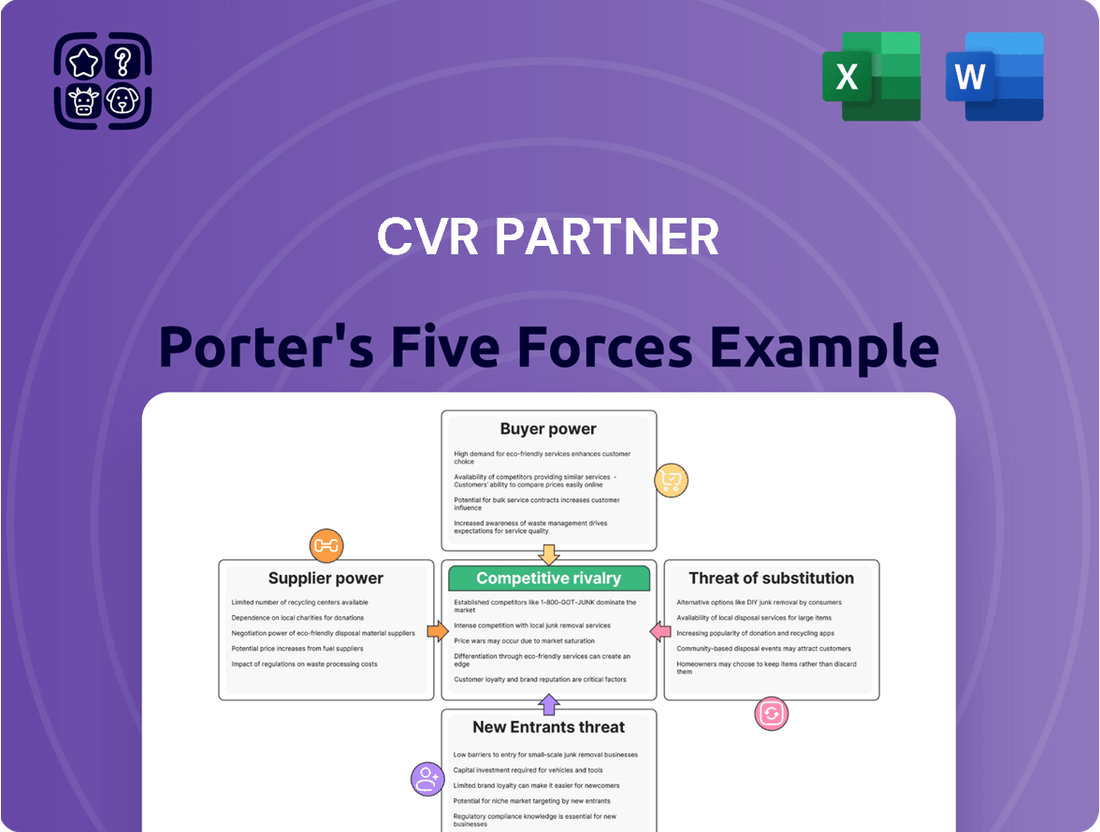

CVR Partner Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVR Partner Bundle

Understanding the competitive landscape is crucial for any business, and CVR Partner is no exception. Our Porter's Five Forces analysis offers a sharp look at the forces shaping their market, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CVR Partner’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for CVR Partners hinges on how concentrated and specialized the sources of their essential raw materials are. For nitrogen fertilizer production, natural gas is a critical feedstock for ammonia, and its availability and pricing are heavily tied to global commodity markets and regional supply conditions.

While 2024 saw some price stability for natural gas, projections for early 2025 indicate a potential for price increases, which could directly raise CVR Partners' production expenses and thus amplify supplier leverage.

The degree of specialization among natural gas suppliers, particularly those with access to cost-advantaged reserves, can further concentrate power, giving them more sway in price negotiations with CVR Partners.

CVR Partners experiences moderate to high switching costs for its essential raw materials, most notably natural gas. The specialized infrastructure at its Coffeyville, Kansas facility is designed for specific processing methods, making it expensive and time-consuming to adapt to different fuel sources or input chemicals. This reliance on dedicated infrastructure significantly restricts CVR's ability to rapidly switch suppliers or alter its input material mix.

