Darling Ingredients Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Darling Ingredients Bundle

Darling Ingredients operates in a sector influenced by moderate buyer power and significant supplier leverage, particularly for specialized raw materials. The threat of substitutes is present but often less direct due to the unique nature of their recycled products.

The full Porter's Five Forces Analysis reveals the real forces shaping Darling Ingredients’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Darling Ingredients' reliance on animal by-products and food waste means its bargaining power is influenced by the concentration of its raw material sources. If the animal agriculture and food industries, which supply these by-products, become more consolidated in certain regions, Darling could face fewer supplier options.

This consolidation could lead to increased raw material costs for Darling, directly impacting its profitability. For instance, fluctuations in fat prices, a key component of their raw materials, have historically shown a direct correlation with the company's financial performance.

Darling Ingredients' suppliers, such as slaughterhouses and food processing plants, often face significant costs and logistical hurdles if they decide to switch to alternative waste disposal methods or partner with other rendering companies. This situation can create a degree of bargaining power for Darling, as these suppliers may find it more convenient and cost-effective to continue utilizing Darling's established and efficient waste management services.

Darling Ingredients' reliance on specific, high-quality bio-nutrient streams for its specialized products, such as pharmaceutical-grade collagen, can elevate the bargaining power of suppliers providing these unique inputs. While many raw materials are common, the consistent availability and precise specifications of certain by-products are crucial for Darling's higher-margin offerings. This dependence means that suppliers of these critical streams can exert more influence over pricing and terms.

Supplier's Ability to Forward Integrate

The bargaining power of suppliers for Darling Ingredients is generally constrained by their limited ability to forward integrate. For most raw material providers, such as individual farms or food waste collectors, the prospect of entering Darling's complex rendering, ingredient, or renewable fuel manufacturing sectors is economically and technically prohibitive. This is due to the substantial capital needed for specialized equipment, advanced technology, and navigating stringent regulatory environments, effectively dampening their power.

While individual suppliers face significant barriers, larger, more integrated food producers might explore greater internal processing of their own waste streams. This could represent a marginal shift in supplier dynamics, but it's unlikely to fundamentally alter the overall supplier power landscape for Darling Ingredients. The core competencies and scale required for Darling's operations remain a significant hurdle for most potential suppliers to overcome.

- Limited Forward Integration: Most suppliers of raw animal by-products and food waste lack the capital, technology, and regulatory know-how to integrate forward into Darling's complex manufacturing processes.

- High Barriers to Entry: The specialized nature of rendering, ingredient production, and renewable fuel manufacturing creates substantial barriers for suppliers wishing to move up the value chain.

- Potential for Large Producers: Integrated food conglomerates may consider more in-house waste stream processing, a minor factor in the broader supplier power equation.

Impact of Regulations on Waste Management

Environmental regulations, particularly those concerning the disposal of animal by-products and food waste, can significantly shift the bargaining power of suppliers. Stricter rules often increase the operational costs and complexity for suppliers managing waste independently.

This increased burden makes them more inclined to partner with specialized companies like Darling Ingredients, which offer sustainable solutions for waste transformation. For instance, in 2024, the global waste management market was valued at approximately $1.1 trillion, with a growing emphasis on circular economy principles driven by regulatory pressures.

- Increased Reliance: Suppliers facing stringent disposal mandates find it more economical and efficient to outsource their waste to processors like Darling Ingredients.

- Cost Pass-Through: Higher compliance costs for suppliers can be passed on, potentially increasing raw material costs for Darling Ingredients, thus strengthening supplier bargaining power.

- Market Consolidation: Regulations can drive consolidation among waste suppliers, potentially creating larger entities with greater leverage.

- Innovation Demand: Suppliers may demand more sophisticated and compliant processing solutions, favoring companies like Darling Ingredients that invest in advanced technologies.

Darling Ingredients' suppliers, primarily from the animal agriculture and food processing sectors, generally hold limited bargaining power. This is largely due to the significant barriers to entry for suppliers wanting to integrate forward into Darling's complex rendering, ingredient, or renewable fuel manufacturing processes. For example, the capital required for specialized equipment and navigating regulatory landscapes is substantial, making it prohibitive for most to move up the value chain.

