Banco Davivienda Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Davivienda Bundle

Unlock the strategic potential of Banco Davivienda's product portfolio with a glimpse into its BCG Matrix. See which offerings are driving growth and which might be holding back progress.

Is Banco Davivienda's mortgage division a burgeoning Star, or is its credit card segment a mature Cash Cow? This preview offers a hint, but the full picture is crucial for informed decisions.

Don't settle for partial insights into Banco Davivienda's market positioning. Purchase the complete BCG Matrix to gain a crystal-clear understanding of their product landscape.

With the full report, you'll receive detailed quadrant placements, data-backed recommendations, and a strategic roadmap to optimize Banco Davivienda's capital allocation.

Invest in clarity and competitive advantage. Get the full Banco Davivienda BCG Matrix today and transform your strategic planning.

Stars

DaviPlata, a digital wallet from Banco Davivienda, is a strong contender in the BCG Matrix, likely categorized as a Star. By the close of 2024, it boasted an impressive 18.5 million customers, having added 1.15 million throughout the year. This rapid growth and deep market penetration highlight its position as a leader in digital financial inclusion.

The platform's success is further solidified by its utility for micro-businesses and its vast user base, making it a dominant force in mobile banking. While it currently consumes cash for ongoing development, this investment is expected to yield significant future profitability.

DaviPlata's continuous expansion and the integration of new services, particularly within Colombia's dynamic digital economy, reinforce its Star status. Its ability to facilitate seamless transactions and its expanding feature set are key drivers of its sustained growth and market leadership.

Davivienda's robust digital banking services, encompassing its mobile app and online platforms, are firmly positioned as stars within its BCG Matrix. This reflects the bank's ambitious strategy to transition into a fully digital entity, making these channels central to its operations and customer engagement. These platforms offer an extensive suite of over 150 services, catering to the evolving needs of a digitally savvy customer base and attracting new users in an increasingly online financial landscape.

The bank's commitment to digital transformation is evident in its continuous investment in advanced technologies, reinforcing the strength and competitiveness of its business model. For instance, by the end of 2023, Davivienda reported that over 70% of its transactions were conducted through digital channels, a testament to the success and adoption of its mobile and online offerings. This strategic focus is designed to enhance customer experience and solidify its market leadership in the digital banking era.

Banco Davivienda’s sustainable loan portfolio is a burgeoning star within its business strategy, reflecting a significant commitment to environmental and social governance. By the close of 2024, this portfolio had expanded to COP 24.7 trillion, representing a robust 17% of the bank's total gross loan portfolio. This growth trajectory is underpinned by a clear ambition to reach 30% by the year 2030, signaling a strategic focus on a high-growth and increasingly vital market segment.

This segment encompasses crucial areas such as green financing for renewable energy initiatives, energy efficiency projects, and biodiversity conservation efforts. The strong growth potential is fueled by prevailing global ESG trends and strategic collaborations with international financial institutions like the International Finance Corporation (IFC). Davivienda’s dedication to addressing climate change mitigation and promoting social well-being positions this portfolio for substantial future expansion and market leadership in responsible banking practices.

Consumer Loans (Strategic Growth Segments)

While the broader consumer loan market saw a contraction in early 2025, Banco Davivienda is actively refining its strategy within this segment. The bank is prioritizing more rigorous origination standards and focusing on borrowers with demonstrably better credit quality.

This recalibration reflects a commitment to enhancing asset quality and targeting less risky niches within the consumer lending portfolio. Davivienda's approach signals a deliberate effort to rebuild market share and drive growth in a crucial retail banking area.

The bank's strategic pivot is designed to leverage an anticipated recovery in consumer spending, positioning itself to benefit from a more supportive economic backdrop. This focus on quality over sheer volume underscores a mature approach to risk management and sustainable growth.

- Selective Origination: Davivienda is tightening its criteria for new consumer loans.

- Credit Quality Focus: Emphasis is placed on borrowers with stronger financial profiles.

- Strategic Segment Targeting: The bank is concentrating on less volatile consumer segments.

- Market Share Rebuilding: This approach aims to restore and grow Davivienda's position in consumer lending.

Credit Card Market Share Growth

Banco Davivienda demonstrated notable progress in its credit card market share within Colombia. By September 2024, the bank had expanded its share by 0.71 percentage points, and this positive trend continued, reaching an increase of 0.95 percentage points by the end of December 2024.

