Banco Davivienda PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Davivienda Bundle

Unlock the critical external factors shaping Banco Davivienda's trajectory. Our PESTLE analysis dives deep into the political stability, economic fluctuations, and social shifts impacting its operations. Understand the technological advancements and environmental regulations that present both challenges and opportunities for the bank. Gain a competitive advantage by leveraging these insights for strategic planning.

Don't be left in the dark about the forces influencing Banco Davivienda. Our comprehensive PESTLE analysis provides a clear roadmap of the political landscape, economic climate, and societal trends. Discover how evolving legal frameworks and environmental considerations are reshaping the financial sector. Download the full version now to arm yourself with actionable intelligence and make informed decisions.

Political factors

The political stability in Colombia, where Banco Davivienda holds a significant presence, is a key factor. As of early 2024, Colombia has been navigating a period of policy adjustments under its current administration, which can impact the financial sector's regulatory landscape. For instance, reforms debated in 2023 and continuing into 2024 regarding fiscal policy and social programs could indirectly affect consumer spending and credit demand, influencing Davivienda's loan portfolio performance.

Similarly, the political environments in Central American countries where Davivienda operates, such as El Salvador and Costa Rica, introduce their own dynamics. In El Salvador, for example, the government's approach to economic management and digital currencies, as seen in earlier years, continues to shape the operational context for financial institutions. Policy continuity or significant changes directly affect the predictability of regulations governing banking operations, capital requirements, and consumer protection, all of which are critical for Banco Davivienda's strategic planning and risk management.

Banco Davivienda operates within stringent regulatory frameworks set by central banks and financial superintendencies across its key markets, notably Colombia and Central America. These bodies dictate crucial aspects like capital adequacy ratios, lending standards, and risk management protocols, directly influencing the bank's operational capacity and financial performance. For instance, in Colombia, the Superintendencia Financiera de Colombia (SFC) mandates specific capital requirements, which Davivienda consistently met, reporting a consolidated capital adequacy ratio well above regulatory minimums throughout 2023 and into early 2024.

Potential shifts in these regulations, often tied to governmental economic policies or responses to global financial trends, pose a significant political risk. For example, a tightening of lending regulations could reduce the volume of new loans, impacting interest income. Conversely, a relaxation might open new avenues for growth. Davivienda actively monitors these evolving political landscapes, as demonstrated by its proactive adjustments to compliance strategies in anticipation of potential regulatory changes impacting areas like digital banking and cybersecurity, critical for maintaining trust and operational integrity in 2024.

Governments worldwide are intensifying efforts against corruption, directly impacting financial sector operations. For instance, Colombia, Davivienda's primary market, has seen increased regulatory scrutiny aimed at bolstering corporate governance. This push for transparency means institutions like Davivienda must maintain robust internal controls and adhere to stringent external reporting requirements to mitigate risks and ensure compliance with evolving standards.

International Relations and Trade

Colombia's trade relationships are a significant factor for Banco Davivienda. For instance, the country's participation in trade blocs like the Pacific Alliance, which includes Mexico, Peru, and Chile, facilitates smoother cross-border transactions and can boost foreign direct investment. In 2023, Colombia's exports to these alliance members saw continued growth, signaling increased economic integration.

International trade agreements directly impact Davivienda's foreign exchange services and its exposure to currency fluctuations. Favorable agreements can lead to increased capital flows into Colombia, benefiting the bank's corporate lending and investment banking divisions. Conversely, trade disputes or protectionist policies by major trading partners could create economic uncertainty and slow down these activities.

The bank's international operations, particularly in Central America, are also shaped by the geopolitical stability and trade policies of those host nations. For example, economic partnerships or trade agreements involving countries like Costa Rica or El Salvador, where Davivienda has a presence, can unlock new avenues for business development and profitability.

- Pacific Alliance Trade: Colombia's exports to Pacific Alliance partners showed a continued upward trend in 2023, providing a more stable environment for international trade finance.

- Foreign Exchange Sensitivity: Davivienda's foreign exchange services revenue is directly influenced by trade volumes and the stability of currency exchange rates, which are often tied to international trade agreements.

- Investment Flows: Favorable international relations and trade pacts can attract foreign investment into Colombia, supporting Davivienda's role in financing these ventures.

- Regional Economic Stability: Davivienda's performance in Central America is linked to the economic and political stability of those countries, as well as their trade relationships with global markets.

Social and Political Unrest

Social and political instability, such as widespread protests or significant shifts in public opinion regarding economic policies, can significantly impact operations and dampen consumer confidence. For a financial institution like Banco Davivienda, this translates to potential disruptions in lending and an elevated credit risk environment. For example, during periods of heightened social unrest in Colombia, such as those seen in 2021, economic activity can slow, affecting loan demand and repayment capabilities.

These events can trigger capital flight as investors seek more stable markets, directly impacting the bank's liquidity and its ability to extend credit. Furthermore, increased political uncertainty can lead to policy changes that affect the financial sector, such as altered interest rate policies or new regulatory requirements. Davivienda's strategic planning must therefore incorporate robust monitoring of socio-political indicators to proactively manage asset quality and navigate potential economic headwinds.

- Monitoring Socio-Political Indicators: Davivienda actively tracks public sentiment and political developments in its key markets, particularly Colombia and Central America, to anticipate potential economic disruptions.

- Impact on Lending: Social unrest can lead to a decline in business investment and consumer spending, directly affecting the demand for loans and increasing the probability of loan defaults, thus impacting asset quality.

