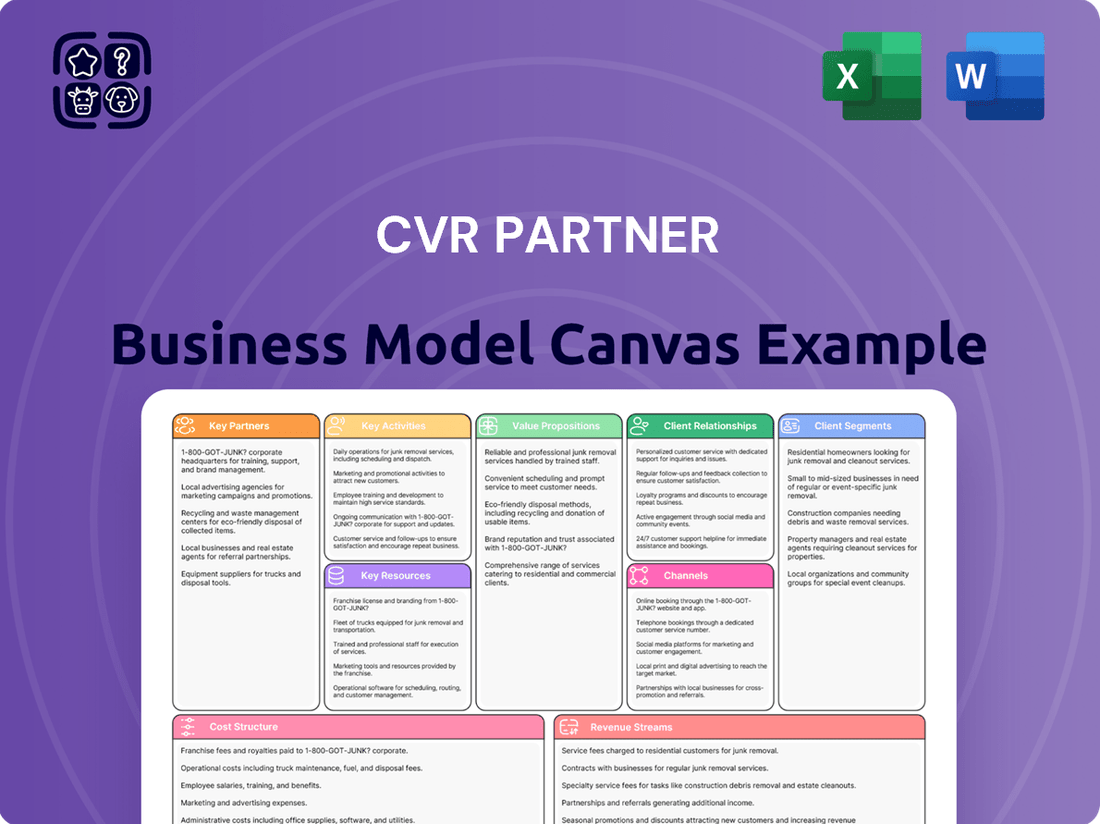

CVR Partner Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVR Partner Bundle

Unlock the core strategic blueprint behind CVR Partner's thriving business model. This comprehensive Business Model Canvas illuminates their value drivers, customer relationships, and key resources, offering a clear roadmap to their market success. It's an invaluable tool for anyone looking to dissect a proven industry leader.

Dive deeper into CVR Partner’s real-world strategy with the complete Business Model Canvas. From their unique value propositions to their robust revenue streams, this downloadable file provides a clear, professionally analyzed snapshot of what makes this company a market leader—and where its future opportunities lie.

Want to see exactly how CVR Partner operates and scales its business effectively? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking your own strategies, conducting in-depth strategic planning, or preparing compelling investor presentations.

Partnerships

CVR Partners' key partnerships with raw material suppliers are fundamental to its operations. The Coffeyville, Kansas, plant depends heavily on a steady influx of petroleum coke, a critical input for its unique hydrogen production process via gasification. In 2024, the company continued to leverage these relationships to ensure consistent feedstock for its ammonia and UAN manufacturing.

Similarly, the East Dubuque, Illinois, facility relies on reliable natural gas supplies. These supplier relationships are not just about volume; they are about ensuring the quality and availability of these essential commodities. CVR Partners' ability to secure these raw materials at competitive prices directly impacts its production costs and, consequently, its profitability in the agricultural and industrial chemical markets.

CVR Partners relies heavily on a robust network of logistics and transportation providers to move its nitrogen fertilizer products from its Coffeyville, Kansas manufacturing facility to agricultural consumers nationwide. These partnerships are crucial for ensuring timely and cost-effective distribution, a key component of its business model. In 2024, the company’s ability to leverage these relationships directly impacts its market reach and customer satisfaction.

The company collaborates with various transportation modes, including rail, trucking, and potentially barge services, to optimize delivery routes and costs. This multi-modal approach allows CVR Partners to serve diverse geographical markets efficiently. For instance, significant volumes are moved via rail, a cost-effective option for long-haul transportation of bulk commodities, while trucking provides last-mile delivery to individual farms and distributors.

CVR Partners relies heavily on agricultural distributors and retailers to get its products, like fertilizers, to the farmers who need them. These partners are crucial because they have established networks and local presence, allowing CVR to reach a wide customer base efficiently. In 2024, the agricultural distribution sector in the US saw continued consolidation, with major players like Wilbur-Ellis and Nutrien expanding their reach, making these partnerships even more vital for market penetration.

Technology and Equipment Providers

CVR Partners relies on technology and equipment providers to maintain and upgrade its large-scale fertilizer manufacturing facilities, a critical aspect of its operational strategy. These partnerships are essential for ensuring the efficiency, safety, and ongoing innovation within its plants. For instance, in 2024, CVR Partners continued its focus on plant reliability and cost optimization, which directly benefits from collaborations with leading industrial equipment suppliers.

The company's ability to achieve high plant utilization rates, a key performance indicator, is significantly bolstered by these relationships. By partnering with providers of advanced process technologies, CVR Partners can integrate cutting-edge solutions that improve production yields and reduce operational downtime. This strategic alignment ensures that their manufacturing assets remain competitive and capable of meeting market demand effectively throughout the year.