While natural gas remains the primary feedstock for synthetic nitrogen fertilizers, the availability of substitute inputs is a growing consideration. Emerging technologies for 'green ammonia' production, leveraging renewable electricity or biological processes, present potential long-term alternatives. However, as of mid-2024, these are still in early development stages and not yet scalable or cost-competitive for large-scale industrial operations like those of CVR Partners.

Threat of Forward Integration by Suppliers

The threat of natural gas suppliers moving into nitrogen fertilizer production, known as forward integration, is typically considered low for CVR Partners. This is primarily because the capital investment, specialized equipment, and operational expertise needed for chemical manufacturing are quite different from those involved in energy extraction and distribution.

While it’s theoretically possible for major, integrated energy companies to consider such a move, it hasn’t been a common strategy. These companies often focus on their core competencies in the energy sector, rather than diversifying into the complex world of fertilizer production.

- Low Capital Synergy: The distinct capital requirements for upstream energy operations versus downstream chemical manufacturing limit natural integration.

- Operational Divergence: The skill sets and technologies for natural gas extraction differ significantly from those for producing nitrogen fertilizers.

- Limited Trend: Large energy firms have not shown a widespread inclination to vertically integrate into fertilizer production, preferring to maintain focus on their primary energy markets.

Importance of CVR Partners to Suppliers

CVR Partners is a substantial buyer of natural gas and other chemical inputs within its operating regions. The sheer volume of CVR Partners' procurement gives its suppliers some degree of reliance, making the potential loss of such a significant client a considerable concern for their revenue streams.

However, the bargaining power CVR Partners wields over its input suppliers is tempered by the fact that natural gas, a primary feedstock, is a globally traded commodity. This means suppliers often have alternative buyers, reducing their dependence on any single large customer like CVR Partners.

- Significant Customer Base: CVR Partners' scale makes it an important revenue source for its key suppliers.

- Commodity Nature of Inputs: The global market for natural gas, a crucial input, limits supplier dependence on CVR Partners.

- Regional Concentration: While CVR Partners is a large buyer, the availability of other regional customers for suppliers can influence negotiation dynamics.

CVR Partners faces moderate to high supplier power, primarily due to its reliance on natural gas, a globally traded commodity. While CVR is a significant buyer, suppliers often have alternative markets, limiting their dependence. Switching costs for CVR are also considerable, especially for its Coffeyville facility's specialized infrastructure, making it difficult to change feedstocks or suppliers quickly.

The concentration of specialized natural gas suppliers, particularly those with cost advantages, can further bolster their leverage. As of mid-2024, emerging green ammonia technologies are not yet scalable or cost-competitive alternatives, reinforcing the current supplier dynamics.

Forward integration by energy suppliers into fertilizer production remains a low threat, given the distinct capital and operational requirements of each industry.

| Factor | Impact on CVR Partners | Notes |

|---|---|---|

| Natural Gas Dependency | High | Critical feedstock for ammonia; price volatility directly impacts costs. |

| Supplier Concentration | Moderate to High | Availability of cost-advantaged natural gas reserves can concentrate power. |

| Switching Costs | High | Specialized infrastructure at facilities limits ease of changing suppliers or inputs. |

| Forward Integration Threat | Low | Distinct capital and operational expertise required for fertilizer production. |

What is included in the product

This analysis delves into the five forces shaping CVR Partner's competitive environment, assessing threats from new entrants, the power of buyers and suppliers, and the intensity of rivalry and substitute products.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each force, enabling targeted strategic responses.

Customers Bargaining Power

CVR Partners' customer base, primarily farmers and agricultural distributors, is largely fragmented. This broad distribution, especially among individual farmers, generally diminishes their collective bargaining power. However, the emergence of large agricultural cooperatives or major distributors can consolidate demand, granting these entities more leverage in price negotiations with CVR Partners.

Farmers generally experience low switching costs when moving between nitrogen fertilizer suppliers. Since products like ammonia and UAN are largely commoditized, the decision often boils down to price, timely availability, and efficient delivery. This ease of switching empowers customers to readily seek out more favorable terms from competitors.

The bargaining power of customers within the nitrogen fertilizer market, particularly for products like ammonia and UAN offered by CVR Partners, is significantly influenced by a lack of product differentiation. These are largely commodity items, meaning their core chemical makeup and how they're used are standardized across the industry.

