Cummins India PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cummins India Bundle

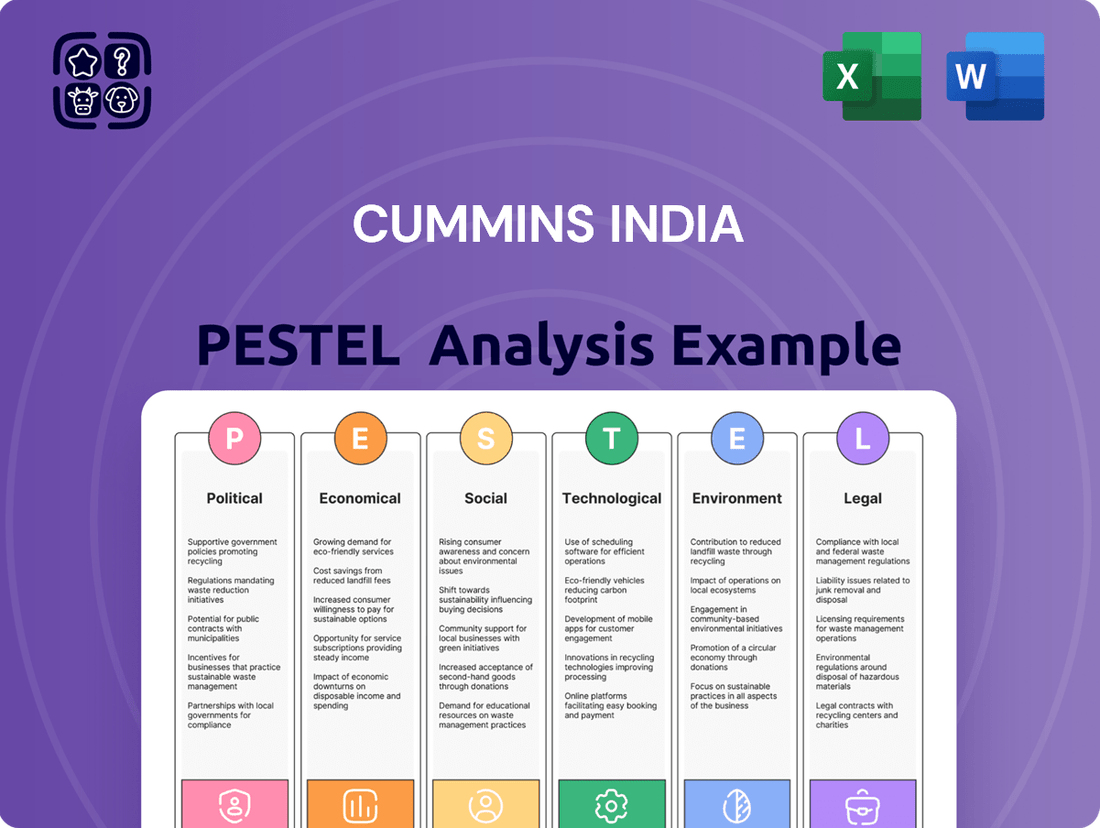

Gain a critical edge by understanding the external forces shaping Cummins India's future. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting this industrial giant. Discover how shifting government policies, economic growth patterns, and technological advancements present both opportunities and challenges for Cummins India. Equip yourself with actionable intelligence to refine your market strategies and anticipate industry shifts. Download the full PESTLE analysis now to unlock these vital insights and stay ahead of the curve.

Political factors

Government policies such as the 'Make in India' initiative and Production Linked Incentive (PLI) schemes are significantly bolstering the manufacturing sector in India, directly impacting companies like Cummins India. These programs aim to boost domestic production and attract foreign investment by offering financial incentives and reducing regulatory hurdles. For instance, the PLI scheme for the automotive sector, which includes components like engines, could directly benefit Cummins India by making local manufacturing more cost-effective and competitive.

These policy shifts are designed to enhance India's manufacturing capabilities and improve the attractiveness of the country for industrial investment. By lowering operational costs and encouraging local value addition, such policies provide a conducive environment for companies to expand their production base within India, thereby supporting their growth strategies in the domestic market and potentially for export.

