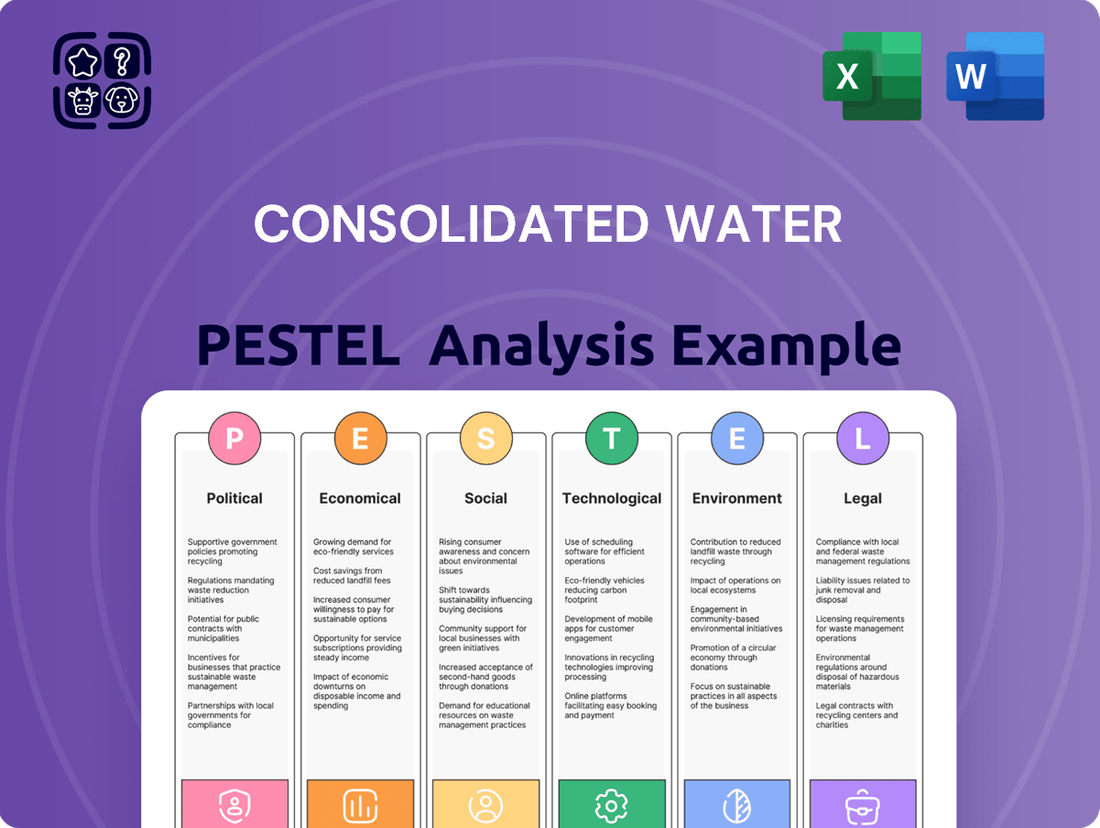

Consolidated Water PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consolidated Water Bundle

Curious about the external forces shaping Consolidated Water's future? Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting this vital company. Gain a strategic advantage by understanding these critical trends. Download the full analysis now to unlock actionable insights and fortify your own market approach.

Political factors

Government regulations concerning water resource management, including desalination project approvals and pricing, are pivotal for Consolidated Water's business. For instance, the company's operations in places like the Cayman Islands are shaped by local water authority policies and environmental impact assessments, which can influence project timelines and costs.

Shifts in these policies, particularly in water-scarce areas such as parts of the Caribbean or California where Consolidated Water has interests, can either open avenues for new projects or introduce limitations on existing operations and future growth strategies. For example, evolving clean water standards can necessitate upgrades to treatment facilities.

The political stability within the countries where Consolidated Water operates is a critical determinant for the long-term success and financial security of its investments. Unstable political environments can introduce risks related to contract enforcement, expropriation, or abrupt regulatory changes, impacting the company's ability to secure financing and deliver consistent returns on its water infrastructure projects.

Consolidated Water's operations are significantly shaped by international relations and trade agreements, particularly those concerning water resources. For instance, bilateral agreements on transboundary water management, like those potentially impacting shared river basins in regions where Consolidated Water operates, directly influence market access and operational frameworks. These agreements can dictate water allocation, environmental standards, and even infrastructure development, creating both opportunities and constraints for the company.

Geopolitical shifts and evolving trade policies pose tangible risks. A rise in protectionism or trade disputes could escalate the cost of importing specialized equipment and materials essential for desalination plants or water infrastructure projects, potentially delaying critical projects and increasing overall expenditure. For example, tariffs imposed on manufactured goods could directly impact the capital expenditure for new facilities.

Conversely, stable international relations foster an environment conducive to cross-border collaboration and technological advancement. Consolidated Water can leverage strong diplomatic ties to secure funding for large-scale projects, facilitate the transfer of cutting-edge water treatment technologies, and expand its reach into new markets where collaborative agreements are in place, such as partnerships for infrastructure development in emerging economies.

Public-private partnerships (PPPs) are a cornerstone for Consolidated Water's expansion, particularly in developing essential water infrastructure. These collaborations allow governments to leverage private sector expertise and capital for major projects, such as desalination plants and distribution networks. For Consolidated Water, successfully navigating and securing these PPPs is crucial, as they typically offer predictable, long-term revenue streams and access to substantial development opportunities.

