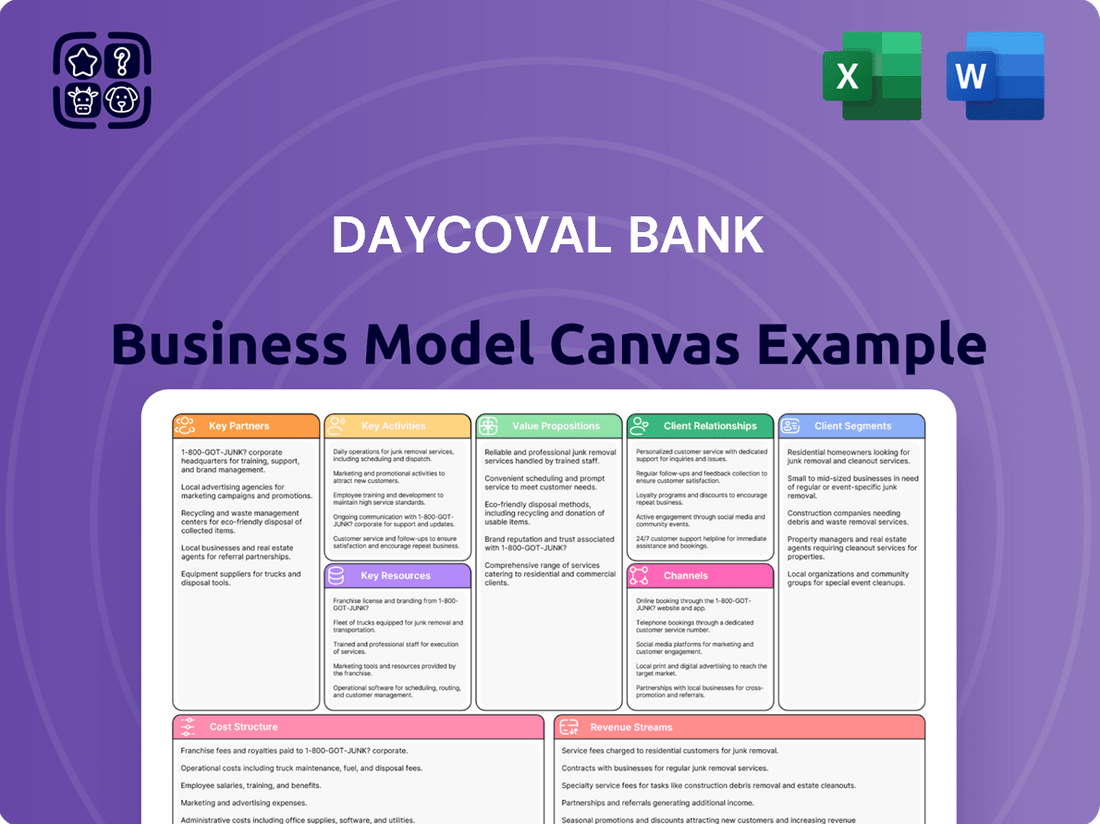

Daycoval Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daycoval Bank Bundle

Unlock the strategic blueprint of Daycoval Bank's thriving business model. This comprehensive Business Model Canvas details their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Dive into the core components that drive their market position and gain actionable insights for your own ventures.

Partnerships

Daycoval Bank actively cultivates strategic alliances with a variety of financial institutions, including multilateral agencies and commercial banks. This approach is crucial for diversifying its funding streams and broadening its operational footprint.

These partnerships are instrumental in facilitating access to syndicated loans, which in turn allows Daycoval to extend vital credit to underserved segments such as Micro, Small, and Medium-sized Enterprises (MSMEs) and women-led businesses. For instance, a significant loan agreement in December 2024, involving the International Finance Corporation (IFC) and fourteen other financial institutions, underscores this commitment to collaborative growth and targeted lending.

Daycoval Bank actively partners with fintech firms to bolster its digital capabilities, aiming to provide a superior customer experience. These alliances are instrumental in co-creating innovative digital banking products and services, thereby optimizing operational efficiency and broadening market reach.

For instance, Daycoval Seguros has set ambitious targets for 2025, underscoring the bank's dedication to leveraging technology for enhanced customer engagement. This strategic focus on digital transformation through fintech collaborations is a cornerstone of Daycoval's business model.

Following its acquisition of BMG Seguros in January 2025, Daycoval Bank significantly enhances its strategic alliances with insurance providers and brokerage firms. This move is pivotal for expanding its product offerings, which now include surety bonds, performance insurance, and rental guarantee insurance, thereby deepening relationships with its corporate clientele.

This strategic expansion not only broadens Daycoval's product portfolio but also diversifies its revenue streams, a key objective for sustainable growth. By integrating BMG Seguros, the bank is better positioned to meet the complex needs of its corporate customers, solidifying its market presence.

Correspondent Banks and International Investors

Daycoval Bank actively cultivates relationships with correspondent banks, which are essential for executing its international foreign exchange operations. These partnerships enable seamless cross-border transactions, ensuring efficient processing of payments and receipts for its clients.

The bank also strategically engages with international investors, including multilateral agencies. This engagement is crucial for diversifying its funding sources and securing capital that supports its ongoing operations and expansion initiatives. In 2024, Daycoval continued to strengthen these ties, aiming to enhance its liquidity and funding profile.

