Daiwa Securities Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daiwa Securities Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Daiwa Securities Group's strategic direction. Our expertly crafted PESTLE analysis provides a comprehensive overview of the external landscape, equipping you with the foresight to navigate market complexities and capitalize on emerging opportunities. Gain a competitive advantage by understanding these vital forces—download the full report now for actionable intelligence.

Political factors

The Japanese government, through its Financial Services Agency (FSA), prioritizes market stability and investor protection, a key consideration for Daiwa Securities Group. The FSA's approach aims to balance robust oversight with encouraging advancements in areas like fintech and sustainable finance.

In 2024, Japan's financial sector saw continued regulatory focus on digital transformation and ESG investments, impacting how firms like Daiwa navigate compliance and pursue growth opportunities. Daiwa's strategic alignment with these evolving regulatory landscapes is crucial for its operational efficiency and market positioning.

Regional geopolitical tensions, especially in East Asia, directly influence investor sentiment and the movement of capital across borders. For Daiwa Securities Group, this means that events like the ongoing trade disputes between major economies or localized conflicts can create volatility, impacting their ability to conduct business smoothly.

Daiwa's extensive international operations and its significant presence in investment banking are particularly vulnerable to changes in global trade relationships and overall political stability. For instance, a sudden imposition of tariffs or a deterioration in diplomatic ties could disrupt cross-border M&A activity or affect the performance of international equity offerings, underscoring the need for sophisticated risk management.

In 2024, the global landscape continues to be shaped by these geopolitical undercurrents. For example, the ongoing strategic competition between the US and China, along with regional security concerns in the Indo-Pacific, directly affects market access and investment opportunities for firms like Daiwa. The firm must continually assess these risks, as evidenced by the increased focus on supply chain resilience and geopolitical risk premiums in financial market analyses throughout 2024.

Government fiscal policies, including public spending and taxation adjustments, significantly shape the economic landscape. For instance, Japan's fiscal deficit was projected to be around 5.5% of GDP in 2024, impacting overall market conditions and investment appetite.

The Bank of Japan's monetary policy, particularly its stance on interest rates and quantitative easing, directly affects market liquidity and borrowing costs. As of early 2024, the Bank of Japan maintained its ultra-loose monetary policy, though discussions around a potential shift were ongoing, creating a dynamic environment for financial services firms like Daiwa Securities.

International Trade Agreements

Daiwa Securities Group's global operations are significantly influenced by international trade agreements. These pacts can either streamline cross-border financial services, opening up new markets, or impose complex compliance hurdles. For instance, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which includes Japan, potentially offers expanded market access for financial services, though specific regulatory alignment remains key.

Changes to existing agreements or the formation of new ones can reshape Daiwa's strategic approach to international expansion and client service. For example, ongoing discussions and potential revisions to trade frameworks involving major economies where Daiwa operates, such as the EU or the US, could introduce new opportunities or necessitate adjustments to compliance protocols.

Daiwa's ability to leverage these agreements depends on several factors:

- Market Access: Agreements that reduce tariffs and non-tariff barriers for financial services can allow Daiwa to offer its products and services more competitively in new regions.

- Regulatory Harmonization: Trade deals that promote alignment in financial regulations can simplify compliance and reduce operational costs for Daiwa's global subsidiaries.

- Investment Protection: Provisions within trade agreements that protect foreign investments can provide Daiwa with greater certainty and security when establishing or expanding its presence in foreign markets.

Anti-Monopoly and Competition Policy

Japan's Fair Trade Commission (FTC) actively monitors the financial services industry, influencing consolidation and market dynamics. This regulatory stance can shape Daiwa Securities Group's strategic options regarding mergers and acquisitions, as well as its approach to maintaining and expanding market share. The aim is to foster a competitive environment that benefits consumers through diverse offerings and fair pricing.

In 2024, the Japanese financial sector continued to see regulatory scrutiny focused on preventing monopolistic practices. For instance, the FTC's ongoing review of market concentration in areas like securities brokerage and investment banking impacts how firms like Daiwa can pursue growth through M&A. The government's commitment to ensuring fair competition means that any significant consolidation would likely face rigorous examination to safeguard consumer interests and prevent undue market power.

- Regulatory Oversight: The Japanese FTC's active role in overseeing the financial sector aims to prevent anti-competitive behavior.

- M&A Impact: Stricter competition policies can limit or shape the nature of mergers and acquisitions for companies like Daiwa.

- Market Share Strategies: Daiwa must navigate these regulations when developing strategies to grow its market share, ensuring compliance and fair play.

The Japanese government's commitment to financial stability, overseen by the FSA, directly influences Daiwa's operational framework. In 2024, regulatory priorities included bolstering cybersecurity and promoting sustainable finance initiatives. Geopolitical stability in East Asia remained a key concern, impacting investor confidence and cross-border capital flows, with ongoing US-China strategic competition influencing market access for Daiwa in 2024.

