Daiwa Securities Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daiwa Securities Group Bundle

Unlock the strategic blueprint of Daiwa Securities Group's success with our comprehensive Business Model Canvas. Discover how they cultivate customer relationships, leverage key resources, and generate revenue in the dynamic financial sector.

Dive into the core of Daiwa Securities Group's operations with our detailed Business Model Canvas. This essential tool breaks down their value propositions, customer segments, and revenue streams, offering invaluable insights for strategic planning.

See how Daiwa Securities Group thrives by understanding their cost structure, key activities, and channels. Our full Business Model Canvas provides a clear, actionable roadmap to their market position.

Ready to gain a competitive edge? Download the complete Business Model Canvas for Daiwa Securities Group and access a professional, in-depth analysis of their business strategy, perfect for investors and strategists.

Partnerships

Daiwa Securities Group actively cultivates strategic alliances with financial institutions that command substantial customer bases, exemplified by its partnerships with Aozora Bank and Japan Post Insurance. These collaborations are designed to broaden Daiwa's operational reach and bolster its asset management expertise.

Through these alliances, Daiwa aims to synergize with partners to deliver a more comprehensive suite of financial products and services. This expansion is particularly focused on high-growth areas such as wealth management and alternative investments, leveraging the combined strengths and customer access of each entity.

Daiwa Securities Group actively cultivates emerging asset managers through initiatives like the Daiwa EMP Private Fund 1 L.P. This program injects crucial seed capital and provides access to the specialized knowledge of Daiwa Corporate Investment and Daiwa Fund Consulting.

This strategic collaboration is designed to broaden the group's investment horizons and enrich its product offerings. By supporting new talent, Daiwa aims to foster innovation and contribute to a more dynamic capital market landscape.

Daiwa Securities Group actively invests in technology and research, with a significant focus on fintech solutions and digital platforms to drive innovation. This strategic approach highlights their reliance on external technology providers and emerging fintech startups to refine their service offerings and boost operational efficiency. For instance, in fiscal year 2023, Daiwa reported substantial investments in digital transformation initiatives, underscoring the critical role of these partnerships.

Real Estate Partnerships

Daiwa Real Estate Asset Management actively cultivates relationships with a diverse group of partners to bolster the long-term value of its investment vehicles. These collaborations extend to unitholders, who provide capital, and tenants, who generate rental income, forming the bedrock of property performance. Furthermore, engagement with local communities is crucial for sustainable development and property appreciation.

A prime example of these partnerships in action is the property acquisition activities undertaken by entities such as Daiwa Office Investment Corporation. In fiscal year 2023, Daiwa Office Investment Corporation completed several strategic acquisitions, including the acquisition of a prime office building in Tokyo for approximately ¥25 billion, demonstrating the tangible outcomes of these key relationships.

- Unitholders: Providing essential capital for investment and growth.

- Tenants: Generating stable rental income and driving property occupancy rates.

- Local Communities: Fostering positive relationships for long-term property value enhancement and social responsibility.

- Property Developers & Sellers: Enabling strategic acquisitions and portfolio expansion, such as the 2023 acquisitions by Daiwa Office Investment Corporation.

Global Market Collaborations

Daiwa Securities Group actively cultivates global market collaborations to expand its operational footprint and service capabilities. A prime example is its strategic partnership with Value Partners in Hong Kong. This alliance is designed to significantly deepen their collaboration in asset management, a move aimed at fueling business growth through effective cross-selling initiatives and the joint development of innovative products tailored for the dynamic Asian markets.

These partnerships are crucial for Daiwa’s business model, allowing it to leverage the expertise and market access of its collaborators. For instance, by joining forces with Value Partners, Daiwa can tap into established networks and product suites, thereby enhancing its competitive edge. Such alliances are particularly vital in the fast-evolving financial landscape, enabling quicker adaptation to market trends and client needs across diverse geographies.

The financial impact of such collaborations can be substantial. While specific figures for the Value Partners collaboration are proprietary, similar strategic alliances in the asset management sector have historically driven significant revenue growth. For example, in 2023, the global asset management industry saw continued inflows, with strategic partnerships often playing a key role in capturing market share. Daiwa’s focus on Asia, a region experiencing robust economic growth, positions these partnerships for considerable success.

- Strategic Alliance: Collaboration with Value Partners in Hong Kong to enhance asset management capabilities.

- Growth Drivers: Focus on cross-selling and joint product development across Asian markets.

- Market Expansion: Leveraging partnerships to broaden global reach and service offerings.

- Industry Context: Aligning with trends in asset management where strategic partnerships are key to growth.

Daiwa Securities Group's key partnerships are vital for expanding its reach and enhancing its service offerings. Collaborations with financial institutions like Aozora Bank and Japan Post Insurance broaden its customer base and asset management expertise. Strategic alliances with emerging asset managers, such as through the Daiwa EMP Private Fund 1 L.P., inject capital and provide specialized knowledge, fostering innovation in the capital markets.

| Partner Type | Key Role | Example/Benefit | Fiscal Year Data (2023) |

|---|---|---|---|

| Financial Institutions | Customer base expansion, asset management enhancement | Aozora Bank, Japan Post Insurance | N/A (Ongoing strategic focus) |

| Emerging Asset Managers | Seed capital, knowledge access, product diversification | Daiwa EMP Private Fund 1 L.P. | N/A (Programmatic support) |

| Technology Providers | Fintech solutions, digital platform enhancement | Various fintech startups | Substantial investments in digital transformation initiatives |

| Global Partners | Market expansion, asset management collaboration | Value Partners (Hong Kong) | N/A (Focus on Asian markets) |

What is included in the product

Daiwa Securities Group's Business Model Canvas outlines its strategy of providing comprehensive financial services to diverse customer segments, leveraging its extensive distribution channels and robust value propositions. It details key resources, activities, and partnerships essential for its operations, supported by a clear revenue model and cost structure.