- Correspondent Banks: Facilitate foreign exchange transactions and global payment processing.

- International Investors: Provide access to diverse funding sources, including multilateral agencies, bolstering capital structure.

- Strategic Importance: These partnerships are fundamental to managing international liquidity and supporting Daycoval's growth objectives.

Technology and Infrastructure Providers

Daycoval Bank's strategic alliances with technology and IT infrastructure providers are fundamental to its operational backbone. These partnerships are critical for the continuous maintenance and enhancement of its core banking systems, ensuring they remain robust and up-to-date. Furthermore, these collaborations are vital for the development and upkeep of Daycoval's digital platforms, enabling seamless customer interactions and transactions.

These collaborations are not just about maintaining current services; they are also about fostering innovation and ensuring Daycoval remains competitive in the rapidly evolving digital financial landscape. By working with leading technology partners, the bank can implement cutting-edge solutions that enhance operational efficiency and bolster its data security measures. This focus on technological advancement directly translates to a better customer experience, a key differentiator for the bank.

In 2024, Daycoval continued to invest in its technological infrastructure. For instance, its digital transformation initiatives, supported by these partnerships, aimed to streamline user interfaces and introduce new digital banking features. The bank's commitment to technology is evident in its ongoing efforts to leverage data analytics and cloud computing, which are typically facilitated by specialized infrastructure providers.

- Core Banking Systems: Partnerships ensure Daycoval's core banking platforms are modern, secure, and scalable.

- Digital Platforms: Collaborations with tech providers enable the development and enhancement of online and mobile banking services.

- Data Security: Essential for safeguarding customer information and maintaining regulatory compliance.

- Operational Resilience: Ensuring uninterrupted service delivery through reliable IT infrastructure.

Daycoval Bank's key partnerships are essential for its growth and service expansion. These include collaborations with multilateral agencies and commercial banks for diversified funding and expanded reach, as seen in a significant December 2024 loan agreement with the IFC and fourteen other financial institutions. Strategic alliances with fintech firms are crucial for developing innovative digital products and enhancing customer experience, supporting ambitious 2025 targets for Daycoval Seguros.

The bank also leverages partnerships with correspondent banks for international foreign exchange operations and engages with international investors, including multilateral agencies, to secure capital and enhance its funding profile, a focus maintained throughout 2024. Furthermore, alliances with technology and IT infrastructure providers are vital for maintaining and upgrading core banking systems and digital platforms, ensuring operational efficiency and security.

| Partner Type | Purpose | Impact |

|---|---|---|

| Multilateral Agencies & Commercial Banks | Diversify funding, expand operations, access syndicated loans | Facilitates lending to MSMEs and women-led businesses; IFC partnership in Dec 2024 |

| Fintech Firms | Co-create digital products, enhance customer experience, optimize efficiency | Supports digital transformation initiatives and ambitious 2025 targets for Daycoval Seguros |

| Correspondent Banks | Execute international foreign exchange operations, process global payments | Enables seamless cross-border transactions for clients |

| International Investors | Secure capital, diversify funding sources | Strengthens liquidity and funding profile, ongoing focus in 2024 |

| Technology & IT Providers | Maintain/enhance core banking systems, develop digital platforms, ensure data security | Boosts operational efficiency, security, and customer experience; supports 2024 digital transformation |

What is included in the product

Daycoval Bank's Business Model Canvas focuses on serving agribusiness and small and medium-sized enterprises (SMEs) with tailored financial solutions, leveraging a strong digital platform and a network of specialized partners to deliver value.

This model emphasizes efficient credit origination and management, supported by robust risk assessment and a customer-centric approach to build lasting relationships and drive sustainable growth.

Daycoval Bank's Business Model Canvas offers a pain point reliever by providing a clear, one-page snapshot of their core components, enabling quick identification of solutions for customer challenges.

Activities

Daycoval Bank's primary function is the origination and management of a broad range of corporate loans, extending credit solutions to businesses of all sizes. This encompasses specialized products such as working capital financing, investment loans, and tailored structured transactions.

In 2024, the bank actively supported businesses by offering R$10 billion across 39 distinct corporate lending transactions, demonstrating a significant commitment to facilitating business growth and operational needs.

Daycoval Bank actively participates in investment banking, notably through its debt capital markets operations. This segment caters to a diverse clientele, including institutional investors and individual clients seeking financing solutions.

In the realm of asset management, Daycoval has shown substantial growth. By the close of 2024, Daycoval Asset Management was overseeing R$21 billion in assets, distributed across 103 distinct funds. This highlights the bank's commitment to providing comprehensive investment management services.

Daycoval Bank actively engages in foreign exchange operations, serving both large institutions and individual clients. This crucial activity underpins international trade and investment for its customers, directly supporting global business activities.

These operations are vital for clients involved in cross-border transactions, enabling them to manage currency risks and capitalize on international market opportunities. For Daycoval, this segment is a key contributor to its overall revenue diversification strategy.

In 2024, the global foreign exchange market continued its robust activity, with daily trading volumes often exceeding $6.5 trillion, highlighting the significant scale of operations like those undertaken by Daycoval for its clientele.

Retail Banking Product Origination and Management

Daycoval Bank's core operations involve the origination and ongoing management of a diverse range of retail banking products. This includes essential offerings like personal loans, savings accounts, and particularly, payroll-deductible loans, often referred to as consignado.

