Daycoval Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daycoval Bank Bundle

Daycoval Bank navigates a competitive landscape shaped by moderate bargaining power of buyers and suppliers, reflecting the industry's maturity. The threat of new entrants is somewhat mitigated by regulatory hurdles and capital requirements, while the threat of substitutes remains a constant consideration in the evolving financial services sector.

The complete report reveals the real forces shaping Daycoval Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Daycoval Bank's access to a broad range of capital and funding sources significantly diminishes supplier power. For instance, the bank's partnerships with international entities such as the IFC provide alternative funding avenues, lessening reliance on any single capital provider.

The bank's diversified funding structure, which includes attracting retail clients and engaging with both domestic and international institutional investors, further bolsters its position. This broad access means Daycoval isn't beholden to the terms of a limited number of lenders or investors, thereby curtailing their bargaining leverage.

As Brazilian banks, including Daycoval, ramp up investments in cutting-edge technologies like artificial intelligence and cloud computing, specialized technology and infrastructure providers are positioned to gain some influence. In 2024, the Brazilian financial sector saw significant digital transformation initiatives, with banks allocating substantial budgets to modernize their systems and enhance customer experience through technology.

However, this widespread adoption of advanced technologies across the banking landscape also fosters a competitive environment among these tech suppliers. The presence of multiple capable providers offering similar solutions, from AI platforms to cloud infrastructure, tends to dilute the individual bargaining power of any single supplier, creating a more balanced dynamic with the banks.

The bargaining power of suppliers, particularly concerning human capital and specialized talent, plays a significant role for Daycoval Bank. The availability of skilled financial professionals and IT talent directly influences the cost and quality of services offered by the bank.

In Brazil's dynamic banking sector, there's a robust demand for IT professionals. However, the overall labor market dynamics, coupled with the presence of numerous educational institutions, can help moderate the bargaining power of suppliers in this segment. For instance, in 2024, Brazil's IT sector experienced a notable increase in graduates, potentially easing the pressure on specialized talent acquisition costs for banks like Daycoval.

Regulatory Bodies and Compliance Services

The Central Bank of Brazil (BCB) and other regulatory bodies are significant suppliers, dictating the operational framework for banks like Daycoval. Their mandates are non-negotiable, meaning Daycoval has little to no power to influence these fundamental rules.

The increasing need for specialized RegTech and compliance services grants these providers a degree of bargaining power. As of early 2024, the financial sector's investment in compliance technology continues to rise, driven by evolving regulations and the need for efficient risk management.

- Regulatory Authority: The BCB's directives are binding, limiting Daycoval's ability to negotiate terms of operation.

- Compliance Demand: Growing regulatory complexity fuels demand for RegTech, potentially increasing supplier leverage.

- Market Trends: Global spending on RegTech was projected to reach tens of billions of dollars by 2024, highlighting the market's significance.

Payment System Providers (e.g., Pix)

The Central Bank of Brazil's introduction of Pix in November 2020 significantly altered the payment landscape. This instant payment system, adopted by over 137 million people and 11.9 million businesses by early 2024, offers a low-cost alternative for transactions.

For banks like Daycoval, the widespread adoption and government backing of Pix diminish the individual bargaining power of other payment processing suppliers. Banks must integrate with Pix to remain competitive, reducing their reliance on and negotiation leverage with alternative providers.

- Pix Adoption: Over 137 million individuals and 11.9 million businesses were using Pix by early 2024, highlighting its dominance.

- Cost Efficiency: Pix offers a significantly lower transaction cost compared to traditional payment methods, pressuring other providers.

- Central Bank Control: As a system mandated and regulated by the Central Bank, Pix reduces the autonomy and pricing power of individual payment service providers.

- Competitive Pressure: The ubiquity of Pix forces banks to prioritize its integration, thereby weakening their bargaining position with other, less essential payment system suppliers.

Daycoval Bank's diverse funding sources, including retail deposits and institutional investors, significantly dilute the bargaining power of capital providers. The widespread adoption of Brazil's Pix system also reduces reliance on traditional payment processors, further limiting supplier leverage in that area.

While technological advancements create opportunities for specialized IT suppliers, the competitive landscape among these providers moderates their individual influence. Similarly, the ample supply of IT talent in Brazil in 2024 helps to balance the bargaining power of human capital suppliers.

