Darling Ingredients Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Darling Ingredients Bundle

Unlock the strategic potential of Darling Ingredients with a comprehensive BCG Matrix analysis. Understand which of their diverse offerings are market leaders (Stars), reliable profit generators (Cash Cows), underperforming assets (Dogs), or emerging opportunities (Question Marks).

This preview offers a glimpse into Darling Ingredients' product portfolio's strategic positioning. To gain actionable insights and a clear roadmap for optimizing resource allocation and future investments, purchase the full BCG Matrix report today.

Stars

Renewable Diesel, represented by Diamond Green Diesel (DGD), is a strong contender in Darling Ingredients' portfolio. As a leading producer, DGD's expansion into Sustainable Aviation Fuel (SAF) highlights its strategic positioning in the rapidly growing clean energy sector. The global renewable diesel market was valued at an estimated USD 23 billion in 2024, a figure expected to climb to USD 52.1 billion by 2034, fueled by environmental consciousness and government incentives like the U.S. Renewable Fuel Standard.

In fiscal year 2024, DGD achieved significant sales, moving 1.25 billion gallons of renewable diesel. Further solidifying its market leadership, DGD commenced operations at one of the world's largest SAF facilities in Port Arthur, Texas, during the fourth quarter of 2024. This move into SAF production is particularly noteworthy given the increasing global demand for lower-emission aviation fuels.

While the biofuel market has seen some fluctuations, the long-term prospects for renewable fuels like those produced by DGD remain robust. The increasing adoption of fuels that offer environmental advantages and can seamlessly integrate with existing energy infrastructure provides a solid foundation for continued growth and market dominance.

Darling Ingredients' Rousselot division is a powerhouse in the collagen and gelatin sector, commanding an estimated 30% of the global market. This segment is booming, with the global collagen market valued at USD 6.91 billion in 2024 and expected to hit USD 7.57 billion in 2025, showing a robust 9.4% compound annual growth rate. The increasing demand from beauty, healthcare, and nutraceutical industries fuels this expansion.

The formation of Nextida, a new joint venture, signifies Darling Ingredients' strategic focus on capitalizing on the high-growth health and wellness markets. This venture is specifically designed to accelerate the development and distribution of high-purity collagen peptide compositions. These advanced products are targeted at key consumer needs such as anti-aging benefits, improved joint health, and enhanced muscle recovery, positioning Darling Ingredients for continued success in these lucrative areas.

Darling Ingredients' Sustainable Natural Ingredients from Bio-nutrients segment showcases a strong position. This business leverages edible and inedible animal by-products to create a diverse range of sustainable ingredients. The company's significant global footprint, with over 260 facilities worldwide, enables it to process approximately 15% of global animal by-products, highlighting its substantial market share in the growing circular economy sector.

Sustainable Aviation Fuel (SAF) Production

Darling Ingredients' joint venture, Diamond Green Diesel, launched one of the world's largest Sustainable Aviation Fuel (SAF) production facilities in Port Arthur, Texas. This move firmly places SAF into the high-growth category of the BCG matrix. The global SAF market is projected to reach $15.8 billion by 2030, demonstrating a strong upward trajectory driven by aviation industry decarbonization efforts.

The aviation sector's commitment to reducing its carbon footprint is a significant tailwind for SAF. Airlines and governments worldwide are setting ambitious sustainability targets, creating substantial future demand for SAF. This strategic expansion by Darling Ingredients capitalizes on their established feedstock supply chains and renewable fuel production expertise, positioning them for potential market leadership in this burgeoning sector.

- High Growth Potential: SAF's market is expanding rapidly due to decarbonization mandates in aviation.

- Strategic Advantage: Darling leverages existing infrastructure and renewable fuel expertise.

- Market Demand: Airlines and governments are prioritizing sustainable aviation solutions.

- Investment Focus: The Port Arthur facility represents a significant investment in a high-growth area.

