Darling Ingredients PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Darling Ingredients Bundle

Navigate the complex external forces impacting Darling Ingredients with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping their operational landscape and future growth. Equip yourself with this vital intelligence to refine your own strategic approach and uncover hidden opportunities. Download the full report now for actionable insights.

Political factors

Government policies, particularly those supporting renewable energy, are a significant driver for Darling Ingredients. For instance, federal tax credits for renewable diesel, like the $1 per gallon credit, directly boost the economics of Darling's renewable fuels segment. These incentives are crucial for the profitability and strategic expansion of ventures such as their Diamond Green Diesel (DGD) joint venture with Valero.

The continuation or modification of these political supports, such as the Inflation Reduction Act's provisions for clean fuels, directly impacts Darling's investment decisions and the overall growth trajectory of their renewable diesel production. Policy stability and favorable regulatory environments are therefore paramount for sustaining and growing this key business area.

Trade policies and tariffs significantly impact Darling Ingredients. For instance, the U.S. imposed tariffs on certain agricultural products in 2018, which could indirectly affect the cost of raw materials Darling sources globally. Navigating these evolving trade landscapes, including international agreements like the USMCA, is crucial for maintaining cost-effective operations and ensuring market access for their renewable fuels and animal feed products.

Darling Ingredients' operations are intrinsically linked to stringent regulations governing animal by-products and waste management. These rules dictate how the company collects, processes, and disposes of materials, directly impacting its core business model.

Evolving health, safety, and environmental standards, particularly in rendering and waste stream management, often require substantial capital outlays for compliance. For instance, in 2024, continued focus on reducing methane emissions from waste processing facilities could drive further investment in advanced capture technologies.

Maintaining operating licenses and public confidence hinges entirely on Darling Ingredients' ability to meet these complex regulatory requirements. Failure to comply can lead to severe penalties and reputational damage, underscoring the critical nature of regulatory adherence.

Agricultural and Food Safety Policies

Government policies concerning agriculture, livestock farming, and food safety are pivotal for Darling Ingredients, directly influencing the supply and quality of its raw materials for food, feed, and pharmaceutical ingredients. For instance, the U.S. Department of Agriculture (USDA) sets standards for animal health and meat processing, which directly affect the sourcing and processing of animal by-products. In 2024, ongoing discussions around stricter animal welfare regulations could impact livestock availability and associated costs.

Regulations governing feed additives and food processing standards, such as those from the Food and Drug Administration (FDA), shape Darling Ingredients' product development and market acceptance. Compliance with these evolving standards, including those related to traceability and ingredient safety, is crucial for maintaining market access and consumer trust. The company's adherence to these policies in 2024 ensures the integrity of its diverse product portfolio.

- Impact on Raw Material Sourcing: Agricultural subsidies and livestock farming regulations directly influence the volume and cost of animal by-products available to Darling Ingredients.

- Product Development and Market Access: Food safety standards, like HACCP, and regulations on feed additives dictate product formulation and market approval processes.

- Consumer Confidence and Brand Reputation: Strict adherence to food safety and animal health policies underpins consumer trust and the company's reputation in sensitive markets.

- Regulatory Compliance Costs: Investments in meeting evolving food safety and environmental regulations represent a significant operational consideration for Darling Ingredients.

Geopolitical Stability and Supply Chain Security

Global geopolitical events, such as the ongoing conflicts in Eastern Europe and the Middle East, directly impact Darling Ingredients by threatening the stability of its supply chains for essential raw materials like animal by-products and fats. Political instability in key operating regions can also disrupt the distribution networks for its finished products, which are sold worldwide. For example, trade restrictions or sanctions imposed due to political tensions could limit market access or increase transportation costs.

Darling Ingredients' ability to ensure supply chain resilience and diversify its sourcing is paramount to mitigating risks stemming from political unrest or trade disruptions. The company's reliance on a global network of suppliers and customers means that localized political instability can have far-reaching consequences. In 2023, the company continued to invest in optimizing its logistics and exploring new sourcing regions to bolster its resilience against such disruptions.

Monitoring the global political landscape is crucial for Darling Ingredients to anticipate and respond effectively to potential impacts on its operations. This includes tracking evolving trade policies, the likelihood of new tariffs, and the security of shipping lanes. The company's proactive approach to risk management, including scenario planning for geopolitical events, is vital for maintaining operational continuity and protecting its financial performance.

- Geopolitical Risk: Ongoing conflicts and political instability in regions where Darling Ingredients sources raw materials or sells products present a significant risk to its supply chain and distribution.

- Supply Chain Resilience: Diversifying sourcing locations and strengthening logistics are key strategies for Darling Ingredients to counter potential disruptions caused by political events.

- Market Access: Evolving trade policies and sanctions related to geopolitical situations can impact Darling Ingredients' ability to access international markets for its products.

- Operational Continuity: Proactive monitoring of global political trends allows Darling Ingredients to anticipate and mitigate the operational and financial impacts of geopolitical instability.

Government incentives, particularly for renewable fuels, remain a critical political factor for Darling Ingredients. The continued support through tax credits, such as the $1 per gallon renewable diesel credit, directly influences the profitability of its Diamond Green Diesel (DGD) joint venture. Policy stability, as seen with the Inflation Reduction Act's clean fuel provisions, is essential for Darling's investment decisions and growth in renewable diesel production.