The Central Bank of Brazil (BCB) acts as a powerful supplier, dictating operational frameworks with non-negotiable mandates, leaving Daycoval with no room for negotiation on these fundamental rules.

The increasing demand for RegTech solutions grants these specialized providers a degree of bargaining power, as financial sector investments in compliance technology continued to rise in early 2024.

| Supplier Type | Bargaining Power | Key Factors |

| Capital Providers | Low | Diversified funding, access to international markets |

| Technology Providers (IT/Cloud) | Moderate | Competition among suppliers, increasing demand for digital transformation |

| Human Capital (IT/Financial Talent) | Moderate | Robust IT sector growth, increasing number of graduates |

| Regulatory Bodies (BCB) | Very High | Mandatory compliance, non-negotiable directives |

| Payment Processors | Low | Dominance of Pix, low-cost alternative |

| RegTech Providers | Moderate to High | Growing regulatory complexity, increased investment in compliance |

What is included in the product

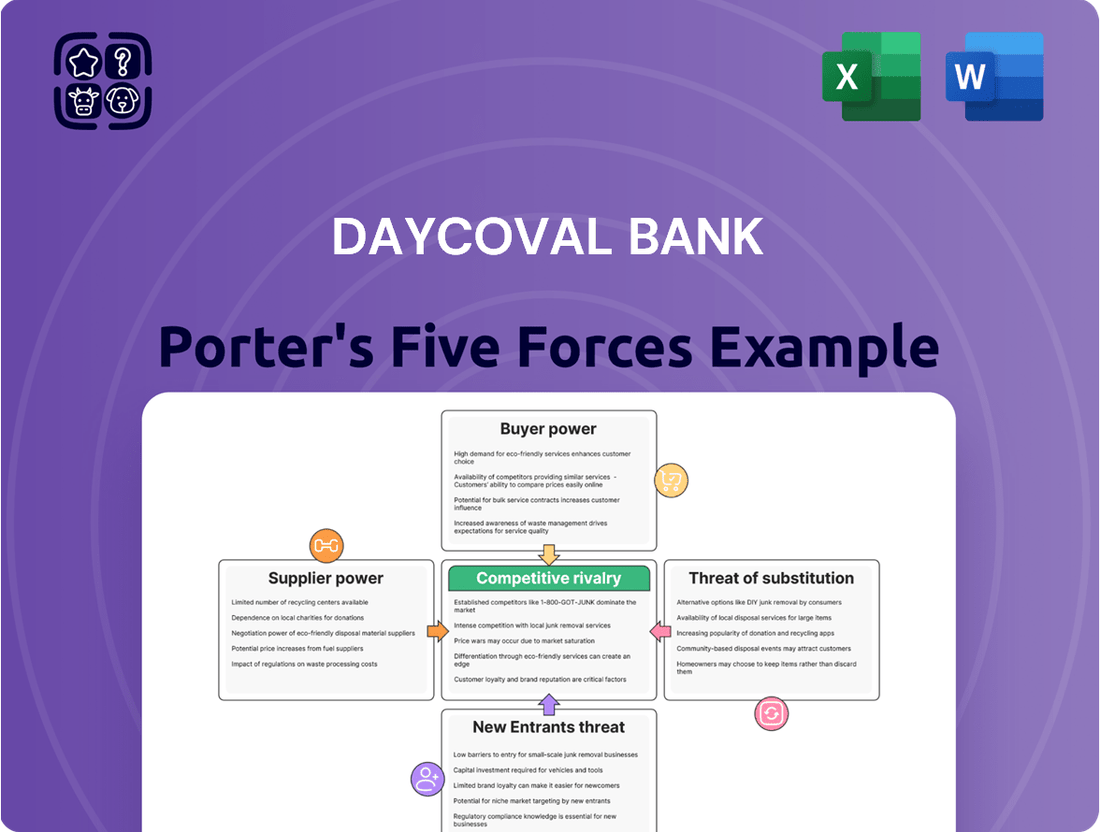

This analysis dissects the competitive landscape for Daycoval Bank, examining the intensity of rivalry, the bargaining power of customers and suppliers, and the threats from new entrants and substitute products.

Daycoval Bank's Five Forces Analysis provides a clear, one-sheet summary of all competitive forces, perfect for quick, informed strategic decision-making.

Instantly understand strategic pressure points with a powerful spider/radar chart, allowing for rapid identification of areas needing attention.