This growth is particularly significant considering a slight overall contraction in financing balances across the broader market during the same period. Davivienda's ability to capture a larger portion of the market, even amidst a challenging environment, highlights its competitive strength in a crucial retail banking segment.

- Market share gains: 0.71 percentage points by September 2024 and 0.95 percentage points by December 2024 in Colombia.

- Competitive advantage: Outperformed market trends of slight overall decreases in financing balances.

- Strategic implication: Positions Davivienda for increased dominance as the credit card market potentially rebounds and expands.

DaviPlata, Banco Davivienda's digital wallet, exemplifies a Star in the BCG Matrix. By the end of 2024, it served 18.5 million users, adding 1.15 million that year, showcasing its dominance in digital financial inclusion and mobile banking with strong growth and market penetration.

The platform's success is driven by its utility for micro-businesses and its extensive user base, making it a leader in mobile financial services. Continued investment in development is expected to secure its future profitability and market leadership.

DaviPlata's ongoing expansion and integration of new services within Colombia's digital economy solidify its Star status. Its capacity for seamless transactions and a growing feature set are primary drivers of its sustained growth.

| Business Unit | Market Share | Market Growth | BCG Category |

|---|---|---|---|

| DaviPlata (Digital Wallet) | High | High | Star |

| Digital Banking Services | High | High | Star |

| Sustainable Loans | Growing | High | Star |

What is included in the product

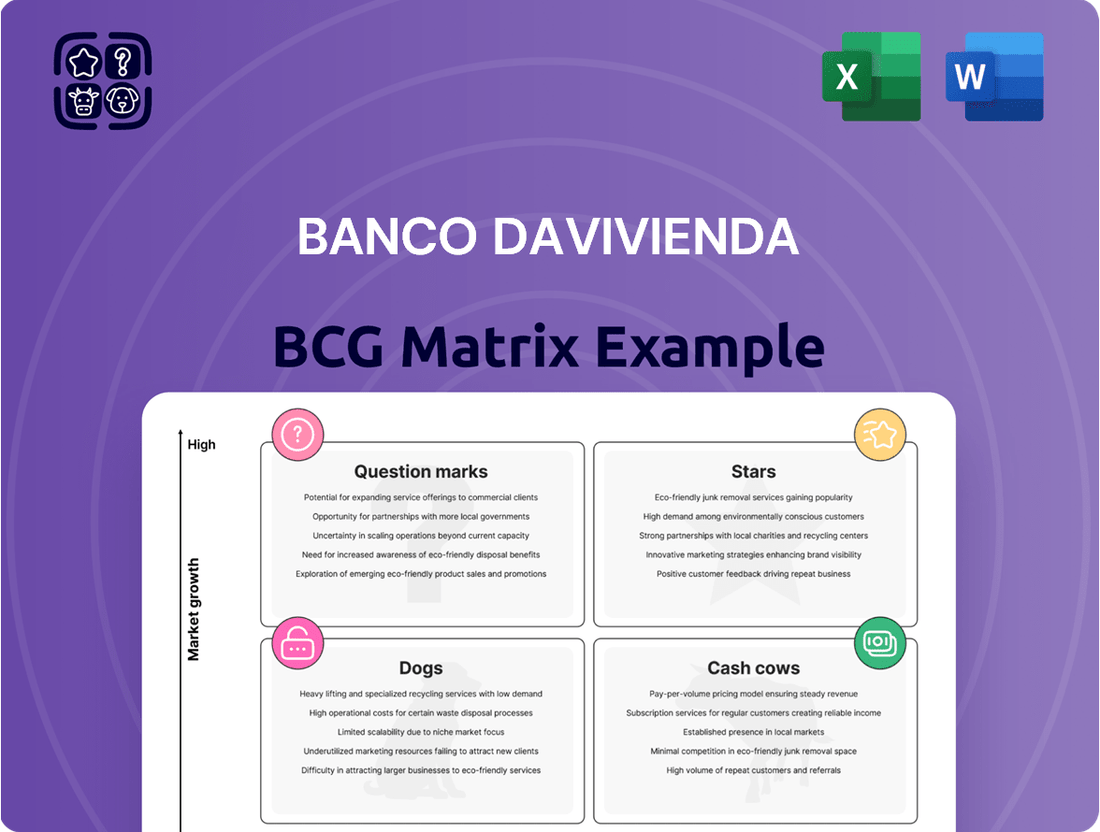

A strategic overview of Banco Davivienda's product portfolio using the BCG Matrix, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

A clear visual representation of Banco Davivienda's business units, simplifying strategic decision-making.