Specialty Proteins for Pet Food and Feed

Specialty Proteins for Pet Food and Feed is a strong contender in Darling Ingredients' portfolio, holding a significant market share. This segment thrives on the consistent demand from the pet food and animal feed industries, which are relatively stable markets. Darling's established infrastructure and expertise in processing by-products provide a competitive edge.

While the growth rate in these mature markets might not be as explosive as some newer ventures, Darling's substantial market presence ensures a reliable revenue stream. The company's ability to transform waste into valuable protein ingredients taps into the increasing consumer demand for sustainable and natural pet food options. This focus on value creation from by-products is a key differentiator.

- Market Share: High, reflecting Darling's established position.

- Market Growth: Moderate, characteristic of mature industries.

- Demand Drivers: Consistent need for protein in pet food and animal feed.

- Sustainability Angle: Leverages consumer preference for natural and upcycled ingredients.

Darling Ingredients' Renewable Diesel and Sustainable Aviation Fuel (SAF) operations, primarily through Diamond Green Diesel (DGD), represent the company's "Stars" in the BCG matrix. DGD is a leading producer, with 2024 sales of 1.25 billion gallons of renewable diesel. The global renewable diesel market is projected to grow significantly, reaching an estimated USD 52.1 billion by 2034 from USD 23 billion in 2024. The recent launch of one of the world's largest SAF facilities in Port Arthur, Texas, in late 2024 further solidifies this segment's star status, tapping into the rapidly expanding SAF market, which is expected to reach $15.8 billion by 2030.

| Segment | BCG Category | Key Metrics/Drivers | Market Outlook |

|---|---|---|---|

| Renewable Diesel & SAF (DGD) | Star | 1.25 billion gallons sold (FY24 RD). New SAF facility operational (Q4 2024). | Global RD market: USD 23B (2024) to USD 52.1B (2034). Global SAF market: $15.8B by 2030. |

