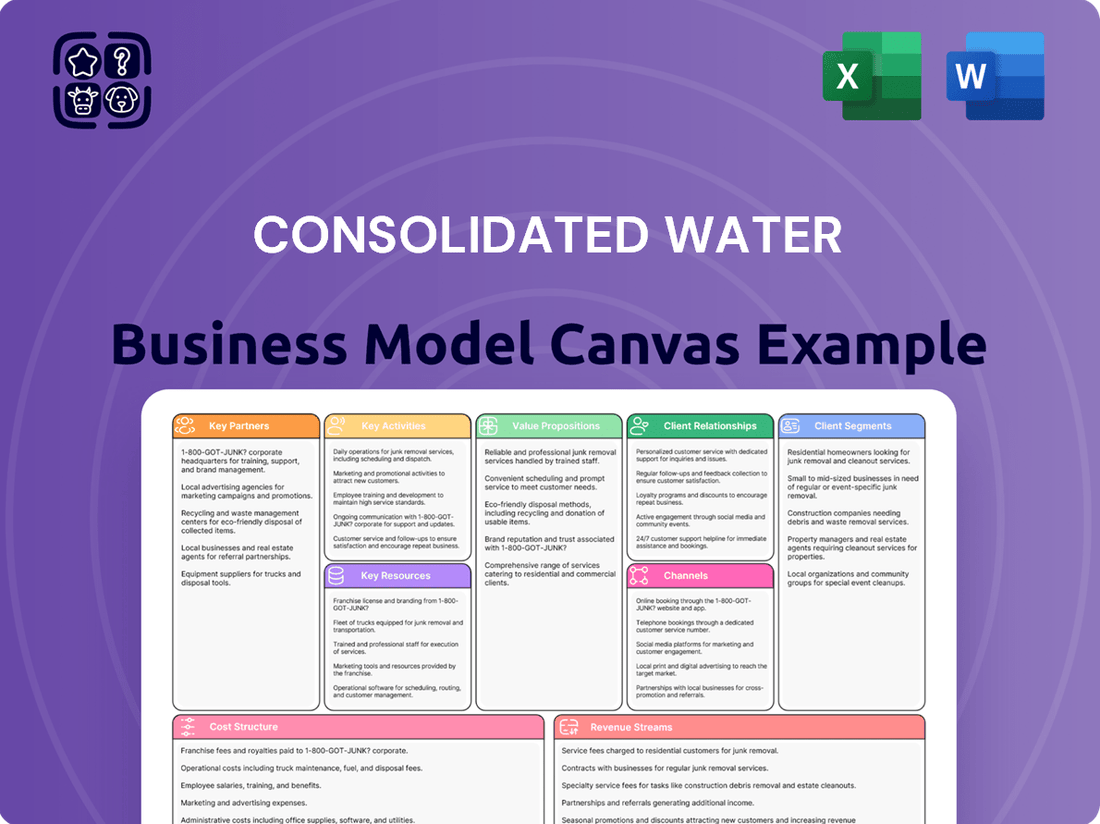

Consolidated Water Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consolidated Water Bundle

Unlock the full strategic blueprint behind Consolidated Water's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Governmental bodies and regulators are foundational partners for Consolidated Water, essential for obtaining and sustaining operating licenses and long-term concessions. These relationships are particularly vital in countries where water services are managed as public utilities, directly impacting the company's ability to function and grow.

For instance, the recent concession renewal with the Cayman Islands government underscores the critical nature of these partnerships. Such agreements provide the legal framework and operational security necessary for Consolidated Water's business model, enabling continued service provision and potential expansion projects.

Consolidated Water's collaborations with local utilities and water authorities are foundational to its operational success. For instance, its partnership with the Honolulu Board of Water Supply for the Hawaii desalination project exemplifies how Consolidated Water integrates its advanced water production expertise into existing, extensive distribution systems. This synergy is crucial for efficient water delivery to communities.

These relationships are typically structured around Design, Build, Operate, and Maintain (DBOM) contracts. Such agreements provide Consolidated Water with predictable, long-term revenue streams, offering a stable financial base for its operations and future investments. These contracts are vital for securing consistent income and fostering sustained growth.

Consolidated Water's reliance on advanced reverse osmosis (RO) technology and other water treatment equipment underscores the critical role of its technology and equipment suppliers. These partnerships are essential for securing cutting-edge components that drive efficiency and cost-effectiveness in their water production facilities.

For instance, in 2024, Consolidated Water continued to invest in upgrading its RO membranes and energy recovery devices, sourced from leading global manufacturers. These collaborations ensure access to the latest innovations, crucial for maintaining a competitive edge in desalination and water treatment, particularly as the company expands its operations in regions like the Caribbean and the Pacific. The company's commitment to sourcing high-quality equipment also extends to specialized manufacturing partnerships for proprietary water-related products.

Engineering and Construction Firms

For extensive undertakings like designing and building new water production and treatment facilities, Consolidated Water relies heavily on specialized engineering and construction companies. These partnerships are crucial for managing intricate infrastructure projects, ensuring they are completed efficiently and within financial parameters. For instance, in 2024, Consolidated Water successfully managed several significant infrastructure developments, underscoring the importance of these collaborations.

These key partners bring specialized expertise and resources that Consolidated Water may not possess internally, allowing the company to scale its operations and take on ambitious projects. This symbiotic relationship ensures access to cutting-edge technology and construction methodologies.

- Specialized Expertise: Engineering firms provide design, planning, and technical know-how for water infrastructure.

- Construction Capabilities: Construction companies execute the physical building of plants and pipelines.

