Consolidated Water Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consolidated Water Bundle

Consolidated Water operates in a market shaped by moderate buyer power and the ever-present threat of substitutes, particularly in regions where alternative water sources exist. The company's ability to manage supplier relationships and navigate industry rivalry is crucial for sustained profitability.

This glimpse into Consolidated Water's competitive landscape is just the beginning. Unlock the full Porter's Five Forces Analysis to explore the intricate details of each force, understand their impact on Consolidated Water's strategic positioning, and gain the insights needed to make informed decisions.

Suppliers Bargaining Power

The market for specialized reverse osmosis (RO) membranes, high-pressure pumps, and energy recovery devices is quite concentrated, with a few major players holding sway. This concentration allows these suppliers to wield considerable bargaining power over Consolidated Water, particularly when it comes to unique or top-tier components.

This supplier leverage is amplified for proprietary technologies or components where alternatives are scarce. For instance, a single supplier of a critical, patented RO membrane could dictate terms, impacting Consolidated Water's cost structure and operational efficiency.

However, the desalination market's robust growth, with projections indicating it will reach $49.80 billion by 2032, could attract new competitors. This influx of new entrants has the potential to dilute supplier concentration and consequently, lessen their bargaining power in the long run.

Consolidated Water's reliance on advanced reverse osmosis (RO) technology means its suppliers of specialized components, like cutting-edge membrane materials and smart RO system integrations, hold significant bargaining power. These suppliers often possess unique inputs and intellectual property that are crucial for Consolidated Water's operational efficiency and technological edge. For instance, the development of nanostructured membranes and the integration of IoT and AI into RO systems represent proprietary advancements that are not easily replicated.

This uniqueness makes it challenging and costly for Consolidated Water to switch to alternative suppliers or technologies. The specialized nature of these inputs means that disruptions in supply or significant price increases from these key suppliers can directly impact Consolidated Water's production costs and competitive standing. In 2024, the global market for advanced water treatment membranes continued to see consolidation among key players, further concentrating supply power.

Switching suppliers for critical components like reverse osmosis (RO) membranes or large-scale pumps presents substantial hurdles for Consolidated Water. These switching costs aren't trivial; they encompass re-engineering plant designs to accommodate new equipment, recalibrating intricate water treatment systems, and the rigorous process of requalifying new vendors to ensure compliance and performance. For instance, a single RO membrane replacement can cost tens of thousands of dollars, and a system-wide overhaul can run into millions, impacting operational continuity.

Threat of Forward Integration by Suppliers

Suppliers of core desalination technologies, particularly those providing advanced membrane systems or energy recovery devices, possess the potential to integrate forward. This means they could move into developing, constructing, and operating their own water production facilities, directly competing with Consolidated Water.

While component manufacturers might find this less feasible, large engineering, procurement, and construction (EPC) firms that supply significant equipment packages could explore this avenue. For instance, if an EPC firm secures a major contract for a large-scale desalination plant, they might see an opportunity to operate it long-term, thus increasing their bargaining power over Consolidated Water by becoming a direct competitor.

- Forward Integration Threat: Suppliers of critical desalination technology, such as advanced membrane manufacturers, could establish their own water production facilities.

- Competitive Landscape Shift: This would transform them from mere suppliers into direct competitors, potentially altering market dynamics.

- Leverage Increase: Such integration would significantly enhance supplier leverage by offering Consolidated Water the option to purchase water from them, rather than solely relying on their equipment.

Importance of Consolidated Water to Suppliers

Consolidated Water's substantial demand for essential components like membranes and pumps makes it a valuable customer for its suppliers. This significant purchasing volume incentivizes suppliers to foster strong relationships and offer competitive pricing to secure Consolidated Water's ongoing business.

The mutual reliance between Consolidated Water and its suppliers helps to moderate the suppliers' bargaining power. For instance, in 2023, Consolidated Water's capital expenditures on new projects and facility upgrades would have represented a considerable revenue stream for its key equipment and service providers.

- Significant Customer: Consolidated Water's consistent need for specialized water treatment equipment and services positions it as a major client for many suppliers.

- Volume Dependency: The sheer volume of materials and services Consolidated Water procures means suppliers are keen to maintain this business.

- Competitive Pricing: To retain Consolidated Water's patronage, suppliers are often motivated to offer attractive pricing structures.