Customers Bargaining Power

Daycoval Bank's diverse customer base, encompassing small, medium, and large enterprises, alongside institutional investors and individual clients, significantly mitigates the bargaining power of any single customer segment. This broad client spectrum means the bank isn't disproportionately dependent on any one group, diffusing concentrated power. For instance, in 2023, Daycoval's loan portfolio reflected this diversity, with a substantial portion allocated to small and medium-sized businesses, a key segment that benefits from the bank's tailored financial solutions.

Customers in Brazil face a robust banking sector with numerous choices, significantly impacting their bargaining power. This includes established giants like Itaú Unibanco and Bradesco, alongside rapidly expanding fintech players such as Nubank and C6 Bank, offering diverse services and competitive pricing.

The proliferation of these alternatives, particularly in high-demand areas like personal loans and payroll-deductible credit, empowers consumers. For instance, as of early 2024, Brazil's fintech sector continued its aggressive growth, with companies like Nubank reporting millions of active customers, creating a highly competitive environment for traditional banks.

Brazil's Open Finance initiative is a significant driver of increased customer bargaining power. By mandating data sharing among financial institutions, it places greater control of financial information directly into the hands of consumers.

This transparency allows customers to readily compare products and services from various banks, making it easier to identify the best deals. For instance, as of early 2024, the number of customers sharing their data through Open Finance in Brazil has been steadily growing, indicating a heightened awareness and utilization of this empowered position.

With a clearer view of market offerings and a simpler way to switch providers, customers are better equipped to negotiate for improved rates, lower fees, and more favorable terms, directly impacting the bargaining power they hold against financial institutions like Daycoval Bank.

Switching Costs

Switching costs for banking customers, while historically a barrier, are diminishing thanks to digital advancements. Many banks in 2024 offer streamlined online account opening and fund transfer processes, significantly lowering the administrative burden of moving accounts. This ease of transition empowers customers to seek better deals.

The reduced friction in switching banks means customers can more readily shift their business to competitors offering superior interest rates, lower fees, or more convenient digital services. For instance, a customer might find it takes mere minutes to open a new account online and initiate a transfer, compared to the more involved processes of the past.

- Reduced Administrative Effort: Digital platforms simplify account opening and fund transfers.

- Increased Customer Mobility: Lower switching costs encourage customers to explore competitive offerings.

- Impact on Pricing: Banks may need to offer more attractive terms to retain customers who can easily switch.

Sensitivity to Price and Service Quality

Customers, especially those with significant capital or borrowing needs, are acutely aware of pricing and service. For Daycoval Bank, this translates to a strong focus on competitive interest rates for loans and deposits, as well as efficient and responsive customer service. For instance, in 2024, the average interest rate on personal loans in Brazil hovered around 8% per month, a benchmark Daycoval must consider.

The bank's success in attracting and retaining these discerning clients hinges on its capacity to deliver attractive credit products and a comprehensive suite of financial services. Failing to meet customer expectations on these fronts can lead to a swift migration to competitors, particularly in a market where digital banking solutions are increasingly prevalent and accessible.

- Price Sensitivity: Customers actively compare interest rates on loans and savings accounts across different institutions.

- Service Quality: The speed of loan approvals, the ease of digital transactions, and the availability of personalized advice are key differentiators.

- Competitive Landscape: Daycoval operates in a market where numerous banks and fintechs vie for customer attention, intensifying price and service pressures.

- Client Retention: Offering tailored solutions and superior customer experience is vital to preventing customer churn in 2024.

Daycoval Bank's diverse customer base, encompassing small, medium, and large enterprises, alongside institutional investors and individual clients, significantly mitigates the bargaining power of any single customer segment. This broad client spectrum means the bank isn't disproportionately dependent on any one group, diffusing concentrated power. For instance, in 2023, Daycoval's loan portfolio reflected this diversity, with a substantial portion allocated to small and medium-sized businesses, a key segment that benefits from the bank's tailored financial solutions.

Customers in Brazil face a robust banking sector with numerous choices, significantly impacting their bargaining power. This includes established giants like Itaú Unibanco and Bradesco, alongside rapidly expanding fintech players such as Nubank and C6 Bank, offering diverse services and competitive pricing. Brazil's Open Finance initiative is a significant driver of increased customer bargaining power, allowing customers to readily compare products and services from various banks, making it easier to identify the best deals. As of early 2024, the number of customers sharing their data through Open Finance in Brazil has been steadily growing, indicating a heightened awareness and utilization of this empowered position.