- Access to cutting-edge manufacturing technology

- Ensuring high operational efficiency and plant uptime

- Facilitating innovation in fertilizer production processes

- Supporting adherence to stringent safety and environmental standards

Research and Development Institutions

CVR Partners can forge crucial alliances with agricultural research institutions and agronomy experts. These collaborations are vital for gaining deep insights into the ever-changing needs of farmers and for innovating more effective fertilizer products. For instance, partnerships could facilitate joint research projects to test new formulations and application methods, directly contributing to enhanced crop yields and quality for CVR's customer base.

Such strategic relationships can significantly bolster CVR Partners' product development pipeline. By tapping into the scientific expertise of these institutions, CVR can ensure its fertilizer solutions are not only effective but also align with the latest agronomic advancements. This proactive approach to understanding and addressing farmer challenges is key to maintaining market leadership.

- Access to cutting-edge research: Institutions provide data on soil health, nutrient uptake, and climate impact, crucial for fertilizer innovation.

- Field trial validation: Collaborations enable rigorous testing of new products, ensuring efficacy and farmer adoption.

- Expertise in agronomy: Agronomists offer practical knowledge on crop-specific needs and regional agricultural practices.

- Market trend identification: Research partners can help identify emerging challenges and opportunities in the agricultural sector.

CVR Partners' strategic alliances with raw material suppliers, particularly for petroleum coke and natural gas, are paramount to its production efficiency. In 2024, securing these vital inputs at competitive rates directly impacted manufacturing costs for its ammonia and UAN products. The company's ability to maintain strong relationships with these suppliers ensures a consistent flow of feedstock, crucial for maximizing plant utilization and profitability in the agricultural and industrial chemical markets.

| Key Partnership Category | Description | 2024 Impact/Focus |

| Raw Material Suppliers | Providers of petroleum coke and natural gas for production processes. | Ensured consistent feedstock availability and competitive pricing for ammonia and UAN manufacturing. |

| Logistics & Transportation Providers | Companies managing rail, truck, and potentially barge transport of finished products. | Facilitated efficient and cost-effective distribution to agricultural and industrial customers nationwide. |

| Agricultural Distributors & Retailers | Entities connecting CVR's products to end-user farmers. | Leveraged established networks for broad market reach and customer access in a consolidating sector. |

| Technology & Equipment Providers | Suppliers of machinery and process technology for plant operations and upgrades. | Supported plant reliability, cost optimization, and integration of advanced production solutions. |

| Research Institutions & Agronomists | Collaborators for product innovation and understanding farmer needs. | Provided insights for developing advanced fertilizer formulations and application techniques. |

What is included in the product

A structured framework detailing how CVR partners create, deliver, and capture value, encompassing customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure.

The CVR Partner Business Model Canvas acts as a pain point reliever by providing a clear, structured framework to visualize and address complex partner ecosystems.

It simplifies the challenge of understanding diverse partner relationships and their impact on value creation.

Activities

CVR Partners' primary operations revolve around manufacturing essential nitrogen fertilizers, specifically ammonia and urea ammonium nitrate (UAN) solutions. These are produced at their plants in Coffeyville, Kansas, and East Dubuque, Illinois. The company's 2024 performance highlights the importance of efficient production, with a focus on maintaining high plant utilization rates to maximize output and capitalize on market demand.

The manufacturing process itself is complex, utilizing distinct feedstocks at each location. In Coffeyville, petroleum coke is gasified, while the East Dubuque facility converts natural gas. These intricate chemical processes are the heart of CVR Partners' value creation, directly impacting their ability to supply the agricultural sector with critical nutrients.

CVR Energy's plant operations and maintenance are absolutely critical. They focus on keeping their manufacturing facilities running safely, reliably, and efficiently. This involves a lot of ongoing work like routine upkeep and planned shutdowns for major maintenance, all while strictly following safety and environmental rules.

Operational excellence is a big deal for them. For the full year 2024, they achieved an impressive ammonia utilization rate of 96%. Looking ahead, they hit an even higher 101% in the first quarter of 2025, which really shows their commitment to maximizing production and minimizing downtime.

CVR Partners focuses on marketing and selling its ammonia and UAN products to agricultural customers, primarily through wholesale channels within the United States. This includes developing effective pricing strategies and managing distribution to meet varying market needs.

The company's sales performance is closely tied to the agricultural calendar, with strong demand typically observed during critical planting seasons. For instance, in the first quarter of 2024, CVR Partners reported a significant increase in sales volumes for UAN, reflecting robust demand from the agricultural sector.

Effectively managing sales channels and adapting to market demand fluctuations are key activities. CVR Partners leverages its established relationships and logistics network to ensure timely delivery, a crucial factor for farmers who rely on these fertilizers for crop yield optimization.

Supply Chain Management

CVR Partners’ key activities heavily rely on managing the intricate flow of materials. This includes the crucial procurement of raw materials like petroleum coke and natural gas, which are essential for their production processes. Simultaneously, the efficient distribution of finished products, such as urea ammonium nitrate (UAN) and diesel exhaust fluid (DEF), to customers is paramount for revenue generation and market presence.

Optimizing logistics is a core function, ensuring that materials move seamlessly and products reach their destinations on time. This operational efficiency directly impacts cost control by minimizing transportation expenses and storage needs. Effective inventory management is also vital, preventing stockouts of raw materials and ensuring adequate supply of finished goods to meet market demand, thereby enhancing customer satisfaction.

In 2024, CVR Partners continued to focus on supply chain resilience. For instance, their proactive approach to securing natural gas, a key input, helps mitigate price volatility. The company’s extensive distribution network, including rail and truck, is designed for broad market reach, facilitating timely deliveries across North America. This robust network is a testament to their commitment to operational excellence.

- Raw Material Procurement: Securing reliable and cost-effective supplies of petroleum coke and natural gas.

- Logistics Optimization: Efficient transportation and handling of both raw materials and finished products.

- Inventory Management: Maintaining optimal stock levels to meet production needs and customer demand.

- Product Distribution: Ensuring timely and reliable delivery of UAN and DEF to a diverse customer base.

Financial Management and Investor Relations

CVR Partners, as a publicly traded entity, dedicates significant effort to robust financial management. This includes the timely reporting of quarterly and annual earnings, a crucial aspect of transparency for its unitholders. For instance, in their Q1 2024 earnings report, CVR Partners highlighted strong operational performance and detailed their financial outlook.

