Consolidated Water Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consolidated Water Bundle

This glimpse into Consolidated Water's BCG Matrix highlights key areas of their business, but to truly understand their strategic positioning, you need the full picture. Discover which of their ventures are market leaders and which require a closer look.

Unlock the complete BCG Matrix for Consolidated Water and gain a definitive view of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the full report for actionable insights and a clear path to optimizing your investment strategy.

Stars

Consolidated Water's ambitious $204 million design-build-operate seawater desalination plant in Hawaii represents a substantial future revenue stream. This project is anticipated to transition into its more lucrative construction phases during 2026 and 2027, highlighting the company's strategic positioning within the burgeoning U.S. market for water infrastructure, particularly in water-scarce areas.

The project's viability received a significant boost with the Honolulu Board of Water Supply's approval of pilot test reports in May 2025. This milestone underscores the plant's potential to evolve into a key asset for Consolidated Water, contributing to its long-term growth and market presence.

Consolidated Water's U.S. Operations & Maintenance (O&M) Services are a clear star in its BCG Matrix. The segment experienced a significant 51% surge in recurring revenue during 2024. This impressive growth is largely attributed to the successful integration of acquired companies such as PERC Water and REC, which operate in key water-stressed areas in California, Arizona, and Colorado.

This strategic expansion into the U.S. O&M market is paying off handsomely. In the first quarter of 2025, the segment continued its upward trajectory, posting a 9% increase in recurring revenue. These acquired subsidiaries are actively securing and expanding long-term O&M contracts, solidifying their market position and contributing to a stable, high-margin revenue base for Consolidated Water.

Consolidated Water's mastery and ongoing implementation of cutting-edge reverse osmosis (RO) technology for converting seawater and brackish water is a significant competitive advantage. This expertise allows them to effectively secure and advance major new projects, solidifying their position in the expanding global desalination sector.

The company's deployment of this cost-effective and highly efficient RO technology in securing and executing new large-scale projects, like the Hawaii plant, positions them as leaders in a rapidly growing global desalination market. For instance, in 2023, Consolidated Water reported revenue of $222.8 million, with their desalination segment playing a crucial role.

This technological leadership is instrumental in capturing substantial market share within new, high-demand regions. The global desalination market was valued at approximately $9.5 billion in 2023 and is projected to reach over $17 billion by 2030, underscoring the significant growth potential where Consolidated Water's advanced RO capabilities are a key enabler.

Strategic Acquisitions for U.S. Market Penetration

Consolidated Water's (CWCO) strategic acquisitions, such as the October 2023 deal for REC, are designed to bolster its presence in the U.S. market. These moves are aimed at expanding the company's geographic reach and broadening its service portfolio within the United States.

The acquisition of PERC Water further solidifies this strategy. These inorganic growth initiatives are specifically targeting regions experiencing water scarcity, enabling CWCO to quickly capture market share in lucrative domestic areas. This approach accelerates entry into high-demand markets.

- REC Acquisition: October 2023, aimed at expanding U.S. footprint.

- PERC Water Acquisition: Further strengthens domestic market penetration.

- Growth Strategy: Focuses on water-stressed regions for rapid market share gains.

- Market Impact: Targets high-demand areas for water solutions, driving inorganic growth.

Expansion of Water Reuse and Recycling Services

Consolidated Water's PERC Water division is a key player in the wastewater recycling sector, leveraging advanced reverse osmosis technology for high-quality water reclamation. This positions them favorably in a market driven by increasing water scarcity. For example, in 2023, the global water and wastewater treatment market was valued at approximately $641.9 billion, with the water reuse segment showing robust growth potential.

The demand for recycled water, especially for non-potable applications like agricultural and industrial irrigation, is on the rise. Consolidated Water's expertise allows them to meet this demand effectively. The company's projects demonstrate their capacity to deliver treated water suitable for various reuse purposes, contributing to sustainable water management solutions.

- PERC Water's Expertise: Advanced wastewater treatment, including reverse osmosis.