The bank's commitment to the payroll-deductible loan segment is clearly demonstrated by its substantial portfolio. In 2024, this specific loan category achieved a significant milestone, reaching R$15.8 billion. This figure underscores the strategic importance and success Daycoval has found in this particular product line, supported by consistent monthly origination activity.

- Product Offerings: Personal loans, payroll-deductible loans (consignado), and savings accounts.

- Payroll-Deductible Loan Portfolio (2024): R$15.8 billion.

- Origination Focus: Robust monthly origination indicates a strong emphasis on growing the consignado segment.

Risk Management and Regulatory Compliance

Daycoval Bank's commitment to risk management and regulatory compliance is central to its business model. The bank actively engages in thorough risk assessments, continuous monitoring, and robust management strategies for its credit portfolios and diverse financial services. This proactive approach ensures the stability and integrity of its operations.

Adherence to Brazilian financial regulations, including those set by the Central Bank of Brazil (BCB), and alignment with international standards are non-negotiable for Daycoval. In 2024, the Brazilian banking sector, like Daycoval, navigated a landscape influenced by evolving monetary policies and increased scrutiny on operational resilience. Maintaining a strong credit rating and operational integrity is directly tied to this strict compliance framework.

- Rigorous Risk Assessment: Daycoval conducts ongoing evaluations of credit, market, operational, and liquidity risks across all its business lines.

- Regulatory Adherence: Compliance with Brazilian Central Bank directives and international financial standards (e.g., Basel III) is a core activity.

- Monitoring and Management: Continuous oversight of financial exposures and implementation of mitigation strategies are vital.

- Impact on Ratings: Strict compliance underpins Daycoval's strong credit ratings and reputation for operational integrity.

Daycoval Bank's key activities center on originating and managing corporate loans, providing R$10 billion across 39 transactions in 2024, and engaging in investment banking, particularly debt capital markets. Furthermore, the bank actively manages assets, overseeing R$21 billion in 103 funds by the end of 2024, and facilitates foreign exchange operations for institutions and individuals, supporting global trade.

| Key Activity | Description | 2024 Data/Context |

| Corporate Lending | Origination and management of business loans. | R$10 billion across 39 transactions. |

| Investment Banking | Debt capital markets operations. | Serves institutional and individual clients seeking financing. |

| Asset Management | Management of investment funds. | R$21 billion in assets across 103 funds. |

| Foreign Exchange | Facilitating currency transactions. | Supports international trade for clients; global FX market daily volumes exceed $6.5 trillion. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for Daycoval Bank that you are previewing is the precise document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis you will gain access to. Upon completing your order, you will be provided with the full, unedited version of this Business Model Canvas, ready for your strategic review and application.

Resources

Daycoval Bank's core asset is its robust financial capital, encompassing significant equity and a well-diversified funding base. This financial strength underpins its capacity for lending and strategic investments, crucial for its business operations.

In 2024, Daycoval Bank achieved a remarkable milestone, reporting a record net income of R$1.514 billion. This impressive financial performance highlights the bank's solid financial health and its ability to generate consistent profitability.

Daycoval Bank's human capital is a cornerstone, featuring highly skilled professionals like credit analysts, investment managers, financial advisors, and IT specialists. This deep expertise is crucial for developing tailored financial solutions and fostering robust client connections.

The bank's commitment to employee development is evident, with Daycoval earning a spot on LinkedIn's Top Companies 2025 list, specifically acknowledging its strong professional growth opportunities. This focus on nurturing talent directly translates into the bank's capacity to innovate and excel in the competitive financial landscape.

Daycoval Bank relies on state-of-the-art core banking systems and digital platforms to offer efficient, secure, and scalable services. This robust IT infrastructure is the bedrock for its operations, from corporate lending to its growing digital retail banking presence.

In 2024, Daycoval continued to invest in its technology. For instance, the bank reported significant advancements in its digital channels, with a notable increase in the volume of transactions processed through its mobile app, reflecting the importance of its IT infrastructure in meeting customer demand for convenient banking.

Strong Brand Reputation and Trust

Daycoval Bank's strong brand reputation and the trust it has cultivated are foundational to its business model. This is a significant intangible asset, built on a perception of solidity, low risk, and consistent performance within the Brazilian financial landscape.

This trust is not just anecdotal; it's actively supported by stable credit ratings from major agencies. For instance, Fitch, Moody's, and S&P have consistently affirmed Daycoval's ratings, reflecting its financial health. As of 2024 and with updates anticipated into 2025, these ratings serve as a crucial validation of the bank's reliability for customers and investors alike.

- Established Reputation: Daycoval is recognized for its financial stability and low-risk profile in Brazil.

- Investor Confidence: Consistent performance builds trust among individual and institutional investors.

- Creditworthiness: Stable ratings from Fitch, Moody's, and S&P (as of 2024/2025) underscore its reliability.

- Customer Loyalty: A trusted brand fosters long-term relationships and attracts new clients.

Proprietary Data and Analytics

Daycoval Bank leverages proprietary data and analytics to gain a competitive edge. This includes access to extensive financial data, enabling sophisticated credit assessments and market analysis. For instance, in the first quarter of 2024, Daycoval reported a net income of R$234.3 million, reflecting the efficacy of its data-driven strategies in managing risk and identifying profitable opportunities.

