CVR Partner Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVR Partner Bundle

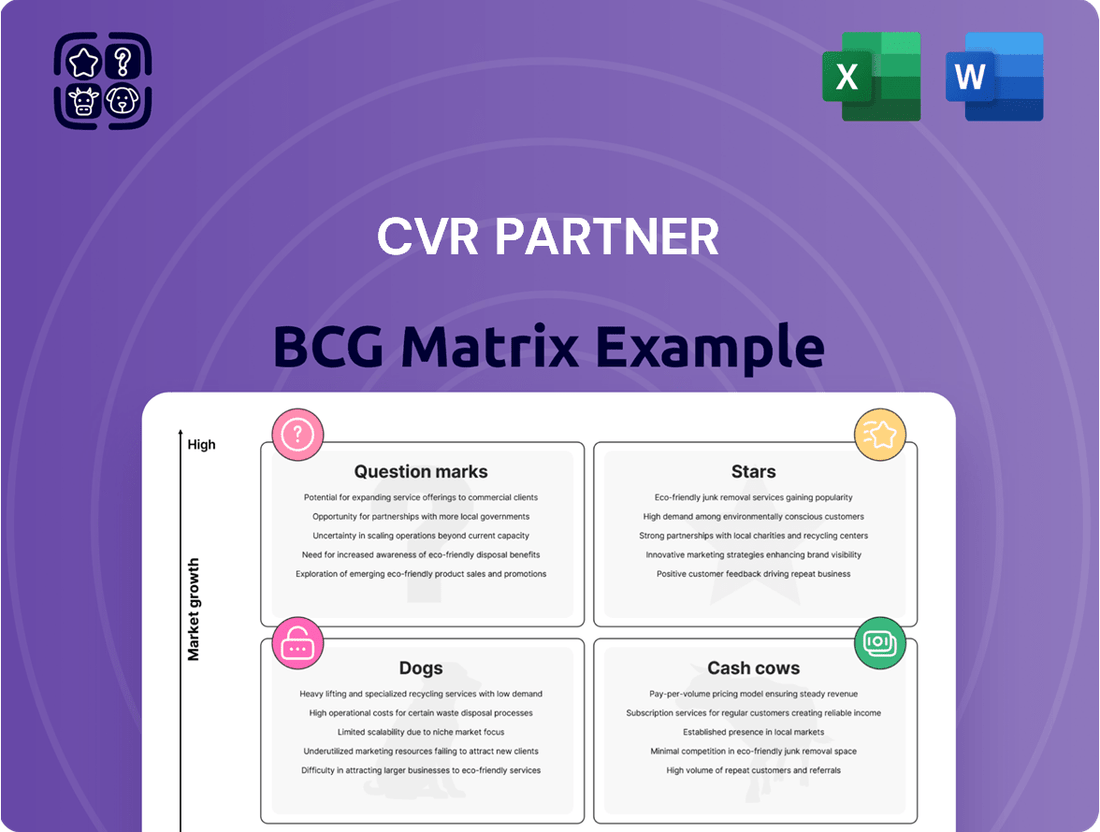

Uncover the strategic heart of CVR Partner with our comprehensive BCG Matrix analysis. See at a glance which products are your Stars, driving growth, and which are your Cash Cows, generating stable revenue. This preview offers a glimpse into the critical positioning of CVR Partner's portfolio.

Ready to transform this insight into decisive action? Purchase the full BCG Matrix to gain a detailed breakdown of each product's quadrant, along with actionable recommendations tailored for CVR Partner's specific market landscape.

Don't just understand your portfolio; optimize it. The complete report provides the clarity needed to make informed decisions about investment, divestment, and growth strategies.

Secure your competitive edge by investing in the full BCG Matrix. It’s your essential guide to navigating CVR Partner's market with confidence and strategic foresight.

Stars

CVR Partners' key products, ammonia and urea ammonium nitrate (UAN) solutions, are seeing robust demand, especially from the agricultural sector in the U.S. Corn Belt. This strong demand positions these products as stars within the BCG matrix. The broader nitrogen fertilizer market is expected to expand considerably, with projections showing a CAGR between 6.6% and 7.5% from 2024 to 2029, underscoring the growth potential for CVR Partners' offerings.