What is included in the product

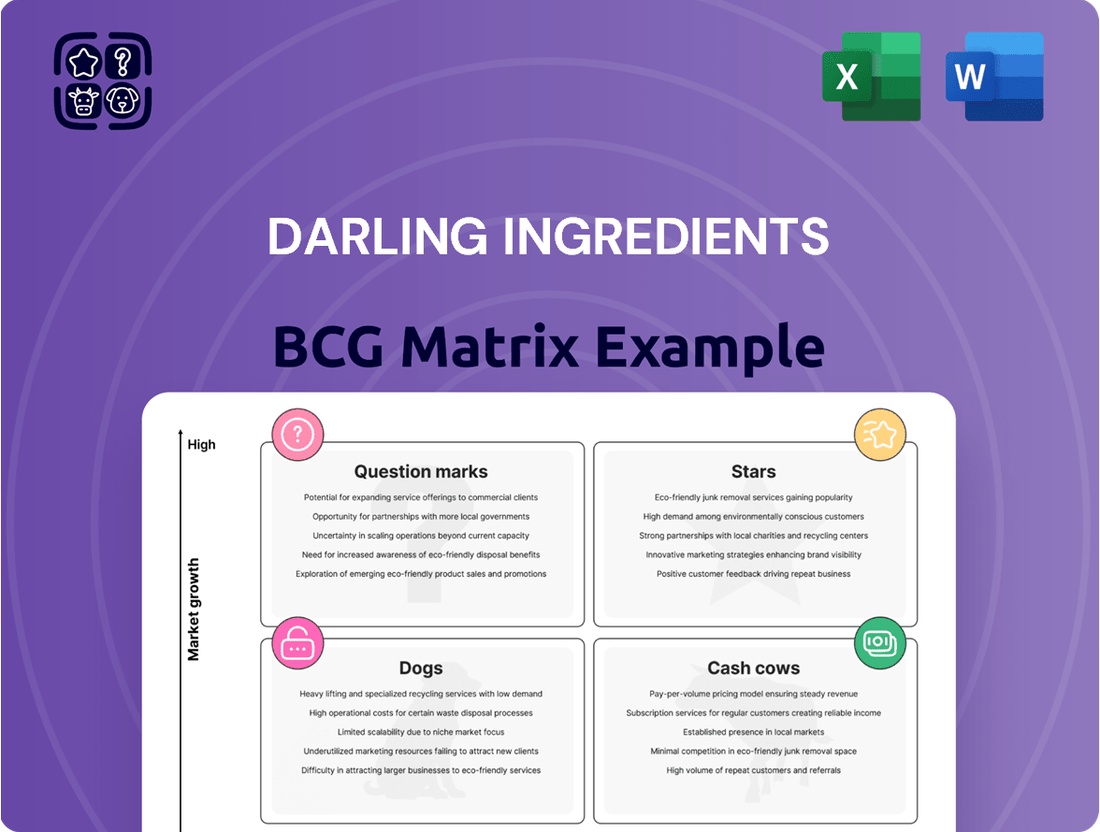

This BCG Matrix overview analyzes Darling Ingredients' portfolio, categorizing its business units as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic recommendations on investment, holding, or divestment for each category.

A clear BCG Matrix visualizes Darling Ingredients' portfolio, easing the pain of strategic resource allocation.

Cash Cows

Darling Ingredients' traditional rendering operations, a cornerstone of its business, transform animal by-products into valuable fats and proteins. This segment operates in a mature market where Darling holds a significant share, generating substantial and consistent cash flow.

These established operations are crucial for the company's financial stability, acting as a reliable source of income. Even with fluctuations in finished product prices, Darling has demonstrated effective management, evidenced by gross margin improvements in its feed segment, highlighting the efficiency of these core assets.

Edible fats and oils represent a stable cash cow for Darling Ingredients, leveraging animal by-products to serve the food industry. This segment benefits from consistent demand and mature markets, leading to robust profit margins driven by efficient production and established competitive advantages. For instance, in 2023, Darling Ingredients reported that its Specialty Products segment, which includes edible oils, saw a significant contribution to its overall revenue, demonstrating the segment's reliable performance.

Tallow and yellow grease are significant cash cows for Darling Ingredients, serving as foundational components for numerous industries and the burgeoning renewable fuels sector. These mature markets benefit from Darling's extensive operational scale and global distribution network, which solidify its dominant market position and drive substantial profits.

In 2024, the company's performance in this segment has been bolstered by favorable market dynamics. For instance, the price of yellow grease, a key feedstock, saw an upward trend throughout the year, directly enhancing the profitability of this product line. Darling Ingredients' ability to efficiently produce and distribute these materials globally ensures consistent cash flow, underscoring their role as a reliable profit engine for the company.

Basic Feed Ingredients

Darling Ingredients' basic feed ingredients, serving the livestock and aquaculture sectors, represent a significant Cash Cow. This segment holds a substantial market share within a mature, yet fundamentally vital, industry.

The consistent, unwavering demand for these essential feed components translates into a dependable stream of revenue and robust cash flow for Darling Ingredients. Because these products are well-established, the need for extensive marketing and sales efforts is minimized, further enhancing profitability.

- Market Position: High market share in a mature, essential market.

- Revenue Stability: Consistent demand ensures reliable cash flow.

- Cost Efficiency: Low promotion and placement investments due to established presence.

- Competitive Edge: Broad product portfolio reinforces market leadership.

Existing Bio-nutrient Collection and Processing Infrastructure

Darling Ingredients' existing bio-nutrient collection and processing infrastructure represents a significant cash cow. This established global network of facilities efficiently transforms waste streams into valuable bio-nutrients, a mature market where Darling holds a strong competitive edge.

The low growth nature of this segment minimizes the need for substantial capital reinvestment, enabling the business to generate consistent and robust cash flow. This surplus cash can then be strategically deployed to fuel growth in other areas of the company.

- Global Reach: Over 200 processing facilities worldwide.

- Revenue Contribution: Bio-nutrient segment consistently contributes a significant portion of Darling's overall revenue, often exceeding $2 billion annually in recent years.

- Efficiency: Optimized collection and processing routes lead to high operational efficiency and cost control.

- Market Dominance: Darling is a leading player in the rendering and recycled food processing industry, leveraging its infrastructure as a key differentiator.