As of early 2024, the Indian government continued its focus on manufacturing, with ongoing evaluations and potential expansions of existing PLI schemes. The government's commitment to fostering a robust manufacturing ecosystem, coupled with improvements in infrastructure and ease of doing business, creates a favorable landscape for companies like Cummins India to leverage local production for greater market penetration and operational efficiency.

Changes in import duties on essential raw materials and components directly affect Cummins India's production costs. For instance, if India increases tariffs on specialized steel alloys used in engine manufacturing, Cummins India's input expenses rise, potentially impacting its pricing strategy and profit margins. Conversely, export incentives on finished diesel engines could bolster its international sales volume and market share.

The landscape of bilateral trade agreements is crucial for Cummins India's global operations. Favorable agreements that reduce tariffs on exported engines from India to major markets like the United States or European Union nations enhance its competitiveness. However, the imposition of protectionist measures, such as retaliatory tariffs by trading partners, can significantly disrupt supply chains and diminish the economic viability of exporting finished goods.

Cummins India operates within a dynamic regulatory landscape driven by increasingly stringent emission standards for both vehicles and industrial applications. The push for cleaner technologies is paramount, pushing the company to allocate significant resources towards research and development for advanced engine solutions. This commitment to innovation is directly linked to maintaining product relevance and securing market access, particularly for their core diesel and natural gas engine offerings.

Government Infrastructure Spending

The Indian government's commitment to bolstering infrastructure is a major tailwind for Cummins India. Significant investments in national highways, dedicated freight corridors, and renewable energy projects directly translate into increased demand for the company's robust diesel and natural gas engines, as well as its advanced generator sets. These initiatives are not just about building; they are about powering the nation's growth.

For instance, the National Infrastructure Pipeline (NIP) targets an investment of approximately INR 111 lakh crore (around $1.4 trillion) for the period 2020-2025. This massive outlay includes substantial allocations for roads, railways, and power. Cummins India, as a key supplier of power solutions for construction equipment, locomotives, and power generation, stands to benefit immensely as these projects move from planning to execution.

The company's generator sets are crucial for ensuring uninterrupted power supply at construction sites and for various industrial applications that underpin these infrastructure developments. Furthermore, the expansion of railway networks and the development of new airports and ports require reliable power for operations and signaling systems, areas where Cummins has a strong presence.

Key areas benefiting from this government push include:

- Road and Highway Development: Increased construction activity drives demand for engines in earthmoving and road-building machinery.

- Railways Modernization: Electrification projects and new line constructions necessitate powerful diesel-electric locomotives and power solutions.

- Power Generation and Distribution: Investments in thermal, renewable, and grid infrastructure require reliable backup and primary power generation.

- Urban Infrastructure: Development of smart cities and public transport systems often involves significant power requirements.

Geopolitical Stability

Geopolitical stability within India and its surrounding regions is a crucial factor for Cummins India's operations. Fluctuations in regional stability directly influence investor confidence, potentially impacting foreign direct investment inflows. For instance, any perceived increase in regional tensions could lead to a more cautious investment climate, affecting capital availability for expansion or upgrades. This stability also underpins the resilience of global and local supply chains, which are vital for sourcing components and ensuring timely delivery of products.

Political tensions or instability can create significant operational hurdles for Cummins India. Disruptions might arise from difficulties in securing raw materials or components due to border disputes or trade restrictions. Furthermore, an uncertain political environment can lead to unpredictable policy changes, affecting regulatory compliance and market access. India’s strong economic growth trajectory, projected to remain robust through 2024-2025, provides a generally stable backdrop, but localized political friction can still pose short-term challenges.

- Investor Confidence: Stable geopolitics attract and retain foreign and domestic investment, crucial for Cummins India's growth capital.

- Supply Chain Resilience: Regional stability ensures uninterrupted flow of raw materials and finished goods, a key operational advantage.

- Market Access: Peaceful relations facilitate trade agreements and open markets, expanding Cummins India's reach.

- Operational Continuity: Predictable political landscapes minimize disruptions to manufacturing and distribution networks.

Government initiatives like Make in India and Production Linked Incentive (PLI) schemes are actively boosting India's manufacturing sector, directly benefiting companies such as Cummins India. These policies aim to increase domestic production and attract foreign investment through financial incentives and fewer regulations. For example, the PLI scheme for the automotive sector, which includes engine components, could make local manufacturing more cost-effective for Cummins India.