- Market Driver: Intensifying global water scarcity.

- Application Focus: High-quality water reclamation for non-potable uses such as irrigation.

- Market Growth: The water reuse and recycling market is experiencing significant expansion.

Consolidated Water's U.S. Operations & Maintenance (O&M) Services are a clear star in its BCG Matrix, demonstrating robust growth and market penetration. The segment experienced a significant 51% surge in recurring revenue during 2024, largely due to successful acquisitions like PERC Water and REC in water-stressed U.S. regions. This momentum continued into Q1 2025 with a 9% increase in recurring revenue, driven by expanding long-term O&M contracts from these subsidiaries.

| Segment | 2024 Revenue Growth | Q1 2025 Revenue Growth | Key Growth Drivers |

|---|---|---|---|

| U.S. O&M Services | 51% | 9% | Acquisitions (PERC, REC), expanding long-term contracts in water-stressed areas |

What is included in the product

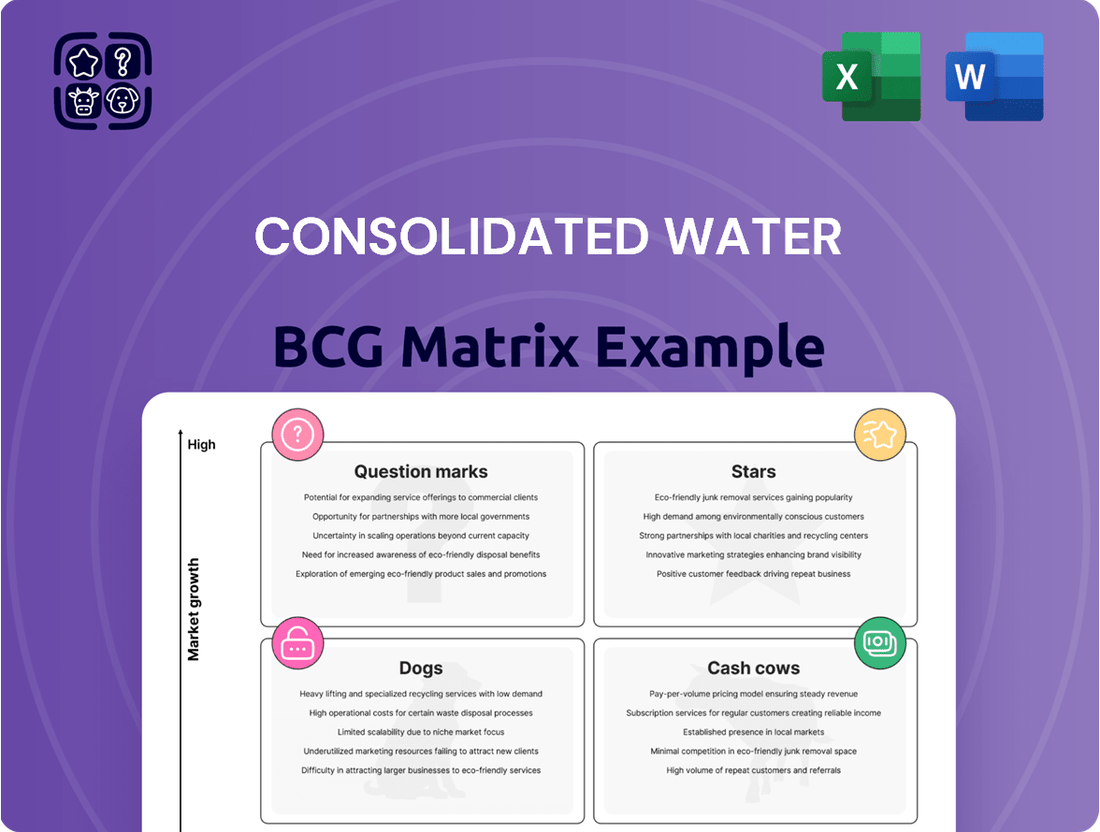

The Consolidated Water BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs, guiding investment and divestment decisions.