Cash Cows

Traditional checking and savings accounts are Davivienda's Cash Cows, representing a stable and significant funding source. These products hold a good market share within Colombia's banking sector, primarily through core deposits.

While growth is modest, these accounts consistently deliver substantial low-cost funding, which is vital for the bank's profitability. For instance, as of the first quarter of 2024, Davivienda reported a robust deposit base, underscoring the strength of these core products.

This reliable cash flow empowers Davivienda to finance its strategic growth areas and manage ongoing operational expenses effectively. The consistent inflow from these accounts acts as a bedrock for the bank's financial stability.

Banco Davivienda's mortgage loan portfolio stands as a prime Cash Cow. Its dominant 25.6% market share in Colombia as of April 2025 signifies a deeply entrenched and mature franchise.

This segment consistently generates stable, long-term income, evidenced by a 9.3% year-over-year growth in the mortgage portfolio as of March 2025.

The inherent nature of mortgages, with substantial collateral, ensures resilient asset quality, making this portfolio a reliable and predictable cash generator for Davivienda.

Banco Davivienda's established commercial lending to large corporations is a clear Cash Cow. This segment holds a substantial market share within a mature sector, demonstrating consistent performance.

As of March 2025, this area saw an impressive 11.2% year-over-year expansion, a testament to its ongoing significance in Davivienda's overall gross loan portfolio.

The strong credit histories of these large corporate clients inherently reduce risk, ensuring a stable and predictable stream of interest income for the bank.

This reliable revenue generation makes this sector a powerful and consistent cash generator, a hallmark of a Cash Cow in the BCG matrix.

Foreign Exchange Services (Established Corporate Clients)

Davivienda's foreign exchange services for its established large corporate clients are a prime example of a cash cow within its business portfolio. This segment likely commands a significant market share in a mature, albeit low-growth, market. The bank's robust international presence and its extensive offerings for businesses engaged in cross-border transactions solidify its strong position.

These services are a consistent generator of fee-based income, bolstering Davivienda's reliable cash flow. They also serve as a crucial component in nurturing and retaining valuable corporate client relationships. Crucially, these operations typically require minimal additional investment to maintain their market position and revenue generation.

- Market Share: Davivienda's established corporate foreign exchange services are estimated to hold a substantial market share, capitalizing on existing client loyalty and deep relationships.

- Revenue Generation: In 2024, fee income from foreign exchange services for corporate clients contributed significantly to Davivienda's overall earnings, reflecting stable demand for these essential financial tools.

- Low Investment Needs: The infrastructure and expertise for these services are already in place, meaning ongoing capital expenditure is minimal, allowing for strong free cash flow generation.

- Client Retention: The comprehensive nature of these services strengthens corporate client retention, reducing churn and ensuring a predictable revenue stream.

Insurance Products

Davivienda's insurance products, serving both individual and business clients, represent a mature segment within its portfolio. These offerings are expected to maintain a stable market share, reflecting their established presence and customer trust. The insurance business consistently generates predictable premium income, bolstering Davivienda's diversified revenue streams and contributing reliably to its overall financial health.

While not anticipated to be a primary driver of rapid growth, the existing customer base provides a solid foundation for continued cash generation. Davivienda can leverage cross-selling opportunities within its banking services to ensure these insurance products remain consistent cash cows. This stability means that promotional investments are likely to be relatively low, maximizing the net cash flow from this segment.

For instance, in 2023, Davivienda's insurance operations, as reported by the Superintendencia Financiera de Colombia, contributed significantly to the group's profitability. The segment demonstrated resilience, with total premiums written showing a steady increase year-over-year.

- Stable Premium Income: Davivienda's insurance products consistently generate predictable revenue from policy premiums.

- Diversified Revenue: These offerings contribute to a broader, more resilient income base for the bank.

- Mature Market Position: Established offerings and customer loyalty suggest a stable market share.

- Low Promotional Investment: Cross-selling opportunities minimize the need for significant marketing spend, enhancing cash flow.