Trade policies and tariffs can significantly impact Darling Ingredients' raw material costs and market access. Navigating international agreements and potential trade restrictions is vital for maintaining cost-effective operations and ensuring global sales of its diverse product lines. For instance, in 2024, the company continues to monitor trade dynamics that could affect its global supply chains and product distribution.

Stringent environmental and safety regulations are fundamental to Darling Ingredients' business model, dictating its processing and waste management practices. The company must invest in compliance with evolving standards, such as those aimed at reducing methane emissions from processing facilities, to maintain operating licenses and public trust.

Agricultural and food safety regulations, enforced by bodies like the USDA and FDA, directly shape Darling Ingredients' raw material sourcing and product development. Adherence to these evolving standards, including those related to animal welfare and ingredient traceability, is crucial for market access and consumer confidence in 2024.

What is included in the product

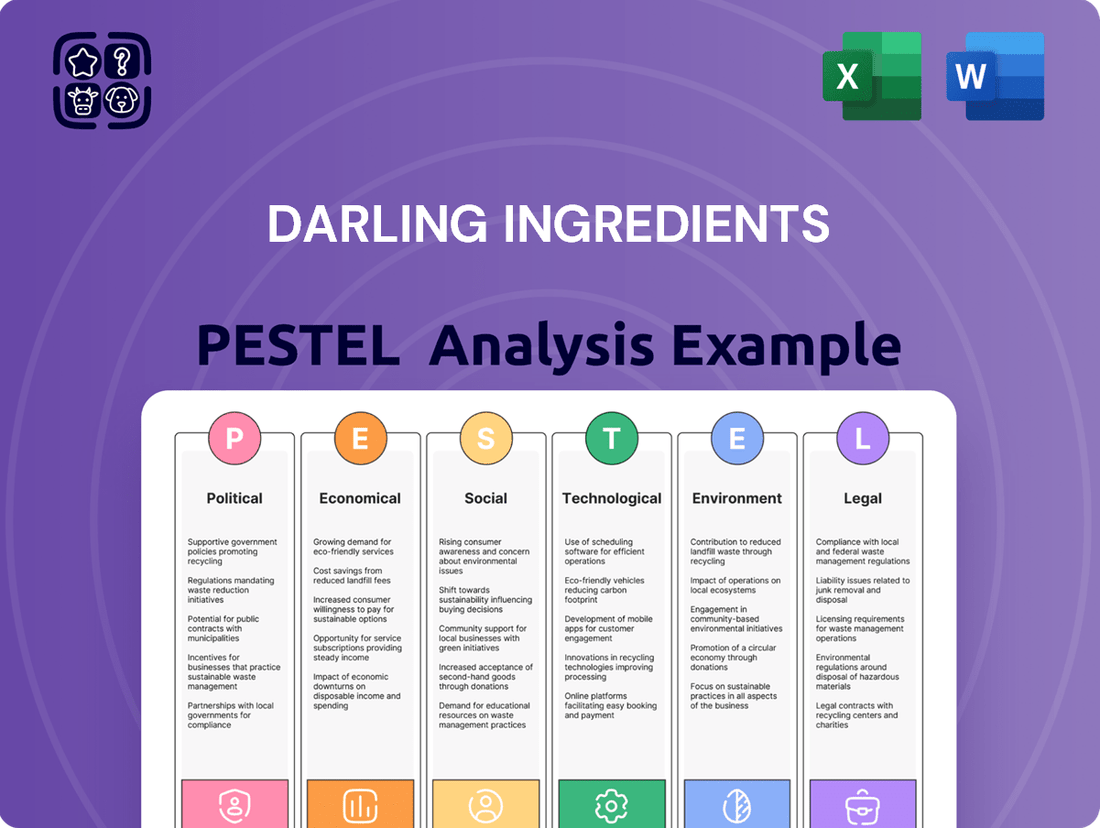

This PESTLE analysis delves into how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, shape the operational landscape and strategic positioning of Darling Ingredients.

This Darling Ingredients PESTLE analysis provides a clear, summarized version of external factors for easy referencing during meetings or presentations, alleviating the pain of sifting through lengthy reports.

Economic factors

Darling Ingredients relies heavily on raw materials like animal fats and oils, whose prices are inherently volatile. These fluctuations are driven by complex global factors including weather patterns affecting agriculture, shifts in consumer demand for certain products, and the ever-present influence of energy costs on transportation and processing. For instance, the price of tallow, a key ingredient, can swing considerably based on the supply of rendered animal by-products and demand from the biodiesel industry.

Such price swings directly affect Darling's bottom line, impacting their ability to maintain consistent profit margins and dictating their pricing for finished goods. In 2024, for example, disruptions in agricultural supply chains, partly due to geopolitical events and adverse weather in key producing regions, led to a noticeable increase in the cost of certain fats and oils, putting pressure on Darling's cost of goods sold.

Consequently, managing this commodity price risk is a critical financial strategy for Darling. The company employs various hedging techniques and seeks long-term supply agreements to mitigate the impact of sharp price increases, aiming to stabilize input costs and protect its profitability in an unpredictable market.