A clear visual map of Consolidated Water's portfolio, identifying growth opportunities and areas needing strategic attention.

Cash Cows

The retail water operations in Grand Cayman stand as a prime example of a Cash Cow for Consolidated Water. This segment boasts a dominant market share within its exclusive service area, a testament to its established presence and the essential nature of its product.

In 2024, this operation demonstrated robust performance, with retail revenue climbing 5% to $31.7 million. A record 1.01 billion gallons were sold, underscoring the sustained growth in both population and business activity on the island.

The consistent generation of strong cash flow is a hallmark of this segment. This is largely attributable to its loyal customer base and the non-discretionary demand for its services, allowing it to reliably fund other business initiatives.

Consolidated Water's Caribbean Bulk Water Supply segment functions as a Cash Cow within its BCG Matrix. The company's operations in the Cayman Islands and The Bahamas, under long-term Design, Build, Own, and Operate (DBOO) contracts, generate highly predictable and stable cash flows. These contracts, often with government-owned distributors, ensure a consistent revenue stream.

Despite a slight dip in bulk revenue in 2024, the segment's strength lies in its long-term nature and the pass-through of variable costs, which shields it from significant fluctuations. This stability, coupled with a high market share in its operational regions, solidifies its Cash Cow status, providing reliable earnings to fund other business ventures.

Consolidated Water's established Operations and Maintenance (O&M) contracts are a prime example of a cash cow within its business portfolio. These long-term agreements, especially those generating recurring revenue, are crucial for stable financial performance.

The company saw a substantial 51% surge in O&M recurring revenue in 2024, hitting $29.3 million. This growth underscores the dependable nature and profitability of these contracts once the initial infrastructure is in place.

These O&M agreements consistently deliver robust cash flow with minimal additional capital expenditure required, solidifying their status as a core revenue generator for Consolidated Water.

Manufacturing Segment

Consolidated Water's manufacturing segment is a cornerstone of its operations, focusing on specialized water products and systems for a diverse client base. This segment has demonstrated a steady performance, a hallmark of a cash cow. In 2024, revenue saw a modest increase of 1%, reaching $17.6 million, and continued this positive trend with a 10% rise in Q1 2025 to $5.8 million. This growth, coupled with enhanced profitability, underscores the segment's maturity and its role in generating consistent cash flow for the company.

- Segment Focus: Production and servicing of specialized water-related products and systems for commercial, municipal, and industrial sectors.

- 2024 Revenue: $17.6 million, a 1% increase year-over-year.

- Q1 2025 Revenue: $5.8 million, showing a 10% growth compared to the previous year's first quarter.

- Performance Indicator: Stable revenue growth and improved profitability signal a mature product line with a strong market position, contributing reliable cash flow.

Long-Term Water Production and Distribution Agreements

Long-term water production and distribution agreements are the bedrock of Consolidated Water's business, essentially acting as its cash cows. This model, which involves designing, building, and operating water facilities, then securing these long-term agreements, has cemented the company's high market share in its established service territories. These contracts are crucial because they guarantee a steady stream of demand and predictable revenue, providing a very reliable source of cash flow.

These agreements function much like a utility service, where customers are dependent on the consistent supply of water. For Consolidated Water, this translates into stable earnings that can be reinvested into other ventures or used to cover operational costs. For instance, in fiscal year 2023, the company reported total revenue of $244.4 million, with a significant portion stemming from its regulated utility operations, which are largely underpinned by these types of agreements.

- Core Business: Designing, building, and operating water production and treatment facilities.

- Revenue Stability: Long-term distribution agreements ensure consistent demand and predictable revenue streams.

- Market Position: High market share in established service areas due to these foundational agreements.

- Cash Flow Generation: These operations act as a reliable source of cash flow for the company.

