Daiwa Securities Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daiwa Securities Group Bundle

Daiwa Securities Group operates within a highly competitive financial services landscape, where the threat of new entrants is moderate, and buyer power is significant due to readily available alternatives. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Daiwa Securities Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Daiwa Securities Group's reliance on specialized technology and data providers, particularly for advanced trading platforms, data analytics, and cybersecurity, grants these suppliers considerable bargaining power. The firm's need for robust IT infrastructure and sophisticated data feeds is paramount for maintaining its competitive edge and operational efficiency across its diverse business lines.

In 2023, the global financial technology market was valued at over $110 billion, highlighting the significant investment in and reliance on technology within the sector. This trend is amplified in Japan, where the ongoing digital transformation necessitates strong partnerships with these technology providers, further solidifying their leverage.

In the financial services sector, the availability of specialized human capital significantly impacts supplier power. Daiwa Securities Group relies on highly skilled professionals such as investment bankers, asset managers, and IT experts. A shortage of these individuals, particularly in rapidly evolving fields like fintech and cybersecurity, can amplify the bargaining leverage of employees and specialized recruitment agencies within Japan.

For instance, reports from the Japanese Ministry of Health, Labour and Welfare in late 2023 indicated persistent labor shortages in advanced technology sectors, a trend expected to continue into 2024. This environment demands that Daiwa implement robust talent acquisition and retention strategies, including competitive remuneration packages and professional development opportunities, to secure and keep essential personnel.

Regulatory bodies, such as Japan's Financial Services Agency (FSA), act as significant influencers, akin to suppliers, by defining the operational landscape for financial institutions like Daiwa Securities Group. Their mandates on compliance, capital requirements, and market conduct directly shape business strategies and incur costs.

For 2024-2025, the FSA's emphasis on enhancing corporate governance, promoting digital innovation, and ensuring market stability presents both opportunities and challenges for Daiwa. These regulatory priorities necessitate strategic adjustments and investment in compliance and technology, thereby influencing Daiwa's cost structure and competitive positioning.

Financial Market Infrastructure Providers

Financial market infrastructure providers, like stock exchanges and clearing houses, wield significant bargaining power. Daiwa Securities Group depends on these essential services for smooth trade execution and settlement. In 2024, the global FinTech market, which includes many of these infrastructure components, was valued at over $1.1 trillion, highlighting the scale and importance of these players.

The high barriers to entry for new infrastructure providers mean limited alternatives for firms like Daiwa Securities. This lack of substitutability strengthens the position of existing providers. For instance, the cost and regulatory hurdles to establishing a new major stock exchange are immense, often running into billions of dollars.

- High Switching Costs: Moving between critical infrastructure providers can be complex and expensive, locking in existing relationships.

- Limited Number of Key Providers: The market for essential financial infrastructure is often concentrated, reducing competition.

- Essential Nature of Services: Without these providers, trading and settlement would be impossible, giving them inherent leverage.

- Regulatory Influence: Infrastructure providers often operate under strict regulatory frameworks, which can also act as a barrier to entry for competitors.

External Consultants and Professional Services

Specialized consulting firms, legal advisors, and auditors are crucial for Daiwa Securities Group, offering expertise in complex financial transactions, navigating regulatory landscapes, and shaping strategic direction. Their deep, often niche, knowledge in areas like international finance or evolving compliance requirements can significantly amplify their influence. For instance, the global legal services market was valued at over $700 billion in 2023, highlighting the substantial economic impact and specialized nature of these providers.

Daiwa's reliance on these external professionals, particularly for intricate international deals or adapting to new financial regulations, means these suppliers can wield considerable bargaining power. The need for highly specific, often scarce, expertise in a rapidly changing financial environment means Daiwa must often accept terms dictated by these specialized service providers.

- Critical Expertise: Consultants, legal counsel, and auditors provide essential skills for Daiwa's complex operations.