What is included in the product

This PESTLE analysis of Cummins India provides a comprehensive overview of how external macro-environmental factors, spanning Political, Economic, Social, Technological, Environmental, and Legal dimensions, impact the company's operations and strategic positioning within the Indian market.

It offers actionable insights for stakeholders to identify emerging threats and opportunities, enabling informed decision-making and proactive strategy development in a dynamic business landscape.

A PESTLE analysis for Cummins India acts as a pain point reliever by offering a structured framework to anticipate and navigate external challenges, enabling proactive strategy development and mitigating potential market disruptions.

Economic factors

India's economy is projected to grow by 6.5% in fiscal year 2024-25, according to the Reserve Bank of India. This sustained GDP growth, coupled with increasing industrial output, directly fuels demand for power solutions. Sectors like manufacturing, construction, and automotive, all key markets for Cummins India, are experiencing expansion.

A strong economic expansion means more factories are operating, more infrastructure projects are underway, and more vehicles are being produced. This translates directly into higher sales volumes for Cummins India's engines and generator sets. For instance, the automotive sector, a significant user of Cummins' products, saw a healthy growth trajectory in 2023 and is expected to continue this trend into 2024.

The robust performance of the industrial sector, which grew by approximately 5.8% in FY24, further bolsters Cummins India's market position. Increased production necessitates reliable power sources, a core offering from the company. This positive economic environment provides a solid foundation for Cummins India's revenue generation and market penetration strategies.

Inflationary pressures in India directly affect Cummins India's bottom line by increasing the cost of essential raw materials like steel and copper, as well as labor expenses. For instance, India's retail inflation hovered around 5.11% in January 2024, a slight decrease from previous months but still a significant factor impacting operational costs.

Managing these fluctuating input costs is paramount for Cummins India to sustain its profitability and maintain competitive pricing for its engines and power generation equipment. The company must carefully navigate these economic headwinds to ensure its pricing strategies remain attractive in the marketplace.

Interest rates significantly impact Cummins India's financial strategy. As of late 2024, India's Reserve Bank (RBI) has maintained a hawkish stance, with the repo rate holding steady at 6.50% to manage inflation. This means borrowing costs for Cummins India's expansion projects and working capital remain elevated. Higher borrowing expenses can potentially dampen investment in new manufacturing capabilities or research and development, impacting long-term growth prospects.

Furthermore, prevailing interest rates directly affect customer financing, influencing demand for Cummins India's products, particularly in sectors like construction and transportation where equipment purchases are often financed. If interest rates remain high, customers may delay or scale back their capital expenditures, leading to softer sales volumes for Cummins India. Conversely, a potential future reduction in interest rates by the RBI could stimulate market demand, making it more attractive for customers to acquire new machinery and vehicles powered by Cummins engines.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations, especially the Indian Rupee's volatility against the US Dollar, directly influence Cummins India's financial performance. A weaker Rupee, for instance, increases the cost of imported raw materials and components, which are crucial for their manufacturing operations. In early 2024, the Indian Rupee traded around 83 against the US Dollar, a level that has presented ongoing challenges for businesses reliant on imports.

Conversely, a stronger Rupee can make Indian exports more expensive in international markets, potentially impacting Cummins India's export revenue realization. For example, if the Rupee strengthens significantly, the dollar-denominated earnings from exports translate into fewer Rupees upon repatriation, affecting profitability. This necessitates robust financial risk management and hedging strategies to mitigate the impact of these currency swings.

- Impact on Imports: In 2024, the INR depreciated against the USD, raising the cost of imported components for Cummins India.

- Impact on Exports: Currency movements affect the competitiveness and profitability of Cummins India's exports.

- Hedging Necessity: Significant currency volatility necessitates strategic hedging to protect profit margins.

- Financial Performance: Exchange rate swings can lead to unpredictable impacts on Cummins India's bottom line.

Consumer and Business Spending

Consumer and business spending habits are pivotal for Cummins India, as they directly influence demand for its core products like engines for vehicles, power generation equipment, and industrial machinery. A robust economy encouraging higher spending translates into more orders and increased revenue for the company. For instance, in the fiscal year 2023-24, India's GDP grew by an estimated 7.6%, signaling a healthy economic environment conducive to increased capital expenditure by businesses and consumer spending on durables and transportation.