- Capital Flight Risk: Periods of political instability can cause investors to withdraw capital, potentially reducing the bank's funding sources and liquidity.

- Regulatory Uncertainty: Shifts in government or policy directions can introduce new regulations or alter existing ones, creating operational challenges and affecting profitability.

Government policies and regulatory frameworks in Colombia and Central America significantly shape Banco Davivienda's operational landscape. For instance, in early 2024, Colombia's government continued to implement fiscal reforms that could influence disposable income and credit accessibility for consumers, impacting loan growth. Davivienda, as of the first quarter of 2024, maintained capital adequacy ratios well above regulatory minimums, demonstrating its resilience to potential policy shifts.

Political stability is crucial; for example, the 2023-2024 period saw ongoing discussions in Colombia regarding economic policies that could indirectly affect the financial sector's growth prospects. Davivienda's strategic planning actively incorporates monitoring these political developments to manage associated risks and opportunities, ensuring compliance with evolving regulations in its key markets.

The bank's adherence to stringent capital requirements, a direct outcome of political and regulatory oversight, remains a priority. In Q1 2024, Banco Davivienda reported a consolidated Common Equity Tier 1 (CET1) ratio of 12.5%, comfortably exceeding the regulatory requirement of 7.5% in Colombia, underscoring its robust financial footing despite the dynamic political environment.

What is included in the product

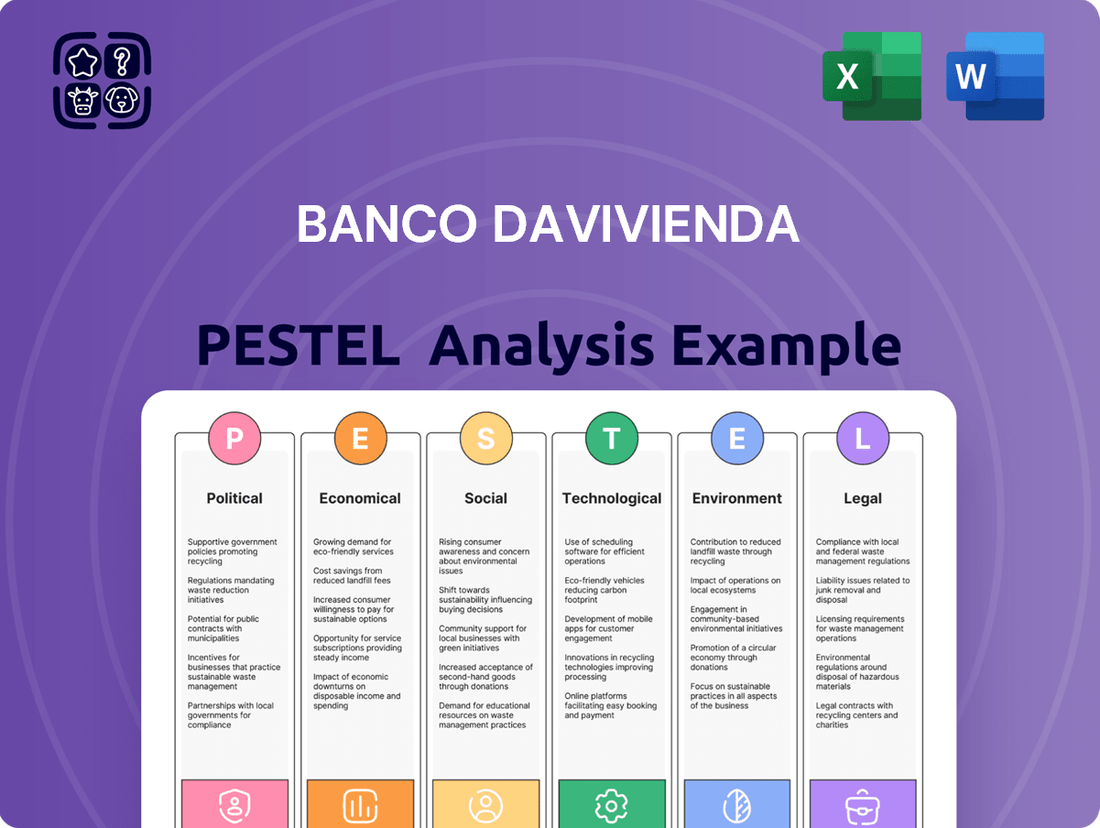

This PESTLE analysis critically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Banco Davivienda's operations and strategic positioning.

It provides actionable insights into external factors, enabling informed decision-making for navigating current market conditions and future opportunities.

Banco Davivienda's PESTLE analysis offers a clear and simple language version, making complex external factors accessible for all stakeholders to understand and discuss market positioning.

Economic factors

Colombia's economy showed resilience, with GDP growth projected at 2.5% for 2024, a slight moderation from 2023's estimated 2.9%. This sustained growth underpins demand for Davivienda's banking services, as businesses and individuals are more likely to seek credit and investment opportunities.

In Central America, economic expansion remains a key factor. For instance, Costa Rica's GDP is forecast to grow by approximately 3.8% in 2024, while Panama anticipates robust growth around 4.5%. These figures suggest a healthy environment for increased consumer spending and business investment, directly benefiting Davivienda's loan portfolios.

However, global economic uncertainties, including inflation and potential interest rate hikes, could temper this growth. A slowdown in these markets would likely translate to reduced credit demand and a potential increase in non-performing loans for Davivienda, impacting overall profitability.