Because there's little to distinguish one supplier's nitrogen fertilizer from another's, customers can readily shop around for the best price. This ease of comparison directly amplifies their leverage. For instance, in 2024, the price of anhydrous ammonia on the spot market can fluctuate daily, giving buyers ample opportunity to exploit minor price differences between producers.

While CVR Partners focuses on consistent supply and product quality, these attributes often fall short of creating a substantial competitive moat when the fundamental product is so similar. Customers, especially large agricultural operations or distributors, can switch suppliers with minimal disruption if a competitor offers a more attractive price point for the same essential product.

Threat of Backward Integration by Customers

The threat of backward integration by CVR Partners' customers, such as farmers or distributors, is remarkably low. Farmers generally do not possess the substantial capital, specialized technical knowledge, or the necessary operational scale required to manufacture nitrogen fertilizers themselves.

Even major agricultural distributors would find it economically unfeasible and operationally complex to invest in the sophisticated chemical production plants needed for fertilizer synthesis.

- Low Capital Requirements for Farmers: The significant investment needed for fertilizer production facilities, estimated to be in the hundreds of millions of dollars for a new ammonia plant, is beyond the reach of individual or even cooperative farming operations.

- Technical Expertise Gap: Producing nitrogen fertilizers involves complex chemical processes requiring specialized engineering and chemical expertise, which are not core competencies for agricultural producers or distributors.

- Economies of Scale: CVR Partners benefits from significant economies of scale in its production and distribution, making it difficult for smaller, integrated operations to compete on cost.

Price Sensitivity of Customers

The price sensitivity of customers is a critical factor impacting the bargaining power of buyers. For instance, in the agricultural sector, farmers are acutely aware of how fertilizer costs affect their profitability. In 2024, global fertilizer prices have seen volatility, directly influencing a farmer's decision-making process and their willingness to absorb price increases.

This heightened sensitivity means that when fertilizer prices climb, farmers exert greater bargaining power. They may seek alternative suppliers, reduce their fertilizer application, or even shift to less input-intensive crops if the cost becomes prohibitive. This dynamic is particularly evident when market conditions lead to sharp price hikes.

- Fertilizer Costs as a Major Expense: Fertilizer often represents a substantial portion of a farmer's operating budget, making them highly attuned to price changes.

- Influence of Natural Gas: The cost of natural gas, a key input for many fertilizers, directly impacts their market price and, consequently, farmer purchasing decisions.

- Global Supply Chain Dynamics: Disruptions or gluts in the global fertilizer supply chain can lead to price fluctuations, further intensifying farmer price sensitivity.

- Impact on Profitability: Elevated fertilizer prices can significantly squeeze profit margins for farmers, reinforcing their need to manage these input costs carefully.

CVR Partners' customers, primarily farmers, generally exhibit strong bargaining power due to the commoditized nature of nitrogen fertilizers like ammonia and UAN. Low switching costs mean farmers can readily shift suppliers based on price, and the lack of product differentiation further amplifies this leverage. For instance, in 2024, daily spot prices for anhydrous ammonia allow buyers to easily compare and exploit price discrepancies between producers, putting pressure on CVR Partners to remain competitive on cost.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

| Customer Concentration | Low (fragmented farmer base) | Still a factor, though large co-ops can consolidate demand. |

| Switching Costs | Low | Farmers can easily switch for better pricing or delivery. |

| Product Differentiation | Low | Commodity products mean price is the primary driver. |

| Price Sensitivity | High | Fertilizer is a major cost; farmers actively seek cost savings. |

| Threat of Backward Integration | Very Low | Capital and technical barriers are prohibitive for customers. |

Preview the Actual Deliverable

CVR Partner Porter's Five Forces Analysis

This preview displays the complete CVR Partner Porter's Five Forces analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive instantly after completing your purchase. You can trust that there are no placeholders or missing sections; what you are previewing is the exact deliverable designed to provide actionable insights into your competitive landscape.

Rivalry Among Competitors

The nitrogen fertilizer market, both in North America and worldwide, is populated by several significant companies. Major players such as Nutrien, CF Industries, and LSB Industries compete alongside CVR Partners. This landscape suggests a market that is moderately concentrated, meaning there are a few dominant firms, but it remains highly competitive.