Economic expansion and a growing preference for sustainable, circular economy products are fueling demand for Darling Ingredients' solutions. This trend directly supports the company's revenue streams as consumers and industries increasingly seek environmentally conscious alternatives.

The economic feasibility of renewable diesel, a key product area, is closely tied to crude oil prices and governmental support. For instance, the U.S. Renewable Fuel Standard (RFS) and California's Low Carbon Fuel Standard (LCFS) provide crucial incentives, influencing the price spread between renewable diesel and conventional diesel. In 2024, the market continues to see volatility in these factors, impacting the cost-competitiveness of sustainable fuels.

A strong and expanding market for sustainable ingredients and renewable fuels is a critical driver for Darling Ingredients' sustained long-term revenue growth. The company's ability to capitalize on this demand, supported by favorable economic conditions and policy frameworks, positions it for continued success.

Rising inflation in 2024 and projected into 2025 directly impacts Darling Ingredients' operational expenses. Increased costs for essential inputs like fuel for transportation, energy for processing, and wages for its workforce can squeeze profit margins. For instance, if the Producer Price Index (PPI) for transportation services continues its upward trend, Darling's logistics costs will rise proportionally.

Higher interest rates, a likely response to persistent inflation, present a dual challenge. Darling Ingredients may face increased borrowing costs for necessary capital investments in new facilities or technology upgrades. Servicing existing debt also becomes more expensive, potentially affecting the company's financial flexibility and its ability to pursue growth opportunities aggressively.

Darling Ingredients' financial performance is intrinsically linked to the Federal Reserve's monetary policy decisions. As of mid-2024, the Fed's stance on interest rates, influenced by inflation data, directly shapes the cost of capital and the overall economic environment in which Darling operates.

Global Economic Growth and Consumer Spending

Global economic growth is a significant driver for Darling Ingredients, directly impacting industrial demand for its ingredients across food, feed, and pharmaceutical sectors. A robust global economy typically boosts consumer spending, which in turn increases demand for Darling's products, including pet food and specialty items. Conversely, economic slowdowns can lead to decreased demand and put pressure on pricing for the company's offerings.

Looking at projections for 2024 and 2025, the International Monetary Fund (IMF) in its April 2024 World Economic Outlook anticipated global growth to be 3.2% in 2024, moderating slightly from 3.5% in 2023, and projected a similar 3.2% growth for 2025. This steady, albeit moderate, growth suggests a generally supportive environment for industrial demand. However, regional variations are important; for instance, while advanced economies might see slower growth, emerging markets could offer more dynamic opportunities for ingredient consumption.

- Global GDP Growth: Projected at 3.2% for both 2024 and 2025 by the IMF, indicating a stable but not exceptionally rapid expansion of the global economy.

- Consumer Spending Impact: Higher disposable incomes in growing economies translate to increased spending on premium pet foods and specialty food ingredients, key markets for Darling.

- Inflationary Pressures: Persistent inflation in some regions could temper consumer spending, potentially affecting demand for non-essential or premium products.

- Supply Chain Resilience: Global economic stability is also linked to supply chain efficiency, which is crucial for Darling's sourcing and distribution networks.

Currency Exchange Rate Fluctuations

Darling Ingredients operates globally, meaning its financial results are exposed to the ups and downs of currency exchange rates. When earnings from foreign operations are converted back to its reporting currency, unfavorable shifts can reduce reported revenues, increase costs, and shrink profits. For instance, if the US dollar strengthens significantly against currencies where Darling has substantial operations, its reported international earnings would appear lower.

Managing these currency risks is crucial for maintaining financial stability. Darling Ingredients likely employs strategies such as hedging to mitigate the impact of adverse currency movements. In 2023, Darling reported that foreign currency translation adjustments had a negative impact on its financial results, highlighting the real-world effect of these fluctuations.

- Global Operations Exposure: Darling Ingredients' international presence exposes it to fluctuations in exchange rates across various currencies.

- Impact on Financials: Adverse currency movements can negatively affect reported revenues, costs, and profits due to the translation of foreign earnings.

- Risk Management Importance: Effective currency risk management strategies are vital for Darling Ingredients' financial stability and predictable performance.

- 2023 Impact: In 2023, foreign currency translation adjustments were noted as having a negative impact on Darling's financial reporting, demonstrating the practical implications of these fluctuations.

Global economic growth directly influences Darling Ingredients' demand across various sectors. The IMF projected global GDP growth at 3.2% for both 2024 and 2025, indicating a stable economic environment that supports industrial consumption of its products. This growth translates to increased consumer spending, particularly on premium pet foods and specialty ingredients, which are key revenue drivers for Darling.