Consolidated Water's established retail water operations, particularly in Grand Cayman, are a prime example of a cash cow. This segment benefits from a dominant market share and the essential nature of its product, leading to consistent revenue generation. In 2024, retail revenue grew 5% to $31.7 million, with record sales of 1.01 billion gallons, highlighting its stable demand and profitability.

The company's Caribbean Bulk Water Supply segment, operating under long-term contracts in the Cayman Islands and The Bahamas, also functions as a cash cow. Despite a minor revenue dip in 2024, the segment’s predictable cash flows, shielded by cost-pass-through mechanisms, underscore its stable and reliable contribution to the company's earnings.

Furthermore, Consolidated Water's Operations and Maintenance (O&M) contracts, especially those with recurring revenue, are strong cash cows. A significant 51% surge in O&M recurring revenue to $29.3 million in 2024 demonstrates the low capital expenditure required and the consistent, robust cash flow these agreements provide.

The manufacturing segment, focusing on specialized water products, also exhibits cash cow characteristics. With a 1% revenue increase to $17.6 million in 2024 and a 10% rise in Q1 2025, this segment's steady growth and improved profitability indicate a mature product line consistently generating cash.

| Segment | 2024 Revenue | Key Characteristic | BCG Matrix Status |

| Grand Cayman Retail Water | $31.7 million | Dominant market share, essential product | Cash Cow |

| Caribbean Bulk Water Supply | (Slight dip in 2024) | Long-term contracts, predictable cash flow | Cash Cow |

| Operations & Maintenance (O&M) | $29.3 million (recurring revenue) | Recurring revenue, low capex | Cash Cow |

| Manufacturing | $17.6 million | Steady growth, improved profitability | Cash Cow |

Delivered as Shown

Consolidated Water BCG Matrix

The Consolidated Water BCG Matrix preview you're examining is the identical, fully intact document you will receive immediately after completing your purchase. This means no watermarks, no sample data, and no limitations—just a professionally formatted and analysis-ready strategic tool. You can confidently use this preview as a direct representation of the comprehensive report that will be yours to download and implement for your business planning. It's designed for immediate application, offering clear insights into Consolidated Water's product portfolio performance.

Dogs

Completed fixed-price construction projects represent Consolidated Water's "Dogs" in the BCG Matrix. The substantial drop in services revenue, a 48% decrease in 2024 and 42% in Q1 2025, directly reflects the conclusion of these projects, which were significant revenue drivers in the prior year.

These completed projects, while contributing to past financial performance, now offer minimal growth potential and are no longer active revenue generators. Their completion signifies a shift from a growth phase to a mature or declining stage within the company's service offerings.

Consolidated Water's Bahamas operations are significantly hampered by delinquent accounts receivable from the Water and Sewerage Corporation (WSC). As of March 2024, a substantial 81% of the WSC's accounts receivable were overdue, a figure that stood at 78% in December 2023. This persistent issue effectively traps cash within the subsidiary, creating a liquidity constraint and limiting its ability to generate favorable returns.

The Divested Mexico Project in Consolidated Water's BCG Matrix represents a classic 'Dog' scenario. In 2024, the company finalized the sale of assets from this discontinued desalination project, marking the end of an investment that failed to generate expected returns.

This project, which never reached its full operational potential, consumed capital and management attention without contributing to long-term growth. Such 'cash trap' characteristics are typical of Dogs, often necessitating divestiture to reallocate resources more effectively.

Declining Energy Pass-Through Component in Bulk Revenue

Consolidated Water's bulk segment faced a revenue dip in 2024 and early 2025, influenced by falling energy prices. This decline was significantly driven by a reduction in the energy pass-through component for CW-Bahamas.

This specific revenue stream, directly linked to volatile energy costs and contractual pass-throughs, exhibits limited growth prospects. Consequently, it acts as a drag on the overall performance of the bulk water segment.

- Declining Energy Pass-Through: The energy pass-through component in the bulk segment revenue for CW-Bahamas saw a decrease in 2024 and Q1 2025 due to lower energy prices.