- Niche Knowledge: Specialized firms possess unique insights into international finance and regulatory changes, strengthening their position.

- Market Value: The global legal services market's substantial valuation underscores the economic significance and bargaining leverage of professional service providers.

- Supplier Dependence: Daiwa's need for specialized advice in a dynamic market increases its reliance on these external experts.

Daiwa Securities Group faces significant bargaining power from its suppliers, particularly in technology and specialized talent. The reliance on advanced trading platforms, data analytics, and cybersecurity solutions means technology providers hold considerable sway, especially given the global FinTech market's substantial growth, exceeding $1.1 trillion in 2024. This dependence, coupled with high switching costs and limited alternatives for critical infrastructure like stock exchanges, further amplifies supplier leverage.

| Supplier Category | Key Dependencies for Daiwa | Factors Amplifying Bargaining Power | Illustrative Market Data (2023/2024) |

|---|---|---|---|

| Technology Providers | Trading platforms, data analytics, cybersecurity | High demand, specialized nature, reliance on innovation | Global FinTech Market: >$1.1 trillion (2024) |

| Specialized Human Capital | Investment bankers, asset managers, IT experts | Labor shortages in tech sectors, demand for niche skills | Japan Tech Labor Shortage: Persistent trend (late 2023 onwards) |

| Financial Market Infrastructure | Stock exchanges, clearing houses | High barriers to entry, essential services, limited providers | Cost to establish new exchange: Billions USD |

| Professional Services | Consultants, legal advisors, auditors | Critical expertise, niche knowledge, regulatory complexity | Global Legal Services Market: >$700 billion (2023) |