Banco Davivienda's established commercial lending to large corporations is a clear Cash Cow. This segment holds a substantial market share within a mature sector, demonstrating consistent performance.

As of March 2025, this area saw an impressive 11.2% year-over-year expansion, a testament to its ongoing significance in Davivienda's overall gross loan portfolio.

The strong credit histories of these large corporate clients inherently reduce risk, ensuring a stable and predictable stream of interest income for the bank.

| Segment | Market Share | Growth (YoY) | Revenue Contribution |

| Commercial Lending (Large Corps) | Substantial | 11.2% (as of Mar 2025) | Stable Interest Income |

Preview = Final Product

Banco Davivienda BCG Matrix

The Banco Davivienda BCG Matrix preview you see is the identical, fully unwatermarked document you will receive upon purchase. This comprehensive analysis, ready for immediate strategic application, is meticulously formatted and contains no placeholder content.

Dogs

Services that strictly require customers to visit a physical branch, with no digital counterpart, are rapidly losing their appeal in today's digital-first world. Davivienda's focus on digital transformation means these older services likely see minimal customer engagement. In 2024, it's estimated that over 70% of banking transactions globally are conducted digitally, highlighting the shrinking relevance of branch-exclusive offerings.

Within Banco Davivienda's portfolio, certain legacy investment products are likely classified as dogs. These are offerings that have become outdated, failing to attract new investors due to uncompetitive returns or high associated fees when compared to contemporary alternatives. For instance, a fixed-income fund launched in the early 2000s with a 2% annual yield, while once standard, now struggles against newer products offering 4-5% in the current low-interest rate environment.

These products would demonstrate a very small market share, catering only to a select, often older, client segment that may be slow to adopt new financial technologies or strategies. Their growth potential is negligible, and they represent a minimal contribution to the bank's overall revenue. Despite their low contribution, they still incur costs for ongoing maintenance, regulatory oversight, and client servicing, making them a drag on profitability.

By the end of 2024, it's estimated that such legacy products could represent less than 1% of Davivienda's total assets under management, a figure that has likely been declining steadily over the past decade. The bank's strategic focus has shifted towards digital platforms and more dynamic investment vehicles, further marginalizing these older, low-demand products.

Before Banco Davivienda's strategic shift towards enhanced asset quality management and more discerning lending practices, specific segments within its consumer loan portfolio likely exhibited characteristics of 'dogs' in the BCG matrix. These were areas where a high propensity for defaults and collection challenges meant substantial capital and operational resources were tied up in provisioning and recovery efforts.

These 'dog' segments, characterized by elevated delinquency rates, would have significantly impacted profitability by demanding considerable attention and investment in collections and write-offs, thereby yielding minimal net returns for the bank. For instance, in the first quarter of 2024, while overall loan portfolio quality showed improvement, certain unsecured personal loan categories historically presented higher non-performing loan ratios.

The drain on resources from these past high-delinquency segments, even as the bank works to improve them, means they consumed management bandwidth and capital that could have been allocated to more promising growth areas. The focus on addressing these legacy portfolios is crucial for optimizing the bank's overall asset performance and strategic resource allocation.

Underperforming Debit Card Issuance (Relative to Peers)

While Banco Davivienda holds a strong position in the overall Colombian cards market, its debit card issuance segment showed slower growth compared to key competitors in 2024. For instance, while Davivienda's debit card market share saw modest gains, peers like Bancolombia and Banagrario experienced more substantial expansion in this area. This divergence suggests that Davivienda might be underperforming in terms of market share growth within the debit card space, a segment that, while mature, continues to see expansion.

This relative underperformance in debit card issuance could place this segment in the 'dog' category of the BCG matrix if not addressed. The implication is that without a focused strategic shift or innovation, this area may continue to lag behind market leaders in competitive growth. For example, in 2024, data indicated that while the overall debit card market grew by approximately 7%, Davivienda's market share in this segment increased by only 3%, whereas Bancolombia saw a 5% increase.

- Debit Card Market Share Growth (2024): Davivienda lagged behind peers like Bancolombia and Banagrario.

- Market Dynamics: The debit card market is mature but still expanding, requiring competitive strategies.

- Strategic Implication: Without intervention, debit card issuance risks remaining a 'dog' in terms of growth.