- Impact on Bulk Revenue: This reduction in the pass-through component contributed to the overall decline in the bulk segment's revenue during the specified periods.

- Low Growth Potential: Revenue tied to fluctuating energy prices and pass-through mechanisms inherently possesses low growth potential, impacting segment performance.

- Segment Performance Drag: The energy pass-through component's nature can act as a drag on the bulk segment's overall financial performance, particularly when energy prices fall.

Inconsistent Design and Consulting Services Revenue

Consolidated Water's design and consulting services, while part of its broader services segment, experienced a revenue decrease in the first quarter of 2025. This project-based revenue stream, unlike the more predictable operations and maintenance (O&M) services, inherently carries inconsistency.

These services often do not automatically translate into larger, more profitable long-term engagements or subsequent construction projects. Consequently, this segment represents a low-growth, low-market-share contribution within Consolidated Water's overall services portfolio, aligning with the characteristics of a 'Dog' in the BCG Matrix.

- Q1 2025 Revenue Decline: Design and consulting services saw a reduction in revenue during the first quarter of 2025.

- Project-Based Inconsistency: Unlike recurring O&M revenue, this segment's income is tied to individual projects, leading to fluctuations.

- Limited Long-Term Impact: These services may not consistently secure follow-on work or larger construction contracts.

- Low Growth, Low Share: The segment contributes minimally to overall growth and market share within the services division.

Consolidated Water's "Dogs" are primarily characterized by completed projects and segments with declining revenue and limited growth prospects. The divestment of the Mexico Project and the reduced revenue from design and consulting services, exemplified by a Q1 2025 decline, highlight these characteristics. Additionally, the energy pass-through component within the bulk segment, impacted by falling energy prices in 2024 and early 2025, also falls into this category due to its inherent low growth potential.

| Segment/Project | BCG Category | Key Financial Indicator (2024/Q1 2025) | Reason for Classification |

|---|---|---|---|

| Completed Fixed-Price Construction Projects | Dog | 48% services revenue drop (2024) | Conclusion of major revenue-generating projects, no future growth |

| Divested Mexico Project | Dog | Divested in 2024 | Failed to generate expected returns, capital consumption |

| Design and Consulting Services | Dog | Revenue decrease in Q1 2025 | Project-based, inconsistent, limited long-term impact |

| Bulk Segment (Energy Pass-Through) | Dog | Revenue dip in 2024/Q1 2025 | Linked to volatile energy prices, low growth potential |

Question Marks

Consolidated Water (CWCO) is strategically pursuing expansion into new geographic markets, focusing on water-stressed regions outside its current Caribbean base to offer drinking water and wastewater services. These early-stage initiatives are positioned in high-growth potential areas, mirroring the characteristics of a question mark in the Boston Consulting Group (BCG) matrix. For example, the company has been exploring opportunities in regions like the United States, which present substantial long-term growth prospects but currently represent a very small portion of CWCO's overall revenue, necessitating significant upfront investment to build market presence.

Consolidated Water's (CWCO) ventures into new U.S. wastewater treatment and reuse facilities are positioned in a rapidly expanding sector. This growth is fueled by escalating water scarcity and stricter environmental mandates across the nation. These new projects, while leveraging PERC Water's expertise, represent a nascent entry into a market with significant potential but also high initial investment needs.

While specific market share data for CWCO's newly launched U.S. wastewater reuse projects isn't publicly detailed, the overall U.S. water and wastewater treatment market was valued at approximately $100 billion in 2023 and is projected to grow. CWCO's strategy here involves substantial capital allocation and a focused approach to gain traction and scale operations in this developing segment.

Consolidated Water, a leader in advanced water solutions, is heavily investing in the development of next-generation water treatment technologies. These cutting-edge ventures, such as advanced membrane filtration and electrochemical processes, represent potential game-changers in the industry.

These R&D initiatives are positioned as question marks in the BCG matrix. They require substantial capital for research and development, aiming to capture future market share in areas like desalination and wastewater reuse, which are projected to grow significantly in the coming years.