- Relationship Value: Suppliers recognize the long-term value in a relationship with a company like Consolidated Water, influencing their willingness to negotiate.

Suppliers of specialized reverse osmosis (RO) membranes and high-pressure pumps hold significant bargaining power due to market concentration and proprietary technology. This is particularly true for unique or top-tier components where alternatives are scarce, impacting Consolidated Water's costs and efficiency. The global market for advanced water treatment membranes saw continued consolidation among key players in 2024, further concentrating supplier power.

Switching costs for critical components are substantial, involving re-engineering, recalibration, and vendor requalification, which can cost millions and disrupt operations. However, Consolidated Water's significant purchasing volume makes it a valuable customer, fostering relationships and encouraging competitive pricing from suppliers, thus moderating their power.

| Factor | Impact on Consolidated Water | Evidence/Data |

|---|---|---|

| Supplier Concentration | High bargaining power for key component suppliers | Few major players in specialized RO membrane market. |

| Proprietary Technology | Increased supplier leverage; difficult to switch | Patented RO membranes, unique inputs, and intellectual property. |

| Switching Costs | High costs and operational disruption for supplier changes | Re-engineering, recalibration, requalification; millions in potential costs. |

| Consolidated Water's Demand | Moderates supplier power; fosters competitive pricing | Significant purchasing volume creates mutual reliance. |

What is included in the product

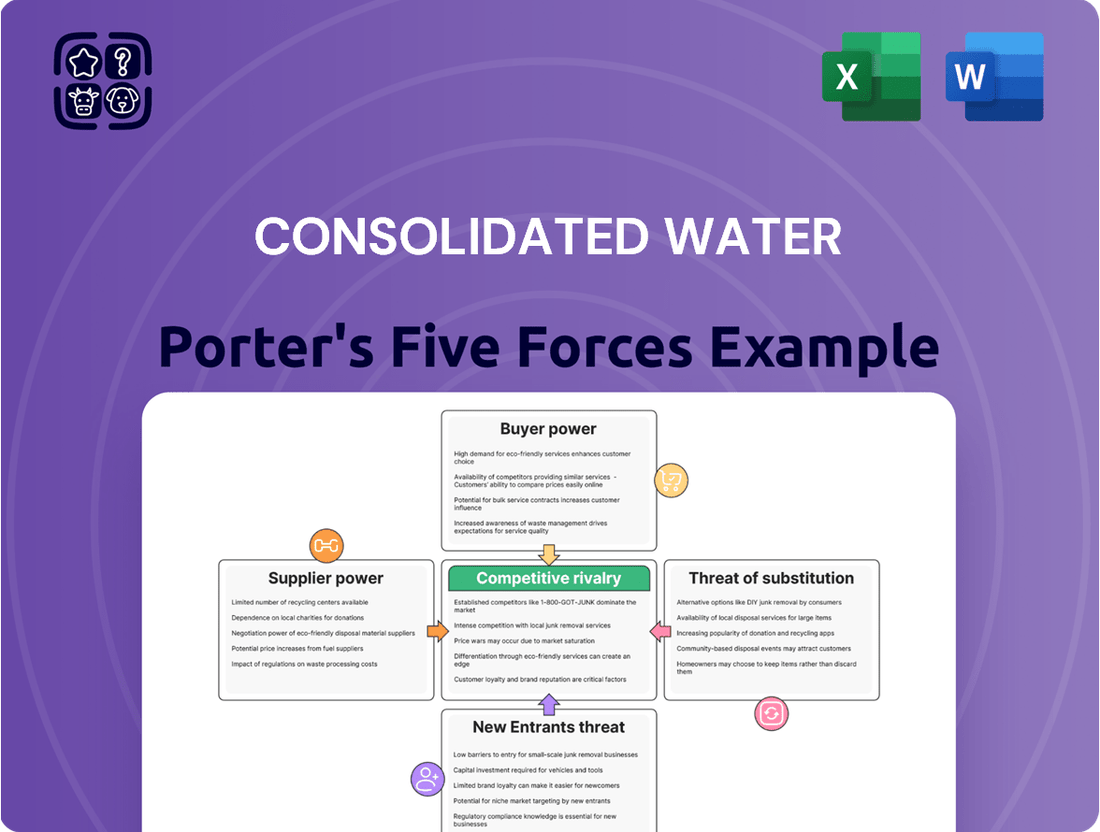

This analysis unpacks the competitive forces impacting Consolidated Water, revealing how industry rivalry, buyer and supplier power, new entrants, and substitutes shape its strategic environment.