Daiwa Securities Group's Business Model Canvas offers a high-level, editable view of their financial services, effectively relieving the pain point of complex strategy by providing a clear, one-page snapshot of core components for quick understanding and adaptation.

Activities

Daiwa Securities Group's investment banking arm is a cornerstone of its operations, offering a full suite of services crucial for corporate finance. This includes the underwriting of securities, facilitating mergers and acquisitions (M&A), and managing private placements. These activities are vital for companies looking to raise capital or restructure through strategic transactions.

In 2023, Daiwa Securities' investment banking segment demonstrated robust performance. The firm was a lead underwriter in numerous equity and debt offerings, contributing to a substantial portion of its overall revenue. For instance, Daiwa played a key role in several high-profile IPOs and follow-on offerings, underscoring its market presence and client trust.

Daiwa Securities Group's asset management and advisory services are a cornerstone of their business. This includes the creation and ongoing management of investment trusts, catering to a wide range of investor needs.

Beyond retail investment products, Daiwa also excels in providing sophisticated investment advisory and management for significant pools of capital, such as pension assets and alternative investments. Their focus is on leveraging advanced investment strategies to enhance client wealth.

In 2024, Daiwa Asset Management, a key subsidiary, managed a substantial amount of assets under management, demonstrating their significant market presence and client trust. This robust AUM underscores their capability in delivering high-value-added investment solutions and expert advisory services.

Daiwa Securities Group maintains a strong retail brokerage presence, enabling individual investors to trade securities. In fiscal year 2023, their retail segment played a crucial role in customer acquisition and transaction volume.

The company actively strengthens its wealth management arm by offering tailored consulting and exclusive financial products. This focus aims to provide bespoke solutions that cater to the unique needs and financial goals of each client, enhancing customer loyalty and asset growth.

Proprietary Trading and Global Markets Operations

Daiwa Securities Group actively participates in proprietary trading and global markets operations, a core activity that diversifies its revenue. This involves the buying and selling of various securities and derivatives across international exchanges. The firm leverages its market insights and risk management expertise to generate income from these transactions.

In 2024, Daiwa's global markets segment demonstrated robust performance, contributing significantly to the group's overall financial results. For instance, their trading revenues are a vital component of their income, alongside investment banking and asset management. The firm's ability to navigate complex global financial landscapes is crucial for its success in this area.

- Proprietary Trading: Daiwa engages in trading activities to generate profits from market movements, managing a diverse portfolio of financial instruments.

- Global Markets Operations: This encompasses trading across various asset classes and geographies, including equities, fixed income, and foreign exchange.

- Risk Management: A critical aspect is the sophisticated management of market risks inherent in trading operations to protect capital.

- Revenue Diversification: Proprietary trading and global markets activities provide a substantial and dynamic revenue stream for Daiwa Securities Group.

Investment Research and Analysis

Daiwa Securities Group's core activity involves rigorous investment research and analysis. They operate as a think tank, generating timely and high-quality information to guide clients' investment choices. This commitment to deep analysis underpins their role in fostering economic growth and societal development.

This research function is critical for Daiwa's value proposition. For instance, in fiscal year 2023, Daiwa Securities' research division published numerous reports across various asset classes, covering over 1,000 companies. Their analysts specialize in sectors ranging from technology to healthcare, providing detailed insights into market trends and company performance.

- In-depth Market Analysis: Daiwa's analysts provide comprehensive reports on global economic conditions, industry trends, and macroeconomic factors impacting investment portfolios.

- Company-Specific Valuations: They conduct detailed financial modeling and valuation of individual companies, utilizing discounted cash flow (DCF) analysis and other methodologies to assess intrinsic value.

- Sector Expertise: Dedicated teams focus on specific sectors, offering specialized knowledge and identifying emerging opportunities or risks within those industries.

- Timely Information Dissemination: Research findings are delivered to clients promptly through various channels, including online platforms, client meetings, and publications, ensuring informed decision-making.

Daiwa Securities Group's key activities revolve around facilitating capital markets transactions through investment banking, managing assets for diverse clients, and providing robust retail brokerage services. They also actively engage in global markets operations and proprietary trading, underpinned by extensive investment research and analysis.