Inflationary pressures, however, pose a risk to consumer spending power, potentially impacting demand for non-essential or premium products. Furthermore, rising interest rates, a likely response to inflation, could increase Darling's borrowing costs for capital investments and debt servicing, impacting financial flexibility. Darling's financial results are also subject to currency exchange rate fluctuations, as evidenced by negative impacts from foreign currency translation adjustments reported in 2023.

| Economic Factor | 2024/2025 Projection/Data | Impact on Darling Ingredients |

|---|---|---|

| Global GDP Growth | IMF: 3.2% (2024 & 2025) | Supports industrial demand and consumer spending, boosting sales of pet food and specialty ingredients. |

| Inflation | Persistent in some regions | May reduce consumer purchasing power for premium products; increases operational costs (fuel, energy, wages). |

| Interest Rates | Likely higher due to inflation | Increases borrowing costs for capital expenditures and debt servicing, potentially limiting growth initiatives. |

| Currency Exchange Rates | Volatile global markets | Unfavorable movements can negatively impact reported revenues and profits from international operations; hedging is crucial. |

Full Version Awaits

Darling Ingredients PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Darling Ingredients PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand market dynamics and strategic opportunities with this complete report.

Sociological factors

Consumers increasingly favor natural and sustainably sourced products, a trend that perfectly complements Darling Ingredients' core business. This shift boosts demand for their specialty ingredients across food, pet food, and pharmaceutical sectors, as these items align with a circular economy ethos.

Darling Ingredients' ability to market bio-nutrient derived products as eco-friendly choices is a significant advantage. For instance, the global market for sustainable food ingredients was projected to reach $11.1 billion in 2024, with a compound annual growth rate (CAGR) of 7.5% expected through 2030, highlighting strong consumer pull.

Public perception regarding animal by-products is a significant sociological factor. Growing consumer awareness around animal welfare and ethical sourcing can directly impact the acceptance of products derived from these materials. For instance, a 2024 survey indicated that over 60% of consumers are more likely to purchase products with transparent and ethically sourced ingredients, a trend that directly affects companies like Darling Ingredients.

Darling Ingredients' business model, which transforms waste into valuable ingredients, faces scrutiny through the lens of societal values. While the company emphasizes sustainability, negative public sentiment concerning animal exploitation or the perceived "ick factor" of by-products can create reputational challenges. This necessitates clear communication about their role in the circular economy and the responsible management of resources.

The escalating global emphasis on health and wellness directly fuels demand for Darling Ingredients' core products, like collagen and specialized proteins. Consumers are increasingly seeking out ingredients that support healthier lifestyles, a trend that saw the global collagen market valued at approximately $7.6 billion in 2023 and projected to reach $13.2 billion by 2030.

Dietary shifts, such as the growing preference for high-protein foods and functional ingredients, present significant market expansion opportunities for Darling. For instance, the plant-based protein market, a related area, is expected to grow substantially, indicating a broader consumer interest in alternative and beneficial protein sources.

Darling Ingredients is well-positioned to capitalize on these health-conscious movements by innovating and diversifying its product portfolio. This strategic alignment with consumer preferences for nutritional ingredients can lead to enhanced market share and revenue growth in the coming years.

Awareness of Circular Economy Principles

There's a noticeable rise in public understanding and support for circular economy concepts. This growing awareness, focusing on minimizing waste and using resources more effectively, directly benefits companies like Darling Ingredients. Their core business, which involves turning byproducts into valuable materials, aligns perfectly with this societal trend towards sustainability and efficiency.

This societal shift amplifies the appeal of Darling Ingredients' business model. As consumers and policymakers increasingly prioritize environmental responsibility, Darling's ability to create value from what would otherwise be discarded becomes a significant competitive advantage. For instance, in 2023, the global circular economy market was valued at approximately $2.4 trillion, with projections indicating continued strong growth, underscoring the economic viability of these principles.

- Growing Public Demand for Sustainable Products: Consumers are actively seeking products made from recycled or upcycled materials, driving demand for Darling's offerings.

- Policy Support for Circularity: Governments worldwide are implementing policies that encourage waste reduction and resource recovery, creating a favorable regulatory environment.

- Investor Focus on ESG: Environmental, Social, and Governance (ESG) factors are increasingly important for investors, favoring companies with strong sustainability credentials like Darling Ingredients.

Workforce Demographics and Labor Availability

Changes in workforce demographics, such as an aging population and evolving skill requirements, directly influence Darling Ingredients' operational efficiency. For instance, processing facilities often depend on specialized labor, and shifts in labor availability can strain production capacity. In 2024, the U.S. Bureau of Labor Statistics reported a labor force participation rate of around 62.5%, highlighting ongoing challenges in attracting sufficient talent across various sectors.

Attracting and retaining skilled workers is paramount for Darling Ingredients to maintain production levels and drive innovation. The company's ability to adapt its human resource strategies to these changing labor markets, including investing in training and development programs, will be key. As of mid-2025, many industries are reporting increased competition for workers with expertise in areas like advanced manufacturing and sustainable practices.

- Aging Workforce: Many developed nations are experiencing an aging workforce, potentially leading to a smaller pool of available labor for physically demanding roles in processing plants.

- Skill Gaps: Darling Ingredients may face challenges in finding workers with the specific technical skills needed for efficient operation and innovation in its processing facilities.

- Talent Retention: Competitive compensation, benefits, and a positive work environment are critical for retaining employees amidst a tight labor market, with employee turnover rates varying by region and industry.

- Adaptable HR Strategies: The company's success hinges on its ability to implement flexible human resource policies that cater to diverse workforce needs and attract new talent.

