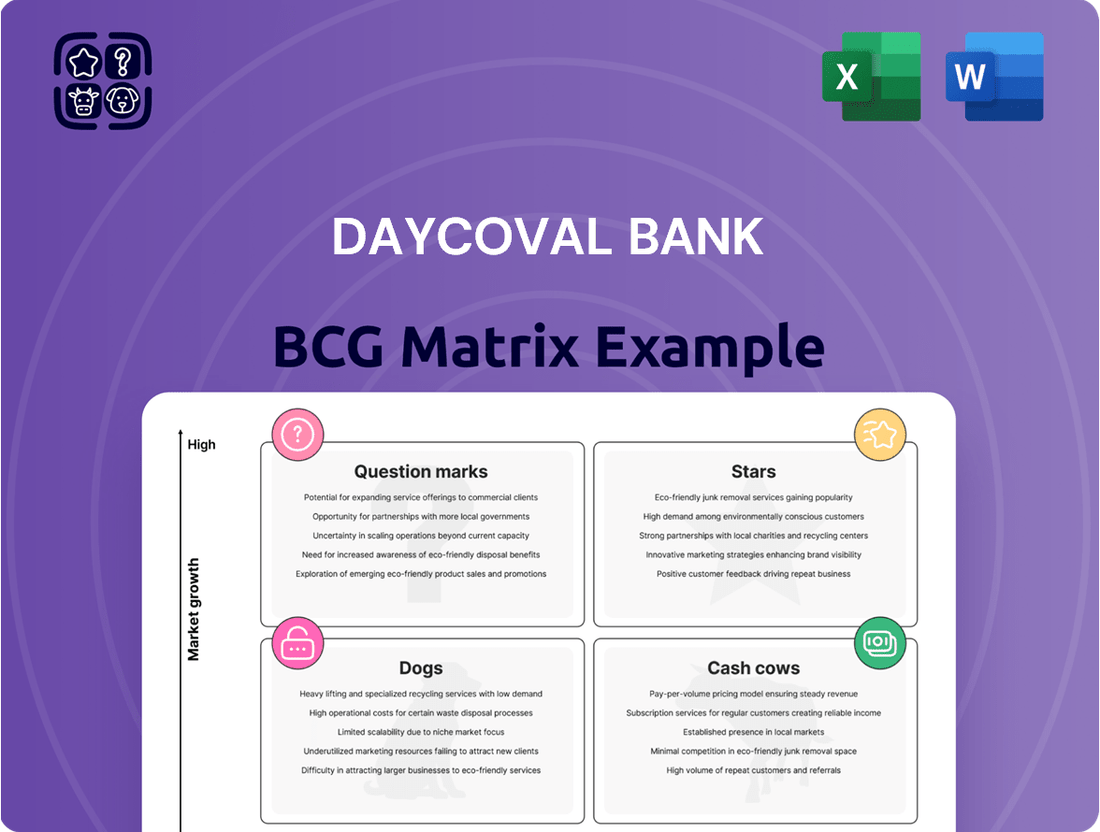

Daycoval Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daycoval Bank Bundle

Uncover the strategic positioning of Daycoval Bank's product portfolio with our insightful BCG Matrix preview. See which offerings are driving growth and which might require a closer look.

This glimpse into Daycoval Bank's market performance is just the beginning. Purchase the full BCG Matrix report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable strategic recommendations.

Don't miss out on the complete picture! Get the full BCG Matrix for Daycoval Bank and unlock the data-driven insights needed to make informed investment and product development decisions, ensuring your business stays ahead of the curve.

Stars

Daycoval's corporate lending, making up about 70% of its total loans, saw a healthy 7.1% rise in Q2 2024. This expansion in its main area of business highlights its strong position in Brazil's growing economy.

The bank's strategy of serving small, medium, and large businesses enables it to secure a significant portion of the market in this dynamic sector.

Daycoval Asset Management is a shining star in the BCG matrix, demonstrating impressive growth. Its assets under management have surged, a testament to its expanding market presence.