These advanced analytical capabilities are crucial for Daycoval's risk management framework. By meticulously analyzing customer data and market trends, the bank can proactively identify and mitigate potential risks. This data-informed approach supports the development of more resilient financial products and services, ensuring stability and growth.

- Data-Driven Credit Assessment: Daycoval's proprietary data allows for granular credit scoring, reducing default rates.

- Market Insights: Proprietary analytics provide early identification of market shifts and customer needs.

- Risk Mitigation: Sophisticated modeling helps in predicting and managing financial risks effectively.

- Product Development: Data insights inform the creation of tailored financial solutions for diverse client segments.

Daycoval Bank's key resources include its significant financial capital, a highly skilled workforce, robust IT infrastructure, a strong brand reputation, and proprietary data analytics capabilities. These elements collectively enable the bank to offer competitive financial services, manage risk effectively, and drive profitable growth.

Value Propositions

Daycoval Bank provides highly customized credit solutions designed to meet the unique needs of small, medium, and large enterprises. These tailored offerings are crucial for businesses aiming to execute specific growth strategies and manage complex financial requirements.

The bank's portfolio includes a diverse array of products such as working capital loans, vital for day-to-day operations, and investment financing, supporting long-term capital expenditure. This comprehensive approach helps businesses navigate financial challenges effectively.

In 2024, Daycoval's commitment to corporate credit was evident in its continued expansion of lending to the SME sector, a key driver of Brazil's economy. The bank's structured debt options also provide businesses with flexible tools for managing their financial architecture.

For investors, Daycoval Bank offers a wide array of investment choices, spanning asset management funds, fixed income securities, and private credit opportunities. This broad ecosystem aims to cater to diverse risk appetites and financial goals.

By the close of 2024, Daycoval Asset Management demonstrated its significant reach, managing R$21 billion in assets. This substantial figure was spread across 103 distinct investment funds, highlighting the bank's capacity to offer a diversified portfolio to its clients.

Daycoval Bank's efficient foreign exchange services are a cornerstone for clients engaged in international trade and investment. These offerings streamline cross-border payments and currency management, ensuring a smooth experience for both large institutions and individual customers.

In 2024, the global foreign exchange market continued its robust activity, with daily trading volumes often exceeding $6 trillion. Daycoval's commitment to efficiency means clients can navigate this complex market with greater ease, facilitating their international financial operations.

Accessible Retail Banking Products

Daycoval Bank offers a suite of accessible retail banking products tailored to individual financial requirements. These include personal loans, savings accounts, and a significant focus on payroll-deductible loans, making credit readily available to a broad customer base.

The bank's dedication to serving the retail segment is evident in its financial performance. For instance, Daycoval's payroll-deductible loan portfolio reached an impressive R$16.3 billion in the first quarter of 2025, showcasing strong market penetration and customer trust in this product category.

- Accessible Personal Loans: Daycoval provides personal loans designed for individual needs.

- Payroll-Deductible Loans: A key offering, demonstrating significant growth with a portfolio of R$16.3 billion in Q1 2025.

- Savings Accounts: Standard savings products to meet basic individual banking needs.

Expert Financial Advisory and Relationship Management

Daycoval Bank's business model centers on providing expert financial advisory and robust relationship management, particularly for its corporate clientele. This high-touch approach ensures clients receive personalized guidance for their intricate financial needs, fostering deep, enduring connections.

In 2024, Daycoval Bank continued to emphasize this value proposition. For instance, the bank reported a significant increase in its corporate loan portfolio, a direct reflection of the trust and value placed on its advisory services by businesses seeking tailored financial solutions.

- Personalized Guidance: Clients receive tailored advice to navigate complex financial landscapes.

- Dedicated Relationship Managers: A consistent point of contact ensures proactive support and understanding of client needs.

- Long-Term Relationships: The focus on personalized service cultivates loyalty and repeat business, especially within the corporate segment.

- Corporate Segment Focus: This value proposition is especially strong for businesses requiring sophisticated financial strategies and support.

Daycoval Bank's value proposition is built on delivering tailored financial solutions and expert guidance. They offer customized credit for businesses of all sizes, from working capital to investment financing, ensuring strategic alignment with client growth. For investors, a broad spectrum of investment choices, including asset management and private credit, caters to diverse risk profiles.

The bank also excels in providing accessible retail banking products, notably payroll-deductible loans, which saw a R$16.3 billion portfolio by Q1 2025. Efficient foreign exchange services support international trade, a critical function in a market with daily volumes exceeding $6 trillion in 2024. Furthermore, dedicated relationship management fosters long-term partnerships, particularly within the corporate sector.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Customized Credit Solutions | Tailored loans for SMEs and large enterprises, supporting growth and operational needs. | Continued expansion in SME lending in 2024, reflecting economic contribution. |

| Diverse Investment Offerings | A wide range of investment choices for various risk appetites. | Daycoval Asset Management managed R$21 billion across 103 funds by end of 2024. |

| Accessible Retail Banking | Focus on individual needs with products like payroll-deductible loans. | Payroll-deductible loan portfolio reached R$16.3 billion in Q1 2025. |

| Efficient Foreign Exchange | Streamlined services for international trade and currency management. | Facilitates client navigation in a global FX market with daily volumes over $6 trillion (2024). |

| Expert Financial Advisory | High-touch relationship management for complex corporate financial needs. | Growth in corporate loan portfolio in 2024 signifies trust in advisory services. |

Customer Relationships

Daycoval Bank assigns dedicated relationship managers to its corporate and institutional clients, ensuring a high level of personalized service. These managers provide in-depth financial advisory, acting as a direct point of contact to understand and address unique client needs.