Darling Ingredients' core rendering and processing operations are quintessential Cash Cows. These segments operate in mature markets with consistent demand, generating substantial and stable cash flow for the company. Their established infrastructure and market share allow for efficient operations and minimal reinvestment needs, making them reliable profit engines.

| Segment | Market Maturity | Cash Flow Generation | Key Products |

|---|---|---|---|

| Traditional Rendering | Mature | High & Stable | Fats, Proteins |

| Edible Fats & Oils | Mature | Robust | Edible Oils |

| Tallow & Yellow Grease | Mature | Substantial | Feedstock, Renewable Fuels |

| Basic Feed Ingredients | Mature | Dependable | Livestock & Aquaculture Feed |

| Bio-Nutrient Processing | Mature | Consistent & Robust | Bio-Nutrients |

What You See Is What You Get

Darling Ingredients BCG Matrix

The BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase, offering a clear strategic overview of Darling Ingredients' portfolio. This comprehensive report, free from watermarks or demo content, is designed for immediate application in your business planning and analysis. You can trust that the insights and structure presented here are exactly what you'll get, ready for strategic decision-making. This preview ensures you know precisely what you are acquiring—a professional, analysis-ready BCG Matrix for Darling Ingredients.

Dogs

Underperforming legacy facilities in Darling Ingredients' portfolio might be classified as Dogs. These are older, less efficient plants situated in competitive or shrinking local markets. They typically hold a low market share within their segments, which are characterized by minimal growth.

These facilities often struggle to generate profits, sometimes breaking even or even consuming more cash than they bring in. For instance, in 2024, a segment of Darling's older rendering operations in a mature European market might have shown a negative EBITDA margin, reflecting the challenges of high operational costs and limited pricing power.

Efforts to revitalize these underperforming assets through turnaround plans are often costly and may not guarantee substantial gains in profitability or market standing. The decision to invest in such facilities is weighed against the potential for better returns in other, more promising business areas.

Products with declining demand or obsolete technologies within Darling Ingredients' portfolio, often termed Dogs in the BCG Matrix, represent areas where market share is low and growth prospects are minimal. These could include certain legacy animal by-product processing lines that are being phased out due to shifts in consumer demand for more sustainable or novel protein sources. For instance, if a particular rendering process for a less popular animal species sees a significant drop in demand from its primary industrial customers, it would fit this category.

These "Dogs" tie up valuable capital and resources that could be better allocated to more promising segments of the business. In 2024, Darling Ingredients has been actively managing its portfolio, and identifying such declining segments is crucial for optimizing operational efficiency and financial performance. The company's strategic focus remains on high-growth areas like plant-based ingredients and advanced bioproducts, making the divestment or repurposing of obsolete technologies a priority.

Operating in specific regional markets characterized by fierce competition and thin profit margins, with little room for expansion, can be categorized as 'Dogs' within Darling Ingredients' portfolio. These segments often demand substantial investment for minimal returns, which can drag down overall profitability.

For instance, if a particular European region saw Darling Ingredients' market share remain stagnant at 5% in 2024 amidst a highly fragmented market with over 20 competitors, and average industry EBITDA margins hovering around 3%, this would exemplify a 'Dog' scenario. Such a market might require significant marketing spend to maintain even that small share, yielding negligible profit.

Biodiesel Production (if distinct from Renewable Diesel)

While Darling Ingredients is a leader in renewable diesel, some of its biodiesel production might not share the same robust market growth or technological edge. These operations could be considered question marks in the BCG matrix.

The biodiesel sector, though related to renewable fuels, faces distinct market dynamics. This can result in slower growth and a smaller market share for facilities that aren't as competitive.

- Biodiesel Market Dynamics: The global biodiesel market, while expanding, often sees different growth rates and price sensitivities compared to renewable diesel. For instance, in 2023, the U.S. biodiesel production was around 2.7 billion gallons, a slight decrease from 2022, indicating a more mature or competitive landscape for some players.