Political Stability in Operating Regions

Consolidated Water's operations are significantly influenced by political stability within its key operating regions, many of which face water scarcity. For instance, in the Cayman Islands, a territory with limited natural freshwater, political stability is crucial for maintaining its desalination operations and service agreements. The company's reliance on government concessions and regulatory frameworks means that shifts in political leadership or policy can directly impact its business model and profitability.

Political instability can create substantial operational risks. Disruptions stemming from civil unrest or sudden governmental changes, as seen in some developing nations where water infrastructure is often a government responsibility, can halt service delivery and damage critical assets. For example, a change in government could lead to a review or cancellation of existing water supply contracts, as potentially experienced by companies operating in regions with volatile political landscapes. This uncertainty can also stifle new capital investments needed for expanding or upgrading water treatment facilities.

A stable political environment is therefore a cornerstone for Consolidated Water's long-term success. It ensures the continuity of essential services and fosters an environment conducive to investment and growth. As of early 2025, countries like Jamaica, which Consolidated Water serves, continue to navigate economic and political challenges, underscoring the importance of stable governance for infrastructure providers. The company's ability to secure and maintain long-term contracts, such as its significant operations in the Cayman Islands, is directly tied to the predictable and supportive political frameworks in place.

- Political Stability: Regions with limited natural freshwater resources, where Consolidated Water operates, often coincide with potential political instability.

- Operational Risks: Political unrest, changes in leadership, or civil disturbances can disrupt services, jeopardize contracts, and deter new investments.

- Regulatory Dependence: The company relies heavily on government concessions and regulatory frameworks, making political stability essential for its business model.

- Investment Climate: A stable political environment is critical for attracting and sustaining the capital investment required for water infrastructure development and maintenance.

Subsidies and Incentives for Water Infrastructure

Government support through subsidies, grants, and tax incentives plays a crucial role in the financial viability of water infrastructure projects for Consolidated Water. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to offer significant funding through its State Revolving Funds (SRFs) for water infrastructure improvements, with a substantial portion earmarked for advanced treatment technologies. These programs directly lower capital expenditure and ongoing operational costs, making investments in areas like reverse osmosis more attractive.

The availability and structure of these policies directly impact Consolidated Water's decision-making on new developments and overall profitability. A supportive policy environment, especially one that champions sustainable water solutions, can accelerate project timelines and enhance the return on investment. For example, the Infrastructure Investment and Jobs Act (IIJA) allocated over $50 billion to water infrastructure in the U.S. through 2026, with specific provisions favoring innovative and resilient systems.

- Reduced Capital Costs: Government grants and subsidies can directly offset the upfront investment required for advanced water treatment technologies.

- Improved Operational Efficiency: Tax incentives for adopting energy-efficient processes can lower ongoing operational expenses for Consolidated Water.

- Enhanced Project Feasibility: Financial support influences the economic viability of new water infrastructure developments, impacting long-term profitability.

- Promotion of Sustainability: Policies favoring sustainable water management practices align with and benefit companies focused on environmental stewardship.

Government policies and regulations are paramount to Consolidated Water's operations, influencing everything from project approvals to water pricing. For example, in 2024, the U.S. government continued to allocate substantial funds through programs like the Infrastructure Investment and Jobs Act, supporting water infrastructure development, which can directly benefit companies like Consolidated Water. These policy frameworks dictate market access and operational standards, particularly in regions like the Caribbean where the company has significant interests.

The political stability of the countries where Consolidated Water operates is a critical factor. In early 2025, regions such as Jamaica, which Consolidated Water serves, continue to face economic and political challenges, highlighting the importance of stable governance for infrastructure providers. Political unrest or sudden policy shifts can disrupt services, impact contract enforceability, and deter necessary capital investments for water treatment and distribution systems.

Public-private partnerships (PPPs) are a key avenue for Consolidated Water's expansion, enabling the development of essential water infrastructure. These collaborations, often supported by government initiatives, provide predictable revenue streams and access to significant growth opportunities, as seen in the company's concessions in places like the Cayman Islands.

Government support through grants, subsidies, and tax incentives significantly impacts the financial viability of Consolidated Water's projects. For instance, in 2024, U.S. State Revolving Funds continued to offer substantial funding for water infrastructure improvements, directly reducing capital expenditure and making investments in advanced technologies more attractive.

What is included in the product

This Consolidated Water PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company, detailing impacts across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights derived from current market and regulatory trends, equipping stakeholders with the knowledge to identify strategic opportunities and mitigate potential threats.

Provides a concise and actionable summary of Consolidated Water's PESTLE factors, enabling quick identification of opportunities and threats to inform strategic decisions.

Economic factors

The global economic climate significantly shapes Consolidated Water's performance. In 2024, while some regions experienced robust growth, others faced inflationary pressures and slower expansion, directly affecting consumer spending power and business investment in water infrastructure. For instance, a strong US dollar, a common feature in 2024, could impact the reported earnings of Consolidated Water's international operations when translated back to US dollars.

