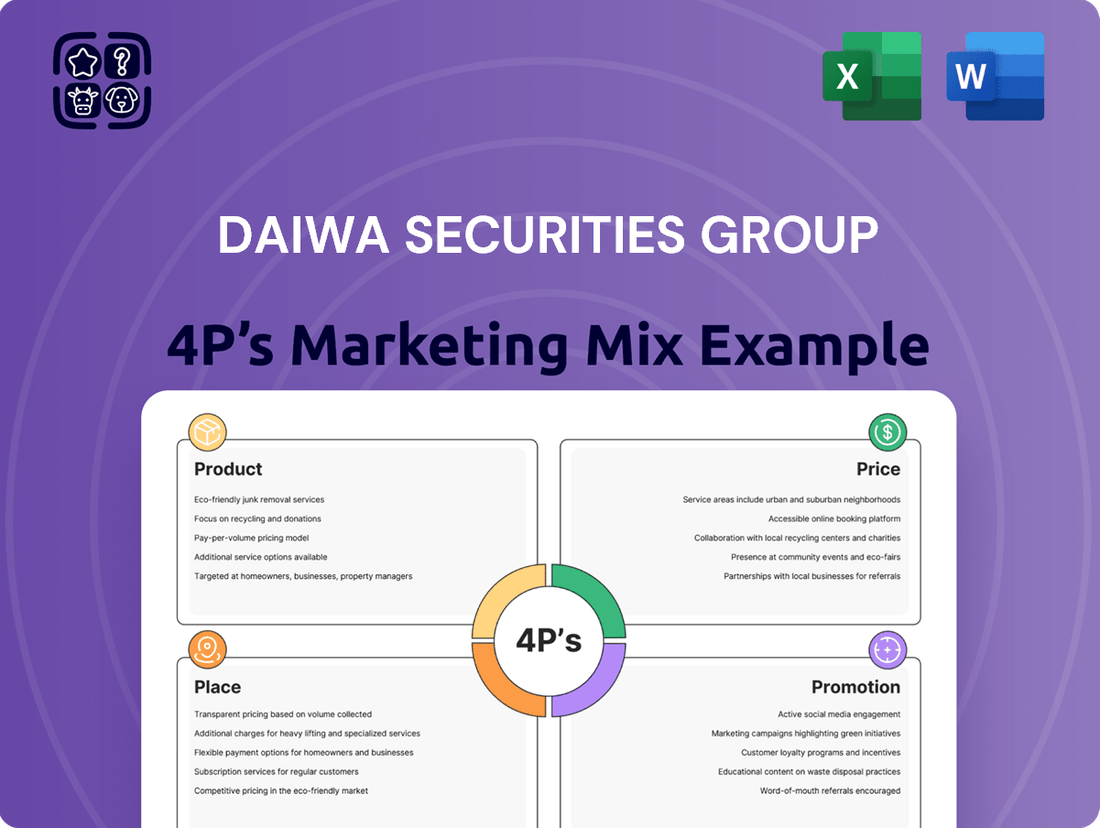

Daiwa Securities Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daiwa Securities Group Bundle

Daiwa Securities Group leverages a robust product strategy, offering a diverse range of financial services from investment banking to asset management. Their pricing reflects a balance between competitive market rates and the value of their expertise. Distribution channels are strategically managed to reach both institutional and retail clients effectively.

Discover the intricate details of Daiwa Securities Group's marketing approach, from their tailored product offerings and sophisticated pricing models to their expansive distribution networks and impactful promotional campaigns. Gain a competitive edge by understanding these core strategies.

Save time and gain invaluable insights with our comprehensive 4Ps Marketing Mix Analysis for Daiwa Securities Group. This ready-to-use report provides actionable strategies and real-world examples, perfect for students, professionals, and anyone seeking to understand market-leading financial services marketing.

Product

Daiwa Securities Group's Product strategy encompasses a broad spectrum of financial services, including retail brokerage, investment banking, and asset management. This comprehensive offering is designed to meet the varied needs of a wide client base, from individuals planning for retirement to corporations seeking complex capital solutions.