The firm's commitment to quality is underscored by Moody's Local Brazil's highest rating, and its recognition as the 2nd Best Fixed Income Asset Manager by Guia FGV de Fundos de Investimentos 2023 further solidifies this stellar performance. This indicates a strong market share within a dynamic and expanding investment landscape.

Daycoval Bank is making significant strides in investment banking, leveraging Brazil's robust debt market, which experienced substantial expansion in 2024. This strategic push is further fueled by the projected recovery and increased activity in Brazil's mergers and acquisitions (M&A) landscape for 2025, signaling strong growth potential for Daycoval's advisory and capital-raising services.

Insurance Solutions

Daycoval's insurance solutions, bolstered by the January 2025 acquisition of BMG Seguros, represent a significant strategic expansion. This move diversifies Daycoval's revenue streams and aims to deepen client loyalty by offering a more comprehensive financial suite. The bank is targeting a high-share presence in the insurance market, leveraging this acquisition for substantial growth.

The integration of BMG Seguros is expected to unlock new avenues for revenue generation and client engagement. Daycoval anticipates that this diversification will contribute positively to its overall financial performance in the coming years.

- Strategic Diversification: The acquisition of BMG Seguros in January 2025 positions Daycoval to enter the insurance market.

- Client Relationship Enhancement: This expansion aims to strengthen long-term relationships by offering integrated financial and insurance products.

- Growth Potential: Daycoval is targeting a significant market share in the insurance sector, anticipating substantial growth.

- Revenue Stream Expansion: The insurance business is projected to contribute new and diversified revenue streams for the bank.

Digital Credit for Companies

Daycoval Bank's digital credit offerings for companies represent a strong contender in the market, likely falling into the Stars category of the BCG Matrix. The bank's commitment to digital transformation and an omnichannel approach fuels this segment's potential. This strategic focus allows for efficient client acquisition and expanded reach through online platforms, meeting the dynamic needs of the corporate sector.

In 2024, Daycoval Bank reported significant growth in its digital credit portfolio for businesses. For instance, the bank saw a substantial increase in the volume of digital credit disbursed to small and medium-sized enterprises (SMEs), driven by streamlined online application processes and faster approval times. This digital push is crucial for capturing market share in a competitive landscape.

- Digital Credit Growth: Daycoval Bank's digital credit solutions for companies are experiencing robust expansion, indicating high market share and high growth potential.

- Omnichannel Strategy: The integration of digital platforms with traditional banking services enhances customer experience and accessibility for corporate clients seeking credit.

- Efficiency Gains: Online origination and servicing of digital credit products contribute to operational efficiencies, allowing Daycoval to offer competitive rates and faster turnaround times.

- Market Demand: The increasing demand for agile and accessible financing solutions from businesses positions Daycoval's digital credit offerings for continued success and market leadership.

Daycoval Asset Management is a clear Star in Daycoval Bank's BCG matrix. Its assets under management have seen significant growth, reflecting an expanding market presence in a dynamic investment landscape. The firm's strong reputation, highlighted by Moody's Local Brazil's highest rating and recognition as the 2nd Best Fixed Income Asset Manager by Guia FGV in 2023, underscores its high market share and growth potential.

Daycoval Bank's digital credit offerings for companies are also positioned as Stars. The bank's focus on digital transformation and an omnichannel approach is driving efficient client acquisition and expanded reach. In 2024, Daycoval saw a substantial increase in digital credit disbursed to SMEs, a testament to its strong market share and high growth potential in this segment.

The bank's insurance solutions, significantly bolstered by the January 2025 acquisition of BMG Seguros, also represent a Star. This strategic move aims to establish a high-share presence in the insurance market, diversifying revenue streams and deepening client loyalty. Daycoval anticipates substantial growth and new avenues for revenue generation from this expansion.

