CVR Partner PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVR Partner Bundle

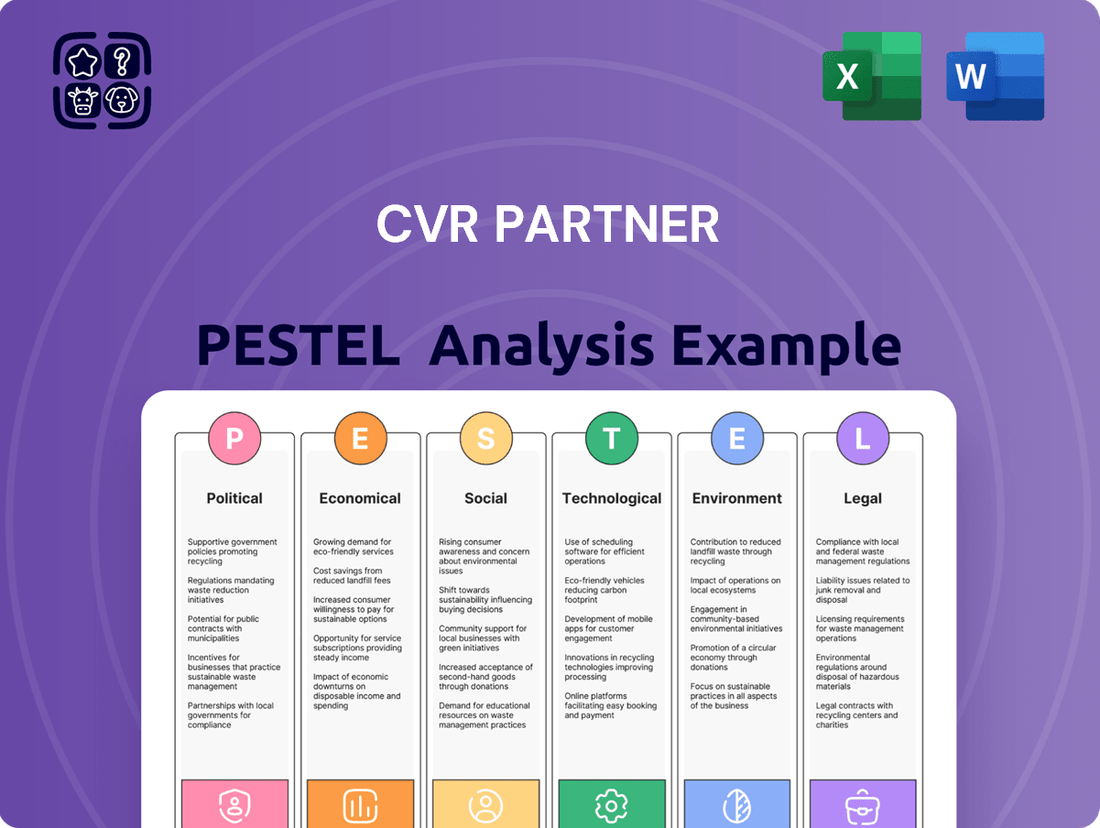

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping CVR Partner's trajectory. Our expertly crafted PESTLE analysis provides a comprehensive overview of these external forces, equipping you with the foresight to anticipate challenges and seize opportunities. Gain a competitive advantage by understanding the intricate landscape CVR Partner operates within. Download the full PESTLE analysis now to unlock actionable intelligence and refine your strategic planning.

Political factors

Government agricultural policies, such as the Farm Bill, directly shape fertilizer demand. Programs like crop insurance, subsidies, and conservation initiatives influence what farmers plant and how they manage their land, ultimately impacting their need for nitrogen fertilizer. The American Relief Act of 2025 extended the 2018 Farm Bill through September 30, 2025, offering a degree of stability in agricultural policy.

As farm bill negotiations progress into 2025, potential shifts in subsidy structures and crop insurance programs could significantly affect farmer profitability. This financial stability, or lack thereof, will directly translate into their purchasing power for essential agricultural inputs like nitrogen fertilizer, a key product for CVR Partners.

Environmental regulations, particularly those targeting nitrogen runoff and emissions from agriculture, directly influence fertilizer application. The EPA's Clean Water Act, for instance, dictates permissible quantities and methods of fertilizer use, impacting demand. Nebraska's Nitrogen Reduction Incentive Act of 2024 incentivizes farmers with payments for reducing commercial fertilizer use, pushing for alternative nutrient strategies.

These evolving regulations can increase compliance expenses for agricultural producers and potentially steer market demand towards more eco-friendly or precision application technologies. Such shifts could affect CVR Partners' product portfolio and sales strategies as they adapt to a more environmentally conscious market.

Changes in international trade agreements significantly influence CVR Partners' operating landscape. For instance, shifts in trade policies can directly affect the cost of imported raw materials, such as natural gas, a key input for fertilizer production. Tariffs on finished fertilizer products also pose a direct challenge to CVR Partners' competitiveness in export markets.

The specter of trade disputes, particularly those involving major economies like China, creates volatility across industries, including agriculture, which is a primary consumer of fertilizers. These potential tariff wars can lead to substantial value shifts, impacting demand and pricing for CVR Partners' products.

