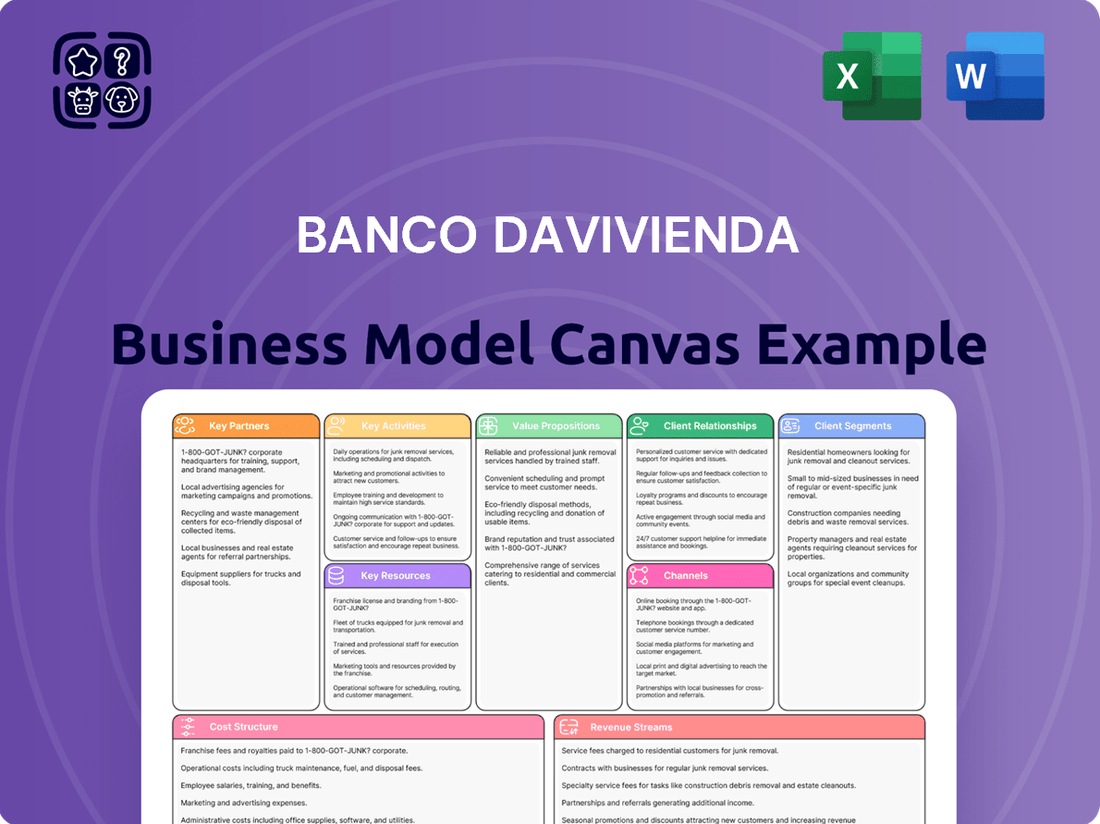

Banco Davivienda Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Davivienda Bundle

Unlock the core strategic blueprint behind Banco Davivienda's success. This comprehensive Business Model Canvas details their key customer segments, value propositions, and revenue streams. Discover how they leverage key partnerships and activities to build a robust financial institution.

Partnerships

Banco Davivienda's key partnerships are significantly bolstered by strategic acquisitions and integrations. A prime example is the acquisition of Scotiabank's operations in Colombia, Costa Rica, and Panama, a deal finalized in early 2025. This integration brought over 27 million new clients into the Davivienda fold, dramatically expanding its regional footprint and client base. This move solidifies Davivienda's position as a dominant force in the Latin American banking landscape.

Furthermore, this strategic alliance includes Scotiabank acquiring a 20% stake in Davivienda, indicating a strong, vested partnership. This financial tie-up not only enhances Davivienda's capital structure but also signifies a shared vision for growth and stability in the region. The integration of Scotiabank's assets and customer relationships through this partnership is crucial for Davivienda's ongoing expansion and market competitiveness.

Banco Davivienda collaborates with significant international financial institutions such as the International Finance Corporation (IFC) and IDB Invest. These alliances are pivotal for advancing sustainable finance and expanding green lending programs. This strategic alignment allows Davivienda to tap into specialized expertise and capital for environmentally focused projects.

A prime example of this partnership is the US$50 million biodiversity bond issued with the IFC in October 2024. This financial instrument is specifically designated for funding projects that champion biodiversity conservation and actively work towards mitigating the impacts of climate change.

These international collaborations significantly bolster Davivienda's capabilities. They provide the necessary financial backing and technical support to effectively finance projects and small and medium-sized enterprises (SMEs) that are committed to environmental responsibility and sustainability.

Banco Davivienda’s strategic alliances with technology and digital solution providers are crucial for its operational advancement. Collaborations with firms such as Dataiku and Google Workspace are integral to its digital transformation initiatives, enhancing data accuracy and streamlining internal processes.

These partnerships empower Davivienda to refine customer engagement and optimize its digital service delivery. By integrating advanced analytics and cloud-based platforms, the bank is focused on creating seamless omnichannel experiences and boosting overall operational efficiency.

Sector-Specific Alliances

Banco Davivienda cultivates sector-specific alliances to deliver tailored financial solutions. A prime example is its collaboration with the National Federation of Coffee Growers, supporting over 550,000 coffee-growing families in Colombia. These partnerships are crucial for addressing the unique needs of clients within key industries and fostering their growth.

These strategic collaborations allow Davivienda to deeply understand and serve specific economic sectors. By aligning with industry leaders, the bank can offer specialized products and services that resonate with particular client bases. This approach not only strengthens Davivienda's market position but also contributes to the overall development of vital Colombian industries.

- Sector-Specific Focus: Davivienda partners with organizations like the National Federation of Coffee Growers to address the distinct financial requirements of various economic sectors.

- Broad Reach: This alliance directly impacts over 550,000 coffee-growing families, demonstrating the significant scale of these partnerships.

- Industry Development: By providing targeted financial support, Davivienda actively contributes to the advancement and sustainability of key industries within Colombia.

Payment Ecosystem Partners

Banco Davivienda actively cultivates key partnerships within the payment ecosystem to bolster its value proposition. A significant move in this direction was the acquisition of EPAYCO.COM S.A.S. in October 2024.