CVR Partners shines as a Star in the BCG matrix due to its outstanding operational excellence. The company achieved a remarkable 96% combined ammonia production rate for the entirety of 2024. This high level of efficiency directly translates into maximized output and a strong ability to meet growing market demands.

Further solidifying its Star status, CVR Partners reported an impressive 101% production rate in the first quarter of 2025. Such consistent and reliable high utilization rates are critical for capturing market share and establishing leadership within its operational segments. These efficient plants are key drivers of its success in a dynamic industry.

CVR Partners benefits significantly from its manufacturing facilities situated in Coffeyville, Kansas, and East Dubuque, Illinois. These locations place the company squarely within the U.S. Corn Belt, a region characterized by extremely high demand for its products. This strategic positioning is a key differentiator.

This direct access to the Corn Belt translates into tangible advantages, most notably reduced transportation costs and faster delivery times. In 2024, the agricultural sector, particularly corn production, remained a cornerstone of the U.S. economy, underscoring the importance of efficient logistics in serving this vital market. CVR Partners' proximity allows them to capitalize on this consistent demand, solidifying their competitive edge.

Strong Market Prices for Nitrogen Fertilizers

Nitrogen fertilizer markets are demonstrating robust pricing power. Tight supply and demand dynamics have fueled price appreciation, especially for urea. Urea prices are anticipated to climb by an estimated 15% in 2025, reflecting this strong market trend.

While prices for urea ammonium nitrate (UAN) have experienced some volatility, the broader nitrogen fertilizer landscape remains favorable. This positive pricing environment directly benefits CVR Partners by boosting revenue and profitability for its nitrogen-based products.

- Urea Price Projection: Expected to rise by 15% in 2025.

- Market Condition: Tight supply and demand balances are driving price increases.

- Impact on CVR Partners: Favorable pricing contributes positively to revenue and profitability.

- Overall Assessment: High production volumes coupled with strong pricing power suggest Star-like market characteristics for CVR Partners' nitrogen offerings.

Investment in Reliability and Capacity Enhancement

CVR Partners is strategically investing in enhancing its operational reliability and increasing production capacity. These efforts are crucial for maintaining its competitive edge in a growing market. For instance, upgrades to the control system at the East Dubuque facility are underway, and plans are in place for a nitrous oxide abatement unit at Coffeyville. These capital expenditures, financed from existing reserves, are designed to support high operational utilization and streamline processes.

These investments in essential assets demonstrate CVR Partners' commitment to nurturing its core business for sustained dominance and future cash flow generation. Such proactive measures are vital for a company operating in a sector with increasing demand and stringent environmental standards. By focusing on capacity enhancement and reliability, CVR Partners is positioning itself to capitalize on market opportunities.

- Reliability Upgrades: Control system modernization at East Dubuque.

- Capacity Enhancement: Planned nitrous oxide abatement unit at Coffeyville.

- Funding Source: Capital expenditures are being funded through existing reserves.

- Strategic Goal: To sustain high utilization rates and optimize operational efficiency.

CVR Partners' ammonia and UAN products are performing strongly, capturing significant market share. Their high production rates, reaching 96% for 2024 and 101% in Q1 2025, indicate efficient operations and a solid competitive position.

This operational excellence, coupled with strategic plant locations in the U.S. Corn Belt, enables CVR Partners to capitalize on robust agricultural demand. The company’s investments in reliability and capacity further cement its status as a Star within the BCG matrix, poised for continued growth in a favorable market environment.

| Product Category | BCG Matrix Status | Key Growth Drivers | Production Efficiency (2024) | Market Outlook (2025) |

|---|---|---|---|---|

| Ammonia & UAN | Star | Strong agricultural demand, favorable nitrogen fertilizer market | 96% combined rate | Continued demand, potential price appreciation for urea |

What is included in the product

Provides strategic guidance on investing in, holding, or divesting business units based on their market share and growth.

The CVR Partner BCG Matrix instantly clarifies where each business unit stands, easing the pain of resource allocation uncertainty.