Geopolitical instability adds another layer of complexity. Ongoing supply chain uncertainties for natural gas, often exacerbated by international conflicts, directly translate into fluctuating fertilizer market prices. This volatility underscores the critical need for CVR Partners to closely monitor global political developments.

Energy Policies

Energy policies, particularly those concerning natural gas, are a critical factor for CVR Partners. Since natural gas is the main ingredient for nitrogen fertilizer, how it's extracted, transported, and priced directly affects CVR's manufacturing expenses. For instance, in 2023, the Henry Hub natural gas spot price averaged $2.57 per million British thermal units (MMBtu), a decrease from previous years, which could offer some cost relief, but volatility remains a concern.

Fluctuations in natural gas prices, often influenced by global supply, demand, and geopolitical events, significantly impact the profitability of fertilizer producers like CVR Partners. Policy decisions on energy infrastructure and international trade can create price swings that affect CVR's margins. The company's financial reports often highlight natural gas costs as a major component of its operating expenses.

Looking ahead, policies that encourage renewable energy sources or carbon capture technologies could reshape production methods for fertilizer manufacturers. While these might not immediately alter feedstock costs, they represent a long-term shift that CVR Partners will need to monitor and potentially adapt to. The ongoing energy transition could introduce new operational considerations and investment requirements for the industry.

- Natural Gas Price Impact: The average spot price for natural gas at the Henry Hub in 2023 was $2.57/MMBtu, directly influencing CVR Partners' production costs.

- Feedstock Dependency: Natural gas remains the primary feedstock for nitrogen fertilizer, making energy policy crucial for CVR's operational expenses.

- Policy Influence on Profitability: Government regulations and global energy market dynamics, shaped by policy, significantly sway the profitability of fertilizer manufacturers.

- Long-Term Adaptation: Policies promoting renewable energy and carbon capture present future strategic considerations for CVR Partners' production processes.

Geopolitical Stability

Global geopolitical events and conflicts significantly impact CVR Partners' operating environment, particularly its agricultural and industrial segments. Disruptions in key shipping lanes, such as continued instability in the Red Sea, directly affect the cost and reliability of importing essential raw materials like natural gas, a critical input for fertilizer production. For instance, rerouting due to conflict can add substantial transit times and increase freight costs, as seen with extended shipping durations for bulk commodities in late 2023 and early 2024.

Ongoing conflicts, like the war in Ukraine, continue to create volatility in commodity prices, including those for agricultural products and inputs such as natural gas and nitrogen-based fertilizers. This instability can lead to unpredictable input costs for CVR Partners and influence demand patterns in major agricultural markets globally. The price of natural gas, a major component of CVR's fertilizer manufacturing costs, has experienced significant fluctuations, trading at averages of $2.50-$3.00 per MMBtu in early-to-mid 2024, but susceptible to sharp increases based on geopolitical developments.

- Supply Chain Disruptions: Geopolitical tensions can impede the smooth flow of raw materials and finished goods, raising logistical costs and lead times.

- Commodity Price Volatility: International conflicts directly influence the prices of energy and agricultural commodities, impacting CVR's cost of goods sold and revenue streams.

- Market Demand Uncertainty: Instability can create hesitations in global agricultural markets, affecting demand for CVR's fertilizer products and other industrial chemicals.

- Input Cost Fluctuations: Reliance on globally sourced inputs like natural gas exposes CVR to price swings driven by geopolitical events, directly impacting profitability.

Government agricultural policies, like the Farm Bill, directly influence fertilizer demand by affecting farmer profitability and planting decisions. The extension of the 2018 Farm Bill through September 30, 2025, by the American Relief Act of 2025, offers some policy stability. However, ongoing Farm Bill negotiations for 2025 could introduce shifts in subsidies and crop insurance, impacting farmers' purchasing power for inputs like nitrogen fertilizer.

Environmental regulations, such as the EPA's Clean Water Act and state-level initiatives like Nebraska's Nitrogen Reduction Incentive Act of 2024, are increasingly shaping fertilizer application methods and potentially reducing demand for traditional products. These regulations can increase compliance costs for farmers and drive market interest towards precision agriculture and alternative nutrient strategies, requiring CVR Partners to adapt its product offerings.

Geopolitical events and energy policies critically affect CVR Partners. Natural gas, the primary feedstock for nitrogen fertilizer, saw its Henry Hub spot price average $2.57/MMBtu in 2023, but policy-driven energy market dynamics and international conflicts introduce significant price volatility. For instance, global instability can disrupt supply chains and commodity markets, impacting CVR's input costs and overall profitability.

| Political Factor | Impact on CVR Partners | Data/Examples |

| Agricultural Policy | Shapes farmer profitability and input demand. | American Relief Act of 2025 extended Farm Bill through 9/30/2025. Farm Bill negotiations for 2025 could alter subsidies. |

| Environmental Regulations | Influences fertilizer application and product demand. | EPA's Clean Water Act; Nebraska's Nitrogen Reduction Incentive Act of 2024. |

| Energy Policy & Geopolitics | Affects feedstock costs and market stability. | Henry Hub natural gas spot price averaged $2.57/MMBtu in 2023. Geopolitical events cause commodity price volatility. |

What is included in the product

This comprehensive PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the CVR Partner's operating landscape, offering actionable insights for strategic decision-making.