This strategic acquisition directly enhances Davivienda's capabilities, offering more robust online and in-person payment solutions to its clientele. The integration of EPAYCO's technology and market presence is designed to streamline transactions for businesses and individuals alike.

These collaborations are instrumental in solidifying Davivienda's position as a vital financial intermediary. By expanding its digital transaction infrastructure, the bank broadens its reach and service offerings in an increasingly cashless society.

- Strategic Acquisition: Davivienda acquired EPAYCO.COM S.A.S. in October 2024, significantly strengthening its payment processing capabilities.

- Enhanced Offerings: The partnership allows for improved online and in-person payment solutions, benefiting both businesses and consumers.

- Digital Reach Expansion: This move reinforces Davivienda's role as a key financial partner, extending its influence in the digital transaction space.

Banco Davivienda's key partnerships extend to technology providers like Dataiku and Google Workspace, crucial for its digital transformation and data management. These collaborations aim to enhance customer engagement and operational efficiency through advanced analytics and cloud solutions.

The bank also strategically partners within the payment ecosystem, notably through the October 2024 acquisition of EPAYCO.COM S.A.S., to bolster its online and in-person transaction capabilities. This move strengthens Davivienda's position as a vital financial intermediary in the growing digital payment landscape.

Sector-specific alliances, such as the one with the National Federation of Coffee Growers, are vital for providing tailored financial solutions to key industries, directly supporting over 550,000 families and fostering industry development.

Furthermore, collaborations with international financial institutions like the IFC and IDB Invest, including a US$50 million biodiversity bond in October 2024, facilitate sustainable finance and green lending programs.

What is included in the product

A detailed breakdown of Banco Davivienda's operations, covering key customer segments, diverse distribution channels, and clear value propositions, all organized within the 9 classic Business Model Canvas blocks.

This model offers insights into how Davivienda leverages its resources and activities to build strong customer relationships and generate revenue, reflecting its strategic approach to the financial services market.

Banco Davivienda's Business Model Canvas acts as a pain point reliever by clearly defining its value proposition, customer segments, and channels, allowing for efficient problem-solving in financial services.

This model helps diagnose and address customer frustrations by mapping out key resources and activities, thereby streamlining financial product delivery and support.

Activities

Banco Davivienda actively pursues continuous digital transformation, a cornerstone of its operations. This involves modernizing its technology infrastructure and integrating AI for enhanced decision-making, ensuring the bank stays ahead in financial services.

A key component of this strategy is the development of mobile-first services, epitomized by Davivienda's Super App, Daviplata. This platform provides access to over 150 services, demonstrating a commitment to user convenience and broad accessibility.

By the end of 2023, Daviplata had already surpassed 17 million users, a testament to its success in reaching a vast customer base and facilitating digital engagement across Colombia.

These digital initiatives are crucial for creating seamless omnichannel experiences for customers. This approach is vital for maintaining competitiveness in an increasingly digitized financial landscape where user expectations are constantly evolving.

Banco Davivienda's core activities revolve around providing a wide spectrum of lending products. This includes crucial offerings like consumer loans for personal needs, commercial loans to fuel business growth, and mortgage loans to facilitate home ownership. In 2024, Davivienda continued its leadership in the Colombian housing finance market, a sector where it has consistently demonstrated strength.

A significant focus for Davivienda is the strategic expansion of its loan portfolios, particularly in areas deemed less risky. The bank actively cultivates growth in its sustainable finance offerings and its portfolio dedicated to Small and Medium-sized Enterprises (SMEs). This targeted approach reflects a commitment to prudent risk management and long-term stability.

Davivienda implements conservative lending methodologies across its operations. This careful approach ensures that credit risk is managed effectively, contributing to the bank's overall financial health. For instance, in the first quarter of 2024, Davivienda reported a non-performing loan ratio of 1.8%, a testament to its disciplined credit underwriting.

Banco Davivienda's core activities include attracting and managing customer deposits, such as savings and checking accounts. This is crucial for establishing a stable funding base that supports its lending activities. In 2023, Davivienda reported total deposits of COP 178.2 trillion, showcasing its significant ability to gather customer funds.

Beyond basic deposit-taking, the bank actively engages in wealth management and offers a range of investment products tailored for both individual and corporate clients. This dual focus on deposits and wealth management allows Davivienda to provide comprehensive financial solutions, catering to various client needs and solidifying its market position.

Payment Processing and Financial Services

Banco Davivienda's key activities center on providing a comprehensive suite of financial services, extending well beyond basic banking. This includes offering diverse products like insurance and foreign exchange, which cater to a wide range of customer financial needs and create multiple revenue avenues.

A significant development in this area is Davivienda's acquisition of Epayco. This strategic move has substantially bolstered its capacity to deliver advanced payment processing solutions, both for online transactions and in-person retail environments. This integration is designed to streamline financial interactions for its customers.

These expanded payment processing and financial services are crucial for enhancing customer convenience and broadening Davivienda's market reach. By offering integrated solutions, the bank aims to become a central financial hub for individuals and businesses alike. For instance, in 2023, the Colombian financial sector saw a significant increase in digital payment adoption, with transactions through platforms like Epayco growing substantially, indicating a strong market demand for these services.

- Diverse Financial Products: Offering insurance, foreign exchange, and other specialized financial instruments alongside traditional banking.

- Advanced Payment Solutions: Leveraging Epayco acquisition for sophisticated online and in-person payment processing.

- Customer Convenience: Streamlining financial transactions to meet evolving customer expectations.

- Revenue Diversification: Creating new income streams through a broader range of service offerings.

Regional Expansion and Market Consolidation

Banco Davivienda actively pursues regional expansion, with a sharp focus on Central America. This strategic move is designed to tap into growing economies and diversify its operational footprint beyond Colombia. The bank's approach involves both organic growth and strategic acquisitions to build a stronger presence.

A key aspect of this strategy is market consolidation. Davivienda's integration of Scotiabank's operations in countries such as Costa Rica and Panama exemplifies this. This integration allows the bank to combine customer bases and operational efficiencies, thereby solidifying its market share in these crucial markets.

The overarching goal of this regional expansion and consolidation is to unlock synergies and broaden the bank's customer reach. By extending its services across multiple Central American nations, Davivienda aims to become a more dominant player in the regional financial landscape, offering a wider array of products and services to a larger demographic.

- Regional Expansion Focus: Central America is the primary target for Davivienda's growth initiatives.