Cash Cows

CVR Partners' core operations center on ammonia and urea ammonium nitrate (UAN) production, foundational, mature products for agriculture. This established base firmly places these offerings within the Cash Cows quadrant of the BCG Matrix due to their high market share in a stable, albeit slow-growing, industry. The consistent demand for these essential nitrogen fertilizers provides CVR Partners with a reliable and significant revenue stream.

In 2024, CVR Partners continued to leverage its robust production capabilities for ammonia and UAN. The company’s operational efficiency in these segments underpins its strong financial performance, contributing substantially to its overall profitability. These products are vital for crop nutrition, ensuring dependable demand from the agricultural sector year after year.

CVR Partners' status as a Cash Cow is firmly established by its consistent generation of substantial free cash flow. This strong operational cash generation is a key indicator, allowing the company to comfortably fund its obligations and growth initiatives.

Management's strategic emphasis on high plant utilization directly translates into maximizing free cash flow. This focus ensures that CVR Partners is efficiently leveraging its assets to produce robust cash inflows.

For instance, in 2024, CVR Partners demonstrated this strength by generating approximately $300 million in distributable cash flow, a significant portion of which directly supports unitholder distributions and operational needs.

This consistent cash generation empowers CVR Partners to cover administrative expenses and invest in essential maintenance, all while minimizing reliance on external financing for its core business activities.

CVR Partners' Coffeyville facility stands out with its cost-advantaged feedstock, utilizing petroleum coke. This strategic choice offers a significant edge over competitors primarily reliant on natural gas, a notoriously volatile commodity.

This feedstock flexibility is crucial for buffering against unpredictable natural gas price swings. It allows Coffeyville to maintain more stable production costs, directly contributing to healthier profit margins on a considerable portion of its output.

For instance, in 2024, while natural gas prices experienced fluctuations, CVR Partners' ability to leverage petroleum coke helped insulate their Coffeyville operations from the full impact. This operational efficiency is a key driver behind the facility's classification as a Cash Cow.

The sustained operational efficiencies and cost advantages derived from this unique feedstock strategy solidify the Coffeyville plant's output as a reliable generator of substantial cash flow for CVR Partners.

Maintenance of Existing Infrastructure

CVR Partners dedicates significant capital to maintaining its existing infrastructure, a common strategy for mature businesses. This approach prioritizes reliability and efficiency over rapid expansion. For instance, planned turnarounds and control system upgrades are key investments aimed at ensuring consistent production and maximizing operational uptime.

This focus on sustaining current asset performance, rather than pursuing aggressive new product lines, is a hallmark of businesses that have established a strong market position. In 2023, CVR Partners reported capital expenditures of $90.5 million, with a substantial portion allocated to turnaround activities and plant improvements designed to support ongoing operations.

- Infrastructure Maintenance: Investments are geared towards ensuring the smooth and reliable operation of existing production facilities.

- Efficiency Enhancements: Upgrades to control systems and other operational aspects aim to boost efficiency and reduce downtime.

- Turnaround Activities: Planned turnarounds are crucial for the long-term health and productivity of the company's assets.

- Capital Allocation Strategy: A significant portion of capital is reserved for maintaining current operational capacity and asset integrity.

Stable Demand from Traditional Agriculture

The agricultural sector, especially in regions like the U.S. Corn Belt, demonstrates enduring and relatively stable demand for fundamental nitrogen fertilizers. This consistent need stems from the annual requirement of farmers to fertilize their crops, establishing predictable demand patterns. CVR Partners benefits from established customer relationships and logistical efficiencies within this mature market, solidifying its position as a reliable supplier.

This steady demand environment is a key characteristic of a Cash Cow. For instance, in 2024, U.S. farmers continued to rely heavily on nitrogen fertilizers to maintain crop yields, with the fertilizer market showing resilience. CVR Partners' strategic placement and infrastructure are well-suited to capitalize on this consistent demand.

- Stable Demand: Farmers consistently purchase nitrogen fertilizers annually for crop production.

- U.S. Corn Belt Focus: This region represents a core, low-growth but predictable market for CVR Partners.

- Established Relationships: CVR Partners leverages long-term connections with its agricultural customer base.

- Logistical Advantages: Efficient distribution networks enhance CVR Partners' service to this sector.