Switching costs for banking customers are diminishing thanks to digital advancements, with many banks in 2024 offering streamlined online account opening and fund transfer processes. This ease of transition empowers customers to seek better deals, potentially shifting their business to competitors offering superior interest rates, lower fees, or more convenient digital services. For instance, a customer might find it takes mere minutes to open a new account online and initiate a transfer, compared to the more involved processes of the past.

Customers, especially those with significant capital or borrowing needs, are acutely aware of pricing and service. For Daycoval Bank, this translates to a strong focus on competitive interest rates for loans and deposits, as well as efficient and responsive customer service. For example, in 2024, the average interest rate on personal loans in Brazil hovered around 8% per month, a benchmark Daycoval must consider to retain clients.

| Factor | Description | Impact on Daycoval | 2024 Data Point |

| Customer Concentration | Broad customer base reduces reliance on any single segment. | Lowers individual customer bargaining power. | Daycoval's 2023 loan portfolio showed significant diversification across SMEs and other segments. |

| Availability of Substitutes | Numerous competitors (traditional banks and fintechs) offer similar services. | Increases customer bargaining power due to choice. | Nubank reported millions of active customers by early 2024, highlighting fintech growth. |

| Switching Costs | Digital advancements are reducing the effort required to switch banks. | Empowers customers to seek better terms, increasing bargaining power. | Online account opening and fund transfers are now significantly streamlined. |

| Price Sensitivity | Customers actively compare rates and fees. | Pressures Daycoval to offer competitive pricing and service. | Average personal loan interest rates in Brazil were around 8% monthly in 2024. |

Preview Before You Purchase

Daycoval Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Daycoval Bank Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the institution. You're looking at the actual document; once your purchase is complete, you’ll get instant access to this exact, fully formatted file, offering immediate insights into the bank's industry dynamics.

Rivalry Among Competitors

Daycoval Bank faces intense competition from Brazil's dominant traditional banks such as Itaú Unibanco, Bradesco, and Banco do Brasil. These giants boast vast branch networks, extensive customer loyalty, and substantial financial muscle, directly challenging Daycoval across its core services, from corporate finance to consumer credit.

The Brazilian financial landscape is experiencing a significant shift with the rapid ascent of fintechs and digital banks. Companies like Nubank and PicPay are disrupting traditional banking by offering innovative, cost-effective, and highly accessible services. This surge in digital-first players is dramatically increasing competitive pressure, especially within the retail banking sector, impacting areas such as personal loans and payroll-deductible credit.

These agile competitors are directly challenging established institutions like Daycoval Bank by leveraging technology to reduce operational costs and provide superior customer experiences. For instance, by Q1 2024, Nubank reported over 100 million customers across Latin America, showcasing the scale of their reach and the rapid adoption of digital banking solutions. This intense rivalry forces incumbents to accelerate their own digital transformation efforts to remain competitive.

Daycoval Bank's strategy of both specializing in corporate lending and diversifying into areas like investment banking, asset management, foreign exchange, and retail products means it contends with a broad range of competitors. This dual approach places Daycoval in competition within numerous specialized financial segments, where other banks and financial institutions offer similar services.

For instance, in the corporate lending space, Daycoval faces rivals like Banco do Brasil and Itaú Unibanco, which also have significant corporate client bases. In 2023, the Brazilian banking sector saw continued competition, with major players reporting strong net income figures, indicating robust market activity and intense rivalry across all service lines.

Market Growth and Economic Conditions

Brazil's loan market is showing consistent expansion, a trend that naturally invites new participants and consequently heightens competition among existing banks like Daycoval. This growth means more institutions vying for the same customer base, potentially leading to price wars or increased marketing efforts.

Economic conditions play a crucial role in shaping this competitive landscape. For instance, fluctuating interest rates directly impact the cost of lending and the profitability of loan portfolios. In 2024, Brazil's Selic rate, a key benchmark, has seen adjustments, influencing credit demand and the overall competitive intensity within the banking sector. Inflation also affects consumer purchasing power and businesses' ability to repay loans, further complicating the competitive environment.

- Brazil's Gross Domestic Product (GDP) growth projections for 2024 indicate a moderate expansion, supporting loan demand.