Delivered as Displayed

Business Model Canvas

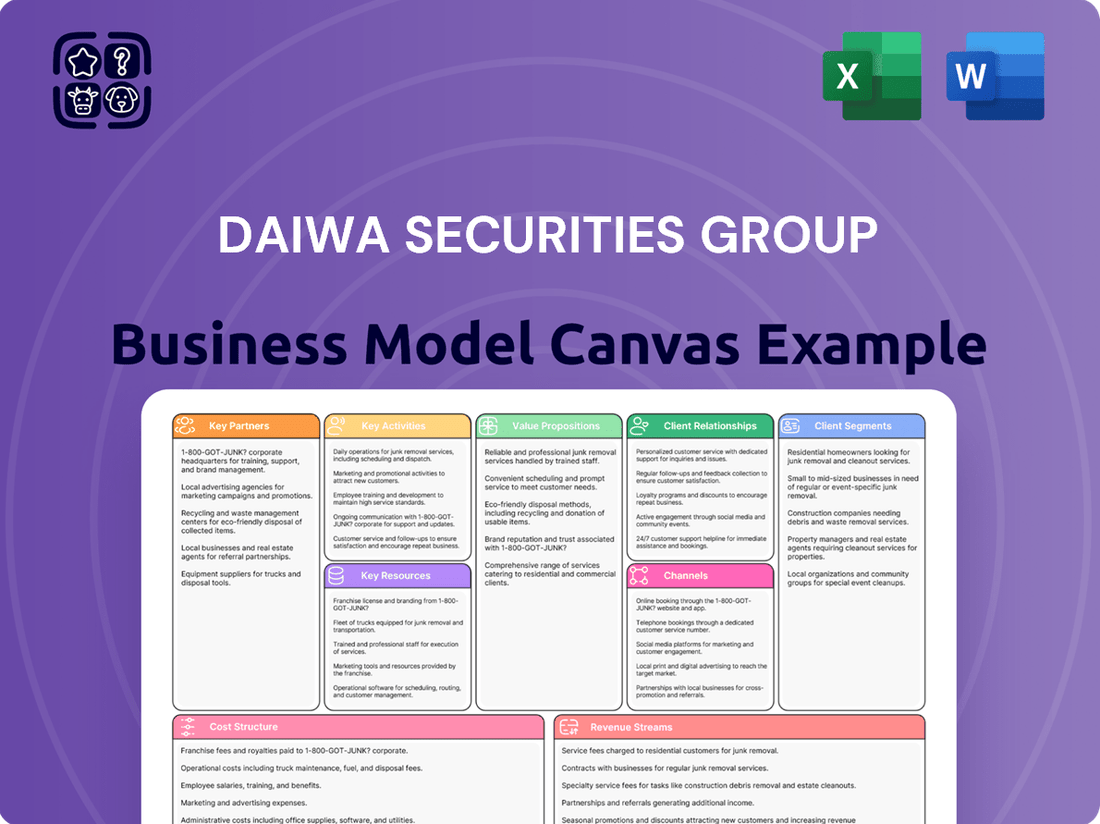

This preview showcases the actual Daiwa Securities Group Business Model Canvas you will receive upon purchase. You are seeing a direct representation of the final document, with no alterations or placeholder content. Once your order is complete, you will gain full access to this exact, professionally structured Business Model Canvas, ready for immediate use and analysis.

Resources

Daiwa Securities Group leverages significant financial capital and maintains robust liquidity, essential for its diverse securities operations. This strong financial footing, evidenced by solid liquidity coverage and stable funding ratios as reported for FY 2024, underpins its capacity for trading, underwriting, and investment activities.

Daiwa Securities Group's human capital is paramount, featuring highly skilled financial professionals. This includes analysts, advisors, portfolio managers, and investment bankers, all crucial to delivering specialized financial services.

Their deep expertise across diverse financial sectors, coupled with a strong client-centric philosophy, directly fuels the group's value proposition. For instance, in fiscal year 2023, Daiwa Securities reported a significant increase in its workforce, reflecting ongoing investment in talent acquisition and development.

Daiwa Securities Group heavily invests in proprietary technology, including cutting-edge fintech solutions and AI-driven tools, to boost operational efficiency and client satisfaction. These advancements are crucial for delivering superior service and developing innovative offerings, such as next-generation mobile trading applications.

In 2024, Daiwa continued its focus on digital transformation, with significant allocations towards enhancing its digital platforms. This strategic investment aims to streamline processes, personalize client interactions, and expand its reach in the evolving financial landscape, ensuring competitiveness and future growth.

Extensive Client Base and Network

Daiwa Securities Group's extensive client base is a cornerstone of its business model, providing access to a wide array of financial needs and opportunities. This diverse clientele includes millions of individual investors, substantial institutional investors such as pension funds and asset managers, and numerous corporations requiring sophisticated financial services. In 2024, Daiwa continued to leverage this broad reach, with its retail segment alone serving a significant portion of Japan's individual savers.

The company's established network and deep-rooted relationships are critical assets that fuel its various operational segments. This network is instrumental in driving business across its retail operations, where it connects with individual savers, as well as its wholesale activities, which involve underwriting and trading for corporate clients. Furthermore, this robust client network directly supports the asset management division by providing a consistent flow of capital and diverse investment mandates.

- Broad Client Spectrum: Serves millions of individual investors, major institutional players, and corporate entities.

- Network Synergy: Relationships are vital for retail, wholesale, and asset management operations.

- 2024 Impact: Continued strong engagement with individual investors in the Japanese market.

Brand Reputation and Trust

Daiwa Securities Group's brand reputation and trust are cornerstones of its business model, built on a legacy dating back to 1902. This long-standing history as a premier Japanese financial services provider fosters significant client confidence and loyalty in a highly competitive landscape. This intangible asset is critical for attracting and retaining customers.

The firm's established presence and consistent performance have cultivated a strong brand image, which directly translates into client acquisition and retention. In 2024, maintaining this trust is paramount, especially as financial markets evolve.

- Established History: Founded in 1902, providing over a century of financial expertise.

- Market Leadership: Recognized as one of Japan's leading financial services firms.

- Client Trust: A crucial intangible asset for attracting and retaining business.

