Darling Ingredients Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Darling Ingredients Bundle

Discover how Darling Ingredients masterfully leverages its product innovation, strategic pricing, global distribution network, and targeted promotional campaigns to maintain its industry leadership. This analysis goes beyond the surface, revealing the intricate interplay of their 4Ps.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Darling Ingredients' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Darling Ingredients' diverse sustainable ingredients are derived from bio-nutrients, transforming animal by-products into valuable resources. This approach directly supports the circular economy, with the company reporting that in 2023, they processed over 10 million tons of raw materials, diverting them from landfills.

Their extensive product range caters to multiple industries, from food and feed to fuel and fertilizer, demonstrating a commitment to resource maximization. For instance, their collagen and gelatin products are key ingredients in the global food and pharmaceutical sectors, valued for their natural origin and functionality.

Darling Ingredients' specialty solutions, including collagen, tallow, and proteins, are crucial for sectors like pharmaceuticals, food, pet food, and feed. These are not just basic ingredients; they are engineered to meet precise industry needs, focusing on quality and how they add value. For instance, their collagen products are vital for everything from nutritional supplements to medical applications, highlighting the functional importance of these specialty offerings.

The company's commitment to tailored solutions is evident in how they adapt these ingredients for various uses, ensuring they perform optimally and provide distinct benefits. This focus on customization allows Darling to capture niche markets and build strong relationships with clients across different industries who rely on these specialized components for their own product development.

The recent creation of Nextida, a joint venture merging Darling's Rousselot collagen business with PB Leiner, underscores their strategic push into health, wellness, and nutrition. This move is particularly significant as the global collagen market was valued at approximately $6.5 billion in 2023 and is projected to grow substantially, with Darling now better positioned to capitalize on this expanding market through this strategic alliance.

Renewable energy, primarily through Diamond Green Diesel (DGD), is a key product offering for Darling Ingredients. DGD produces renewable diesel and sustainable aviation fuel (SAF), directly addressing the growing demand for cleaner energy alternatives and contributing to decarbonization goals. This strategic focus positions Darling as a significant player in the green energy transition.

Darling Ingredients is actively expanding its renewable energy segment, with a particular emphasis on SAF. The company anticipates significant growth in SAF sales by 2025, reflecting a commitment to capturing market share in this high-potential sector. This forward-looking strategy aims to leverage their existing infrastructure and expertise to meet increasing global demand for sustainable fuels.

Focus on Circular Economy and Innovation

Darling Ingredients’ product strategy is deeply embedded in the circular economy, transforming by-products from the food industry into valuable ingredients. This approach minimizes waste and maximizes resource utilization, a core tenet of their innovation. For instance, in 2023, the company processed approximately 10 million tons of raw materials, diverting a significant portion from landfills.

Innovation is a constant driver for Darling. They actively invest in research and development to create new, sustainable ingredient solutions and improve existing processes. This commitment ensures their product portfolio remains relevant and competitive in a market increasingly focused on environmental responsibility. Their focus on innovation has led to the development of specialized ingredients for various sectors, including pet food, animal feed, and biofuels.

- Circular Economy Core: Darling's business model inherently creates value from by-products, exemplified by their processing of millions of tons of materials annually.

- Continuous Innovation: Investment in R&D fuels the development of new sustainable ingredients and process enhancements.

- Product Diversification: Innovation targets new applications in sectors like pet food, animal feed, and biofuels, expanding market reach.

Quality and Regulatory Compliance

Darling Ingredients places paramount importance on quality and regulatory compliance, a critical factor given its use of animal by-products and its reach into sensitive markets like food, pharmaceuticals, and biofuels. This focus is not just about meeting standards; it's about building trust and ensuring the safety and efficacy of its diverse product portfolio.

The company navigates a complex web of regulations, from food safety laws and pharmaceutical Good Manufacturing Practices (GMP) to environmental and fuel standards. In 2023, Darling Ingredients reported a strong commitment to these areas, with ongoing investments in process improvements and certifications. For instance, their food-grade ingredients must meet rigorous standards set by bodies like the FDA and EFSA, while their pharmaceutical ingredients adhere to USP and EP monographs.

This dedication to quality and compliance directly impacts market access and customer confidence. By consistently meeting or exceeding these requirements, Darling Ingredients solidifies its position as a reliable supplier across industries.