- Market Consolidation: Integration of Scotiabank's operations in Costa Rica and Panama is a prime example.

- Synergy Leverage: The strategy aims to combine customer bases and operational efficiencies for greater impact.

- Customer Base Extension: Expanding its reach to a wider customer segment across the region is a core objective.

Banco Davivienda's key activities encompass a robust digital transformation, focusing on modernizing infrastructure and integrating AI for enhanced decision-making.

The development of mobile-first services, particularly the Daviplata Super App, which offered over 150 services by 2024, underscores this commitment, having already reached over 17 million users by the close of 2023.

These digital initiatives are vital for creating seamless omnichannel experiences, crucial for maintaining competitiveness in an evolving financial landscape.

Full Document Unlocks After Purchase

Business Model Canvas

The Banco Davivienda Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This isn't a sample or mockup; it's a direct snapshot of the final deliverable, containing all the essential components of Davivienda's strategic framework. You'll gain immediate access to this meticulously crafted canvas, ready for your analysis and application, with no hidden sections or altered formatting.

Resources

Banco Davivienda's financial capital, exceeding COP 191 trillion in total assets as of early 2024, is a cornerstone of its business model. This vast financial base, including a gross loan portfolio of COP 145.5 trillion, directly fuels its lending activities and operational capacity.

The strength of Davivienda's equity and its substantial deposit base are vital for maintaining liquidity and solvency. These elements are crucial for supporting the wide array of financial services the bank provides to its diverse customer base.

These considerable financial resources are the engine behind Davivienda's ability to innovate and offer a broad spectrum of products, from savings accounts to complex investment solutions. This financial muscle enables strategic market expansion and strengthens its competitive position.

Banco Davivienda's human capital is a cornerstone, boasting a dedicated workforce exceeding 17,000 employees. This extensive team provides the essential expertise and manpower to manage its broad banking operations and deliver services effectively across its network.

The bank prioritizes continuous development through upskilling and reskilling initiatives. This ensures employees are proficient in new technologies and adaptable to the dynamic financial landscape, crucial for navigating digital transformation.

This investment in its people directly fuels Davivienda's customer-centric model and drives innovation. By equipping its workforce with the latest knowledge and skills, the bank enhances its ability to meet evolving customer needs and introduce novel financial solutions.

Banco Davivienda’s digital platforms, particularly Daviplata and the Super App, are vital resources. These platforms, supported by a strong technology infrastructure, allow for streamlined service delivery and digital sales, enhancing customer interaction.

These digital assets are central to the bank's operations, enabling millions of transactions daily. For instance, Daviplata alone reported over 20 million users by late 2023, showcasing its extensive reach and importance in facilitating financial inclusion and digital banking services.

Investments in cloud-native systems and artificial intelligence further bolster this resource. These advancements provide scalability and efficiency, allowing Davivienda to adapt quickly to market changes and offer personalized, AI-driven financial solutions to its growing customer base.

Extensive Branch and ATM Network

Davivienda leverages an extensive physical network of hundreds of branches and thousands of ATMs across Colombia and Central America, complementing its digital strategy. This robust infrastructure ensures widespread accessibility, catering to customers who value face-to-face interactions and providing a tangible presence in key markets. For instance, as of the first quarter of 2024, Davivienda operated over 300 branches and more than 2,500 ATMs, demonstrating its commitment to a hybrid service model.

This physical footprint is crucial for customer acquisition and retention, particularly in regions where digital penetration may still be developing or for customers who prefer traditional banking methods. The network acts as a vital touchpoint, supporting a broad range of financial services and reinforcing customer trust. This extensive reach is a key differentiator, allowing Davivienda to serve a diverse customer base effectively.

- Physical Accessibility: Hundreds of branches and thousands of ATMs across Colombia and Central America.

- Hybrid Model Support: Facilitates both in-person and digital customer interactions.

- Market Reach: Ensures broad customer access and service delivery.

- Customer Trust: A tangible presence that builds confidence and loyalty.

Strong Brand Reputation and Trust

Banco Davivienda benefits immensely from a robust and widely recognized brand reputation in Colombia. This strong image, often highlighted in its distinctive media presence, translates into high public recall and significant customer trust, a crucial intangible asset.

This established trust directly contributes to customer acquisition and loyalty, making Davivienda a preferred financial institution. For instance, in 2024, brand perception studies consistently placed Davivienda among the top financial institutions in terms of trustworthiness and customer satisfaction.

Davivienda’s proactive commitment to sustainability and genuine focus on customer well-being further bolster its brand value. These initiatives not only resonate with socially conscious consumers but also reinforce the bank's image as a responsible corporate citizen.

- Brand Recognition: High public recall in Colombia due to unique media strategy.

- Customer Trust: A key intangible asset driving customer acquisition and retention.

- Sustainability Focus: Enhances brand value through commitment to environmental and social responsibility.

- Customer Well-being: Prioritizing customer needs builds loyalty and positive brand perception.

Banco Davivienda's key resources are multifaceted, encompassing significant financial capital, a dedicated human workforce, advanced digital platforms, an extensive physical network, and a strong brand reputation. These elements collectively enable the bank to deliver a comprehensive range of financial services and maintain a competitive edge in the market.

The bank's financial muscle, evidenced by total assets exceeding COP 191 trillion in early 2024, directly supports its lending activities and operational capacity. Coupled with a strong deposit base and equity, this financial foundation ensures liquidity and solvency, allowing for innovation and market expansion.

Human capital, exceeding 17,000 employees, provides the expertise for managing operations and delivering services. Continuous development ensures proficiency in new technologies, supporting a customer-centric model and driving innovation in financial solutions.

Digital platforms like Daviplata, with over 20 million users by late 2023, and the Super App, powered by cloud-native systems and AI, are crucial for streamlined service delivery and digital sales, enhancing customer interaction and financial inclusion.

The physical network of over 300 branches and 2,500 ATMs as of Q1 2024 ensures broad accessibility and supports a hybrid service model, reinforcing customer trust and facilitating customer acquisition.