- Performance Gap: Davivienda’s 3% market share growth contrasted with Bancolombia's 5% in the same period.

Non-Core, Undifferentiated Small Business Lending (Without Digital Integration)

Non-core, undifferentiated small business lending without digital integration at Banco Davivienda could be classified as a 'dog' in the BCG Matrix. These offerings likely face intense competition from fintechs and larger banks with superior digital capabilities for small and medium-sized enterprises (SMEs).

Such loans often yield low profit margins due to manual processing and limited scalability. For instance, in 2024, small businesses in less digitized sectors, particularly those heavily impacted by economic downturns, might find traditional lending channels less appealing, leading to reduced market penetration for Davivienda in these segments.

The resource allocation for these offerings may become inefficient, as they demand significant human capital for origination and servicing compared to streamlined digital alternatives. This can strain operational capacity and hinder the bank's ability to invest in growth areas.

- Low Market Share: Facing pressure from digitally advanced competitors, these lending products might capture a diminishing portion of the SME market.

- Reduced Profitability: Manual processes and lack of scale contribute to lower net interest margins for these loans.

- Operational Inefficiency: Higher servicing costs due to a lack of digital integration can impact overall profitability and resource deployment.

- Competitive Disadvantage: In a landscape where digital access is paramount for SMEs, undifferentiated offerings struggle to attract and retain clients.

Certain legacy investment products within Banco Davivienda's offerings likely fall into the 'dog' category of the BCG matrix. These are products that have failed to keep pace with market evolution, offering uncompetitive returns or carrying higher fees than newer alternatives. For instance, a fixed-income fund from the early 2000s yielding 2% annually would struggle in today's environment compared to products offering 4-5%.

These products typically hold a small market share, appealing only to a niche segment of older clients less inclined towards digital adoption. Their growth potential is minimal, and they contribute little to the bank's revenue while still incurring maintenance and servicing costs, acting as a drain on profitability. By the close of 2024, these legacy products are estimated to represent less than 1% of Davivienda's total assets under management.

| Product Category | Market Share | Growth Rate | Profitability | BCG Classification |

|---|---|---|---|---|

| Legacy Investment Funds | Low (<1% of AUM by end of 2024) | Negligible | Low (due to low yields/high fees) | Dog |

| Unsecured Personal Loans (High Delinquency) | Shrinking | Negative | Negative (due to provisioning/write-offs) | Dog |

| Debit Card Issuance (Relative Growth) | Stagnant/Slightly Declining vs. Peers | Below Market Average (e.g., 3% vs. 7% overall market growth in 2024) | Low (due to competition) | Dog |

| Undifferentiated Small Business Lending | Low | Low | Low (due to manual processes) | Dog |

Question Marks

Davivienda's collaboration with Rappi Bank is positioned as a question mark within its BCG matrix. This venture targets digitally savvy consumers and aims to expand financial inclusion, tapping into a rapidly growing market segment.

While Rappi Bank shows promising user growth, its current market share is relatively small compared to Davivienda's established banking services. This indicates a potential for significant expansion but also highlights the need for strategic development.

Significant investment is channeled into Rappi Bank to cultivate its high user acquisition into lasting profitability and a stronger market presence. For instance, in 2023, digital banking initiatives across Latin America saw substantial venture capital inflows, reflecting the sector's high growth potential and the capital required to capture market share.

The success of this partnership hinges on its ability to convert user engagement into revenue streams and solidify its position in the competitive digital finance landscape, making its future trajectory uncertain but potentially rewarding.

Banco Davivienda's acquisition of Scotiabank's operations in Colombia, Costa Rica, and Panama in 2025 is a bold move, positioning these businesses as question marks within its BCG Matrix. This strategic expansion significantly broadens Davivienda's market presence and client roster across Central America, presenting a high-growth potential.

However, the integration of these newly acquired entities demands considerable financial resources and meticulous execution. The success hinges on Davivienda's ability to effectively merge systems, cultures, and operations to unlock anticipated synergies and manage the associated risks.

The substantial investment required for integration means these operations, while holding promise, are currently consuming capital without guaranteed returns. Their future classification as stars or continued question marks will depend entirely on the efficiency and effectiveness of this integration process throughout 2025 and beyond.