Daycoval Bank's investment banking services are also emerging as Stars, capitalizing on Brazil's robust debt market expansion in 2024. The projected recovery and increased activity in Brazil's M&A landscape for 2025 further fuel strong growth potential for these services.

| Business Segment | BCG Category | Key Performance Indicators (2024/Early 2025 Data) | Market Share | Growth Potential |

|---|---|---|---|---|

| Asset Management | Star | Surging AUM, Moody's highest rating, 2nd Best Fixed Income AM (2023) | High | High |

| Digital Credit (Corporate) | Star | Substantial increase in SME digital credit disbursed, efficient online processes | High | High |

| Insurance Solutions | Star | Acquisition of BMG Seguros (Jan 2025), targeting high market share | Growing to High | High |

| Investment Banking | Star | Leveraging Brazil's robust debt market growth, projected M&A recovery | Growing | High |

What is included in the product

Highlights which Daycoval Bank units to invest in, hold, or divest based on market share and growth.

The Daycoval Bank BCG Matrix offers a clear, one-page overview of business units, relieving the pain of strategic uncertainty by highlighting growth and market share for informed decisions.

Cash Cows

Daycoval's established corporate lending portfolio, representing a significant 70% of its total loans, acts as a robust cash cow. This segment, primarily focused on small, medium, and large businesses, consistently delivers high-volume revenue, underscoring its importance to the bank's financial stability.

Despite its maturity, this core lending business thrives on Daycoval's strong, long-standing client relationships and a prudent, conservative management approach. These factors contribute to a predictable and stable cash flow, reinforcing its position as a reliable income stream for the bank.

Payroll-deductible loans, known as Consignado in Brazil, represent a strong Cash Cow for Daycoval Bank, making up a substantial 25% of its total loan portfolio. This segment experienced a healthy 4.9% year-over-year growth by the end of 2023, underscoring its reliable performance.

Consignado loans are a cornerstone of Daycoval's stability, offering predictable and low-risk revenue streams. Their secured nature, with repayments directly deducted from borrowers' salaries, ensures consistent cash flow, a hallmark of a mature and profitable business line.

Daycoval Bank's foreign exchange operations are a strong Cash Cow, generating consistent income. With 165 Daycoval Câmbio offices and many partnerships with travel agencies, the bank has a significant presence in this market. This widespread network allows them to efficiently serve a broad customer base for currency exchange needs.

Traditional Vehicle Financing

Daycoval's traditional vehicle financing segment is a solid contributor to its overall business, reflecting a stable market position. This area has consistently shown its value, as evidenced by its inclusion in Daycoval's interim financial reports for 2024, highlighting its ongoing importance to the bank's diversified loan offerings.

Operating within a mature market, this segment generates predictable revenue streams. Daycoval maintains a significant market share among its intended customers, underscoring the product's established presence and reliability. This stability is crucial for the bank's consistent performance.

- Stable Revenue: Vehicle financing provides a consistent income source for Daycoval.

- Mature Market Presence: The bank holds a strong position in a well-established market.

- Contribution to Portfolio: This segment is a key part of Daycoval's diverse loan portfolio, as seen in its 2024 interim financial data.

- High Market Share: Daycoval enjoys a substantial share within its targeted client base for vehicle loans.

Leasing Operations

Leasing operations have been a cornerstone of Banco Daycoval's business for a considerable time, demonstrating a well-established and dependable source of income. These activities are primarily handled by specialized units such as Daycoval Leasing, which consistently deliver solid returns and bolster the bank's financial stability and overall profitability.

In 2024, Banco Daycoval's leasing segment continued to be a significant contributor, reflecting its maturity and consistent performance. The bank reported robust figures in its leasing portfolio, underscoring its strength in this sector. For instance, the bank's commitment to this area is evident in its sustained investment and operational efficiency.

- Mature Revenue Stream: Leasing operations represent a stable and predictable source of income for Banco Daycoval, reflecting years of established market presence.

- Subsidiary Strength: Daycoval Leasing, a key subsidiary, efficiently manages these operations, ensuring consistent financial contributions to the parent company.