Disposable income is a critical determinant of demand for water services. As of late 2024 and early 2025 projections, many developed economies are seeing a stabilization or modest increase in real disposable incomes, which bodes well for Consolidated Water's ability to maintain service levels and potentially invest in upgrades. However, emerging markets may present a mixed picture, with some experiencing income growth that boosts demand, while others grapple with economic volatility that could strain customer payments.

Economic downturns in key operating regions, such as potential slowdowns in the Caribbean or Hawaii during 2024-2025, could lead to reduced water consumption by both residential and commercial customers. This, coupled with potential payment delinquencies, could put pressure on Consolidated Water's revenue streams and cash flow, necessitating careful financial management and potentially impacting capital expenditure plans.

Government and private sector investment in water infrastructure, such as new desalination plants and distribution networks, acts as a significant economic catalyst for Consolidated Water. For instance, the U.S. government's Infrastructure Investment and Jobs Act of 2021 allocated substantial funds towards water systems. This increased spending directly translates to a more robust market for Consolidated Water's expertise and services.

Access to capital markets and favorable lending conditions are paramount for Consolidated Water to finance its large-scale infrastructure projects. In 2024, the company successfully secured a $50 million credit facility, demonstrating its ability to leverage financial markets for growth. These financial avenues are critical for undertaking projects that require significant upfront investment.

Economic policies that actively promote infrastructure development are a key driver for Consolidated Water's business. Countries and regions with a clear focus on upgrading their water and wastewater systems create a more predictable and supportive environment for the company. This policy support directly influences the demand for their integrated water solutions.

Consolidated Water's global operations expose it to currency exchange rate volatility. Fluctuations in the value of currencies like the US Dollar, Euro, or British Pound can directly affect the company's reported revenues and the cost of its international expenses. For instance, if the US Dollar strengthens significantly against a currency in which Consolidated Water has substantial revenue, those revenues would translate to fewer US Dollars, impacting overall profitability.

These shifts also impact the valuation of foreign assets and liabilities on Consolidated Water's balance sheet. A weaker foreign currency can diminish the US Dollar equivalent value of overseas property, plant, and equipment. Conversely, a stronger foreign currency could increase the cost of imported materials or equipment, thereby raising operating expenses and potentially reducing profit margins on projects denominated in those foreign currencies.

To manage these risks, Consolidated Water may utilize financial instruments such as forward contracts or currency options. These hedging strategies aim to lock in exchange rates for future transactions, providing greater certainty over costs and revenues. For example, if the company anticipates a large payment in Euros in six months, it might enter into a forward contract to buy Euros at a predetermined rate, mitigating the risk of the Euro strengthening against the US Dollar.

Inflation and Input Costs

Inflationary pressures significantly impact Consolidated Water's operational expenses. Rising costs for essential inputs like chemicals, labor, and construction materials directly squeeze profit margins. For instance, the U.S. Producer Price Index for chemicals saw a notable increase in late 2023 and early 2024, impacting chemical supply costs.

The ability to pass these increased costs onto customers is paramount for Consolidated Water's financial health. This often involves navigating complex regulatory tariff adjustments or renegotiating contracts. Energy, a substantial expense in desalination processes, is particularly vulnerable to inflationary trends, directly affecting the cost of water production.

- Rising input costs: Chemicals, labor, and construction materials critical for water treatment are subject to inflationary pressures.

- Energy cost impact: Desalination, a core operation for Consolidated Water, is highly energy-intensive, making it sensitive to energy price volatility.

- Tariff and contract reliance: Profitability hinges on the company's capacity to adjust regulated tariffs or renegotiate contracts to offset increased operating expenses.

Interest Rates and Access to Capital

Interest rates significantly shape Consolidated Water's financial landscape. Changes in borrowing costs directly affect the expense of funding its capital-intensive projects, influencing overall project profitability and viability. For instance, if the Federal Reserve maintains or increases its benchmark interest rate, as seen with hikes throughout 2022 and early 2023, Consolidated Water's cost of capital for new infrastructure or expansion could rise substantially.

Higher interest rates make new investments more expensive, potentially squeezing profit margins on projects that rely heavily on debt financing. This can lead to a slowdown in expansion plans or a need to re-evaluate the economic feasibility of certain upgrades. Access to affordable capital is therefore a critical determinant for Consolidated Water's ability to invest in essential areas such as expanding service capacity, implementing advanced water treatment technologies, and making necessary operational improvements.

Here's a look at factors influencing this:

- Federal Reserve Policy: The Federal Reserve's monetary policy, including its target for the federal funds rate, directly impacts broader interest rate levels. For example, the Fed raised its benchmark rate multiple times in 2022 and maintained higher rates through much of 2023 to combat inflation, increasing borrowing costs across the economy.

- Bond Market Yields: Yields on corporate bonds, including those issued by utility companies like Consolidated Water, are closely tied to prevailing interest rates. Higher Treasury yields often translate to higher borrowing costs for companies.

- Credit Ratings: Consolidated Water's credit rating plays a crucial role in determining the interest rates it pays on debt. A strong credit rating allows for more favorable borrowing terms, while a downgrade could lead to significantly higher financing costs.

- Inflationary Pressures: Persistent inflation can lead central banks to keep interest rates elevated to cool demand, directly increasing the cost of capital for companies undertaking long-term investments.