- Technological and Scale Advantages: Darling's significant investment in its Diamond Green Diesel (DGD) joint venture leverages advanced technologies and economies of scale, positioning it strongly in the renewable diesel market. Smaller, standalone biodiesel plants might lack these advantages, impacting their market position.

- Potential for Question Mark Status: Facilities producing biodiesel without the same scale or technological advancements as DGD could represent question marks. This classification suggests they require careful monitoring to determine if they can become stars or if they should be divested.

Non-core, Divested or Phased-Out Business Units

Non-core, divested, or phased-out business units within Darling Ingredients' BCG Matrix would represent those segments that the company has decided to exit. These are typically characterized by low growth and low market share, indicating they are not contributing significantly to the company's overall strategy or financial performance.

The divestment of such units is a strategic move to streamline operations, reduce complexity, and reallocate resources towards more promising areas. For instance, in 2023, Darling Ingredients completed the sale of its Canadian rendering operations, a move consistent with focusing on core competencies.

- Divestment Rationale: These units are divested because they are no longer strategically aligned or financially viable, freeing up capital for higher-growth opportunities.

- Low Growth, Low Share: They typically exhibit low market growth rates and hold a small market share, making them less attractive for continued investment.

- Focus on Core: Exiting these segments allows Darling Ingredients to concentrate its efforts and investments on its core, higher-potential business areas.

- Capital Reallocation: The proceeds from divestitures can be reinvested in areas with stronger growth prospects or used to strengthen the balance sheet.

Dogs in Darling Ingredients' portfolio represent underperforming segments with low market share and minimal growth potential. These can include older facilities or product lines facing declining demand, often characterized by low profitability or even cash consumption. For example, a legacy rendering plant in a mature, competitive market might have struggled in 2024 with thin margins, potentially showing negative EBITDA. The company's strategy involves carefully managing these assets, often by divesting or repurposing them to reallocate capital to more promising growth areas.

These 'Dogs' are typically legacy operations or product lines that have become obsolete due to technological shifts or changing consumer preferences. For instance, certain animal by-product processing lines that are no longer in high demand, perhaps due to the rise of novel protein sources, would fall into this category. Darling Ingredients actively works to identify and address these segments, aiming to optimize its overall portfolio and enhance financial performance by focusing on its core, high-growth businesses.

Such segments often operate in highly competitive regional markets with limited expansion opportunities, demanding significant investment for meager returns. A scenario in 2024 where Darling Ingredients held a mere 5% market share in a fragmented European region with over 20 competitors, and industry EBITDA margins around 3%, would clearly illustrate a 'Dog' classification. These situations can strain overall profitability and necessitate strategic decisions regarding continued investment or divestment.

Darling Ingredients' strategic focus on high-growth areas, such as plant-based ingredients and advanced bioproducts, means that legacy segments with low market share and growth are prime candidates for divestment or restructuring. The company's 2023 divestiture of its Canadian rendering operations exemplifies this approach, freeing up resources for more strategic investments.

Question Marks

Emerging sustainable aviation fuel (SAF) technologies, while not yet fully commercialized by Darling Ingredients, represent potential 'Question Marks' in their BCG matrix. These nascent technologies, such as advanced alcohol-to-jet (ATJ) or novel biomass conversion pathways, are positioned in a high-growth market driven by decarbonization mandates. However, they currently possess a low market share due to their early stage of development and the substantial capital investment needed for scaling.

Novel high-purity collagen peptide compositions beyond Nextida's initial launch represent potential stars in Darling Ingredients' portfolio. These specialized products are currently in early market testing, targeting niche, high-value health and wellness sectors. Their market share is minimal, but their significant growth potential is undeniable as they seek broader buyer adoption.

Darling Ingredients' expansion into new geographic markets, particularly where demand for its sustainable ingredients and renewable fuels is high but its market share is low, positions these ventures as potential stars in its BCG Matrix. These initiatives, like its recent investments in Europe and Asia, represent significant capital outlays for infrastructure and market development. For instance, in 2024, Darling announced plans to expand its rendering capacity in Germany, a market with strong regulatory tailwinds for circular economy solutions.