Davivienda's strong brand reputation, built on a distinctive media presence and a commitment to sustainability and customer well-being, translates into high public trust and loyalty, positioning it as a preferred financial institution.

| Key Resource | Description | Key Data Point (Early 2024/Late 2023) |

| Financial Capital | Total assets and deposit base supporting operations and lending. | Total Assets: > COP 191 trillion; Gross Loan Portfolio: COP 145.5 trillion |

| Human Capital | Skilled workforce driving operations and customer service. | Employees: > 17,000 |

| Digital Platforms | Daviplata and Super App facilitating digital services and financial inclusion. | Daviplata Users: > 20 million (Late 2023) |

| Physical Network | Branches and ATMs ensuring accessibility and hybrid service model. | Branches: > 300; ATMs: > 2,500 (Q1 2024) |

| Brand Reputation | Customer trust and loyalty built on media presence and corporate responsibility. | Consistently ranked among top financial institutions for trustworthiness (2024) |

Value Propositions

Banco Davivienda provides a complete spectrum of financial tools, encompassing everything from basic savings and checking accounts to a variety of loans, including consumer, commercial, and mortgage options. This broad selection ensures clients can manage multiple aspects of their financial lives through a single institution.

The bank's offerings extend to credit cards, investment opportunities, and insurance products, creating a truly integrated financial ecosystem. This allows individuals and businesses to access diverse financial services without needing to engage with multiple providers.

This extensive product portfolio is designed to meet the varied and evolving needs of its customer base, which spans individuals, small and medium-sized enterprises (SMEs), and large corporations. For instance, in early 2024, Davivienda's loan portfolio showed robust growth, particularly in mortgage and commercial lending, reflecting the demand for comprehensive solutions across different segments.

By consolidating these essential financial services, Davivienda positions itself as a convenient, one-stop shop, simplifying financial management and fostering deeper client relationships built on trust and accessibility.

Banco Davivienda significantly enhances customer experience through digital convenience and innovation, primarily via its DaviPlata platform and Super App. These digital tools provide millions of users with easy, fast access to a broad spectrum of self-service banking functions, making financial management much simpler.

The bank’s commitment to continuous digital transformation ensures a banking experience that is both modern and highly efficient. By the first quarter of 2024, Davivienda reported that its digital channels were handling a substantial portion of transactions, reflecting strong user adoption and trust in its innovative solutions.

Banco Davivienda is deeply committed to sustainable finance, setting an ambitious goal for 30% of its loan portfolio to be classified as sustainable by the year 2030. This dedication extends to actively financing projects that promote green initiatives and protect biodiversity, aligning financial growth with environmental stewardship.

This strong stance on sustainability resonates with a growing segment of customers and investors who prioritize environmentally and socially responsible banking. It showcases Davivienda's commitment to being a forward-thinking financial institution that considers its broader impact.

Beyond environmental concerns, Davivienda’s initiatives are also geared towards fostering financial inclusion and providing crucial support for climate adaptation efforts. These efforts highlight a holistic approach to business, aiming to create value not just for shareholders but for society and the planet as well.

Personalized Customer Experience

Banco Davivienda prioritizes a personalized customer experience, aiming to build deeper relationships through tailored financial solutions. This is achieved by using data to understand individual customer needs, allowing them to offer relevant educational resources and products. This focus on individual needs helps foster trust and improve financial well-being.

In 2024, Davivienda continued to invest in digital tools and analytics to segment its customer base more effectively. This data-driven approach allows for the proactive identification of opportunities to offer specialized advice and product bundles, enhancing customer engagement and loyalty. The bank reported a significant increase in digital channel adoption, with over 70% of transactions occurring through its online and mobile platforms by mid-2024.

- Data-Driven Insights: Leveraging analytics to understand and anticipate customer financial needs.

- Tailored Solutions: Offering personalized financial products, services, and educational content.

- Relationship Building: Fostering trust and long-term partnerships by focusing on individual customer well-being.

- Digital Engagement: Enhancing personalized experiences through advanced digital platforms and tools.

Regional Accessibility and Market Leadership

Banco Davivienda's regional accessibility, with operations across Colombia and Central America, strengthens its market leadership. This geographical reach allows it to serve a broader client base and capitalize on diverse economic landscapes.

The bank’s significant market share in crucial areas like credit cards and housing finance in 2024 underscores its established presence and customer trust. For instance, in Colombia, Davivienda consistently ranks among the top financial institutions for mortgage lending, indicating a deep penetration in this vital segment.

- Expanded Geographic Footprint: Operations in Colombia, El Salvador, Honduras, and Costa Rica.

- Market Share Leadership: Strong positions in credit cards and housing finance across key markets.

- Customer Trust: Perceived security and reliability derived from its substantial market presence.

- Diversified Client Base: Serving a wide range of customer segments through its regional network.

Banco Davivienda's value proposition centers on providing a comprehensive suite of financial products, from everyday banking to specialized loans and investments. This all-encompassing approach simplifies financial management for individuals and businesses alike, fostering convenience and deeper client relationships.

Innovation in digital channels, exemplified by DaviPlata and the Super App, offers millions of users seamless, self-service banking. This commitment to digital transformation ensures efficient and modern financial interactions, with a significant portion of transactions handled digitally by mid-2024.

A strong commitment to sustainable finance, aiming for 30% of its loan portfolio to be sustainable by 2030, appeals to environmentally conscious customers. This focus, coupled with efforts in financial inclusion and climate adaptation support, highlights a responsible and forward-thinking banking model.

Personalized customer experiences driven by data analytics allow Davivienda to offer tailored solutions and educational resources. This data-driven strategy, evident in the bank's mid-2024 digital adoption figures exceeding 70%, enhances customer engagement and loyalty.

| Value Proposition | Description | Key Data/Fact |

|---|---|---|

| Comprehensive Financial Solutions | Offers a full range of banking, credit, investment, and insurance products. | Robust growth in mortgage and commercial lending in early 2024. |

| Digital Innovation & Convenience | Provides easy, fast access to banking services via DaviPlata and Super App. | Over 70% of transactions handled through digital channels by mid-2024. |

| Commitment to Sustainability | Aims for 30% of loan portfolio classified as sustainable by 2030. | Finances green initiatives and biodiversity protection projects. |

| Personalized Customer Experience | Uses data to offer tailored advice, products, and educational content. | Invested in digital tools and analytics for effective customer segmentation in 2024. |

Customer Relationships

Banco Davivienda champions digital engagement, offering robust mobile applications and online banking platforms. These channels empower customers to conduct a vast array of transactions and access services autonomously, reflecting a commitment to a digital-first banking experience. This approach directly addresses the increasing demand for convenience and immediate accessibility among today's banking clientele.