However, environmental regulations, especially those concerning waste disposal, can shift this dynamic. Stricter mandates increase operational costs for suppliers, making them more reliant on specialized processors like Darling. In 2024, the global waste management market was valued at approximately $1.1 trillion, with a growing emphasis on circular economy principles, driven by regulatory pressures.

| Factor | Impact on Supplier Bargaining Power | Darling Ingredients' Position |

|---|---|---|

| Limited Forward Integration | Suppliers lack capital and technology to enter Darling's value chain. | Strong position due to high barriers to entry for suppliers. |

| Environmental Regulations | Increased compliance costs for suppliers make them more reliant on processors. | Can lead to increased raw material costs if suppliers pass on costs; potentially strengthens supplier leverage. |

| Specialized Raw Materials | Suppliers of high-quality, specific by-products for niche products have more leverage. | Dependence on these suppliers for higher-margin offerings can increase their power. |

What is included in the product

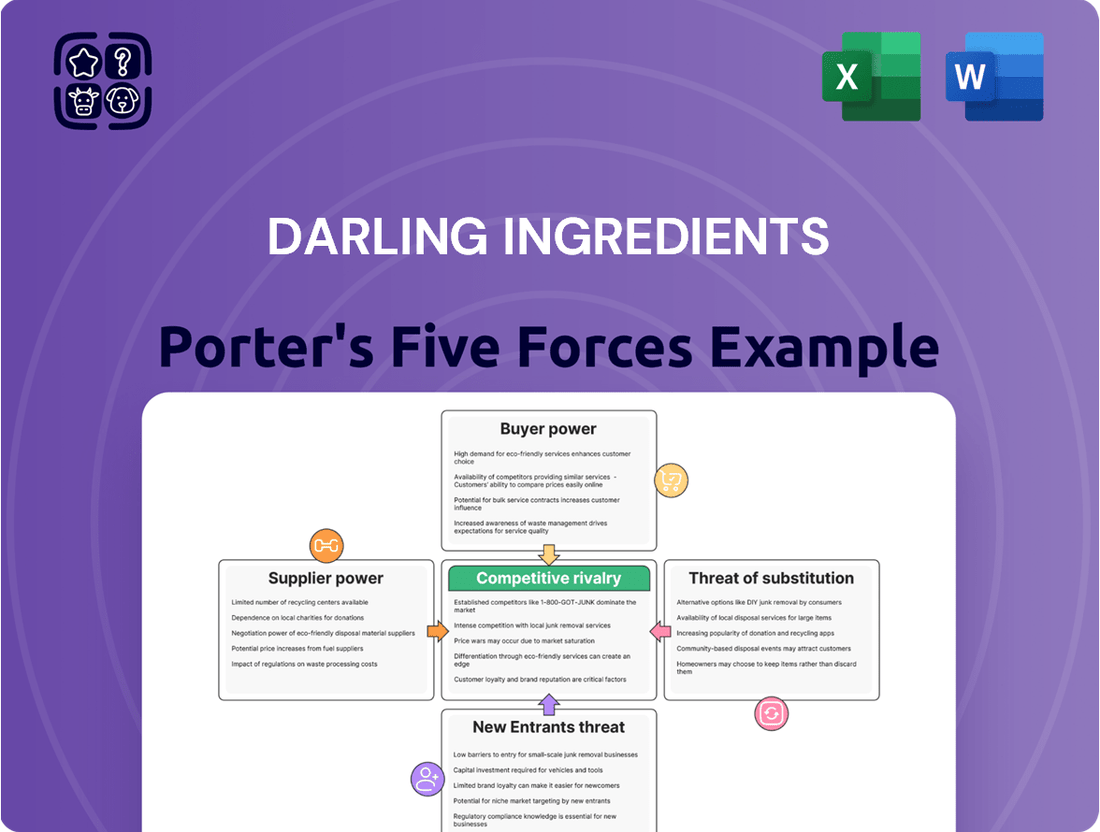

This analysis dissects Darling Ingredients' competitive environment, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the rendering and ingredient industries.

Effortlessly navigate the complexities of Darling Ingredients' competitive landscape with a visual, interactive model that highlights key pressure points and opportunities.