- The Central Bank of Brazil's monetary policy decisions, particularly regarding the Selic rate, directly influence lending margins and competitive pricing strategies.

- Inflationary pressures in Brazil during 2024 can impact borrower affordability and increase the risk profile of loan portfolios, affecting competitive dynamics.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) are shaping the Brazilian financial sector, influencing competitive dynamics. For instance, Daycoval's acquisition of BMG Seguros in 2023 exemplifies this trend, demonstrating a strategic move to expand its offerings and market presence. Such consolidation can lead to the emergence of larger, more formidable competitors, intensifying rivalry for all players.

This consolidation activity directly impacts competitive rivalry by creating entities with greater scale and broader service portfolios. For Daycoval, integrating BMG Seguros allows for cross-selling opportunities and a more diversified revenue stream, potentially strengthening its position against other banks. The ongoing M&A landscape suggests a market where strategic combinations are key to maintaining or improving competitive standing.

- Daycoval's acquisition of BMG Seguros in 2023: This move aimed to bolster Daycoval's insurance segment and expand its financial services ecosystem.

- Market Consolidation Trend: The Brazilian banking sector has witnessed a trend towards consolidation, with larger institutions often acquiring smaller or specialized players to enhance market share and operational efficiency.

- Impact on Rivalry: Increased M&A activity can lead to fewer, but stronger, competitors, thereby heightening the intensity of competition for market share and customer acquisition.

- Diversification and Scale Benefits: Acquired entities often provide immediate access to new customer bases, product lines, and geographic regions, granting the acquiring bank greater scale and diversification.

Daycoval Bank operates in a highly competitive Brazilian market, facing pressure from both established traditional banks and agile fintechs. Major players like Itaú Unibanco and Bradesco possess significant market share and resources, while digital disruptors such as Nubank are rapidly gaining traction, particularly in retail banking.

This intense rivalry is further fueled by Brazil's expanding loan market and evolving economic conditions, including fluctuating interest rates and inflation, which impact pricing and profitability. Strategic moves like Daycoval's acquisition of BMG Seguros in 2023 highlight the ongoing consolidation trend, where larger entities aim to enhance scale and diversify offerings, thereby intensifying competition.

| Competitor Type | Key Players | Impact on Daycoval |

|---|---|---|

| Traditional Banks | Itaú Unibanco, Bradesco, Banco do Brasil | Direct competition across all service lines, leveraging large customer bases and branch networks. |

| Fintechs/Digital Banks | Nubank, PicPay | Disrupting retail banking with lower costs and innovative digital solutions, forcing digital acceleration. |

| Specialized Financial Institutions | Various players in corporate lending, investment banking, etc. | Competition within specific segments, requiring Daycoval to maintain specialization and diversification. |

SSubstitutes Threaten

The threat of substitutes for traditional bank lending is significant, especially for larger corporations. These companies can increasingly tap into capital markets directly. For instance, in 2024, the issuance of corporate debentures and commercial paper by Brazilian companies continued to grow, offering an alternative to bank loans. This bypasses the need for intermediaries like Daycoval Bank, directly accessing funds from investors.

Peer-to-peer (P2P) lending platforms represent a significant threat of substitutes for Daycoval Bank, particularly in its retail and small and medium-sized enterprise (SME) lending segments. These platforms provide individuals and businesses with direct access to capital from individual investors, bypassing traditional financial institutions. This disintermediation offers a more streamlined and potentially faster application process, appealing to borrowers seeking alternatives to conventional bank loans.

The fintech sector's rapid expansion fuels the growth of P2P lending. In 2023, the global P2P lending market was valued at approximately $113.6 billion and is projected to reach $227.7 billion by 2028, demonstrating a compound annual growth rate of over 15%. This substantial growth indicates a rising acceptance of these platforms as viable substitutes for traditional banking services, directly impacting Daycoval's market share in lending.

Established companies with robust financial health can leverage internal cash flow and retained earnings to fund operations and growth, presenting a significant substitute for traditional corporate lending from banks like Daycoval. This self-sufficiency diminishes their reliance on external credit facilities.

For instance, in 2024, many large Brazilian corporations demonstrated strong cash generation, with some sectors reporting improved profitability, allowing them to finance capital expenditures internally rather than seeking bank loans. This trend directly impacts the demand for Daycoval's corporate credit products.