Changes in benchmark interest rates, such as those set by Colombia's Banco de la República, directly affect Banco Davivienda's cost of borrowing and the rates it charges on loans. For instance, if the policy rate increases, Davivienda's funding costs likely rise, potentially squeezing its net interest margin unless it can pass these costs to borrowers.

High inflation, a persistent concern globally and in Colombia, can significantly impact Davivienda. Elevated inflation erodes the real value of savings and can dampen consumer spending, leading to lower demand for credit. Furthermore, it can increase the bank's own operational expenses, from salaries to technology costs.

In 2024, inflation in Colombia has shown a downward trend, with the annual rate falling to 7.16% by May 2024, down from 10.76% in December 2023. This easing inflation provides some relief, but the benchmark interest rate, while reduced, remained at 11.75% as of May 2024, indicating ongoing monetary policy caution.

Managing these intertwined factors is paramount for Davivienda's profitability. The bank must navigate the delicate balance of adjusting lending rates to account for funding costs and economic conditions while remaining competitive and supporting customer demand for financial services.

Unemployment rates and average disposable income are crucial for Banco Davivienda, directly impacting client creditworthiness. For instance, in Colombia, the unemployment rate for the first quarter of 2024 was reported at 10.7%, a slight increase from the previous year, while average real wages showed modest growth. These figures are vital for Davivienda to gauge potential loan defaults.

When unemployment falls and incomes rise, individuals and businesses are generally more capable of meeting their financial obligations. This translates to stronger loan portfolios for Davivienda, particularly in consumer and mortgage lending segments, and a reduced risk of clients defaulting on their payments. For example, a rise in disposable income in key markets like Colombia, where Davivienda has a significant presence, can boost demand for credit products.

Davivienda's entire credit risk management framework hinges on its ability to accurately assess and adapt to these socio-economic indicators. By closely monitoring unemployment trends and income levels, the bank can make more informed decisions about lending, provisioning, and overall risk exposure, ensuring the health of its financial operations.

Exchange Rate Fluctuations

Exchange rate fluctuations present a significant challenge for Banco Davivienda, given its presence in multiple Latin American countries. As of early 2025, the Colombian Peso (COP) has experienced volatility against currencies like the US Dollar (USD) and the Peruvian Sol (PEN). For instance, a stronger USD against the COP can reduce the value of dollar-denominated assets held by the bank and impact the profitability of its operations in countries where the local currency depreciates. This dynamic directly affects the translation of foreign earnings and the overall financial health of its international subsidiaries.

The bank's exposure to these currency movements is substantial. For example, if Banco Davivienda holds a significant portion of its assets in USD and the COP depreciates, the peso-denominated value of those assets increases. Conversely, if liabilities are denominated in a strengthening currency while revenues are in a weaker one, profitability suffers. This necessitates robust currency risk management strategies.

Effective management of these risks is paramount. Banco Davivienda employs various hedging techniques, such as forward contracts and currency options, to mitigate potential losses arising from adverse exchange rate movements. The success of these strategies is often gauged by their ability to stabilize earnings and protect the bank's capital base against unpredictable currency swings. As of the latest available data, the bank actively monitors its net open currency positions across its various operating markets.

- Impact on Assets and Liabilities: A stronger US Dollar relative to the Colombian Peso (COP) in early 2025 potentially decreases the COP value of dollar-denominated assets held by Banco Davivienda.

- Profitability of International Operations: Depreciation of regional currencies against the COP can negatively affect the translated profits from foreign subsidiaries, impacting the bank's consolidated financial statements.

- Cross-Border Transaction Value: Significant appreciation of the COP can make cross-border transactions more expensive for customers and the bank, potentially influencing trade finance volumes.

- Currency Risk Mitigation: Banco Davivienda utilizes hedging instruments to manage its exposure to foreign exchange volatility, aiming to preserve the value of its earnings and capital.

Credit Market Conditions

Credit market conditions significantly influence Banco Davivienda's operations, affecting its capacity to lend and pursue growth. The availability and cost of wholesale funding, crucial for a bank's balance sheet, are directly tied to these conditions. Investor sentiment, national debt figures, and global capital movements all play a role in shaping the credit landscape.

For instance, in early 2024, global interest rate hikes, though showing signs of stabilization, continued to influence the cost of capital for financial institutions. Emerging markets, including Colombia where Davivienda operates, faced scrutiny regarding sovereign debt levels, which can impact international investor confidence and access to foreign funding. A robust credit market is therefore fundamental for Davivienda's sustained expansion and effective financial management.

- Liquidity and Stability: The overall health of credit markets dictates how easily Davivienda can access funds to lend to its customers.

- Cost of Capital: Higher interest rates or increased perceived risk in the market will raise Davivienda's borrowing costs.

- Investor Confidence: Strong investor belief in economic stability and sovereign creditworthiness improves access to funding.

- International Capital Flows: The movement of money across borders directly impacts the pool of available capital for banks like Davivienda.

Colombia's economic growth, projected at 2.5% for 2024, supports demand for banking services, while Central American economies like Costa Rica (3.8% GDP growth forecast for 2024) and Panama (4.5% forecast) offer further opportunities. However, global inflation and interest rate uncertainty pose risks, potentially reducing credit demand and increasing defaults for Banco Davivienda.

Inflation in Colombia eased to 7.16% by May 2024, but the benchmark interest rate remained at 11.75%, influencing Davivienda's borrowing costs and lending rates. Unemployment at 10.7% in Q1 2024 and modest real wage growth impact client creditworthiness, necessitating careful risk management.