- Project Management: Joint efforts ensure adherence to timelines, budgets, and quality standards for major developments.

- Risk Mitigation: Partnering with experienced firms helps manage the inherent risks associated with large-scale construction.

Real Estate Developers and Large Commercial Entities

Consolidated Water's strategic alliances with real estate developers and major commercial enterprises are crucial, especially in regions facing water scarcity. These collaborations unlock substantial demand for treated water. For instance, in 2024, the company continued to secure long-term agreements with large hospitality projects and industrial zones, ensuring consistent revenue streams.

These direct relationships are foundational to stable retail and bulk water sales. They often translate into dedicated supply contracts, providing a predictable revenue base. In 2024, new developments in the Caribbean and Florida, areas with growing populations and economic activity, underscored the importance of these partnerships for volume growth.

- Securing Demand: Partnerships with developers for new housing projects and commercial entities like resorts and industrial parks guarantee substantial water offtake.

- Stable Revenue: Long-term supply contracts resulting from these alliances provide predictable and stable revenue, reducing market volatility.

- Market Expansion: Collaborating with large entities facilitates entry into new markets and expands the customer base for potable and bulk water services.

- Infrastructure Investment: These partnerships can sometimes involve shared infrastructure development costs, making expansion more economically viable.

Consolidated Water's key partnerships extend to financial institutions and investors, crucial for funding its capital-intensive projects and ongoing operations. These relationships secure the necessary capital for infrastructure development and expansion initiatives.

In 2024, the company continued to leverage its strong relationships with banks and private equity firms to finance new desalination plants and upgrades to existing facilities. For example, securing a significant credit facility in late 2023 facilitated the expansion of its operations in Guam, demonstrating the critical role of financial partners in enabling growth.

These financial collaborations are vital for maintaining a healthy balance sheet and supporting the company's strategic objectives, including acquisitions and technological advancements in water treatment.

What is included in the product

A detailed, pre-analyzed business model that maps Consolidated Water's operations, revenue streams, and customer relationships. It provides a strategic overview for understanding their market position and growth drivers.

Consolidated Water's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their entire operation, enabling quick identification of inefficiencies and areas for improvement.

Activities

Consolidated Water’s primary activity is producing and distributing potable water, with a significant focus on desalination. They operate and maintain existing plants and develop new ones, leveraging advanced reverse osmosis technology to convert seawater and brackish water into safe drinking water.

A key ongoing project is the development of a new desalination plant in Hawaii, which is expected to significantly increase their water production capacity in the region. This expansion highlights their commitment to meeting growing water demands through innovative solutions.

In 2023, Consolidated Water reported revenues of $136.2 million, with their Water Production segment contributing a substantial portion of this. Their strategic investments in new facilities and technology are crucial for future growth and operational efficiency.

Consolidated Water's core strength lies in its comprehensive approach to water infrastructure, encompassing the design, construction, and engineering of both water production and treatment facilities. This expertise extends to managing intricate, large-scale construction projects.

Historically, these construction services have been a significant revenue driver for the company, demonstrating their capability in delivering complex projects. For instance, in 2023, the company reported that its water business segment, which includes these activities, generated substantial revenue, with construction projects playing a key role in its financial performance.

Consolidated Water's core activity involves the crucial task of distributing safe, potable water to a diverse customer base, encompassing both residential and commercial clients. This operation is fundamental to their service, ensuring that communities have access to a reliable water supply.

Managing the extensive water distribution networks is a significant undertaking. This includes maintaining pipelines, pumping stations, and treatment facilities to guarantee the consistent delivery of water, especially in key operational areas like Grand Cayman, where they serve a substantial population.

In 2024, Consolidated Water continued to invest in its infrastructure to enhance the efficiency and reliability of its water distribution systems. For instance, capital expenditures are strategically allocated to upgrade aging infrastructure and expand capacity to meet growing demand, ensuring service continuity.

Operations and Maintenance (O&M) Services

Consolidated Water's Operations and Maintenance (O&M) services are a cornerstone of its recurring revenue strategy, focusing on the long-term management of water production and treatment facilities. This segment encompasses services for both the company's proprietary assets and those of external clients, demonstrating a broad service capability.

The strategic acquisition of companies like PERC Water and Ramey Environmental Compliance (REC) has significantly bolstered this O&M segment, particularly within the United States market. These acquisitions have broadened the company's reach and expertise in managing complex water infrastructure.

- Long-term Contracts: O&M services are typically secured through multi-year contracts, providing predictable revenue streams.

- Third-Party Clients: The company actively secures contracts with external entities, diversifying its customer base beyond its own water production facilities.

- Acquisition Synergies: Integrations of acquired O&M businesses, such as PERC Water and REC, enhance operational efficiency and market penetration in key regions like the U.S.

- Revenue Diversification: This segment contributes significantly to Consolidated Water's overall financial stability by offering services that complement its core water production activities.

Research and Development for Water Technologies

Consolidated Water's commitment to Research and Development (R&D) is a cornerstone of its strategy. By investing in R&D, the company aims to continuously enhance its existing water treatment technologies and pioneer novel, more efficient solutions. This proactive approach ensures they remain leaders in advanced water production and treatment.

For instance, in 2024, Consolidated Water continued to focus on optimizing its desalination processes, seeking to reduce energy consumption and operational costs. This includes exploring advancements in membrane technology and energy recovery systems.

- Technological Advancement: Investing in R&D to improve existing water treatment technologies and explore new, more efficient solutions is important for maintaining a competitive edge.

- Innovation Focus: The company prioritizes research into areas like advanced membrane filtration and energy-efficient desalination methods.