When consumers and businesses feel confident about the economic outlook, they tend to invest more. This translates into a higher demand for commercial vehicles, where Cummins engines are integral, and for power generation solutions, especially as infrastructure development projects gain momentum. The automotive sector, a key segment for Cummins India, saw robust growth in commercial vehicle sales during 2023, with reports indicating significant year-on-year increases in certain categories, reflecting this spending pattern.

Conversely, a downturn in consumer confidence or a slowdown in business investment can lead to reduced orders. This impacts Cummins India's production schedules and financial performance. The automotive industry's recovery and expansion, driven by both personal and commercial needs, directly correlates with the company's sales figures, highlighting the sensitivity to these spending patterns.

- Consumer Spending: Increased disposable income and positive economic sentiment drive purchases of vehicles and goods, indirectly benefiting Cummins through its supply chain.

- Business Investment: Higher corporate profits and confidence lead to expansion, infrastructure development, and fleet upgrades, boosting demand for Cummins' engines and power systems.

- Vehicle Market Demand: Sales performance in the commercial vehicle segment, a major market for Cummins India, is a direct indicator of how these spending patterns are translating into orders.

- Power Generation Needs: Industrial growth and the need for reliable power backup for businesses and infrastructure projects directly influence the demand for Cummins' power generation solutions.

India's economic trajectory is a primary driver for Cummins India. With the nation's GDP projected to grow by 6.5% in FY 2024-25, this expansion fuels demand across key sectors like manufacturing and construction, which are significant markets for Cummins' engines and power generation solutions.

Inflationary pressures, exemplified by retail inflation around 5.11% in January 2024, directly impact Cummins India's operational costs through higher raw material and labor expenses, necessitating careful cost management.

The Reserve Bank of India's steady repo rate of 6.50% in late 2024 means elevated borrowing costs for both Cummins India and its customers, potentially influencing investment and purchasing decisions.

Currency volatility, with the INR trading around 83 to the USD in early 2024, affects the cost of imported components and the realization of export revenues, underscoring the need for robust hedging strategies.

What You See Is What You Get

Cummins India PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Cummins India delves into Political stability, Economic growth, Social trends, Technological advancements, Legal frameworks, and Environmental regulations impacting the company. Understand the key external factors shaping Cummins India's operations and strategic decisions with this detailed report.

Sociological factors

Cummins India relies heavily on a skilled workforce, particularly in manufacturing, engineering, and after-sales service. The company's operational efficiency and the quality of its products are directly tied to the availability of these specialized skills. A robust pipeline of talent is essential for maintaining its competitive edge.

Educational and vocational training trends significantly impact Cummins India's ability to recruit and retain qualified employees. For instance, as of 2023, India's engineering graduate output continues to grow, though the industry often points to a gap between academic learning and practical application needs. Cummins actively engages in initiatives to bridge this gap.

Labor mobility also plays a role, with skilled professionals often seeking opportunities that offer better compensation and career advancement. Cummins India must therefore focus on creating an attractive work environment and offering competitive benefits to retain its valuable talent pool amidst a dynamic job market.

India's rapid urbanization is a major sociological driver impacting power demand. As more people move to cities, the need for consistent electricity in homes, businesses, and public infrastructure surges. This trend is particularly evident as India aims for further economic development, with urban centers becoming hubs of activity and consumption. For instance, urban populations are projected to reach 65% by 2035, a significant increase from today, directly fueling this demand.

This demographic shift presents a substantial market opportunity for Cummins India. As new urban centers develop and existing ones expand, there's a growing requirement for reliable power generation solutions. Cummins' generator sets and integrated power systems are well-positioned to meet this demand, supporting everything from residential complexes to critical commercial and industrial operations in these burgeoning urban landscapes.

Consumer preferences in India are rapidly shifting towards environmentally conscious choices. This means a growing demand for products that are not only efficient but also contribute to a cleaner planet. For Cummins India, this translates to a need for engines that align with these evolving societal values, pushing for innovations in cleaner energy technologies and quieter operational capabilities.

The market is increasingly signaling a preference for improved fuel efficiency, a direct response to both economic considerations and environmental awareness. Cummins India is seeing this trend play out as customers actively seek out solutions that reduce their operational costs while minimizing their carbon footprint. This shift is a significant driver for product development and market acceptance, especially as new engine models are introduced.