Currency volatility, particularly the COP against the USD in early 2025, affects Davivienda's asset values and international operations, requiring robust hedging strategies. Credit market conditions, including global interest rates and investor sentiment towards emerging markets, also shape Davivienda's access to funding and cost of capital.

Full Version Awaits

Banco Davivienda PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Banco Davivienda explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain insights into market dynamics, regulatory landscapes, and emerging trends crucial for understanding Banco Davivienda's position. This comprehensive report is designed to equip you with the knowledge needed for informed business strategy and risk assessment.

Sociological factors

Changes in population demographics, such as age distribution and urbanization rates, directly influence the demand for specific banking products. For example, a growing youth population in Colombia, which saw a significant portion of its population under 30 in recent years, might drive demand for digital banking services. Davivienda needs to adapt its offerings to these evolving demographic segments.

An aging population, also a growing trend globally and in Latin America, could increase demand for retirement planning and investment products. Davivienda's financial advisory services and wealth management solutions become more critical as more individuals plan for their later years. Understanding these shifts is key to product development.

Household formation patterns also play a role. Smaller, more diverse household structures might require different financial products, such as flexible loan options or digital payment solutions. Davivienda’s ability to cater to these changing family dynamics will impact its market share.

The financial inclusion rate in Colombia, a key market for Banco Davivienda, stood at around 53.6% by the end of 2023, indicating a significant portion of the population remains unbanked or underbanked. This presents both challenges and opportunities; lower financial literacy can limit the uptake of complex financial products, but initiatives to improve it, such as Davivienda's own educational programs, can unlock new customer segments and drive demand for formal banking services. For instance, by focusing on accessible digital platforms and simplified product offerings, Davivienda can effectively tap into these underserved populations, potentially expanding its customer base by millions.

Consumer preferences are shifting rapidly, with a strong emphasis on digital and mobile banking. Davivienda needs to cater to this by offering intuitive apps and online platforms. For instance, in 2024, it's estimated that over 70% of banking transactions in Latin America occurred through digital channels, a trend that continues to grow, pushing banks like Davivienda to innovate.

Customers now expect personalized services and a seamless experience across all touchpoints. This means not just having a good app, but also ensuring interactions are smooth whether online, in-branch, or via customer support. Davivienda's ability to offer tailored financial advice and products based on individual customer data will be crucial for retaining loyalty in this competitive landscape.

Adapting service delivery is key to meeting these evolving expectations. Banks must invest in technology that allows for instant transactions, easy account management, and responsive customer service. Davivienda's strategic investments in fintech partnerships and internal digital transformation efforts are directly aimed at securing its position by aligning with these consumer demands.

Income Inequality and Social Stratification

Income inequality significantly shapes Banco Davivienda's operational landscape in Colombia and other Latin American markets. For instance, in 2023, Colombia's Gini coefficient, a measure of income inequality, stood at approximately 0.53, indicating a substantial gap between high and low earners. This necessitates a dual approach for Davivienda: offering accessible financial products for lower-income segments, such as micro-loans and basic savings accounts, while simultaneously developing sophisticated wealth management and investment services for affluent clients.

The bank must adapt its product development to address varying purchasing power and financial needs arising from social stratification. High income disparity can lead to segmented demand, where a significant portion of the population requires affordable financial solutions, while a smaller segment seeks premium banking services. Davivienda's strategy needs to balance serving these diverse groups effectively to capture a wider market share.

- Market Segmentation: Catering to both low-income individuals needing basic banking and high-net-worth clients requiring wealth management.

- Product Diversification: Offering a spectrum of products from microfinance to investment portfolios.

- Risk Management: Understanding how income disparities affect loan default rates and credit risk across different customer segments.

- Social Impact: Developing financial inclusion initiatives to serve underserved populations, potentially mitigating some effects of inequality.

Cultural Attitudes Towards Debt and Saving

Cultural norms significantly shape how individuals in Colombia approach debt and saving, directly influencing Banco Davivienda's customer base. For instance, a strong cultural emphasis on family support might lead some to prioritize immediate needs over long-term savings, impacting loan demand for investments versus consumption. Conversely, a growing aspirational middle class might exhibit a greater propensity for financial planning and debt utilization for educational or housing purposes.

Societal attitudes towards borrowing can be quite varied. While some cultures may view debt with caution, others see it as a tool for achieving financial goals, such as homeownership or business expansion. This duality is evident in Colombia, where access to credit can be a key enabler for many, but a history of economic volatility also fosters a sense of prudence regarding financial commitments.

Davivienda's success hinges on understanding these diverse cultural attitudes. For example, marketing campaigns for personal loans might need to be tailored differently for regions with a more conservative saving culture compared to those more open to leveraging credit. This nuanced approach ensures products resonate with local financial behaviors and aspirations.

Recent data from 2024 indicates a continued trend of increasing financial inclusion in Colombia. A significant portion of the population, particularly in urban centers, is becoming more receptive to digital banking solutions and structured financial products. This suggests a growing comfort with formal financial systems and, by extension, a potentially higher demand for credit and savings products offered by institutions like Davivienda. For example, a survey in early 2024 found that over 70% of urban Colombian adults actively use at least one financial service, up from 55% in 2020, highlighting a shift in attitudes towards formal finance.

- Cultural Attitudes: Colombian society exhibits a spectrum of views on debt, from cautious avoidance to strategic utilization for wealth building.

- Saving Propensity: Family obligations and immediate consumption needs can sometimes outweigh long-term savings goals for certain demographics.

- Impact on Demand: Attitudes directly influence the uptake of mortgages, personal loans, and investment products, core to Davivienda's offerings.