- Competitive Advantage: Strong brand image differentiates Daiwa in the global market.

Daiwa Securities Group's key resources encompass its substantial financial capital, a highly skilled workforce of financial professionals, advanced proprietary technology, a vast and diverse client base, and a deeply ingrained brand reputation built over a century. These elements are fundamental to its ability to deliver comprehensive financial services and maintain market leadership.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Financial Capital | Robust liquidity and strong financial footing for trading and investment. | Underpinned by solid liquidity coverage and stable funding ratios reported for FY 2024. |

| Human Capital | Highly skilled analysts, advisors, portfolio managers, and investment bankers. | Significant workforce increase in FY 2023 reflects ongoing investment in talent. |

| Proprietary Technology | Fintech solutions and AI-driven tools for efficiency and client satisfaction. | Continued focus on digital transformation and enhancing mobile trading applications in 2024. |

| Client Base | Millions of individual investors, institutional investors, and corporations. | Retail segment serving a significant portion of Japan's individual savers in 2024. |

| Brand Reputation | Legacy dating back to 1902, fostering client confidence and loyalty. | Maintained trust is paramount in evolving financial markets throughout 2024. |

Value Propositions

Daiwa Securities Group's value proposition in Comprehensive Financial Solutions is built on its expansive service offerings. This includes robust investment banking, sophisticated asset management, and accessible retail brokerage, creating a singular platform for clients to address all their financial requirements.

This integrated model is designed to serve a broad clientele, from individual investors to large institutions, offering them a unified and efficient way to manage their wealth and investments. For instance, Daiwa's asset management arm reported ¥62.5 trillion in assets under management as of March 31, 2024, highlighting its significant reach.

Daiwa Securities Group's core mission centers on maximizing customer asset value. They accomplish this by providing precisely tailored solutions that adapt to evolving economic conditions and each client's unique circumstances.

This commitment is realized through a deep understanding of client needs, allowing them to offer high-value-added products and services. For instance, in 2024, Daiwa's wealth management segment reported a significant increase in assets under management, reflecting successful strategies in enhancing client portfolio performance.

Clients of Daiwa Securities Group gain a significant edge through our profound market understanding and extensive investment research capabilities. This expertise translates into data-driven decision-making for our clients, empowering them with sophisticated financial insights that refine their investment strategies.

Our commitment to rigorous research is a cornerstone of our value proposition. For instance, Daiwa Securities' analysts cover over 1,000 stocks, providing detailed reports and forecasts that inform investment choices. This dedication ensures clients receive actionable intelligence, enabling them to navigate complex markets with confidence.

Innovative Products and Digital Accessibility

Daiwa Securities Group is actively developing and offering a range of innovative financial products, notably expanding into alternative assets to provide clients with more diverse investment avenues. This strategic move aims to capture growth opportunities beyond traditional markets.

To bolster user engagement and reach, Daiwa is significantly enhancing its digital platforms. This includes the rollout of advanced mobile trading applications and the creation of highly customizable investment solutions designed to meet individual client needs.

In 2023, Daiwa Securities reported a net revenue of ¥715.6 billion, with a focus on digital transformation contributing to client acquisition and service delivery improvements. The company has invested heavily in technology to support these digital initiatives.

- Digital Expansion: Launch of new mobile trading apps and enhanced online platforms.

- Product Innovation: Introduction of alternative asset products and tailored investment solutions.

- Client Accessibility: Increased focus on user experience and digital service delivery.

- Financial Performance: Continued investment in technology to support digital growth and revenue generation.

Reliability and Financial Stability

Daiwa Securities Group prioritizes reliability and financial stability, underscored by its robust liquidity management and consistently strong financial performance. This focus provides clients with a high degree of confidence in the firm's stability and its capacity for operational resilience, even in volatile market conditions.

This unwavering commitment to financial soundness serves as a crucial differentiator within the competitive financial services landscape. As of the first quarter of 2024, Daiwa Securities Group reported a consolidated net income of ¥103.2 billion, demonstrating sustained profitability and a solid financial footing.

- Strong Capital Adequacy: Maintaining high capital ratios provides a substantial buffer against unexpected market downturns.

- Robust Liquidity Reserves: Significant liquid assets ensure the ability to meet financial obligations promptly.

- Consistent Profitability: Demonstrated by ¥103.2 billion in consolidated net income for Q1 2024, highlighting operational strength.

- Risk Management Framework: Advanced systems are in place to identify, assess, and mitigate financial risks effectively.

Daiwa Securities Group empowers clients with a holistic financial ecosystem, integrating investment banking, asset management, and retail brokerage for comprehensive wealth management. This unified approach streamlines financial activities, offering clients a single point of access for diverse needs.

The group's value proposition is anchored in maximizing client asset value through bespoke solutions that adapt to market shifts and individual circumstances. This client-centric philosophy ensures tailored strategies designed for optimal financial outcomes.

Daiwa provides a distinct competitive advantage through its deep market insights and extensive research capabilities, equipping clients with data-driven intelligence for refined investment strategies.