Societal shifts towards health and wellness are a major driver for Darling Ingredients, as consumers increasingly seek out nutrient-rich products like collagen and proteins. This trend is underscored by the global collagen market, which was valued at approximately $7.6 billion in 2023 and is projected to reach $13.2 billion by 2030. Furthermore, the growing acceptance of circular economy principles directly benefits Darling's waste-to-value business model, aligning with a global market valued at around $2.4 trillion in 2023 and showing continued robust growth.

Public perception regarding animal welfare and ethical sourcing significantly impacts the acceptance of products derived from animal by-products. A 2024 survey indicated that over 60% of consumers prefer products with transparent and ethically sourced ingredients, a factor Darling must address through clear communication about its responsible resource management. Additionally, evolving workforce demographics, including an aging population and specific skill gaps, present operational challenges, with the U.S. labor force participation rate around 62.5% in 2024, indicating potential labor availability constraints.

Technological factors

Darling Ingredients continuously benefits from ongoing innovation in biorefining and processing technologies. For instance, in 2024, the company highlighted advancements in its rendering processes that yield higher protein concentrates and specialized fats, increasing the value extracted from raw materials. This focus on technological improvement is crucial for staying ahead in a competitive market.

These technological leaps directly translate into improved operational efficiency and cost reductions. By optimizing extraction methods, Darling Ingredients can more effectively process bio-nutrients and waste streams, leading to a broader range of higher-value products. This efficiency gain was evident in their 2024 operational reports, which showed a consistent improvement in yield metrics across key product lines.

Furthermore, investment in research and development for advanced processing is a cornerstone of Darling Ingredients' strategy to maintain its competitive advantage. The company's commitment to R&D in 2024 focused on developing novel ingredients with enhanced functionalities, such as improved emulsification properties for food applications and specialized oleochemicals for industrial use.

Technological advancements in material science and biochemistry are key drivers for Darling Ingredients. These breakthroughs allow the company to innovate, transforming byproducts into high-value sustainable ingredients. For instance, in 2024, Darling highlighted its progress in developing specialized proteins for the booming plant-based meat market, a sector projected to reach $17.9 billion by 2030.

These scientific leaps enable Darling to create diverse applications, from advanced collagen for health and beauty to bio-based materials for industrial sectors. This diversification strategy is crucial for expanding market reach and securing new revenue streams, as seen with their continued investment in specialty ingredient development throughout 2024 and into 2025.

Ongoing technological improvements in renewable diesel production, like advanced catalyst technologies and broader feedstock options, are crucial for Darling Ingredients' renewable energy sector. These advancements directly impact yield, production costs, and the overall environmental footprint of their renewable fuels.

For instance, Darling Ingredients has been a key player in leveraging innovations that improve the efficiency of converting used cooking oil and animal fats into renewable diesel. In 2023, the company reported significant growth in its renewable fuels segment, driven by these technological capabilities and increasing demand for sustainable alternatives.

Staying ahead in renewable energy technology is paramount for maintaining market leadership. As of early 2024, the industry is seeing increased investment in next-generation technologies that promise even higher conversion rates and lower emissions, areas where Darling Ingredients is actively engaged.

Data Analytics and Automation in Operations

Darling Ingredients is increasingly leveraging advanced data analytics and automation to streamline its operations. This technological shift is crucial for optimizing the collection, processing, and distribution of its diverse product streams. For instance, in 2024, the company continued its investment in digital platforms aimed at enhancing supply chain visibility and efficiency, a key component of its global strategy.

The adoption of AI and automation directly impacts Darling's ability to achieve operational excellence. By implementing predictive maintenance on its processing equipment, the company can reduce downtime and associated costs. Furthermore, sophisticated data analytics allow for better resource allocation, ensuring raw materials are utilized most effectively, which is particularly important given the fluctuating nature of its feedstock.

- Enhanced Efficiency: Automation in processing plants, such as automated sorting and rendering, can increase throughput by an estimated 10-15% in pilot programs.

- Cost Optimization: Predictive maintenance, powered by AI, is projected to reduce unexpected equipment failures by up to 20%, leading to significant savings in repair and lost production.

- Supply Chain Visibility: Real-time tracking and analytics across Darling's global network improve inventory management and reduce waste, contributing to a more sustainable and cost-effective operation.

- Product Quality Improvement: Automated process controls and data analysis ensure more consistent product specifications, meeting the stringent requirements of customers in the food, feed, and fuel industries.

Waste-to-Value Conversion Technologies

Emerging waste-to-value conversion technologies are a significant technological factor for Darling Ingredients. These advancements allow for more efficient and varied processing of waste streams into valuable products, potentially broadening Darling's access to feedstocks and diversifying its product offerings. For instance, innovations in anaerobic digestion and pyrolysis are enabling the conversion of organic waste into biogas, biochar, and other valuable byproducts, which could supplement Darling's existing ingredient and fuel portfolios.

Darling Ingredients can leverage these technological shifts to explore less conventional bio-nutrients, transforming them into high-value ingredients or energy sources. This strategic investment in pioneering technologies is key to unlocking new business segments and reinforcing the company's commitment to a circular economy model. By staying at the forefront of these developments, Darling can enhance its competitive advantage and operational efficiency.