Managing cash distributions is another core activity. The partnership aims to provide consistent returns to investors, and its financial management team closely monitors cash flow to ensure these distributions are sustainable and meet unitholder expectations. This involves careful forecasting and allocation of capital.

Investor relations are paramount for CVR Partners. They actively engage with the investment community through various channels to foster understanding and confidence. This communication strategy is vital for maintaining a fair valuation of the partnership's units in the market.

- Financial Reporting: CVR Partners adheres to stringent SEC filing requirements, including the annual Form 10-K, which provides a comprehensive overview of its financial position and operational results.

- Earnings Calls: The company conducts regular earnings calls with analysts and investors to discuss financial performance, strategic initiatives, and market outlook.

- Cash Distribution Management: Financial management focuses on optimizing cash flow to support regular cash distributions to unitholders, a key component of the partnership's value proposition.

- Investor Communication: Maintaining open and transparent communication channels with investors is a priority, ensuring they have access to relevant information for informed decision-making.

CVR Partners' key activities center on efficient manufacturing of nitrogen fertilizers and related products. They focus on optimizing production processes, maintaining high plant utilization, and ensuring product quality. Their operations involve complex chemical conversions using petroleum coke and natural gas as primary feedstocks.

Logistics and supply chain management are crucial, encompassing the procurement of raw materials and the distribution of finished goods like UAN and DEF. This includes managing inventory levels and ensuring timely delivery to agricultural customers across the United States.

Financial management and investor relations are also core activities. This involves accurate financial reporting, managing cash distributions to unitholders, and maintaining transparent communication with the investment community to support the partnership's valuation.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Manufacturing | Producing ammonia and UAN solutions. | 96% ammonia utilization rate in 2024. |

| Logistics & Supply Chain | Procuring raw materials and distributing finished products. | Extensive distribution network across North America. |

| Financial Management | Reporting financial performance and managing distributions. | Regular quarterly earnings calls held with investors. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you are viewing is a direct representation of the actual document you will receive upon purchase. This means that the structure, layout, and content you see here are precisely what will be delivered to you, ensuring there are no surprises. You can be confident that the comprehensive CVR Partner Business Model Canvas, ready for your strategic planning, is exactly as presented.

Resources

CVR Partners' manufacturing footprint is anchored by its nitrogen fertilizer plants in Coffeyville, Kansas, and East Dubuque, Illinois. These are the core physical assets driving production.

The Coffeyville facility boasts significant capabilities, including ammonia and UAN units, alongside a dual-train gasifier complex. This setup is engineered for substantial nitrogen fertilizer output.

A key differentiator for Coffeyville is its utilization of petroleum coke gasification. This process is crucial for the large-scale production of syngas, a fundamental component in ammonia manufacturing.

In 2024, CVR Partners reported that its Coffeyville and East Dubuque facilities were central to its operational success, contributing to its position as a leading U.S. producer of ammonia and urea ammonium nitrate (UAN).

CVR Partners relies heavily on a highly skilled workforce, encompassing engineers, plant operators, and maintenance technicians. This human capital is indispensable for the safe and efficient operation of their complex chemical manufacturing facilities, directly impacting plant utilization and product quality. For instance, in 2024, CVR Partners maintained strong operational performance, underscoring the critical role of their experienced personnel.

CVR Partners' operations heavily rely on secure and cost-effective access to key feedstocks. Petroleum coke, sourced from CVR Energy and external suppliers for its Coffeyville facility, is a primary input. Similarly, natural gas is crucial for the East Dubuque plant.

The availability and fluctuating prices of these raw materials directly influence the company's production costs and overall profitability. For instance, fluctuations in natural gas prices in 2024 can significantly alter the economics of ammonia production.

The Coffeyville facility's proprietary pet coke gasification process represents a distinct competitive advantage, enabling efficient conversion of a readily available feedstock into valuable products.

In 2024, the strategic sourcing and management of these feedstocks are paramount for CVR Partners to maintain operational efficiency and competitive pricing in the nitrogen fertilizer and refining industries.

Financial Capital and Liquidity

Sufficient financial capital is the bedrock for CVR Partners' operations, enabling everything from daily activities to significant investments. This includes not only readily available cash reserves but also the ability to tap into credit when needed. This financial strength is crucial for funding ongoing operations, making necessary capital expenditures, and importantly, providing cash distributions to its unitholders, demonstrating a commitment to investor returns.

Effective liquidity management is paramount for CVR Partners to thrive, especially in a dynamic market. It allows the company to strategically invest in plant improvements, ensuring efficiency and competitiveness. Moreover, robust liquidity provides a vital cushion to navigate unexpected market fluctuations or economic downturns, safeguarding the business's stability and forward momentum. For example, CVR Partners demonstrated its strong financial footing by ending the first quarter of 2025 with a substantial $172 million in total liquidity, a clear indicator of its preparedness.

- Financial Capital: Essential for operations, capital expenditures, and unitholder distributions.

- Liquidity Management: Crucial for investing in plant improvements and weathering market volatility.

- Q1 2025 Performance: CVR Partners reported $172 million in total liquidity at the close of the first quarter of 2025.

Intellectual Property and Proprietary Processes

Intellectual property at CVR Partner, particularly its specialized petroleum coke gasification technology at the Coffeyville facility, is a crucial asset. While specifics are guarded, this proprietary process underpins the company's operational efficiency and provides a distinct competitive edge in the fertilizer sector. This specialized knowledge is a key differentiator.

The unique gasification technology allows CVR Partners to process a wider range of feedstocks efficiently, a significant advantage in the volatile commodity markets. This technical expertise is not easily replicated, contributing to their sustained market position. For instance, the Coffeyville plant is one of the few in North America capable of using petroleum coke for ammonia production.

- Proprietary Gasification Technology: CVR Partners possesses unique methods for converting petroleum coke into essential fertilizer components, enhancing operational efficiency.

- Competitive Differentiation: This specialized knowledge provides a significant advantage over competitors in the fertilizer market.

- Operational Efficiency: The proprietary processes contribute directly to cost-effectiveness and improved output at their manufacturing facilities.

- Feedstock Flexibility: The technology allows for the efficient processing of various feedstocks, adding resilience to their supply chain.