Government fiscal policies, such as Japan's projected 5.5% GDP deficit in 2024, shape the broader economic environment. The Bank of Japan's monetary policy, including its ultra-loose stance as of early 2024, affects liquidity and borrowing costs. International trade agreements, like the CPTPP, offer potential market access but require careful navigation of regulatory alignment for firms like Daiwa.

Daiwa Securities Group's strategic options regarding mergers and acquisitions are shaped by the Fair Trade Commission's focus on preventing monopolistic practices. In 2024, this scrutiny impacted how firms pursued growth, with any significant consolidation likely undergoing rigorous examination to ensure fair competition and consumer interests.

What is included in the product

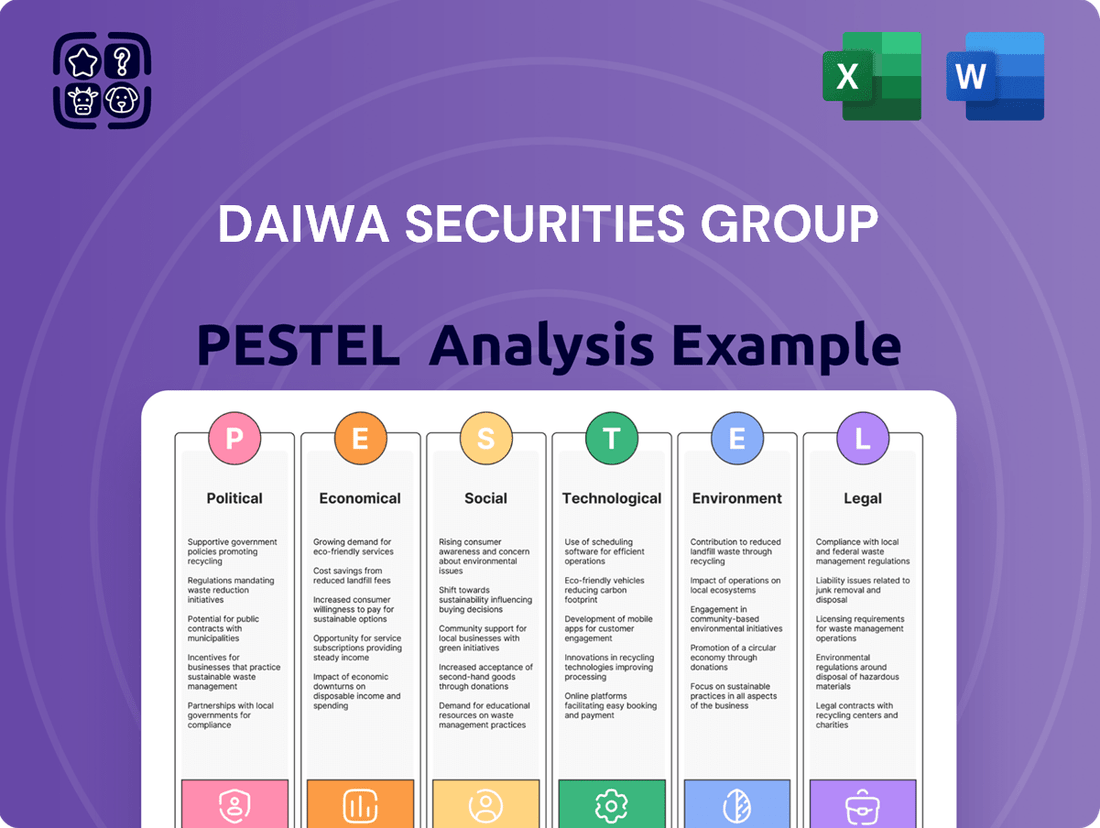

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Daiwa Securities Group, offering a comprehensive view of its operating landscape.

It provides a strategic framework for understanding external influences, enabling proactive decision-making and identification of potential opportunities and challenges for Daiwa Securities Group.

A Daiwa Securities Group PESTLE Analysis acts as a pain point reliever by providing a clear, summarized version of external factors for easy referencing during meetings or presentations, ensuring all stakeholders are aligned on market dynamics.

Economic factors

Japan's economic growth trajectory is a critical factor for Daiwa Securities Group. For 2024, the International Monetary Fund (IMF) projects Japan's GDP growth at 0.9%, a figure that directly impacts retail brokerage activity, corporate earnings, and investment banking deal flow. A stronger economy generally translates to higher disposable incomes for individuals, encouraging more investment in securities, and robust corporate profits, which fuels mergers, acquisitions, and capital raising activities that Daiwa facilitates.

Conversely, a slowdown in domestic economic growth presents challenges. If Japan's economy experiences stagnation or contraction, as seen in potential dips in consumer spending or business investment, it can lead to reduced trading volumes and fewer corporate finance transactions. This directly impacts Daiwa's revenue streams across its various business segments, highlighting the sensitivity of its operations to the broader economic climate.