Instantly identify and strategize against competitive pressures with a visual breakdown of Consolidated Water's industry landscape.

Customers Bargaining Power

Consolidated Water's customer base is broad, encompassing residential users, commercial enterprises, and government entities, especially in areas where freshwater is scarce. This diversity generally dilutes individual customer bargaining power.

However, the company does face situations with higher customer concentration, particularly through large government contracts or major industrial clients. These significant purchasers, by virtue of the sheer volume of water they procure and the essential nature of the service, can exert considerable bargaining power.

For instance, in 2023, Consolidated Water reported that its largest customer accounted for approximately 10% of its total revenue, highlighting the potential leverage held by major clients.

Consolidated Water's customers, particularly in regions with limited natural freshwater, often have few immediate alternatives to desalinated water, which is a critical supply. This scarcity naturally limits their bargaining power in the short term.

However, the increasing viability of advanced wastewater reuse and stormwater harvesting technologies presents a potential shift. While these alternatives are not yet widely adopted for direct potable use, their future development could offer customers more options, thereby enhancing their bargaining power over time.

For most residential and commercial customers, the ability to switch water providers is virtually nonexistent. This is due to the entrenched nature of existing water infrastructure, such as pipes and treatment facilities, and the rigid regulatory environments governing water utilities. These factors create extremely high switching costs, effectively nullifying customer bargaining power in this segment.

Large industrial and municipal clients, while potentially having more options, still face significant hurdles if they consider alternative water sourcing. The investment required to build entirely new water production or purification facilities, or to connect to a different supply network, would be massive. For instance, a large manufacturing plant relying on a consistent, high-quality water supply would need to consider the capital expenditure for new plants, which can run into tens or even hundreds of millions of dollars, making switching prohibitively expensive.

Price Sensitivity of Customers

The price sensitivity of customers for potable water, especially in regions facing scarcity, tends to be low. This inelastic demand means customers are less likely to drastically reduce consumption even if prices increase, as access to clean water is a necessity. For instance, in areas like the Cayman Islands, where Consolidated Water operates, water is a critical utility, and customers generally accept price adjustments to ensure reliable supply.

Conversely, industrial and agricultural sectors, which often require larger volumes of water, exhibit greater price sensitivity. For these users, the cost-effectiveness of water, including desalinated water, becomes a more significant consideration. In 2024, the operational costs associated with desalination, influenced by energy prices, directly impact the price point offered to these larger consumers. If these costs rise significantly, industrial clients might explore alternative water sources or efficiency measures, thereby increasing their bargaining power.

- Inelastic Demand for Potable Water: Essential water services often face low price elasticity, meaning customers continue to purchase water even with price hikes due to its necessity.

- Price Sensitivity in Industrial Use: Large-volume users like agricultural operations or industrial facilities are more attuned to water costs, especially when desalination expenses are high.

- Impact of Desalination Costs: Fluctuations in energy prices in 2024 directly affect the cost of producing desalinated water, influencing the pricing strategies for industrial and agricultural customers and their sensitivity to these changes.

Customer Information and Transparency

Consolidated Water, like many utility providers, operates in an environment where customer information and transparency are significant factors. While there can be an inherent information asymmetry, with the company possessing deeper insights into production costs and operational complexities, regulatory oversight plays a crucial role in leveling the playing field.

Regulatory bodies often set or approve the pricing for municipal water services. This means customers benefit from a degree of transparency and fairness in the rates they pay. For instance, in 2024, Consolidated Water's operations in various jurisdictions are subject to rate review processes that involve public hearings and data submission, allowing for scrutiny of their cost structures and proposed price adjustments.

- Information Asymmetry: Consolidated Water generally has more detailed knowledge of its operational costs and supply chain dynamics than the average customer.

- Regulatory Oversight: Pricing for municipal water services is frequently regulated, ensuring a baseline of transparency and consumer protection.

- Rate Review Processes: In 2024, the company's pricing is subject to regulatory reviews, which often include public input and data disclosure, enhancing customer awareness.

- Customer Bargaining Power: While direct bargaining is limited, the collective voice of customers, amplified through regulatory channels, influences pricing decisions.