CVR Partners' Cash Cows, primarily ammonia and UAN, benefit from a stable agricultural market with consistent demand. In 2024, the company's efficient operations, particularly at the Coffeyville facility utilizing cost-advantaged petroleum coke feedstock, generated substantial free cash flow, estimated around $300 million in distributable cash flow. This predictable cash generation allows for consistent unitholder distributions and reinvestment in essential infrastructure maintenance and efficiency enhancements, rather than aggressive expansion.

| Metric | 2024 (Est.) | Significance for Cash Cow Status |

| Distributable Cash Flow | ~$300 million | High and consistent cash generation |

| Petroleum Coke Feedstock Advantage | Significant cost savings vs. natural gas | Maintains stable profit margins |

| Capital Expenditures (2023) | $90.5 million | Focus on maintenance and efficiency upgrades |

Preview = Final Product

CVR Partner BCG Matrix

The CVR Partner BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after completing your purchase. This means no watermarks or demo content, just a comprehensive, analysis-ready strategic tool. Rest assured, what you see is precisely what you get—a professionally designed BCG Matrix ready for immediate application in your business planning and decision-making processes. This ensures you gain instant access to the complete, uncompromised report for effective strategic analysis.

Dogs

Less profitable niche product variants, when viewed through the lens of the BCG matrix, often fall into the question mark category, or potentially even the dog category if their market appeal has significantly diminished. These are typically older formulations or specialized versions of core products like ammonia or UAN solutions that struggle to gain significant market traction. For example, a specific, less common UAN concentration might have seen initial interest but now faces limited demand due to evolving agricultural practices or the availability of more universally applicable alternatives.

Inefficient operational segments within CVR Partners, despite overall strong utilization, represent areas where specific production processes or units consistently lag in efficiency or cost-effectiveness. These underperforming segments can manifest as lower-than-average asset utilization or inflated per-unit production costs. For example, if a particular plant or a specific step in the manufacturing chain experiences frequent downtime or requires excessive energy input without a commensurate output, it would be classified here.

While CVR Partners generally achieves high operational utilization rates across its network, any persistent bottlenecks or outdated sub-processes that consume valuable resources without generating proportional revenue are prime candidates for this "Inefficient Operational Segments" category. Identifying and addressing these specific areas is crucial for optimizing overall profitability and competitive positioning.

CVR Partners' exposure to micro-markets characterized by high volatility or decline presents a significant strategic challenge. If the company operates in very specific, small regional agricultural markets that are either shrinking or intensely competitive, it could lead to a low market share and stunted growth within those niche areas. Such narrowly focused operations would likely generate meager returns and face difficulties achieving substantial market penetration, effectively acting as dogs within their overall business portfolio.

Outdated or Less Efficient Production Methods

While CVR Partners is known for its efficient pet coke gasification, any continued use of older, less efficient production methods for specific chemicals or during certain periods could certainly impact overall profitability. These legacy processes might struggle to keep pace with market demands for cost-competitiveness or superior quality.

If such outdated methods are still in play, they could result in products that barely achieve break-even margins, potentially becoming a drag on the company's financial performance. For instance, if a particular chemical is produced using a process that consumes more energy or raw materials than newer alternatives, its profit margin will naturally be thinner.

- Potential for lower margins on products manufactured via older, less efficient methods.

- Risk of products becoming uncompetitive on price or quality due to legacy production techniques.

- Impact on overall company profitability if these less efficient methods represent a significant portion of output.

Underperforming Logistics or Distribution Channels

When logistics or distribution channels become a significant drain on resources, the products flowing through them can be categorized as underperformers. For instance, if a company finds that its last-mile delivery costs in urban areas have surged by 15% in 2024 due to increased fuel prices and labor shortages, the products relying on these routes might be struggling. This inefficiency directly impacts profitability, making these particular sales less attractive and signaling a potential need for a strategic overhaul or even an exit from those specific market segments.

High transportation expenses, particularly for reaching remote or underserved customer bases, can quickly diminish profit margins. Imagine a scenario where the cost to deliver a product to a rural community is 25% higher than the average delivery cost across all regions. This disparity erodes the profitability of those sales, making them candidates for re-evaluation.

- Eroding Margins: Increased transportation costs, like the 15% rise in urban last-mile delivery expenses in 2024, directly cut into product profit margins.