- Technological Advancement: Development of advanced bioreactor designs for enhanced biogas production from diverse organic waste streams.

- Feedstock Diversification: New enzymatic processes capable of breaking down complex organic materials into usable components, expanding feedstock options beyond traditional animal by-products.

- Product Innovation: Research into converting agricultural residues and food waste into specialty ingredients for animal feed, pet food, and even human food applications.

- Circular Economy Enhancement: Integration of carbon capture technologies with waste conversion processes to create carbon-neutral or carbon-negative energy and material outputs.

Technological advancements are pivotal for Darling Ingredients, driving innovation in biorefining and processing. In 2024, the company noted progress in rendering technologies that boost protein concentrate and specialized fat yields, enhancing value extraction from raw materials. This commitment to R&D fuels the development of novel ingredients with improved functionalities, such as enhanced emulsification properties for food and specialized oleochemicals for industrial use, positioning Darling to capitalize on markets like the projected $17.9 billion plant-based meat sector by 2030.

The company's strategic investment in advanced processing technologies directly translates to improved operational efficiency and cost reductions. Optimized extraction methods allow for more effective processing of bio-nutrients and waste streams, leading to a wider array of higher-value products, as evidenced by consistent yield metric improvements in their 2024 reports. Furthermore, advancements in renewable diesel production, including next-generation catalyst technologies and expanded feedstock options, are critical for Darling's renewable energy segment, impacting yield, production costs, and environmental footprints.

Darling Ingredients is increasingly adopting data analytics and automation to streamline operations, enhancing supply chain visibility and efficiency through digital platforms. Predictive maintenance, powered by AI, is projected to cut unexpected equipment failures by up to 20%, leading to significant cost savings. Real-time tracking across its global network also improves inventory management and reduces waste, contributing to more sustainable and cost-effective operations.

Emerging waste-to-value conversion technologies represent a significant technological factor, enabling more efficient processing of waste streams into valuable products. Innovations in areas like anaerobic digestion and pyrolysis are facilitating the conversion of organic waste into biogas and biochar, potentially diversifying Darling's product offerings and feedstock access, reinforcing its circular economy model.

Legal factors

Darling Ingredients operates under a complex web of environmental regulations, including strict limits on air and water emissions, waste management, and general pollution control. These rules apply across its worldwide facilities, impacting everything from rendering processes to renewable fuel production.

The company must continually invest in advanced abatement technologies and robust monitoring systems to meet these evolving environmental standards, especially those related to its significant presence in the renewable fuels sector. For instance, in 2023, Darling's renewable diesel segment continued to be a key driver of its business, necessitating ongoing capital expenditures to ensure compliance with emission standards for these operations.

Failure to adhere to these environmental mandates can lead to severe consequences, including significant financial penalties and damage to Darling Ingredients' corporate reputation. The company's commitment to sustainability and regulatory compliance is therefore a critical aspect of its operational strategy and financial planning.

Darling Ingredients operates under stringent food and feed safety regulations, a critical aspect for its diverse product lines. Agencies like the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) set comprehensive standards that Darling must meet. These rules govern every stage of production, from the initial sourcing of raw materials to the final labeling and distribution of ingredients used in food, animal feed, and pharmaceutical applications.

Compliance with these evolving regulations is non-negotiable for maintaining market access and consumer confidence. For instance, in 2024, the FDA continued to emphasize enhanced traceability measures throughout the food supply chain, a significant undertaking for ingredient processors. Similarly, EFSA's ongoing reviews of feed additives and contaminants directly impact Darling's operational protocols and product development, ensuring the safety and integrity of its offerings.

Darling Ingredients operates within a complex web of legal frameworks governing animal by-product processing and rendering, which differ significantly across its global operations. These regulations dictate everything from how raw materials are collected and transported to the specific methods used for processing and the ultimate disposal or utilization of end products. For instance, in the European Union, the Animal By-Products Regulation (EC) No 1069/2009 sets stringent standards for the protection of public and animal health, impacting how Darling Ingredients sources and processes materials to prevent disease transmission.

Compliance with these specialized laws is not merely a procedural requirement but a critical factor for operational continuity and market access. Failure to adhere to these evolving legal mandates can result in substantial fines, operational shutdowns, and reputational damage. Darling Ingredients' ability to navigate and adapt to these diverse legal landscapes, such as the U.S. Department of Agriculture's (USDA) regulations for rendering plants, directly influences its cost structure and the marketability of its products, including its renewable fuels and animal nutrition ingredients.

International Trade Laws and Sanctions

Darling Ingredients operates globally, making adherence to diverse international trade laws, customs rules, and sanctions crucial for its operations. Navigating these regulations is key to seamless cross-border product movement and avoiding legal repercussions. For instance, in 2023, the company reported that approximately 35% of its net sales were generated outside of North America, highlighting the significance of international trade compliance.

Changes in trade policies, such as tariffs or import/export restrictions, can directly impact Darling's supply chain and profitability. The company must remain agile to adapt to evolving trade landscapes, which can influence the cost and availability of raw materials and finished goods. For example, shifts in European Union trade agreements could affect the import of certain animal by-products or the export of rendered products.