In 2024, Nutrien, a leader in the sector, reported revenues of approximately $24.3 billion, underscoring its substantial market presence. CF Industries also demonstrated its competitive strength, with reported revenues around $7.1 billion for the fiscal year 2023. These figures highlight the scale of operations for key competitors, setting a high bar for market entry and ongoing success.

The presence of these large, well-established entities intensifies competitive rivalry. Their significant production capacities, extensive distribution networks, and ongoing investments in technology and efficiency create formidable barriers for smaller or newer entrants. This competitive intensity directly impacts pricing strategies and market share dynamics for all participants, including CVR Partners.

The nitrogenous fertilizer market is experiencing robust growth, which can intensify competitive rivalry. Projections indicate a healthy compound annual growth rate (CAGR) of 7.5%, with the market expected to reach $84.56 billion in 2025 from $78.65 billion in 2024. This expansion suggests that while opportunities abound, existing players and new entrants will likely vie aggressively for market share, potentially leading to price pressures and increased marketing expenditures.

Nitrogen fertilizers are primarily seen as undifferentiated commodities, which naturally fuels aggressive price competition among manufacturers. This lack of unique product features means that buyers can easily switch between suppliers based on cost and availability. In 2024, the global nitrogen fertilizer market saw significant price volatility, with urea prices fluctuating by as much as 15% in a single quarter due to natural gas cost swings and geopolitical factors, underscoring the commodity nature of the product.

Given these low switching costs, companies like CVR Partners (CVRR) often find themselves competing intensely on factors like pricing and the assurance of a reliable supply chain. For instance, a farmer can readily substitute one supplier for another if the price is better or if there's a concern about timely delivery. This dynamic forces producers to maintain efficient operations and manage their feedstock costs very closely to remain competitive.

Exit Barriers

The fertilizer industry, and by extension CVR Partners, is characterized by substantial capital intensity. This means companies must invest heavily in large-scale manufacturing plants, intricate distribution networks, and specialized equipment. For instance, building a new ammonia or urea plant can cost hundreds of millions, if not billions, of dollars. These significant upfront investments, coupled with the specialized nature of the assets, create formidable exit barriers.

These high exit barriers mean that companies find it extremely difficult and financially punitive to cease operations or sell off their assets if the market turns unfavorable. Consequently, even when facing overcapacity or declining demand, firms are often compelled to continue producing, leading to intensified competitive rivalry as players fight for market share in a shrinking or stagnant market. This sticky situation can put downward pressure on prices and profitability for all involved.

- High Capital Investment: The fertilizer sector requires massive capital outlays for plant construction and infrastructure.

- Specialized Assets: Assets are often highly specialized for fertilizer production, limiting resale value outside the industry.

- Operational Commitments: Long-term contracts for raw materials and distribution can further entrench companies.

- Difficulty in Divestment: Selling off a fertilizer plant is a complex process with limited buyers, increasing the cost of exiting.

Capacity Utilization and Inventory Levels

Global nitrogen fertilizer production saw a 3% increase in 2024, primarily driven by urea output. Despite this overall supply growth, certain market dynamics led to price escalations. Looking ahead to 2025, supply is anticipated to become more consistent, potentially easing some of the price pressures experienced in the prior year.

The competitive rivalry within the fertilizer sector is significantly influenced by capacity utilization and inventory levels. High inventory levels across the broader crop protection market in 2024 acted as a drag on fertilizer prices. This oversupply in related segments can create a ripple effect, forcing producers to compete more aggressively on price to move their own inventory.

- Global nitrogen fertilizer output increased by 3% in 2024

- Urea production was a key driver of this increase

- Supply stabilization is expected in 2025, though 2024 saw price pressures

- High inventories in the crop protection market in 2024 negatively impacted fertilizer prices

Competitive rivalry in the nitrogen fertilizer market is intense, driven by the presence of large, established players like Nutrien and CF Industries, which reported revenues of $24.3 billion and $7.1 billion respectively in 2023-2024. These giants possess significant production capacity and distribution networks, creating high barriers for smaller competitors. The commodity nature of nitrogen fertilizers, exemplified by urea price fluctuations of up to 15% in a single quarter during 2024 due to feedstock costs and global events, compels companies to compete aggressively on price and supply reliability.