Alternative Investment Vehicles

Investors can bypass traditional banking services by directly investing in assets like real estate or private equity funds, offering an alternative to savings accounts and managed portfolios. In 2024, global alternative investment assets under management were projected to reach over $20 trillion, highlighting a significant shift away from conventional banking products.

These substitute investments, often managed by specialized firms rather than banks, can provide potentially higher returns and greater control over investment strategies. For instance, the global private equity market saw significant deal activity in 2024, with total capital raised by private equity funds reaching hundreds of billions.

- Direct Real Estate Investment: Offers tangible asset ownership, bypassing bank-managed property funds.

- Private Equity and Venture Capital: Allows direct participation in high-growth companies, often with higher risk/reward profiles than bank deposits.

- Hedge Funds and Managed Futures: Provide alternative strategies for portfolio diversification, managed by specialized external managers.

- Cryptocurrencies and Digital Assets: Represent a rapidly growing class of assets offering decentralized investment opportunities outside traditional financial institutions.

Cryptocurrencies and Digital Assets

The rise of cryptocurrencies and digital assets presents a potential threat of substitution for traditional banking services. These digital alternatives offer new avenues for transactions and investments, potentially bypassing established financial intermediaries.

The Central Bank of Brazil's exploration of a digital Brazilian Real, known as DREX, further amplifies this threat. By the end of 2024, DREX is expected to be fully operational, providing a government-backed digital currency that could streamline payments and offer investment opportunities, directly competing with services offered by banks like Daycoval.

- Digital Asset Growth: The global cryptocurrency market capitalization reached approximately $2.6 trillion in early 2024, indicating significant adoption and a growing appetite for digital alternatives.

- DREX Development: Brazil's Central Bank has been actively testing DREX, with pilot programs involving financial institutions, aiming for a secure and efficient digital payment ecosystem.

- Potential Substitution: As these digital assets mature and gain wider acceptance, they could fulfill roles traditionally held by banks, such as facilitating payments, offering investment vehicles, and even providing lending or borrowing mechanisms.

The threat of substitutes for Daycoval Bank's services is multifaceted, impacting both its lending and deposit-taking activities. Direct access to capital markets for large corporations and the growing popularity of peer-to-peer lending platforms for SMEs and individuals represent key alternatives to traditional bank loans.

Furthermore, investors are increasingly exploring direct investments in real estate, private equity, and even digital assets, bypassing conventional banking products and services. The development of digital currencies like Brazil's DREX by the end of 2024 is poised to introduce further competition by offering a government-backed digital payment and investment avenue.

| Substitute Category | Key Examples | Impact on Daycoval | 2024 Data/Trend |

|---|---|---|---|

| Capital Markets | Corporate Debentures, Commercial Paper | Reduces demand for corporate loans | Continued growth in Brazilian corporate debt issuance |

| Alternative Lending | P2P Lending Platforms | Competes for retail and SME borrowers | Global P2P market projected to reach $227.7 billion by 2028 |

| Direct Investment | Real Estate, Private Equity, Digital Assets | Decreases reliance on bank deposits and managed funds | Global alternative investment AUM over $20 trillion; Crypto market cap ~ $2.6 trillion (early 2024) |

| Digital Currencies | DREX (Digital Real) | Potential disintermediation of payment and investment services | DREX expected to be fully operational by end of 2024 |

Entrants Threaten

Entering the Brazilian banking landscape, particularly for full-service operations, is heavily guarded by substantial capital requirements and a labyrinth of regulations set forth by the Central Bank of Brazil. These hurdles are designed to ensure financial stability but effectively deter new players. For instance, in 2024, the minimum capital for establishing a new bank in Brazil often runs into hundreds of millions of Reais, a figure that immediately limits the pool of potential entrants.

Daycoval Bank, like other established financial institutions, benefits significantly from its existing brand reputation and the trust it has cultivated over years of operation. This is particularly crucial in the corporate lending sector, where building strong, long-term relationships is paramount. New entrants, on the other hand, face a substantial hurdle in replicating this level of credibility and customer loyalty from the ground up.

Fintechs may have lower operational costs, but establishing a secure and scalable technological backbone for comprehensive financial services demands significant capital. For example, developing advanced fraud detection systems and ensuring data privacy compliance are costly endeavors for any new player.