The bargaining power of Consolidated Water's customers is generally low, particularly for residential and small commercial users, due to the essential nature of water and high switching costs associated with infrastructure. However, large industrial and government clients can exert more influence, especially when water scarcity is less pronounced or viable alternatives emerge.

In 2024, the cost of energy significantly impacts desalination expenses, making large-volume users more sensitive to price fluctuations. Consolidated Water's largest customer represented about 10% of revenue in 2023, indicating potential leverage for major clients.

While direct customer negotiation is limited, regulatory oversight and public input during rate reviews in 2024 provide an indirect channel for customer influence on pricing and service terms.

| Customer Segment | Bargaining Power Factors | Impact on Consolidated Water |

|---|---|---|

| Residential/Small Commercial | High necessity, low alternatives, high switching costs | Very Low Bargaining Power |

| Large Industrial/Government | Potential for volume discounts, price sensitivity, emerging alternatives | Moderate Bargaining Power |

| Overall Customer Base | Regulatory oversight, collective voice via public hearings | Indirect Influence on Pricing |

Full Version Awaits

Consolidated Water Porter's Five Forces Analysis

This preview shows the exact Consolidated Water Porter's Five Forces analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You're looking at the actual document detailing threats of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and intensity of rivalry within the water utility sector. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The water production and treatment sector, especially desalination, features a blend of major international companies and smaller, localized businesses. Consolidated Water stands out as a prominent designer, builder, and operator in this space.

The global desalination market is experiencing significant growth, attracting a multitude of companies competing for new projects. This intense competition, particularly for securing new contracts, indicates a moderate to high level of rivalry within the industry.

The global desalination technologies market is booming, expected to grow from $19.47 billion in 2024 to $21.73 billion in 2025, a healthy 11.6% compound annual growth rate. This robust expansion to an estimated $49.80 billion by 2032 offers breathing room for companies like Consolidated Water. The expanding market size can temper the intensity of competitive rivalry by providing ample opportunities for all participants, thereby lessening the pressure to aggressively capture market share from competitors.

Consolidated Water stands out by leveraging advanced reverse osmosis technology and offering a full suite of services, from initial design and construction to ongoing operation and maintenance. This integrated approach sets them apart in a market where the fundamental product, potable water, is inherently similar across providers.

While the water itself is a commodity, Consolidated Water's emphasis on reliability, operational efficiency, and specialized service capabilities creates a distinct value proposition. For instance, their commitment to water quality and system uptime, crucial for their clients, offers a tangible advantage over competitors focusing solely on water supply.

Exit Barriers

Consolidated Water, like many in the water utility sector, faces substantial exit barriers. The immense capital required for water production, desalination, and treatment facilities means that exiting the market isn't a simple decision. This high initial investment locks companies into operations, making it difficult to recoup costs if they decide to leave.

Furthermore, long-term contracts with municipalities and governments, often spanning decades, bind companies to their operational commitments. These agreements are crucial for revenue stability but also represent a significant hurdle to exiting. Specialized infrastructure, tailored for specific water sources or distribution networks, further complicates any potential divestment or closure.

These formidable exit barriers can directly influence competitive rivalry. Companies are less likely to abandon the market, even when facing financial strain or intense competition. Instead, they tend to remain and fight for market share, potentially leading to prolonged periods of aggressive pricing or service competition. For example, in 2024, the global water and wastewater treatment market was valued at approximately $700 billion, indicating substantial ongoing investment and commitment from established players.

- High Capital Intensity: Building and maintaining water infrastructure demands significant upfront and ongoing investment, making it costly to exit.

- Long-Term Contracts: Commitments to supply water over extended periods create operational and financial ties that are hard to break.

- Specialized Assets: Infrastructure is often bespoke, reducing its resale value or alternative use, thus increasing exit costs.

- Intensified Rivalry: The difficulty of exiting encourages companies to compete fiercely to maintain their market position rather than withdraw.

Switching Costs for Competitors' Customers

Switching costs for customers of rival water utilities are substantial, mirroring those faced by Consolidated Water's own clientele. These high barriers stem from entrenched infrastructure, like existing pipeline networks and treatment facilities, as well as long-term service contracts. For instance, in 2023, the average municipal water contract duration can extend for decades, making immediate shifts economically prohibitive for many communities and businesses.

This high switching cost environment means that direct competition for established customer bases is somewhat constrained. Instead, rivalry among water service providers intensifies in the pursuit of new projects and the expansion into previously unserved or underserved geographical areas. This strategic focus on growth and market penetration, rather than customer poaching, is a key characteristic of the competitive landscape.