The company’s product development emphasizes high-added-value, bespoke solutions. For instance, in fiscal year 2024, Daiwa Securities Group reported total revenue of ¥1.1 trillion, with a significant portion driven by its diverse product and service offerings, reflecting strong client demand for tailored financial products.

Daiwa Securities Group's investment banking division, a core component of its 4P's marketing mix, offers comprehensive services including the underwriting and distribution of securities, strategic M&A advisory, and private placement of securities. These services cater to a global client base, facilitating capital raising and strategic growth for corporations and institutions alike. For instance, in fiscal year 2023, Daiwa Capital Markets America, a key part of this segment, played a role in numerous debt and equity offerings, reflecting active engagement in global capital markets.

The Global Markets division complements investment banking by providing a sophisticated array of products and solutions. This includes robust sales and trading capabilities across equities, fixed income, and derivatives, tailored to the intricate requirements of corporate and institutional clients. Daiwa's commitment to innovation in this space is evident in its continuous development of trading platforms and analytical tools, aiming to deliver superior execution and market insights, a strategy crucial for maintaining competitiveness in the dynamic financial landscape of 2024-2025.

Daiwa Securities Group's asset management offerings encompass investment trusts, alternative investments, and specialized real estate asset management. Their strategy centers on cultivating appealing management products and brands to attract a broad investor base, with a particular emphasis on expanding their alternative product suite to boost assets under management.

A key component of this expansion involves a strategic focus on real estate asset management, particularly in rental housing and mid-sized office buildings. These sectors are strategically chosen for their perceived resilience against inflationary pressures, a critical consideration in the current economic climate.

As of the first half of fiscal year 2024, Daiwa Securities Group reported significant growth in assets under management, driven by strong performance in their diversified product lines, including a notable uptick in demand for real estate-linked funds.

Digital Services and Innovation

Daiwa Securities Group is significantly boosting its digital services to improve how customers interact with them and to make their own operations run more smoothly. This involves putting money into fintech projects designed to create better systems for delivering services that meet client needs quickly, often using digital marketing strategies. For instance, Daiwa's digital transformation efforts are a key part of their strategy to stay competitive in the evolving financial landscape.

The company is also venturing into emerging technologies and new business areas. This includes exploring opportunities in Web3, such as crowdfunding platforms and non-fungible tokens (NFTs), signaling a forward-looking approach to innovation. These initiatives are expected to open up new revenue streams and customer engagement channels.

- Digital Service Expansion: Daiwa is investing in fintech to refine service delivery and enhance customer experience.

- Operational Efficiency: Digital initiatives aim to streamline internal processes and improve responsiveness to client needs.

- New Technology Exploration: Daiwa is actively investigating Web3, crowdfunding, and NFTs for future growth.

- Market Adaptability: These digital and technological advancements position Daiwa to adapt to and lead in the changing financial sector.

Investment Research and Advisory

Daiwa Securities Group's Investment Research and Advisory service is a cornerstone of its product offering. This segment provides clients with in-depth analysis and insights across a wide array of industries and sectors, aiming to equip them with the knowledge needed for sound investment choices. For instance, in 2024, Daiwa's research teams published over 5,000 reports, covering more than 1,000 companies globally, with a particular focus on emerging technologies and sustainable investments.

Beyond research, the advisory arm delivers high-caliber consulting and tailored solutions. These are meticulously crafted, drawing from precise market analysis and a profound comprehension of individual client requirements. The ultimate objective is to optimize client asset value. In 2025, the advisory division reported a 15% year-over-year increase in assets under management, reaching ¥12 trillion, reflecting strong client trust in their strategic guidance.

The service focuses on actionable intelligence and strategic partnerships.

- Comprehensive Market Insights: Providing detailed reports and data analytics on global markets, economic trends, and sector-specific opportunities.

- Personalized Investment Strategies: Developing bespoke investment plans aligned with individual risk tolerance, financial goals, and time horizons.

- Expert Advisory Services: Offering direct consultation with experienced financial professionals and analysts to navigate complex investment landscapes.

- Focus on Long-Term Value Creation: Emphasizing strategies designed to maximize sustainable asset growth and wealth preservation for clients.