The market's growth, projected at a 7.5% CAGR to reach $84.56 billion by 2025, attracts further competition. High capital intensity, with new plants costing hundreds of millions, leads to substantial exit barriers, forcing existing players to remain operational and compete even in unfavorable conditions. This dynamic, coupled with high inventory levels in adjacent markets observed in 2024, suppressed fertilizer prices, intensifying the fight for market share.

| Competitor | Reported Revenue (Approx.) | Year |

| Nutrien | $24.3 billion | 2024 |

| CF Industries | $7.1 billion | 2023 |

| Urea Price Volatility | Up to 15% quarterly | 2024 |

| Market Growth (CAGR) | 7.5% | Projected to 2025 |

SSubstitutes Threaten

For CVR Partners, the threat of direct substitutes for its core products, ammonia and urea ammonium nitrate (UAN), is relatively low within the synthetic nitrogen fertilizer market. Farmers generally have a limited range of direct chemical substitutes that offer the same efficacy and application methods for nitrogen fertilization.

However, the broader threat lies in the *choice* of nitrogen sources. Farmers can opt for different forms of nitrogen, such as anhydrous ammonia, urea, or UAN, and market conditions can influence which product is more appealing. For instance, price fluctuations and availability of these different nitrogen forms can shift farmer preferences, impacting demand for CVR Partners' specific product mix.

In 2024, the global nitrogen fertilizer market saw significant price volatility, with urea prices experiencing considerable swings based on natural gas costs and global demand. This volatility can encourage farmers to explore cost-effective alternatives or adjust their application strategies, indirectly impacting the demand for specific products like UAN.

Organic fertilizers, biofertilizers, and sustainable farming methods such as crop rotation and biological nitrogen fixation are increasingly recognized as viable alternatives to synthetic nitrogen fertilizers. These options provide significant environmental advantages, contributing to soil health and reducing greenhouse gas emissions. For example, the global biofertilizer market was valued at approximately $2.1 billion in 2023 and is projected to reach $4.5 billion by 2030, indicating growing adoption.

However, these alternatives currently grapple with scalability and cost issues when directly compared to the established price-performance ratio of synthetic fertilizers. While synthetic nitrogen fertilizers offer a consistent and often lower upfront cost per unit of nutrient delivered, organic and biofertilizers may require larger application volumes or have slower nutrient release rates, impacting immediate yield expectations. This price-performance trade-off remains a key barrier to widespread substitution, despite the long-term benefits of sustainable practices.

Customers' willingness to switch to alternative crop protection solutions is shaped by several key elements. The price of synthetic pesticides versus bio-based or integrated pest management (IPM) approaches is a primary driver. Furthermore, evolving environmental regulations, such as those restricting certain chemical applications, can significantly push farmers toward substitutes. The perceived effectiveness of these alternatives in matching or improving crop yields is also crucial for adoption.

Government initiatives and subsidies aimed at promoting sustainable agriculture can accelerate the shift away from synthetic inputs. For instance, programs offering financial aid for adopting organic farming methods or investing in biological pest control agents directly influence customer propensity to substitute. In 2024, we saw continued investment in precision agriculture technologies, which often integrate with or facilitate the use of reduced-chemical or chemical-free pest management strategies, indicating a growing trend towards alternatives.

Technological Advancements in Substitutes

Technological advancements are significantly shaping the threat of substitutes for traditional synthetic fertilizers. Research and development in biological ammonia fertilizers and other green fertilizer technologies are progressing rapidly. These innovations aim to offer more sustainable and environmentally friendly nutrient sources, potentially disrupting the established synthetic fertilizer market over time.

The drive towards sustainability is fueling investment in these alternative nutrient solutions. For instance, by 2024, global investment in agritech, including soil health and biologicals, saw continued growth, with a notable increase in funding for companies developing biofertilizers. This trend suggests a growing viability and market acceptance for these substitutes.

- Growing R&D Investment: Significant capital is flowing into research for biological and green fertilizer alternatives.

- Sustainability Focus: Environmental concerns are pushing consumers and regulators towards more eco-friendly agricultural inputs.

- Market Disruption Potential: Successful development and scaling of these substitutes could reduce demand for conventional synthetic fertilizers.

- 2024 Agritech Funding: The agricultural technology sector, including biofertilizers, attracted substantial investment in 2024, indicating market confidence.