The Daviplata application stands as a cornerstone of this strategy, significantly streamlining everyday financial management for users. By facilitating easy and quick access to banking functions, Davivienda ensures its customer relationships are built on efficiency and user-friendliness. As of early 2024, Davivienda reported that over 70% of its transactions were conducted through digital channels, underscoring the success of this customer relationship model.

Banco Davivienda cultivates strong customer relationships by delivering personalized financial advice and solutions designed to enhance financial well-being. By leveraging data analytics, the bank pinpoints individual customer needs, enabling the delivery of customized product recommendations and valuable educational resources.

This tailored approach empowers customers to navigate their financial journeys with greater confidence, making more informed decisions about managing their money. For instance, in 2024, Davivienda reported a significant increase in engagement with its digital advisory tools, indicating a strong customer preference for personalized financial guidance.

Banco Davivienda excels in multichannel customer service, blending digital accessibility with a strong physical presence. Customers can engage through online banking, a feature-rich mobile app, or by visiting any of its extensive branch network and ATM locations. This approach caters to diverse customer preferences, offering seamless interactions across all touchpoints.

In 2024, Davivienda continued to emphasize digital transformation, with a significant portion of its transactions occurring through its online and mobile platforms. This digital shift complements its physical infrastructure, ensuring customers have convenient access to services whether they prefer self-service or personalized assistance from bank representatives.

Proactive Communication and Support

Banco Davivienda prioritizes proactive communication, aiming to keep its customers informed and engaged through timely notifications and tailored marketing campaigns. This approach is crucial for maintaining strong customer relationships.

By ensuring accurate contact details and optimizing communication channels, Davivienda enhances its capacity to deliver essential updates, such as new product offerings or important policy changes. For instance, in 2024, the bank continued to refine its digital platforms to facilitate these seamless interactions.

This commitment to proactive outreach not only builds trust but also fosters loyalty, which is vital for long-term success in the competitive banking sector. It allows the bank to anticipate customer needs and address potential concerns before they arise.

- Proactive Outreach: Timely notifications and relevant marketing campaigns keep customers informed.

- Data Accuracy: Ensuring correct contact information is key to effective communication.

- Trust Building: Consistent and relevant communication strengthens customer confidence.

- Relationship Focus: Proactive support fosters long-term customer loyalty and engagement.

Community and Inclusion Initiatives

Davivienda actively cultivates strong customer relationships by fostering community and inclusion. Their commitment extends beyond standard banking services, focusing on initiatives that uplift society and promote financial well-being for all segments of the population. This approach builds deep loyalty and a sense of shared purpose.

- Financial Inclusion: Davivienda's efforts to finance low-income housing, for instance, directly address a critical need, enabling more families to achieve homeownership and build financial stability.

- Community Development: Supporting sectors like coffee growers demonstrates a dedication to the economic health of specific communities, recognizing their vital contributions.

- Enriching Lives: These initiatives are designed to have a tangible, positive impact on customers' lives, moving beyond mere transactions to create meaningful connections.

- Societal Contribution: By prioritizing inclusivity and development, Davivienda positions itself as a partner in building a more prosperous and equitable society, reinforcing customer trust and brand value.

Banco Davivienda builds lasting customer connections through a multi-pronged strategy emphasizing digital convenience, personalized guidance, and community engagement. This comprehensive approach ensures customers feel supported and valued at every interaction.

The bank's digital-first ethos, exemplified by the DaviPlata app, saw over 70% of transactions occur through digital channels in early 2024. This digital focus is complemented by proactive, data-driven communication and tailored financial advice, enhancing customer confidence and loyalty.

Davivienda's commitment to financial inclusion and community development further strengthens its relationships, demonstrating a dedication to societal well-being that resonates deeply with its customer base.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Digital Engagement | Mobile App (DaviPlata), Online Banking | Over 70% of transactions via digital channels |

| Personalized Advice | Data analytics for tailored recommendations, Digital advisory tools | Increased customer engagement with advisory services |

| Community & Inclusion | Low-income housing finance, Support for sectors like coffee growers | Strengthening societal contribution and brand loyalty |

Channels

Mobile banking applications, specifically Daviplata and the Super App, are cornerstone digital channels for Davivienda, facilitating direct customer engagement and transaction processing. These platforms offer comprehensive financial management, from simple account checks to sophisticated investment tools, all accessible via smartphone. Their role is critical in driving the bank's digital sales figures and overall transaction volume, as evidenced by the significant increase in digital channel usage reported by many financial institutions in recent years, with mobile banking adoption rates soaring globally.

Despite the digital shift, Davivienda's extensive physical branch network across Colombia and Central America remains a vital component of its business model. In 2023, Davivienda operated hundreds of branches, a testament to its commitment to physical accessibility.

These branches are indispensable for handling complex transactions and offering personalized financial advice, catering to a significant customer segment that values in-person interaction. This tangible presence reinforces the bank's brand and trust.

The network supports a wide array of services, from account opening to loan processing, ensuring that customers across diverse demographics can access essential banking functions. This multi-channel approach is key to Davivienda's market penetration.

By 2024, while digital channels continue to grow, the strategic importance of these physical touchpoints is undeniable for maintaining customer relationships and facilitating high-value financial services.

Automated Teller Machines (ATMs) are a cornerstone of Davivienda's customer service strategy, providing a widespread and accessible channel for essential banking. This extensive network ensures customers can conduct transactions like cash withdrawals and deposits at any time, significantly boosting convenience and reducing reliance on physical branches.

In 2024, Davivienda continues to leverage its substantial ATM fleet, which numbers in the thousands across its operating regions. This robust infrastructure grants customers 24/7 access to fundamental financial services, reinforcing the bank's commitment to user-friendly banking solutions and operational efficiency.

Online Banking and Web Platforms

Davivienda’s official website and online banking portals are central to its digital strategy, allowing customers to manage accounts, conduct transactions, and discover a broad spectrum of products and services. These platforms offer a secure and integrated digital experience, accessible from any internet-connected device. They cater to diverse financial and informational requirements, enhancing customer convenience.

These digital channels are crucial for facilitating everyday banking activities, from checking balances and making payments to applying for loans and managing investments. In 2024, Davivienda continued to invest in enhancing the user experience on its web platforms, aiming for greater personalization and streamlined access to financial tools. The bank reported a significant increase in digital transaction volumes, underscoring the growing reliance on these channels. For instance, mobile banking sessions saw a substantial uptick, with customers increasingly preferring self-service options. This digital push is vital for operational efficiency and expanding market reach beyond traditional branch networks.