Stricter environmental regulations are also playing a crucial role in shaping consumer preferences. As India's commitment to sustainability intensifies, so does the demand for engines that can meet and exceed these stringent norms. For instance, the implementation of Bharat Stage VI (BS-VI) emission standards has already necessitated significant technological advancements in diesel engine design, a trend that is expected to continue with future regulations.

Corporate Social Responsibility

Societal expectations for corporate social responsibility (CSR) are increasingly shaping business operations in India, directly influencing companies like Cummins India. Consumers and communities now demand ethical practices and a tangible commitment to social good, impacting brand perception and operational sustainability.

Cummins India’s engagement in CSR initiatives is crucial for its brand reputation and stakeholder relationships. Strong adherence to these principles can foster deeper customer loyalty and attract socially conscious investors and talent. For instance, many Indian companies reported significant CSR spending in 2023, with the corporate sector contributing substantially to national development goals, reflecting this growing trend.

The company’s CSR efforts, focusing on areas like education, environmental sustainability, and community development, directly contribute to its social license to operate. These actions not only mitigate risks but also create shared value, enhancing Cummins India's appeal to a broad spectrum of stakeholders.

- Increased CSR Spending: Indian companies, in aggregate, saw a notable rise in CSR expenditure in the fiscal year ending March 2024, driven by regulatory mandates and growing stakeholder pressure for social impact.

- Focus on Sustainability: Cummins India’s commitment to environmental sustainability, including reducing emissions and promoting clean energy solutions, resonates with a public increasingly concerned about climate change.

- Community Engagement: Active participation in local community development projects, such as skill development programs and healthcare initiatives, strengthens Cummins India's ties with the communities in which it operates.

- Attracting Talent: A strong CSR record makes Cummins India an attractive employer for young professionals who prioritize working for organizations with a clear social purpose.

Demographic Shifts

India's demographic landscape is undergoing significant transformation, presenting both opportunities and challenges for companies like Cummins India. A notable trend is the expanding middle class, which, coupled with rising disposable incomes, directly fuels demand for more sophisticated and dependable power generation and management solutions. This growing consumer base is increasingly seeking quality and reliability, aligning with Cummins' product offerings.

These demographic shifts also have a profound impact on the labor market. As the population ages and the skill sets required by industries evolve, Cummins India must adapt its strategies for talent acquisition and development. The availability of skilled engineers and technicians is crucial for innovation and efficient operations, making workforce planning a key consideration.

- Growing Middle Class: India's middle class is projected to reach 475 million people by 2030, indicating a substantial increase in potential customers for power solutions.

- Urbanization: Rapid urbanization is concentrating populations, leading to increased demand for reliable power infrastructure in cities and industrial hubs.

- Skilled Workforce: While India has a large young population, the availability of highly specialized skills for advanced manufacturing and engineering remains a critical factor for companies like Cummins.

- Disposable Income: The rise in per capita income, expected to continue growing in the 2024-2025 period, empowers households and businesses to invest in higher-quality power equipment.

Societal expectations around corporate responsibility are increasingly influencing business practices in India, impacting companies like Cummins India. Consumers and communities now expect ethical operations and a tangible commitment to social good, which affects brand image and operational sustainability. Cummins India's engagement in Corporate Social Responsibility (CSR) initiatives is vital for its reputation and stakeholder relations. Strong CSR practices foster customer loyalty and attract socially conscious investors and employees. For example, Indian companies collectively increased their CSR spending significantly in the fiscal year ending March 2024, driven by regulations and stakeholder pressure for social impact.

Cummins India's CSR efforts in education, environmental stewardship, and community development are crucial for its social license to operate. These actions not only mitigate risks but also create shared value, enhancing the company's appeal. The growing trend of increased CSR spending in India reflects a broader societal shift, with many companies actively contributing to national development goals.

The increasing consumer preference for environmentally friendly products and services directly impacts Cummins India. As awareness of climate change grows, there's a heightened demand for efficient and sustainable power solutions. This trend is further amplified by stricter environmental regulations, such as the Bharat Stage VI (BS-VI) emission standards, which necessitate continuous innovation in cleaner engine technologies. For instance, new engine models are being developed with improved fuel efficiency and reduced emissions to meet these evolving market demands and regulatory requirements.