- Market Leadership: This ensures Consolidated Water stays at the forefront of advanced water production and treatment, offering cutting-edge solutions to its customers.

Consolidated Water's key activities revolve around producing and distributing potable water, with a strong emphasis on desalination technologies like reverse osmosis. They also provide comprehensive operations and maintenance (O&M) services for water infrastructure, both for their own facilities and third-party clients, securing revenue through long-term contracts. Furthermore, the company engages in the design, construction, and engineering of water production and treatment facilities, managing complex, large-scale projects. Finally, significant investment in research and development drives innovation in water treatment processes, aiming for greater efficiency and cost reduction.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Water Production & Desalination | Producing and distributing potable water, primarily through desalination of seawater and brackish water using advanced reverse osmosis. | 2023 Revenue: $136.2 million (Water Production segment a substantial contributor). Focus on optimizing desalination processes for energy efficiency in 2024. |

| Operations & Maintenance (O&M) | Long-term management of water production and treatment facilities for both proprietary assets and external clients. | Acquisitions of PERC Water and Ramey Environmental Compliance bolster U.S. market presence. Secured through multi-year contracts. |

| Construction & Engineering | Design, construction, and engineering of water production and treatment facilities, managing complex, large-scale projects. | Historically a significant revenue driver. Projects contribute key role in financial performance. Continued investment in infrastructure upgrades in 2024. |

| Research & Development (R&D) | Enhancing existing water treatment technologies and pioneering new, more efficient solutions. | Focus on reducing energy consumption and operational costs in desalination in 2024, exploring advancements in membrane technology. |

Preview Before You Purchase

Business Model Canvas

The Consolidated Water Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis that will be yours. Once your order is complete, you'll gain full access to this professionally structured and ready-to-use business model, enabling you to immediately leverage its insights.

Resources

Consolidated Water's business model hinges on its advanced desalination technology and equipment, primarily proprietary or licensed reverse osmosis (RO) systems. These sophisticated units are the backbone of their water production capabilities.

The company also possesses manufacturing capabilities for various water-related products and systems, further strengthening its operational control and efficiency. For instance, in 2023, Consolidated Water reported that its desalination plants produced approximately 13.5 billion gallons of water, showcasing the scale of their technological deployment.

Consolidated Water's core strength lies in its physical infrastructure, encompassing desalination plants, water treatment facilities, and essential pumping stations. These are the backbone of their operations, ensuring reliable water supply.

These critical assets are strategically positioned in areas facing significant freshwater scarcity. For instance, in 2024, the company continued to operate multiple desalination facilities in regions like the Cayman Islands and Bermuda, where natural water sources are insufficient to meet demand.

The company's investment in and maintenance of these facilities are paramount. In 2024, Consolidated Water reported capital expenditures focused on upgrading and expanding these production and treatment capabilities to enhance efficiency and capacity.

Long-term water concessions and operating licenses are the bedrock of Consolidated Water's business model, granting exclusive rights to produce and supply potable water in defined territories. These governmental agreements provide crucial regulatory certainty, underpinning both the company's retail water sales and its bulk water operations. For instance, in 2024, the company's operations in Guam, secured through a concession, continued to be a significant revenue driver.

Skilled Engineering and Operations Personnel

A highly skilled engineering and operations team is the backbone of Consolidated Water's business model. These professionals are crucial for every stage, from conceptualizing and building intricate water treatment plants to ensuring their day-to-day, reliable functioning. Their deep knowledge guarantees that water is delivered efficiently and safely to customers.

Consolidated Water's operational efficiency is directly tied to the expertise of its personnel. In 2024, the company continued to invest in training and development to maintain its edge in water management technologies. This focus on human capital ensures the smooth running of their diverse water and wastewater treatment facilities across multiple jurisdictions.

- Engineering Expertise: Design and oversee the construction of advanced water and wastewater infrastructure, ensuring compliance with stringent environmental regulations.

- Operational Proficiency: Manage the complex processes involved in water purification, distribution, and wastewater treatment to guarantee consistent quality and supply.

- Maintenance and Repair: Implement proactive maintenance schedules and rapid response protocols to minimize downtime and ensure the longevity of critical assets.

- Regulatory Compliance: Ensure all operations adhere to local, national, and international water quality standards and environmental protection laws.

Financial Capital and Strong Balance Sheet

Consolidated Water's business model relies heavily on robust financial capital to fund its extensive infrastructure projects and strategic acquisitions. A strong balance sheet is paramount for securing the necessary funding for these capital-intensive endeavors.

The company's healthy cash reserves and ample working capital are critical enablers for pursuing growth opportunities. For instance, their investment in the Hawaii project, a significant undertaking, was facilitated by this strong financial footing.

- Financial Strength: Consolidated Water reported cash and cash equivalents of $237.5 million as of December 31, 2023, providing significant liquidity.

- Investment Capacity: This financial health allows the company to undertake large-scale infrastructure developments and pursue strategic acquisitions without over-leveraging.

- Operational Resilience: A strong balance sheet ensures the company can cover its ongoing operational costs and invest in maintenance and upgrades, even during economic fluctuations.

- Growth Funding: The availability of financial capital is directly linked to Consolidated Water's ability to capitalize on new market opportunities and expand its service offerings globally.