The Bank of Japan's (BOJ) monetary policy, particularly its stance on interest rates, is a critical factor for Daiwa Securities Group. For much of 2024 and into early 2025, Japan has maintained a zero or near-zero interest rate policy, which has historically squeezed net interest margins for financial institutions like Daiwa. This environment can limit the profitability of their wholesale and treasury businesses, where income is often derived from the spread between lending and borrowing rates.

However, as of early 2025, there are ongoing discussions and expectations of a potential shift in the BOJ's policy. Should rates begin to rise, even modestly, it could offer a tailwind for Daiwa's profitability by widening net interest margins. Conversely, any increase in borrowing costs for Daiwa's clients, particularly corporations and individuals seeking loans or financing, could potentially dampen demand for securities and other financial services, presenting a balancing act for the firm.

Inflationary pressures directly affect Daiwa Securities Group's clients by diminishing their purchasing power and influencing consumer spending habits. For instance, in early 2024, many developed economies experienced inflation rates that, while moderating from 2023 peaks, remained above central bank targets, impacting disposable income.

The real returns on investments are significantly impacted; high inflation erodes the value of fixed-income assets and can reduce client demand for products that don't outpace price increases. As of mid-2024, persistent inflation in some regions meant that nominal investment gains were often offset by rising costs, leading to a re-evaluation of investment strategies.

Conversely, a stable and predictable inflation environment, typically around 2%, can create a more favorable backdrop for long-term investment planning, allowing Daiwa to offer products with greater confidence in their real yield potential. The global inflation outlook for late 2024 and 2025 suggests a gradual return towards target levels in many major economies, which could support a more stable operating environment.

Global Market Volatility

Global market volatility significantly impacts Daiwa Securities Group. Fluctuations in international equity, bond, and commodity markets directly influence trading revenues, asset management performance, and investment banking activities. For instance, during periods of heightened uncertainty, such as the market turbulence experienced in early 2024, trading volumes can surge, but this often comes with increased bid-ask spreads and reduced investor confidence, potentially dampening deal flow.

Economic slowdowns or financial crises exacerbate these effects. A global economic slowdown, as projected by many institutions for parts of 2024 and 2025, can lead to reduced client activity across all of Daiwa's business segments. This means fewer M&A deals, lower demand for investment banking services, and potentially outflows from asset management portfolios, increasing the firm's risk exposure.

- Market Fluctuations: In Q1 2024, global equity markets saw considerable swings, with the MSCI World Index experiencing a notable correction before partially recovering, directly impacting the valuation of assets under management for Daiwa.

- Economic Headwinds: Projections for global GDP growth in 2024 were revised downwards by organizations like the IMF, signaling potential challenges for revenue generation in investment banking and trading.

- Risk Management: Increased geopolitical tensions in 2024 and early 2025 have heightened the need for robust risk management frameworks within Daiwa to navigate potential market shocks and protect client assets.

Demographic Dividend/Challenge

Japan's demographic shift, characterized by an aging population and a declining birthrate, presents a dual-edged sword for Daiwa Securities Group. By the end of 2023, Japan's population had fallen below 124 million, with the elderly (65 and over) making up a record 29.1% of the total population. This trend directly impacts the domestic workforce and client base, potentially reducing the pool of younger investors and employees.

However, this demographic challenge also cultivates specific market needs that Daiwa is well-positioned to address. The increasing number of seniors, coupled with longer life expectancies, fuels a growing demand for specialized financial services such as wealth management, inheritance planning, and financial products catering to long-term care needs. Daiwa's expertise in these areas can be leveraged to capture this expanding market segment.

- Shrinking Workforce: Japan's working-age population (15-64) continues to decline, impacting domestic consumption and investment capacity.

- Aging Population Growth: The proportion of individuals aged 65 and over reached 29.1% in 2023, creating a significant demand for retirement and healthcare-related financial services.

- Demand for Specialized Products: An aging demographic necessitates growth in wealth management, inheritance planning, and long-term care insurance products, areas where Daiwa can expand its offerings.

- Client Base Evolution: Daiwa must adapt its strategies to serve an older client base with different financial priorities and risk appetites.

Japan's economic growth is crucial for Daiwa, with the IMF projecting 0.9% GDP growth for 2024, directly influencing investment activity and corporate finance. A slowdown, however, would reduce trading volumes and deal flow, impacting Daiwa's revenue across segments.

The Bank of Japan's monetary policy, particularly interest rates, significantly affects Daiwa's net interest margins. While near-zero rates have compressed margins, a potential modest rate hike in early 2025 could improve profitability, though it might also increase borrowing costs for clients.

Inflation erodes client purchasing power and investment returns. While global inflation was expected to moderate towards target levels by late 2024 and 2025, persistent price increases in early 2024 impacted real investment gains, necessitating strategic adjustments.