Customers Bargaining Power

Darling Ingredients benefits from a highly diversified customer base, spanning industries like pharmaceuticals, food, pet food, animal feed, and renewable energy. This broad reach means that no single customer segment holds significant sway over the company's overall sales.

For example, while the renewable diesel sector is a major contributor, Darling Ingredients also generates substantial revenue from its food and feed ingredient segments. This wide distribution of sales across various industries effectively dilutes the bargaining power of any individual customer or industry group.

For specialized ingredients such as collagen or particular feed proteins, customers may incur switching costs. These costs can arise from the need to reformulate products, obtain new regulatory approvals, or reconfigure supply chains when changing suppliers.

These switching costs effectively reduce the bargaining power of customers for these high-value, specialized offerings. For instance, a food manufacturer relying on Darling Ingredients' specific collagen for a popular product line would face significant R&D and testing expenses to switch to a competitor, making them less likely to demand lower prices.

In segments like feed-grade fats and certain protein meals, Darling Ingredients faces customers who are very sensitive to price. This means they actively shop around for the best deals, which can put pressure on Darling's margins.

Large industrial buyers, who often purchase significant volumes, wield more bargaining power in these commodity markets. They can leverage their purchasing volume to negotiate more favorable pricing, directly impacting Darling's profitability in these specific product lines.

Customer's Ability to Backward Integrate

While the theoretical possibility of backward integration exists for some very large customers, the practical reality for most of Darling Ingredients' clientele makes it an unfeasible strategy. The immense capital investment and specialized operational expertise needed to replicate Darling's complex collection, rendering, and processing capabilities are simply too prohibitive for the vast majority of their customers.

This difficulty in backward integration significantly curtails the bargaining power of customers. For instance, a large food manufacturer might consider producing some basic animal fats, but replicating Darling's global network for sourcing and processing specialized by-products for renewable fuels or advanced ingredients is an entirely different and far more challenging undertaking.

Consider the scale: Darling Ingredients operates over 200 facilities worldwide, processing millions of tons of raw materials annually. Building even a fraction of this infrastructure would require billions in investment and years of development, making it a non-starter for most buyers seeking to gain leverage.

- Impracticality of Replication: Most customers lack the specialized infrastructure for collection, rendering, and processing required to produce Darling's diverse product portfolio.

- High Capital Costs: Establishing similar operational capabilities would necessitate massive capital outlays, far exceeding the cost-benefit for most clients.

- Limited Scope of Integration: Even if possible for basic ingredients, backward integration is generally not viable for Darling's more specialized or complex product lines.

- Reduced Bargaining Leverage: The inability to easily replicate Darling's offerings inherently limits customers' power to negotiate more favorable terms.

Demand for Sustainable and Circular Economy Products

The growing demand for sustainable and circular economy products significantly bolsters the bargaining power of customers in certain segments for companies like Darling Ingredients. Consumers and regulators are increasingly prioritizing eco-friendly ingredients and renewable fuels. This trend allows customers who value sustainability to exert more influence, as they can choose suppliers that align with their environmental goals.

Customers seeking these green alternatives may exhibit less price sensitivity when purchasing from companies like Darling, which specializes in transforming waste streams into valuable products. This shift in consumer preference enhances Darling's value proposition, as its offerings are inherently linked to environmental responsibility. For instance, in 2024, the global market for sustainable ingredients continued its upward trajectory, with many B2B customers actively seeking suppliers with robust ESG (Environmental, Social, and Governance) credentials.

- Growing Demand: The market for sustainable products is expanding, driven by consumer awareness and corporate sustainability targets.

- Reduced Price Sensitivity: Customers prioritizing eco-friendly options may be willing to pay a premium, lessening their focus on price alone.

- Supplier Preference: Darling's core business model of utilizing waste streams positions it favorably with environmentally conscious buyers.

- Value Proposition Enhancement: Sustainability credentials become a key differentiator, strengthening customer loyalty and bargaining power for Darling.