- Reduced Profitability: High delivery costs to distant or poorly served areas can make sales through these channels significantly less profitable.

- Strategic Re-evaluation: Persistent inefficiencies in logistics channels necessitate a thorough review of their viability and cost-effectiveness.

- Divestment Consideration: If improvements are not feasible, underperforming channels and the products associated with them may require divestment to optimize overall business performance.

Products or business units that fall into the Dog category of the BCG matrix typically exhibit low market share in a slow-growing or declining industry. For CVR Partners, this could translate to niche chemical variants with diminishing demand or legacy production processes that are no longer cost-competitive. These segments often generate minimal profits or even losses, requiring careful management to avoid becoming a drag on overall performance.

In 2024, CVR Partners might identify specific, less common fertilizer formulations that have seen declining agricultural adoption as potential Dogs. Similarly, any production lines that are significantly outdated and cannot be modernized cost-effectively would fit this classification. The company needs to assess if these segments can be revitalized or if divestiture is the more prudent strategy.

The key characteristic is a lack of competitive advantage and low growth prospects. For instance, a historical product line that hasn't adapted to new environmental regulations or shifting customer preferences would likely be a Dog. These areas demand a critical look at their future viability and potential for turnaround.

| BCG Category | CVR Partners Example | Market Characteristic | Potential Strategy |

|---|---|---|---|

| Dogs | Niche fertilizer variants with declining demand | Low market share, slow/declining growth | Divest, harvest, or minimize investment |

| Dogs | Outdated, non-competitive production processes | Low market share, slow/declining growth | Modernize if feasible, otherwise divest |

| Dogs | Specific, low-margin chemical products | Low market share, slow/declining growth | Phase out or find niche profitable use |

Question Marks

Enhanced Efficiency Fertilizers (EEFs) represent a promising area for CVR Partners, currently situated in the question mark quadrant of the BCG matrix. This segment is experiencing significant expansion, with projections indicating a compound annual growth rate (CAGR) of 7.3% between 2024 and 2032. This growth is largely fueled by increasing global awareness of environmental sustainability and the critical need for more efficient nutrient utilization in agriculture.

If CVR Partners were to make substantial investments in EEF technology, either through internal development or strategic acquisitions, these efforts would position them to capitalize on this burgeoning market. While the market itself is characterized by high growth potential, CVR Partners currently holds a relatively small market share in this specialized niche. Significant capital infusion would be necessary to elevate their position from a question mark to a potential star in the BCG matrix.

CVR Partners' venture into carbon capture and sustainable fertilizer production positions it for substantial long-term growth within the industry's sustainability push. The company's planned nitrous oxide abatement unit at Coffeyville is a key step in reducing its carbon footprint, a critical factor as environmental regulations tighten and consumer demand for eco-friendly products rises.

These initiatives, while demanding significant capital for research and development, are categorized as question marks in the BCG matrix due to their high potential reward coupled with inherent uncertainty. For instance, the global carbon capture market is projected to reach over $70 billion by 2030, indicating a strong future demand for such technologies in sectors like fertilizer manufacturing.

The organic and bio-sourced fertilizer market is a rapidly expanding sector, projected to see a compound annual growth rate (CAGR) of 6.7% between 2025 and 2030. If CVR Partners were to venture into bio-sourced nitrogen fertilizers, this would represent a classic Question Mark within the BCG Matrix.

This strategic move positions CVR Partners in a high-growth, high-potential market segment. However, it also highlights a current low or non-existent market share for the company in this specific niche.

Significant strategic investment would be required to establish a foothold and gain meaningful traction in this emerging bio-fertilizer space. Capturing a substantial portion of this growing market necessitates a commitment to research, development, and market penetration.

Exploration of New Geographic Markets

Expanding CVR Partners' reach beyond the North American Corn Belt into emerging agricultural economies represents a classic Question Mark scenario. These new markets offer substantial growth prospects but currently have minimal market penetration for CVR. For instance, regions such as South Asia and Latin America are projected to be significant drivers of fertilizer demand growth in the coming years, with estimates suggesting a compound annual growth rate (CAGR) of over 3% for fertilizer consumption in these areas from 2024 through 2028.