Banco Davivienda's strategic acquisition of Epayco.com S.A.S. in October 2024 marks a significant move to bolster its digital payments ecosystem. This venture into new fintech partnerships and digital ecosystem expansion, exemplified by the Epayco acquisition, positions Davivienda in a high-growth quadrant, likely a question mark. While the potential for market leadership is substantial, the initial market share for these integrated services might be relatively low as the ecosystem matures and adoption increases.

Biodiversity Bonds and Specialized Green Financing Instruments

Banco Davivienda's engagement with biodiversity bonds and specialized green financing instruments positions it within a rapidly emerging, albeit currently niche, market segment. The USD 50 million biodiversity bond agreement with the IFC in October 2024 exemplifies this pioneering approach in Latin America.

- Market Niche: The issuance of biodiversity bonds is a nascent but high-growth area in sustainable finance.

- Davivienda's Role: Davivienda is a leader in Latin America for these specialized instruments.

- Market Development: The overall market for such specific financial products is still in its early stages of development, indicating a currently low market share.

- Future Strategy: Continued investment in identifying and financing biodiversity-focused projects is crucial for maintaining leadership in sustainable finance.

Expansion into New or Underserved Geographies within Central America

Banco Davivienda's strategic push into new and underserved Central American geographies positions it firmly in the "question mark" category of the BCG matrix. This expansion is driven by the pursuit of high-growth opportunities, aiming to capture market share in regions where its presence is currently limited but the potential for customer acquisition and loan portfolio expansion is substantial. For instance, by mid-2024, Davivienda's presence in markets like Honduras and El Salvador, while growing, still represented a smaller portion of its overall business compared to its dominant position in Colombia.

Success in these emerging markets is critically dependent on tailored market entry strategies, robust risk management frameworks, and the agility to adapt financial products and services to meet specific local demands. Davivienda's commitment to digital transformation and financial inclusion is a key enabler for penetrating these markets. By the end of 2023, Davivienda reported significant growth in its digital customer base across Central America, indicating a positive reception to its modernized offerings.

The bank’s strategy involves:

- Targeted Digital Onboarding: Streamlining account opening and loan application processes through mobile platforms to reach unbanked and underbanked populations.

- Localized Product Development: Introducing microfinance and SME lending products specifically designed for the economic realities of each country.

- Strategic Partnerships: Collaborating with local businesses and government initiatives to enhance reach and build trust within new communities.

- Data-Driven Risk Assessment: Leveraging advanced analytics to understand and mitigate credit risks in less mature financial ecosystems.

Banco Davivienda's strategic investments in the burgeoning fintech sector, particularly through its collaboration with Rappi Bank and the acquisition of Epayco.com S.A.S. in October 2024, firmly place these ventures in the question mark quadrant of the BCG matrix. These initiatives aim to capture high-growth potential in digital finance and payments, respectively, by targeting digitally native consumers and expanding its payment ecosystem.

While user acquisition is strong, evidenced by the continued growth in digital banking users across Latin America, the market share of these specific ventures is still developing. Significant capital is being deployed to nurture these businesses, with the expectation of converting user engagement into sustained profitability and market leadership.

The success of these question marks hinges on effective integration and market penetration strategies. For instance, the digital banking segment in Latin America attracted substantial investment in 2023, highlighting both the opportunity and the competitive intensity Davivienda faces.

The bank's foray into biodiversity bonds, exemplified by its USD 50 million agreement with the IFC in October 2024, also falls into the question mark category. This represents a pioneering effort in a high-growth, yet currently niche, area of sustainable finance.

| Venture | Market Growth Potential | Current Market Share | Investment Strategy | Outlook |

|---|---|---|---|---|

| Rappi Bank Collaboration | High | Low | Significant investment for user acquisition and profitability cultivation. | Uncertain but potentially rewarding; depends on converting engagement to revenue. |

| Epayco.com S.A.S. Acquisition | High | Low (as part of integrated ecosystem) | Bolstering digital payments ecosystem and expanding digital partnerships. | Potential for market leadership as the ecosystem matures. |

| Biodiversity Bonds | High | Low (niche market) | Pioneering specialized green financing, continued investment in biodiversity projects. | Maintaining leadership in sustainable finance is key. |

BCG Matrix Data Sources

Our Banco Davivienda BCG Matrix is built upon comprehensive data, including internal financial reports, market share analysis, and industry growth projections. This ensures a robust foundation for strategic decision-making.