Provides actionable insights by identifying external threats and opportunities, enabling proactive strategic adjustments to mitigate risks and capitalize on market shifts.

Economic factors

The cost of natural gas, a key ingredient in making nitrogen fertilizers, directly affects CVR Partners' expenses. Global supply disruptions and geopolitical tensions have made natural gas prices quite unpredictable. For instance, in early 2025, natural gas prices saw fluctuations, with some regions experiencing higher costs due to increased demand and limited supply.

Agricultural commodity prices, such as those for corn, wheat, and soybeans, play a vital role in farmer spending on fertilizers. When crop prices are strong, farmers are more likely to invest in fertilizers to boost yields. Projections for 2025 suggest a modest decrease in major crop prices, which could put pressure on farmers' budgets.

Despite an anticipated gradual decline in agricultural prices through 2025, the cost of essential inputs like fertilizers continues to be a major consideration for the farming community. This dynamic creates a challenging environment where farmers must balance potential revenue with rising production costs, directly impacting demand for fertilizer products.

Inflationary pressures continue to impact CVR Partners' operational landscape. Rising costs for labor, transportation, and essential maintenance directly affect profitability. While fertilizer prices saw some stabilization in 2024, they have not returned to pre-inflationary levels, presenting ongoing cost challenges for the agricultural sector, a key market for CVR Partners.

Higher interest rates directly impact farmers' ability to finance essential purchases like fertilizers, potentially reducing demand. For instance, the Federal Reserve's benchmark interest rate, which influences agricultural lending rates, has seen significant increases through 2023 and into 2024, averaging around 5.25%-5.50% for the federal funds rate. This makes borrowing more expensive for farmers, potentially squeezing profit margins and investment capacity.

CVR Partners also faces increased borrowing costs for its operational needs and capital investments. As of their latest reports in late 2023 and early 2024, the company's debt structure and financing costs are directly influenced by prevailing market interest rates. This can affect their ability to fund expansions or upgrades, impacting overall competitiveness.

While the agricultural sector in 2024 generally shows resilience, with strong commodity prices supporting farm incomes, it remains sensitive to interest rate fluctuations. A sustained period of elevated rates could erode this financial health, making farmers more cautious about spending on inputs, which directly affects companies like CVR Partners that supply those materials.

Global Fertilizer Demand and Supply Dynamics

Global nitrogen fertilizer demand is poised for robust growth, with consumption anticipated to rise in both 2024 and 2025. This surge is primarily fueled by escalating global food security concerns and a trend towards improved affordability of these crucial agricultural inputs.

Projections indicate that nitrogen production capacity will see an increase through 2025. Notably, this expansion is expected to be led by cost-efficient projects in the United States, which could contribute to a more stable and predictable supply landscape.

This expanding market presents a favorable backdrop for CVR Partners. The increasing demand for nitrogen fertilizers directly aligns with the core business of CVR Partners, supporting a positive outlook for its operations and revenue streams.

- Projected Nitrogen Fertilizer Consumption Growth: Expected to increase in 2024 and 2025.

- Key Demand Drivers: Rising global food security needs and improving affordability.

- Nitrogen Capacity Expansion: Forecasted increase through 2025, with a focus on low-cost US projects.

- Market Impact on CVR Partners: Growing demand supports a positive business outlook.

Economic Growth and Food Consumption Patterns

Global economic expansion directly impacts how much money consumers have to spend on food, influencing overall demand. This, in turn, spurs the need for more efficient farming and greater fertilizer application to meet rising agricultural needs.

The world population is projected to reach 9.7 billion by 2050, and alongside evolving dietary preferences, this surge will significantly increase the demand for food. Consequently, agricultural output must rise, creating a stronger market for fertilizers.

- Global GDP Growth: The International Monetary Fund (IMF) projects global GDP growth to be 3.2% in 2024 and 3.2% in 2025, indicating continued economic activity that supports consumer spending on food.

- Fertilizer Market Growth: The global fertilizer market size was valued at approximately $255.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 3.6% from 2024 to 2030, reflecting increased agricultural demand.

- Food Demand Increase: Projections suggest that global food demand could increase by 50-60% by 2050, driven by population growth and dietary shifts, particularly in developing economies.

Economic factors such as the cost of natural gas, a primary input for fertilizer production, directly influence CVR Partners' operational expenses. For instance, natural gas prices experienced volatility in early 2025, with some regions facing increased costs due to demand-supply imbalances.

Agricultural commodity prices, like those for corn and soybeans, affect farmer purchasing power for fertilizers. Modest price decreases are projected for major crops in 2025, potentially impacting farmers' willingness to invest in fertilizers and thus influencing demand for CVR Partners' products.

Inflationary pressures continue to raise costs for labor, transportation, and maintenance for CVR Partners. While fertilizer prices saw some stabilization in 2024, they remain elevated compared to pre-inflationary periods, presenting ongoing cost challenges for the agricultural sector.