What is included in the product

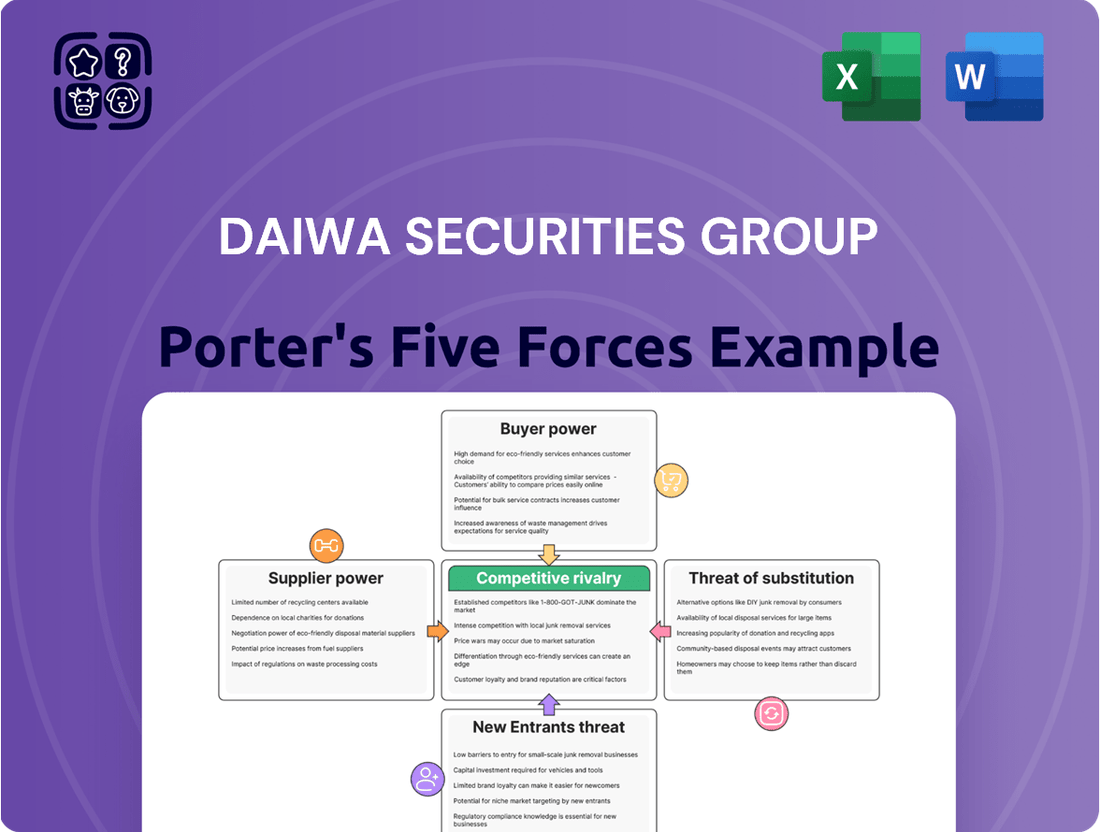

This analysis of Daiwa Securities Group's competitive landscape reveals the intensity of rivalry, bargaining power of customers and suppliers, threat of new entrants, and the impact of substitutes on its market position.

Instantly identify and prioritize competitive threats with a visually intuitive breakdown of Daiwa Securities Group's Porter's Five Forces, streamlining strategic planning.

Customers Bargaining Power

The introduction of Japan's new NISA program is significantly boosting the bargaining power of individual investors by encouraging a move from saving to investing, thereby expanding Daiwa Securities' potential client base. This shift means more individuals are actively participating in the market, increasing their collective influence even if their individual transaction sizes are smaller.

While individual investors might not wield significant power on their own due to lower transaction volumes, their collective strength is amplified by growing financial literacy and easier access to a wide array of investment information and platforms. This increased knowledge empowers them to seek better terms and services from financial institutions like Daiwa Securities.

Despite this growing influence, a historically conservative investment culture in Japan means many individual investors still lean towards established and trusted institutions. This preference can temper their bargaining power, as they may prioritize perceived safety and reliability over aggressively negotiating fees or services.

The growing population of High-Net-Worth Individuals (HNWIs) in Japan, a trend expected to continue through 2024 and beyond, significantly amplifies their bargaining power. These clients are not just looking for basic investment accounts; they demand intricate, personalized wealth management solutions that often encompass asset allocation, estate planning, and tax advisory services.

Their substantial financial resources mean they can easily shift their business if they perceive a lack of value or customization. For instance, by late 2023, the number of Japanese HNWIs had surpassed 3.5 million, collectively holding trillions in assets, making them a critical segment for firms like Daiwa Securities.

This demand for bespoke services forces financial institutions to compete fiercely on service quality and tailored offerings. Daiwa Securities, like its peers, must demonstrate a deep understanding of individual client needs and provide a comprehensive suite of services to retain and attract these influential customers.

Large institutional clients, including pension funds and corporations, wield significant bargaining power at Daiwa Securities Group. Their substantial transaction volumes and assets under management mean they can negotiate for better pricing and demand tailored services. For instance, in 2024, major pension funds often seek fee reductions on the billions they entrust to asset managers, directly impacting revenue streams.

Digital Platform Users

The increasing prevalence of digital platforms and mobile apps has significantly amplified the bargaining power of customers within the financial services sector. These digital tools offer users unprecedented transparency, allowing them to easily compare services, fees, and investment options across various providers. This heightened accessibility to information and reduced switching costs empower customers to demand better value and more competitive offerings from firms like Daiwa Securities Group.

For instance, in 2024, the global fintech market, which underpins many of these digital platforms, was projected to reach over $1.1 trillion, demonstrating the scale of digital transformation impacting customer expectations. This digital shift forces traditional financial institutions to continuously innovate and improve their digital interfaces and customer service to retain clients.

- Increased Transparency: Digital platforms provide readily available comparative data on fees, performance, and service quality.

- Lower Switching Costs: It's now simpler for customers to move their accounts or investments to a competitor with a better digital experience or lower costs.

- Demand for Enhanced Digital Offerings: Customers expect seamless, intuitive, and feature-rich digital experiences from their financial service providers.