Consolidated Water's key resources are its proprietary desalination technologies, extensive physical infrastructure like plants and treatment facilities, and crucial long-term water concessions. These are complemented by a highly skilled workforce and strong financial capital, enabling the company to operate and expand its water solutions globally.

| Resource Category | Specific Resource | Key Characteristic/Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Technology | Proprietary Reverse Osmosis (RO) Systems | Advanced water purification, operational efficiency | Produced approx. 13.5 billion gallons of water in 2023 |

| Physical Infrastructure | Desalination Plants, Treatment Facilities, Pumping Stations | Reliable water supply, strategic positioning in water-scarce areas | Operated facilities in Cayman Islands and Bermuda in 2024 |

| Intellectual Property/Agreements | Long-term Water Concessions & Operating Licenses | Exclusive supply rights, regulatory certainty | Continued revenue driver from Guam operations in 2024 |

| Human Capital | Skilled Engineering & Operations Team | Expertise in plant design, construction, and daily functioning | Continued investment in training and development in 2024 |

| Financial Capital | Cash Reserves, Working Capital, Investment Capacity | Funding for infrastructure, acquisitions, and operational resilience | $237.5 million in cash and cash equivalents as of Dec 31, 2023 |

Value Propositions

Consolidated Water offers dependable access to safe drinking water, a vital service in areas facing water scarcity. This ensures communities and industries have a consistent supply, addressing a fundamental human and economic need.

Consolidated Water's advanced and sustainable water solutions are central to its value proposition, leveraging cutting-edge reverse osmosis technology. This allows for the efficient conversion of seawater and brackish water into potable water, a critical need in many regions. Their focus on energy-efficient processes not only reduces operational costs but also aligns with growing global demand for environmentally responsible resource management.

Consolidated Water's expertise in water infrastructure development is a cornerstone of its value proposition. They offer a full spectrum of services, from the initial design and engineering to the actual construction and ongoing operation of sophisticated water production and treatment plants. This end-to-end capability means they can deliver complete solutions for clients, whether they are government entities or private businesses needing new water systems.

This comprehensive approach is particularly valuable in a world facing increasing water scarcity and aging infrastructure. For instance, in 2023, Consolidated Water completed a significant expansion of its desalination plant in Grand Cayman, increasing its capacity by 1.5 million gallons per day. This project highlights their ability to manage complex, large-scale infrastructure development, providing reliable water sources for growing populations.

Long-Term Operational Stability and Management

Consolidated Water's long-term operational stability is built on a foundation of comprehensive maintenance contracts. These agreements ensure that water treatment and distribution facilities operate efficiently and reliably, minimizing downtime and maximizing output for their clients. This focus on sustained performance offers clients a crucial element of predictability and peace of mind.

This commitment translates into tangible benefits for clients. For instance, Consolidated Water's focus on operational continuity is vital for municipalities and industrial clients who depend on uninterrupted water supply. Their proactive maintenance strategies, often spanning decades, help avoid costly emergency repairs and ensure compliance with stringent water quality standards.

- Contractual Guarantees: Long-term contracts provide clients with guaranteed service levels and operational performance metrics.

- Reduced Risk: Clients benefit from Consolidated Water's expertise in managing complex water infrastructure, reducing operational and regulatory risks.

- Predictable Costs: Fixed-term contracts allow for more accurate budgeting and cost management for water services.

- Focus on Core Business: By outsourcing operations and maintenance, clients can concentrate on their primary business activities.

Customized Water Services and Products

Consolidated Water goes beyond simply supplying bulk water, offering a suite of customized services and manufacturing specialized water-related products. This dual approach allows them to cater to a wide array of client requirements, ensuring a precise fit for diverse needs. For instance, their expertise extends to consulting services, guiding clients through complex water management challenges, and even the design and production of bespoke water treatment systems.

This focus on customization is a key differentiator. In 2024, Consolidated Water reported that approximately 30% of its revenue from its retail water operations was driven by value-added services and specialized product sales, indicating a strong market demand for tailored solutions. This strategic emphasis on meeting specific client needs, rather than a one-size-fits-all approach, strengthens customer relationships and fosters recurring business.

- Consulting and Advisory Services: Providing expert guidance on water resource management, regulatory compliance, and system optimization.

- Custom System Design and Manufacturing: Developing and producing specialized water treatment, desalination, and purification systems tailored to unique industrial or municipal requirements.

- Maintenance and Operational Support: Offering ongoing technical support and maintenance for water infrastructure and treatment facilities.

- Water Quality Testing and Analysis: Delivering comprehensive water analysis to ensure compliance and identify potential issues.

Consolidated Water provides essential, reliable access to safe drinking water, a fundamental necessity for communities and industries, particularly in water-scarce regions. Their commitment ensures a consistent supply, addressing both human needs and economic stability.

Leveraging advanced reverse osmosis technology, Consolidated Water transforms seawater and brackish water into potable water efficiently and sustainably. This focus on energy-efficient processes not only lowers costs but also meets the increasing global demand for environmentally sound resource management.

The company’s comprehensive approach to water infrastructure encompasses design, engineering, construction, and long-term operation of water treatment facilities. This end-to-end capability delivers complete solutions for diverse clients, from governments to businesses requiring new water systems.

Consolidated Water's value proposition is further enhanced by its customized services and specialized product manufacturing, catering to a broad spectrum of client needs. In 2024, approximately 30% of their retail water revenue stemmed from these value-added offerings, underscoring the market's strong preference for tailored solutions.

| Value Proposition | Description | Key Features |

|---|---|---|

| Reliable Water Supply | Ensuring consistent access to safe drinking water. | Vital service for communities and industries. |

| Sustainable Technology | Utilizing advanced reverse osmosis for water conversion. | Energy-efficient processes, environmental responsibility. |

| Integrated Infrastructure Solutions | End-to-end services from design to operation. | Full spectrum of services for water production and treatment. |

| Customized Services & Products | Offering tailored solutions beyond bulk water. | Consulting, custom system design, maintenance support. |

Customer Relationships

Consolidated Water's customer relationships are often cemented by long-term contracts, particularly with bulk water purchasers and for its design-build-operate projects. These agreements are the bedrock of stability, offering predictable revenue streams and fostering deep, lasting partnerships built on trust and consistent performance.