Higher interest rates, with the Federal Reserve's rate holding steady around 5.25%-5.50% through late 2023 and 2024, make financing more expensive for farmers, potentially curbing fertilizer demand. This also increases borrowing costs for CVR Partners' own operations and investments.

| Economic Factor | 2024/2025 Data/Trend | Impact on CVR Partners |

| Natural Gas Prices | Volatile in early 2025; regional increases due to demand/supply. | Increases operational costs. |

| Agricultural Commodity Prices | Modest decrease projected for major crops in 2025. | May reduce farmer spending on fertilizers. |

| Inflation | Elevated costs for labor, transport, maintenance persist. | Increases operational expenses, impacting profitability. |

| Interest Rates | Federal Funds Rate ~5.25%-5.50% (late 2023-2024). | Higher borrowing costs for farmers and CVR Partners. |

Full Version Awaits

CVR Partner PESTLE Analysis

The preview you see here is the exact CVR Partner PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. It meticulously details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CVR Partners. This comprehensive analysis provides actionable insights for strategic planning and decision-making.

Sociological factors

The world's population is on a steady climb, with projections indicating it will exceed 10 billion by 2050. This growth directly translates into a greater need for food, which in turn means a higher demand for agricultural products and, consequently, nitrogen fertilizers. CVR Partners' offerings are therefore crucial in supporting this escalating global food requirement.

Current global food security remains a significant concern. In 2024, acute food insecurity impacted approximately 295 million people, marking the sixth consecutive year of increase. This stark reality underscores the vital role that fertilizers play in boosting crop production and ensuring that enough food is available for everyone.

CVR Partners' business is intrinsically linked to addressing these food security challenges. By providing essential nitrogen fertilizers, the company enables farmers to increase their crop yields, which is fundamental to feeding a growing global population and mitigating food insecurity.

Societal preferences are increasingly leaning towards food produced through sustainable and organic farming methods. This shift directly impacts agricultural practices, potentially reducing the demand for synthetic fertilizers as consumers seek alternatives. For instance, the global organic fertilizer market was valued at approximately USD 11.5 billion in 2023 and is projected to grow, although conventional fertilizers still hold the larger market share.

This growing demand for organic options signifies a trend that CVR Partners should monitor closely. It suggests a need to consider the environmental footprint of their products and explore opportunities for diversification into more eco-friendly fertilizer solutions. The market is responding, with innovation focused on creating more efficient and environmentally benign fertilizer technologies.

Labor availability and costs are crucial for CVR Partners, impacting both their manufacturing operations and the agricultural sector they serve. In 2024, the U.S. manufacturing sector faced ongoing labor challenges, with the Bureau of Labor Statistics reporting a median hourly wage of $22.97 for production occupations. Rising wage expectations and a shortage of skilled workers can directly increase operational expenses at CVR's Coffeyville, Kansas, plant.

For the agricultural industry, which supplies raw materials like grain to CVR, labor availability is equally critical. Farm labor shortages, exacerbated by demographic shifts and immigration policies, can limit a farmer's capacity for planting, harvesting, and managing their operations efficiently. In 2023, the U.S. Department of Agriculture noted that the average annual wage for crop farm workers reached $34,000, a figure that continues to climb, affecting farmers' profitability and their ability to invest in crops that utilize CVR's products.

Public Perception of Industrial Agriculture

Public perception of industrial agriculture is increasingly shaped by concerns over its environmental footprint, particularly the impact of chemical inputs like nitrogen fertilizers. Consumers and regulators are paying closer attention to issues such as nitrate runoff into waterways and greenhouse gas emissions linked to fertilizer production and use. For instance, studies in 2024 highlighted a growing consumer demand for sustainably sourced products, with over 60% of surveyed individuals indicating a willingness to pay more for food produced with reduced environmental impact.

This shift in public opinion directly influences regulatory pressures. Governments are more likely to implement stricter environmental standards for agricultural practices. For CVR Partners, this means an increased need to demonstrate and promote the sustainable and efficient use of their fertilizer products, aligning with growing demands for eco-friendly farming solutions and potentially mitigating risks associated with future environmental legislation.

The company must proactively address these sociological factors by emphasizing its commitment to sustainability. This could involve highlighting product innovations that improve nutrient efficiency, reduce emissions, or support soil health.

- Growing consumer demand: Over 60% of consumers in 2024 expressed willingness to pay more for sustainably produced food.

- Environmental concerns: Public awareness of nitrate runoff and greenhouse gas emissions from fertilizers is at an all-time high.

- Regulatory pressure: Increased public scrutiny is likely to lead to stricter environmental regulations on agricultural inputs.

- CVR Partners' focus: Emphasis on sustainable production methods and efficient product utilization is crucial for market adaptation.

Rural Community Health and Agricultural Spending

The economic well-being of rural areas, where agriculture often forms the backbone, directly influences farmers' capacity to purchase essential inputs like fertilizer. For instance, in 2024, a significant portion of U.S. agricultural regions faced tighter credit conditions, potentially impacting spending on crop nutrients. Policies that bolster rural economies, such as improved access to financing or support for stable commodity prices, can translate into a more robust customer base for companies like CVR Partners.

Stable commodity prices, a key factor in farmer profitability, directly affect their investment decisions. In 2024, fluctuations in corn and soybean prices presented challenges for some farmers in planning their input purchases. Government programs and economic conditions that ensure fair prices for agricultural products indirectly benefit CVR Partners by creating a more financially stable farming community.

Access to credit is another critical element for farmers to manage their operational expenses, including fertilizer acquisition. In 2024, reports indicated that some agricultural lenders tightened lending standards, potentially limiting farmers' ability to secure the necessary capital for their operations. Favorable lending environments and economic stability in rural communities are therefore crucial for CVR Partners’ sales performance.