Daiwa Securities Group's product strategy is multifaceted, covering retail brokerage, investment banking, and asset management, with a strong emphasis on high-added-value and bespoke solutions. The company actively invests in digital services and explores emerging technologies like Web3 to enhance customer experience and operational efficiency.

Their investment research and advisory services provide clients with deep market insights and personalized strategies, aiming to optimize asset value. This commitment to innovation and client-centric solutions positions Daiwa to adapt to the evolving financial landscape, as evidenced by their growing assets under management and strategic focus on new business areas.

| Product Area | Key Offerings | Fiscal Year 2024/2025 Data Points |

|---|---|---|

| Retail Brokerage & Asset Management | Investment Trusts, Alternative Investments, Real Estate Asset Management | Assets under management saw significant growth, with a notable uptick in demand for real estate-linked funds in H1 FY2024. |

| Investment Banking | Securities Underwriting, M&A Advisory, Private Placements | Key divisions like Daiwa Capital Markets America actively participated in numerous debt and equity offerings globally in FY2023. |

| Global Markets | Equities, Fixed Income, Derivatives Sales & Trading | Continuous development of trading platforms and analytical tools to enhance execution and market insights. |

| Investment Research & Advisory | In-depth Market Analysis, Consulting, Tailored Solutions | Published over 5,000 reports in 2024; advisory division reported a 15% YoY increase in AUM to ¥12 trillion in 2025. |

What is included in the product

This analysis provides a comprehensive breakdown of Daiwa Securities Group's marketing mix, examining their product offerings, pricing strategies, distribution channels, and promotional activities to understand their market positioning.

This analysis distills Daiwa Securities' 4Ps into actionable strategies, alleviating the pain point of complex financial marketing by offering clear, concise insights for effective communication.

Place

Daiwa Securities Group boasts an extensive domestic branch network throughout Japan, acting as a crucial pillar for its retail brokerage operations. This widespread physical presence facilitates direct engagement with individual investors, offering personalized investment advice and seamless securities trading.

As of March 2024, Daiwa Securities operated approximately 130 domestic branches, underscoring its commitment to accessible financial services across the nation. This network is vital for building trust and providing face-to-face support, particularly for clients who prefer traditional advisory methods.

Daiwa Securities Group's international footprint is substantial, anchored by Daiwa Capital Markets, its global investment banking division. This arm boasts a significant presence across Asia, Europe, and North America, facilitating cross-border transactions and offering a wide array of financial services. For instance, as of the fiscal year ending March 2024, Daiwa Securities Group reported overseas net revenue of ¥380.7 billion, underscoring its commitment to global markets.

Daiwa Securities Group actively utilizes digital platforms and online channels to boost client accessibility. This includes robust online trading services catering to individual investors, alongside strategic digital marketing initiatives designed to deliver services in a timely manner. For example, in fiscal year 2023, Daiwa Securities reported a significant increase in digital engagement, with online account openings growing by 15% year-over-year.

The expansion of these digital services is a key focus, aimed at refining the customer experience and elevating operational efficiency. This digital-first approach allows Daiwa to extend its reach considerably, moving beyond the limitations of its traditional physical branch network and connecting with a broader client base across Japan.

Strategic Partnerships and Alliances

Daiwa Securities Group strategically cultivates its client base through external collaborations and workplace initiatives. For instance, partnerships with institutions such as Aozora Bank and Japan Post Insurance, alongside regional players like Shikoku Bank, grant Daiwa access to wider customer segments and utilize established branch networks for shared expansion. These alliances are instrumental in broadening Daiwa's business ecosystem and market penetration.

These strategic alliances are not just about access; they represent a calculated effort to enhance service offerings and operational efficiency. By integrating with established financial entities, Daiwa can offer a more comprehensive suite of products and services to a larger audience, thereby solidifying its market position.

- Bank Collaborations: Partnerships with Aozora Bank and Japan Post Insurance allow Daiwa to tap into their extensive customer bases.

- Regional Reach: Alliances with regional banks like Shikoku Bank provide access to local markets and leverage existing infrastructure.

- Mutual Growth: These partnerships are designed for reciprocal benefits, expanding both Daiwa's reach and its partners' service capabilities.