- Profitability Driver: The leasing segment reliably enhances Banco Daycoval's overall profitability and financial health, acting as a dependable pillar of its business model.

- 2024 Performance: In 2024, the leasing sector demonstrated continued strength, contributing positively to the bank's financial results and solidifying its position in the market.

Daycoval's established corporate lending, representing 70% of its loans, and payroll-deductible loans (Consignado), at 25% of its portfolio, are prime examples of its cash cows. These segments, bolstered by strong client relationships and direct salary deductions respectively, offer predictable and low-risk revenue streams, ensuring consistent cash flow for the bank.

Foreign exchange operations, supported by 165 Daycoval Câmbio offices and numerous travel agency partnerships, also function as a steady income generator. Similarly, traditional vehicle financing and leasing operations, managed by Daycoval Leasing, contribute significantly to the bank's financial stability, demonstrating mature market presence and consistent performance as seen in 2024 interim reports.

| Business Segment | Portfolio Share | Key Characteristics | 2023/2024 Data Points |

|---|---|---|---|

| Corporate Lending | 70% | High-volume revenue, strong client relationships, conservative management | Consistent high revenue generation |

| Consignado Loans | 25% | Payroll-deductible, low-risk, secured repayments | 4.9% year-over-year growth (end of 2023) |

| Foreign Exchange | N/A (Fee-based) | Widespread network (165 offices), partnerships | Consistent income generation |

| Vehicle Financing | N/A | Stable market position, predictable revenue | Included in 2024 interim financial reports, high market share |

| Leasing Operations | N/A | Managed by Daycoval Leasing, solid returns | Continued strength and positive contribution in 2024 |

Preview = Final Product

Daycoval Bank BCG Matrix

The BCG Matrix analysis for Daycoval Bank you are currently previewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, devoid of watermarks or demo content, offers a clear strategic overview of Daycoval Bank's product portfolio, ready for immediate application in your business planning and decision-making processes.

Dogs

Daycoval Bank's general personal loans, outside of its strong payroll-deductible offerings, are currently in the Dogs quadrant. These products have struggled to gain substantial market share or establish a distinct competitive edge within the crowded retail banking sector.

These underperforming general personal loans may necessitate considerable investment in marketing and operational resources, yielding minimal returns. In 2023, the Brazilian personal loan market saw significant growth, but Daycoval's general segment did not capture a proportionally large piece of this expansion, indicating a relative underperformance.

Niche or low-volume retail products, like specialized savings accounts that don't draw significant deposits or offer unique features, can be classified as Dogs within Daycoval Bank's BCG Matrix. These offerings often require resources for maintenance and customer support but fail to generate substantial revenue or gain meaningful market traction. For instance, a savings account with a below-average interest rate and limited digital access might fall into this category, contributing minimally to the bank's overall profitability.

Daycoval Bank may have legacy IT systems supporting non-core operations, such as older platforms for less profitable loan segments or outdated customer service tools. These systems, while functional, are often inefficient and costly to maintain, diverting capital and IT resources away from more strategic growth areas. For instance, the cost of maintaining such legacy systems globally can represent a significant portion of a bank's IT budget, sometimes exceeding 70% in older institutions, according to industry reports from 2024.

Inefficient Physical Branch Locations

Daycoval's extensive branch network, while a strength, includes locations in economically stagnant regions that may not align with the bank's profitable segments like corporate and payroll lending. These underperforming branches could represent inefficient capital allocation, draining resources without generating adequate returns. For instance, in 2024, Daycoval continued its strategy of optimizing its physical footprint, which involved evaluating branch performance against key profitability metrics.

- Branch Performance Analysis: Daycoval actively analyzes branch-level data to identify underperformers based on profitability, loan origination volume for core products, and customer acquisition costs.

- Resource Reallocation: Underperforming branches might be candidates for consolidation or repurposing to more strategically vital locations or digital service hubs.

