer acquisition and retention. | Late 2023: Transparency in fees and loan processes a key customer concern. |

| Demographic Shifts (Aging Population) | Drives demand for retirement and long-term financial products. | 2025 Projection: ~14.3% of Brazil's population aged 65+. |

| Digital Adoption & Behavior | Necessitates enhanced mobile banking and digital payment solutions. | End of 2024 Projection: >80% of Brazilians actively using smartphones for financial management. |

| Income Inequality | Shapes demand for diverse financial products and impacts credit risk. | 2024: Brazil's Gini coefficient remained a concern, indicating wealth disparity. |

Technological factors

The financial sector is rapidly shifting towards digital channels, with mobile banking and online platforms becoming increasingly crucial for customer engagement. Daycoval must prioritize investments in its digital infrastructure to meet the growing demand for convenient, accessible banking services. This includes enhancing its mobile app and online portal to offer a seamless experience for both individual and corporate customers.

In 2023, Brazil saw a significant increase in digital banking adoption, with over 70% of financial transactions conducted through digital channels, according to data from the Central Bank of Brazil. Daycoval's strategic focus on digital innovation positions it to capture this expanding market share by providing intuitive and secure mobile banking solutions that cater to the evolving preferences of its customer base.

Brazil's fintech sector is experiencing explosive growth, with digital payments and lending platforms leading the charge. This dynamic environment presents significant opportunities for banks like Daycoval, but also intensifies competition.

Fintechs are agile, often offering highly specialized services that can outmaneuver traditional banking models. To stay competitive, Daycoval must embrace innovation, potentially exploring strategic partnerships or acquisitions of fintech companies to integrate their advanced digital capabilities.

For instance, Pix, Brazil's instant payment system, has seen widespread adoption, processed over R$10.7 trillion in 2023 alone, highlighting the shift towards digital transactions and creating a fertile ground for fintech innovation that banks must adapt to.

Brazil's Open Banking initiative, launched in phases starting in February 2021, is evolving into Open Finance, aiming to foster greater data sharing and interoperability among financial institutions. This technological shift mandates that banks like Daycoval adapt their IT infrastructure and data management practices to accommodate secure API-driven data exchange, enabling more personalized financial products and services for consumers.

By mid-2024, Open Finance in Brazil is expected to cover a broader range of financial services beyond basic account information, including credit, investments, and insurance. This expansion presents Daycoval with opportunities to innovate and offer tailored solutions, but also requires significant investment in cybersecurity and data analytics capabilities to remain competitive and compliant with evolving regulations.

Cybersecurity and Data Security

The increasing reliance on digital platforms for financial transactions makes robust cybersecurity and data security absolutely critical for Daycoval Bank. Protecting sensitive customer information and financial operations from evolving cyber threats is a non-negotiable investment. A significant data breach could not only lead to substantial financial losses and legal penalties but also irreparably damage the bank's reputation and customer trust. For instance, global cybersecurity spending was projected to reach over $270 billion in 2024, highlighting the immense scale of this challenge and investment area.

Daycoval must prioritize continuous investment in advanced security technologies and protocols to safeguard against sophisticated cyberattacks. This includes measures like multi-factor authentication, encryption, and regular security audits. The bank's commitment to data security directly impacts its ability to maintain customer confidence and operational continuity in an increasingly digital financial landscape.

- Cybersecurity Investment: Global cybersecurity spending is expected to exceed $270 billion in 2024, underscoring the critical need for financial institutions like Daycoval to allocate significant resources to protect digital assets.

- Data Breach Impact: The average cost of a data breach globally reached $4.45 million in 2024, a figure that emphasizes the severe financial consequences Daycoval could face from security failures.

- Customer Trust: Maintaining strong data security is paramount for preserving customer trust, which is a key differentiator in the competitive banking sector.

Artificial Intelligence (AI) and Automation

The increasing integration of Artificial Intelligence (AI) and automation is reshaping the banking sector, offering Daycoval Bank significant opportunities to boost operational efficiency and refine risk management. By employing AI for tasks like credit scoring and fraud detection, Daycoval can streamline its processes, leading to more competitive and personalized customer service offerings. For instance, in 2024, financial institutions globally are investing heavily in AI-driven fraud detection systems, with some reporting a reduction in fraudulent transactions by up to 20%.