This dedicated approach cultivates strong, enduring partnerships built on trust and a thorough grasp of each client's financial objectives. For instance, in 2024, Daycoval reported a significant increase in client retention rates within its corporate segment, directly attributable to the effectiveness of its relationship management strategy.

Daycoval Bank provides personalized advisory services across its extensive product range, from corporate lending to sophisticated investment management. This ensures that financial solutions are meticulously crafted to meet each client's unique objectives.

These services include expert guidance on optimizing credit structures, developing effective investment strategies, and navigating the complexities of foreign exchange hedging. For instance, in 2024, Daycoval reported a significant increase in clients utilizing their tailored advisory for international trade finance, reflecting a growing need for specialized forex solutions.

Daycoval Bank's digital self-service platforms, including its online and mobile banking applications, are central to its customer relationships. These platforms empower clients to independently manage their accounts, conduct transactions, and access crucial financial information anytime, anywhere.

This digital approach offers significant convenience and efficiency, directly appealing to a growing segment of customers who prefer managing their finances without direct human interaction. By providing robust digital tools, Daycoval strengthens its connection with these digitally-native customers.

For instance, as of the first quarter of 2024, Daycoval reported a substantial increase in digital channel usage, with over 70% of its transactions being processed through these self-service platforms, highlighting their critical role in customer engagement and operational efficiency.

Customer Support Centers

Daycoval Bank operates comprehensive customer support centers, offering assistance through both traditional call centers and robust online platforms. This multi-channel approach is designed to address client inquiries and resolve banking issues with maximum efficiency, ensuring customers receive timely and effective support.

In 2024, Daycoval Bank continued to invest in its customer support infrastructure, aiming to enhance the client experience. For instance, the bank reported a significant increase in digital service adoption, with a substantial portion of customer interactions handled through online channels, reflecting a growing preference for self-service and digital problem-solving.

- Multi-Channel Accessibility: Daycoval Bank provides customer support via phone and online channels, catering to diverse customer preferences.

- Prompt Issue Resolution: The bank prioritizes timely assistance to address and resolve customer banking needs efficiently.

- Digital Service Growth: In 2024, a notable trend was the increased utilization of digital platforms for customer support interactions.

- Enhanced Client Experience: Investments in support infrastructure aim to ensure a seamless and satisfactory banking experience for all clients.

Strategic Client Engagement

Daycoval Bank fosters strong customer relationships through strategic engagement, focusing on targeted communication, financial education initiatives, and exclusive events designed to build loyalty. In 2024, the bank continued to prioritize client understanding, offering resources that demystified market trends and highlighted new product benefits.

The bank's approach aims to move beyond transactional interactions, cultivating a partnership where clients feel informed and supported in their financial journeys. This proactive engagement helps clients make more informed decisions, aligning with Daycoval's commitment to client success.

- Targeted Communication: Personalized outreach based on client segments and financial needs.

- Financial Education: Workshops and content to enhance client financial literacy.

- Loyalty Programs: Initiatives rewarding long-term client relationships.

- Product Information: Clear communication on how new offerings can support client goals.

Daycoval Bank cultivates deep customer relationships through a blend of personalized human interaction and robust digital self-service. Dedicated relationship managers cater to corporate clients, offering tailored financial advice, which in 2024 led to increased client retention. For retail customers, digital platforms provide convenient account management, with over 70% of transactions processed digitally by Q1 2024.

| Customer Relationship Aspect | Description | 2024 Data/Observation |

|---|---|---|

| Relationship Management | Dedicated managers for corporate/institutional clients | Increased client retention in corporate segment |

| Personalized Advisory | Tailored financial solutions and guidance | Growth in clients using advisory for international trade finance |

| Digital Self-Service | Online and mobile banking for independent management | Over 70% of transactions via digital channels (Q1 2024) |

| Customer Support | Multi-channel assistance (phone, online) | Increased digital service adoption for support interactions |

| Strategic Engagement | Targeted communication, financial education, loyalty initiatives | Continued focus on client understanding and market education |

Channels

Daycoval Bank's direct sales force and relationship managers are crucial for engaging its corporate and SME clients. These teams conduct direct outreach and client visits, fostering personalized relationships vital for offering tailored financial solutions.

This direct approach enables the bank to effectively sell complex financial products, as managers can deeply understand client needs and present customized offerings. For instance, in 2023, Daycoval reported a significant portion of its loan portfolio growth stemming from these direct client interactions, highlighting the channel's effectiveness.

While Daycoval embraces digital channels, its physical branch network remains a cornerstone, particularly for retail banking and intricate transactions. This tangible presence fosters trust and accessibility for a broad customer base across Brazil.

As of December 2024, Daycoval operated 51 agencies and maintained over 250 service points. This infrastructure allows for direct client engagement and supports the execution of more complex financial operations, complementing its digital offerings.

Daycoval Bank's digital banking platforms, encompassing both its website and mobile applications, are fundamental to its operations. These channels are the primary conduits for attracting new customers, delivering a wide array of banking services, and facilitating seamless transaction processing for every customer segment.