- Global Operations: Darling Ingredients' international footprint necessitates compliance with a multitude of trade laws and sanctions.

- Trade Policy Impact: Evolving trade policies, like tariffs and quotas, directly influence import/export activities and costs.

- Sanctions Compliance: Adhering to economic sanctions imposed by entities like the U.S. Treasury or the EU is critical to avoid penalties.

- Market Access: Favorable trade agreements and compliance with regulations ensure continued access to key international markets for Darling's diverse product lines.

Labor Laws and Workplace Safety Regulations

Darling Ingredients must navigate a complex web of global labor laws, covering everything from minimum wages and working hours to unionization rights. For instance, in 2024, the US Department of Labor continued to enforce overtime pay rules, impacting companies with hourly workers. Adherence to these diverse regulations is paramount in all operating regions.

Workplace safety is another critical legal factor. Darling Ingredients is subject to stringent regulations designed to prevent accidents and ensure the well-being of its employees, particularly in processing facilities. The Occupational Safety and Health Administration (OSHA) in the US, for example, sets standards for machinery guarding and chemical handling, with fines for non-compliance. Maintaining a safe environment is not just a legal obligation but also vital for employee morale and reducing operational disruptions.

- Compliance with diverse global labor laws: Darling Ingredients must adhere to varying regulations concerning wages, working conditions, and collective bargaining across its international operations.

- Adherence to strict workplace safety standards: The company is legally bound to implement and maintain rigorous safety protocols to protect its workforce, as mandated by bodies like OSHA.

- Impact on employee morale and retention: Ensuring fair labor practices and a safe working environment directly influences employee satisfaction and the ability to retain talent.

- Need for regular policy updates: Continuous monitoring and updating of internal policies are essential to remain compliant with evolving legal landscapes in labor and safety.

Darling Ingredients faces significant legal scrutiny concerning its environmental impact, particularly regarding emissions and waste management across its global facilities. The company's substantial investment in renewable diesel production in 2023 and 2024 necessitates strict adherence to evolving emission standards, with potential for substantial fines for non-compliance. Continuous investment in advanced abatement technologies is crucial to meet these stringent environmental mandates and maintain operational license.

Food and feed safety regulations are paramount, with agencies like the FDA and EFSA setting comprehensive standards for Darling's diverse product lines. Enhanced traceability measures, a focus for the FDA in 2024, directly impact ingredient processors. Ongoing reviews by EFSA on feed additives and contaminants in 2024 further shape Darling's operational protocols, ensuring product safety and market access.

The legal framework governing animal by-product processing and rendering varies significantly worldwide, impacting collection, processing, and disposal methods. Compliance with regulations like the EU's Animal By-Products Regulation (EC) No 1069/2009 is critical for disease prevention and operational continuity. Failure to adhere can lead to substantial fines and operational shutdowns, affecting marketability of products, including renewable fuels.

Darling Ingredients' global operations expose it to a multitude of trade laws, customs rules, and sanctions. In 2023, over 35% of net sales were generated internationally, underscoring the importance of compliance. Changes in trade policies, such as tariffs and import/export restrictions, directly affect supply chains and profitability, requiring agility to adapt to evolving landscapes.

Labor laws and workplace safety are critical legal considerations for Darling Ingredients. The company must comply with diverse global regulations on wages and working hours, and adhere to strict safety standards, such as those set by OSHA, to prevent accidents and ensure employee well-being. Non-compliance can result in significant fines and operational disruptions.

Environmental factors

Darling Ingredients' commitment to sustainability is evident in its renewable diesel production, a key component of its business model that offers a lower-carbon fuel alternative. This directly addresses climate change concerns by displacing fossil fuels. For instance, in 2023, Darling Ingredients reported a significant increase in its renewable diesel output, contributing to a substantial reduction in greenhouse gas emissions for its customers.

However, the company is also under scrutiny to lower its own operational carbon footprint. This pressure comes from regulators, consumers, and investors increasingly focused on environmental, social, and governance (ESG) performance. Darling Ingredients is actively investing in technologies and process improvements at its rendering and processing facilities to achieve these reductions, aiming to improve energy efficiency and waste management.

Demonstrating tangible progress in emission reductions is vital for Darling Ingredients' environmental reputation and its ability to attract ESG-focused investors. The company's 2024 sustainability report is expected to detail specific targets and achievements in carbon footprint reduction, a critical factor for maintaining investor confidence and market positioning in an era of heightened climate awareness.

Darling Ingredients excels at turning waste into value, a core tenet of the circular economy. In 2023, the company processed approximately 10 million metric tons of raw materials, significantly diverting waste from landfills and repurposing it into essential ingredients. This approach not only minimizes environmental impact but also maximizes the utility of agricultural by-products.

The company's ongoing investment in developing new applications for bio-nutrients, such as those for animal feed and fertilizers, further solidifies its contribution to sustainable waste management. For instance, their collagen and gelatin products, derived from animal by-products, are increasingly sought after in the food and pharmaceutical industries, demonstrating a tangible shift towards resource efficiency.