Capacity Expansion for Aerex Industries

Consolidated Water's plan to expand Aerex Industries' manufacturing space positions Aerex as a potential question mark within the BCG matrix. This significant investment in capacity, particularly for new specialized products or nascent market segments, carries inherent risk. The company must achieve rapid market share gains to justify this expansion and ensure efficient utilization of the new facilities.

- Strategic Rationale: The expansion aims to meet anticipated future demand and capitalize on emerging opportunities in specialized product lines.

- Risk Assessment: Uncertainty surrounds the adoption rate of new products and the stability of unproven market segments, making capacity utilization a key concern.

- Performance Metrics: Success will be measured by Aerex's ability to quickly capture market share and generate sufficient revenue to offset the capital expenditure.

- Financial Implications: Consolidated Water's 2024 financial reports will likely show increased capital expenditures related to this Aerex expansion, impacting cash flow and potentially debt levels.

Diversification into Complementary Service Industries

Consolidated Water (CWCO) is strategically diversifying into complementary service industries, viewing these as potential growth engines. This expansion is being pursued through various avenues, including standalone ventures, collaborative efforts like joint ventures and strategic alliances, and outright acquisitions. The goal is to leverage existing expertise while tapping into new, high-growth markets.

These new ventures, while promising, are in sectors where CWCO is still building its presence and market share. This means they are likely positioned as question marks within the BCG matrix, demanding significant investment and careful analysis to ascertain their long-term potential and eventual trajectory. For instance, in 2024, the company continued to explore opportunities in areas like smart water management technologies and water-related data analytics, sectors experiencing substantial global growth but where CWCO’s market penetration is still developing.

- Diversification Strategy: CWCO is expanding into adjacent service industries to broaden its operational scope.

- Growth Potential: These new areas are characterized by high growth rates globally.

- Market Position: CWCO is entering these sectors with the aim of establishing a stronger market position, acknowledging that initial market share may be limited.

- Investment Focus: Significant evaluation and investment will be directed towards these diversified services to confirm their future viability and market success.

Consolidated Water's (CWCO) new market entries, such as its expansion into U.S. wastewater treatment and reuse, are classic examples of question marks. These initiatives require substantial capital investment with uncertain returns, aiming to capture future market share in high-growth sectors. The company's 2024 capital expenditures reflect this strategy, with significant allocations towards developing these nascent operations.

CWCO's diversification into areas like smart water management and data analytics also falls into the question mark category. While these sectors show strong global growth potential, CWCO's current market penetration is limited, necessitating further investment and strategic development to establish a solid foothold. The success of these ventures hinges on their ability to gain significant market traction quickly.

The expansion of Aerex Industries' manufacturing capacity, particularly for new specialized products, represents another question mark. This investment carries inherent risks related to market adoption and segment stability, making rapid market share capture crucial for justifying the capital outlay. Financial reports from 2024 will likely detail these increased expenditures.

Consolidated Water's research and development into next-generation water treatment technologies, like advanced membrane filtration, are also positioned as question marks. These ventures demand considerable funding for R&D, with the goal of securing future market leadership in areas with projected significant growth.

| Initiative | BCG Category | Strategic Focus | Investment Rationale | Key Challenge |

| U.S. Wastewater Treatment & Reuse | Question Mark | Market Penetration | High growth potential, water scarcity | Capital intensity, market adoption |

| Smart Water Management & Data Analytics | Question Mark | Diversification | Emerging high-growth sectors | Limited initial market share |

| Aerex Industries Capacity Expansion | Question Mark | New Product Lines | Meet future demand, capitalize on opportunities | Market adoption uncertainty |

| Next-Gen Water Treatment R&D | Question Mark | Technological Advancement | Future market leadership | Substantial R&D funding needs |

BCG Matrix Data Sources

Our Consolidated Water BCG Matrix is built using official company financial reports, independent market research on water sector growth, and competitor analysis to ensure a comprehensive view.