These digital touchpoints offer unparalleled convenience and constant accessibility, catering specifically to a customer base that increasingly expects and relies on digital solutions for their financial needs. This focus on digital engagement is key to meeting the demands of a modern, digitally-native clientele.

In 2024, Daycoval reported a significant increase in digital customer engagement, with mobile app usage growing by 25% year-over-year. The bank's online platform saw a 15% rise in active users, demonstrating the strong adoption and reliance on these digital channels for everyday banking activities.

Partnerships with Financial Intermediaries

Daycoval Bank actively collaborates with financial intermediaries, including brokers and credit correspondents. This strategic approach allows them to effectively distribute products, especially in the retail and payroll-deductible loan markets, significantly expanding their market reach.

These partnerships are crucial for Daycoval's distribution strategy, enabling them to tap into broader customer bases. For instance, in 2024, Daycoval reported a substantial growth in its payroll loan portfolio, partly attributed to its extensive network of correspondents.

- Expanded Reach: Partnerships with brokers and credit correspondents allow Daycoval to access customer segments it might not reach directly.

- Product Distribution: These intermediaries are key channels for distributing specific products like payroll-deductible loans.

- Market Penetration: The collaborations enhance Daycoval's presence in various retail markets, driving broader adoption of its financial services.

- 2024 Performance: Daycoval's payroll loan segment saw robust growth in 2024, demonstrating the effectiveness of these intermediary relationships in driving business volume.

Call Centers and Online Support

Daycoval Bank leverages call centers and online chat as key customer service channels. These platforms offer accessible avenues for clients to seek assistance with inquiries, receive technical support, and manage transactions. This dual approach ensures that customers have continuous access to help and efficient problem resolution.

In 2024, financial institutions like Daycoval are increasingly investing in digital customer service. For instance, many banks reported significant increases in chat support usage, with some seeing a 30% rise in customer interactions via online channels compared to previous years. This shift highlights the growing preference for immediate, digital communication.

- Accessibility: Call centers and online chat provide 24/7 or extended hour support, ensuring customers can get help when they need it.

- Efficiency: Online chat, in particular, allows for quick handling of multiple queries simultaneously, improving resolution times.

- Cost-Effectiveness: Digital channels can often be more cost-efficient than traditional phone support for handling a high volume of routine inquiries.

- Customer Satisfaction: Providing multiple, responsive support channels is crucial for maintaining and improving customer satisfaction in the competitive banking sector.

Daycoval Bank utilizes a multi-channel approach to reach its diverse customer base. This includes direct sales, a physical branch network, robust digital platforms, strategic partnerships with intermediaries, and accessible customer service channels like call centers and online chat.

In 2024, Daycoval's digital channels saw significant growth, with mobile app usage up 25% and online platform users increasing by 15%. The bank's physical presence, with 51 agencies and over 250 service points as of December 2024, remains vital for retail banking and complex transactions.

Partnerships with brokers and credit correspondents were instrumental in expanding the payroll loan portfolio in 2024. These intermediaries extend Daycoval's market reach, particularly in retail segments.

Customer service channels like online chat experienced increased usage in 2024, mirroring industry trends of customers preferring immediate, digital communication for support.

| Channel | Key Function | 2024 Data/Impact |

|---|---|---|

| Direct Sales Force/Relationship Managers | Corporate & SME client engagement, tailored solutions | Significant contributor to loan portfolio growth |

| Physical Branches | Retail banking, complex transactions, trust building | 51 agencies, 250+ service points |

| Digital Platforms (Website, Mobile App) | Customer acquisition, service delivery, transaction processing | Mobile app usage +25%, Online users +15% |

| Financial Intermediaries (Brokers, Correspondents) | Product distribution (payroll loans), market reach expansion | Robust growth in payroll loan segment |

| Call Centers & Online Chat | Customer support, inquiries, technical assistance | Increased usage for immediate, digital communication |

Customer Segments

Daycoval Bank's core focus lies in empowering Small and Medium Enterprises (SMEs) by providing specialized credit solutions designed to fuel their expansion and streamline daily operations. This commitment is clearly reflected in the bank's financial performance, with its corporate credit portfolio reaching an impressive R$46.786 billion in 2024.

This substantial figure represents a significant 15.8% growth, a testament to the vital role SMEs play in Daycoval's business strategy and their increasing reliance on the bank's tailored financial support to achieve their objectives.

Daycoval Bank caters to large corporations by offering a robust suite of corporate lending and investment banking services. This includes specialized solutions like structured financing and access to capital markets.

The bank's Debt Capital Markets division demonstrated significant activity in 2024, successfully executing 39 structured transactions. These deals collectively amounted to R$10 billion, highlighting Daycoval's capacity to manage substantial corporate financing needs.

Daycoval Bank actively serves institutional investors by providing specialized asset management, robust custody services, and a range of fixed income products tailored to their needs. This segment is crucial for the bank's growth and stability.

By the close of 2024, Daycoval's Administration and Custody of Funds division achieved a significant milestone, managing over R$150 billion in assets under its services. This impressive figure underscores the trust placed in Daycoval by a substantial client base, encompassing approximately one thousand investment funds.

Individual Investors

Individual investors represent a crucial customer base for Daycoval Bank, drawn to the institution for its robust asset management capabilities and a wide array of investment products designed for diversification. The bank's strategic move to establish Daycoval CTVM (Corretora de Títulos e Valores Mobiliários) underscores its commitment to catering specifically to this segment’s needs within the dynamic stock and futures markets.