- Customer-Centric Market Shift: The power dynamic is shifting, compelling firms to prioritize customer needs and digital engagement.

Demand for Value-Added Services

Customers are increasingly demanding more than just basic brokerage services. They're looking for comprehensive financial planning, in-depth investment research, and opportunities that align with Environmental, Social, and Governance (ESG) principles. This shift empowers them to select firms that offer tailored, high-quality advice and solutions to meet their complex financial needs.

Daiwa Securities Group, recognizing this trend, is actively focusing on maximizing customer asset value. For instance, in the fiscal year ending March 2024, Daiwa's asset management segment saw continued growth, with net revenue from investment trusts increasing by 8% year-over-year, reflecting client engagement with value-added products and advisory services.

- Increased demand for ESG investments: In 2024, global sustainable fund flows continued to show strength, with ESG-focused ETFs attracting significant inflows, indicating a strong customer preference for responsible investing options.

- Growth in financial advisory services: Many firms, including Daiwa, reported a rise in demand for personalized financial planning, with a notable uptick in clients seeking advice on retirement and wealth preservation strategies.

- Client retention driven by value-added services: Research indicates that clients who utilize a broader suite of services, such as research and advisory, exhibit higher retention rates compared to those solely using transactional brokerage.

The bargaining power of customers for Daiwa Securities Group is significantly influenced by the increasing transparency and accessibility offered by digital platforms. Customers can now easily compare services and fees, leading to lower switching costs and a greater demand for competitive offerings. This digital shift compels financial institutions to prioritize customer experience and innovation to retain clients.

High-Net-Worth Individuals (HNWIs) and large institutional clients exert substantial bargaining power due to their significant assets and demand for tailored wealth management solutions. Their ability to shift business easily forces firms like Daiwa Securities to compete on service quality and personalized offerings, particularly as HNWIs in Japan surpassed 3.5 million by late 2023.

The growing demand for value-added services, including ESG investments and comprehensive financial planning, further empowers customers. Firms that can provide these tailored solutions, like Daiwa Securities' growth in asset management, are better positioned to retain clients. In 2024, ESG-focused ETFs saw strong inflows, highlighting this customer preference.

| Customer Segment | Key Bargaining Factors | Impact on Daiwa Securities |

| Individual Investors | Increased financial literacy, collective strength via digital platforms, NISA program participation | Need for competitive fees, user-friendly digital services, educational content |

| High-Net-Worth Individuals (HNWIs) | Substantial assets, demand for bespoke wealth management, estate planning, tax advisory | Requirement for personalized service, advanced advisory capabilities, competitive pricing on complex solutions |

| Institutional Clients | Large transaction volumes, assets under management, demand for fee reductions | Pressure on management fees, need for customized institutional products and reporting |

Preview the Actual Deliverable

Daiwa Securities Group Porter's Five Forces Analysis

This preview showcases the comprehensive Daiwa Securities Group Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning within the financial services industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry for Daiwa Securities Group.

Rivalry Among Competitors

Daiwa Securities Group operates within a fiercely competitive Japanese financial services landscape, largely shaped by formidable domestic rivals. Major players such as Mitsubishi UFJ Financial Group, Mizuho Financial Group, and Japan Post Bank command significant market presence across various financial segments. These diversified giants offer comprehensive services, intensifying rivalry for Daiwa in retail banking, corporate finance, and investment management.

Competitors in the financial services sector, such as Nomura Holdings and Mitsubishi UFJ Financial Group, often boast diversified business portfolios that include banking, insurance, and securities. This integration allows them to cross-sell a wide array of products and tap into extensive customer bases, creating a significant competitive advantage. For instance, in fiscal year 2023, Mitsubishi UFJ Financial Group reported total assets of ¥335.8 trillion, showcasing the scale of its integrated operations.