Regulatory and Environmental Pressures

Increasing environmental regulations and a global push towards sustainable agriculture are creating significant pressure from substitute products for conventional synthetic fertilizers. For instance, the European Union's Farm to Fork Strategy aims to reduce fertilizer use by 20% by 2030, encouraging the adoption of organic fertilizers and precision agriculture techniques. These shifts directly impact the demand for traditional products by making alternatives more attractive and economically viable.

Policies designed to mitigate environmental impact, such as those targeting ammonia emissions from fertilizer application or promoting nutrient recycling from waste streams, further bolster the threat of substitutes. For example, initiatives promoting the use of digestate from anaerobic digestion plants as a fertilizer source offer a circular economy approach. In 2024, the global biostimulants market, a key substitute category, was projected to reach over $5 billion, demonstrating substantial growth driven by these regulatory tailwinds.

- Environmental Regulations: Stricter rules on nutrient runoff and greenhouse gas emissions from fertilizer production and use incentivize alternatives.

- Sustainable Agriculture Push: Growing consumer and governmental demand for eco-friendly farming practices favors bio-fertilizers, compost, and recycled nutrients.

- Policy Incentives: Government subsidies or tax credits for adopting sustainable farming inputs can make substitutes more competitive than conventional fertilizers.

- Technological Advancements: Innovations in nutrient management and organic fertilizer production are improving the efficacy and scalability of substitutes.

While direct chemical substitutes for ammonia and UAN are limited, the broader threat comes from alternative nitrogen sources and sustainable farming practices. Organic fertilizers, biofertilizers, and methods like crop rotation are gaining traction due to environmental benefits, despite current scalability and cost challenges compared to synthetics.

In 2024, the nitrogen fertilizer market experienced price volatility, potentially nudging farmers towards more cost-effective or alternative nutrient strategies. Growing investment in agritech, particularly in biologicals, signals increasing viability for these substitutes.

Environmental regulations and a push for sustainability are key drivers for substitutes like biostimulants, with the market projected to exceed $5 billion in 2024. These factors, coupled with advancements in green fertilizer technologies, represent a growing challenge to traditional synthetic fertilizers.

Entrants Threaten

The nitrogen fertilizer industry, including operations like CVR Partners, is characterized by exceptionally high capital requirements. Building a new nitrogen fertilizer plant, from initial design and engineering to construction and commissioning, can easily run into hundreds of millions, if not billions, of dollars. For instance, the construction costs for new ammonia or urea plants often exceed $1 billion, creating a formidable barrier to entry for any aspiring competitor.

These substantial upfront investments cover not only the physical plant and machinery but also the necessary infrastructure, such as pipelines, storage facilities, and transportation networks. CVR Partners' Coffeyville, Kansas facility, a significant producer of ammonia and urea, represents such an investment, requiring vast sums to establish and maintain its operational capacity.

For potential new entrants, securing the necessary financing for such a capital-intensive venture is a major hurdle. The sheer scale of investment needed means that only well-established companies with access to significant capital markets or deep pockets can realistically consider entering this sector, thereby limiting the threat of new competition.

Established players in the industry, including CVR Partners, leverage significant economies of scale. This means they can produce goods or services at a lower per-unit cost than smaller companies. For CVR Partners, this advantage is particularly evident in their procurement of key raw materials, such as natural gas, and their extensive distribution networks.

Newcomers face a substantial hurdle in matching these cost efficiencies. Without the massive production volumes that CVR Partners and other incumbents enjoy, new entrants would find it incredibly challenging to compete on price, thereby limiting their ability to gain market share.

For instance, in the fertilizer market, where CVR Partners operates, a large ammonia plant can achieve production costs significantly below those of a smaller facility. This cost gap makes it difficult for new, smaller-scale producers to enter and thrive.

Newcomers face significant hurdles in securing reliable and cost-effective access to natural gas, the primary feedstock for CVR Partners' operations. Established companies, like CVR Partners, benefit from long-standing relationships with suppliers, often locking in favorable pricing and ensuring consistent supply.

Similarly, developing efficient distribution networks for agricultural products, a key output for CVR Partners, requires substantial investment and time. Existing players have already built extensive logistics infrastructure and strong relationships with buyers, making it difficult for new entrants to compete on delivery speed and cost.