Biotech Collagen Alternatives

Biotech collagen alternatives, developed via fermentation, are currently a Question Mark for Darling Ingredients. While the global collagen market is projected to reach $4.7 billion by 2027, with a CAGR of 6.1%, these novel alternatives represent a small fraction of that. Consumer demand for sustainable and ethical sourcing is a significant growth driver, but these technologies are still in their early stages, requiring substantial investment in research and development.

These products face the challenge of scaling production and achieving cost parity with traditional collagen derived from animal by-products. High upfront capital expenditure for fermentation facilities and ongoing R&D costs contribute to their current Question Mark status.

- Market Potential: The demand for plant-based and alternative proteins is surging, with the alternative protein market expected to reach $290 billion by 2030.

- Investment Needs: Significant capital is required for scaling fermentation processes and ensuring regulatory approval for food and cosmetic applications.

- Competitive Landscape: Traditional collagen suppliers hold a dominant market share, making market penetration for biotech alternatives a significant hurdle.

- Growth Prospects: Despite current challenges, the long-term growth potential is high as technology matures and consumer acceptance increases.

Advanced Bio-energy Solutions (Beyond Current Renewable Diesel)

Advanced bio-energy solutions, beyond Darling Ingredients' current renewable diesel operations, would likely be categorized as Stars or Question Marks in a BCG matrix, depending on their market growth and competitive position. These could encompass novel processes for generating biogas, sustainable aviation fuel (SAF) from non-traditional feedstocks, or even advanced biofuels from algae or cellulosic materials.

These emerging technologies often represent high-growth potential markets, but their current market share might be limited due to technological hurdles, regulatory landscapes, or the need for significant capital investment to achieve commercial viability. For instance, while the global SAF market is projected to grow substantially, reaching an estimated $12.5 billion by 2030, many advanced production pathways are still in pilot phases.

- Sustainable Aviation Fuel (SAF) Innovation: Research into SAF production from diverse waste streams, including agricultural residues and municipal solid waste, could represent a significant growth area.

- Biogas and RNG Expansion: Developing more efficient methods for capturing and upgrading biogas from various organic waste sources into renewable natural gas (RNG) offers further untapped potential.

- Next-Generation Biofuels: Exploring advanced biofuels derived from non-food crops or algae, which promise higher yields and reduced land-use impact, could also fall into this category.

Darling Ingredients' ventures into emerging sustainable aviation fuel (SAF) technologies, such as advanced alcohol-to-jet (ATJ), are currently classified as Question Marks. These technologies operate in a high-growth market driven by global decarbonization efforts, with the SAF market projected to reach $12.5 billion by 2030. However, they hold a low market share due to their nascent stage of development and the substantial capital required for scaling, facing challenges in achieving cost competitiveness and widespread adoption.

Biotech collagen alternatives, produced through fermentation, also fall into the Question Mark category for Darling Ingredients. The broader collagen market is expanding, expected to reach $4.7 billion by 2027 with a 6.1% CAGR, fueled by demand for sustainable and ethical sourcing. Yet, these novel alternatives represent a small market fraction, necessitating significant R&D investment and facing hurdles in scaling production to compete with established, animal-derived collagen.

These products require substantial capital for fermentation facility construction and ongoing research to achieve regulatory approval for food and cosmetic uses. The competitive landscape is dominated by traditional collagen suppliers, making market entry a significant challenge, though long-term growth prospects remain strong as technology advances and consumer acceptance grows.

| Category | Market Growth | Market Share | Darling's Position | Key Considerations |

| Emerging SAF Technologies | High (Projected $12.5B by 2030) | Low | Question Mark | High R&D, Capital Intensive, Cost Competitiveness |

| Biotech Collagen Alternatives | High (Part of $4.7B collagen market by 2027) | Low | Question Mark | Scaling Production, Regulatory Approval, Competition |

BCG Matrix Data Sources

Our Darling Ingredients BCG Matrix is built on robust financial disclosures, comprehensive market research, and detailed industry analysis to provide strategic clarity.