- Food Safety: Adherence to HACCP principles and GFSI-recognized schemes ensures the safety of ingredients used in human and animal food.

- Pharmaceutical Standards: Compliance with GMP and specific pharmacopoeia requirements for ingredients used in medicines.

- Environmental Regulations: Meeting stringent environmental laws for processing and waste management, crucial for sustainability.

- Biofuel Certifications: Obtaining and maintaining certifications like RSB or ISCC for renewable fuel feedstocks.

Darling Ingredients' product strategy centers on transforming by-products into high-value, sustainable ingredients across diverse sectors. Their commitment to the circular economy is evident in processing millions of tons of materials annually, diverting waste and creating essential components for food, feed, fuel, and fertilizer. Innovation drives their expansion into specialized areas like collagen for health and wellness, and renewable fuels, positioning them as a leader in sustainable solutions.

| Product Category | Key Applications | 2023 Data/Focus |

|---|---|---|

| Bio-Nutrients (Collagen, Gelatin, Proteins) | Food, Pharmaceuticals, Pet Food, Animal Feed | Processed over 10 million tons of raw materials; Nextida joint venture formed to enhance health and nutrition offerings. |

| Renewable Energy (Renewable Diesel, SAF) | Transportation, Aviation | Significant focus on Diamond Green Diesel (DGD); Anticipating substantial SAF sales growth by 2025. |

| Specialty Solutions | Pharmaceuticals, Food, Pet Food, Feed | Engineered ingredients meeting precise industry needs; Collagen vital for supplements and medical applications. |

What is included in the product

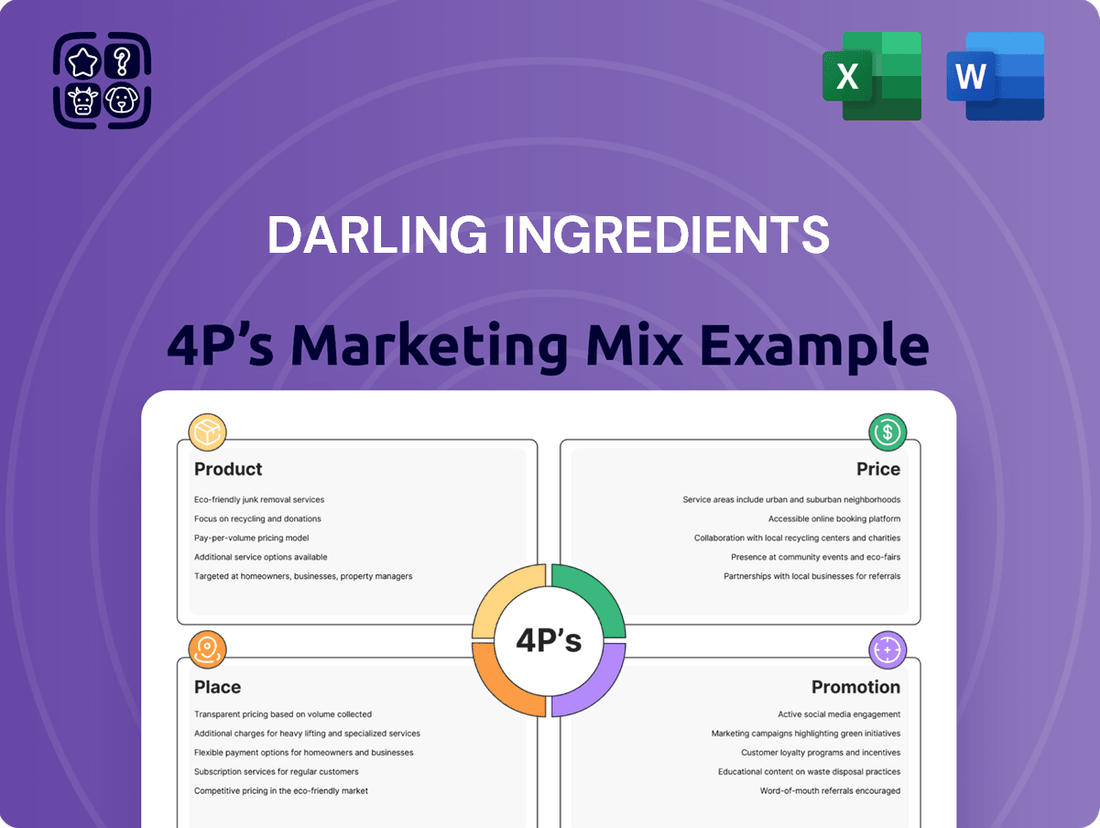

This analysis provides a comprehensive breakdown of Darling Ingredients' marketing strategies, examining their Product offerings, Pricing structures, Place (distribution) channels, and Promotion tactics.