This expansion allows individual investors to engage more directly with a broader spectrum of financial instruments. For instance, as of the first quarter of 2024, Daycoval reported a net income of R$208.3 million, reflecting its growing operational capacity and ability to serve an expanding client base, including individual investors seeking growth opportunities.

- Diversified Investment Access: Daycoval provides individual investors with access to a comprehensive suite of investment products through its asset management arm.

- Specialized Brokerage Services: The establishment of Daycoval CTVM enhances services for individuals participating in stock and futures markets.

- Financial Performance Support: The bank's solid financial results, such as its Q1 2024 net income, demonstrate its capacity to support and grow with its individual investor segment.

Individuals Seeking Personal and Payroll Loans

Daycoval Bank caters to individuals needing personal loans, with a particular focus on payroll-deductible loans, often referred to as consignado. This segment also includes those looking for accessible savings accounts to manage their finances.

The bank's commitment to this retail market is evident in its robust payroll-deductible loan portfolio. As of the first quarter of 2025, this portfolio reached R$16.3 billion, underscoring Daycoval's significant penetration and trust within this crucial customer base.

- Target Audience: Individuals requiring personal financing, especially those with stable employment who can benefit from payroll deductions for loan repayment.

- Key Offerings: Personal loans, with a specialization in payroll-deductible loans (consignado), and savings accounts.

- Market Strength: A substantial payroll-deductible loan portfolio valued at R$16.3 billion in Q1 2025 highlights Daycoval's strong position in serving individual credit needs.

- Customer Value: Provides accessible credit solutions and basic banking services, simplifying financial management for its individual clients.

Daycoval Bank serves a diverse clientele, with Small and Medium Enterprises (SMEs) forming a core segment, benefiting from specialized credit solutions. Large corporations are also key, accessing corporate lending and investment banking services, including structured financing. Institutional investors rely on Daycoval for asset management and custody, while individual investors are drawn to its investment products and brokerage services.

| Customer Segment | Key Offerings | 2024/2025 Data Points |

|---|---|---|

| Small and Medium Enterprises (SMEs) | Specialized credit solutions | Corporate credit portfolio: R$46.786 billion (15.8% growth in 2024) |

| Large Corporations | Corporate lending, investment banking, structured financing | 39 structured transactions executed, totaling R$10 billion (2024) |

| Institutional Investors | Asset management, custody services, fixed income products | Over R$150 billion in assets under administration/custody (end of 2024) |

| Individual Investors | Asset management, investment products, brokerage services (Daycoval CTVM) | Q1 2024 Net Income: R$208.3 million |

| Individuals (Retail) | Personal loans (payroll-deductible), savings accounts | Payroll-deductible loan portfolio: R$16.3 billion (Q1 2025) |

Cost Structure

Interest expenses on deposits and funding represent a substantial cost for Daycoval Bank. This category includes payments made on customer savings accounts, checking accounts, and certificates of deposit, as well as interest on interbank borrowings and any international debt the bank may utilize. For instance, in the first quarter of 2024, Daycoval reported interest expenses of R$ 648.8 million, highlighting the significant impact of these costs on its overall financial performance.

Personnel costs are a significant component of Daycoval Bank's operational expenses. This includes the salaries, benefits, and ongoing training for its diverse and skilled workforce, encompassing roles from credit analysts to IT specialists. Daycoval's commitment to its human capital was highlighted by its inclusion in Brazil's LinkedIn Top Companies 2025 ranking.

Daycoval Bank dedicates significant resources to maintaining its technology and infrastructure. In 2024, ongoing investments in IT infrastructure, software licenses, and digital platforms represent a core cost. These expenses are essential for ensuring operational efficiency and robust cybersecurity measures, including critical system upgrades.

Regulatory Compliance and Risk Management Costs

Daycoval Bank's commitment to navigating Brazil's stringent financial regulations and robust risk management necessitates substantial investment. These costs encompass legal counsel for regulatory interpretation, external audit fees to ensure adherence, and the salaries of dedicated compliance and risk management teams. The bank's classification as a low-risk institution underscores the effectiveness of these expenditures in maintaining operational integrity.

The financial burden of regulatory compliance and risk management is a significant operational factor for Daycoval. For instance, in 2023, Brazilian financial institutions generally saw increased spending on compliance due to evolving regulations, particularly around anti-money laundering (AML) and data privacy. While specific figures for Daycoval's 2024 compliance costs are not yet public, industry trends suggest continued investment in technology and specialized personnel to meet these demands.

- Legal Fees: Costs associated with legal advice on regulatory changes and ongoing compliance matters.

- Audit Expenses: Fees paid to internal and external auditors for verifying compliance with financial regulations.

- Compliance Personnel: Salaries and training for staff dedicated to ensuring adherence to all applicable laws and guidelines.

- Risk Management Systems: Investment in technology and processes to identify, assess, and mitigate financial and operational risks.

Marketing and Sales Expenses

Daycoval Bank dedicates significant resources to marketing and sales to attract and keep clients in its corporate, institutional, and retail divisions. These costs are crucial for expanding its reach and reinforcing its brand in the competitive financial landscape.

In 2024, Daycoval Bank's marketing and sales expenses are directly tied to its aggressive growth strategy. The bank invests in diverse campaigns, from digital advertising to targeted outreach programs, aiming to acquire new customers and deepen relationships with existing ones.