- High Infrastructure Investment: The significant capital expenditure required to build and maintain water infrastructure creates a natural lock-in for existing customers.

- Contractual Obligations: Long-term service agreements and regulatory approvals further solidify customer relationships with incumbent providers.

- Limited Direct Competition for Existing Customers: The high switching costs reduce the likelihood of customers readily switching to a competitor for current service needs.

- Focus on New Market Acquisition: Competitive efforts are therefore redirected towards securing new contracts and expanding into new service territories.

The competitive rivalry within the water production and treatment sector, particularly for desalination, is shaped by a growing market and significant exit barriers. While the expanding global desalination technologies market, projected to reach $49.80 billion by 2032 from $19.47 billion in 2024, offers opportunities, it also attracts numerous players. Consolidated Water differentiates itself through its integrated service model and technological expertise, moving beyond the commodity nature of water itself.

The difficulty in exiting the water utility market, due to high capital intensity, long-term contracts, and specialized assets, means companies tend to stay and compete vigorously. This intensifies rivalry as firms fight for market share rather than withdrawing. The global water and wastewater treatment market's approximate $700 billion valuation in 2024 underscores the substantial, ongoing commitment and competition from established entities.

High switching costs for customers, stemming from entrenched infrastructure and long-term contracts, limit direct competition for existing customer bases. Consequently, rivalry is primarily focused on acquiring new projects and expanding into new geographical territories, rather than poaching customers from rivals.

| Factor | Description | Impact on Rivalry |

| Market Growth | Global desalination market expansion (2024: $19.47B, 2032 est: $49.80B) | Tempered rivalry due to ample opportunities |

| Exit Barriers | High capital, long-term contracts, specialized assets | Intensified rivalry as firms remain and compete |

| Switching Costs | Infrastructure lock-in, long-term contracts | Reduced direct competition for existing customers, focus on new markets |

| Consolidated Water's Differentiation | Integrated services, advanced technology, reliability focus | Creates a distinct value proposition against competitors |

SSubstitutes Threaten

The primary substitute for desalinated water is naturally occurring freshwater from sources like rivers, lakes, and groundwater. However, Consolidated Water operates in regions where natural freshwater resources are limited, significantly reducing the direct threat of this substitute in its core markets. For instance, in the Cayman Islands, where Consolidated Water is a major supplier, reliance on groundwater is constrained by the island's geology and environmental considerations.

Traditionally, sourcing freshwater from natural reservoirs or rivers has been cheaper than desalination. This is largely due to the significant energy requirements and high initial investment needed for desalination plants. For instance, the operational costs of desalination can be around $0.50 to $1.00 per cubic meter, depending on the technology and energy prices.

However, this cost dynamic is shifting. As accessible freshwater sources become scarcer and increasingly polluted, the expenses associated with treating and transporting these natural supplies are rising. In some regions, the cost of conventional water treatment and distribution can now approach or even exceed the cost of desalinated water, making desalination a more viable alternative.

The increasing cost of conventional water management, coupled with advancements in desalination efficiency, is narrowing the cost gap. By 2024, the global desalination market is projected to reach over $25 billion, indicating a growing acceptance of its economic feasibility despite initial capital outlays.

For drinking water, the quality and dependability of substitutes are critical. While some areas have natural freshwater sources, their quality can be poor, necessitating expensive treatment processes.

Reverse osmosis (RO) desalination, however, offers a reliable and high-quality alternative. For instance, Consolidated Water's operations in the Cayman Islands, which rely heavily on desalination, consistently provide potable water meeting stringent quality standards, demonstrating the viability of this substitute technology.

Technological Advancements in Substitutes

Technological progress is creating more robust substitutes for traditional water sources. Advancements in wastewater treatment and reuse, alongside stormwater harvesting and aquifer recharge techniques, are becoming increasingly competitive options. These innovations are particularly effective for non-potable applications such as agricultural irrigation and industrial cooling, driven by a global push for environmental sustainability.

The growing viability of these substitutes is underscored by increasing investment and adoption rates. For instance, the global water and wastewater treatment market was valued at approximately $600 billion in 2023 and is projected to grow significantly. This expansion highlights the market's increasing acceptance of advanced treatment and reuse technologies as viable alternatives to conventional water supplies.