It offers actionable insights into how Darling Ingredients leverages its 4P's to maintain its market position and drive growth in the ingredients sector.

Simplifies complex marketing strategies into actionable insights, addressing the pain point of understanding Darling Ingredients' market approach at a glance.

Provides a clear, concise overview of Darling Ingredients' 4Ps, alleviating the challenge of deciphering their market positioning and strategic execution.

Place

Darling Ingredients' global processing and collection network is a cornerstone of its marketing mix, boasting over 260 facilities strategically located in more than 15 countries across five continents. This expansive infrastructure is crucial for efficiently sourcing and processing bio-nutrients, underpinning their commitment to a circular economy. For instance, in fiscal year 2023, Darling Ingredients processed approximately 10.5 million tons of raw materials, a testament to the scale and reach of this network.

Darling Ingredients leverages a robust network of strategic distribution channels to serve its global B2B clientele across food, feed, pharmaceutical, and fuel industries. Their approach centers on direct sales teams and sophisticated logistics, ensuring efficient delivery of bulk ingredients and specialized products to industrial customers worldwide.

Darling Ingredients' integrated supply chain is a cornerstone of its marketing strategy, ensuring efficiency from sourcing animal by-products to delivering finished ingredients. This vertical integration, a key part of their Product and Place strategies, allows for meticulous quality control and cost management. In 2023, Darling reported a net sales increase to $7.2 billion, partly driven by the operational efficiencies gained through this integrated model.

Proximity to Raw Material Sources

Darling Ingredients' strategy heavily relies on placing its processing facilities strategically near the sources of its raw materials, primarily animal by-products and food waste. This proximity is crucial for minimizing the significant costs associated with transporting these materials. For instance, in 2023, Darling operated over 250 facilities globally, many situated in agricultural heartlands or near food processing centers, reducing their reliance on long-haul transportation.

This localized approach not only cuts down on fuel expenses and associated emissions, directly impacting operational efficiency but also aligns with their sustainability goals. By reducing the distance materials travel, Darling effectively lowers its carbon footprint. The company's commitment to a circular economy is underscored by this logistical advantage, ensuring that by-products are processed efficiently and with minimal environmental impact.

- Reduced Transportation Costs: Proximity to raw material sources directly lowers freight expenses, a significant operational cost for Darling.

- Environmental Benefits: Shorter transport distances translate to lower greenhouse gas emissions, supporting sustainability initiatives.

- Operational Efficiency: Faster and cheaper inbound logistics contribute to overall streamlined processing and higher margins.

- Supply Chain Resilience: Local sourcing can offer greater stability and reduce vulnerability to external supply chain disruptions.

Strategic Partnerships and Joint Ventures

Strategic partnerships are a cornerstone of Darling Ingredients' market strategy, particularly in the renewable fuels sector. A prime example is the Diamond Green Diesel (DGD) joint venture with Valero. This collaboration is instrumental in expanding Darling's distribution capabilities for its renewable diesel, leveraging Valero's extensive logistics and retail network.

These alliances are vital for accessing specialized markets and strengthening their competitive edge. For instance, the DGD joint venture, which began operations in 2013, has seen significant expansion. By the end of 2023, DGD's production capacity reached approximately 1.2 billion gallons annually, showcasing the scale and impact of such strategic alliances. This partnership allows Darling to efficiently move its high-demand products to consumers, reinforcing its market presence.

- Diamond Green Diesel (DGD) Joint Venture: A significant collaboration with Valero Energy Corporation, focusing on the production and distribution of renewable diesel.

- Market Reach Expansion: Partnerships like DGD provide access to established distribution channels, significantly broadening market penetration for Darling's renewable fuel products.

- Leveraging Expertise: These ventures allow Darling to tap into partners' logistical and retail infrastructure, optimizing the delivery of specialized products to a wider customer base.