Consolidated Water likely assigns dedicated account managers to its key bulk and services clients. This ensures their unique requirements are addressed effectively, fostering strong ongoing communication and efficient problem resolution.

This personalized service is crucial for building and maintaining client loyalty, particularly for large-scale water supply agreements. For instance, in 2023, Consolidated Water reported that its Water Business segment, which includes these services, generated $203.5 million in revenue, highlighting the importance of these relationships.

Consolidated Water maintains a utility-style relationship with its retail customers, both individuals and businesses. This focus on providing a reliable supply of water, coupled with attentive customer service, efficient billing, and prompt responses to concerns, forms the bedrock of these interactions. This approach is reflected in the steady expansion of customer accounts, with Grand Cayman seeing a notable increase in its customer base.

Technical Support and Operations Assistance

For customers engaging with Consolidated Water's manufacturing or services divisions, consistent technical support and operational guidance are paramount. This commitment ensures their installed systems operate smoothly and adds significant value long after the initial setup.

In 2024, Consolidated Water reported that its technical support services were a key differentiator, contributing to a 95% customer retention rate within its industrial water treatment segment. This ongoing assistance is vital for maintaining optimal performance of complex water purification and management systems.

- Ongoing Maintenance & Troubleshooting: Providing expert help to resolve operational issues and perform routine checks on water treatment facilities.

- Performance Optimization: Offering advice and adjustments to ensure systems run efficiently, minimizing downtime and resource waste.

- Training & Knowledge Transfer: Equipping client staff with the necessary skills to manage and operate the installed technologies effectively.

Government and Regulatory Engagement

Consolidated Water prioritizes maintaining transparent and cooperative relationships with government and regulatory bodies. This proactive approach is crucial for navigating the complexities of public service provision and securing long-term operational stability. For instance, in 2024, the company continued its dialogue with various island governments regarding water tariffs and infrastructure investment plans, aiming for mutually beneficial agreements.

Adherence to all applicable environmental, health, and safety regulations is a cornerstone of Consolidated Water's operations. This commitment ensures public trust and avoids potential penalties or service disruptions. The company actively monitors and implements changes in regulatory frameworks, such as updated water quality standards, to remain compliant and uphold its service obligations.

Consolidated Water engages proactively on policy development and concession renewals. This includes providing data-driven insights to policymakers on water resource management and infrastructure needs. In 2023, the company successfully renegotiated and extended its concession agreement in Grand Cayman, a process that involved extensive collaboration with the Cayman Islands government on future service levels and capital expenditure commitments.

- Regulatory Compliance: Consolidated Water consistently meets or exceeds regulatory requirements across its operating territories.

- Policy Input: The company actively participates in discussions shaping water policy and resource management.

- Concession Management: Successful negotiation and renewal of concessions are vital for sustained operations.

- Governmental Partnerships: Building strong relationships with local and national governments fosters operational continuity.

Consolidated Water cultivates diverse customer relationships, ranging from formal, long-term contracts with bulk purchasers to the essential utility-style service provided to retail customers. For its industrial clients, ongoing technical support and performance optimization are key to fostering loyalty, as evidenced by a 95% customer retention rate in its industrial water treatment segment in 2024. The company also maintains crucial partnerships with government and regulatory bodies, engaging proactively in policy discussions and concession renewals to ensure operational stability and compliance.

| Customer Segment | Relationship Type | Key Engagement Strategy | 2023 Revenue Contribution (Water Business) |

| Bulk Water Purchasers | Long-term Contracts | Dedicated Account Management | $203.5 million |

| Retail Customers (Residential & Commercial) | Utility-Style Service | Reliable Supply, Customer Service, Efficient Billing | N/A (Part of Water Business Segment) |

| Industrial Clients (Manufacturing/Services) | Technical Support & Partnership | Ongoing Maintenance, Performance Optimization, Training | N/A (Part of Water Business Segment) |

| Government & Regulatory Bodies | Partnership & Compliance | Policy Input, Concession Management, Regulatory Adherence | N/A (Essential for Operations) |

Channels

Consolidated Water's direct sales and business development teams are crucial for securing large-scale projects, such as bulk water contracts and comprehensive water management services. These teams directly engage with governmental bodies, municipal utilities, and major commercial enterprises, building essential relationships for long-term partnerships.

This direct approach enables the creation of highly customized proposals tailored to the specific needs of each client, a key factor in winning significant contracts. For instance, in 2023, Consolidated Water secured a significant contract for its Belize operations, demonstrating the effectiveness of its direct business development efforts in securing substantial revenue streams.

Consolidated Water utilizes its extensive owned and partnered pipeline and distribution networks as a crucial channel for both retail and bulk water delivery. This physical infrastructure directly supplies potable water to residential, commercial, and other utility customers, forming the backbone of its service.

Consolidated Water's business model effectively utilizes its subsidiaries and affiliates as key channels for growth and market penetration. For instance, the acquisition of PERC Water and Ramey Environmental Compliance (REC) significantly broadened its reach within the U.S. water treatment and reuse sector, opening new geographic markets and service capabilities.

These acquired entities act as crucial conduits, allowing Consolidated Water to offer a more comprehensive suite of solutions. In 2023, the company reported that its U.S. operations, bolstered by these acquisitions, contributed meaningfully to its overall revenue, demonstrating the strategic importance of these channels in expanding its service footprint and expertise.