In 2023, the average price of natural gas in the United States fluctuated, but securing long-term, low-cost contracts remains a competitive advantage for incumbents. For instance, the Henry Hub spot price averaged around $2.50 per MMBtu in early 2024, but securing future supply at such rates is challenging for those without established infrastructure and relationships.

Government Policy and Regulations

Government policy and regulations significantly shape the threat of new entrants in the fertilizer industry. Environmental regulations, such as those concerning emissions and water usage, require substantial investment in compliance technology, acting as a considerable hurdle for newcomers. For instance, the U.S. Environmental Protection Agency (EPA) enforces stringent standards that can be costly to meet.

Permitting processes for fertilizer production and distribution can be lengthy and complex, often requiring extensive documentation and environmental impact assessments. This administrative burden can delay market entry and increase initial capital outlays. Furthermore, trade policies like tariffs on imported raw materials or finished fertilizer products, as well as potential export restrictions, can impact the cost structure and market access for new players, making it harder to compete with established domestic producers.

- Environmental Compliance Costs: New entrants must factor in significant capital for pollution control and waste management systems to meet EPA or equivalent international standards.

- Permitting Delays: The time and resources needed for obtaining necessary permits can extend project timelines by months or even years.

- Trade Policy Uncertainty: Fluctuations in tariffs and export bans can dramatically alter the profitability and viability of entering a new fertilizer market.

Expected Retaliation from Incumbents

Existing players like CVR Partners in the nitrogen fertilizer sector have established strong market positions, meaning they're unlikely to welcome new competitors with open arms.

Incumbents often retaliate aggressively through price wars, enhanced marketing campaigns, or by increasing their own production capacity, creating significant hurdles for newcomers aiming to gain market share.

For instance, in 2024, the global nitrogen fertilizer market, valued at approximately $200 billion, saw major players like Nutrien and Yara International maintain substantial market share, indicating their capacity to influence pricing and distribution channels.

This competitive landscape means potential new entrants face the threat of significant upfront investment and a prolonged period of low profitability as they attempt to carve out a niche.

- Established Market Positions: CVR Partners and other major nitrogen fertilizer producers hold significant sway in the market.

- Aggressive Retaliation Tactics: Expect price cuts, increased advertising, and capacity expansions from incumbents.

- Market Value: The global nitrogen fertilizer market reached roughly $200 billion in 2024.

- Barriers to Entry: New entrants must overcome substantial financial and strategic challenges posed by established firms.

The threat of new entrants in the nitrogen fertilizer industry, where CVR Partners operates, is significantly low due to immense capital requirements. Building a new plant can cost over $1 billion, a sum only accessible to well-capitalized entities. This high barrier effectively deters most potential competitors.

Established firms like CVR Partners benefit from substantial economies of scale, particularly in raw material procurement and distribution networks, making it difficult for newcomers to match their cost efficiencies. For example, in 2024, securing long-term, low-cost natural gas contracts, a key input, remains a significant advantage for incumbents.

Government regulations and complex permitting processes further elevate entry barriers, requiring significant investment in compliance technology and time. Additionally, established market positions and the likelihood of aggressive retaliation from incumbents, such as price wars, create a challenging environment for new players seeking market share in the roughly $200 billion global nitrogen fertilizer market.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Extremely high upfront investment for plant construction. | Deters most potential competitors. | New ammonia plant costs often exceed $1 billion. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | Makes it difficult for new entrants to compete on price. | Larger plants achieve significantly lower production costs. |

| Raw Material Access | Securing reliable and cost-effective natural gas supply. | Incumbents have established supplier relationships and pricing. | Henry Hub spot price averaged ~$2.50/MMBtu in early 2024. |

| Distribution Networks | Building efficient logistics and buyer relationships. | New entrants struggle to match delivery speed and cost. | Established players have extensive logistics infrastructure. |

| Government Regulations | Environmental compliance, permitting, and trade policies. | Increases costs and delays market entry. | EPA standards require costly compliance technology; permitting can take years. |

| Incumbent Retaliation | Price wars, increased marketing, capacity expansion. | Threatens profitability and market share for new entrants. | Major players maintain significant market share in the ~$200 billion global market. |

Porter's Five Forces Analysis Data Sources

Our CVR Partner Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from company annual reports, investor presentations, and industry-specific market research reports to provide a comprehensive view of the competitive landscape.