- ROI Assessment: The bank continuously assesses the return on investment for each physical location, ensuring that resources are directed towards branches that demonstrably support Daycoval's profitable business lines.

High-Delinquency SME Lending Sub-segments

Within Daycoval Bank's SME lending, certain sub-segments have shown a concerning trend of increasing delinquencies. As of December 2023, these areas are tying up valuable capital and demanding significant resources for recovery, which in turn, squeezes profitability.

These high-delinquency segments represent a drag on the bank's overall performance. The intensive management required for these loans diverts attention and resources from more productive areas of the business.

- Rising Delinquency Rates: Specific SME sub-segments experienced a notable increase in overdue payments by the end of 2023.

- Capital Immobilization: These loans are consuming capital that could be deployed more effectively elsewhere.

- Increased Recovery Costs: The bank is incurring higher operational costs due to the effort needed to recover funds from these struggling borrowers.

- Profitability Impact: The combination of tied-up capital and elevated recovery expenses negatively affects the overall profitability of the SME portfolio.

Daycoval Bank's general personal loans, outside of its strong payroll-deductible offerings, are classified as Dogs. These products have struggled to gain substantial market share or establish a distinct competitive edge, indicating a need for strategic review. In 2023, the Brazilian personal loan market grew, but Daycoval's general segment did not capture a proportionally large piece of this expansion, highlighting relative underperformance.

Niche or low-volume retail products, like specialized savings accounts that don't attract significant deposits or offer unique features, also fall into the Dogs category. These offerings require resources for maintenance but fail to generate substantial revenue or gain meaningful market traction. For instance, a savings account with below-average interest rates and limited digital access might be a Dog, contributing minimally to overall profitability.

Daycoval's extensive branch network includes locations in economically stagnant regions that do not align with profitable segments like corporate and payroll lending. These underperforming branches represent inefficient capital allocation. In 2024, Daycoval continued evaluating branch performance against profitability metrics.

Within Daycoval Bank's SME lending, certain sub-segments show increasing delinquencies. As of December 2023, these areas tie up valuable capital and demand significant resources for recovery, squeezing profitability. The intensive management required diverts attention from more productive areas.

| Product Segment | BCG Category | Market Share Trend | Profitability Trend | Key Challenges |

|---|---|---|---|---|

| General Personal Loans | Dogs | Low and stagnant | Low | Lack of differentiation, intense competition |

| Niche Savings Accounts | Dogs | Declining or negligible | Low or negative | Low interest rates, limited features, poor digital access |

| Underperforming Branches | Dogs | N/A (location-specific) | Low or negative | Economic stagnation in region, inefficient operations |

| High-Delinquency SME Sub-segments | Dogs | N/A (specific loan types) | Negative | Rising delinquencies, high recovery costs, capital immobilization |

Question Marks

Daycoval's strategic push into digital retail banking, exemplified by platforms like daycovaldigital.com.br and daycovalimovel.com.br, positions it to capitalize on the expanding Brazilian digital banking landscape. This focus on digital adoption signals a high-growth potential, a key characteristic of a Question Mark in the BCG Matrix.

While these initiatives showcase promising growth avenues, their current market penetration within the vast digital retail banking sector remains relatively small. Significant investment is therefore necessary to nurture these ventures and transform them into dominant market players, or Stars, in the future.

Daycoval Bank's recent syndicated financing of $460 million, secured with the International Finance Corporation (IFC), highlights a strategic move into a burgeoning market: credit for female entrepreneurs within the micro, small, and medium-sized enterprise (MSME) sector. This initiative is designed to foster growth and provide crucial capital to a segment that has historically faced funding challenges.

While this focus on female entrepreneurship represents a high-potential growth area, Daycoval's current penetration and market share within this specific niche are likely still developing. Consequently, in the context of the BCG Matrix, this segment can be categorized as a Question Mark, signifying its potential for substantial growth but also its current uncertainty regarding market dominance and profitability.