- Market Segmentation: Tailoring financial products and marketing to varying cultural financial behaviors is crucial for effective market penetration.

- Financial Inclusion Trends: Growing access to and use of formal financial services, especially in urban areas, indicates a positive shift in attitudes towards managed debt and savings.

Societal attitudes towards debt and savings significantly impact banking preferences in Colombia, influencing how Banco Davivienda tailors its products. While some segments view debt cautiously, others see it as a tool for advancement, impacting demand for various financial instruments. Davivienda must align its offerings with these diverse cultural perspectives, recognizing that regional differences in financial behavior exist.

The increasing financial inclusion observed in urban Colombia, with over 70% of adults using financial services in early 2024, signals a growing comfort with formal banking. This trend suggests a higher potential demand for credit and savings products, presenting opportunities for Davivienda to expand its customer base by catering to evolving financial literacy and engagement levels.

Cultural norms surrounding family support can influence saving habits, sometimes prioritizing immediate needs over long-term financial planning. This dynamic affects the uptake of products like mortgages or investment accounts, requiring Davivienda to develop flexible solutions that acknowledge these familial obligations while encouraging financial prudence.

| Sociological Factor | Impact on Banco Davivienda | Relevant Data/Observation (2023-2024) |

|---|---|---|

| Cultural Attitudes to Debt | Influences demand for loans and credit products. | Varying views on debt as a tool for growth vs. a risk, impacting uptake of personal loans and mortgages. |

| Saving Propensity | Affects demand for savings accounts and investment products. | Family obligations can sometimes lead to prioritizing immediate needs over long-term savings. |

| Financial Inclusion | Expands potential customer base for formal banking. | Over 70% of urban Colombian adults used financial services in early 2024; growing comfort with digital banking. |

| Social Stratification | Requires tailored product offerings for different income levels. | Colombia's Gini coefficient around 0.53 in 2023 necessitates products from micro-loans to wealth management. |

Technological factors

The banking sector is undergoing a significant digital transformation, compelling institutions like Banco Davivienda to prioritize investments in digital infrastructure. This includes enhancing online portals, mobile banking apps, and streamlining digital account opening procedures to improve customer engagement and operational efficiency. By Q3 2024, Davivienda reported a substantial increase in digital transactions, reflecting customer preference for these channels.

The rise of fintech firms presents a dual challenge and opportunity for Banco Davivienda. These agile companies, often focusing on niche areas like digital payments or peer-to-peer lending, are rapidly gaining market share by offering user-friendly and often cheaper alternatives to traditional banking services. For instance, by the end of 2024, global fintech investment was projected to surpass previous years, indicating a significant influx of capital into this sector, further fueling innovation and competition.

Davivienda faces the imperative to adapt by either enhancing its own technological capabilities or forging strategic alliances with these fintech innovators. Failure to do so could lead to a decline in customer acquisition and retention, particularly among younger demographics who are more inclined to adopt digital-first financial solutions. The bank's ability to integrate new technologies and offer competitive digital products will be crucial for its sustained growth and market position in the coming years.

As banking increasingly shifts online, cybersecurity and data protection are critical. Davivienda faces significant risks from cyber threats and data breaches, which can erode customer trust and lead to regulatory issues. Protecting sensitive financial and personal information demands ongoing investment in advanced security systems and strict protocols.

Failure to comply with evolving data protection regulations, such as GDPR or similar regional laws, carries substantial financial penalties and can severely damage a bank's reputation. For instance, in 2024, financial institutions globally reported billions in losses due to cyberattacks, highlighting the immense financial and reputational stakes involved.

Artificial Intelligence and Analytics

The integration of Artificial Intelligence (AI) and big data analytics presents a transformative opportunity for Banco Davivienda. By harnessing these technologies, Davivienda can significantly improve its operational efficiency and customer engagement. For instance, AI-powered tools can enhance personalized customer service by anticipating needs and offering tailored solutions. In 2024, the global AI in banking market was valued at an estimated $26.5 billion, with projections indicating substantial growth, underscoring the strategic importance of this adoption.

AI and advanced analytics are crucial for bolstering security and risk management. Fraud detection systems powered by AI can identify and prevent suspicious transactions in real-time, protecting both the bank and its customers. Furthermore, sophisticated credit risk assessment models leveraging big data can lead to more accurate lending decisions, reducing non-performing loans. Davivienda's investment in these areas can directly impact its profitability and stability.

The strategic implementation of AI is paramount for maintaining a competitive advantage in the evolving financial landscape.

- Enhanced Customer Experience: AI enables hyper-personalization of services, improving customer satisfaction and loyalty.

- Improved Risk Management: Advanced analytics provide deeper insights into credit risk and fraud patterns, minimizing financial losses.

- Operational Efficiency: Automation of tasks through AI reduces costs and speeds up processes, from onboarding to loan processing.

- Product Innovation: AI can identify market gaps and customer needs, driving the development of new and competitive financial products.

Mobile Banking and Connectivity

The increasing penetration of smartphones, projected to reach over 85% of the Latin American population by 2025, directly fuels demand for advanced mobile banking at Banco Davivienda. This technological shift necessitates a robust digital offering to serve a growing, digitally native customer base, particularly in regions where physical branch networks are less dense. Reliable internet connectivity, which saw significant expansion in key markets like Colombia and Central America during 2024, is the bedrock upon which these mobile services operate.

- Smartphone Adoption: Over 80% of adults in Colombia owned a smartphone as of late 2024.