The firm actively innovates by expanding into alternative assets and enhancing digital platforms, including advanced mobile trading, to offer diverse investment avenues and improve client accessibility.

| Value Proposition Component | Key Offering | Supporting Data (as of March 31, 2024, unless otherwise noted) |

|---|---|---|

| Comprehensive Financial Solutions | Integrated Investment Banking, Asset Management, Retail Brokerage | ¥62.5 trillion in assets under management (Asset Management) |

| Maximizing Client Asset Value | Tailored Investment Strategies, High-Value-Added Products | Reported significant increase in wealth management AUM in 2024 |

| Market Insight & Research | Data-Driven Decision Making, Actionable Intelligence | Analysts cover over 1,000 stocks |

| Innovation & Digitalization | Alternative Assets, Advanced Mobile Trading Apps | Net revenue of ¥715.6 billion in 2023, with tech investment |

| Financial Stability & Reliability | Robust Liquidity Management, Strong Capital Adequacy | Consolidated net income of ¥103.2 billion in Q1 2024 |

Customer Relationships

Daiwa Securities Group excels in personalized consulting and advisory, especially within wealth management. They deeply understand client needs to offer tailored products and solutions for high-net-worth individuals and corporations.

In 2024, Daiwa continued to emphasize this, with their private wealth management segment reporting robust growth, reflecting the success of their bespoke client approaches. This focus allows them to build strong, lasting relationships by delivering precisely what each client requires.

Daiwa Securities Group prioritizes client satisfaction through dedicated support teams, ensuring quick responses and high-quality service. This focus strengthens long-term relationships and boosts client loyalty.

Daiwa Securities Group is significantly enhancing its digital engagement by expanding mobile trading apps and online platforms. This strategic move provides clients with convenient self-service options, allowing them to manage investments and access information anytime, anywhere. This focus on digital interaction is crucial for meeting the evolving preferences of modern investors.

Community and Stakeholder Engagement

Daiwa Securities Group actively cultivates strong connections with its broader community and various stakeholders, extending beyond its direct client base. This commitment is a cornerstone of their sustainability strategy and reflects a deep-seated dedication to corporate social responsibility.

These engagement efforts are vital for fostering trust and ensuring long-term viability. For instance, in fiscal year 2023, Daiwa invested in numerous community support programs and environmental initiatives, underscoring their proactive approach to social contribution.

- Community Investment: Daiwa's commitment to local communities is demonstrated through financial contributions and volunteer efforts, supporting social welfare and educational programs.

- Stakeholder Collaboration: They actively engage with industry associations, regulatory bodies, and non-governmental organizations to align business practices with societal expectations and advance sustainable finance.

- Sustainability Reporting: Transparent communication regarding their environmental, social, and governance (ESG) performance, including community impact metrics, is a key aspect of their stakeholder engagement strategy.

Strategic Partnerships for Customer Base Expansion

Daiwa Securities Group strategically leverages alliances with entities possessing substantial customer networks to broaden its market penetration. A prime example is its partnership with Japan Post Group, a move designed to tap into a vast retail customer base. Similarly, collaborations with regional financial institutions like Shikoku Bank aim to introduce Daiwa's comprehensive financial solutions to new client segments, thereby expanding its overall reach.

These alliances are crucial for customer base expansion, allowing Daiwa to offer its services to demographics it might not otherwise easily access. By partnering with established organizations, Daiwa benefits from immediate customer trust and existing distribution channels.

- Japan Post Group Alliance: This partnership grants Daiwa access to millions of potential retail investors through Japan Post's extensive network.

- Shikoku Bank Collaboration: This initiative targets regional clients, offering them specialized investment products and advisory services.

- Customer Segment Diversification: These partnerships enable Daiwa to reach new customer segments, including those in rural areas or those who prefer traditional banking channels.

Daiwa Securities Group fosters deep client loyalty through personalized advisory, particularly in wealth management, tailoring solutions to individual needs. Their 2024 performance saw continued growth in private wealth management, validating this bespoke approach.

Beyond direct client interaction, Daiwa actively engages with communities and stakeholders, investing in social and environmental initiatives. This commitment, highlighted by fiscal year 2023 investments in community programs, builds trust and supports long-term sustainability.

Strategic alliances, such as the one with Japan Post Group, are vital for customer acquisition, providing access to vast retail networks and diversifying their client base. These partnerships allow Daiwa to reach new market segments effectively.

| Customer Relationship Aspect | Key Initiatives | Impact/Data (as of latest available, including 2024 trends) |

|---|---|---|

| Personalized Advisory | Wealth Management, Tailored Solutions | Robust growth in private wealth management in 2024, indicating strong client satisfaction with bespoke services. |

| Digital Engagement | Mobile Trading Apps, Online Platforms | Enhanced digital offerings cater to evolving investor preferences for anytime, anywhere access and self-service. |

| Community & Stakeholder Engagement | CSR Programs, ESG Reporting, Partnerships | Fiscal year 2023 saw significant investment in community support and environmental initiatives, strengthening societal trust. |

| Strategic Alliances | Japan Post Group, Regional Banks | Access to millions of potential retail investors via Japan Post; expansion into new client segments through regional bank collaborations. |

Channels

Daiwa Securities leverages its extensive branch network, a cornerstone of its business model, to offer personalized, face-to-face financial advice and services. This traditional channel remains vital for cultivating deep relationships with both individual and corporate clients throughout Japan, particularly in wealth management and retail brokerage.

As of March 31, 2024, Daiwa Securities operated approximately 130 branches across Japan, serving as crucial hubs for client engagement. This physical presence allows for tailored consultations, addressing diverse financial needs from investment planning to estate management, thereby reinforcing client trust and loyalty.