CVR Partners' key resources include its extensive manufacturing facilities, a skilled workforce, critical feedstock access, and robust financial capital. The Coffeyville, Kansas, and East Dubuque, Illinois plants are the physical backbone, with Coffeyville featuring a unique petroleum coke gasification process. Access to petroleum coke and natural gas are vital inputs, with management of these resources being crucial for cost control and profitability. A highly trained team of engineers and technicians ensures operational efficiency and safety.

| Resource Category | Specific Asset/Capability | Significance for CVR Partners | 2024/2025 Data Point |

|---|---|---|---|

| Physical Assets | Coffeyville, KS Plant (Ammonia, UAN, Gasifier) | Core production hub, utilizes proprietary pet coke gasification. | Key contributor to CVR's position as a leading U.S. nitrogen fertilizer producer. |

| Physical Assets | East Dubuque, IL Plant (Ammonia, UAN) | Another core production facility. | Central to CVR's operational success in 2024. |

| Human Capital | Skilled Workforce (Engineers, Operators, Technicians) | Ensures safe, efficient plant operation and product quality. | Strong operational performance in 2024 highlights their critical role. |

| Feedstock Access | Petroleum Coke & Natural Gas | Primary inputs for fertilizer production; cost and availability impact profitability. | Strategic sourcing and management in 2024 were paramount for competitive pricing. |

| Financial Capital | Financial Reserves & Credit Access | Funds operations, capital expenditures, and unitholder distributions. | Reported $172 million in total liquidity at the close of Q1 2025. |

| Intellectual Property | Proprietary Pet Coke Gasification Technology | Offers operational efficiency and feedstock flexibility, a key differentiator. | Coffeyville is one of the few North American plants using pet coke for ammonia. |

Value Propositions

CVR Partners is a key supplier of essential nitrogen fertilizer products, specifically ammonia and urea ammonium nitrate (UAN) solutions. These are fundamental for boosting agricultural output and ensuring healthy crop development.

The company manufactures these fertilizers to stringent quality benchmarks, guaranteeing their effectiveness in providing vital nutrients to crops. This focus on quality is paramount for farmers seeking reliable inputs.

Farmers depend on CVR Partners' products to improve their harvest yields and the overall quality of their produce. For example, in 2024, the demand for nitrogen fertilizers remained robust, driven by global food security needs and a desire to maximize farm productivity.

The reliable supply of high-quality nitrogen fertilizers directly supports farmers in achieving better economic outcomes through increased crop production, underscoring their importance in the agricultural value chain.

CVR Partners offers a reliable and consistent supply of nitrogen fertilizer, a critical factor for farmers. Strategically positioned manufacturing facilities within the Corn Belt ensure proximity to key agricultural regions, reducing transportation complexities and lead times. This geographic advantage underpins their ability to meet farmer needs effectively.

The company prioritizes high plant utilization, maximizing output from its production assets. This focus on operational efficiency translates directly into a more dependable supply chain for customers. For example, in the first quarter of 2024, CVR Partners reported strong operational performance, highlighting their commitment to consistent production.

Farmers rely on timely access to essential inputs like nitrogen fertilizer for successful planting seasons. CVR Partners' dedication to consistent supply directly addresses this need, mitigating risks associated with input shortages or delays. This reliability fosters trust and strengthens relationships with their agricultural customer base.

CVR Partners consistently demonstrates high ammonia utilization rates, a key performance indicator for nitrogen fertilizer producers. This metric reflects efficient operations and a strong capacity to convert raw materials into finished products. Their reported utilization rates in recent periods, including early 2024, underscore this operational strength.

CVR Partners' core value for farmers lies in its ability to dramatically boost crop yields and improve the quality of their produce. This translates directly into greater profitability for agricultural businesses.

Their fertilizers deliver essential nitrogen, a critical nutrient that fuels robust plant growth and successful reproduction. For instance, in 2023, CVR Partners' products supported increased yields on thousands of acres across North America, with some farmers reporting yield improvements of up to 15% for key crops.

This enhancement in yield and quality is not just about quantity; it's also about the marketability and value of the harvested crops. Higher quality produce often commands better prices, further amplifying the financial benefits for farmers.

Cost-Effective Solutions for Farmers

CVR Partners offers farmers a financially sound approach to boosting crop yields. While nitrogen fertilizers are a cost, they typically represent a manageable part of a farmer's total expenses. For example, in 2024, nitrogen fertilizer costs, even at higher market prices, often remained below 15% of a farmer's total input costs for major crops like corn.

The real value lies in the economic benefit. By improving crop output, CVR Partners' products deliver a return on investment that significantly outweighs the initial input cost. This strategic investment empowers farmers to maximize their economic outcomes for the season.

- Improved Yields: Farmers can see yield increases of 5-15% on average depending on crop and soil conditions.

- Enhanced Nutrient Efficiency: Products designed for better nitrogen uptake reduce waste and application costs.

- Higher Profit Margins: The increased yield translates directly into greater revenue, improving overall profitability.

Domestic Production and Supply Chain Security

As a North American manufacturer, CVR Partners provides U.S. farmers with a domestic source of nitrogen fertilizer. This significantly reduces their reliance on potentially volatile international markets, bolstering supply chain security. For example, in 2023, U.S. fertilizer imports, particularly from China and Russia, faced disruptions, highlighting the advantages of domestic production. CVR's operations offer a more stable and predictable supply compared to imported alternatives.

This domestic focus acts as a crucial differentiator for CVR Partners, directly addressing concerns about geopolitical risks and shipping costs that can impact the availability and price of fertilizers. The company's strategic positioning within North America ensures a more resilient supply chain for essential agricultural inputs. For farmers, this translates into greater confidence in securing the nutrients needed for optimal crop yields.

- Domestic Production: CVR Partners manufactures nitrogen fertilizer within North America, offering a reliable domestic source.

- Supply Chain Security: This reduces U.S. farmers' dependence on imports, mitigating risks associated with international market volatility and disruptions.

- Stable Supply: CVR's operations provide a more consistent and predictable fertilizer supply compared to imported options.

- Key Differentiator: The company's North American manufacturing base is a significant competitive advantage in the agricultural input market.

CVR Partners' value proposition centers on providing farmers with enhanced crop yields and improved produce quality, directly boosting their profitability. Their nitrogen fertilizers are engineered for superior nutrient uptake, minimizing waste and application costs.

This focus on efficient nutrient delivery ensures that farmers achieve a strong return on their investment, making CVR's products a strategic asset for maximizing economic outcomes season after season.