- Rural Economic Health: The economic stability of agricultural communities is paramount for fertilizer demand.

- Farmer Investment Capacity: A farmer's ability to invest in inputs like fertilizer is tied to their profitability and access to credit.

- Policy Impact: Supportive agricultural policies and stable commodity prices can indirectly boost CVR Partners' customer base.

- Credit Access: Tightened credit conditions in rural areas can negatively impact farmers' purchasing power for agricultural inputs.

Societal shifts towards sustainable and organic farming practices are gaining momentum, potentially influencing demand for synthetic fertilizers. While the organic fertilizer market was valued at approximately USD 11.5 billion in 2023, conventional fertilizers still dominate, presenting a nuanced market dynamic for CVR Partners to navigate.

Public concern over the environmental impact of industrial agriculture, particularly regarding nitrate runoff and greenhouse gas emissions from fertilizer use, is growing. In 2024, over 60% of consumers indicated a willingness to pay more for sustainably produced food, signaling a trend that could lead to increased regulatory scrutiny on agricultural inputs.

Labor availability and costs continue to be significant factors, affecting both CVR Partners' operational expenses and the agricultural sector's capacity. In 2024, the median hourly wage for U.S. production occupations was $22.97, and farm worker wages reached an average of $34,000 annually in 2023, impacting farmers' investment decisions.

Technological factors

Technological advancements in precision agriculture are significantly transforming how fertilizers are used. Innovations like variable-rate technology, the integration of the Internet of Things (IoT), artificial intelligence (AI), and drone deployment allow for much more precise and efficient fertilizer application. This means farmers can apply nutrients exactly where and when they are needed, minimizing waste and boosting environmental benefits.

For CVR Partners, these developments directly impact product sales and usage patterns. As farmers adopt these advanced tools, the demand may shift towards specialized fertilizers that work optimally with precision application systems. The ability to optimize nutrient delivery not only reduces overall fertilizer consumption but also maximizes crop yields, a key selling point for CVR Partners’ offerings.

The global precision agriculture market was valued at approximately USD 8.5 billion in 2023 and is projected to reach over USD 22 billion by 2030, demonstrating strong growth. This trend suggests a growing market for CVR Partners if they can align their product development and marketing with these technological shifts, potentially seeing a reduction in bulk fertilizer sales but an increase in demand for high-efficiency, precision-oriented formulations.

Technological advancements are revolutionizing fertilizer production, particularly in making ammonia, a key component. The focus is squarely on boosting energy efficiency and slashing greenhouse gas emissions. For instance, by 2024, many plants are implementing improved catalyst technologies that can reduce energy consumption in ammonia synthesis by up to 15% compared to older methods.

Emerging ‘green’ nitrogen fixation techniques are also gaining traction. These methods leverage bio-based systems or renewable electricity, aiming to drastically lower the environmental footprint of fertilizer manufacturing. Early pilot projects in 2025 show potential for these green methods to cut CO2 emissions from ammonia production by over 90%.

CVR Partners, as a significant player in this sector, stands to gain immensely from adopting these innovations. Investing in such efficiencies is not just about staying competitive; it's crucial for meeting increasingly stringent sustainability targets and consumer demand for eco-friendly products. By 2024, the company’s strategic investments in upgrading its ammonia production facilities are projected to yield a 10% reduction in its overall carbon intensity.

The agricultural sector is seeing a significant shift towards alternative crop nutrition methods, moving away from traditional synthetic fertilizers. These innovations include biofertilizers, which utilize living microorganisms to enhance plant growth and nutrient availability, and microbial inoculants, specifically selected microbes that can improve soil health and nutrient uptake. This trend is driven by a growing awareness of environmental sustainability and the desire to reduce the carbon footprint associated with synthetic fertilizer production and application.

For CVR Partners, these developments represent a dual-edged sword. On one hand, the increasing adoption of biofertilizers, projected to significantly reduce the demand for synthetic nitrogen, could impact the market share of conventional fertilizer products. For instance, the global biofertilizer market was valued at approximately USD 2.5 billion in 2023 and is anticipated to reach over USD 7.0 billion by 2030, showcasing rapid growth.

Conversely, this evolution offers CVR Partners a strategic opportunity to adapt and diversify. Exploring partnerships with biofertilizer producers or investing in research and development for integrated nutrient management solutions could open new revenue streams. By embracing these biological crop protection and nutrition alternatives, CVR Partners can position themselves at the forefront of sustainable agriculture, meeting the evolving demands of farmers and consumers alike.

Digitalization in Agricultural Management

The agricultural sector is rapidly embracing digitalization, with farm management software, data analytics, and remote sensing becoming increasingly common. This technological shift empowers farmers with enhanced insights, enabling more precise optimization of fertilizer application. For CVR Partners, this means a growing opportunity to supply products that integrate seamlessly with these advanced systems, supporting more informed, data-driven farming practices.

AI-driven soil health monitoring is a prime example of this trend, showing the potential to significantly cut down on fertilizer waste. Studies indicate that precision agriculture techniques, which heavily rely on digitalization, can reduce fertilizer usage by as much as 15-20% while maintaining or even improving yields. This efficiency directly benefits CVR Partners by promoting the targeted and effective use of their fertilizer products, aligning with sustainable agricultural goals.