The Central Bank is actively observing the deployment of AI within the financial system, indicating a regulatory landscape that will likely evolve to address these technological advancements. This oversight ensures that AI adoption aligns with financial stability and consumer protection goals. By 2025, it's projected that AI will handle over 60% of customer service inquiries in the banking sector, a substantial increase from previous years.

Daycoval can strategically leverage AI to enhance its competitive edge. This includes implementing AI-powered chatbots for instant customer support, which can handle a high volume of queries, freeing up human agents for more complex issues. Furthermore, AI's predictive analytics capabilities can assist in identifying potential credit risks more accurately, thereby improving loan portfolio quality. The global AI in banking market was valued at approximately $10 billion in 2023 and is expected to grow significantly by 2025, underscoring the widespread adoption and perceived value of these technologies.

Technological advancements are fundamentally reshaping banking, pushing Daycoval towards enhanced digital offerings and robust cybersecurity. The rapid growth of digital transactions in Brazil, with over 70% conducted digitally in 2023, underscores the need for superior mobile and online platforms. Daycoval's strategic investment in AI and automation, expected to handle over 60% of customer service inquiries by 2025, aims to improve efficiency and personalize services.

| Technology Area | 2023/2024 Data/Projection | Impact on Daycoval |

|---|---|---|

| Digital Banking Adoption | Over 70% of financial transactions in Brazil were digital in 2023. | Increased demand for seamless mobile and online banking experiences. |

| AI in Banking | AI projected to handle >60% of customer service inquiries by 2025. Global AI in banking market valued at ~$10 billion in 2023. | Opportunities for operational efficiency, improved fraud detection, and personalized customer service. |

| Cybersecurity Spending | Global cybersecurity spending projected to exceed $270 billion in 2024. Average cost of a data breach reached $4.45 million in 2024. | Critical need for significant investment to protect customer data and maintain trust. |

| Open Finance | Expansion to include credit, investments, and insurance by mid-2024. | Requires IT infrastructure adaptation for data sharing and offers opportunities for tailored financial products. |

Legal factors

Daycoval operates within Brazil's intricate banking regulatory landscape, governed by the Central Bank of Brazil (BCB) and the National Monetary Council (CMN). These bodies impose strict prudential standards designed to safeguard financial stability, ensuring banks maintain adequate capital and robust risk management practices. For instance, in 2024, the BCB continued its focus on strengthening capital requirements, with ongoing discussions around Basel III finalization impacting Brazilian banks.

The regulatory environment is dynamic, with new rules scheduled to be implemented between 2025 and 2028. These upcoming regulations will likely necessitate further adjustments in Daycoval's capital adequacy ratios and operational frameworks, reflecting global trends in banking supervision. For example, the ongoing implementation of IFRS 17, effective from 2025, will significantly alter how insurance contracts are accounted for, impacting financial reporting and potentially capital calculations for institutions with insurance-related activities.

Consumer protection laws are a significant legal factor for Daycoval Bank, particularly concerning its retail banking services like personal and payroll-deductible loans. These regulations mandate fair practices, clear disclosure of terms, and responsible lending, all crucial for maintaining customer confidence and avoiding legal repercussions. For instance, in 2024, Brazil's Central Bank continued to emphasize stringent consumer protection measures, with fines for non-compliance potentially reaching millions of Reais, directly affecting financial institutions like Daycoval.

Brazil's General Data Protection Law (LGPD) mandates stringent controls over personal data processing. Daycoval, dealing with extensive customer information, must adhere to LGPD's requirements for data collection, storage, usage, and cross-border transfers. Recent updates in 2024 and 2025 further refine these obligations.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Regulations

Daycoval Bank, like all financial institutions, operates under strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These rules are designed to prevent illegal financial activities and ensure the integrity of the financial system. Compliance is a continuous process, requiring strong internal controls, diligent reporting of any suspicious transactions, and keeping pace with ever-changing global and national standards. For instance, the Central Bank of Brazil has been actively emphasizing transparency and robust AML-CTF compliance, particularly with the introduction of new regulations for virtual assets, impacting how institutions like Daycoval manage digital transactions.

Meeting these regulatory demands involves significant investment in technology and personnel. Daycoval must implement sophisticated systems for customer due diligence, transaction monitoring, and suspicious activity reporting. Failure to comply can result in substantial fines and reputational damage. In 2023, global AML fines reached record highs, underscoring the critical nature of these regulations for financial entities worldwide.