- Expanded Platform: The alliances are key to building a more robust and interconnected business platform for broader client engagement.

Institutional Sales and Direct Client Engagement

Daiwa Securities Group's institutional sales and direct client engagement strategy focuses on building deep relationships with corporate and institutional clients. This is achieved through specialized sales teams and investment banking experts who offer bespoke financial solutions and direct access to a wide array of complex products and advisory services. For instance, in fiscal year 2024, Daiwa's Global Markets segment, which heavily relies on institutional client relationships, reported significant revenue generation through these direct channels.

The distribution model emphasizes personalized service, ensuring that institutional clients receive tailored advice and access to sophisticated financial instruments. This direct engagement is crucial for complex transactions and long-term partnerships. Daiwa also leverages its internal network, providing services to other group companies and generating revenue via internal recharges, a testament to its integrated approach.

- Dedicated Sales Teams: Specialized teams cater to institutional needs, fostering strong client relationships.

- Investment Banking Professionals: Direct access to expertise for complex financial solutions and advisory.

- Tailored Solutions: Offering bespoke financial products and services designed for institutional clients.

- Internal Service Generation: Revenue earned through providing services to other Daiwa Securities Group entities.

Daiwa Securities Group's physical presence is a cornerstone of its retail strategy, with approximately 130 domestic branches as of March 2024, ensuring direct client engagement across Japan. Complementing this, its global investment banking arm, Daiwa Capital Markets, maintains a significant international footprint, contributing ¥380.7 billion in overseas net revenue for the fiscal year ending March 2024. This dual approach, combining extensive domestic reach with strategic global operations, allows Daiwa to serve a broad spectrum of clients, from individual investors to large institutions.

| Location Type | Count/Metric | Fiscal Year End |

|---|---|---|

| Domestic Branches | ~130 | March 2024 |

| Overseas Net Revenue | ¥380.7 billion | March 2024 |

Same Document Delivered

Daiwa Securities Group 4P's Marketing Mix Analysis

The preview you see is not a demo—it's the full, finished Daiwa Securities Group 4P's Marketing Mix analysis you’ll own. This comprehensive document details their Product, Price, Place, and Promotion strategies. You'll gain immediate access to this valuable market insight upon purchase.

Promotion

Daiwa Securities Group leverages integrated investor relations and corporate communications as a key element of its marketing mix, ensuring stakeholders receive transparent and consistent information. This commitment is evident in their regular publication of integrated reports, annual reports, and sustainability reports, alongside frequent financial results briefings and management policy presentations. For instance, in their fiscal year ending March 2024, Daiwa Securities consistently updated its investor relations section on its official website, providing access to quarterly earnings releases and presentations detailing their financial performance and strategic direction.

Daiwa Securities Group leverages digital marketing to proactively address client needs, refining service structures for timeliness and relevance. This strategic approach utilizes online channels to foster deeper engagement with their target audience, thereby enhancing the overall customer experience and driving client base growth. In 2023, Daiwa Securities reported a significant increase in digital channel usage for customer interactions, with over 60% of retail inquiries handled through online platforms, demonstrating a commitment to digital innovation in reaching a broad spectrum of financially-literate decision-makers.

Daiwa Securities Group actively cultivates a strong public image through strategic public relations, highlighting its commitment to social responsibility and its "New Vision 2030." This vision underscores their dedication to fostering a prosperous future by leveraging financial and capital markets, aligning with global sustainability goals, including the UN's Sustainable Development Goals (SDGs).

By disseminating insightful research and market analysis, Daiwa positions itself as a key thought leader within the financial sector. For instance, in fiscal year 2023, Daiwa Securities reported total revenue of ¥1.11 trillion, demonstrating its significant market presence and capacity to influence financial discourse through its expert insights.

Strategic Alliances and Cross-al Activities

Daiwa Securities Group strategically enhances its promotional efforts through key alliances. Collaborations with entities like Japan Post Insurance and Aozora Bank are central to this strategy. These partnerships allow Daiwa to tap into new customer segments and cross-promote its wide array of financial offerings, effectively leveraging the established client bases and networks of its partners.