- Wastewater Reuse: Technologies like membrane bioreactors and advanced oxidation processes are making treated wastewater suitable for a wider range of uses, reducing reliance on freshwater.

- Stormwater Harvesting: Systems designed to capture, treat, and store rainwater are becoming more efficient, offering a decentralized and sustainable water source, especially in urban environments.

- Aquifer Recharge: Managed aquifer recharge projects are increasingly employed to replenish groundwater reserves, providing a buffer against drought and over-extraction of surface water.

- Desalination Advancements: While energy-intensive, ongoing improvements in desalination technology, particularly in reverse osmosis, are making it a more cost-effective substitute in water-scarce coastal regions.

Regulatory and Environmental Factors

The threat of substitutes for Consolidated Water is heightened by increasingly stringent environmental regulations. For example, in 2024, many regions saw tighter wastewater discharge permits, pushing industries to invest in advanced treatment and water reuse technologies, which serve as viable alternatives to traditional freshwater sources. This trend is further amplified by government incentives, such as the Bipartisan Infrastructure Law in the US, which allocated billions towards water infrastructure upgrades and sustainable water management practices, making substitute solutions more economically appealing.

These regulatory and environmental shifts directly impact Consolidated Water's business model by making alternative water supply methods, like desalination and advanced water recycling, more competitive. As water quality standards become more rigorous, the cost and complexity of meeting these standards for traditional water sources may increase, thereby improving the relative attractiveness of substitute technologies. For instance, the cost of advanced wastewater treatment can be offset by reduced reliance on expensive, newly sourced freshwater, especially in water-scarce areas.

- Stricter Regulations: Enhanced wastewater discharge and water quality standards in 2024 made advanced treatment and reuse technologies more appealing substitutes.

- Government Support: Initiatives like the Bipartisan Infrastructure Law in the US, with its significant water infrastructure funding, actively promote alternative water management solutions.

- Economic Viability: The increasing cost of compliance for traditional water sources, coupled with government backing for alternatives, improves the economic case for substitutes.

- Market Shift: These factors collectively encourage a market shift towards technologies that offer more sustainable and compliant water solutions.

The threat of substitutes for Consolidated Water is moderate, primarily due to the limited availability and increasing costs of traditional freshwater sources in its operating regions. While natural freshwater remains a cheaper alternative where abundant, its scarcity and quality issues in many of Consolidated Water's markets, such as the Cayman Islands, diminish this threat. Advancements in water treatment and reuse technologies are emerging as more significant substitutes, particularly for non-potable uses, driven by environmental regulations and government incentives that make these alternatives more economically viable.

| Substitute Type | Cost Competitiveness (vs. Desalination) | Quality/Reliability | Market Penetration/Growth |

|---|---|---|---|

| Natural Freshwater | Generally Lower (where available) | Variable; often requires treatment | High (historically), but declining in water-scarce areas |

| Wastewater Reuse | Increasingly Competitive | High (with advanced treatment) | Growing rapidly, especially for industrial/agricultural use |

| Stormwater Harvesting | Variable; localized benefits | Moderate; typically for non-potable uses | Emerging; potential in urban areas |

| Aquifer Recharge | Variable; long-term strategy | High (natural quality) | Growing; focused on groundwater replenishment |

Entrants Threaten

The capital required to establish a water production and treatment facility, particularly advanced operations like desalination plants, presents a formidable barrier. For instance, constructing a modern desalination plant can easily cost hundreds of millions, sometimes exceeding a billion dollars, a sum that deters many potential new players from entering the market.

The water utility sector is characterized by substantial regulatory hurdles, demanding extensive permits, licenses, and adherence to stringent environmental and health standards. For instance, in 2024, companies operating in this space must navigate evolving EPA regulations concerning PFAS contamination, adding layers of compliance complexity and cost.

Successfully entering this market requires significant investment in understanding and meeting these rigorous requirements, which can deter potential new competitors. The lengthy and costly process of obtaining necessary approvals, like securing water rights or environmental impact assessments, acts as a significant barrier, particularly for smaller or less capitalized entities aiming to enter markets like Consolidated Water's service territories.

Consolidated Water's reliance on advanced reverse osmosis technology presents a significant hurdle for potential new entrants. This technology demands specialized knowledge, proprietary membranes, and highly experienced personnel for its design, construction, and ongoing operation. For instance, the capital expenditure for a modern desalination plant can easily run into hundreds of millions of dollars, a substantial upfront investment that deters many. Acquiring or developing this level of expertise is a considerable barrier to entry, as it involves not just financial outlay but also a lengthy learning curve and the recruitment of niche talent.