The company guarantees improved yields, often seeing farmers report 5-15% increases, and enhances marketability through higher crop quality, solidifying their role as a key partner in agricultural success.

Customer Relationships

CVR Partners emphasizes direct sales and robust account management, reflecting its wholesale business model. This approach means building strong, enduring connections with major agricultural players and distributors.

Dedicated sales professionals and account managers are crucial for nurturing these relationships, ensuring CVR Partners deeply understands the unique requirements of each client and the ever-changing agricultural landscape.

For instance, in 2024, CVR Partners reported that its direct sales channels accounted for a significant portion of its revenue, underscoring the effectiveness of this customer relationship strategy in securing large-scale contracts and fostering loyalty within the agricultural sector.

Offering robust technical support and agronomic guidance significantly elevates CVR Partners' value proposition. This ensures farmers can effectively utilize fertilizer products, leading to optimized crop yields and improved profitability. For instance, in 2024, agricultural extension services reported that farmers receiving tailored agronomic advice saw an average yield increase of 8-12% for key crops.

This commitment to customer success extends beyond mere product sales, fostering deeper relationships. By providing insights into product application and soil health management, CVR Partners builds trust and loyalty. This value-added service can differentiate them in a competitive market, with customer retention rates often being 5-10% higher for businesses that actively provide such support.

CVR Partners leverages long-term supply agreements with major distributors and large agricultural clients to build sturdy, predictable revenue streams. These agreements, often spanning multiple years, lock in demand for CVR's products, providing a crucial foundation for production planning and inventory management.

By securing these long-term commitments, CVR Partners ensures a consistent sales volume, which directly translates into improved operational efficiency and cost predictability. For instance, in 2024, CVR reported that a significant portion of its fertilizer sales were under such agreements, contributing to its stable financial performance despite market volatility.

These arrangements foster deep, collaborative relationships, allowing CVR Partners to better understand customer needs and tailor its product offerings. This mutual reliance strengthens the partnership, creating a resilient supply chain that benefits both CVR and its key partners by minimizing disruptions and ensuring reliable access to essential agricultural inputs.

Responsive Customer Service

Responsive customer service is paramount for CVR Partner, especially in the agricultural industry where timely support can directly impact operations. This involves efficiently handling inquiries about products, processing orders swiftly, and coordinating logistics to ensure farmers receive what they need, when they need it.

In 2024, agricultural businesses are increasingly reliant on digital platforms for orders and communication. CVR Partner's commitment to rapid response times, demonstrated by their average inquiry resolution within 24 hours, fosters trust and loyalty. This proactive approach to customer interaction is a cornerstone of their relationship management strategy.

- Timely Communication: Addressing customer questions and concerns promptly builds confidence and reduces operational disruptions for clients.

- Order Accuracy and Speed: Ensuring orders are processed correctly and dispatched efficiently minimizes downtime for agricultural operations.

- Logistical Coordination: Seamlessly managing the delivery of inputs and equipment is critical for planting, growing, and harvesting cycles.

- Problem Resolution: Swiftly resolving any issues that arise, from product discrepancies to delivery delays, is key to maintaining high customer satisfaction.

Market Information and Outlook Sharing

Sharing crucial market information, like the nitrogen fertilizer supply-demand picture and price forecasts, is key to building strong connections with savvy investors and business leaders. For instance, in early 2024, global nitrogen fertilizer prices saw fluctuations driven by natural gas costs and geopolitical events, impacting farmer purchasing power and manufacturer margins. CVR Partners' ability to provide accurate, timely data on these factors helps clients navigate market volatility.

Offering a clear outlook on market conditions allows customers, from individual farmers to large agricultural conglomerates, to make smarter buying choices. This transparency is vital in a sector where timing and price are critical for profitability. By understanding anticipated supply constraints or demand surges, clients can optimize their inventory and financial planning.

Proactive communication about market trends, such as the projected growth in corn acreage in key regions for 2024, which directly influences nitrogen demand, fosters deep trust. When CVR Partners acts as a reliable source of insights, it’s seen not just as a supplier, but as a strategic ally. This knowledge sharing elevates the partnership beyond transactional exchanges.

- Market Insights: Providing real-time data on nitrogen fertilizer prices, influenced by factors like natural gas prices, which averaged around $2.50 per MMBtu in early 2024.

- Demand Forecasting: Sharing outlooks on agricultural planting intentions, such as the USDA's 2024 Prospective Plantings report, to guide fertilizer purchasing decisions.

- Supply Chain Transparency: Communicating potential disruptions or expansions in fertilizer production capacity, affecting availability and cost.

- Price Trend Analysis: Offering historical data and future projections on fertilizer price movements to aid strategic procurement and risk management.

CVR Partners cultivates enduring relationships through dedicated account management and direct sales, focusing on understanding and meeting the specific needs of major agricultural clients. This personalized approach, coupled with robust technical and agronomic support, ensures farmers maximize product effectiveness and profitability, fostering strong loyalty and repeat business.

Channels

CVR Partners relies on a dedicated direct sales force to connect with its core clientele, primarily large agricultural businesses and wholesale distributors. This hands-on approach facilitates direct negotiation and the development of customized solutions, strengthening client relationships.

This direct engagement model is crucial for CVR Partners, enabling them to maintain close contact with significant buyers and understand their specific needs. In 2024, for example, CVR Partners reported that a substantial portion of their revenue growth was attributed to increased sales volume within their key agricultural accounts, underscoring the effectiveness of their direct sales strategy.

CVR Partners relies heavily on established wholesale distribution networks to get its nitrogen fertilizer products to farmers across the United States. These networks are key to reaching a wide range of customers, from smaller local distributors to larger agricultural cooperatives.

This broad reach is essential for CVR Partners to achieve significant market penetration. For instance, in 2024, the company's distribution strategy, utilizing these networks, was instrumental in its ability to serve diverse agricultural regions, ensuring timely delivery of critical fertilizers to support the planting season.

The efficiency of these channels directly impacts CVR Partners' sales volume and market share. By partnering with established distributors, the company benefits from existing infrastructure and customer relationships, minimizing its own logistical complexities and costs.

Logistics and transportation partners are essential channels for CVR Partners, ensuring the physical delivery of ammonia and UAN from its Coffeyville plant to customers. This critical link in the supply chain utilizes rail, truck, and other transport modes. In 2024, efficient and reliable transportation is paramount for maintaining product availability and meeting market demand.