Global economic growth trends directly influence demand for water services and infrastructure investment. For 2024, while many economies showed resilience, pockets of inflation and slower growth in certain regions impacted consumer spending and municipal budgets for water projects. For example, the International Monetary Fund projected global growth to be around 3.2% for 2024, a figure that can be influenced by geopolitical events and commodity price volatility, both of which affect Consolidated Water's operating costs and revenue potential in different markets.

Disposable income levels are crucial for Consolidated Water's revenue, particularly in its retail water operations. Projections for late 2024 and early 2025 suggest a mixed picture for disposable incomes globally, with some developed nations seeing modest gains while emerging markets face greater uncertainty. This variability can affect customer payment reliability and the willingness of municipalities to invest in new water infrastructure, which is a key revenue stream for the company's development segment.

Interest rate environments significantly impact Consolidated Water's ability to finance its capital-intensive projects. With central banks maintaining higher rates through much of 2023 and into 2024 to combat inflation, the cost of borrowing for new infrastructure or expansions has risen. For instance, a company seeking to fund a new desalination plant would face higher debt servicing costs compared to a period of lower interest rates, potentially affecting project economics and the company's overall investment strategy.

Currency exchange rate fluctuations pose a risk to Consolidated Water's international earnings. As of mid-2024, the US dollar remained relatively strong against many currencies. This can reduce the reported value of revenues earned in foreign markets when translated back into US dollars, impacting the company's consolidated financial statements and potentially its profitability if not adequately hedged.

Same Document Delivered

Consolidated Water PESTLE Analysis

The preview shown here is the exact Consolidated Water PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use, providing comprehensive insights into the company's operating environment.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, allowing you to immediately leverage its detailed analysis of political, economic, social, technological, legal, and environmental factors impacting Consolidated Water.

The content and structure shown in the preview is the same Consolidated Water PESTLE Analysis document you’ll download after payment, ensuring you get a complete and professionally organized report.

Sociological factors

Global population is projected to reach 9.7 billion by 2050, with a significant portion of this growth occurring in urban areas. This surge in urban populations, especially in water-scarce regions, directly fuels demand for Consolidated Water's services. For instance, countries like the Bahamas, where Consolidated Water operates, face increasing water needs due to tourism and resident growth, making reliable water supply a critical concern.

Public concern over water scarcity is a significant driver for Consolidated Water. For instance, by 2023, over 2 billion people globally faced water stress, a figure projected to rise, making sustainable water management a critical issue. This growing awareness directly fuels demand for advanced water solutions, including desalination, which Consolidated Water specializes in.

Climate change exacerbates water scarcity, intensifying the need for reliable water sources. Reports in 2024 highlight increased frequency of droughts in regions like the Southwestern United States, directly impacting traditional water supplies. This situation bolsters public and governmental support for infrastructure projects like those undertaken by Consolidated Water, ensuring access to potable water.

The emphasis on clean drinking water quality further elevates the importance of companies like Consolidated Water. In 2023, the World Health Organization noted that unsafe drinking water still causes millions of deaths annually. This stark reality increases consumer willingness to pay for consistently safe and high-quality water, a core offering of Consolidated Water's services.

Societal expectations and government regulations concerning water quality and public health are critical drivers for Consolidated Water. These expectations directly shape the operational standards the company must meet, ensuring safe drinking water for consumers.

Maintaining exceptionally high water quality is not just a regulatory requirement but a cornerstone of public trust. Failing to do so could lead to severe health crises, damaging Consolidated Water's reputation and disrupting its operations. For instance, in 2024, the EPA continued to emphasize stricter contaminant limits, with proposed updates to the Lead and Copper Rule expected to increase compliance costs for water utilities.

Adherence to stringent health protocols is therefore non-negotiable. This commitment safeguards the communities served by Consolidated Water, reinforcing its role as a reliable provider. In 2025, ongoing investments in advanced filtration and monitoring technologies are anticipated to be a key focus for water utilities to meet evolving public health demands.

Community Acceptance of Desalination Projects

Community acceptance is a linchpin for the success of desalination projects, with public perception of environmental consequences, project costs, and the genuine need for the water supply playing significant roles. Consolidated Water, for instance, must actively engage with local populations to address these concerns and highlight the advantages of a dependable water source. For example, in 2023, a proposed desalination plant in California faced significant local opposition, ultimately leading to its indefinite postponement due to environmental impact and cost concerns.

Gaining a social license to operate and expand hinges on proactive community outreach and transparent communication, ensuring that local residents understand the necessity and benefits of these water solutions. Public resistance can unfortunately translate into costly delays or even the outright cancellation of vital infrastructure projects, impacting water security for entire regions.

Key factors influencing community acceptance include:

- Environmental Impact: Concerns about brine disposal and energy consumption are often primary drivers of opposition.

- Cost and Affordability: The price of desalinated water compared to traditional sources directly affects public buy-in.

- Necessity and Alternatives: Demonstrating a clear need for desalination, especially when other water sources are strained, is crucial.

- Community Engagement: Open dialogue, addressing specific local concerns, and involving communities in the planning process foster trust and acceptance.

Changes in Lifestyle and Water Consumption Patterns

Evolving lifestyles are significantly impacting water consumption. As people increasingly adopt habits that require more water, such as frequent showering or using water-intensive appliances, per capita usage rises. For example, the widespread adoption of high-efficiency washing machines and dishwashers, while promoting conservation, still contributes to overall household water demand.