- Internet Penetration: Internet access in Latin America is expected to surpass 75% by mid-2025.

- Mobile Banking Growth: Davivienda's mobile app saw a 25% increase in active users during 2024.

- Digital Infrastructure: Investments in 5G networks across Davivienda's operating regions are enhancing mobile service delivery.

Banco Davivienda's technological landscape is heavily influenced by the accelerating digital transformation within the banking sector, pushing for investments in online platforms and mobile applications. The bank must also contend with agile fintech companies that are capturing market share through specialized, user-friendly services, a trend amplified by substantial global fintech investment in 2024.

To maintain competitiveness, Davivienda is prioritizing enhanced cybersecurity and data protection measures, crucial given the increasing reliance on digital channels and the significant financial and reputational risks associated with cyber threats, which cost financial institutions billions globally in 2024.

The integration of Artificial Intelligence (AI) and big data analytics is a key focus for Davivienda, aiming to boost operational efficiency, personalize customer service, and improve risk management. The global AI in banking market's estimated $26.5 billion valuation in 2024 highlights the strategic importance of adopting these technologies.

The increasing smartphone penetration, projected to exceed 85% in Latin America by mid-2025, alongside expanding internet connectivity, directly supports Davivienda's strategy to deliver advanced mobile banking services. This digital shift is evidenced by a 25% surge in active users for Davivienda's mobile app in 2024.

| Key Technological Factors | Impact on Banco Davivienda | Data/Trend (as of 2024/2025) |

| Digital Transformation | Need for robust online and mobile banking infrastructure; enhanced customer engagement. | Q3 2024: Substantial increase in Davivienda's digital transactions. |

| Fintech Competition | Challenge to traditional services; opportunity for strategic alliances or internal innovation. | 2024: Projected global fintech investment surpassing previous years. |

| Cybersecurity & Data Protection | Critical for trust and regulatory compliance; requires ongoing investment in advanced systems. | 2024: Financial institutions reported billions in losses due to cyberattacks globally. |

| AI & Big Data Analytics | Potential for improved efficiency, personalization, risk management, and fraud detection. | 2024: Global AI in banking market valued at approx. $26.5 billion. |

| Smartphone & Internet Penetration | Drives demand for mobile banking; essential for service delivery in key markets. | 2024: Over 80% smartphone adoption in Colombia; Latin America internet penetration >75% by mid-2025. |

Legal factors

Banco Davivienda navigates a stringent regulatory landscape, with key frameworks like Basel III influencing its capital adequacy and liquidity requirements. For instance, as of early 2024, Colombian banks are expected to maintain a minimum CET1 ratio above 4.5%, a figure Davivienda consistently meets. Changes to consumer protection laws or anti-money laundering statutes, such as those recently updated by the Financial Superintendence of Colombia, directly shape its operational procedures and compliance costs.

The bank's adherence to international standards, including those set by the Financial Stability Board, is also crucial for its global operations and investor confidence. In 2023, regulatory scrutiny on digital banking and data privacy intensified, requiring Davivienda to invest further in cybersecurity measures and transparent data handling practices. Failure to comply with these evolving financial regulations can result in substantial fines, impacting profitability and market reputation.

Banco Davivienda operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) laws, compelling the bank to maintain rigorous protocols for customer identification and transaction monitoring. For instance, in 2023, financial institutions globally faced increased scrutiny, with the Financial Action Task Force (FATF) continuing to emphasize enhanced due diligence measures. Failure to comply can lead to substantial penalties; for example, in 2024, several major banks faced multi-million dollar fines for AML deficiencies.

These legal frameworks necessitate ongoing investment in technology and personnel training to adapt to evolving international standards and prevent illicit financial activities. Davivienda must ensure its systems are equipped to detect and report suspicious transactions effectively, thereby mitigating risks of financial crime. The reputational damage from non-compliance, coupled with potential loss of operating licenses, underscores the critical importance of adhering to these legal mandates.

Consumer protection laws are a significant legal factor for Banco Davivienda. These regulations, covering fair lending, transparent product information, and effective dispute resolution, directly shape how the bank interacts with its customers. For instance, in Colombia, where Davivienda is a major player, the Superintendencia Financiera de Colombia (SFC) actively enforces consumer protection norms, such as those outlined in Circular Externa 026 of 2014, which mandates clear and timely information for financial products.

Adhering to these consumer protection frameworks is crucial for building and maintaining customer trust. Davivienda's commitment to transparency in disclosing fees, interest rates, and terms and conditions for products like savings accounts and loans is paramount. Failure to comply can lead to substantial regulatory penalties and reputational damage, impacting customer acquisition and retention efforts in the competitive financial landscape.

Ensuring all of Davivienda's offerings, from digital banking services to credit products, meet these protective standards is an ongoing operational requirement. For example, regulations around data privacy and security, like those influenced by global trends and potentially local adaptations of GDPR principles, are critical in safeguarding customer information and preventing fraud, thereby strengthening the bank's legal standing and customer loyalty.

Data Privacy and Security Regulations

Data privacy and security regulations are paramount for Banco Davivienda, especially as banking services become increasingly digital. These laws dictate how customer data is collected, stored, and processed. For instance, Colombia's Law 1581 of 2012, the Personal Data Protection Statute, sets strict guidelines for data handling.

Davivienda's adherence to these regulations is critical to prevent significant financial penalties and reputational damage associated with data breaches. In 2023, data breaches globally cost an average of $4.45 million USD, a figure that underscores the importance of robust security measures.