While Darling Ingredients' diversified customer base generally limits individual customer power, certain segments experience higher pressure. In commodity markets for feed-grade fats and protein meals, price-sensitive industrial buyers leverage their volume to negotiate better terms, impacting Darling's margins in these areas. Conversely, for specialized ingredients like collagen, switching costs related to product reformulation and regulatory approvals significantly reduce customer bargaining power.

| Customer Segment | Bargaining Power Level | Key Factors |

|---|---|---|

| Commodity Feed Ingredients (e.g., fats, protein meals) | Moderate to High | Price sensitivity, volume purchasing, ease of supplier switching |

| Specialized Ingredients (e.g., collagen, pharmaceutical intermediates) | Low to Moderate | Switching costs (reformulation, regulatory), product differentiation |

| Renewable Energy Sector (e.g., renewable diesel feedstock) | Moderate | Volume, but influenced by feedstock availability and sustainability demands |

What You See Is What You Get

Darling Ingredients Porter's Five Forces Analysis

This preview showcases the complete Darling Ingredients Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. You're looking at the actual, professionally formatted analysis, providing you with immediate access to valuable market insights the moment you buy.

Rivalry Among Competitors

While Darling Ingredients operates globally, the rendering sector itself can be quite fragmented. This means there are many smaller, regional companies, particularly for basic rendering services. This fragmentation often fuels strong price competition in specific areas or for less specialized outputs.

The renewable fuels sector, especially renewable diesel, is a battleground with established giants and emerging producers constantly vying for market share. This intense rivalry is further fueled by ongoing capacity expansions, making it a dynamic and challenging environment for all participants.

Factors like fluctuating commodity prices and evolving government policies, including the growing demand for sustainable aviation fuel (SAF), significantly shape the competitive landscape. For instance, the U.S. renewable diesel capacity alone saw substantial growth, with projections indicating continued increases, intensifying the pressure on existing players.

Darling Ingredients stands out by offering a diverse range of specialized products, including collagen, plasma, and unique pet food ingredients. These niche offerings often fetch higher profit margins and encounter less intense direct competition compared to more generalized or commodity-like products in the industry.

This strategic focus on high-value, sustainable solutions effectively softens the blow of direct rivalry. For instance, in 2024, Darling's specialty ingredients segment continued to show robust growth, contributing significantly to their overall revenue, demonstrating the success of this differentiation strategy in a competitive landscape.

Global Reach and Operational Scale

Darling Ingredients' vast global footprint, spanning 23 countries and over 260 facilities, significantly intensifies competitive rivalry. This extensive network allows for superior raw material procurement and efficient production, creating a formidable barrier for smaller players. For instance, in 2024, Darling's operational scale directly impacts its ability to absorb price fluctuations and maintain consistent supply, a crucial advantage in the ingredients sector.

- Global Presence: Operations in 23 countries.

- Facility Count: Over 260 facilities worldwide.

- Competitive Advantage: Enhanced raw material sourcing and production efficiency.

- Market Impact: Challenges smaller competitors with integrated supply chain.

Impact of Regulatory and Policy Landscape

Darling Ingredients operates in an industry heavily shaped by government policies and regulations, particularly concerning renewable energy and environmental standards. Changes in these areas can significantly alter the competitive landscape.

For instance, evolving biofuel mandates directly impact the demand for Darling's products, influencing their pricing power and market share. Similarly, shifts in tax credits for renewable fuels or sustainability initiatives can create or erode competitive advantages for companies like Darling and their rivals.

In 2024, the global push for decarbonization continues to drive regulatory focus. For example, the European Union's Renewable Energy Directive (RED III) sets ambitious targets for renewable energy use, which could benefit companies like Darling that supply feedstocks for biofuels. Conversely, stricter emissions regulations could increase operational costs or require significant investment in compliance technologies.

- Government Mandates: Biofuel blending mandates, such as those in the United States (e.g., Renewable Fuel Standard) and Europe, directly influence demand for Darling's rendered products and fats used in biodiesel production.

- Tax Incentives: Tax credits for renewable energy production, like the US Biodiesel Tax Credit, can significantly boost profitability and competitiveness for producers. The status and renewal of these credits are critical market factors.

- Environmental Regulations: Stricter regulations on waste management, emissions, and water usage can increase operational costs but also create barriers to entry for less compliant competitors, potentially benefiting established players like Darling.

- Sustainability Standards: Growing demand for sustainable sourcing and production practices, often driven by regulatory frameworks and consumer pressure, can favor companies with robust sustainability credentials.