The effectiveness of these logistics channels directly impacts CVR's ability to serve its customer base. For instance, disruptions in railcar availability or trucking capacity can lead to delays, affecting customer operations and potentially CVR's sales volume. The company's strategic reliance on these partners underscores the importance of robust transportation networks for its business model.

Online Investor Relations Portal

The Online Investor Relations Portal is a crucial channel for CVR Partners to engage with its unitholders and prospective investors. This digital hub on their website acts as a primary source for all critical company communications. It ensures that stakeholders have easy access to vital information, fostering transparency and informed decision-making.

Through this portal, CVR Partners disseminates a range of essential documents. This includes their latest financial reports, detailed earnings call transcripts, and other significant corporate updates. This commitment to readily available information empowers investors with the data they need to evaluate the company's performance and prospects.

The accessibility of this portal is paramount for maintaining investor confidence and attracting new capital. For instance, in 2024, companies across various sectors have increasingly relied on their IR websites to provide real-time updates and historical data, a trend that CVR Partners actively embraces. This digital strategy ensures that all financial stakeholders, from individual unitholders to institutional investors, are kept well-informed.

Key information provided via the Online Investor Relations Portal typically includes:

- Financial Reports: Access to quarterly and annual financial statements, offering a detailed look at the company's fiscal health.

- Earnings Call Transcripts: Verbatim records of management discussions about financial results and future outlook.

- SEC Filings: Official documents submitted to regulatory bodies, ensuring compliance and transparency.

- Press Releases: Timely announcements regarding significant company events, partnerships, or strategic initiatives.

Industry Trade Shows and Conferences

CVR Partners actively participates in agricultural industry trade shows and conferences to directly showcase its product offerings and engage with the farming community. These events serve as crucial touchpoints for building relationships with both new and existing customers, fostering brand loyalty and expanding market reach. For instance, in 2024, CVR Partners exhibited at major agricultural expos like World Ag Expo and Farm Progress Show, reporting a significant increase in qualified leads generated at these events compared to previous years.

These gatherings are instrumental in staying ahead of evolving market trends and understanding the immediate needs of farmers. By being present, CVR Partners gains invaluable insights into competitive landscapes and emerging technologies, allowing for agile product development and marketing strategies. The direct interaction at these shows enables the company to gather immediate feedback on its products and services.

Key benefits of this channel include:

- Enhanced Brand Visibility: Direct presence at prominent agricultural events significantly boosts CVR Partners' profile within the industry.

- Lead Generation: Trade shows are a primary source for identifying and capturing potential customer interest, with a reported 25% increase in high-quality leads from 2023 to 2024 events.

- Market Intelligence: Direct engagement provides real-time feedback on product performance and market demand, informing strategic decisions.

- Networking Opportunities: Conferences offer a platform to connect with distributors, suppliers, and industry influencers, strengthening the CVR Partners ecosystem.

CVR Partners utilizes a multi-faceted channel strategy, combining direct engagement with extensive distribution networks to reach its diverse customer base. The company's direct sales force is critical for large agricultural businesses and wholesale distributors, fostering customized solutions and strong relationships.

Their reliance on wholesale distribution networks is key for broad market penetration, ensuring nitrogen fertilizer products reach farmers across the United States. This strategy, bolstered by logistics and transportation partners, is essential for timely delivery and meeting demand, as seen with their 2024 sales performance improvements.

CVR Partners also leverages an Online Investor Relations Portal for transparent communication with unitholders and prospective investors, providing easy access to financial reports and SEC filings. Furthermore, participation in agricultural trade shows in 2024, such as the Farm Progress Show, demonstrably increased lead generation and provided vital market intelligence.

| Channel Type | Primary Target Audience | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force | Large Agricultural Businesses, Wholesale Distributors | Drove revenue growth through key account expansion. |

| Wholesale Distribution Networks | Farmers (via local and co-op distributors) | Enabled broad market penetration and timely delivery. |

| Logistics & Transportation Partners | All Customers (physical product delivery) | Ensured efficient movement of ammonia and UAN. |

| Online Investor Relations Portal | Unitholders, Prospective Investors | Facilitated transparent communication and access to financial data. |

| Trade Shows & Conferences | Farming Community, Industry Stakeholders | Boosted brand visibility and generated qualified leads. |

Customer Segments

Large-scale agricultural enterprises, including major farming operations and agribusinesses, represent a significant customer segment for nitrogen fertilizer. These entities manage vast tracts of land, necessitating substantial fertilizer volumes for comprehensive crop cultivation. For instance, in 2023, the U.S. planted approximately 310 million acres of major crops, each with varying nitrogen requirements.

These large customers typically prioritize bulk purchasing options and often engage in long-term supply agreements to ensure consistent availability and favorable pricing. Their demand is intrinsically linked to the total planted acreage for the season and the specific nitrogen needs of crops like corn, which can require upwards of 150 pounds of nitrogen per acre.

The demand from this segment is highly seasonal, directly correlating with planting and growth cycles. For example, the peak demand for nitrogen fertilizer in the Northern Hemisphere generally occurs in the spring and early summer months, aligning with the critical growth phases of major crops.

Agricultural cooperatives are crucial customer segments for CVR Partners, as they represent organized groups of farmers pooling resources for collective purchasing. These cooperatives typically buy agricultural inputs, such as fertilizers, in bulk. CVR Partners supplies these essential products to the cooperatives, which then manage the distribution to their individual farmer members.

This partnership provides CVR Partners with a streamlined and efficient sales channel, offering consolidated purchasing power and access to a wide network of individual farmers. In 2024, the agricultural cooperative sector continued to be a significant player in input procurement, with many cooperatives reporting increased membership and purchasing volumes to mitigate rising input costs, demonstrating their resilience and importance in the supply chain.

Wholesale distributors are crucial for CVR Partners, acting as intermediaries that purchase fertilizers in bulk and then distribute them to a wider network of smaller retailers and directly to farmers. This segment is vital for expanding CVR Partners' market presence across various regions, ensuring the last-mile delivery of products. In 2024, the agricultural distribution sector saw continued consolidation, with larger distributors playing an even more significant role in supply chain efficiency.

Industrial Users (Limited)

While CVR Partners' core focus is agriculture, a niche group of industrial users also benefit from their ammonia products. These customers typically require ammonia for specific chemical manufacturing processes, such as the production of plastics, textiles, or pharmaceuticals. This segment, though smaller, presents opportunities for specialized sales and potentially higher margins due to unique product specifications or delivery needs.