Maintaining customer trust hinges on demonstrating a strong commitment to data protection. Establishing and enforcing comprehensive data governance frameworks is therefore essential for Davivienda to ensure compliance and solidify customer confidence in its digital offerings.

- Compliance with Colombian Data Protection Law: Adherence to Law 1581 of 2012 and its decrees is non-negotiable for handling personal customer information.

- Mitigating Breach Costs: The global average cost of data breaches in 2023 ($4.45 million USD) highlights the financial imperative for strong security.

- Customer Trust and Data Governance: Robust data governance frameworks are key to safeguarding data and maintaining customer confidence.

- Digitalization Risk: Increased digital transactions amplify the need for stringent data privacy and security protocols.

Competition Law and Market Conduct

Competition laws are a significant factor for Banco Davivienda, as they aim to prevent monopolies and ensure fair play in the financial sector. These regulations directly impact how Davivienda can approach market strategies, including potential mergers and acquisitions. For instance, in 2023, Colombian authorities continued to scrutinize market concentration within the banking industry, a trend that influences any expansion plans.

Regulations governing market conduct are also paramount. They ensure that financial institutions like Davivienda operate ethically and avoid practices such as predatory pricing or other forms of unfair competition. Adherence to these rules is not just about compliance; it’s essential for maintaining trust and a level playing field. Failure to comply can lead to investigations and significant penalties, as seen in other sectors where competition authorities have taken strong stances.

Banco Davivienda must navigate a complex web of competition and market conduct regulations. These laws shape its strategic decisions, from product pricing to its approach to market expansion. The Colombian Superintendencia de Industria y Comercio (SIC) actively monitors the financial markets for anti-competitive behavior, making robust compliance a business imperative. For example, in 2024, the SIC issued guidelines reinforcing fair competition principles across various economic sectors, including financial services, underscoring the need for vigilance.

Key aspects of competition law for Davivienda include:

- Merger Control: Scrutiny of any proposed acquisitions or mergers to prevent undue market concentration.

- Anti-competitive Practices: Prohibitions against cartels, price fixing, and abuse of dominant market positions.

- Consumer Protection: Regulations designed to prevent unfair or deceptive practices that could harm customers.

- Market Conduct Oversight: Ensuring transparency and fair dealing in all financial transactions and service offerings.

Banco Davivienda must adhere to evolving financial regulations, including capital adequacy rules like Basel III, which dictated minimum CET1 ratios for Colombian banks above 4.5% as of early 2024. The bank also faces stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) laws, requiring robust transaction monitoring and customer identification protocols. Failure to comply with these, or with data privacy laws such as Colombia's Law 1581 of 2012, can result in significant penalties, with global data breaches averaging $4.45 million USD in 2023.

Competition laws, enforced by bodies like Colombia's Superintendencia de Industria y Comercio (SIC), also shape Davivienda's strategies, particularly concerning market concentration and preventing anti-competitive practices. These regulations ensure fair play and consumer protection, impacting potential mergers and acquisitions. For example, the SIC reinforced fair competition principles in 2024, highlighting the need for vigilance in financial services.

| Regulatory Area | Key Requirement/Impact | Recent Data/Trend |

| Capital Adequacy | Basel III CET1 Ratio | Minimum 4.5% for Colombian banks (early 2024) |

| AML/KYC | Transaction Monitoring, Customer ID | Increased scrutiny globally (FATF emphasis on due diligence) |

| Data Privacy | Law 1581 of 2012 (Colombia) | Global data breach cost avg. $4.45 million USD (2023) |

| Competition Law | Market Conduct, Merger Control | SIC reinforced fair competition principles (2024) |

Environmental factors

Climate change presents significant physical risks to Banco Davivienda. Increased occurrences of natural disasters like floods and droughts, which are projected to intensify, directly threaten loan portfolios, especially in agriculture and real estate. For instance, a severe drought in Colombia during 2024 impacted agricultural output, potentially increasing non-performing loans in that sector.

Davivienda needs to proactively adapt by evaluating its exposure to climate-related events. This could involve refining lending criteria for vulnerable regions or sectors, or actively seeking investments in climate-resilient infrastructure and green projects. In 2023, Davivienda announced a commitment to increasing its sustainable finance portfolio by 15% by 2027, signaling a strategic response to these environmental pressures.

A deep understanding of regional climate vulnerabilities across Colombia is paramount for effective long-term risk management. Identifying areas with higher susceptibility to extreme weather events allows for more targeted risk mitigation strategies and portfolio diversification, ensuring the bank's resilience against a changing climate.

Regulatory pressure and investor demand for ESG reporting are significantly shaping Davivienda's approach to sustainability. As of 2024, a growing number of global investors are prioritizing ESG factors, with reports indicating that sustainable investments reached over $37.8 trillion in 2023, a trend expected to continue rising. This increasing focus means Davivienda must enhance its operational transparency and sustainability initiatives to align with these expectations.

Adhering to robust ESG standards offers tangible benefits for Davivienda. It can significantly boost the bank's reputation among customers and stakeholders, making it more attractive for ‘green’ investments, which saw substantial growth in 2024. Furthermore, strong ESG practices contribute to better risk management by identifying and mitigating environmental and social vulnerabilities, ultimately leading to more resilient operations.

To capitalize on these trends, Davivienda is actively developing and implementing comprehensive ESG strategies. A key component of this is transparently reporting on its performance across environmental, social, and governance metrics. For instance, by 2025, many financial institutions are expected to disclose Scope 3 emissions, a complex undertaking that Davivienda will need to navigate effectively to maintain investor confidence and regulatory compliance.