Global market volatility, as seen with equity swings in Q1 2024, directly impacts Daiwa's assets under management and trading revenues. Economic headwinds and geopolitical tensions in 2024-2025 further heighten the need for robust risk management.

| Economic Factor | 2024/2025 Data Point | Impact on Daiwa Securities Group |

|---|---|---|

| Japan GDP Growth (IMF Projection) | 0.9% (2024) | Influences retail brokerage, corporate earnings, and deal flow. |

| Bank of Japan Interest Rate Policy | Near-zero, potential modest rise expected early 2025 | Affects net interest margins; rising rates could improve profitability but increase client borrowing costs. |

| Global Inflation Outlook | Moderating but above targets in early 2024; expected gradual return to targets late 2024/2025 | Impacts client purchasing power and real investment returns; stable inflation supports long-term planning. |

| Global Market Volatility | Notable equity swings in Q1 2024; downward GDP revisions for 2024 | Affects trading revenues, AUM, and investment banking activity; necessitates strong risk management. |

Same Document Delivered

Daiwa Securities Group PESTLE Analysis

The preview shown here is the exact Daiwa Securities Group PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting Daiwa Securities Group.

The content and structure shown in the preview is the same Daiwa Securities Group PESTLE Analysis document you’ll download after payment, offering actionable insights for strategic decision-making.

Sociological factors

Japan's demographic shift, with an increasing proportion of its population over 65, is a defining sociological factor. By 2025, it's estimated that nearly 30% of Japan's population will be aged 65 or older, a figure that continues to climb.

This aging trend directly fuels a substantial intergenerational wealth transfer, with trillions of yen expected to change hands in the coming years. Daiwa Securities Group is well-positioned to capitalize on this by offering enhanced wealth management services, inheritance planning, and bespoke financial products designed for both the aging population and the beneficiaries of their estates.

Societal trends are significantly reshaping how people invest. There's a noticeable surge in the demand for sustainable and responsible investing, often referred to as ESG (Environmental, Social, and Governance). This means investors are increasingly looking beyond just financial returns and considering the ethical and environmental impact of their investments.

Daiwa Securities Group needs to actively adapt its product range and strategic approach to cater to this growing client appetite for ESG-compliant funds and investments that deliver social impact. For instance, by the end of 2023, global sustainable fund assets reached an estimated $37.7 trillion, demonstrating the significant market shift towards responsible investing.

Daiwa Securities Group's success in retail brokerage and asset management hinges on the public's financial literacy and their embrace of digital tools. A higher level of financial understanding allows clients to better engage with complex investment products, while comfort with digital platforms streamlines service delivery and reduces operational costs.

In Japan, a significant portion of the population shows a growing interest in investing, with surveys indicating that over 60% of individuals aged 20-60 are considering or actively investing in financial markets as of early 2024. This trend underscores the need for accessible educational resources and intuitive digital interfaces to cater to a diverse client base, from novice investors to seasoned professionals.

Changing Work Lifestyles

The rise of remote work and flexible employment arrangements, accelerated by events in 2020-2021, is fundamentally altering how individuals approach their finances. This shift impacts savings patterns as traditional office-related expenses decrease, potentially freeing up capital for investment. Daiwa Securities Group must adapt its financial planning services to cater to these evolving client needs, offering solutions tailored to a more fluid work-life balance and diverse income streams.

Societal expectations around work are also changing, with a growing emphasis on work-life integration rather than strict separation. This can influence investment horizons and risk appetites, as individuals may prioritize financial security that supports lifestyle flexibility. For instance, a significant portion of the workforce now seeks roles offering autonomy, which may correlate with a desire for financial independence earlier in life.

- Remote Work Adoption: By late 2024, global surveys indicated that over 30% of the workforce was engaged in hybrid or fully remote work, a substantial increase from pre-pandemic levels.

- Gig Economy Growth: The gig economy continued its expansion through 2024, with millions of individuals relying on freelance and contract work, necessitating flexible financial products.

- Employee Preferences: A 2025 study revealed that over 70% of employees consider flexible work options a key factor in job satisfaction and retention, signaling long-term behavioral shifts.

- Savings Behavior Impact: Early 2025 data suggested that households with remote workers reported slightly higher savings rates, attributed to reduced commuting and dining-out expenses.

Consumer Trust and Ethics

Consumer trust is the bedrock of Daiwa Securities Group's operations. In 2024, a significant portion of Japanese investors, particularly younger demographics, prioritize transparency and ethical practices when selecting financial service providers. Daiwa's commitment to robust corporate governance and data privacy is therefore crucial for maintaining and expanding its client base.

Societal expectations for financial institutions to act with integrity and uphold ethical standards are increasingly stringent. Daiwa's proactive approach to compliance and its emphasis on responsible business conduct directly impact its reputation. For instance, a 2024 survey indicated that over 70% of potential clients consider a firm's ethical standing as a primary factor in their decision-making process.