Economies of Scale and Experience Curve

Existing players in the water utility sector, such as Consolidated Water, leverage significant economies of scale. This advantage spans procurement of materials, construction of infrastructure, and the ongoing operation of water treatment and distribution systems. For instance, larger operational footprints allow for bulk purchasing discounts on chemicals and equipment, reducing per-unit costs. In 2023, Consolidated Water reported revenue of $254.1 million, indicating a substantial scale of operations that new entrants would struggle to match initially.

Furthermore, an established experience curve provides a critical edge. Over time, companies like Consolidated Water refine their processes, improve efficiency in water management, and develop expertise in navigating regulatory landscapes and project complexities. This accumulated knowledge translates into lower operational costs and higher project success rates. New entrants would face a steep learning curve and associated higher costs until they achieve a comparable level of operational maturity and efficiency.

- Economies of Scale: Consolidated Water's substantial revenue of $254.1 million in 2023 highlights its ability to achieve lower per-unit costs through large-scale operations in procurement and construction.

- Experience Curve: Decades of operational experience allow for optimized water treatment, distribution, and maintenance, leading to cost efficiencies not readily available to newcomers.

- Cost Disadvantage for Entrants: New companies would need to invest heavily to reach a similar scale and build the necessary expertise, creating an initial cost barrier.

- Barriers to Entry: The combination of scale and experience creates a significant hurdle for potential new competitors looking to enter the water utility market.

Access to Distribution Channels/Customer Relationships

Consolidated Water's deep-seated, long-term relationships with municipal and industrial clients present a significant barrier for potential new entrants. These established connections are built on trust and a proven track record in providing a critical public service, making it difficult for newcomers to gain traction. For instance, in 2023, Consolidated Water reported securing multiple multi-year contracts for water and wastewater services across its various operating segments, highlighting the sticky nature of these customer relationships.

Securing access to essential distribution channels and fostering customer loyalty is a formidable hurdle. Newcomers must invest heavily in building credibility and demonstrating reliability to even be considered for contracts, a process that can take years. The water utility sector, in particular, is characterized by high switching costs for customers due to the essential nature of the service and the infrastructure involved, further solidifying the position of incumbents like Consolidated Water.

- Established Client Base: Consolidated Water has cultivated enduring partnerships with municipal and industrial customers in its operational territories.

- Trust and Contract Acquisition: For new competitors, earning the trust of these vital clients and winning contracts is a protracted and demanding endeavor.

- Critical Service Nature: Water supply is a fundamental public necessity, meaning clients are hesitant to switch providers without substantial assurance of continued, reliable service.

- Barriers to Entry: The time and resources required to replicate Consolidated Water's established customer relationships and distribution network act as a significant deterrent to new market participants.

The threat of new entrants for Consolidated Water is moderately low, primarily due to the substantial capital requirements and regulatory complexities inherent in the water utility sector. High upfront investment for infrastructure, coupled with stringent environmental and operational standards, creates significant barriers. For instance, the cost of building a new desalination plant can easily reach hundreds of millions of dollars, a prohibitive sum for many potential competitors. Furthermore, navigating evolving regulations, such as those concerning water quality and environmental impact assessments, adds layers of complexity and cost in 2024.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of infrastructure (e.g., desalination plants costing hundreds of millions). | Deters smaller or less capitalized firms. |

| Regulatory Hurdles | Extensive permits, licenses, and compliance with evolving standards (e.g., PFAS regulations in 2024). | Increases time-to-market and operational costs. |

| Technology & Expertise | Need for specialized knowledge in areas like reverse osmosis technology. | Requires significant investment in R&D and skilled personnel. |

| Economies of Scale | Established players benefit from lower per-unit costs due to large operations (e.g., Consolidated Water's $254.1 million revenue in 2023). | New entrants face a cost disadvantage until scale is achieved. |

| Customer Relationships | Long-term contracts and established trust with municipal and industrial clients. | Makes it difficult for new entrants to secure initial business. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Consolidated Water leverages data from their annual reports, investor presentations, and SEC filings. This is supplemented by industry reports from water sector analysts and government regulatory databases to provide a comprehensive view of the competitive landscape.