Daiwa Securities Group heavily utilizes digital platforms and mobile applications to reach its clients. This includes their main website, which offers a wealth of investment information and research, alongside sophisticated online trading portals. In 2024, the company continued to enhance its mobile trading apps, aiming to provide a seamless and intuitive experience for investors on the go.

These digital channels are crucial for delivering accessible services and empowering clients with self-service options. For instance, users can easily manage their portfolios, execute trades, and access market data directly through these platforms. The group's commitment to digital innovation is reflected in the ongoing development and updates to these user-friendly interfaces, ensuring they remain competitive in the evolving financial landscape.

Daiwa Securities Group leverages dedicated sales and advisory teams to serve its institutional clients, corporations, and high-net-worth individuals. These specialized teams provide tailored solutions and direct engagement, crucial for navigating complex financial needs such as investment banking and asset management.

In 2024, Daiwa Securities continued to emphasize personalized service. For instance, its global institutional sales force actively engages with major asset managers and pension funds, facilitating access to a wide range of equity and fixed income products. This direct client interaction is a cornerstone of their strategy to deliver bespoke financial advice and execute intricate transactions.

Partnership Networks

Daiwa Securities Group leverages partnership networks as crucial indirect channels. Collaborations with banks and other financial institutions allow them to tap into wider customer bases and distribute specialized financial products, effectively broadening market reach and enhancing their service portfolio.

These alliances are vital for expanding Daiwa's distribution capabilities beyond its direct channels. For instance, in 2024, Daiwa continued to foster relationships with regional banks in Japan to offer investment trusts and other wealth management solutions to a broader demographic.

- Expanded Distribution: Partnerships with over 50 regional financial institutions across Japan in 2024 facilitated the sale of Daiwa's investment products.

- Product Diversification: Collaborations enabled the co-creation and distribution of tailored financial instruments, meeting diverse client needs.

- Market Penetration: These networks are key to reaching underserved segments and increasing Daiwa's overall market share in retail financial services.

Investment Seminars and Educational Events

Daiwa Securities Group leverages investment seminars and educational events as a key channel to connect with both prospective and current clients. These sessions, held both virtually and in person, aim to educate attendees on emerging investment opportunities, critical market trends, and effective financial planning strategies.

These events are instrumental in Daiwa's client acquisition efforts and play a vital role in nurturing and strengthening existing client relationships. For instance, in fiscal year 2023, Daiwa Securities hosted over 150 online and offline seminars, attracting more than 25,000 participants, which contributed to a 10% increase in new retail accounts.

The content covered in these events includes:

- Market Outlook: Expert analysis of current economic conditions and future projections.

- Investment Strategies: Guidance on portfolio diversification and risk management.

- Financial Planning: Tools and advice for achieving long-term financial goals.

- Product Information: Details on Daiwa's diverse range of investment products and services.

Daiwa Securities Group utilizes a multi-channel approach, blending traditional branch networks with robust digital platforms and strategic partnerships to serve its diverse clientele. This integrated strategy ensures broad market reach and caters to varying client preferences for engagement and service delivery.

The group's extensive physical presence, with around 130 branches across Japan as of March 2024, facilitates personalized advice and relationship building, especially for wealth management. Simultaneously, digital channels, including enhanced mobile apps and online portals, provide convenient access to trading, portfolio management, and market research for a growing segment of users.

Furthermore, dedicated sales teams cater to institutional and high-net-worth clients with tailored solutions, while partnerships with over 50 regional financial institutions in 2024 expanded product distribution. Educational seminars also play a key role, with over 150 events in fiscal year 2023 attracting more than 25,000 participants, contributing to a 10% rise in new retail accounts.

| Channel | Key Features | 2024 Data/Activity | Client Segment Focus |

|---|---|---|---|

| Branch Network | Face-to-face advice, relationship building | Approx. 130 branches in Japan | Retail, High-Net-Worth, Corporate |

| Digital Platforms (Web/Mobile) | Online trading, portfolio management, research access | Continued enhancement of mobile trading apps | Retail, Younger Investors |

| Sales & Advisory Teams | Specialized solutions, direct engagement | Global institutional sales force active | Institutional Investors, Corporations, HNWIs |

| Partnership Networks | Expanded distribution, co-creation of products | Partnerships with >50 regional financial institutions | Retail (via partners) |

| Seminars & Events | Client education, market insights, acquisition | >150 events in FY2023, >25,000 participants | Prospective and Current Clients (Retail) |

Customer Segments

Daiwa Securities Group serves a broad spectrum of individual investors, from those just starting out to seasoned market participants. These clients look to Daiwa for essential services like securities brokerage, access to investment trusts, and comprehensive wealth management solutions tailored to their financial goals.

The introduction of Japan's new NISA (Nippon Individual Savings Account) program in 2024 has significantly boosted engagement from this segment. For example, by the end of March 2024, the number of new NISA accounts opened had surged, with many individuals actively investing through these tax-advantaged schemes, demonstrating a renewed interest in capital markets.

Institutional Clients, including pension funds, corporations, and other financial institutions, represent a significant revenue stream for Daiwa Securities Group. In 2024, this segment likely accounted for a substantial portion of the firm's assets under management and trading volumes, demanding highly specialized services like bespoke asset management and complex global markets trading solutions.

Daiwa Securities Group's corporate clients encompass a broad range of businesses, from newly established startups to large, publicly traded enterprises. These companies rely on Daiwa's expertise for critical financial activities such as underwriting new stock or bond issuances, advising on mergers and acquisitions, and facilitating various capital raising strategies. For instance, in 2023, Daiwa played a significant role in numerous M&A deals, contributing to the overall health and dynamism of the corporate landscape.