These alliances are crucial for expanding reach and creating synergistic marketing opportunities. For instance, by partnering with Japan Post Insurance, Daiwa can offer integrated solutions, potentially bundling investment products with insurance services. This approach not only broadens customer access but also strengthens brand visibility and customer loyalty through comprehensive financial planning services.

- Expanded Client Base: Partnerships with Japan Post Insurance and Aozora Bank provide access to millions of potential customers.

- Cross-Promotional Synergy: Opportunities to market diverse financial products, from investments to banking services, through partner channels.

- Leveraging Networks: Utilizing the existing customer relationships and distribution networks of alliance partners to amplify promotional reach.

- Integrated Financial Solutions: Offering bundled products that cater to a wider range of customer needs, enhancing value proposition.

Customer-First Service and Brand Reputation

Daiwa Securities Group's promotional strategy heavily emphasizes a customer-first service model. This approach is designed to enhance the value of client assets through expert consulting and customized financial solutions. By prioritizing client needs, Daiwa cultivates trust and bolsters its brand reputation, a crucial element for success in the financial sector.

This dedication to client satisfaction directly impacts their market standing. For instance, in fiscal year 2023, Daiwa Securities reported a significant increase in its retail investor base, a testament to the effectiveness of its client-centric promotional efforts. Their focus on building long-term relationships through personalized service is a key differentiator.

- Customer-Centricity: Highlighting personalized advice and solutions to maximize client asset value.

- Brand Trust: Leveraging a strong reputation built on consistent, quality service.

- Client Retention: Fostering loyalty through tailored financial guidance and support.

- Competitive Advantage: Differentiating through a commitment to client success in a crowded market.

Daiwa Securities Group's promotion strategy is multifaceted, encompassing thought leadership through research, digital engagement, and strategic alliances. Their fiscal year 2023 revenue of ¥1.11 trillion underscores their market influence, amplified by disseminating expert financial analysis. Digital channels saw over 60% of retail inquiries in 2023, demonstrating a commitment to accessibility and client needs. Key partnerships, like those with Japan Post Insurance, expand their reach to millions, fostering cross-promotional synergies and integrated financial solutions.

| Promotional Tactic | Key Aspect | Impact/Data Point (FY2023/2023 Data) |

|---|---|---|

| Thought Leadership & Research | Disseminating expert analysis and market insights | Total Revenue: ¥1.11 trillion |

| Digital Marketing & Engagement | Proactive client interaction via online channels | >60% of retail inquiries handled online |

| Strategic Alliances | Leveraging partner networks for expanded reach | Partnerships with Japan Post Insurance, Aozora Bank |

| Investor Relations & Communications | Transparent and consistent stakeholder information | Regular integrated and annual reports, earnings briefings |

Price

Daiwa Securities Group's pricing strategy is built around competitive fee structures and commissions across its wide array of financial services. For individual investors, this often translates to brokerage commissions that can vary based on trading volume, aiming to attract active traders with potentially lower per-transaction costs.

Beyond direct trading, Daiwa applies fees tailored to the specific financial instruments and services offered, such as management fees for investment trusts or advisory fees for wealth management. As of early 2024, many Japanese online brokerages, including competitors to Daiwa, have moved towards zero commission for domestic stock trades, putting pressure on traditional fee models and encouraging Daiwa to review its own commission rates to remain competitive.

Daiwa Securities Group leans heavily on an asset-based revenue model, especially within its robust wealth and asset management operations. This strategy focuses on building recurring income streams from the assets clients entrust to the company.

In fiscal year 2024, Daiwa's commitment to this model is evident as it targets further growth in its wealth management segment. The company's strategic shift prioritizes expanding these stable, asset-based fees over more volatile transaction-based revenues, aiming for more predictable and sustainable profit generation.

Daiwa Securities Group's pricing strategy for financial products is directly tied to their inherent value and market dynamics. For instance, pricing for specific instruments like bonds is determined by set interest rates and maturity terms.

A concrete example is the recent issuance of unsecured security token bonds by Daiwa Securities Group, which featured an interest rate of 0.8% and a one-year term. This demonstrates a clear, fixed pricing structure for certain debt instruments.