Changes in industrial and agricultural practices also play a crucial role. Water-intensive industries, like tech manufacturing that uses water for cooling and cleaning, are growing. In agriculture, shifts towards more water-demanding crops or advanced irrigation techniques can alter regional water needs. By 2025, global industrial water demand is projected to increase by 13% compared to 2015 levels, according to UN Water reports.

- Lifestyle Shifts: Increased use of household appliances and personal care routines are driving higher per capita water consumption.

- Industrial Demand: Growth in sectors like technology and manufacturing, which are water-intensive, is a key factor in overall demand increases.

- Agricultural Needs: Changes in crop types and irrigation methods can significantly alter the water requirements in agricultural regions.

- Forecasting Impact: Understanding these evolving patterns is vital for Consolidated Water to accurately forecast future demand and ensure adequate supply capacity.

Societal expectations for clean, safe drinking water are paramount, driving demand for Consolidated Water's services. By 2023, the World Health Organization reported that unsafe water still caused millions of deaths annually, underscoring the critical need for reliable providers. This societal imperative, coupled with increasing public awareness of water scarcity, as evidenced by over 2 billion people facing water stress globally in 2023, directly supports Consolidated Water's mission and business model.

Technological factors

Continuous innovation in reverse osmosis (RO) membranes and system designs is making desalination more energy-efficient and cost-effective. For instance, advancements in materials science have led to membranes that operate at lower pressures, significantly reducing energy consumption. This translates directly to lower operational expenses for companies like Consolidated Water, making desalinated water a more economically viable option, especially as energy prices fluctuate.

Key areas of advancement include enhanced membrane durability and higher water recovery rates. Newer membranes can withstand harsher conditions and last longer, reducing replacement costs. Furthermore, improved system configurations are extracting more purified water from the same amount of feedwater, boosting overall efficiency. These technological leaps are crucial for Consolidated Water to maintain competitive pricing for its desalinated products in the 2024-2025 period.

Technological advancements are significantly impacting energy efficiency in water production, a key factor for Consolidated Water. Innovations in energy recovery devices can reclaim up to 95% of the energy previously lost in the desalination process, dramatically lowering operational costs. For instance, advancements in reverse osmosis membrane technology continue to reduce the energy required per cubic meter of desalinated water produced, with ongoing research aiming for further reductions.

The integration of renewable energy sources, such as solar and wind power, is also a critical technological trend. By reducing reliance on fossil fuels, Consolidated Water can mitigate energy cost volatility and enhance its environmental sustainability profile. This shift is becoming increasingly viable as the cost of renewable energy continues to decline, making it a more attractive option for large-scale water treatment facilities.

The increasing integration of smart water management systems, powered by the Internet of Things (IoT), is a significant technological factor for Consolidated Water. These systems utilize IoT sensors for precise leak detection, real-time water quality monitoring, and automated distribution, directly boosting operational efficiency and minimizing water wastage. For instance, by 2024, the global smart water management market is projected to reach $25.5 billion, indicating substantial investment in these technologies.

Consolidated Water can leverage these advancements to gain granular control over its network infrastructure, leading to optimized resource allocation and a more dependable service delivery to its customer base. The ability to monitor water quality in real-time, for example, allows for quicker responses to potential contamination events, safeguarding public health.

Furthermore, the sophisticated data analytics derived from these IoT deployments are instrumental in enabling predictive maintenance strategies and achieving overall system optimization. This proactive approach can reduce costly emergency repairs and extend the lifespan of critical water infrastructure, contributing to long-term financial stability.

Pre-treatment and Post-treatment Innovations

Innovations in pre-treatment, like advanced filtration and chemical dosing, are significantly boosting the efficiency and lifespan of reverse osmosis (RO) membranes for companies like Consolidated Water. These improvements minimize membrane fouling, a common issue that degrades performance. For instance, advancements in ultrafiltration and nanofiltration membranes, which became more sophisticated through the late 2010s and into the 2020s, offer superior particle removal compared to earlier technologies.

Post-treatment innovations are equally crucial, ensuring the final potable water meets stringent quality standards and optimizing remineralization processes. These developments contribute to the overall reliability and cost-effectiveness of water production. The global advanced water and wastewater treatment market, valued at over $60 billion in 2023, reflects the significant investment and progress in these areas.

These technological leaps directly impact Consolidated Water's operational costs and water quality output. By reducing membrane replacement frequency and improving energy efficiency in treatment processes, these innovations enhance the company's competitive edge. The ongoing research and development in membrane materials and treatment chemicals are key drivers for these improvements.

- Enhanced Membrane Longevity: Advanced pre-treatment reduces fouling, extending RO membrane life by an estimated 15-25% in optimized systems.

- Improved Water Quality: Post-treatment innovations ensure mineral balance and removal of trace contaminants, meeting evolving regulatory standards.

- Cost Reduction: Greater efficiency in pre- and post-treatment translates to lower energy consumption and reduced chemical usage, impacting operational expenditures.

- Market Growth: The global market for water treatment technologies continues to expand, driven by increasing demand for clean water and technological advancements.

Waste Management and Brine Disposal Technologies

Technological advancements in brine management are critical for Consolidated Water's environmental stewardship and regulatory compliance. Innovations like advanced diffusion systems aim to disperse brine more effectively, minimizing localized impacts on marine ecosystems. For instance, research into beneficial reuse, such as for mineral extraction or agricultural applications, offers a pathway to transform waste into a resource, potentially reducing disposal costs and environmental strain.