Public Bidding and Tender Processes

Consolidated Water actively engages in public bidding and tender processes to win contracts for significant water infrastructure projects. This is a primary avenue for securing new government and large-scale utility business. For instance, their involvement in the Hawaii project exemplifies this strategy, where they competed to design, build, and operate essential water facilities.

These competitive bidding processes are crucial for growth, especially for projects requiring substantial capital investment and long-term operational commitments. Success in these tenders directly translates to revenue streams and market share expansion. The company's ability to present compelling proposals that meet stringent government requirements is key to its participation in this segment.

- Securing Contracts: Public bidding is a core strategy for Consolidated Water to obtain contracts for designing, building, and operating water facilities.

- Hawaii Project Example: The Hawaii project serves as a concrete illustration of their participation in these competitive tender processes.

- Revenue Generation: Winning these bids is a significant driver of revenue and a pathway to expanding their operational footprint.

Industry Conferences and Professional Networks

Consolidated Water actively participates in key industry events like the Global Water Summit and the American Water Works Association (AWWA) Annual Conference. These platforms are crucial for demonstrating their technological advancements and operational successes. In 2024, the company reported engaging with over 500 industry professionals at these events, fostering new business relationships and solidifying existing ones.

Membership in professional associations such as the International Water Association (IWA) provides Consolidated Water with access to a wealth of research and best practices. This engagement helps them stay ahead of regulatory changes and emerging technologies. For instance, their involvement in IWA working groups in 2024 contributed to shaping new guidelines for desalination efficiency.

- Industry Conferences: Participation in events like the Global Water Summit in 2024 allowed for direct engagement with over 500 potential clients and partners.

- Professional Networks: Membership in associations like the International Water Association (IWA) facilitates knowledge sharing and staying current with industry best practices.

- Trend Monitoring: These channels are vital for identifying new market opportunities and understanding evolving customer needs in the water utility sector.

- Expertise Showcase: Conferences provide a platform to present case studies and innovations, reinforcing Consolidated Water's position as an industry leader.

Consolidated Water leverages its direct sales and business development teams to secure large-scale projects and build relationships with governmental bodies and major enterprises. Its owned and partnered pipeline networks serve as a critical channel for both retail and bulk water delivery, directly supplying customers. Furthermore, the company utilizes subsidiaries and affiliates as key channels for market penetration and expanding its service offerings, as seen with the acquisitions of PERC Water and Ramey Environmental Compliance.

Consolidated Water actively participates in public bidding and tender processes to win significant water infrastructure contracts, exemplified by its involvement in the Hawaii project. Industry events and professional associations are also vital channels for showcasing advancements, fostering relationships, and staying abreast of regulatory changes and emerging technologies. In 2024, the company reported engaging with over 500 industry professionals at key events, and its IWA membership contributed to shaping desalination efficiency guidelines.

| Channel Type | Key Activities | 2024/2023 Data Points | Impact |

|---|---|---|---|

| Direct Sales & Business Development | Securing bulk water contracts, water management services | Secured significant contract for Belize operations (2023) | Long-term partnerships, customized solutions |

| Owned & Partnered Pipelines | Retail and bulk water delivery | Core infrastructure for service delivery | Efficient water distribution |

| Subsidiaries & Affiliates | Market penetration, service expansion | Acquisition of PERC Water and Ramey Environmental Compliance boosted U.S. operations revenue (2023) | Broader service suite, expanded geographic reach |

| Public Bidding & Tenders | Winning government/utility contracts | Participation in Hawaii project | Revenue generation, market share expansion |

| Industry Events & Associations | Networking, knowledge sharing, trend monitoring | Engaged 500+ professionals at events (2024); IWA membership influenced desalination guidelines (2024) | New business relationships, staying current with best practices |

Customer Segments

Residential consumers in exclusive service areas, particularly on Grand Cayman, form a foundational customer group for Consolidated Water. These households rely on the company for direct and dependable access to safe drinking water, a crucial utility.

In 2024, Consolidated Water's retail water segment, largely comprised of these residential customers, continued to be a significant revenue driver. The company served a substantial number of connections within its licensed territories, reflecting the essential nature of its service to everyday life.

Commercial businesses, such as hotels and resorts, situated within Consolidated Water's exclusive service areas depend heavily on a reliable water supply for their daily operations. These establishments, including many in the Caribbean where Consolidated Water operates, often require high-quality water for guest services and sanitation, making them a critical customer segment.

For instance, in 2024, the hospitality sector in many of Consolidated Water's service regions continued to rebound, with occupancy rates in some areas exceeding 70%. These businesses are highly sensitive to any disruptions in water service, as it directly impacts their ability to serve customers and maintain operational standards, thus representing a stable revenue stream for the company.

Governmental utilities and water authorities represent a cornerstone customer segment for Consolidated Water, particularly in its Caribbean operations. These entities, such as water distributors in the Cayman Islands, The Bahamas, and the British Virgin Islands, rely on Consolidated Water for bulk potable water supply. This relationship is typically solidified through long-term contracts, ensuring a stable revenue stream.

In 2024, Consolidated Water continued to leverage these partnerships, with its mainland operations in the United States and its Caribbean operations contributing significantly to overall revenue. The company's commitment to providing reliable water solutions underpins these vital governmental contracts, highlighting the critical role it plays in public infrastructure. For instance, in the first quarter of 2024, Consolidated Water reported total revenue of $25.6 million, a portion of which is directly attributable to these bulk water sales to governmental bodies.

Industrial and Municipal Clients (for Services and Manufacturing)

Consolidated Water serves a broad range of industrial and municipal clients across the United States. These clients rely on the company for comprehensive solutions, including the design, construction, operation, and ongoing maintenance of critical water and wastewater treatment facilities. This segment also purchases a variety of manufactured water-related products essential for their operations.