- Digital Reach: Davivienda’s online banking and web platforms serve millions of users, providing 24/7 access to financial services.

- Transaction Volume: The digital channels process a vast number of daily transactions, including transfers, payments, and account inquiries.

- Productivity Gain: By enabling self-service, these platforms reduce the burden on physical branches and customer service centers.

- Customer Engagement: Interactive features and personalized content on the web and mobile apps foster stronger customer relationships.

Commercial Sales Teams and Contact Centers

Banco Davivienda leverages dedicated commercial sales teams to directly engage with individual, SME, and corporate clients. These teams are crucial for offering tailored financial products and services, ensuring a personalized approach to customer needs. Their efforts are amplified by contact centers that provide essential support, handle inquiries, and actively contribute to commercial expansion. This human-touch channel is instrumental in fostering strong client relationships and driving the acquisition of new business.

In 2024, Davivienda's commercial sales force continued to be a cornerstone of its growth strategy. For instance, the bank reported a significant increase in new loan originations facilitated by these direct sales interactions. Contact centers played a vital role in this, handling millions of customer interactions annually, with a notable percentage leading to successful product uptake. This direct engagement model allows for a deep understanding of client needs, translating into higher conversion rates and customer loyalty.

- Direct Client Engagement: Sales teams build relationships across individual, SME, and corporate segments.

- Personalized Service: Tailored financial solutions are offered based on client-specific needs.

- Contact Center Support: Essential for query resolution and driving commercial growth.

- Relationship Building: This human-centric approach is key to customer acquisition and retention.

Davivienda's channel strategy effectively blends digital and physical touchpoints to serve its diverse customer base. Mobile banking applications like DaviPlata and the Super App are central to its digital engagement, offering comprehensive financial management and driving significant transaction volumes. The bank's extensive physical branch network across Colombia and Central America, numbering in the hundreds as of 2023, remains crucial for complex transactions and personalized advice, reinforcing brand trust and accessibility. Thousands of ATMs provide 24/7 access to essential services, enhancing customer convenience.

| Channel Type | Key Functionality | 2024 Focus/Data Point |

|---|---|---|

| Mobile Apps (DaviPlata, Super App) | Direct engagement, transactions, financial management | Continued investment in user experience and personalization. Significant uptick in mobile banking sessions. |

| Physical Branches | Complex transactions, personalized advice, brand reinforcement | Hundreds of branches operated in 2023, vital for high-value services and customer relationships. |

| ATMs | 24/7 access to essential banking (withdrawals, deposits) | Thousands deployed across operating regions, reinforcing convenience and accessibility. |

| Website/Online Banking | Account management, transactions, product discovery | Enhanced user experience for greater personalization and streamlined access to financial tools. |

| Sales Teams & Contact Centers | Direct client engagement, tailored solutions, support | Significant increase in new loan originations attributed to direct sales; millions of customer interactions handled annually. |

Customer Segments

Individual and retail customers form the bedrock of Davivienda's operations, encompassing a vast array of natural persons looking for everyday banking solutions. This segment is crucial, as it covers everything from basic savings and checking accounts to more significant financial products like consumer loans, mortgages, and a variety of credit cards designed to meet diverse personal needs.

Davivienda's commitment to serving these customers is evident in its focus on accessible digital platforms. For instance, Daviplata, their digital wallet, has been instrumental in driving financial inclusion and catering to the daily financial requirements of millions, making banking more convenient and widespread.

This segment represents the largest customer base for Davivienda by sheer volume, highlighting the bank's success in attracting and retaining a broad spectrum of individuals. In 2024, Davivienda continued to see strong engagement from this segment, with millions of active users across its digital channels, underscoring the importance of these retail customers to the bank's overall growth and stability.

Banco Davivienda actively courts Small and Medium-sized Enterprises (SMEs) by offering a suite of financial and transactional solutions. These include vital commercial loans, flexible business financing options, and efficient payment processing systems. Davivienda acknowledges the critical role SMEs play in driving economic expansion and therefore crafts specialized products to foster their growth and improve their access to essential credit.

In 2024, SMEs represented a significant portion of the Colombian economy, contributing approximately 90% of all businesses and employing over 60% of the workforce. Davivienda's strategic focus on this segment underscores its commitment to sustainable lending and capturing a substantial market share within this dynamic economic engine.

Large corporations and institutional clients are a cornerstone for Banco Davivienda, seeking sophisticated financial solutions across local and international markets. These clients require robust capabilities for managing transactions in various currencies, alongside access to tailored investment and financing products. In 2024, Davivienda continued to solidify its position by offering specialized services, including substantial corporate loan facilities and comprehensive wealth management strategies designed for entities with complex financial structures and significant asset bases.

Agricultural Sector Clients

Banco Davivienda actively supports the agricultural sector by offering tailored financial solutions designed for the unique demands of rural economies and agribusinesses. A prime example of this commitment is its strategic partnership with the National Federation of Coffee Growers, highlighting a dedication to fostering growth and sustainability within this vital industry.

This engagement with the agricultural sector underscores Davivienda's broad economic reach and its strategy to provide specialized financial products. The bank recognizes that agribusinesses often have distinct cash flow cycles and investment needs, requiring flexible lending and advisory services.

- Partnership with National Federation of Coffee Growers: Demonstrates a focused approach to serving a key agricultural segment.

- Tailored Financial Solutions: Addresses the specific requirements of rural communities and agribusinesses, including credit, insurance, and savings products.

- Support for Growth and Sustainability: Aims to bolster the financial health and long-term viability of agricultural enterprises.

Micro-businesses and Underserved Populations

Banco Davivienda leverages platforms like Daviplata to reach micro-businesses and previously underserved populations, allowing them to process payments and oversee their finances digitally. This approach is crucial for fostering financial inclusion.

These segments gain access to simplified financial instruments that encourage greater economic engagement. For instance, by early 2024, Daviplata had surpassed 18 million users in Colombia, demonstrating its extensive reach into these demographics.

This strategy significantly broadens the bank's customer base, tapping into a demographic that often lacks traditional banking access. The ease of use and accessibility of these digital tools are key drivers of adoption.