This broad reach by rivals presents a challenge for Daiwa Securities Group, which historically has a stronger primary focus on its core securities business. While Daiwa has been actively working to expand its business platform, including through strategic alliances and acquisitions, it must contend with competitors who can leverage synergies across multiple financial service lines. This integrated model enables rivals to offer more comprehensive financial solutions, potentially capturing a larger share of customer wallet.

The financial services sector is undergoing a seismic shift due to digital transformation and the rise of fintech. This evolution is directly impacting competitive rivalry by introducing new players and altering customer expectations. Fintech startups, often nimble and technology-focused, are challenging traditional institutions like Daiwa Securities Group. For instance, by mid-2024, global fintech funding reached over $20 billion, indicating significant investment in innovation that directly competes for market share and customer attention.

The increasing adoption of digital payment systems and robo-advisors is a key driver of this intensified rivalry. These technologies offer convenience and often lower costs, attracting a growing segment of the investor base. Daiwa Securities Group, to maintain its competitive edge, must therefore prioritize ongoing investment in its own digital infrastructure and the development of innovative digital services. This proactive approach is crucial to not only retain existing customers but also to capture new market opportunities in this rapidly digitizing environment.

Regulatory Environment and Market Stability

The Japanese financial market is experiencing significant regulatory shifts, notably the move towards a 'world with interest rates.' This transition, coupled with government efforts to position Japan as a premier asset management hub, presents both avenues for growth and intensified competition. Daiwa Securities Group must adeptly manage these evolving dynamics to maintain its profitability.

These regulatory adjustments can foster new business opportunities, but they also necessitate strategic recalibrations from all market participants. For instance, the Financial Services Agency (FSA) has been actively promoting reforms aimed at enhancing the attractiveness of Japan's asset management industry, potentially drawing in more global players and increasing rivalry.

- Regulatory Adjustments: Japan is shifting from a prolonged period of negative interest rates, impacting traditional financial services models.

- Asset Management Hub Initiatives: Government programs are in place to boost Japan's standing in global asset management, potentially increasing competition.

- Strategic Adaptation: Daiwa's success hinges on its capacity to navigate these changes, which could lead to increased competitive pressures as firms adjust their strategies.

Focus on Customer Asset Growth and Capital Efficiency

The financial services industry is intensely competitive, with firms like Daiwa Securities Group vying to grow customer assets and operate efficiently. This focus on capital efficiency and maximizing client asset value means companies are locked in a battle for client funds and the lucrative advisory business.

Daiwa Securities Group's 'Passion for the Best' 2026 Medium-term Management Plan directly addresses this rivalry by prioritizing strategies to boost asset-based revenues and deliver superior consulting services. For instance, in fiscal year 2023, Daiwa Securities reported a consolidated net revenue of ¥1,063.5 billion, highlighting the scale of operations and the revenue potential tied to asset growth.

- Customer Asset Growth: Firms are competing to attract and retain client assets, which directly fuels revenue through management fees and commissions.

- Capital Efficiency: A key battleground involves optimizing the use of capital to generate higher returns, a critical factor for investor confidence and market valuation.

- Advisory Mandates: The demand for high-quality financial advice creates another competitive arena, where expertise and client relationships are paramount.

- Daiwa's Strategy: The 'Passion for the Best' 2026 plan underscores Daiwa's commitment to excelling in these competitive areas to improve overall performance.

Daiwa Securities Group faces intense rivalry from major Japanese financial institutions like Mitsubishi UFJ Financial Group and Nomura Holdings, which benefit from diversified business models and extensive customer bases. These integrated competitors leverage synergies across banking, insurance, and securities to offer comprehensive solutions, a challenge for Daiwa's historically securities-focused approach. For example, in fiscal year 2023, Nomura Holdings reported total revenue of ¥1,304.2 billion, underscoring its significant market presence.