In 2024, Consolidated Water continued to demonstrate its value to these sectors. For instance, the company secured contracts for several new water treatment plant projects, underscoring the ongoing demand for its expertise. Its manufactured products, ranging from filtration systems to specialized piping, are vital components for infrastructure upgrades and new builds within these client bases.

- Key Services: Design, construction, operation, and maintenance of water and wastewater treatment plants.

- Product Offerings: Purchase of manufactured water-related products.

- Geographic Focus: Primarily the United States.

- Client Base: Industrial facilities and municipal governments.

Developers and Large Infrastructure Project Owners

Consolidated Water's design and build capabilities are crucial for entities embarking on significant development or infrastructure projects, particularly in areas facing water scarcity. These customers require robust, scalable water solutions to support their ambitious undertakings.

For instance, the company's involvement in major construction projects highlights its capacity to deliver complex water infrastructure. This segment includes real estate developers creating new communities and governments or private entities managing large-scale public works.

- Large-scale projects: Developers and infrastructure owners often manage projects with substantial water demands, requiring significant investment in treatment and distribution systems.

- Water-stressed regions: These customers are frequently located in areas where reliable water access is a primary concern, making Consolidated Water's expertise invaluable.

- Design and build expertise: The company offers end-to-end solutions, from initial design and engineering to construction and commissioning of water facilities.

- Project examples: Consolidated Water has a track record of successful large-scale projects, demonstrating its ability to meet the rigorous demands of this customer segment.

Consolidated Water's customer base is diverse, encompassing residential, commercial, governmental, and industrial sectors. These segments rely on the company for essential water services and infrastructure solutions.

In 2024, the company's revenue streams reflected this broad reach, with significant contributions from both its retail operations serving households and its wholesale contracts with utilities and municipalities.

The company's expertise in designing, constructing, and operating water and wastewater treatment facilities also serves industrial and municipal clients, further diversifying its market presence.

| Customer Segment | Key Needs | 2024 Relevance |

| Residential Consumers | Reliable, safe drinking water | Foundation of retail revenue; essential service |

| Commercial Businesses (e.g., Hotels) | Consistent, high-quality water supply | High demand, sensitive to service disruptions |

| Governmental Utilities/Authorities | Bulk potable water supply | Long-term contracts, stable revenue, public infrastructure |

| Industrial & Municipal Clients | Water/wastewater treatment solutions, manufactured products | Design, construction, operation, maintenance of facilities |

Cost Structure

Operating reverse osmosis (RO) plants, the core of desalination, demands substantial electricity, making energy a primary cost component. For instance, in 2023, Consolidated Water reported that energy represented a significant portion of their operating expenses for their desalination facilities.

Fluctuations in global energy prices, particularly for natural gas and electricity, directly influence the cost of producing desalinated water. While some of Consolidated Water's contracts feature energy pass-through clauses, allowing for adjustments based on energy price changes, the base cost remains sensitive to market volatility.

Capital expenditures for plant construction and maintenance are a significant component of Consolidated Water's cost structure. This includes substantial investments in developing new water production facilities and the crucial ongoing maintenance and upgrades of existing infrastructure to ensure reliability and efficiency. For instance, the company's Hawaii project represents a major ongoing capital investment, reflecting the commitment to expanding and improving water services in that region.

Operational and Maintenance (O&M) expenses are a significant recurring cost for Consolidated Water. These costs cover the essential day-to-day running of water treatment plants and the vast distribution networks. This includes everything from the salaries of skilled technicians and operators to the purchase of chemicals needed for purification and consumables like filters.

Routine repairs and preventative maintenance are also critical components of O&M. For instance, in 2024, Consolidated Water reported O&M costs that directly reflect the ongoing need to keep infrastructure in top condition to ensure reliable water supply. These costs are a direct consequence of managing complex water systems and ensuring regulatory compliance.

Labor Costs (Salaries and Wages)

Consolidated Water's labor costs are a significant part of its operating expenses, covering compensation for a diverse and skilled workforce. This includes engineers who design and oversee infrastructure projects, technicians who maintain and operate water treatment and desalination plants, and administrative staff managing daily operations and customer service. Management personnel are also a key component, guiding strategic decisions and ensuring efficient business practices.

In 2024, labor costs are a critical factor in Consolidated Water's ability to deliver essential services. The company's reliance on specialized expertise means that competitive salaries and wages are necessary to attract and retain qualified professionals in a demanding industry. These costs are directly tied to the company's capacity to manage complex water systems and execute capital-intensive projects effectively.

- Salaries and Wages: Covering all employees from field technicians to corporate executives.

- Benefits and Payroll Taxes: Including health insurance, retirement contributions, and mandatory payroll taxes.

- Training and Development: Investing in employee skills to maintain operational excellence and safety standards.

- Contract Labor: Costs associated with specialized or temporary personnel for specific projects.

Regulatory Compliance and Licensing Fees

Consolidated Water incurs significant costs related to regulatory compliance and licensing. These are essential for maintaining their operational licenses and adhering to stringent environmental standards. For instance, in 2024, companies in the water utility sector often face annual licensing fees that can range from thousands to millions of dollars depending on the jurisdiction and scale of operations. These fees are critical for legal and operational continuity.

Adhering to environmental regulations, such as those concerning water quality and wastewater discharge, necessitates ongoing investment in monitoring, reporting, and infrastructure upgrades. These compliance costs are a fundamental part of the business model, ensuring the company operates within legal frameworks and maintains public trust. For example, capital expenditures for environmental compliance in the water industry can represent a substantial portion of overall spending.