- Regulatory Scrutiny: Financial institutions face intense scrutiny regarding AML and CTF compliance to combat financial crime.

- Compliance Measures: Robust internal controls, transaction monitoring, and reporting of suspicious activities are mandated.

- Evolving Standards: Continuous adaptation to new international and national regulations, including those for virtual assets, is essential.

- Central Bank Focus: The Central Bank prioritizes transparency and adherence to AML-CTF standards, especially concerning digital assets.

Taxation on Financial Operations (IOF)

Changes to Brazil's Tax on Financial Operations (IOF) directly influence the cost of credit and foreign exchange activities for institutions like Daycoval Bank. For instance, adjustments to IOF rates, particularly those implemented or planned for 2025, can significantly alter Daycoval's net interest margins and the overall appeal of its loan and currency exchange offerings to customers.

Recent legislative proposals and discussions surrounding IOF in Brazil indicate a potential for shifts in these tax burdens. While specific 2025 rates are subject to finalization, the trend suggests a dynamic regulatory environment. For example, discussions in late 2024 have touched upon potential modifications to IOF on credit operations, which could increase the cost for borrowers and, consequently, impact Daycoval's loan volume and profitability.

- IOF Impact on Credit: Alterations in IOF rates directly affect the effective interest rates on loans offered by Daycoval, influencing client borrowing decisions.

- Foreign Exchange Costs: IOF on foreign exchange transactions impacts the cost of international trade and investment for Daycoval's corporate clients.

- Profitability Sensitivity: Daycoval's profitability is sensitive to changes in IOF, as these taxes can reduce transaction volumes or necessitate adjustments in pricing strategies.

- Regulatory Monitoring: Continuous monitoring of IOF legislation and potential rate changes is crucial for Daycoval's financial planning and risk management.

Daycoval Bank operates under Brazil's stringent legal framework, heavily influenced by the Central Bank of Brazil (BCB) and the National Monetary Council (CMN). These bodies enforce capital adequacy, risk management, and consumer protection. For instance, in 2024, the BCB continued its focus on Basel III finalization, impacting capital requirements for banks like Daycoval.

New regulations, scheduled between 2025 and 2028, will necessitate further adjustments, including the implementation of IFRS 17 from 2025, which will alter insurance contract accounting. Daycoval must also adhere to Brazil's General Data Protection Law (LGPD), with updated requirements in 2024 and 2025, governing customer data handling.

The bank faces significant legal obligations regarding Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF). The BCB's emphasis on transparency, particularly with new virtual asset regulations, demands robust compliance measures. Global AML fines reached record highs in 2023, highlighting the critical nature of these regulations.

Changes to Brazil's Tax on Financial Operations (IOF) also directly impact Daycoval, affecting credit costs and foreign exchange activities. Potential IOF rate adjustments planned for 2025 could alter net interest margins and loan appeal.

Environmental factors

Climate change is intensifying extreme weather events, presenting significant physical risks to financial institutions like Daycoval. These events can disrupt businesses, impacting borrowers' capacity to repay loans and potentially devaluing assets held by the bank.

Daycoval must integrate these physical climate risks into its lending and investment strategies to ensure resilience. The Central Bank of Brazil (BCB) has mandated that banks account for losses stemming from climate-related risks, a requirement in place since 2022, underscoring the growing regulatory focus on this area.

The global shift to a low-carbon economy creates transition risks for financial institutions like Daycoval Bank. Policy shifts, like carbon pricing or stricter emissions standards, can negatively impact industries dependent on fossil fuels, potentially affecting their ability to repay loans.

Technological advancements in renewable energy and electric vehicles, while positive long-term, can disrupt traditional sectors, altering the credit profiles of companies in those areas. For instance, the automotive industry's pivot away from internal combustion engines presents credit risks for manufacturers and suppliers heavily invested in older technologies.

Market sentiment is also evolving, with investors increasingly favoring sustainable businesses. This can lead to divestment from carbon-intensive industries, impacting their market valuations and access to capital, which in turn affects their creditworthiness and how banks assess their risk.

Financial institutions are now under greater pressure to disclose their climate-related risks and outline credible transition plans. For example, by the end of 2024, many European banks are expected to have robust climate disclosure frameworks in place, influencing how Daycoval Bank might need to report its exposure to transition risks.