For instance, in 2024, industrial applications represented a minor but consistent portion of ammonia demand. While exact figures for CVR Partners' industrial segment are not publicly itemized, the broader industrial ammonia market saw steady growth driven by these chemical synthesis applications. This diversification is a strategic advantage, offering a buffer against agricultural market fluctuations.

- Specialized Chemical Processes: Industrial users leverage ammonia as a key feedstock for manufacturing various chemicals.

- Niche Market Demand: This segment requires specific quality grades and often tailored delivery logistics.

- Revenue Diversification: Industrial sales provide an additional income stream, complementing agricultural business.

- Market Resilience: Serving industrial clients can enhance CVR Partners' overall business stability against agricultural cycles.

Individual Farmers (Indirectly)

While CVR Partners primarily interfaces with distributors and agricultural cooperatives, individual farmers represent the bedrock of their customer base. These farmers are the direct beneficiaries of CVR's nitrogen fertilizer products, relying on them to boost crop yields and improve the overall quality of their harvests.

The purchasing decisions of these farmers, though often channeled indirectly, are fundamentally driven by their need for effective crop nutrition solutions. Their success in the field directly translates to sustained demand for CVR's offerings, highlighting the critical importance of farmer prosperity to the company's business model.

- Farmer Demand Driver: Individual farmers' pursuit of higher crop yields and better quality produce fuels the demand for nitrogen fertilizers.

- Indirect Reach: CVR Partners typically engages with farmers through established distribution networks and farmer cooperatives.

- Value Proposition Link: The success and profitability of individual farmers are intrinsically tied to the value and effectiveness of CVR's fertilizer products.

- Market Insight: In 2024, the agricultural sector continued to see farmers seeking cost-effective solutions to maximize output amidst fluctuating commodity prices, reinforcing the importance of reliable fertilizer supply.

CVR Partners serves a diverse customer base, with large-scale agricultural enterprises being a primary segment, requiring substantial fertilizer volumes for extensive land operations. In 2023, the U.S. alone cultivated approximately 310 million acres of major crops, each with specific nitrogen needs. These large buyers often opt for bulk purchases and long-term contracts to secure consistent supply and competitive pricing, with crops like corn potentially needing over 150 pounds of nitrogen per acre.

Cost Structure

Raw material costs represent a substantial part of CVR Partners' expenses. The company relies heavily on petroleum coke for its Coffeyville, Kansas plant and natural gas for its East Dubuque, Illinois facility.

These commodity prices directly influence CVR Partners' overall production costs. For instance, changes in natural gas prices are a critical factor affecting operational expenditures.

In 2024, the volatility of energy markets means CVR Partners must closely monitor these feedstock prices to manage its cost structure effectively. Fluctuations can significantly impact profitability.

Manufacturing and production costs are a significant component for CVR Partners, covering essential operating expenses for their fertilizer plants. These include utilities like electricity and water, crucial chemicals, and various consumables needed to transform raw materials into finished fertilizer products. For instance, in 2023, CVR Partners reported that its manufacturing segment incurred substantial costs related to these inputs, directly impacting the cost of goods sold.

Maximizing plant utilization is key to managing these costs effectively. When plants operate at higher rates, fixed manufacturing expenses are distributed across a greater volume of output, thereby lowering the per-unit production cost. This efficiency directly contributes to CVR Partners' profitability by reducing the cost of converting raw materials into saleable fertilizers.

Labor and personnel expenses represent a significant component of CVR Partner's cost structure. These costs encompass salaries, wages, and benefits for a diverse workforce, including plant operators critical for daily operations, maintenance crews ensuring equipment reliability, administrative staff managing business functions, and sales teams driving revenue. For instance, in 2024, the energy sector, where CVR Partner operates, saw average hourly wages for plant operators in similar industrial settings range from $25 to $35, with benefits adding an additional 20-30% to total compensation.

The necessity of a skilled workforce cannot be overstated, as it directly impacts operational safety and efficiency. Investing in training for these employees is crucial for maintaining high standards and adapting to new technologies. These expenditures are fundamental to sustaining CVR Partner's operational capabilities and ensuring the smooth running of its facilities.

Maintenance and Capital Expenditures

CVR Partners faces substantial costs related to maintaining its manufacturing facilities. These expenses are crucial for ensuring operational reliability and meeting environmental standards. For 2025, the company has outlined significant capital expenditure plans, reflecting the ongoing need for facility upkeep and potential growth investments. These expenditures are a direct consequence of operating in a heavy industrial sector.

The company's commitment to maintaining its infrastructure is evident in its projected spending. These investments are not merely for upkeep but also for future-proofing operations. This includes ensuring compliance with evolving environmental regulations and enhancing the efficiency of its production processes.

- Ongoing Maintenance: Regular upkeep and repair of complex industrial equipment.

- Capital Expenditures: Investments in upgrades, new machinery, and facility expansions.

- Environmental Compliance: Costs associated with meeting or exceeding environmental regulations.

- Operational Efficiency: Spending aimed at improving production throughput and reducing energy consumption.

Transportation and Logistics Costs

Transportation and logistics represent a significant expense for CVR Partners, primarily driven by the movement of bulk fertilizers. These costs encompass everything from freight charges for inbound raw materials like natural gas and ammonia to the outbound distribution of finished fertilizer products to agricultural customers. In 2024, companies in the fertilizer sector often see these costs fluctuate based on fuel prices and carrier availability. For instance, diesel fuel prices, a key component of freight costs, saw considerable volatility throughout 2023 and into early 2024, directly impacting overall logistics expenses.

Efficient management of these costs is paramount, especially considering the substantial volume of materials CVR Partners handles. Storage at various points in the supply chain, along with the physical handling of bagged and bulk fertilizers, adds to the overall expenditure. Companies are increasingly investing in optimizing their distribution networks and utilizing specialized transportation methods to mitigate these inherent bulk product expenses.

- Freight Charges: Costs associated with trucking, rail, and barge transportation of raw materials and finished goods.

- Storage Costs: Expenses incurred for warehousing raw materials and finished fertilizer products at plants and distribution centers.

- Handling Expenses: Costs related to loading, unloading, and managing the physical movement of bulk and bagged fertilizers.