- Reputation Management: Public trust directly correlates with Daiwa's ability to attract and retain clients, especially in an era of heightened regulatory scrutiny and consumer awareness.

- Ethical Imperative: Upholding ethical standards in all dealings, from investment advice to data handling, is not just a compliance issue but a strategic necessity for long-term sustainability.

- Data Security Concerns: With the increasing digitization of financial services, consumers' concerns about data security and privacy are paramount, requiring Daiwa to invest heavily in advanced security measures.

The aging Japanese population, with nearly 30% expected to be over 65 by 2025, presents a significant opportunity for wealth management and inheritance planning services. This demographic shift also fuels a growing demand for sustainable and responsible investing (ESG), with global sustainable fund assets reaching an estimated $37.7 trillion by the end of 2023, indicating a strong market preference for ethical investments.

Increased financial literacy and digital adoption are crucial for Daiwa Securities Group, as over 60% of Japanese individuals aged 20-60 were considering or actively investing in financial markets in early 2024. The rise of remote work, with over 30% of the global workforce engaged in hybrid or remote work by late 2024, impacts savings and necessitates flexible financial planning solutions.

Consumer trust, influenced by ethical practices and data privacy, is paramount, with over 70% of potential clients in 2024 considering a firm's ethical standing as a primary decision factor. Daiwa's commitment to transparency and robust governance is vital for client retention in an era of heightened consumer awareness and regulatory scrutiny.

| Sociological Factor | Trend/Data Point | Implication for Daiwa Securities Group |

|---|---|---|

| Demographics | Nearly 30% of Japan's population over 65 by 2025 | Increased demand for wealth management and inheritance planning |

| Investment Preferences | Global ESG assets ~$37.7 trillion (end of 2023) | Need to expand ESG-compliant product offerings |

| Financial Literacy & Digitalization | >60% of Japanese aged 20-60 investing/considering investing (early 2024) | Focus on accessible education and intuitive digital platforms |

| Workforce Changes | >30% global remote/hybrid workforce (late 2024) | Adapt financial planning for flexible work and diverse income streams |

| Consumer Trust & Ethics | >70% clients prioritize ethics (2024) | Strengthen corporate governance, data privacy, and transparency |

Technological factors

Fintech innovation is a major technological factor for Daiwa Securities Group. The rapid growth of fintech firms presents significant competitive challenges, pushing Daiwa to constantly enhance its digital offerings. For instance, the global fintech market was valued at approximately USD 2.4 trillion in 2023 and is projected to grow substantially by 2030, indicating the scale of this evolving landscape.

To stay ahead, Daiwa needs to prioritize innovation in its digital platforms, payment solutions, and client advisory tools. This includes leveraging technologies like AI for personalized investment advice and streamlining transaction processes. By embracing these advancements, Daiwa can ensure it provides state-of-the-art services, meeting the demands of an increasingly tech-savvy client base.

Daiwa Securities Group is significantly investing in artificial intelligence and data analytics to sharpen its competitive edge. By leveraging these technologies, the firm aims to boost its capabilities in crucial areas like investment research, where AI can sift through market data for predictive insights, and risk management, by identifying potential financial exposures with greater accuracy. This strategic focus is designed to improve operational efficiency and deliver more tailored advice to clients, reflecting a broader industry trend towards data-driven financial services.

As financial services increasingly move online, the threat of cyberattacks and data breaches is a significant concern for Daiwa Securities Group. The financial sector is a prime target for cybercriminals, and a successful breach could severely damage client trust and operational stability.

Daiwa must therefore allocate substantial resources to advanced cybersecurity measures. This includes investing in cutting-edge technology and rigorous protocols to safeguard sensitive client data and maintain the integrity of their digital operations, a crucial factor in retaining customer confidence in the evolving digital landscape.

Digitalization of Client Services

Clients increasingly expect seamless digital interactions across all financial services. Daiwa Securities Group must continue to enhance its digital offerings in retail brokerage, asset management, and investment banking.

This includes expanding online account opening, digital advisory services, and robust mobile trading platforms. For instance, in 2024, global fintech adoption rates continued to climb, with a significant portion of consumers preferring digital channels for banking and investment activities.

- Digitalization Drive: Daiwa's focus on digital client services aims to meet evolving customer expectations for convenience and accessibility.

- Platform Enhancement: Investing in user-friendly mobile apps and online portals is crucial for retaining and attracting clients in a competitive market.

- Competitive Edge: Companies that successfully digitalize their services often see improved customer satisfaction and operational efficiency, as evidenced by industry trends showing increased engagement with digital financial tools.