- Capacity Growth: The DGD facility, with its substantial production capacity, highlights the success of these strategic alliances in meeting growing market demand for sustainable fuels.

Darling Ingredients' global presence is a critical component of its Place strategy, with over 260 facilities in more than 15 countries. This vast network ensures efficient sourcing and processing of bio-nutrients, supporting their circular economy model. In fiscal year 2023, the company processed roughly 10.5 million tons of raw materials, demonstrating the sheer scale of their operations and their ability to serve a diverse global market.

The company strategically places its processing plants near raw material sources, minimizing transportation costs and environmental impact. This localized approach, evident in their over 250 global facilities in 2023, reduces fuel expenses and aligns with sustainability objectives. By processing materials closer to their origin, Darling enhances operational efficiency and strengthens supply chain resilience.

Darling's distribution strategy focuses on direct sales and robust logistics to serve its B2B customers across various industries. They leverage their integrated supply chain to ensure timely and cost-effective delivery of ingredients. Strategic partnerships, like the Diamond Green Diesel (DGD) joint venture with Valero, further expand their market reach, particularly in the renewable fuels sector, leveraging established distribution networks.

| Metric | 2023 Data | Significance |

|---|---|---|

| Global Facilities | Over 260 | Extensive reach for sourcing and processing |

| Countries of Operation | 15+ | Global market penetration |

| Raw Material Processed (Tons) | Approx. 10.5 million | Scale of operations |

| Diamond Green Diesel (DGD) Capacity (Gallons/Year) | Approx. 1.2 billion (by end of 2023) | Market leadership in renewable diesel distribution |

What You See Is What You Get

Darling Ingredients 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Darling Ingredients 4P's Marketing Mix analysis provides a detailed breakdown of their product, price, place, and promotion strategies. You'll gain valuable insights into how Darling Ingredients effectively leverages these elements to maintain its market leadership.

Promotion

Darling Ingredients prominently positions itself as a pioneer in the circular economy, consistently promoting its commitment to sustainability. Their marketing efforts underscore the transformation of by-products into essential ingredients, thereby reducing waste and fostering a more environmentally responsible approach. This focus resonates strongly with investors and consumers alike, as evidenced by their significant investments in sustainable technologies and practices.

Darling Ingredients leverages industry-specific trade shows and conferences as a key promotional tool, recognizing their B2B focus. These events are crucial for connecting directly with potential clients in sectors like food manufacturing, pharmaceuticals, and energy. For example, in 2023, Darling Ingredients was a prominent exhibitor at the World Pork Expo, a major agricultural event, highlighting their role in the animal protein supply chain.

Darling Ingredients actively manages its investor relations through detailed quarterly earnings calls and comprehensive annual reports, ensuring transparency regarding financial performance and strategic direction. These communications, along with SEC filings, are crucial for keeping investors and financial professionals informed. In 2023, Darling reported net sales of $7.5 billion, demonstrating consistent growth.

Corporate communications further amplify Darling's message, emphasizing their extensive global footprint and dedication to operational excellence. The company's commitment to innovation, particularly in sustainable ingredient solutions, is a key theme. This focus is reflected in their ongoing investments in new technologies and facilities, supporting their long-term growth strategy.

Digital Presence and Content Marketing

Darling Ingredients leverages its corporate website and professional social media channels, especially LinkedIn, to share crucial company updates, sustainability reports, and industry analyses. This strategic digital outreach is designed to elevate brand visibility and solidify their position as an industry leader.

Their content marketing efforts focus on educating stakeholders about their innovative solutions and the broader trends impacting the rendering and ingredient sectors. For instance, in 2024, Darling Ingredients actively promoted its advancements in bio-nutrients and sustainable protein sources through detailed case studies and expert interviews shared online.

- Website as a Hub: Darling Ingredients' corporate website serves as a central repository for investor relations, product information, and sustainability initiatives, attracting a global professional audience.

- LinkedIn Engagement: The company utilizes LinkedIn to share timely news, thought leadership articles, and engage directly with industry peers, potential partners, and talent.

- Content Pillars: Key content themes include the circular economy, food waste reduction, and the development of high-value ingredients, reinforcing their commitment to sustainability.

- Data-Driven Insights: In 2024, their digital content highlighted the increasing market demand for their sustainable ingredients, citing a projected growth of 7% in the global alternative protein market by 2025.