High-Net-Worth Individuals

High-net-worth individuals represent a crucial customer segment for Daiwa Securities Group, demanding highly personalized financial solutions and sophisticated wealth management strategies. These clients, often with substantial assets, seek tailored investment portfolios, estate planning, and tax advisory services to preserve and grow their wealth effectively.

In 2024, the global wealth management industry continued to see strong demand from HNWIs, with assets under management in this segment projected to grow. For instance, reports indicated that the number of HNWIs globally reached over 23 million in 2023, with their collective wealth exceeding $80 trillion, a trend expected to persist into 2024, underscoring the market opportunity for specialized services.

- Bespoke Investment Solutions: Offering customized portfolio construction, alternative investments, and access to exclusive opportunities.

- Advanced Financial Planning: Providing comprehensive services including tax optimization, retirement planning, and legacy management.

- Dedicated Advisory Services: Assigning experienced relationship managers who understand complex financial needs and provide proactive guidance.

- Global Reach and Expertise: Leveraging international market insights and cross-border financial planning capabilities.

Emerging Asset Managers

Daiwa Securities Group actively cultivates relationships with emerging asset managers, both domestically and internationally. This strategic focus acknowledges the dynamic nature of the investment landscape and the potential for new talent to drive innovation and returns.

Through initiatives like its Emerging Managers Program, Daiwa provides crucial seed capital and ongoing support. This financial backing is essential for these nascent firms to establish operations, build track records, and attract further investment. For instance, in 2024, Daiwa continued to allocate significant resources to such programs, aiming to onboard a diverse range of promising managers.

- Seed Capital Provision: Direct financial investment to launch and sustain emerging fund strategies.

- Growth Fostering: Mentorship, operational support, and access to Daiwa's distribution network.

- Market Access: Facilitating introductions to institutional investors and global markets.

- Performance Benchmarking: Providing tools and insights for managers to track and improve their performance against industry standards.

Daiwa Securities Group caters to a diverse clientele, including individual investors, institutional entities, and corporations, each with distinct financial needs. The firm also actively supports emerging asset managers, recognizing their role in market innovation.

In 2024, the individual investor segment saw a notable surge in activity, partly driven by new tax-advantaged savings schemes like Japan's NISA program. Institutional clients, comprising pension funds and corporations, continue to be a bedrock of Daiwa's business, demanding sophisticated asset management and trading services.

Corporate clients leverage Daiwa for critical financial operations such as underwriting and M&A advisory, with the firm facilitating significant capital raising activities. High-net-worth individuals are a key focus, seeking personalized wealth management, estate planning, and tax advisory services, a trend bolstered by global wealth growth in 2023 and continuing into 2024.

Cost Structure

Personnel expenses represent a substantial cost for Daiwa Securities Group, reflecting the significant investment in its human capital. This category encompasses salaries, bonuses, and comprehensive benefits for a vast workforce, including financial advisors, research analysts, traders, and administrative personnel.

In fiscal year 2023, Daiwa Securities reported personnel expenses of approximately ¥235.2 billion. This figure underscores the critical role of skilled professionals in delivering client services, conducting market analysis, and executing complex financial transactions across its diverse business segments.

Daiwa Securities Group heavily invests in its technology and infrastructure, a significant component of its cost structure. This includes substantial spending on IT systems, digital platforms, and robust cybersecurity measures to protect client data and operations. For instance, in fiscal year 2023, the group continued its digital transformation initiatives, which are crucial for enhancing client services and operational efficiency.

Marketing and sales expenses are a substantial component of Daiwa Securities Group's cost structure. These costs encompass client acquisition, brand building, advertising across various channels, and the ongoing maintenance of their extensive sales force and physical branch network.

In fiscal year 2024, Daiwa Securities Group reported operating expenses of ¥798.5 billion. While specific breakdowns for marketing and sales are not always itemized separately from general administrative costs in public reports, these activities are critical drivers of revenue generation and client engagement.

The group invests in both digital marketing, including online advertising and social media engagement, and traditional outreach methods to attract and retain a diverse client base. Maintaining a broad network of financial advisors and customer service representatives across numerous branches also represents a significant operational expenditure.

Regulatory and Compliance Costs

As a major financial player, Daiwa Securities Group navigates a complex web of regulations. This means significant investment in compliance, legal counsel, and robust risk management systems to maintain trust and operational stability. For instance, in fiscal year 2023, Japanese financial institutions collectively spent billions on compliance, a trend expected to continue as regulatory landscapes evolve.

These costs are essential for Daiwa's continued operation and market access. They ensure adherence to international and domestic financial standards, protecting both the company and its clients.

- Regulatory Adherence: Costs associated with meeting stringent financial regulations like those from the Financial Services Agency (FSA) in Japan.

- Legal and Advisory Fees: Expenses for legal services, external consultants, and compliance expertise to interpret and implement new rules.

- Risk Management Infrastructure: Investment in technology and personnel for monitoring, reporting, and mitigating financial and operational risks.

- Training and Development: Ongoing costs for educating staff on the latest compliance requirements and best practices.

Office and Real Estate Expenses

Daiwa Securities Group incurs significant costs maintaining its global presence, encompassing rent, utilities, and property management for its numerous offices and branches. In fiscal year 2023, Daiwa Securities reported total operating expenses of ¥836.2 billion, a portion of which is directly attributable to its extensive real estate footprint. The ongoing management and upkeep of these physical assets represent a substantial fixed cost within their operational structure.