- Financial Inclusion: Davivienda's digital platforms provide essential financial services to millions, bridging the gap for those historically excluded from traditional banking.

- Digital Payment Solutions: Micro-businesses can efficiently receive payments, streamlining operations and enhancing their ability to participate in the digital economy.

- Broad Demographic Reach: By focusing on accessibility, Davivienda extends its services to a wide array of individuals and small enterprises, expanding its market presence considerably.

The customer segments for Banco Davivienda are diverse, ranging from individual retail customers and SMEs to large corporations and specific sectors like agriculture. Davivienda also focuses on micro-businesses and underserved populations through its digital platforms.

In 2024, Davivienda's digital wallet, DaviPlata, demonstrated significant reach, having amassed over 18 million users in Colombia by early 2024, underscoring its success in financial inclusion for micro-businesses and previously unbanked individuals.

The bank's strategic engagement with SMEs in 2024, a segment contributing approximately 90% of businesses and over 60% of employment in Colombia, highlights its commitment to supporting economic growth through specialized financial products and credit access.

| Customer Segment | Key Offerings | 2024 Highlights/Data |

|---|---|---|

| Individual & Retail | Savings, checking, loans, mortgages, credit cards | Millions of active users on digital channels; DaviPlata usage |

| SMEs | Commercial loans, business financing, payment processing | Targeting a sector that forms ~90% of Colombian businesses |

| Large Corporations & Institutions | Corporate loans, wealth management, international transactions | Specialized services for complex financial structures |

| Agriculture | Tailored credit, insurance for agribusinesses | Partnership with National Federation of Coffee Growers |

| Micro-businesses & Underserved | Digital payments via DaviPlata | DaviPlata surpassed 18 million users by early 2024 |

Cost Structure

Banco Davivienda's cost structure is heavily influenced by its extensive operational footprint. A significant portion of these costs are dedicated to administrative expenses, encompassing everything from employee salaries and benefits for its large workforce to the upkeep of its widespread branch network, including rent and utilities. For instance, in 2023, personnel expenses represented a substantial part of their operating costs, reflecting the human capital investment needed to manage daily banking operations and customer service across Colombia and other regions.

Managing these operating expenses efficiently is paramount for Davivienda's profitability. The bank continuously seeks ways to optimize its administrative overhead, whether through technology adoption to streamline processes or by strategically evaluating its physical presence. In 2024, the bank continued to focus on digital transformation initiatives, aiming to reduce the cost-to-serve for many transactions, thereby impacting the overall administrative cost base.

Banco Davivienda's significant workforce, exceeding 17,000 employees, makes personnel and employee-related expenses a substantial element of its cost structure. These costs encompass salaries, comprehensive benefits packages, and ongoing training initiatives designed to maintain a competitive edge.

The bank's commitment to employee development, including substantial investments in upskilling and reskilling programs, directly impacts these expenses. For instance, in 2023, Davivienda reported operating expenses of COP 3.4 trillion, with a significant portion allocated to its human capital. This strategic investment in a highly skilled and adaptable workforce is crucial for navigating the dynamic financial landscape and ensuring operational excellence.

Banco Davivienda allocates significant capital to its technology and digital infrastructure, a core component of its business model. These investments are crucial for its digital transformation initiatives, encompassing upgrades to IT systems, bespoke software creation, cloud-based solutions, and robust cybersecurity measures.

For instance, in 2023, Davivienda continued to pour resources into enhancing its digital platforms, such as Daviplata and its Super App. These platforms are central to the bank's strategy of offering accessible and user-friendly financial services, directly impacting customer acquisition and retention.

The bank anticipates substantial operational expenditure (OpEx) savings as a direct result of these digital advancements. By streamlining processes and automating tasks through technology, Davivienda aims to reduce its overall cost base, thereby improving profitability and competitive positioning in the market.

Loan-Loss Provisions and Risk Management

Loan-loss provisions are a significant cost for Banco Davivienda, directly tied to the credit risk inherent in its lending activities. These provisions are set aside to cover potential losses from non-performing loans, making them a crucial element of the bank's financial health and cost structure.

While Banco Davivienda has demonstrated a commitment to improving its risk profiles through prudent lending practices, these provisions remain a key financial consideration. For instance, in 2023, the bank's net charge-offs as a percentage of average loans remained relatively stable, indicating effective risk management, though the absolute provision amount is influenced by loan portfolio growth and economic conditions.

- Loan Loss Provisioning: Costs incurred to cover potential defaults on loans extended to customers.

- Risk Management Impact: Effective strategies aim to mitigate these costs by carefully assessing borrower creditworthiness and diversifying loan portfolios.

- 2023 Performance: Davivienda's focus on asset quality in 2023 helped manage the impact of provisions, though specific figures fluctuate based on economic cycles and loan growth.

- Cost Optimization: Continuous improvement in risk assessment models and collections processes are key to minimizing these essential operational costs.

Marketing, Advertising, and Brand Management

Banco Davivienda invests significantly in marketing, advertising, and brand management to solidify its market position and attract a broad customer base. These expenditures are crucial for promoting its diverse financial products and services, with a particular emphasis on digital channels that are increasingly central to customer engagement. The bank's commitment to maintaining a strong, recognizable brand is evident in its consistent and often innovative media presence, which helps reinforce its reputation as a reliable financial partner. In 2023, Davivienda's marketing and advertising expenses were a key component of its operational costs, supporting initiatives that drove customer acquisition and retention.

Key aspects of Davivienda's marketing and brand strategy include:

- Promoting Digital Transformation: Campaigns highlight user-friendly digital banking platforms and mobile applications, aiming to shift customer preference towards online services.

- Reinforcing Brand Trust: Advertising efforts consistently focus on security, customer service, and the bank's commitment to social responsibility, building confidence among consumers.

- Unique Media Engagement: Davivienda is known for distinctive advertising campaigns that capture public attention and differentiate it from competitors in the financial sector.

- Customer Acquisition Costs: Marketing spend directly influences the cost to acquire new customers, making efficient campaign design and execution vital for profitability.

Banco Davivienda's cost structure is significantly shaped by operational necessities and strategic investments. Personnel expenses, including salaries and benefits for its large workforce, form a substantial portion of these costs. For 2023, operating expenses reached COP 3.4 trillion, underscoring the investment in human capital for daily banking and customer service.