Cloud Computing Adoption

Daiwa Securities Group's strategic embrace of cloud computing is a significant technological factor shaping its operations. This adoption promises enhanced scalability, allowing the firm to adjust its IT resources dynamically based on market demands and client activity, a crucial advantage in the fast-paced financial sector. Furthermore, cloud solutions are instrumental in driving down IT operational costs, freeing up capital for innovation and service enhancement.

The ability of cloud infrastructure to bolster data storage and processing capabilities is paramount for Daiwa. In 2024, the global public cloud market was projected to reach $679 billion, a testament to its growing importance. A secure and efficient cloud environment is not just beneficial but essential for supporting advanced analytics, which are critical for informed investment decisions and risk management. It also underpins the delivery of cutting-edge digital services to Daiwa's diverse client base.

- Scalability: Cloud adoption allows Daiwa to flexibly adjust IT resources, crucial for handling fluctuating market volumes and client demands.

- Cost Reduction: Migrating to cloud services can significantly lower IT infrastructure and maintenance expenses, improving operational efficiency.

- Enhanced Data Capabilities: Cloud platforms provide robust capabilities for storing, processing, and analyzing vast amounts of financial data, enabling sophisticated insights.

- Digital Service Delivery: A secure and efficient cloud infrastructure is foundational for delivering advanced digital financial services and improving customer experience.

Technological advancements, particularly in AI and data analytics, are reshaping the financial services landscape for Daiwa Securities Group. By integrating these tools, Daiwa enhances its investment research and risk management, aiming for greater efficiency and personalized client advice. The global AI market, expected to exceed $200 billion by 2025, highlights the significant potential of these technologies.

The increasing reliance on digital platforms necessitates robust cybersecurity measures. Daiwa must invest in advanced protection against cyber threats to safeguard client data and maintain operational integrity, a critical concern given the financial sector's vulnerability. In 2024, the average cost of a data breach in the financial sector remained exceptionally high, underscoring the importance of these investments.

Digitalization is paramount, with clients expecting seamless online experiences. Daiwa's focus on enhancing its digital offerings, from mobile trading to online advisory, is crucial for competitiveness. Global fintech adoption rates continue to rise, with a significant portion of consumers preferring digital channels for financial activities, a trend that is expected to persist through 2025.

| Technology Area | Impact on Daiwa Securities Group | Market Trend/Data (2024-2025) |

|---|---|---|

| Artificial Intelligence & Data Analytics | Enhanced investment research, predictive insights, improved risk management, personalized client advice. | Global AI market projected to grow significantly, with financial services being a key adopter. |

| Cybersecurity | Protection of sensitive client data, maintenance of operational integrity, prevention of financial and reputational damage. | Financial sector remains a prime target for cyberattacks; increased investment in cybersecurity solutions is a priority. |

| Digital Platforms & Mobile Services | Meeting evolving client expectations for convenience, accessibility, and seamless transactions. | Continued growth in digital banking and investment adoption; demand for user-friendly mobile apps and online portals. |

| Cloud Computing | Improved scalability, cost efficiency, enhanced data storage and processing capabilities for advanced analytics. | Global public cloud market continues to expand, enabling greater agility and data-driven decision-making in financial institutions. |

Legal factors

The Financial Services Agency (FSA) in Japan is the main governing body for Daiwa Securities Group, enforcing rigorous standards on capital reserves, how they conduct business in the market, safeguarding investors, and preventing money laundering. These regulations are not static; they evolve, meaning Daiwa must constantly adapt its operations to stay compliant. For instance, in 2023, the FSA continued its focus on strengthening cybersecurity measures within financial institutions, impacting how Daiwa manages its digital infrastructure and data protection protocols.

Japan's Act on the Protection of Personal Information (APPI) significantly shapes how Daiwa Securities Group handles client data, requiring meticulous attention to collection, storage, and usage practices. This regulatory landscape extends globally, with frameworks like the EU's General Data Protection Regulation (GDPR) impacting international operations and data transfers.

Non-compliance with these stringent data privacy laws, including APPI and GDPR, can result in substantial financial penalties, as seen with GDPR fines that can reach up to €20 million or 4% of annual global turnover. Maintaining robust data protection measures is therefore not just a legal obligation but a critical component for preserving client trust and safeguarding Daiwa's reputation in the competitive financial services sector.

Daiwa Securities Group operates under a strict framework of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. This necessitates rigorous adherence to Know Your Customer (KYC) protocols, ongoing transaction monitoring, and the prompt reporting of any suspicious activities to relevant authorities, ensuring financial integrity and preventing illicit fund flows.

The evolving nature of these regulations demands continuous investment in sophisticated compliance systems and comprehensive employee training. For instance, in 2024, global financial institutions are allocating significant resources to enhance their AML/CTF capabilities, with industry reports indicating substantial increases in spending on regulatory technology (RegTech) solutions to manage these complex requirements effectively.