| Competitor | Primary Focus | Fiscal Year 2023 Revenue (JPY billions) | Key Competitive Advantage |

| Mitsubishi UFJ Financial Group | Integrated Financial Services | 11,493.9 (Consolidated) | Diversified portfolio, extensive customer reach |

| Nomura Holdings | Securities, Investment Banking | 1,304.2 | Strong global presence, comprehensive securities services |

| Japan Post Bank | Banking, Savings | 1,850.6 (Net Interest Income) | Vast retail network, stable deposit base |

SSubstitutes Threaten

The rise of direct investment platforms and online brokerages presents a significant threat of substitutes for Daiwa Securities Group. These digital tools empower individual investors to manage their portfolios directly, often with lower transaction costs and greater autonomy. For instance, the global online brokerage market was valued at approximately USD 14.5 billion in 2023 and is projected to grow substantially, indicating a strong preference for these accessible alternatives.

Emerging fintech solutions, such as robo-advisors for automated investment management and diverse digital payment services, present alternative avenues for individuals to handle their financial affairs. These platforms often appeal to customers prioritizing convenience and cost-effectiveness.

While Daiwa Securities Group is actively developing its own digital offerings, the expanding landscape of independent fintech providers poses a significant threat. These firms can attract clients who might otherwise engage with traditional advisory and brokerage services, effectively acting as substitutes.

For instance, the global robo-advisory market was projected to reach over $2.5 trillion in assets under management by 2024, highlighting the growing client adoption of these automated investment solutions. This trend indicates a clear demand for digital alternatives that can challenge established financial institutions.

Traditional banks are increasingly offering wealth management and investment products, directly competing with Daiwa Securities Group. For instance, in 2024, many major global banks reported significant growth in their asset management divisions, with some seeing double-digit increases in fee-based income from these services. This expansion allows them to attract clients who prefer a one-stop shop for all their financial needs, potentially diverting business from specialized firms like Daiwa.

Furthermore, evolving financial regulations in 2024 and projected for 2025 are enabling traditional banks to broaden their scope of services. This regulatory flexibility can empower them to offer more comprehensive investment solutions, thereby intensifying the threat of substitution for Daiwa's core offerings. As banks leverage their established customer base and trust, they present a formidable alternative for clients seeking integrated financial planning and investment management.

Insurance and Real Estate Investments

For individuals and institutions looking to preserve or grow their wealth, alternative asset classes such as insurance products, like annuities, or direct real estate investments can indeed act as substitutes for traditional securities. These alternatives offer different risk-reward profiles and liquidity characteristics compared to stocks and bonds.

The Japanese private banking sector, for instance, actively incorporates services like insurance and real estate consulting. This integration highlights how these alternative options are considered integral components within a comprehensive wealth management strategy, often competing for investor capital alongside traditional financial instruments.

- Insurance Products: Annuities and life insurance policies can offer guaranteed returns or death benefits, serving as a substitute for fixed-income securities or even equity growth for risk-averse investors.

- Real Estate Investments: Direct ownership of property, whether residential or commercial, provides tangible assets that can generate rental income and capital appreciation, acting as an alternative to REITs or other property-related securities.

- Wealth Management Integration: The inclusion of insurance and real estate advisory within private banking services in Japan signifies that these are not just standalone investment options but are actively positioned as alternatives within a diversified portfolio.

Self-Managed Investment Portfolios

The rise of self-managed investment portfolios presents a significant threat of substitutes for traditional brokerage and asset management services offered by firms like Daiwa Securities Group. With an abundance of online resources, readily available financial education, and increasingly user-friendly investment platforms, sophisticated individual and institutional investors are finding it more feasible to manage their own assets. This trend allows them to bypass the need for comprehensive services, effectively insourcing portfolio management.

This shift is amplified by the accessibility of powerful analytical tools and low-cost trading platforms. For instance, in 2024, the growth in robo-advisors and direct-to-consumer investment apps continues to empower individuals to make their own investment decisions. Many platforms offer sophisticated charting, research capabilities, and even automated rebalancing, directly competing with the core offerings of traditional financial institutions.