The increasing global emphasis on sustainability presents significant opportunities for Davivienda to expand its green financing offerings. These could include specialized loans for renewable energy installations, such as solar panel financing which saw a 15% year-over-year growth in Latin America through 2024, or mortgages for energy-efficient homes. Developing these products can attract a growing segment of environmentally conscious consumers and businesses, creating new revenue streams.

By actively promoting and providing access to capital for sustainable projects, Davivienda can position itself as a leader in responsible finance. This strategic move not only supports broader environmental goals but also enhances brand reputation and customer loyalty. For instance, banks that have integrated ESG (Environmental, Social, and Governance) principles into their lending practices have reported a 3-5% higher return on equity in recent years.

Resource Management and Operational Footprint

Banco Davivienda's operational environmental footprint, encompassing energy consumption, waste generation, and water usage across its branches and data centers, faces increasing stakeholder scrutiny. For instance, in 2023, many financial institutions reported on their Scope 1 and 2 emissions, with a growing emphasis on reducing energy intensity per square foot. Davivienda's commitment to improving resource efficiency and lowering its carbon footprint directly translates to potential cost savings and a stronger corporate social responsibility profile. Sustainable operational practices are no longer optional but a critical expectation for investors, customers, and regulators alike.

The drive for sustainability in banking operations is accelerating. Consider the trend observed in 2024 where a significant percentage of major banks are setting science-based targets for emission reductions. Davivienda's proactive engagement in these areas can yield tangible benefits:

- Cost Savings: Enhanced energy efficiency in branches and data centers can significantly reduce utility bills. For example, implementing smart building technologies has shown an average reduction of 15-20% in energy costs for similar organizations.

- Reputational Enhancement: A visible commitment to reducing waste and water usage bolsters Davivienda's image as an environmentally conscious institution, attracting socially responsible investors and customers.

- Regulatory Compliance: As environmental regulations tighten globally and in Colombia, demonstrating proactive resource management helps ensure compliance and avoid potential penalties.

- Risk Mitigation: Reducing reliance on finite resources like water and energy can mitigate operational risks associated with scarcity or price volatility.

Reputational Risk from Environmental Incidents

Banco Davivienda faces reputational risk if its operations or financed projects engage in poor environmental practices. This can erode customer trust and investor confidence, impacting the bank's standing in the market. For instance, a significant environmental incident linked to a Davivienda-backed project could lead to public backlash and calls for boycotts, as seen with other financial institutions that have faced scrutiny over their fossil fuel financing in recent years. In 2024, public awareness and demand for sustainable finance are at an all-time high, making such associations particularly damaging.

Association with environmentally harmful activities can directly result in divestments from concerned investors or consumer boycotts, directly impacting the bank's profitability and market share. For example, in late 2023, several major pension funds announced plans to divest from companies with poor environmental track records, a trend expected to continue and even accelerate into 2025.

To counter these threats, Davivienda must implement robust environmental due diligence for all clients and projects. This proactive approach helps identify and mitigate potential risks before they escalate into reputational crises. By ensuring responsible lending practices, the bank safeguards its image and aligns with growing global expectations for corporate environmental stewardship. This includes rigorous assessment of climate risk in loan portfolios, a critical focus for banks in 2024 and beyond.

Key mitigation strategies for Davivienda include:

- Enhanced Environmental Due Diligence: Implementing stricter screening processes for all new loans and investments to identify and assess environmental risks.

- Sustainable Finance Framework: Developing and promoting financial products that support environmentally sound projects and businesses.

- Transparent Reporting: Publicly disclosing environmental performance metrics and progress towards sustainability goals.

- Stakeholder Engagement: Actively engaging with environmental groups, customers, and investors to understand and address concerns.

Environmental factors pose significant risks and opportunities for Banco Davivienda, particularly concerning climate change and sustainability. The increasing frequency of extreme weather events, like droughts and floods, directly impacts loan portfolios, especially in sectors like agriculture and real estate, as seen with drought impacts in Colombia during 2024. This necessitates proactive risk assessment and adaptation strategies, such as enhancing lending criteria for vulnerable areas and increasing investment in green projects, with Davivienda aiming for a 15% growth in its sustainable finance portfolio by 2027.

Regulatory and investor pressure for Environmental, Social, and Governance (ESG) reporting is a major driver for Davivienda. With sustainable investments exceeding $37.8 trillion in 2023 and expected continued growth, the bank must enhance transparency and sustainability initiatives. Adhering to ESG standards can boost reputation, attract green investments, and improve risk management, leading to more resilient operations.

Davivienda has opportunities to expand its green financing, such as loans for renewable energy and energy-efficient homes, reflecting a 15% year-over-year growth in solar panel financing in Latin America through 2024. By supporting sustainable projects, the bank can strengthen its brand and customer loyalty, potentially improving its return on equity, as banks integrating ESG principles have reported higher returns in recent years. Transparent reporting on ESG metrics, including complex disclosures like Scope 3 emissions by 2025, is crucial for investor confidence and regulatory compliance.

The bank's operational footprint, including energy and water consumption, is under increasing scrutiny, with a trend towards science-based targets for emission reductions observed among major banks in 2024. Improving resource efficiency can lead to cost savings, with smart building technologies showing potential 15-20% reductions in energy costs. Proactive environmental management also enhances reputation, ensures regulatory compliance, and mitigates operational risks related to resource scarcity.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Banco Davivienda is built on a robust foundation of data from official Colombian government agencies, international financial institutions like the IMF and World Bank, and reputable market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the bank.