Securities and Exchange Law

Securities and Exchange Law is a cornerstone for Daiwa Securities Group, directly shaping its investment banking and brokerage activities. These regulations dictate how securities are issued, traded, and the transparency required, impacting everything from initial public offerings to daily market transactions.

Compliance with these laws is not optional; it's fundamental to Daiwa's operations. This includes adhering to strict rules on fair trading, preventing insider trading, and ensuring accurate prospectus disclosures for any new securities offerings. For instance, the Financial Instruments and Exchange Act in Japan sets the framework for these activities.

Daiwa's commitment to these legal standards is crucial for maintaining investor confidence and market integrity. The company must navigate complex regulatory landscapes to ensure all its business practices align with national and international securities laws. Failure to do so can result in significant penalties and reputational damage.

- Securities Issuance: Laws govern the requirements for companies seeking to raise capital through stock or bond offerings, directly impacting Daiwa's underwriting services.

- Trading Regulations: Rules on market manipulation, insider trading, and best execution practices are vital for Daiwa's brokerage and trading desks.

- Disclosure Requirements: Companies must provide accurate and timely information to the public, a process Daiwa facilitates and must also adhere to for its own reporting.

- Investor Protection: Laws are designed to safeguard investors, meaning Daiwa must operate with a high degree of fiduciary duty and transparency.

International Regulatory Harmonization

Daiwa Securities Group, as a global financial player, navigates a complex web of international financial standards and cross-border regulatory frameworks. Efforts to harmonize these regulations, such as those spearheaded by the Basel Committee on Banking Supervision, aim to create a more stable global financial system. For instance, the ongoing implementation of Basel III reforms, which began in earnest in the early 2010s and continues to evolve, sets capital and liquidity requirements for banks worldwide. Daiwa's adherence to these evolving standards directly influences its capital allocation strategies and operational efficiency across different markets.

Divergent regulations across jurisdictions present significant challenges and opportunities for Daiwa. For example, differing data privacy laws, like the EU's General Data Protection Regulation (GDPR) and similar frameworks emerging in Asia and elsewhere, necessitate tailored compliance strategies for each region. This can lead to increased compliance costs but also provides opportunities for firms that can effectively manage these complexities. The Financial Stability Board (FSB) also plays a crucial role in coordinating international regulatory efforts, impacting areas from crypto-asset regulation to climate-related financial disclosures, which Daiwa must monitor and integrate into its global operations.

- Global Regulatory Alignment: Daiwa must comply with evolving international financial standards, such as Basel III capital requirements, which impact its global balance sheet management.

- Jurisdictional Divergence: Differences in regulations, for instance, data privacy laws like GDPR, require country-specific compliance measures, affecting operational costs and strategies.

- Coordination Efforts: International bodies like the Financial Stability Board (FSB) coordinate regulatory approaches, influencing areas from digital assets to sustainable finance, which Daiwa must actively track.

Daiwa Securities Group must navigate a complex web of securities laws, including Japan's Financial Instruments and Exchange Act, which governs issuance, trading, and disclosure. Compliance ensures fair markets and investor protection, impacting underwriting and brokerage activities. For instance, strict rules against insider trading and requirements for accurate prospectus disclosures are paramount.

The company also faces stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, necessitating robust Know Your Customer (KYC) procedures and transaction monitoring. In 2024, global financial institutions are significantly increasing investment in RegTech solutions to meet these evolving AML/CTF demands, highlighting the ongoing operational cost and strategic importance of compliance.

Data privacy laws, such as Japan's APPI and the EU's GDPR, dictate how Daiwa handles client information, with non-compliance carrying substantial penalties, up to 4% of global annual turnover for GDPR violations. This underscores the critical need for strong data protection to maintain client trust and corporate reputation.

International financial standards, like Basel III capital requirements, also shape Daiwa's global operations and capital allocation. The Financial Stability Board (FSB) coordinates regulatory efforts across jurisdictions, influencing areas from digital assets to climate-related disclosures, requiring continuous monitoring and adaptation by Daiwa.

Environmental factors

Daiwa Securities Group is navigating a landscape where environmental, social, and governance (ESG) factors are increasingly central to investment decisions. Regulatory bodies and investors alike are pushing for greater transparency and integration of ESG criteria, directly influencing Daiwa's asset management and investment banking operations.

This shift is fueling a significant demand for sustainable financial products. For instance, the global sustainable fund market saw substantial inflows in 2023, reaching trillions of dollars, and this trend is projected to continue into 2024 and 2025 as investors prioritize companies with strong ESG performance and seek out green bonds and other responsible financing options.

Daiwa Securities Group, like all financial institutions, faces growing pressure to quantify and report climate-related financial risks. This includes understanding how physical events, such as extreme weather impacting real estate collateral, and transition risks, like shifts away from fossil fuels affecting investment portfolios, could influence its financial stability.