India's rapid urbanization is a significant sociological factor driving demand for power solutions. As more people migrate to cities, the need for consistent electricity for homes, businesses, and infrastructure escalates. This trend is projected to continue, with urban populations expected to reach approximately 65% by 2035, further fueling the demand for reliable power generation. Cummins India is well-positioned to meet this growing urban power requirement with its range of generator sets and integrated power systems, supporting various applications in expanding urban centers.

Technological factors

Continuous technological advancements are reshaping the engine industry, directly impacting Cummins India's competitiveness. Improvements in engine design, fuel efficiency, and the integration of alternative fuels are paramount for staying ahead in the market.

Cummins globally invested $778 million in research and development in 2023, with a significant portion dedicated to next-generation power solutions. This includes a strong focus on hydrogen and electric powertrains, crucial for meeting evolving environmental regulations and future market demands in India and beyond.

The company's commitment to innovation is evident in its ongoing development of advanced diesel engines that meet stringent BS-VI emission norms, showcasing technological prowess in cleaner combustion. This technological edge is vital for maintaining market share in a sector increasingly driven by sustainability.

Cummins India is actively integrating advanced manufacturing technologies, robotics, and automation into its production lines. This push for digitization and automation is designed to boost operational efficiency and cut down on expenses. For instance, the company has been investing in smart factory initiatives, aiming to streamline its manufacturing processes and improve overall output quality. This focus on digital transformation across its entire value chain is crucial for staying ahead in a competitive market.

Cummins India's commitment to research and development is a cornerstone of its strategy, with significant investments in creating next-generation power solutions. This focus includes advancing hybrid powertrain technologies and integrating renewable energy sources into their product offerings, ensuring they stay ahead in a rapidly changing market.

For instance, during the fiscal year 2023, Cummins Inc. globally reported R&D expenses of approximately $1.1 billion, a substantial portion of which fuels innovation relevant to the Indian market. This sustained investment allows Cummins India to adapt its global technologies and develop localized solutions that address specific Indian power needs, from cleaner diesel engines to emerging electric and hydrogen power options.

IoT and AI for Predictive Maintenance

Cummins India is leveraging the power of the Internet of Things (IoT) and Artificial Intelligence (AI) to revolutionize its maintenance strategies. By embedding IoT sensors into their engines and generator sets, the company can gather real-time operational data. This data then fuels AI algorithms, enabling predictive maintenance that anticipates potential failures before they occur.

This technological integration directly translates into enhanced customer value. Customers benefit from significantly reduced unexpected downtime, as maintenance can be scheduled proactively. For instance, a study by McKinsey indicated that predictive maintenance can reduce downtime by up to 50% and maintenance costs by up to 40%. Cummins India's adoption of these technologies aims to deliver similar operational efficiencies and cost savings to its clientele, solidifying its position as a reliable solutions provider.

The benefits extend beyond just preventing breakdowns. Remote monitoring capabilities allow Cummins India to offer more sophisticated and responsive service. This means quicker diagnostics, optimized performance tuning, and ultimately, a more reliable product lifecycle for their customers. The company's commitment to integrating advanced analytics underscores its dedication to improving product reliability and customer satisfaction in the evolving Indian market.

- IoT Sensor Integration: Real-time data collection from engines and generator sets.

- AI-Powered Predictive Maintenance: Anticipating failures to minimize downtime.

- Enhanced Service Offerings: Proactive and responsive customer support.

- Improved Product Reliability: Reducing operational disruptions for clients.

Competition from Emerging Technologies

The emergence of advanced battery storage, hydrogen fuel cells, and large-scale renewable energy sources presents a significant technological shift for Cummins India. These innovations offer alternatives to traditional diesel and natural gas engines, potentially impacting demand for Cummins' core products.

For instance, the global energy storage market is projected to grow substantially, with estimates suggesting it could reach hundreds of billions of dollars by the late 2020s, driven by the increasing adoption of electric vehicles and grid modernization efforts. Cummins India's ability to integrate these new technologies into its offerings, perhaps through strategic acquisitions or R&D investments, will be key to navigating this evolving landscape.

Adapting its product portfolio to include solutions for electric powertrains, hybrid systems, and hydrogen-based power generation is therefore paramount. Partnerships with leading technology developers in these fields could accelerate Cummins India's transition and unlock new market segments. For example, collaborations in the hydrogen fuel cell sector, which saw significant investment and development in 2023 and 2024, could position Cummins India as a key player in the future of clean energy transportation and stationary power.