Technology and digital infrastructure are also major cost drivers, essential for digital transformation initiatives like the DaviPlata app. These investments in IT systems and cybersecurity are crucial for enhancing user experience and operational efficiency. The bank anticipates OpEx savings from these digital advancements.

Loan-loss provisions, a direct reflection of credit risk, are another key cost. While Davivienda manages risk prudently, these provisions are influenced by economic cycles and loan portfolio growth. Marketing and advertising expenses are also significant, supporting brand building and customer acquisition, especially through digital channels.

| Cost Category | 2023 Impact (Illustrative) | Strategic Focus |

|---|---|---|

| Personnel Expenses | Major component of COP 3.4 trillion operating expenses. | Talent development and retention. |

| Technology & Digital Infrastructure | Ongoing investment in platforms like DaviPlata. | Streamlining processes, enhancing customer experience. |

| Loan-Loss Provisions | Influenced by credit risk and economic conditions. | Prudent lending and risk management. |

| Marketing & Advertising | Key for brand building and customer acquisition. | Digital channel promotion, reinforcing brand trust. |

Revenue Streams

Net interest income is the backbone of Davivienda's earnings, stemming from the interest it collects on a wide array of loans. This includes everything from personal loans for consumers to larger commercial and mortgage loans for businesses and individuals buying homes. In 2023, Davivienda reported a net interest income of COP 4.6 trillion, showcasing its significant reliance on this core revenue driver.

Banco Davivienda generates significant income from a variety of fees and commissions. This includes charges associated with credit card usage, various transactional services, wealth management offerings, and foreign exchange operations. For instance, by the end of 2023, Davivienda reported a substantial portion of its operating income stemmed from non-interest revenue, highlighting the importance of these fee-based activities.

Banco Davivienda generates significant revenue through its investment products and services, catering to both individual and corporate clients. These offerings encompass asset management, where the bank actively manages client portfolios to achieve growth, and investment banking, providing advisory and underwriting services for capital raising and mergers. This revenue stream is a testament to Davivienda's expertise in wealth management and its capacity to expand client assets, directly impacting its overall financial health.

For instance, in 2023, Banco Davivienda reported substantial income from its investment banking and asset management divisions, reflecting a strong demand for sophisticated financial solutions. The bank's commitment to offering diverse investment vehicles, from mutual funds to structured products, attracts clients looking for tailored wealth enhancement strategies. This focus on client asset growth is a core component of their business model, driving profitability and client loyalty.

Insurance Premiums

Banco Davivienda’s insurance segment acts as a significant revenue generator, built upon the collection of premiums from a wide array of policyholders. This strategic diversification strengthens its financial base by adding a recurring income stream beyond traditional banking services. The company offers a comprehensive suite of insurance products designed to meet diverse customer needs, encompassing everything from individual life and health coverage to more specialized business and property insurance solutions.

In 2024, Davivienda's insurance operations continued to demonstrate robust performance, contributing substantially to its overall financial results. For instance, the company reported that its insurance subsidiaries played a key role in its consolidated earnings, reflecting strong market penetration and effective product management. This segment not only enhances customer loyalty by offering integrated financial protection but also provides a valuable hedge against interest rate volatility inherent in core banking activities.

Key aspects of Davivienda's insurance revenue streams include:

- Life Insurance Premiums: Revenue generated from policies covering life events, providing financial security to beneficiaries.

- General Insurance Premiums: Income from policies such as auto, home, travel, and credit protection.

- Business Insurance: Premiums collected for covering commercial risks, property, and liability for corporate clients.

- Annuity Products: Revenue from long-term savings and investment products that offer a guaranteed stream of income.

Digital Payment Solutions and FinTech Services

Banco Davivienda is significantly expanding its revenue from digital payment solutions and FinTech services, a trend amplified by strategic acquisitions like Epayco. This digital shift is driven by the rapid growth of platforms such as Daviplata, which now serves millions of users.

Key revenue drivers within this segment include a variety of transaction fees associated with digital payments, catering to both individuals and a growing base of micro-businesses. Davivienda also offers specialized digital services tailored to this segment, fostering financial inclusion and enabling small enterprises to operate more efficiently in the digital economy.

The expansion into FinTech services represents Davivienda's proactive adaptation to the changing financial landscape, positioning the bank to capture value from the increasing adoption of digital financial tools and services. This diversification is crucial for maintaining competitiveness and driving future growth.

- Transaction Fees: Revenue generated from processing digital payments, transfers, and other financial transactions facilitated through Davivienda's digital platforms.

- Services for Micro-Businesses: Income derived from offering specialized digital tools, payment gateways, and financial management solutions designed for small and medium-sized enterprises.

- Daviplata Growth: Monetization of the rapidly expanding Daviplata digital wallet through various service charges and premium features.

- FinTech Innovation: Revenue streams from new and evolving digital financial products and services developed to meet emerging market demands.

Banco Davivienda's revenue streams are diverse, encompassing traditional banking income, fees, insurance, and burgeoning digital finance. The bank's net interest income, derived from lending activities, remains a primary driver, complemented by substantial earnings from commissions on services like credit cards and wealth management. Its insurance segment further diversifies income through premiums, while a strategic push into FinTech, particularly through DaviPlata, opens new avenues for transaction-based revenue and services for micro-businesses.

In 2023, Davivienda reported COP 4.6 trillion in net interest income. Non-interest revenue also played a crucial role, highlighting the effectiveness of its fee and commission-based services. The insurance segment showed robust performance in 2024, contributing significantly to consolidated earnings, while digital platforms like DaviPlata are rapidly expanding their user base and associated transaction volumes.

| Revenue Stream | Key Components | 2023 Data (COP Trillions) |

|---|---|---|

| Net Interest Income | Interest on loans (personal, commercial, mortgage) | 4.6 |

| Fees & Commissions | Credit cards, transactional services, wealth management, foreign exchange | Significant portion of operating income |

| Investment Products & Services | Asset management, investment banking | Strong demand, contributing to overall financial health |

| Insurance | Life, general, business insurance premiums, annuities | Robust performance, key contributor to earnings in 2024 |

| Digital Payments & FinTech | Transaction fees, services for micro-businesses, DaviPlata | Rapidly expanding, driven by acquisitions and user growth |

Business Model Canvas Data Sources

The Banco Davivienda Business Model Canvas is informed by a robust blend of internal financial data, extensive market research, and detailed customer insights. These sources are critical for accurately defining value propositions, customer segments, and revenue streams.