- Increased Adoption of Precision Agriculture: Global spending on precision agriculture technologies is projected to reach USD 21.5 billion by 2025, up from USD 10.7 billion in 2020, indicating a strong market trend.

- AI in Soil Monitoring: AI-powered soil analysis can identify nutrient deficiencies and recommend precise fertilizer amounts, potentially reducing over-application by up to 20%.

- Data-Driven Farm Management: Over 70% of large farms in developed countries are expected to utilize some form of digital farm management software by 2026, enhancing operational efficiency.

- Remote Sensing for Crop Health: Satellite imagery and drone technology allow for early detection of crop stress and nutrient needs, enabling timely and targeted fertilizer application.

Carbon Capture and Storage Technologies

Advancements in carbon capture and storage (CCS) technologies present a significant technological factor for CVR Partners, a nitrogen fertilizer manufacturer. As natural gas is a primary feedstock and a source of CO2 emissions in their operations, the ability to capture and store these emissions directly impacts their environmental footprint and future regulatory compliance.

Implementing CCS solutions can offer a pathway for CVR Partners to mitigate its greenhouse gas emissions, a growing concern for industries worldwide. For instance, the U.S. Department of Energy's fiscal year 2025 budget request included $4.3 billion for energy innovation, with a significant portion allocated to carbon capture research and deployment, indicating strong government support and technological development in this area.

The economic viability and efficiency of CCS technologies are rapidly improving. Several large-scale CCS projects are already operational globally, demonstrating the technical feasibility. In 2024, the International Energy Agency (IEA) reported that global CO2 emissions from industrial processes and energy use reached record highs, underscoring the urgent need for solutions like CCS. While specific cost reductions for fertilizer production CCS are still being refined, the overall trend in CCS technology costs has been downward, with estimates suggesting potential reductions in capture costs to below $50 per ton of CO2 captured for certain applications by the end of the decade.

- Technological Advancements: Ongoing research and development are making CCS more efficient and cost-effective.

- Regulatory Alignment: Implementing CCS helps CVR Partners prepare for and comply with potential future carbon pricing or emissions reduction mandates.

- Environmental Benefits: CCS directly addresses CO2 emissions, improving the sustainability profile of fertilizer production.

- Economic Incentives: Government support, such as tax credits and grants for CCS projects, can improve the financial feasibility of adoption.

Technological advancements are reshaping fertilizer application through precision agriculture, with IoT, AI, and drones enabling targeted nutrient delivery. This shift means CVR Partners must adapt to demand for specialized, high-efficiency formulations, potentially seeing reduced bulk sales but increased sales of advanced products.

Innovations in ammonia production are prioritizing energy efficiency and emission reduction, with new catalyst technologies in 2024 offering up to a 15% energy saving. Furthermore, emerging green nitrogen fixation methods using renewables aim to cut CO2 emissions from ammonia production by over 90% by 2025 pilot projects, directly impacting CVR Partners' sustainability and operational costs.

The rise of biofertilizers and microbial inoculants presents both a challenge and an opportunity for CVR Partners, as the global biofertilizer market is expected to grow significantly. Adapting by exploring partnerships or R&D in integrated nutrient management can position CVR Partners to meet evolving sustainable agriculture demands.

Digitalization in agriculture, including AI-driven soil monitoring and remote sensing, is enhancing efficiency and reducing fertilizer waste, with precision techniques potentially cutting usage by 15-20%. This trend supports CVR Partners by promoting the targeted and effective use of their products.

| Technological Factor | Impact on Fertilizer Industry | CVR Partners Implication | Relevant Data (2024/2025) |

| Precision Agriculture | Optimized application, reduced waste | Demand for specialized, high-efficiency products | Precision agriculture market ~$10.7B (2023), growing to ~$22B by 2030 |

| Green Ammonia Production | Lower emissions, higher energy efficiency | Need for investment in sustainable production methods | New catalysts offer up to 15% energy savings (2024); Green methods aim for >90% CO2 reduction (2025 pilots) |

| Biofertilizers/Microbials | Shift from synthetic fertilizers | Opportunity for diversification and R&D | Biofertilizer market ~$2.5B (2023), projected to reach ~$7B by 2030 |

| Digitalization & AI | Data-driven farm management, improved efficiency | Integration of products with digital platforms | AI can reduce fertilizer use by 15-20% |

Legal factors

The Environmental Protection Agency (EPA) plays a significant role in shaping CVR Partners' operations through its stringent regulations. These rules govern fertilizer manufacturing, specifically targeting effluents and emissions from processes like ammonia and urea production, as mandated by the Clean Air Act and Clean Water Act.

CVR Partners must maintain strict adherence to EPA guidelines covering process condensate, treatment plant effluent, and spill management to ensure their operational licenses remain valid and to uphold their environmental reputation. Non-compliance can lead to substantial fines and operational disruptions.

The potential introduction of new EPA regulations, particularly concerning substances such as formaldehyde which is crucial for urea production, presents a notable challenge. Such changes could necessitate significant investments in updated technology or alternative production methods, thereby impacting CVR Partners' overall production costs and operational strategies.