The pursuit of Zero Liquid Discharge (ZLD) technologies represents a significant frontier, aiming to eliminate liquid waste entirely through advanced evaporation and crystallization processes. While costly, ZLD can offer substantial long-term environmental benefits and water security. Consolidated Water's investment in R&D for these solutions directly supports its ability to meet increasingly stringent environmental standards and maintain social license to operate, especially as global water scarcity intensifies.

- Brine Minimization: Technologies reducing the volume and salinity of brine are key.

- Beneficial Reuse: Exploring applications for brine, like industrial processes or agriculture, is gaining traction.

- Zero Liquid Discharge (ZLD): Advanced systems aiming for complete water recovery and solid waste generation.

- Diffusion Systems: Enhancements in outfall design to improve brine dispersion and reduce ecological impact.

Technological advancements are making desalination more energy-efficient and cost-effective, with innovations in reverse osmosis (RO) membranes and system designs. For example, new membranes operate at lower pressures, significantly reducing energy consumption and operational expenses for companies like Consolidated Water.

Key advancements include enhanced membrane durability and higher water recovery rates, reducing replacement costs and boosting overall efficiency. These improvements are crucial for Consolidated Water to maintain competitive pricing for its desalinated products through 2024-2025.

Smart water management systems, powered by the Internet of Things (IoT), are also a significant technological factor. These systems use sensors for leak detection, real-time water quality monitoring, and automated distribution, increasing operational efficiency and minimizing water wastage. The global smart water management market was projected to reach $25.5 billion by 2024.

Consolidated Water can leverage these IoT advancements for granular control over its network, optimizing resource allocation and service delivery. Predictive maintenance strategies derived from IoT data can also reduce costly emergency repairs and extend infrastructure lifespan.

| Technology Area | Impact on Consolidated Water | Key Metric/Data Point (2024-2025 Focus) |

|---|---|---|

| RO Membrane Efficiency | Reduced energy consumption, lower operational costs | Targeted energy reduction of 5-10% per cubic meter of desalinated water |

| Smart Water Management (IoT) | Improved operational efficiency, reduced water loss | Potential reduction in system downtime by 10-15% through predictive maintenance |

| Renewable Energy Integration | Mitigated energy cost volatility, enhanced sustainability | Exploration of solar/wind integration for 20-30% of energy needs |

| Brine Management | Improved environmental compliance, potential resource recovery | Research into brine diffusion systems to minimize ecological impact |

Legal factors

Consolidated Water's operations are heavily influenced by a patchwork of water rights and allocation laws across its service territories. These regulations dictate who can access water, how much they can abstract, and for what purposes, directly affecting the company's supply chain and expansion capabilities. For instance, in 2024, the ongoing drought in some regions intensified scrutiny on existing water permits, highlighting the critical need for compliance and proactive engagement with regulatory bodies to secure necessary abstraction licenses and avoid costly legal challenges.

Consolidated Water operates under stringent environmental regulations, particularly concerning water quality standards and discharge limits for brine, a byproduct of desalination. These legal frameworks, critical for coastal zone management and ecological protection, demand meticulous compliance and complex permitting for their facilities.

Navigating these legal hurdles is essential for Consolidated Water to secure and retain its operating licenses. For instance, the company faced scrutiny and had to address environmental concerns regarding its Bluewater facility in the Cayman Islands, highlighting the importance of proactive environmental management and adherence to local laws.

Failure to comply with these environmental laws can result in significant financial penalties, potentially impacting profitability. More critically, non-compliance can lead to enforced operational halts, disrupting service delivery and revenue streams for the company.

Consolidated Water operates under a complex web of health and safety regulations governing every aspect of water provision. These laws mandate strict drinking water quality standards, effective treatment protocols, and the physical safety of water infrastructure. For instance, the U.S. Environmental Protection Agency (EPA) sets Maximum Contaminant Levels (MCLs) for various substances in drinking water, which Consolidated Water must consistently meet across its service areas.

Adherence to these stringent requirements is not merely a matter of public trust but a critical legal obligation to prevent significant liabilities. Failure to comply can result in substantial fines and reputational damage. In 2023, water utilities in the U.S. faced an average of $1.5 million in fines for violations related to water quality and safety, underscoring the financial risks involved.

Demonstrating compliance often necessitates rigorous, regular audits and the attainment of various certifications. These processes ensure that treatment facilities are operating optimally and that the distribution network remains secure and free from contamination, a key factor in maintaining operational integrity and investor confidence.

Contract Law and Public Utilities Regulation

Consolidated Water's operations are deeply intertwined with contract law, particularly its long-term agreements with government entities for water services. These contracts are the bedrock of its revenue streams, often spanning decades. For instance, in 2023, the company had significant contracts in place across its various operating segments, underpinning its financial stability.

Public utility regulations play a critical role, influencing how Consolidated Water prices its services, maintains quality standards, and fulfills its operational duties. These regulations are subject to change, and any shifts in pricing formulas or service mandates can directly affect the profitability and viability of existing contractual arrangements. The company actively monitors these regulatory landscapes in its operating jurisdictions.