- Increased Accessibility: Online platforms and educational content have democratized investment knowledge, making it easier for individuals to manage their own portfolios.

- Cost Savings: Self-management often eliminates management fees and commissions associated with professional services, appealing to cost-conscious investors.

- Technological Advancements: User-friendly interfaces and advanced analytical tools available through fintech companies empower individuals with capabilities previously exclusive to professionals.

- Growing Investor Sophistication: A larger segment of the investing public possesses the financial literacy and confidence to make independent investment decisions.

The threat of substitutes for Daiwa Securities Group is substantial, stemming from a confluence of digital platforms and alternative investment avenues. Direct investment platforms and online brokerages, for example, allow individuals to manage their portfolios with lower costs and greater autonomy, a trend underscored by the global online brokerage market's valuation of approximately USD 14.5 billion in 2023. Fintech innovations like robo-advisors, with the global market projected to manage over $2.5 trillion in assets by 2024, offer automated, cost-effective alternatives that are increasingly adopted by investors seeking convenience.

Furthermore, traditional banks are expanding their wealth management services, leveraging their existing customer base to offer integrated financial solutions. In 2024, many major global banks reported double-digit growth in their asset management divisions, intensifying competition. Alternative assets such as insurance products and direct real estate investments also serve as substitutes, appealing to different risk appetites and liquidity needs, with Japanese private banking sectors actively integrating these into their offerings.

| Substitute Type | Key Characteristics | Market Trend/Data Point (2023-2024) | Impact on Daiwa |

| Online Brokerages | Low cost, high autonomy | Global market valued at ~USD 14.5 billion (2023) | Direct competition for retail investors |

| Robo-Advisors | Automated management, cost-effective | Projected to manage >$2.5 trillion AUM by 2024 | Attracts clients seeking digital, passive investment |

| Traditional Banks | Integrated services, existing client base | Significant growth in asset management divisions (2024) | Diversion of wealth management clients |

| Alternative Assets (Insurance, Real Estate) | Different risk/reward, tangible assets | Increasingly integrated into private banking services | Competition for investor capital allocation |

Entrants Threaten

The financial services sector in Japan, overseen by the Financial Services Agency (FSA), presents significant hurdles for potential new entrants. Stringent licensing, robust capital adequacy requirements, and extensive compliance mandates are in place, making it challenging for new firms to establish themselves. For instance, in 2023, the FSA continued its focus on strengthening consumer protection measures, adding another layer of complexity for aspiring financial service providers.

Establishing a comprehensive financial services firm, akin to Daiwa Securities Group, necessitates immense upfront capital. Consider that in 2023, global investment banking fees alone reached approximately $100 billion, a testament to the scale of operations and the resources required to compete effectively. This significant financial commitment for infrastructure, cutting-edge technology, and stringent regulatory adherence presents a substantial hurdle for aspiring new players.

Established brand reputation and trust are significant barriers to entry for new firms looking to compete with Daiwa Securities Group. Daiwa has cultivated a strong reputation over many years, fostering deep trust among its clientele. This long-standing recognition and established customer loyalty make it difficult for newcomers to gain a foothold.

In 2023, Daiwa Securities reported a net revenue of ¥752.2 billion, demonstrating its substantial market presence. New entrants would need to invest heavily in marketing and customer acquisition to even begin challenging Daiwa's established brand equity and the extensive distribution networks it has developed over decades of operation.

Technological and Infrastructure Investment

Technological and infrastructure investment presents a significant hurdle for new entrants into the financial services sector, even with the rise of fintech. While digital platforms can lower some traditional entry barriers, establishing a competitive presence still necessitates substantial capital outlay. For instance, developing and maintaining cutting-edge trading systems, secure data management, and advanced analytics platforms requires considerable upfront and ongoing investment. Daiwa Securities Group, like other established players, has invested heavily in its digital transformation, aiming to enhance client experience and operational efficiency.