Competitive rivalry within Darling Ingredients' core rendering operations is influenced by a fragmented market with numerous regional players, leading to price-based competition for basic products. However, the renewable fuels sector, particularly renewable diesel, is characterized by intense competition among large established companies and newer entrants, driven by significant capacity expansions and evolving policy landscapes.

Darling differentiates itself by focusing on higher-margin specialty ingredients like collagen and plasma, which face less direct competition. This strategy proved successful in 2024, with specialty segments showing strong revenue growth. Their extensive global network of over 260 facilities across 23 countries provides a significant advantage in raw material sourcing and production efficiency, posing a challenge for smaller competitors.

Government policies, such as biofuel mandates and tax credits, directly impact demand and competitiveness. For example, the U.S. renewable diesel capacity continued its upward trend in 2024, intensifying competition. Darling's ability to navigate these regulations and leverage sustainability initiatives, like those driven by the EU's RED III, is crucial for maintaining its competitive edge.

| Metric | 2024 Data/Trend | Impact on Rivalry |

|---|---|---|

| U.S. Renewable Diesel Capacity | Continued substantial growth | Intensified competition among producers |

| Darling's Specialty Ingredients Growth | Robust growth contributing significantly to revenue | Mitigates direct competition through differentiation |

| Global Facility Count | Over 260 facilities | Enhances competitive advantage via scale and efficiency |

| Biofuel Mandates (e.g., RFS, RED III) | Continued strong influence on demand | Creates opportunities and competitive pressure based on compliance and feedstock supply |

SSubstitutes Threaten

The availability of alternative protein and fat sources for animal feed and pet food presents a significant threat of substitutes for Darling Ingredients. Plant-based proteins like soy and corn, along with synthetic fats, offer viable alternatives that can compete on price and availability.

While Darling's by-products boast distinct nutritional advantages and strong sustainability credentials, a substantial shift towards these substitutes could occur if Darling's product pricing becomes less competitive. For instance, fluctuations in the agricultural commodity markets can directly impact the cost-effectiveness of plant-based alternatives, potentially influencing customer purchasing decisions away from rendered ingredients.

The rising consumer preference for sustainable and plant-based options across food, cosmetics, and other sectors poses a substantial threat of substitution for Darling Ingredients. This shift directly challenges the market for animal-derived ingredients, which form a core part of Darling's business.

The upcycled ingredients market is experiencing robust growth, transforming food industry by-products from plant sources into valuable components. This burgeoning sector offers viable alternatives that could displace some of Darling's traditional offerings, impacting their market share and revenue streams.

The rise of synthetic and lab-grown alternatives poses a long-term substitution threat to Darling Ingredients, particularly in its collagen and specialty protein segments. As these technologies mature, they could offer comparable or even superior functional properties for food and pharmaceutical applications, potentially diverting demand from Darling's core offerings.

Direct Use of Waste Streams by Generators

While Darling Ingredients excels at transforming by-products, large generators of animal by-products or food waste could potentially bypass rendering services by exploring direct utilization or developing their own in-house processing capabilities. This presents a threat as these entities might find cost-effective ways to extract value from their waste streams, reducing the volume available for Darling to process.

For instance, a large meat processor might invest in equipment to render its own fats and proteins for animal feed or even explore anaerobic digestion for energy generation, thereby internalizing what was previously an outsourced service. This direct use of waste streams by generators acts as a substitute for Darling's core business.

- Potential for large-scale generators to internalize processing.

- Development of alternative in-house waste utilization methods.

- Reduced availability of raw materials for Darling if generators opt for direct use.

Shifts in Renewable Energy Technologies

Advancements in alternative energy sources present a significant threat of substitution for Darling Ingredients' fuel segment. While renewable diesel is a core offering, emerging technologies like advanced biofuels derived from non-bio-nutrient feedstocks, the rapid expansion of electric vehicle (EV) adoption, and the growing potential of hydrogen fuel cells could diminish the long-term demand for Darling's current renewable fuel products.

For instance, the global EV market saw substantial growth, with sales exceeding 13.6 million vehicles in 2023, a figure projected to climb further. This trend directly impacts the demand for liquid fuels, including renewable diesel. Similarly, investments in hydrogen infrastructure and fuel cell technology are escalating, potentially offering a cleaner alternative for transportation sectors that currently rely on biofuels.