The growing integration of artificial intelligence and cloud computing by established banks, as seen with many major financial institutions in 2024, effectively elevates the baseline technological requirements. This trend makes it harder for new entrants to compete without substantial upfront investment in similar, or even superior, capabilities.

Customer Acquisition Costs

The threat of new entrants to the banking sector, specifically concerning customer acquisition costs, is significant. New players must invest heavily in marketing and promotional activities to attract and retain customers, often facing higher initial expenses than established institutions. For instance, in 2023, major banks reported substantial marketing budgets, with some allocating billions globally to brand building and customer acquisition campaigns. This creates a substantial barrier for newcomers aiming to establish a foothold against incumbents with loyal customer bases.

Established banks benefit from existing customer relationships, which translate into lower marginal costs for acquiring new products or services from their current clientele. New entrants, conversely, must build these relationships from scratch, often through aggressive pricing or attractive introductory offers. These strategies, while necessary, can depress margins in the short term. For example, digital-only banks often offer higher interest rates on savings accounts or lower fees on transactions to lure customers away from traditional banks, a tactic that directly increases customer acquisition costs.

The high cost of acquiring customers in the banking industry is a direct consequence of intense competition and the need for differentiation. New entrants must overcome the inertia of existing customer loyalty and the trust associated with well-known financial brands. This often necessitates substantial upfront investment in technology, compliance, and marketing.

- High Marketing Spend: New entrants face significant marketing expenses to build brand awareness and attract initial customers.

- Established Trust: Incumbent banks leverage existing customer trust and loyalty, making it harder for new players to gain traction.

- Customer Retention Costs: Retaining customers also incurs costs, as banks must continually offer competitive products and services.

- Digital Competition: While digital channels can lower some costs, they also intensify competition and can lead to price wars, further increasing acquisition costs.

Niche Market Entry by Fintechs

Fintech companies are increasingly entering the financial services market by focusing on specific niches, often targeting segments that traditional banks like Daycoval may not fully serve. For instance, in 2024, digital-only banks and specialized lending platforms have seen significant growth by offering streamlined onboarding and tailored products. This approach allows them to build a customer base and refine their offerings without immediately challenging established players across the board.

While these new entrants might not offer the full spectrum of services Daycoval provides, their success in capturing niche markets can serve as a stepping stone for broader expansion. For example, a fintech that excels in small business loans could leverage its expertise and customer data to introduce payment processing or other related financial tools. This gradual market penetration poses a threat by chipping away at Daycoval's potential customer base and revenue streams in specific areas.

- Niche Focus: Fintechs target specific customer segments or product areas, such as digital payments or specialized lending, to gain initial traction.

- Innovation: They often leverage technology to offer innovative solutions that are more convenient or cost-effective than traditional banking services.

- Gradual Expansion: Success in a niche market can lead to fintechs expanding their offerings, posing a growing competitive threat over time.

- Market Share Erosion: By capturing specific customer needs, fintechs can gradually erode the market share of incumbent banks like Daycoval in those particular segments.

The threat of new entrants into the Brazilian banking sector, while significant, is tempered by substantial barriers. High capital requirements, stringent regulatory compliance, and the need for established trust present formidable challenges for newcomers. For instance, in 2024, the minimum capital for a new bank in Brazil often reaches hundreds of millions of Reais, a clear deterrent.

New players must also overcome the significant customer acquisition costs, which in 2023 saw major global banks allocating billions to marketing. Established banks like Daycoval benefit from existing customer loyalty and brand recognition, making it difficult for new entrants to gain immediate traction without substantial investment in marketing and technology. Fintechs, while innovative, often start with niche offerings, gradually expanding their reach.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | Substantial minimum capital needed to operate a bank. | Limits the number of potential entrants; requires significant funding. |

| Regulatory Hurdles | Complex licensing and compliance with Central Bank of Brazil regulations. | Increases time-to-market and operational costs; requires specialized expertise. |

| Brand Reputation & Trust | Existing customer loyalty and established credibility of incumbent banks. | Makes customer acquisition more challenging and expensive for new players. |

| Customer Acquisition Costs | High marketing and promotional expenses to attract and retain customers. | Requires significant upfront investment, impacting initial profitability. |

Porter's Five Forces Analysis Data Sources

Our Daycoval Bank Porter's Five Forces analysis is built upon a foundation of comprehensive data, including the bank's official financial statements, investor relations materials, and reports from reputable financial data providers like Bloomberg and Refinitiv.