The global push for Environmental, Social, and Governance (ESG) investing is accelerating, with investors increasingly prioritizing sustainability alongside financial performance. This trend is deeply impacting the banking sector, including in Brazil.

Major Brazilian financial institutions are actively expanding their ESG-focused offerings. For instance, by the end of 2023, several leading banks reported significant growth in green and sustainable financing portfolios, with some aiming for double-digit increases in 2024. This indicates a strong market demand for financial products that align with environmental and social values.

Daycoval Bank has a clear opportunity to capitalize on this momentum. By developing and promoting sustainable finance products, such as green bonds or loans for renewable energy projects, the bank can attract a growing segment of environmentally conscious investors and clients. This strategic alignment with ESG principles can enhance Daycoval's brand reputation and open new avenues for growth in a rapidly evolving financial landscape.

Natural Resource Management and Biodiversity

Brazil's vast natural resources and biodiversity present significant environmental management challenges. Daycoval Bank, like other financial institutions, faces increasing pressure to ensure its financing activities do not negatively impact ecosystems. This includes scrutinizing projects that could contribute to deforestation or habitat loss, a critical aspect of environmental, social, and governance (ESG) considerations.

The bank's lending policies are evolving to incorporate biodiversity risk assessments. This proactive approach is becoming essential as investors and regulators demand greater accountability for environmental stewardship.

- Deforestation Concerns: Brazil's Amazon rainforest, a global biodiversity hotspot, faces ongoing deforestation pressures, with reports indicating significant land clearing in recent years. For instance, data from Brazil's National Institute for Space Research (INPE) showed a concerning increase in deforestation rates in the Amazon during early 2024 compared to previous periods.

- Biodiversity Risk Integration: Financial institutions are increasingly expected to integrate biodiversity risks into their credit analysis and portfolio management, recognizing the potential financial implications of ecosystem degradation.

- ESG Investor Demand: There's a growing trend of investors prioritizing companies with strong ESG performance, which includes robust natural resource management and biodiversity protection strategies.

- Regulatory Landscape: Evolving environmental regulations in Brazil and internationally will likely impose stricter requirements on banks regarding the environmental impact of their financed activities.

Regulatory Focus on Climate Risk Disclosure

The Central Bank of Brazil is intensifying its scrutiny of climate risk disclosure, proposing new regulations to harmonize Brazil's reporting on social, environmental, and climate factors with global benchmarks. This regulatory shift means Daycoval Bank must bolster its reporting capabilities and embed climate-related risks and opportunities directly into its financial statements.

This heightened focus on environmental, social, and governance (ESG) factors is a significant trend. For instance, by the end of 2024, many financial institutions are expected to have more robust frameworks for assessing and reporting climate-related financial risks, a move driven by both regulatory pressure and investor demand for greater transparency.

Daycoval's strategic response will likely involve:

- Enhancing data collection and analysis for climate-related impacts.

- Integrating climate risk assessments into existing risk management frameworks.

- Developing clear and consistent reporting that meets evolving international standards.

- Communicating climate strategies to stakeholders to build confidence and attract investment.

Daycoval Bank must navigate the increasing impacts of climate change, which manifest as both physical risks from extreme weather and transition risks as the economy shifts towards lower carbon emissions. The Central Bank of Brazil's mandate for banks to account for climate-related losses, effective since 2022, highlights the growing regulatory imperative. Furthermore, evolving investor preferences for ESG-aligned businesses are reshaping market dynamics, pushing financial institutions to integrate sustainability into their core strategies.

Brazil's rich biodiversity presents unique environmental management challenges, requiring Daycoval to assess and mitigate the risks associated with financing projects that could impact ecosystems, such as deforestation. This aligns with a broader global trend where investors increasingly favor companies demonstrating strong environmental stewardship, making biodiversity risk integration a critical component of modern financial analysis.

The regulatory environment for climate risk disclosure is tightening, with the Central Bank of Brazil pushing for harmonization with global standards, compelling banks like Daycoval to enhance their reporting capabilities. This increased transparency is driven by both regulatory pressure and investor demand for clear insights into climate-related financial risks and opportunities.

PESTLE Analysis Data Sources

Our Daycoval Bank PESTLE Analysis is meticulously constructed using data from official Brazilian government bodies, reputable financial institutions, and leading economic research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.