The company's strategic response to these technological advancements will determine its competitive positioning in the coming years, with a focus on innovation and adaptability being critical for sustained success.

Technological advancements are fundamentally altering the power solutions landscape, necessitating continuous innovation from Cummins India. The company's global R&D spending, which reached approximately $1.1 billion in fiscal year 2023, underscores a commitment to developing next-generation technologies, including electric and hydrogen powertrains, to meet evolving market demands and stringent environmental regulations in India.

Legal factors

Cummins India navigates a landscape of intricate labor laws, from minimum wage mandates to stringent rules on working conditions and employee benefits. For instance, the Code on Wages, 2019, aims to simplify and consolidate various laws related to wages and bonus payments, impacting how Cummins India structures its compensation. Failure to comply with these regulations, which also cover aspects like contract labor and industrial disputes, can lead to significant penalties and operational disruptions.

These regulations directly influence Cummins India's operational costs and human resource strategies. The company must ensure its employment practices align with laws such as the Industrial Disputes Act, 1947, which governs dispute resolution and retrenchment. Maintaining a compliant and motivated workforce is crucial for avoiding legal challenges and ensuring smooth production cycles.

Cummins India operates under stringent product liability laws, mandating rigorous adherence to safety standards for its engines and power solutions. This commitment is crucial not only for safeguarding consumers but also for mitigating the risk of substantial legal repercussions and financial penalties. For instance, in 2023, the automotive industry faced increased scrutiny regarding emissions compliance, leading to potential fines and recalls for non-compliant manufacturers, a scenario Cummins India actively works to avoid through proactive quality control.

Compliance with both national Indian standards, such as those set by the Bureau of Indian Standards (BIS), and international certifications like ISO 9001 and emissions regulations (e.g., BS VI in India, equivalent to Euro VI), is fundamental. Achieving these certifications, which Cummins India holds for its diverse product lines, directly translates into enhanced customer trust and a significant reduction in potential legal liabilities. These standards often involve detailed testing and validation processes, ensuring product integrity and safety in operation.

Environmental protection laws in India are becoming increasingly stringent, directly impacting Cummins India's manufacturing and product development. Regulations concerning air and water pollution, waste disposal, and the handling of hazardous materials necessitate continuous adaptation of operational practices. For instance, the Central Pollution Control Board (CPCB) has been actively tightening emission standards for diesel engines, a core product for Cummins, requiring significant investment in advanced emission control technologies.

Compliance with these evolving environmental mandates is not merely a regulatory obligation but a critical factor for business continuity and reputation. Failure to adhere to these laws can result in substantial penalties, operational disruptions, and even the suspension of manufacturing licenses. Cummins India's commitment to sustainability, therefore, involves proactive engagement with environmental regulations to ensure it can continue to operate effectively and responsibly in the Indian market.

Intellectual Property Rights

Cummins India relies heavily on intellectual property, particularly patents covering its advanced engine technologies and trademarks for brand recognition. The Indian government's commitment to robust intellectual property rights (IPR) protection, as evidenced by the Patents Act, 1970, and the Trademarks Act, 1999, is fundamental to safeguarding these assets. Legal recourse against infringement is essential for Cummins to protect its significant investments in research and development, ensuring its innovations remain a competitive differentiator in the market.

The enforcement of IPR in India is a critical factor for companies like Cummins. For instance, in 2023, India's intellectual property litigation landscape saw increased activity, with courts increasingly awarding damages for infringement, providing a deterrent effect. Cummins India actively monitors the market to detect and address any unauthorized use of its patented designs or branded products, which is vital for maintaining market share and brand integrity.

- Patents for Engine Technology: Cummins holds numerous patents in India for its cutting-edge engine designs and emission control systems, crucial for its competitive edge.

- Trademark Protection: The Cummins name and logo are registered trademarks, legally protected against unauthorized use in the Indian market.

- Enforcement Measures: Legal actions are pursued against counterfeit products and patent infringements to protect R&D investments and brand reputation.

- Regulatory Compliance: Adherence to Indian patent and trademark laws is paramount for Cummins India's operational and strategic success.

Corporate Governance and Anti-Corruption

Cummins India's commitment to robust corporate governance and anti-corruption measures is paramount. Adherence to these principles is not just a legal requirement but a cornerstone for maintaining investor trust and ethical business conduct. The Companies Act, 2013, for instance, mandates transparency and accountability in management practices, directly influencing Cummins India's operational framework.