The competitive landscape is also evolving with new players and technologies entering the advanced biofuel space, exploring feedstocks beyond traditional bio-nutrients. This diversification of renewable energy options intensifies the substitution pressure on Darling's established renewable diesel business.

The threat of substitutes for Darling Ingredients is significant, stemming from both direct replacements and alternative processing methods. Plant-based proteins and synthetic fats offer competition in animal feed and pet food, especially if Darling's pricing becomes less attractive compared to agricultural commodity market fluctuations. Furthermore, a growing consumer preference for sustainable and plant-derived products across various industries challenges the market for animal-derived ingredients, Darling's core business.

The rise of upcycled ingredients from plant sources and advancements in synthetic and lab-grown alternatives, particularly for collagen and specialty proteins, also present substitution risks. Additionally, large generators of animal by-products might bypass traditional rendering by developing in-house processing, reducing the raw material supply for Darling. For example, a large meat processor could invest in its own rendering equipment or explore anaerobic digestion, thereby internalizing services previously outsourced to Darling.

The fuel segment faces substitution threats from evolving energy sources. While renewable diesel is a key offering, the rapid expansion of electric vehicle (EV) adoption, projected to exceed 13.6 million vehicles globally in 2023, directly impacts demand for liquid fuels. Emerging technologies like advanced biofuels from non-bio-nutrient feedstocks and the growing potential of hydrogen fuel cells also pose long-term substitution risks to Darling's established renewable fuel business.

| Threat of Substitutes | Description | Impact on Darling Ingredients | Examples of Substitutes | Relevant Data (2023/2024) |

|---|---|---|---|---|

| Alternative Protein/Fat Sources | Plant-based proteins and synthetic fats compete in animal feed and pet food markets. | Potential loss of market share if Darling's pricing is less competitive. | Soy protein, corn gluten meal, synthetic fats. | Agricultural commodity prices can fluctuate, impacting the cost-effectiveness of plant-based alternatives. |

| Sustainable & Plant-Based Consumer Trends | Increasing consumer demand for sustainable and plant-derived ingredients. | Challenges the market for animal-derived ingredients, a core Darling business. | Upcycled plant ingredients, plant-based food alternatives. | The global market for plant-based foods is projected to reach $162 billion by 2030, indicating a strong consumer shift. |

| Synthetic & Lab-Grown Alternatives | Emerging technologies offering alternatives in specialty segments. | Long-term threat to collagen and specialty protein offerings. | Cultured collagen, lab-grown proteins. | Investment in cellular agriculture continues to grow, with significant funding rounds in 2023 and early 2024. |

| In-house Processing by Generators | Large by-product generators may process waste internally. | Reduces raw material availability for Darling and potential loss of service revenue. | Direct rendering, anaerobic digestion for energy. | Large meat processors are increasingly exploring vertical integration and waste valorization strategies. |

| Alternative Energy Sources | New technologies and increased adoption of EVs impacting fuel demand. | Threatens demand for Darling's renewable fuel segment. | Electric vehicles, hydrogen fuel cells, advanced biofuels from non-bio-nutrient feedstocks. | Global EV sales exceeded 13.6 million in 2023, with continued strong growth projected for 2024. |

Entrants Threaten

The rendering and specialized ingredient production industry demands significant upfront capital. Darling Ingredients, for instance, operates a vast network of collection routes and sophisticated processing plants, requiring billions in investment. This high financial barrier effectively limits the number of new players who can realistically enter the market and compete.

The complex web of environmental, health, and safety regulations governing the handling and processing of animal by-products and food waste presents a formidable hurdle for any new company looking to enter Darling Ingredients' market. Navigating these stringent requirements, which span from sourcing to final product disposition, demands significant upfront investment in compliance infrastructure and expertise. For instance, the U.S. Environmental Protection Agency (EPA) and similar bodies globally impose strict rules on waste management and emissions, adding substantial operational costs that deter potential newcomers.

Darling Ingredients benefits from deeply entrenched relationships with its suppliers, forming a critical barrier to entry. These partnerships are built on years of trust and reliability, making it difficult for newcomers to secure consistent access to raw materials.