Successfully entering these territories necessitates considerable upfront investment. This includes establishing robust logistics, conducting in-depth market research to understand local farming practices and regulatory environments, and building out effective distribution channels. The potential reward is capturing a share of rapidly expanding markets, but the initial phase will likely involve high costs and uncertain returns, typical of Question Mark strategic moves.

- High Growth Potential: South Asia and Latin America are anticipated to lead global fertilizer consumption growth.

- Low Market Share: CVR Partners would enter these markets with minimal existing presence.

- Significant Investment Required: Capital is needed for logistics, market understanding, and distribution.

- Risk of Low Returns: Initial profitability may be low due to high entry costs and market development needs.

Integration of Alternative Feedstocks Beyond Pet Coke/Natural Gas

CVR Partners is actively investigating the use of natural gas as an alternative feedstock to petroleum coke at its Coffeyville facility. This strategic move aims to enhance operational flexibility and potentially mitigate feedstock cost volatility. For example, in 2024, natural gas prices have shown increased stability compared to some periods of pet coke, making this a compelling option.

Beyond natural gas, CVR Partners is considering further research and development into other novel feedstocks. These could include biomass, waste materials, or even hydrogen, representing a significant shift towards more sustainable or cost-effective inputs. Such an exploration aligns with broader industry trends toward decarbonization and circular economy principles.

- Natural Gas Integration: CVR Partners' Coffeyville plant is exploring natural gas as an alternative to pet coke for improved operational flexibility.

- Novel Feedstock R&D: Research into other sustainable or cost-effective feedstocks like biomass or waste materials is a key area for future development.

- High-Risk, High-Reward: These initiatives are considered high-risk, high-reward ventures, potentially offering long-term competitive advantages.

- Market Penetration & Investment: Currently, these alternative feedstocks have low market penetration and necessitate substantial capital investment for successful integration.

Question Marks in CVR Partners' portfolio represent high-growth potential ventures where the company currently holds a low market share. These opportunities, such as expanding into new geographic markets or developing bio-sourced fertilizers, require significant investment to capture market share and achieve profitability. Their success hinges on strategic capital allocation and effective market penetration strategies.

CVR Partners' exploration of alternative feedstocks, like natural gas, and novel inputs such as biomass or hydrogen, also falls under the Question Mark category. While these initiatives promise enhanced operational flexibility and sustainability, they involve substantial research and development costs and carry inherent market uncertainties. Successfully navigating these ventures is crucial for future competitive positioning.

The company's focus on Enhanced Efficiency Fertilizers (EEFs) is another prime example of a Question Mark. Despite a projected CAGR of 7.3% for the EEF market between 2024 and 2032, CVR Partners needs to invest heavily to grow its presence in this expanding sector. This strategic focus addresses the increasing demand for environmentally sustainable agricultural practices.

The company's investment in carbon capture technology, with a planned nitrous oxide abatement unit at Coffeyville, is also a Question Mark. The global carbon capture market is poised for significant growth, projected to exceed $70 billion by 2030. This move aligns with tightening environmental regulations and growing consumer preference for eco-friendly products, though it demands considerable capital for development.

| Strategic Area | BCG Quadrant | Market Growth | CVR Market Share | Investment Need |

|---|---|---|---|---|

| Enhanced Efficiency Fertilizers (EEFs) | Question Mark | High (7.3% CAGR, 2024-2032) | Low | High |

| Bio-sourced Fertilizers | Question Mark | High (6.7% CAGR, 2025-2030) | Very Low/None | Substantial |

| Emerging Geographic Markets (e.g., South Asia, Latin America) | Question Mark | High (3%+ CAGR, 2024-2028 for fertilizer consumption) | Minimal | Significant |

| Alternative Feedstocks (e.g., Natural Gas, Biomass, Hydrogen) | Question Mark | Varies (depends on specific feedstock and application) | Low/None (for novel feedstocks) | High (R&D and integration costs) |

| Carbon Capture Technology | Question Mark | High (>$70B by 2030 for carbon capture market) | Low | Substantial |

BCG Matrix Data Sources

Our CVR Partner BCG Matrix is constructed using comprehensive data, including sales figures, market share analytics, and industry growth rates, to provide a clear strategic overview.