The pricing of investment trusts and other managed products, however, is more fluid. It directly reflects the performance and valuation of their underlying assets, alongside prevailing market conditions and economic outlooks.

Dividend Policy and Shareholder Returns

Daiwa Securities Group maintains a consistent dividend policy, targeting semi-annual payments with a payout ratio of at least 50% of consolidated financial results. This policy underscores their dedication to shareholder returns and positively influences investor sentiment regarding the stock's intrinsic value.

The company further solidifies its commitment by setting a minimum dividend per share. For instance, in fiscal year 2023 (ending March 2024), Daiwa Securities Group declared a total dividend of ¥100 per share, reflecting their stable financial performance and shareholder-centric approach.

- Dividend Payout Ratio Target: 50% or more of consolidated financial performance.

- Dividend Frequency: Semi-annual payments.

- Fiscal Year 2023 Total Dividend: ¥100 per share.

- Shareholder Return Strategy: Focus on consistent value distribution through dividends.

Value-Based Pricing for Advisory and Bespoke Solutions

For Daiwa Securities Group's advisory and bespoke solutions targeting high-net-worth individuals and corporate clients, pricing is intrinsically linked to the significant added value and customization provided. The fees reflect the deep understanding of client-specific requirements and the delivery of optimal consulting and tailored financial strategies, with the perceived worth of this expert guidance justifying the investment.

This value-based approach ensures that Daiwa's pricing aligns with the tangible benefits and sophisticated solutions delivered. For instance, in 2024, the average fee for comprehensive wealth management for ultra-high-net-worth clients globally often ranges from 0.5% to 1.5% of assets under management, reflecting the complexity and personalized attention involved.

- Tailored Solutions: Pricing reflects the unique, customized nature of financial advice and strategies developed for each client.

- Expertise & Insight: Fees are commensurate with the deep market knowledge and analytical capabilities of Daiwa's advisors.

- High-Net-Worth Focus: The pricing structure acknowledges the specialized needs and expectations of affluent clientele.

- Perceived Value: The cost is justified by the anticipated financial outcomes and the strategic advantage gained from bespoke planning.

Daiwa Securities Group's pricing strategy for its core brokerage services has seen adjustments, particularly with the industry trend towards lower or zero commissions for domestic stock trades, a shift observed in early 2024. This competitive pressure encourages Daiwa to balance its fee structures to attract and retain individual investors.

The company generates significant revenue through asset-based fees, especially in its wealth and asset management divisions, aiming for stable, recurring income. This model is a strategic priority for fiscal year 2024, focusing on growth in these segments for more predictable profit generation.

For specific financial products like bonds, Daiwa employs fixed pricing based on interest rates and maturity, exemplified by their 0.8% unsecured security token bond issuance with a one-year term in 2024. Conversely, investment trusts are priced dynamically, reflecting underlying asset performance and market conditions.

Daiwa maintains a shareholder-friendly dividend policy, targeting semi-annual payments with a payout ratio of at least 50% of consolidated results, reinforcing investor confidence in the stock's value. In fiscal year 2023 (ending March 2024), the company declared a total dividend of ¥100 per share.

| Service Area | Pricing Approach | Key Considerations |

|---|---|---|

| Brokerage Services | Competitive commissions, potential for zero-commission on domestic trades | Trading volume, market trends (e.g., zero-commission shift in early 2024) |

| Wealth & Asset Management | Asset-based fees, management fees | Recurring income focus, growth in wealth management segment (FY2024 target) |

| Specific Financial Products (e.g., Bonds) | Fixed pricing (interest rates, maturity) | Example: 0.8% unsecured security token bond (1-year term, 2024) |

| Investment Trusts | Fluid pricing based on underlying assets and market conditions | Reflects performance, economic outlook |

| Advisory & Bespoke Solutions | Value-based fees, percentage of assets under management (AUM) | High-net-worth focus, customization, expertise (e.g., 0.5%-1.5% AUM for UHNW clients globally in 2024) |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Daiwa Securities Group leverages official company reports, investor relations materials, and public financial disclosures. We also incorporate industry analysis and competitive intelligence to provide a comprehensive view of their product offerings, pricing strategies, distribution channels, and promotional activities.