In 2023, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations continued to shape reporting standards, with many global regulators mandating climate risk disclosures. Daiwa's integration of these assessments into its enterprise-wide risk management framework is crucial for investor confidence and regulatory compliance.

For instance, the increasing frequency and severity of climate-related disasters, evidenced by insured losses from natural catastrophes reaching an estimated $135 billion globally in 2023 according to Swiss Re, highlight the tangible physical risks that could impact Daiwa's asset valuations and loan portfolios.

Government and industry-led initiatives promoting green finance are creating significant new investment avenues for Daiwa Securities Group. For instance, the Japanese government's Green Growth Strategy aims to achieve carbon neutrality by 2050, which includes substantial investments in renewable energy and sustainable infrastructure, potentially worth trillions of yen in the coming years.

Daiwa's participation in and promotion of these green finance initiatives directly supports global sustainability objectives, such as those outlined in the Paris Agreement. The increasing demand for ESG (Environmental, Social, and Governance) investments, which saw global ESG assets reach an estimated $37.8 trillion in 2024, underscores the market's shift towards sustainable practices.

Corporate Environmental Responsibility

Societal expectations for companies to reduce their environmental footprint, such as carbon emissions and waste, significantly shape Daiwa Securities Group's operational practices and public perception. Demonstrating robust internal environmental stewardship is crucial for bolstering its reputation in the financial sector.

Daiwa Securities Group actively engages in initiatives to mitigate its environmental impact, aligning with growing stakeholder demands for corporate sustainability. This commitment is increasingly tied to financial performance and investor confidence.

- Carbon Footprint Reduction: Daiwa Securities Group is committed to reducing its greenhouse gas emissions, with specific targets set for its operations.

- Sustainable Finance: The firm is expanding its offerings in sustainable finance, including green bonds and ESG-focused investment products, reflecting market trends and client demand.

- Waste Management: Implementing comprehensive waste reduction and recycling programs across its offices is a key component of its environmental responsibility strategy.

- Environmental Reporting: Transparency in reporting environmental performance, including metrics on energy consumption and waste diversion, is a growing expectation from regulators and investors.

Shareholder Activism on Environmental Issues

Shareholder activism concerning environmental matters is increasingly shaping corporate behavior. This trend directly impacts Daiwa Securities Group, as investors are demanding greater accountability regarding environmental performance and climate change initiatives. For instance, in 2024, a significant portion of ESG-focused funds, which often drive shareholder proposals, saw substantial inflows, signaling strong investor appetite for sustainable practices.

This heightened activism compels Daiwa to set more ambitious sustainability goals and enhance the transparency of its environmental reporting. Such pressure influences not only Daiwa's internal corporate governance but also the investment decisions made by its clients and the companies within its investment portfolios. For example, many institutional investors now integrate climate risk assessments into their due diligence, directly affecting capital allocation and potentially impacting Daiwa's asset management business.

- Increased Investor Scrutiny: In 2024, reports indicated that over 70% of large institutional investors considered environmental factors when making investment decisions.

- Demand for Transparency: Shareholders are pushing for detailed disclosure of Scope 1, 2, and 3 emissions, as well as clear roadmaps for decarbonization.

- Influence on Governance: Activism can lead to changes in board composition and executive compensation tied to environmental, social, and governance (ESG) targets.

Environmental factors are increasingly shaping Daiwa Securities Group's operations and strategic direction, driven by global sustainability trends and regulatory pressures. The growing demand for green finance products, exemplified by the projected continued inflows into sustainable funds through 2025, presents significant opportunities for Daiwa. Furthermore, the tangible impacts of climate change, as seen in the $135 billion in global insured losses from natural catastrophes in 2023, underscore the need for robust climate risk management within financial institutions.

| Environmental Factor | Impact on Daiwa Securities Group | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Climate Risk & Disclosure | Need for integrating physical and transition risk assessments into risk management; enhanced transparency requirements. | TCFD recommendations widely adopted by regulators; increasing investor demand for climate disclosures. |

| Sustainable Finance Demand | Expansion of green bonds, ESG funds, and other sustainable investment products. | Global sustainable fund market inflows in trillions of dollars (2023), projected continued growth through 2025. |

| Physical Climate Impacts | Potential impact on asset valuations, loan portfolios, and real estate collateral due to extreme weather. | Estimated $135 billion in global insured losses from natural catastrophes in 2023. |

| Green Growth Initiatives | Opportunities in financing renewable energy and sustainable infrastructure projects. | Japan's Green Growth Strategy targeting carbon neutrality by 2050, with significant investment potential. |

| Shareholder Activism | Pressure for ambitious sustainability goals, transparent reporting, and ESG integration in investment decisions. | Over 70% of large institutional investors considered environmental factors in 2024; strong inflows into ESG funds. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Daiwa Securities Group is informed by a robust blend of official government publications, reports from international financial institutions like the IMF and World Bank, and reputable industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the financial services sector.