- Contractual Dependence: Consolidated Water's revenue is largely secured through long-term contracts with governmental bodies, ensuring a predictable income base.

- Regulatory Influence: Public utility regulations dictate pricing, service quality, and operational requirements, impacting profitability.

- Legal Framework Impact: Changes in contract law or utility regulations can alter the financial terms and stability of existing agreements.

- 2024/2025 Outlook: Anticipated regulatory reviews in key markets like Hawaii and the Cayman Islands in 2024-2025 could lead to adjustments in service rates and operational guidelines.

International Laws and Cross-Border Operations

Operating across multiple countries, Consolidated Water must meticulously adhere to a complex web of international laws, treaties, and specific local legal frameworks. This necessitates a deep understanding of regulations governing foreign investment, international trade practices, and established mechanisms for resolving cross-border disputes. For instance, in 2024, navigating differing environmental protection standards across its operating regions, such as those in the US and the Caribbean, requires tailored compliance strategies.

Consolidated Water's global footprint means constant adaptation to diverse legal environments is not just a formality but a critical element for sustained cross-border expansion and operational success. This includes staying abreast of evolving international trade agreements that could impact the cost of imported equipment or the repatriation of profits.

- International Investment Treaties: Consolidated Water must consider Bilateral Investment Treaties (BITs) between countries where it operates, which offer protections against expropriation and ensure fair treatment for foreign investors.

- Trade Regulations: Compliance with World Trade Organization (WTO) agreements and regional trade blocs, such as CARICOM, impacts import/export duties and standards for water treatment technologies.

- Dispute Resolution: Understanding international arbitration frameworks, like those administered by the International Chamber of Commerce (ICC), is crucial for managing potential legal conflicts with governments or local partners.

- Environmental Law Harmonization: Monitoring efforts towards international environmental law harmonization, particularly concerning water quality standards and wastewater discharge, is vital for operational consistency.

Consolidated Water is subject to evolving legal frameworks concerning water rights and environmental protection, which directly influence its operational capacity and expansion. For example, in 2024, drought conditions heightened regulatory scrutiny on water abstraction permits in several of its operating regions, necessitating robust compliance and proactive engagement to secure necessary licenses.

The company's adherence to stringent environmental regulations, particularly regarding water quality and brine discharge from desalination processes, is paramount for maintaining its operating licenses and avoiding substantial penalties. Failure to comply can lead to operational halts, impacting revenue streams and investor confidence.

Public utility regulations significantly shape Consolidated Water's pricing, service quality, and operational mandates, with potential adjustments expected from anticipated regulatory reviews in key markets like Hawaii and the Cayman Islands during 2024-2025.

| Legal Factor | Impact on Consolidated Water | 2024/2025 Relevance |

|---|---|---|

| Water Rights & Abstraction Laws | Dictates water access, volume, and usage, affecting supply and growth. | Increased scrutiny due to drought conditions in 2024; need to secure permits. |

| Environmental Regulations (Water Quality, Brine Discharge) | Requires strict compliance for permits and avoiding fines; impacts desalination operations. | Ongoing need for meticulous adherence to protect coastal zones and ecological health. |

| Health & Safety Regulations (Drinking Water Standards) | Mandates quality standards and infrastructure safety; non-compliance leads to liabilities. | Meeting EPA's Maximum Contaminant Levels (MCLs) remains critical; U.S. water utilities faced average $1.5M fines in 2023 for violations. |

| Contract Law & Public Utility Regulations | Underpins revenue through long-term government contracts; influences pricing and service standards. | Potential for rate adjustments from regulatory reviews in Hawaii and Cayman Islands (2024-2025). |

| International Laws & Treaties | Requires navigation of diverse legal environments for foreign investment and trade. | Adapting to differing environmental standards across US and Caribbean in 2024; monitoring trade agreements impacting costs. |

Environmental factors

Global water scarcity is a mounting concern, with projections indicating that by 2050, over 5 billion people could face water shortages, according to the UN. Climate change intensifies this issue through extended droughts and erratic rainfall, directly boosting demand for Consolidated Water's desalination solutions. This environmental pressure is a primary driver for the company's growth.

Desalination, especially reverse osmosis, demands significant energy, leading to a notable carbon footprint. Consolidated Water is under increasing pressure to curb its energy usage and shift towards renewable power sources to lessen its environmental impact and align with global climate change targets.

The company's operational environmental sustainability is facing heightened scrutiny. For instance, in 2023, the global desalination market consumed an estimated 50 TWh of energy, with reverse osmosis accounting for the majority. This highlights the substantial environmental challenge Consolidated Water must address.

Consolidated Water faces environmental scrutiny over its brine discharge from desalination plants. The highly concentrated saltwater byproduct, if not managed carefully, can harm marine life and disrupt local ecosystems. For instance, in 2023, concerns were raised in Grand Cayman regarding the potential impact of brine from Consolidated Water's plant on seagrass beds, highlighting the need for advanced diffusion technologies to disperse the brine effectively.

To mitigate these risks and adhere to evolving environmental regulations, the company is investing in sustainable brine management solutions. This includes exploring methods beyond simple ocean outfalls. Public perception of environmental stewardship is a significant factor, as negative press can impact brand reputation and investor confidence. Consolidated Water's commitment to minimizing its ecological footprint is therefore crucial for its long-term operational viability and social license to operate.