The need to match the sophisticated digital capabilities of incumbents like Daiwa means new firms must allocate significant financial and technical resources to build comparable infrastructure. This includes robust cybersecurity measures to protect sensitive client data and prevent financial crime, a critical concern in today's digital landscape. For example, the global cybersecurity market was projected to reach over $300 billion by 2024, indicating the scale of investment required to remain secure and competitive.

- High Capital Outlay: New entrants need substantial funds for advanced technology, including AI-driven analytics and blockchain solutions.

- Cybersecurity Demands: Significant investment in cybersecurity is essential to build trust and comply with stringent regulations, with global spending on cybersecurity expected to continue its upward trend.

- Infrastructure Development: Creating efficient operational infrastructure, including cloud computing and data processing capabilities, demands considerable resources.

- Talent Acquisition: Attracting and retaining skilled IT professionals and data scientists adds to the overall cost of entry.

Strategic Alliances and Ecosystems

The growing trend of strategic alliances between established financial institutions, like Daiwa Securities Group, and innovative fintech companies is a significant barrier to new entrants. These collaborations foster integrated financial ecosystems, making it increasingly difficult for standalone newcomers to compete. For instance, in 2024, Daiwa actively pursued capital and business alliances to enhance its digital platform and service offerings, thereby strengthening its market position.

These partnerships create a more complex and interconnected market landscape. New players face the challenge of not only competing with existing firms but also navigating these established networks. The ability of these alliances to offer a wider range of services and a more seamless customer experience, often leveraging advanced technology, raises the barrier to entry considerably.

Daiwa's own strategic initiatives in 2024 highlight this trend. By forming alliances, the company aims to expand its reach and capabilities, creating a more robust and integrated offering. This proactive approach by incumbents solidifies their competitive advantage and makes it harder for new, isolated entities to gain market share.

- Alliances create integrated ecosystems, raising entry barriers.

- Fintech partnerships enhance service offerings and customer experience.

- Daiwa Securities Group actively pursued alliances in 2024 to expand its platform.

- Established networks and integrated services make it difficult for new, isolated players to gain traction.

The threat of new entrants for Daiwa Securities Group remains moderate due to substantial barriers. Stringent regulatory requirements, including licensing and capital adequacy, were actively enforced by the Financial Services Agency in 2023, making entry difficult. The immense capital needed for infrastructure, technology, and compliance, coupled with the need to build brand trust against established players like Daiwa, which reported ¥752.2 billion in net revenue in 2023, presents significant challenges.

Furthermore, the increasing trend of strategic alliances between incumbents and fintech firms in 2024, which Daiwa Securities Group actively participated in, creates integrated ecosystems that are hard for new, standalone entities to penetrate. These collaborations enhance service offerings and customer experience, effectively raising the barrier to entry.

| Barrier Type | Description | Impact on New Entrants | Example (2023-2024 Data) |

|---|---|---|---|

| Regulatory Hurdles | Licensing, capital requirements, compliance | High | FSA's continued focus on consumer protection in 2023 added complexity. |

| Capital Intensity | Infrastructure, technology, marketing | High | Global investment banking fees ~ $100 billion in 2023; Daiwa's ¥752.2 billion net revenue. |

| Brand Loyalty & Trust | Established reputation and customer relationships | High | Decades of operation for Daiwa build deep client trust. |

| Technological Advancement | Cutting-edge trading systems, cybersecurity | High | Global cybersecurity market projected > $300 billion by 2024. |

| Strategic Alliances | Partnerships with fintech companies | Moderate to High | Daiwa pursued alliances in 2024 to expand digital platform. |

Porter's Five Forces Analysis Data Sources

Our Daiwa Securities Group Porter's Five Forces analysis is built on a foundation of comprehensive data, including Daiwa's annual reports, investor presentations, and regulatory filings. We also leverage industry-specific research from financial data providers and market analysis firms to provide a robust assessment of the competitive landscape.