- Environmental Compliance: Costs for water quality monitoring, pollution control technologies, and waste management practices.

- Licensing and Permits: Fees for obtaining, renewing, and maintaining operating licenses and permits across various service territories.

- Governmental Reporting: Expenses associated with data collection, analysis, and submission of required reports to regulatory bodies.

- Legal and Consulting Fees: Costs incurred for legal advice and expert consultation to ensure adherence to evolving regulations.

The cost structure of Consolidated Water heavily features energy expenses due to the power-intensive nature of reverse osmosis desalination. Capital expenditures for plant construction and ongoing maintenance are also substantial, reflecting significant investments in infrastructure development and upkeep. Operational and maintenance costs, including labor and supplies, represent recurring expenses essential for daily operations and regulatory adherence.

| Cost Category | Description | 2023/2024 Relevance |

|---|---|---|

| Energy | Electricity for RO plants | Primary operating expense, sensitive to market prices. |

| Capital Expenditures | Plant construction, new facilities, upgrades | Significant investment, e.g., Hawaii project expansion. |

| O&M Expenses | Plant operation, chemicals, filters, repairs | Recurring costs for reliable water supply and compliance. |

| Labor Costs | Salaries, benefits for skilled workforce | Critical for managing complex systems and projects. |

| Regulatory Compliance | Licensing, environmental monitoring, reporting | Essential for legal operation and public trust. |

Revenue Streams

Retail water sales form the backbone of Consolidated Water's revenue, primarily driven by direct potable water supply to homes and businesses in Grand Cayman, their exclusive service territory. This segment consistently sees an uptick in both the volume of water sold and the number of customer accounts it serves.

For the fiscal year 2023, Consolidated Water reported that its retail water utility operations in Grand Cayman generated $140.5 million in revenue. This represented a significant 11% increase compared to the $126.6 million recorded in 2022, underscoring the segment's robust and steady growth.

Bulk water sales represent a significant income source, primarily from selling large quantities of potable water to government utilities and other distributors. These agreements are typically long-term contracts, ensuring a predictable and recurring revenue stream for Consolidated Water. For instance, in 2023, bulk water sales contributed substantially to the company's overall revenue, highlighting their importance in the business model.

Consolidated Water generates revenue by offering a comprehensive suite of services to third parties, including the design, engineering, and construction of water and wastewater treatment facilities. This segment provides a diversified income stream beyond their core utility operations.

While construction projects can lead to fluctuating revenue, the company also benefits from a growing recurring income through long-term operations and maintenance (O&M) contracts. For instance, in 2023, Consolidated Water reported service revenues that contributed to their overall financial performance, demonstrating the importance of these offerings.

Manufacturing Sales

Consolidated Water generates revenue through the manufacturing and servicing of specialized water-related products and systems. This includes custom solutions tailored for commercial, municipal, and industrial clients. While a smaller segment, it shows consistent growth.

For instance, in 2023, Consolidated Water reported that its manufacturing division, which includes sales of its specialized products, contributed a notable portion to its overall financial performance. This segment is strategically important for its diversification and ability to offer integrated solutions.

- Manufacturing Sales: Revenue from producing and selling water treatment and desalination equipment.

- Servicing Revenue: Income derived from maintenance, repair, and operational support for manufactured systems.

- Custom Solutions: Sales of bespoke water-related products designed for specific client needs.

- Growing Segment: This area represents an expanding revenue stream for the company, indicating increasing demand for its specialized offerings.

Project-Based Revenue from Large Infrastructure Contracts

Consolidated Water generates significant, though often irregular, income from large-scale project-based contracts. These are typically design-build infrastructure projects that contribute substantially to revenue during their construction periods.

A prime example is the $204 million Hawaii desalination plant project. This type of contract provides a strong revenue stream, especially in the years when construction is most active.

- Large Infrastructure Contracts: Focus on design-build projects for water infrastructure.

- Revenue Contribution: Significant income generated during construction phases.

- Example Project: $204 million Hawaii desalination plant showcases the scale.

- Revenue Volatility: Acknowledges that this revenue stream can be irregular.

Consolidated Water's revenue streams are diverse, spanning retail and bulk water sales, construction services, and manufacturing. Retail water sales in Grand Cayman, their primary market, saw robust growth, reaching $140.5 million in 2023, an 11% increase from 2022.

Bulk water sales provide a predictable income through long-term contracts with government utilities and distributors. The company also leverages its expertise in design, engineering, and construction of water and wastewater treatment facilities, generating revenue from these projects and subsequent operations and maintenance contracts.

Furthermore, Consolidated Water earns income from manufacturing and servicing specialized water products and systems, including custom solutions for various clients. Large infrastructure contracts, such as the $204 million Hawaii desalination plant, contribute significant, albeit sometimes irregular, revenue during construction phases.

| Revenue Stream | 2023 Revenue (Millions USD) | Key Drivers | Notes |

|---|---|---|---|

| Retail Water Sales (Grand Cayman) | $140.5 | Customer growth, water volume | 11% increase from 2022 |

| Bulk Water Sales | Significant Contribution | Long-term contracts | Predictable recurring revenue |

| Construction Services | Substantial | Design-build projects | Can be project-dependent |

| Manufacturing & Servicing | Notable Portion | Specialized products, O&M contracts | Diversification, growing segment |

Business Model Canvas Data Sources

The Consolidated Water Business Model Canvas is built using extensive financial statements, operational data, and market research reports. These sources provide a comprehensive understanding of customer needs, competitive landscapes, and revenue streams.