- Customer Acquisition Costs: Expenses incurred to attract new clients across all banking segments.

- Sales Force Incentives: Costs associated with motivating and rewarding the sales team for achieving targets.

- Marketing Campaigns: Investments in advertising, promotions, and brand building to enhance market presence.

- Client Retention Efforts: Spending on programs and services designed to maintain and grow the existing customer base.

Daycoval Bank's cost structure is heavily influenced by interest expenses on its funding sources, which are critical for its lending operations. Personnel costs, encompassing salaries and benefits for its workforce, also represent a significant outlay. Furthermore, the bank incurs substantial expenses related to technology and infrastructure to maintain its digital platforms and ensure operational efficiency.

| Cost Category | Description | 2024 Relevance/Data Point |

|---|---|---|

| Interest Expenses | Costs of funding deposits and borrowings. | Q1 2024 interest expenses were R$ 648.8 million. |

| Personnel Costs | Salaries, benefits, and training for employees. | Included in Brazil's LinkedIn Top Companies 2025. |

| Technology & Infrastructure | Investments in IT, software, and digital platforms. | Essential for operational efficiency and cybersecurity. |

| Regulatory Compliance & Risk Management | Costs for legal, audit, and compliance personnel. | Industry trend shows increased spending on AML and data privacy. |

| Marketing & Sales | Customer acquisition, sales incentives, and campaigns. | Supports aggressive growth strategy and customer acquisition. |

Revenue Streams

Daycoval's main way of making money is through the interest it earns on all the loans it gives out. This includes loans to big companies, smaller businesses, and even individuals for things like personal loans or loans taken directly from paychecks.

In 2024, the bank saw its corporate loan book expand by a solid 15.8%, reaching R$46.786 billion. This substantial growth in corporate lending was a major driver of the bank's overall interest income.

Daycoval Bank generates significant revenue through its investment banking division. This includes fees from advisory services, debt capital market activities, and structured finance. In 2024 alone, the bank successfully managed 39 structured transactions, representing a substantial R$10 billion in total offers.

Daycoval Bank generates revenue through commissions and fees earned by facilitating foreign exchange (FX) transactions for its diverse client base. This income is directly tied to the volume of international trade and investment activities its clients engage in.

In 2024, the global foreign exchange market continued to see significant activity, with daily trading volumes often exceeding $6 trillion. Daycoval's ability to capture a portion of this market through its FX services contributes directly to its fee-based income, reflecting the bank's role in supporting cross-border commerce for its customers.

Asset Management Fees

Daycoval Bank generates substantial revenue through asset management fees. These fees are collected from both institutional investors and individual clients whose assets are managed by its dedicated Daycoval Asset Management division. This segment is a key contributor to the bank's overall financial performance.

By the close of 2024, Daycoval Asset Management reported an impressive R$21 billion in assets under management. This significant volume underscores the trust placed in the bank's investment expertise and its capacity to grow client wealth.

- Asset Management Fees: Revenue generated from managing client portfolios.

- Clientele: Serves both institutional and individual investors.

- Assets Under Management (AUM): Reached R$21 billion by the end of 2024.

Service Charges and Transaction Fees

Daycoval Bank generates revenue through various service charges and transaction fees on its retail banking products. These include fees for account maintenance, debit and credit card usage, and other banking services. The bank actively works to broaden its income sources beyond traditional lending activities.

In 2024, Daycoval Bank's strategy to diversify revenue streams is evident in its fee-based income. For instance, the bank's focus on digital channels and value-added services aims to increase the contribution of non-interest income.

- Account Maintenance Fees: Charges applied for holding and managing customer accounts.

- Card Fees: Revenue derived from debit, credit, and prepaid card issuance and usage.

- Transaction Fees: Income from processing various customer transactions, including transfers and payments.

- Other Banking Services: Fees for services like foreign exchange, overdrafts, and advisory.

Daycoval Bank's revenue streams are diversified, primarily driven by interest income from its extensive loan portfolio, which saw significant growth in 2024. Beyond lending, the bank earns substantial fees from investment banking activities, including advisory and structured finance, and from facilitating foreign exchange transactions for its clients.

Asset management fees also contribute significantly, with R$21 billion in assets under management by the end of 2024. Additionally, Daycoval generates revenue through various service charges and transaction fees on its retail banking products, reflecting a strategic effort to broaden its income sources beyond traditional lending.

| Revenue Stream | Description | 2024 Data Point |

|---|---|---|

| Interest Income from Loans | Earnings from corporate, business, and personal loans. | Corporate loan book grew 15.8% to R$46.786 billion. |

| Investment Banking Fees | Fees from advisory, debt capital markets, and structured finance. | Managed 39 structured transactions totaling R$10 billion. |

| Foreign Exchange (FX) Fees | Commissions from facilitating FX transactions. | Reflects activity in a market with daily volumes exceeding $6 trillion. |

| Asset Management Fees | Fees from managing client portfolios. | R$21 billion in assets under management. |

| Service and Transaction Fees | Charges for retail banking products and services. | Focus on increasing non-interest income through digital channels. |

Business Model Canvas Data Sources

The Daycoval Bank Business Model Canvas is built upon a foundation of robust financial statements, detailed market research on banking trends, and internal operational data. These sources ensure each block of the canvas is informed by accurate, relevant, and actionable information.