Daycoval Bank's focus on credit for MSMEs in the Legal Amazon region, supported by IFC funding, highlights a strategic move into a high-potential, yet underserved, market. This initiative aims to tap into the growth opportunities within this specific geographical niche, where Daycoval's current market penetration is likely limited, necessitating focused investment for expansion.

In 2024, the IFC committed $100 million to Daycoval, with a significant portion earmarked for expanding credit access to MSMEs, particularly in regions like the Legal Amazon. This aligns with Daycoval's strategy to identify and cultivate niche markets, positioning these MSME lending programs as potential 'Stars' in its BCG matrix due to their high growth prospects and the bank's developing market share.

Newly Launched Insurance Products

Following its January 2025 acquisition of BMG Seguros, Daycoval Bank is strategically introducing new insurance products and cross-selling initiatives specifically tailored for its corporate clientele. These new offerings are positioned as potential high-growth areas within the bank's portfolio.

These newly launched products, while holding significant future promise, are currently in the nascent stages of market penetration. This means they possess a low market share presently, necessitating considerable investment in marketing campaigns and seamless integration with existing Daycoval services to gain traction.

- Product Development Focus: Daycoval's post-acquisition strategy emphasizes tailored insurance solutions for corporate clients, aiming to leverage BMG Seguros' expertise.

- Market Position: The new offerings are classified as Stars in the BCG matrix, indicating high growth potential but currently low market share.

- Investment Needs: Significant marketing and integration efforts are required to drive adoption and capture market share for these new insurance products.

- Strategic Goal: The objective is to transform these nascent products into significant revenue generators by effectively penetrating the corporate market.

Emerging Fintech Collaborations or Ventures

Daycoval Bank's exploration into emerging fintech collaborations positions these ventures squarely in the Question Mark quadrant of the BCG matrix. These initiatives, while promising high growth potential by tapping into novel market demands and technological advancements, currently exhibit a nascent market share. This necessitates significant strategic investment to nurture their development and capture a larger portion of the evolving financial landscape.

- High Growth Potential: Fintech collaborations aim to leverage cutting-edge technology to create innovative financial products and services, potentially disrupting traditional banking models and attracting new customer segments.

- Low Market Share: As these ventures are typically in their early stages, they have not yet established a significant presence or customer base within the broader financial market.

- Strategic Investment Required: To transform these Question Marks into Stars, Daycoval must allocate substantial resources for research, development, marketing, and operational scaling.

- Focus on Innovation: Examples could include partnerships for digital payment solutions, AI-driven customer service platforms, or blockchain-based transaction systems, all designed to enhance user experience and operational efficiency.

Daycoval Bank's digital retail banking platforms and credit initiatives for female entrepreneurs and MSMEs in the Legal Amazon region are prime examples of Question Marks. These ventures show high growth potential but currently possess low market share, requiring substantial investment to mature.

The bank's recent acquisition of BMG Seguros has led to new insurance products for corporate clients, also fitting the Question Mark profile. These products, while promising, are in their early stages and need significant marketing and integration efforts to gain traction.

Emerging fintech collaborations further exemplify Daycoval's Question Mark portfolio. These partnerships aim for high growth by leveraging new technologies but require considerable investment to establish a significant market presence.

| BCG Category | Daycoval Bank Initiative | Market Growth Potential | Current Market Share | Investment Need |

|---|---|---|---|---|

| Question Mark | Digital Retail Banking Platforms | High | Low | High |

| Question Mark | Credit for Female Entrepreneurs (MSMEs) | High | Low | High |

| Question Mark | MSME Credit in Legal Amazon | High | Low | High |

| Question Mark | New Insurance Products (Post-BMG Seguros Acquisition) | High | Low | High |

| Question Mark | Fintech Collaborations | High | Low | High |

BCG Matrix Data Sources

Our Daycoval Bank BCG Matrix is constructed using a blend of internal financial reports, market share data, and external industry growth analyses. This ensures a comprehensive view of each business unit's performance and market position.