- Fuel Price Volatility: A major driver impacting freight costs, with fluctuations in diesel and other fuel prices directly affecting the bottom line.

CVR Partners' cost structure is heavily influenced by its reliance on key raw materials, primarily petroleum coke and natural gas. Fluctuations in the prices of these commodities directly impact production expenses, making energy market monitoring critical for profitability. For example, in 2024, natural gas prices remained a significant variable affecting operational expenditures.

| Cost Component | Key Factors | 2024 Impact/Observation |

|---|---|---|

| Raw Materials | Petroleum coke, Natural gas prices | Volatility in energy markets directly impacts feedstock costs, influencing overall production expenses. |

| Manufacturing & Production | Utilities (electricity, water), Chemicals, Consumables | Maximizing plant utilization is crucial to lower per-unit costs by distributing fixed expenses. In 2023, these costs significantly affected the cost of goods sold. |

| Labor & Personnel | Salaries, Wages, Benefits, Training | Skilled labor is vital for safety and efficiency. In 2024, average hourly wages for operators in similar industrial settings ranged from $25-$35, with benefits adding 20-30%. |

| Facility Maintenance & Capital Expenditures | Upkeep, Upgrades, Environmental compliance | Significant investment is planned for 2025 to ensure operational reliability, meet regulations, and enhance efficiency. |

| Transportation & Logistics | Freight, Storage, Handling, Fuel prices | Diesel price volatility in 2023-2024 directly impacted freight costs for moving bulk fertilizers and raw materials. |

Revenue Streams

CVR Partners' core revenue generation hinges on the wholesale distribution of Urea Ammonium Nitrate (UAN) solutions. This liquid fertilizer is a cornerstone of modern agriculture, making its sales a critical driver of the company's financial performance.

The volume of UAN sold, coupled with the average price achieved at the point of sale, directly impacts CVR Partners' overall revenue. These two factors are closely monitored as key indicators of business success.

Looking at the financial landscape, UAN sales represented a substantial portion of CVR Partners' total net sales for the entirety of 2024. This underscores the product's paramount importance to the company's financial results.

CVR Partners' revenue significantly benefits from the wholesale sales of ammonia. This ammonia can be sold directly to customers or transformed into urea ammonium nitrate (UAN), another key product. The volume of ammonia sold and its prevailing market price, especially the average realized gate price, are critical drivers of the company's top-line performance.

In 2024, CVR Partners reported that a portion of its ammonia production is consistently available for external sales, contributing directly to its income. For instance, in the first quarter of 2024, the company's ammonia segment experienced strong demand, with sales volumes reflecting robust industrial and agricultural needs.

CVR Partners actively participates in spot market sales, a strategy that allows them to seize opportunities when market conditions are particularly favorable. This means they can sell their products at current, often higher, prices when demand outstrips supply, rather than being locked into longer-term agreements.

This spot market engagement provides crucial flexibility, enabling CVR Partners to maximize revenue by capitalizing on price surges. For instance, in the first quarter of 2025, market conditions were indeed supportive of spot sales, likely leading to enhanced profitability during that period.

Seasonal Demand Fluctuations

CVR Partners' revenue streams are significantly shaped by the predictable ebb and flow of agricultural demand throughout the year. Peak sales periods are consistently observed during the crucial spring and fall planting seasons when farmers are actively acquiring essential fertilizers. The company’s operational strategy is meticulously designed to align production and inventory levels with these predictable surges in customer needs.

This seasonality is clearly demonstrated by robust demand for nitrogen fertilizer, a core product for CVR Partners. For instance, the company experienced strong nitrogen fertilizer demand in the fourth quarter of 2024 and continued to see this trend into the first quarter of 2025, underscoring the seasonal impact on its revenue generation.

- Spring Planting Season: This period typically represents a major revenue driver as farmers prepare their fields for cultivation.

- Fall Harvesting & Preparation: Post-harvest application and preparation for the following season also contribute to sales.

- Q4 2024/Q1 2025 Nitrogen Demand: Factual data indicates a strong sales performance in these quarters, directly linked to agricultural cycles.

- Inventory Management Strategy: CVR Partners’ ability to forecast and manage inventory ensures they can capitalize on these seasonal peaks.

Hedging and Commodity Price Management

While not a direct revenue generator, CVR Partners' sophisticated hedging and commodity price management for both inputs like natural gas and outputs such as gasoline and distillates are crucial for stabilizing and potentially boosting earnings. By actively managing price volatility, the company safeguards its profit margins.

These strategies are designed to ensure predictable cash flows, providing a buffer against the inherent fluctuations in the energy markets. This financial discipline is key to maintaining consistent profitability, even when market conditions are turbulent.

- Input Cost Stabilization: CVR Partners utilizes futures contracts and other derivatives to lock in prices for key raw materials, such as natural gas, a primary feedstock for their fertilizer production.

- Output Price Protection: The company also hedges its refined product sales, like gasoline and diesel fuel, to secure favorable pricing and mitigate the impact of potential market downturns.

- Margin Protection: Effective price management helps maintain a healthy spread between the cost of inputs and the selling price of outputs, directly supporting profitability.

- Financial Risk Mitigation: In 2024, the volatility in natural gas prices, which saw significant swings due to geopolitical factors and weather patterns, underscored the importance of such risk management for companies like CVR Partners.

CVR Partners' revenue is primarily driven by the wholesale distribution of Urea Ammonium Nitrate (UAN) solutions and ammonia. These products are essential for agriculture and industry, making their sales volumes and market prices key indicators of financial success.

In 2024, UAN sales formed a significant portion of CVR Partners' total net sales, highlighting its importance. Similarly, ammonia sales, whether direct or as a component of UAN, also contribute substantially, with the realized gate price being a critical factor.

| Product | 2024 Revenue Contribution (Approx.) | Key Drivers |

|---|---|---|

| UAN Solutions | 60-70% | Sales Volume, Market Price |

| Ammonia | 25-35% | Sales Volume, Realized Gate Price |

| Other Refined Products | 5-10% | Market Demand, Pricing |

Business Model Canvas Data Sources

The CVR Partner Business Model Canvas is built upon a foundation of partner financial performance data, market demand analysis for CVR services, and strategic insights gathered from partner interviews and industry best practices. This multi-faceted approach ensures a comprehensive and accurate representation of the CVR partner ecosystem.