Product-Specific Branding and Joint Ventures

Darling Ingredients utilizes product-specific branding, such as Rousselot for its collagen and gelatin offerings, to connect with specialized markets. This focused approach allows for promotional campaigns that highlight the unique benefits and applications relevant to health and wellness consumers.

The company is also actively pursuing joint ventures, like the formation of Nextida, to further penetrate niche segments. These strategic alliances enable Darling Ingredients to develop tailored marketing messages that resonate with specific customer needs and preferences.

- Brand Focus: Rousselot for collagen and gelatin targets specialized health and wellness markets.

- New Ventures: Nextida joint venture aims to capture niche opportunities.

- Targeted Promotion: Campaigns are designed to communicate direct benefits and applications to specific consumer groups.

Darling Ingredients' promotional strategy centers on its leadership in the circular economy and sustainability, effectively communicating its value proposition to a diverse audience. Their efforts highlight the transformation of by-products into essential, high-value ingredients, a message that resonates with environmentally conscious investors and consumers. This consistent messaging, amplified through various channels, reinforces their commitment to innovation and responsible resource management.

The company actively engages in industry events and digital platforms to showcase its offerings and expertise. Trade shows provide direct interaction with B2B clients, while their website and LinkedIn presence serve as crucial hubs for company news, sustainability reports, and market insights. In 2024, Darling Ingredients emphasized its progress in bio-nutrients and sustainable proteins, underscoring market demand and their role in this growing sector.

Darling Ingredients employs product-specific branding, such as Rousselot for its collagen and gelatin, to target specialized markets like health and wellness. Strategic alliances, like the Nextida joint venture, further enable tailored promotional campaigns that address specific customer needs and preferences, driving penetration into niche segments.

| Promotional Channel | Key Focus | 2023/2024 Data/Examples |

|---|---|---|

| Sustainability Messaging | Circular economy, waste reduction, ESG | Prominent presence at sustainability-focused conferences; detailed sustainability reports available on website. |

| Industry Events | B2B networking, product showcasing | Exhibitor at World Pork Expo (2023); participation in global food and agricultural trade shows. |

| Digital Platforms | Brand visibility, stakeholder communication | Active LinkedIn presence; website as a hub for investor relations and company updates. |

| Product-Specific Branding | Targeted market penetration | Rousselot brand for collagen and gelatin in health and wellness sectors. |

| Strategic Alliances | Niche market access | Nextida joint venture to develop specialized ingredient solutions. |

Price

Darling Ingredients likely uses value-based pricing for its specialty ingredients such as collagen and pharmaceutical-grade proteins. This approach reflects the unique qualities, superior quality, and distinct advantages these ingredients offer across various sectors.

The pricing strategy is designed to capture the high value associated with these specialized products and the perceived worth by their customer base. For instance, in 2023, Darling reported a significant contribution from its specialty products segment, underscoring the premium pricing these ingredients can command due to their advanced applications and market demand.

For more commoditized products like tallow and certain protein meals, Darling Ingredients’ pricing is largely dictated by global market forces, including shifts in supply and demand and what competitors are charging. This means prices can change quite rapidly. For instance, in Q1 2024, global tallow prices saw fluctuations driven by strong export demand from Southeast Asia, impacting Darling's pricing strategies for these feed ingredients.

Government regulations and incentives are critical drivers for renewable fuel pricing. For instance, the Inflation Reduction Act's Clean Fuel Production Credit (45Z) offers up to $1.75 per gallon for sustainable aviation fuel (SAF) and renewable diesel, directly influencing their market competitiveness. The value of Renewable Identification Numbers (RINs) and California's Low Carbon Fuel Standard (LCFS) credits also fluctuate, impacting Darling Ingredients' profitability in these segments.

Cost Management and Operational Efficiency

Darling Ingredients' commitment to operational excellence and rigorous cost management directly underpins its competitive pricing. Efficiently sourcing and processing raw materials allows the company to maintain favorable cost structures, a critical advantage in fluctuating market conditions. This focus on efficiency enables Darling to offer attractive pricing to its customers while safeguarding its profit margins.

The company's strategic approach to cost control is evident in its operational setup. For instance, in the fiscal year ending September 28, 2024, Darling Ingredients reported a gross profit margin of 22.4%, demonstrating their ability to manage production costs effectively relative to sales revenue. This robust margin is a testament to their operational efficiency.