CVR Partners operates under stringent Occupational Safety and Health Administration (OSHA) regulations, particularly crucial for its chemical manufacturing facilities producing ammonia and UAN solutions. These rules mandate rigorous safety protocols to protect workers from the inherent risks associated with handling hazardous chemicals. Failure to comply can result in significant financial penalties and operational disruptions.

Adherence to OSHA's Process Safety Management (PSM) standard is paramount for CVR Partners. This standard requires comprehensive hazard analyses, detailed operating procedures, and robust emergency planning to prevent catastrophic chemical releases. For instance, in 2023, OSHA issued over $1.7 billion in penalties for workplace safety violations across various industries, highlighting the financial implications of non-compliance.

CVR Partners, as a producer of chemical products like ammonia and UAN solutions, faces significant legal scrutiny regarding product liability and stringent safety standards. Failure to meet these regulations can lead to costly lawsuits and reputational damage. For instance, the Occupational Safety and Health Administration (OSHA) mandates specific handling and storage protocols for hazardous materials, which directly impact CVR's operations and product distribution.

Maintaining rigorous quality control and providing clear, accurate labeling and safe handling instructions are paramount for CVR Partners to minimize legal exposure. Adherence to regulations governing the transportation of hazardous materials, such as those set by the Department of Transportation (DOT), is also critical. In 2023, chemical manufacturers faced an average of $1.2 million in product liability claims, highlighting the financial stakes involved.

Antitrust and Market Competition Laws

Antitrust and market competition laws are crucial for CVR Partners, as they ensure a level playing field in the nitrogen fertilizer industry. These regulations are designed to prevent any single company from gaining excessive market power, which could lead to unfair pricing or reduced innovation.

CVR Partners must continually review its operations, including pricing strategies and potential mergers or acquisitions, to ensure compliance. For instance, the U.S. Department of Justice and the Federal Trade Commission actively monitor industries for anti-competitive behavior. In 2023, the FTC reported over 1,800 merger filings, indicating ongoing regulatory scrutiny across various sectors.

Specifically within the fertilizer market, regulators watch for practices that could harm farmers or limit supply. Any significant consolidation or unusual pricing patterns would likely attract attention. The ongoing focus on supply chain resilience and national security for agricultural inputs means antitrust enforcement in this sector is particularly important.

- Regulatory Oversight: Antitrust laws, enforced by bodies like the FTC and DOJ, aim to prevent monopolies and foster fair competition.

- Industry Impact: CVR Partners must ensure its business practices, including pricing and M&A activities, do not unfairly disadvantage competitors in the nitrogen fertilizer market.

- Scrutiny Areas: Mergers, acquisitions, and pricing strategies are key areas where CVR Partners faces potential antitrust review.

- Market Dynamics: The nitrogen fertilizer market's critical role in agriculture means regulatory bodies pay close attention to any signs of anti-competitive behavior that could impact food production or costs.

Land Use and Zoning Laws

CVR Partners' Coffeyville, Kansas facility operates under a complex web of local and state land use and zoning regulations. These laws dictate what activities are permitted on their industrial site, ensuring that operations align with community development plans and environmental safeguards. For instance, any proposed expansion or modification to the plant would likely trigger requirements for environmental impact assessments, a process that analyzes potential effects on air quality, water resources, and local ecosystems. The proximity of industrial operations to residential areas is also a key consideration within these zoning frameworks, influencing buffer zones and operational noise limits.

Adherence to these land use and zoning stipulations is not merely a procedural formality but a critical factor for CVR Partners' sustained operational viability and future growth prospects. Failure to comply can lead to significant penalties, operational disruptions, or even the inability to proceed with necessary upgrades or expansions. As of early 2024, local zoning boards continue to review and update regulations to balance industrial needs with community well-being and environmental protection, making ongoing compliance a dynamic challenge for businesses like CVR Partners.

- Zoning Ordinances: CVR Partners' Coffeyville plant must comply with specific zoning designations that permit heavy industrial activities, potentially including restrictions on operating hours or emissions.

- Environmental Impact Assessments (EIAs): Significant expansions or new construction at the facility would necessitate EIAs, a process that analyzes potential environmental effects and proposes mitigation strategies.

- Proximity Regulations: Zoning laws often stipulate minimum distances between industrial facilities and residential zones, impacting facility layout and potential future development.

- Permitting and Licensing: Land use permits and operational licenses are subject to renewal and can be influenced by ongoing compliance with zoning and environmental standards.

CVR Partners is subject to evolving labor laws that impact hiring, compensation, and employee rights. Recent legislative trends, including those concerning minimum wage increases and collective bargaining rights, directly influence operational costs and workforce management. For instance, the U.S. Department of Labor reported that in 2023, over 70% of businesses experienced an increase in labor costs due to various regulatory changes and market pressures, underscoring the financial impact of these legal factors.

Environmental factors

Climate change is a significant environmental factor impacting agriculture, directly affecting farmer demand for fertilizers. Extreme weather events such as prolonged droughts and severe floods are becoming more common, leading to reduced crop yields and agricultural productivity. For example, in 2024, several major agricultural regions experienced significant yield losses due to unseasonable weather patterns, increasing the urgency for farmers to manage soil health and nutrient inputs.

These climatic shifts also alter traditional growing seasons and the suitability of certain crops for specific regions. This can lead to a dynamic demand for fertilizers, as farmers adapt to changing environmental conditions and explore new crop varieties. The global fertilizer market, valued at approximately $230 billion in 2023, is expected to see shifts in regional demand patterns driven by these agricultural adaptations.