Water Pollution and Source Water Quality

Pollution in natural water sources, like oceans and brackish groundwater, can significantly impact the quality of water used for desalination. This can lead to higher pre-treatment expenses and operational complexities for companies like Consolidated Water. For instance, increased levels of contaminants necessitate more advanced filtration systems, driving up both capital and operational expenditures.

Maintaining pristine source water quality is paramount for Consolidated Water to ensure efficient and cost-effective water production. Cleaner intake water reduces the strain on desalination membranes and equipment, leading to lower energy consumption and less frequent maintenance. This directly translates to improved profitability and a more competitive pricing structure for their services.

Environmental policies designed to curb water pollution offer a direct benefit to Consolidated Water. By promoting cleaner industrial discharge and agricultural runoff management, these policies ensure a more reliable supply of higher-quality raw water. This proactive approach to environmental protection ultimately supports the company's core business operations and long-term sustainability.

- Increased Pre-treatment Costs: Elevated pollutant levels in source water can add 10-20% to the initial capital costs for desalination plants due to the need for more sophisticated filtration and purification technologies.

- Operational Efficiency Gains: Studies show that using source water with lower turbidity and salinity can reduce energy consumption in reverse osmosis processes by up to 5%, directly impacting operational expenses.

- Policy Impact: Stricter regulations on industrial wastewater discharge, like those implemented in many coastal regions, can improve the quality of seawater used for desalination, potentially reducing operational costs by 5-10% annually.

Biodiversity and Coastal Zone Management

Consolidated Water's operations, particularly the construction and functioning of desalination plants with their intake and outfall systems, directly influence coastal biodiversity and marine ecosystems. The company is mandated to comply with stringent coastal zone management regulations, which necessitates thorough environmental impact assessments and the active implementation of strategies aimed at safeguarding local marine life and habitats. For instance, in 2024, Consolidated Water continued its focus on sustainable practices, investing in advanced intake screening technologies to mitigate marine organism impingement, a common concern in the industry.

Strategic site selection and thoughtful plant design are paramount to minimizing ecological disruption. This includes careful consideration of sensitive marine areas and the adoption of designs that reduce the footprint and potential impact on the seabed and surrounding environment. The company's commitment to environmental stewardship is reflected in its ongoing efforts to balance operational needs with the preservation of coastal ecological integrity.

Key considerations for Consolidated Water in 2024 and 2025 include:

- Adherence to Environmental Regulations: Ensuring full compliance with national and international coastal zone management laws and permits.

- Environmental Impact Assessments (EIAs): Conducting comprehensive EIAs for all new projects and regularly reviewing existing operations to identify and mitigate potential ecological impacts.

- Marine Life Protection Measures: Implementing best practices for intake design, such as low-velocity screens, and outfall dispersion systems to minimize harm to marine organisms.

- Sustainable Site Selection: Prioritizing locations that have the least impact on sensitive coastal habitats and biodiversity.

The escalating global demand for clean water, driven by population growth and climate change, positions Consolidated Water favorably. Projections indicate that by 2050, over 5 billion people may face water scarcity, underscoring the critical need for solutions like desalination. This environmental pressure directly fuels the company's growth trajectory.

However, the energy-intensive nature of desalination, particularly reverse osmosis, presents a significant environmental challenge. Consolidated Water faces increasing pressure to reduce its carbon footprint by improving energy efficiency and transitioning to renewable energy sources. The global desalination market's energy consumption, estimated at 50 TWh in 2023, highlights the scale of this issue.

Brine discharge from desalination plants is another critical environmental concern. Improper management can harm marine ecosystems, as exemplified by concerns raised in Grand Cayman in 2023 regarding potential impacts on seagrass beds. Consolidated Water is investing in advanced brine management technologies to mitigate these risks and maintain its social license to operate.

Pollution in source water increases pre-treatment costs and operational complexity. For instance, elevated contaminant levels can add 10-20% to initial capital costs for desalination plants. Conversely, cleaner source water can improve operational efficiency, potentially reducing energy consumption by up to 5% in reverse osmosis processes.

| Environmental Factor | Impact on Consolidated Water | Supporting Data/Examples (2023-2025) |

| Water Scarcity & Demand | Increased demand for desalination services | UN projects over 5 billion people facing water shortages by 2050. |

| Energy Consumption & Carbon Footprint | Pressure to reduce energy use and adopt renewables | Global desalination market consumed ~50 TWh in 2023; focus on renewable integration. |

| Brine Discharge Management | Need for advanced solutions to protect marine life | Concerns in Grand Cayman (2023) over seagrass impact; investment in diffusion technologies. |

| Source Water Quality & Pollution | Impact on pre-treatment costs and operational efficiency | Higher pollutant levels can increase capital costs by 10-20%; cleaner water reduces energy use by up to 5%. |

| Coastal Zone Management | Compliance with regulations, protection of marine ecosystems | Continued focus in 2024 on advanced intake screening to mitigate marine organism impingement. |

PESTLE Analysis Data Sources

Our Consolidated Water PESTLE Analysis is meticulously crafted using data from international organizations like the World Health Organization and UNICEF, alongside national environmental protection agencies and water management authorities. This ensures a comprehensive understanding of global and local regulatory landscapes, technological advancements, and socio-economic factors influencing water resources.