- Raw Material Efficiency: Darling's integrated supply chain minimizes waste and optimizes the utilization of by-products, directly reducing input costs.

- Processing Innovations: Continuous investment in advanced processing technologies enhances yield and energy efficiency, lowering per-unit production expenses.

- Scale Advantages: The company's global footprint and large-scale operations provide significant purchasing power and economies of scale, further driving down costs.

- Logistics Optimization: Streamlined collection and transportation networks for raw materials reduce logistical expenditures, contributing to overall cost competitiveness.

Global Market Dynamics and Hedging

Darling Ingredients' global pricing strategy is directly shaped by international trade dynamics, including tariffs and the ever-shifting value of currencies. For instance, as of Q1 2024, the company's revenue is exposed to fluctuations in major currencies like the Euro and the Brazilian Real, which can impact the cost of raw materials and the final price of its products in different regions.

To navigate this complex landscape, Darling Ingredients likely employs sophisticated hedging techniques. These strategies aim to neutralize the impact of volatile commodity prices, such as those for fats and proteins, and mitigate risks tied to unfavorable exchange rate movements. This proactive approach seeks to create more stable and predictable revenue streams, bolstering financial performance against external market shocks.

- Global Exposure: Darling Ingredients operates in over 200 locations worldwide, making it susceptible to varied international trade policies and currency exchange rates.

- Commodity Volatility: Prices for key inputs like animal fats and oils can fluctuate significantly, impacting production costs and final product pricing.

- Hedging as a Strategy: The company utilizes financial instruments to lock in prices for raw materials and currency transactions, aiming for greater cost certainty.

- Revenue Stability: Effective hedging can lead to more predictable earnings, allowing for better financial planning and investment decisions.

Darling Ingredients employs a tiered pricing strategy, with value-based pricing for high-demand specialty ingredients like collagen and pharmaceutical-grade proteins, reflecting their unique benefits and advanced applications. For more commoditized products, such as tallow and protein meals, pricing is primarily driven by global supply and demand dynamics and competitor pricing, leading to greater price volatility.

Government incentives, particularly for renewable fuels, significantly influence pricing. For example, the Inflation Reduction Act's Clean Fuel Production Credit (45Z) can add substantial value to sustainable aviation fuel and renewable diesel. Furthermore, the fluctuating values of Renewable Identification Numbers (RINs) and low carbon fuel credits, like California's LCFS, directly impact profitability in these segments.

Operational efficiency and cost management are foundational to Darling's pricing. In the fiscal year ending September 28, 2024, the company achieved a gross profit margin of 22.4%, showcasing effective cost control across its integrated supply chain, processing innovations, and economies of scale. This efficiency allows for competitive pricing while maintaining healthy profit margins.

Global trade dynamics, including tariffs and currency fluctuations, also shape Darling's pricing. With operations in over 200 locations, the company's revenue is exposed to shifts in currencies like the Euro and Brazilian Real. To mitigate these risks, Darling likely utilizes hedging strategies to stabilize commodity prices and exchange rates, ensuring more predictable revenue streams.

| Product Segment | Pricing Strategy | Key Influences | 2024/2025 Data Insight |

|---|---|---|---|

| Specialty Ingredients (Collagen, Pharma Proteins) | Value-Based | Unique qualities, superior quality, advanced applications | High demand in 2023 contributed significantly to segment revenue. |

| Commoditized Products (Tallow, Protein Meals) | Market-Driven | Global supply & demand, competitor pricing | Q1 2024 saw tallow price fluctuations due to strong export demand. |

| Renewable Fuels (SAF, Renewable Diesel) | Incentive-Driven | Government credits (e.g., 45Z), RINs, LCFS | IRA credits up to $1.75/gallon for SAF impact competitiveness. |

| Global Operations | Dynamic/Hedging | Trade policies, currency exchange rates, commodity volatility | Exposure to Euro and Brazilian Real fluctuations in Q1 2024. |

4P's Marketing Mix Analysis Data Sources

Our 4P analysis for Darling Ingredients is grounded in a comprehensive review of their official SEC filings, annual reports, and investor presentations. We also incorporate insights from industry reports and competitive analyses to capture their product offerings, pricing strategies, distribution channels, and promotional activities.