Water is absolutely essential for Darling Ingredients' rendering and processing plants, where it's used for cleaning and cooling. Given this, the company is under a microscope regarding how efficiently it uses water and the quality of the water it releases back into the environment. Staying on top of water usage and treatment is key for them to keep operating legally and to be seen as good stewards of natural resources.

Biodiversity and Ecosystem Impact

Darling Ingredients' indirect impact on biodiversity stems from its reliance on the agricultural sector. While the company focuses on transforming animal by-products, its sourcing practices are linked to the environmental footprint of livestock farming. For instance, the global livestock sector, a primary source of Darling's raw materials, accounted for approximately 14.5% of all human-caused greenhouse gas emissions between 2007 and 2017, according to the Food and Agriculture Organization of the United Nations (FAO). This highlights the interconnectedness of Darling's operations with broader agricultural sustainability efforts.

Responsible sourcing and minimizing any ecological footprint from processing are key to Darling's environmental stewardship. This includes efficient waste management and pollution control at their facilities. The company's commitment to a circular economy model, by repurposing materials that might otherwise be discarded, can contribute to reduced landfill waste and a lower demand for virgin resources, thereby supporting ecosystem health.

Darling Ingredients' dedication to sustainable practices can foster positive ecosystem influences. By diverting by-products from landfills and converting them into valuable ingredients, the company reduces the potential for environmental contamination. This approach aligns with global conservation goals, as it lessens the pressure on natural resources and can contribute to a healthier planet.

- Agricultural Link: Darling's sourcing is tied to the agricultural industry, which faces scrutiny for its environmental impact, including land use and water consumption.

- Circular Economy Contribution: By upcycling animal by-products, Darling supports a circular economy, reducing waste and the need for new resource extraction.

- Ecosystem Benefits: Sustainable processing and waste reduction efforts by Darling can lead to less pollution and a reduced ecological footprint, benefiting local ecosystems.

- Industry Standards: Adherence to stringent environmental regulations and voluntary sustainability initiatives by Darling reinforces its commitment to minimizing operational impact on biodiversity.

Resource Scarcity and Sustainable Sourcing

The availability of Darling Ingredients' core raw materials, primarily animal by-products, is directly tied to livestock production. Trends in global meat consumption and agricultural practices, which can be impacted by factors like land and water scarcity, therefore play a crucial role. For instance, projections suggest that by 2050, global food demand could increase by 50-70%, putting further pressure on agricultural resources and potentially influencing the supply of by-products.

Darling Ingredients' operational strength lies in its capacity to process a wide array of bio-nutrient streams, effectively turning what might otherwise be waste into valuable products. This positions the company favorably to mitigate the effects of resource scarcity by extracting maximum value from available inputs. Their business model inherently supports a circular economy approach, making efficient use of materials that might be under pressure from broader environmental constraints.

Sustainable sourcing practices are becoming non-negotiable for long-term business resilience and stakeholder acceptance. Darling Ingredients' commitment to these practices is vital for maintaining its supply chain integrity and its social license to operate. The company's 2023 sustainability report highlights efforts to enhance traceability and reduce the environmental footprint of its sourcing, aligning with growing investor and consumer demand for responsible supply chains.

- Livestock Production Impact: Global livestock numbers, a key indicator for by-product availability, are influenced by feed costs and environmental regulations.

- Circular Economy Advantage: Darling's processing capabilities allow it to valorize by-products, a strategy that becomes increasingly important as primary resource scarcity grows.

- Sustainable Sourcing Focus: The company's investment in sustainable sourcing and traceability is crucial for mitigating supply chain risks related to environmental pressures.

Darling Ingredients' operations are intrinsically linked to environmental factors, particularly concerning waste management and resource utilization. The company's core business of transforming animal by-products into valuable ingredients directly addresses landfill diversion, a critical environmental concern. For example, in 2023, Darling processed approximately 10 million metric tons of raw materials, significantly reducing waste destined for landfills.

The company's renewable diesel segment is a key contributor to environmental solutions, offering a lower-carbon fuel alternative that displaces fossil fuels and helps mitigate climate change impacts. Darling's 2023 performance saw a notable increase in renewable diesel output, underscoring its role in the energy transition.

Water usage and discharge quality are also significant environmental considerations for Darling's processing facilities. The company is focused on efficient water management and treatment to comply with regulations and maintain its environmental stewardship image.

Darling Ingredients' reliance on the agricultural sector means its environmental footprint is indirectly tied to livestock farming practices. The company's commitment to a circular economy model, by upcycling by-products, minimizes the demand for virgin resources and supports ecosystem health.

| Environmental Factor | Darling Ingredients' Relevance | 2023/2024 Data/Context |

|---|---|---|

| Waste Diversion | Core business model of transforming by-products | Processed ~10 million metric tons of raw materials |

| Renewable Energy | Production of renewable diesel | Increased renewable diesel output contributing to emissions reduction |

| Water Management | Operational necessity for processing plants | Focus on efficient usage and discharge quality |

| Circular Economy | Upcycling of materials | Reduces landfill waste and demand for virgin resources |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Darling Ingredients is built on a robust foundation of data from government regulatory bodies, international financial institutions like the World Bank and IMF, and leading industry-specific market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.