These expenses are crucial for supporting client interactions, housing trading floors, and facilitating back-office operations across key financial hubs. The group's commitment to a physical presence necessitates substantial investment in prime real estate, impacting their overall cost structure. For instance, the cost of leasing and maintaining office spaces in major financial districts can be a considerable line item.

- Rent and Lease Payments: Direct costs for occupying office spaces globally.

- Property Management Fees: Expenses related to the upkeep and administration of owned or leased properties.

- Utilities and Maintenance: Costs for electricity, water, heating, cooling, and general repairs.

- Depreciation of Fixed Assets: Amortization of costs associated with office furniture, fixtures, and building improvements.

Daiwa Securities Group's cost structure is largely driven by personnel, technology, marketing, and regulatory compliance. In fiscal year 2023, personnel expenses alone reached approximately ¥235.2 billion, highlighting the investment in its skilled workforce. The group also incurs significant costs for its global real estate footprint, with total operating expenses in FY2023 amounting to ¥836.2 billion, a portion of which covers property management and maintenance.

| Cost Category | FY2023 (JPY Billion) | Significance |

|---|---|---|

| Personnel Expenses | 235.2 | Salaries, bonuses, benefits for a large workforce. |

| Total Operating Expenses | 836.2 | Includes all operational costs, a portion for real estate. |

| Regulatory Compliance | Not specifically itemized, but a significant investment. | Essential for market access and client protection. |

Revenue Streams

Daiwa Securities Group generates significant revenue through commissions and brokerage fees. These are charged on a wide range of securities trading, including equities, bonds, and derivatives. This provides a consistent income from the transactional activities of both individual and institutional investors.

Daiwa Securities Group generates substantial revenue from asset management fees, collecting charges for overseeing assets held in investment trusts, pension funds, and various alternative investment products. These fees are a cornerstone of their financial model.

In the fiscal year ending March 2024, Daiwa Securities reported significant income from its asset management operations, reflecting the scale of assets under their stewardship. For instance, their investment trust business alone managed trillions of yen, with fees typically calculated as a percentage of these assets, directly impacting profitability.

Daiwa Securities Group generates significant income from its investment banking division, primarily through fees earned from underwriting new equity and debt offerings. In fiscal year 2024, the firm was actively involved in numerous capital markets transactions, reflecting robust demand for its services.

Mergers and acquisitions (M&A) advisory services also represent a crucial revenue stream, with Daiwa facilitating complex transactions for its corporate clients. Fees from these advisory engagements, alongside income from private placement deals, contribute substantially to the overall investment banking segment's profitability.

Net Trading Income

Daiwa Securities Group generates significant revenue through net trading income, which encompasses profits from its proprietary trading in global markets. This includes activities in fixed income, currencies, and commodities (FICC).

In the fiscal year ending March 2024, Daiwa Securities reported substantial trading gains. For instance, their trading income segment demonstrated robust performance, reflecting effective market navigation and risk management.

- Proprietary Trading Profits: Earnings derived from the firm's direct investments and trading in various financial instruments.

- Global Market Exposure: Trading activities span across international fixed income, currency, and commodity markets, diversifying revenue sources.

- Fiscal Year 2024 Performance: The company's trading operations contributed positively to its overall financial results, with specific figures available in their annual reports.

Interest Income and Banking Services

Daiwa Securities Group generates significant revenue through interest income, primarily from its banking subsidiary, Daiwa Next Bank. This includes interest earned on loans and other banking activities, contributing a stable income stream.

Beyond traditional banking, the group also earns revenue from a diverse range of financial products and services offered to its retail and institutional clients. These services encompass brokerage fees, asset management fees, and advisory fees, all contributing to the overall revenue mix.

- Interest Income: Daiwa Next Bank's lending activities and deposit-taking operations are a core source of interest-based revenue.

- Banking Services: Fees and commissions from various banking services, such as transaction processing and account management, add to income.

- Financial Product Sales: Revenue is also derived from the sale of investment products, insurance, and other financial instruments to clients.

- Advisory and Consulting Fees: Fees earned for providing financial advice and strategic consulting services to corporate and individual clients.

Daiwa Securities Group's revenue streams are diverse, encompassing commissions from securities trading, fees from asset management, and income from investment banking activities like underwriting and M&A advisory. The group also benefits from net trading income and interest earned through its banking subsidiary, Daiwa Next Bank.

| Revenue Stream | Description | Fiscal Year 2024 Relevance |

|---|---|---|

| Commissions & Brokerage Fees | Fees on trading equities, bonds, derivatives. | Consistent income from client transactions. |

| Asset Management Fees | Charges for overseeing investment trusts, pension funds. | Significant income, with trillions of yen managed. |

| Investment Banking Fees | Underwriting, M&A advisory, private placements. | Robust activity in capital markets transactions. |

| Net Trading Income | Profits from proprietary trading in global markets. | Positive contribution, with substantial trading gains reported. |

| Interest Income | From Daiwa Next Bank's lending and banking activities. | Stable income stream from banking operations. |

Business Model Canvas Data Sources

The Daiwa Securities Group Business Model Canvas is informed by a robust combination of financial disclosures, market intelligence, and internal strategic planning documents. These sources provide a comprehensive view of the company's operations, market position, and future direction.