Nitrogen runoff from agricultural lands into rivers and lakes is a growing environmental issue, leading to eutrophication and a decline in water quality. This problem directly influences how fertilizers are regulated and applied. For instance, in the United States, the Chesapeake Bay Program has been working to reduce nitrogen pollution, with agricultural sources being a major contributor; as of 2023, efforts continue to meet stringent nutrient reduction targets.

These environmental pressures are prompting stricter regulations on nitrogen usage and encouraging farmers to adopt more efficient application techniques. This trend could potentially decrease the demand for conventional nitrogen fertilizers while increasing interest in and the market share for advanced products like slow-release or precision fertilizers, which CVR Partners might offer.

The production of nitrogen fertilizers, a core activity for CVR Partners, is inherently energy-intensive, leading to substantial greenhouse gas emissions, primarily carbon dioxide (CO2) and nitrous oxide (N2O). These emissions are a significant environmental concern within the industry.

Globally, synthetic nitrogen fertilizers contribute about 2% to total greenhouse gas emissions, highlighting the scale of this environmental impact. This makes it a critical area for regulatory and public scrutiny.

CVR Partners, like other fertilizer producers, is under increasing pressure to mitigate these emissions. This involves exploring and implementing technological innovations such as green nitrogen fixation processes and enhancing overall energy efficiency throughout their production facilities.

Resource Depletion (Natural Gas Feedstock)

Natural gas is a critical, non-renewable feedstock for CVR Partners' nitrogen fertilizer production. The ongoing extraction and use of this resource raise concerns about future availability and price stability, presenting a significant long-term challenge for the company's operations and profitability.

The potential for resource depletion directly impacts the cost structure of fertilizer manufacturing. For instance, in early 2024, natural gas prices experienced fluctuations, with spot prices in the Henry Hub sometimes exceeding $2.50 per MMBtu, demonstrating the inherent volatility that can arise from supply-demand dynamics and geopolitical events affecting energy markets.

This environmental and economic pressure incentivizes CVR Partners and the broader industry to actively explore and invest in alternative, more sustainable feedstocks and innovative production methods. Such shifts are crucial for mitigating the risks associated with natural gas scarcity and price volatility, ensuring long-term operational resilience.

- Feedstock Reliance: Natural gas is essential for ammonia production, a core component of nitrogen fertilizers.

- Price Volatility: Fluctuations in natural gas prices, driven by supply, demand, and global events, directly affect CVR Partners' production costs.

- Sustainability Push: Growing environmental awareness and regulatory pressures encourage the search for renewable or less resource-intensive feedstocks.

- Innovation Imperative: Investment in new technologies for feedstock diversification and production efficiency is becoming increasingly vital for competitive advantage.

Waste Management and Industrial Byproducts

CVR Partners' manufacturing of nitrogen fertilizers inherently creates waste streams like process condensate, treatment plant effluent, and gypsum pond water. Effective management of these byproducts is paramount for CVR Partners to mitigate environmental pollution and meet stringent disposal regulations.

Adherence to these environmental standards is not just about compliance; it's a critical operational factor. For instance, in 2023, the fertilizer industry globally faced increased scrutiny and investment in cleaner production technologies, with some regions mandating stricter limits on effluent discharge. CVR Partners must invest in advanced treatment processes to handle these byproducts responsibly.

- Process Condensate: Requires treatment to remove dissolved solids and organic compounds before discharge or reuse.

- Treatment Plant Effluent: Needs continuous monitoring and treatment to ensure compliance with local and national water quality standards, often involving nutrient removal.

- Gypsum Pond Water: Management involves controlling potential seepage and ensuring the structural integrity of ponds to prevent environmental contamination.

- Regulatory Compliance Costs: Investments in waste treatment technology and ongoing monitoring can represent a significant operational expense, impacting CVR Partners' profitability.

Environmental factors significantly shape the fertilizer industry, influencing everything from agricultural practices to production methods. Climate change, for instance, is altering crop yields and growing seasons, prompting shifts in fertilizer demand as farmers adapt. The industry also faces scrutiny over its environmental footprint, particularly concerning greenhouse gas emissions from production and nutrient runoff into waterways, pushing for cleaner technologies and more efficient fertilizer use.

CVR Partners, as a nitrogen fertilizer producer, is directly impacted by these environmental trends. Growing concerns about climate change and water quality are driving stricter regulations and a push for sustainable agricultural inputs. The company's reliance on natural gas also exposes it to the environmental and economic risks associated with fossil fuel extraction and price volatility. These pressures necessitate innovation in production processes and potential exploration of alternative feedstocks to ensure long-term viability and minimize environmental impact.

The company's operations also generate waste streams that require careful management to meet environmental standards and avoid pollution. Investments in advanced treatment technologies for process condensate, effluent, and pond water are crucial for compliance and responsible operations, representing a significant cost factor. These environmental considerations are not just regulatory hurdles but also strategic imperatives for CVR Partners in the evolving market landscape.

PESTLE Analysis Data Sources

Our CVR Partner PESTLE Analysis is informed by a robust blend of official government publications, reputable market research firms, and global economic indicators. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in factual, timely data.