The company's extensive collection network, which processes a significant portion of global meat and food waste, represents another formidable hurdle. For instance, Darling Ingredients handles approximately 15% of the world's meat production and food waste, demonstrating the sheer scale and efficiency of its operations that new entrants would struggle to replicate.

Economies of Scale and Experience Curve

Darling Ingredients benefits from significant economies of scale due to its extensive global operations and high processing volumes. In 2023, the company reported net sales of $7.5 billion, reflecting its substantial market presence. New entrants would find it challenging to match Darling's cost efficiencies without substantial upfront investment in infrastructure and processing capacity, making it difficult to compete on price.

The experience curve also plays a crucial role, as Darling has honed its processes over decades, leading to optimized production and reduced per-unit costs. This accumulated knowledge allows for greater efficiency and quality control, which are difficult for newcomers to replicate quickly. For instance, their specialized rendering and processing techniques, developed over years, contribute to a competitive advantage that is not easily overcome.

- Economies of Scale: Darling's global footprint and high processing volumes, evidenced by its 2023 net sales of $7.5 billion, create significant cost advantages.

- Experience Curve Benefits: Decades of operational refinement have led to optimized processes and reduced per-unit costs, a barrier for new competitors.

- Capital Investment Barrier: New entrants require massive capital for infrastructure to match Darling's scale and efficiency, posing a substantial threat deterrent.

- Competitive Pricing: The cost efficiencies derived from scale and experience enable Darling to offer competitive pricing, pressuring new market participants.

Specialized Knowledge and Technology

Transforming various bio-nutrients into valuable ingredients and renewable fuels demands significant scientific and engineering know-how. Companies entering this space need to invest heavily in research and development to acquire or create this specialized knowledge and technology. For instance, Darling Ingredients' expertise in rendering and processing animal by-products into products like collagen and fats requires deep understanding of complex biological and chemical processes.

The development or acquisition of proprietary technologies acts as a substantial barrier. Companies like Darling Ingredients have built their competitive edge through years of refining their processes, which are often protected by patents or trade secrets. This makes it difficult for newcomers to replicate their efficiency and product quality, especially in areas like creating high-value proteins or biofuels from waste streams.

- Specialized Expertise: The bio-nutrient processing industry requires advanced scientific and engineering skills, a significant hurdle for new entrants.

- Proprietary Technology: Darling Ingredients and similar firms rely on patented or secret technologies to maintain a competitive advantage.

- High R&D Investment: New companies must commit substantial resources to research and development to match existing players' capabilities.

The threat of new entrants for Darling Ingredients is generally low due to substantial barriers. Significant capital investment is required for the extensive infrastructure and processing plants needed to operate at scale. For example, Darling's 2023 net sales of $7.5 billion highlight the enormous scale of operations that new companies would need to replicate.

Stringent environmental and safety regulations, coupled with the need for specialized scientific and engineering expertise in bio-nutrient processing, further deter potential competitors. Darling's established relationships with suppliers and its vast collection network are also difficult for newcomers to penetrate, ensuring a consistent supply of raw materials.

Economies of scale and the experience curve, honed over decades, provide Darling with significant cost advantages, enabling competitive pricing that new entrants would struggle to match. Proprietary technologies also create a competitive moat, making it challenging for new players to achieve similar efficiency and product quality.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for processing plants and collection networks. | Substantial financial hurdle. |

| Regulatory Compliance | Navigating stringent environmental, health, and safety rules. | Increases upfront costs and operational complexity. |

| Supplier Relationships | Entrenched, long-term partnerships with raw material providers. | Limits access to essential inputs for newcomers. |

| Economies of Scale | Cost advantages from high processing volumes and global operations. | Makes it difficult to compete on price. |

| Proprietary Technology & Expertise | Patented processes and specialized knowledge in bio-nutrient transformation. | Creates a competitive advantage that is hard to replicate. |

Porter's Five Forces Analysis Data Sources

Our Darling Ingredients Porter's Five Forces analysis is built upon a foundation of comprehensive data, including the company's annual reports and SEC filings, alongside industry-specific market research from sources like IBISWorld and Statista.