The company's focus on these legal factors is crucial for navigating the Indian business landscape. Strong governance helps mitigate risks associated with fraud and unethical practices, ensuring long-term sustainability. Cummins India's compliance efforts, therefore, directly contribute to its reputation and ability to attract and retain investment, especially in light of increasing regulatory scrutiny.

- Compliance Framework: Cummins India operates under the purview of the Companies Act, 2013, ensuring adherence to corporate governance standards.

- Anti-Corruption Laws: The Prevention of Corruption Act, 1988, guides the company's zero-tolerance policy towards bribery and corrupt practices.

- Investor Confidence: Transparent reporting and ethical dealings fostered by strong governance are vital for maintaining investor confidence and market valuation.

- Risk Mitigation: Strict adherence to these legal factors helps Cummins India proactively manage legal and reputational risks.

Cummins India's operations are significantly shaped by India's robust legal framework, particularly concerning labor, product safety, environmental compliance, and intellectual property. The company must diligently adhere to laws like the Code on Wages, 2019, and the Industrial Disputes Act, 1947, ensuring fair employment practices and smooth industrial relations, which directly impact operational continuity. Furthermore, stringent product liability laws and evolving environmental regulations, such as tightening emission standards by the CPCB for diesel engines, necessitate continuous investment in technology and process adaptation to avoid penalties and maintain market access.

Cummins India's commitment to intellectual property rights, guided by the Patents Act, 1970, and the Trademarks Act, 1999, is crucial for protecting its technological innovations and brand identity. The company actively pursues legal actions against infringements, as demonstrated by increased intellectual property litigation in India in 2023, to safeguard its R&D investments and market position. Adherence to corporate governance principles under the Companies Act, 2013, and anti-corruption laws like the Prevention of Corruption Act, 1988, is equally vital for maintaining investor confidence and ensuring ethical business operations.

| Legal Factor Area | Key Legislation/Regulation | Impact on Cummins India | Recent Developments/Data (2023-2025) |

|---|---|---|---|

| Labor Laws | Code on Wages, 2019; Industrial Disputes Act, 1947 | Influences compensation structures, dispute resolution, and workforce management. | Continued focus on fair wages and working conditions, with potential for increased compliance costs. |

| Product Liability & Safety | Bureau of Indian Standards (BIS); Emissions Standards (BS VI) | Mandates adherence to safety and emission standards for engines and power solutions. | Increased scrutiny on emissions compliance, driving investments in advanced emission control technologies. |

| Environmental Regulations | Central Pollution Control Board (CPCB) directives | Governs pollution control, waste management, and hazardous material handling. | Tightening emission standards for diesel engines require significant technological upgrades. |

| Intellectual Property Rights | Patents Act, 1970; Trademarks Act, 1999 | Protects engine technology patents and brand trademarks, crucial for competitive advantage. | Increased IP litigation in India in 2023 highlights the importance of robust enforcement for R&D protection. |

| Corporate Governance | Companies Act, 2013; Prevention of Corruption Act, 1988 | Ensures transparency, accountability, and ethical conduct, vital for investor trust. | Growing regulatory scrutiny reinforces the need for strong compliance frameworks and zero-tolerance for corruption. |

Environmental factors

Cummins India faces increasing pressure from stricter emissions standards for internal combustion engines, a trend driven by global and national environmental concerns. This necessitates ongoing investment in cleaner technologies and research and development to ensure compliance. For instance, India's Bharat Stage VI (BS-VI) emission norms, implemented nationwide in April 2020, significantly tightened limits for pollutants, requiring advanced engine management systems and exhaust after-treatment technologies from manufacturers like Cummins.

The intensifying global and Indian commitment to renewable energy and decarbonization significantly shapes the long-term demand for conventional fossil fuel power solutions. This shift directly impacts companies like Cummins India, necessitating a strategic pivot.

Cummins India faces a crucial imperative to diversify its product offerings, actively incorporating sustainable and low-carbon alternatives to maintain its competitive edge. For instance, India's renewable energy capacity reached approximately 179 GW by March 2024, a substantial increase underscoring this market transformation.

This environmental factor compels Cummins India to invest in and promote technologies such as hydrogen fuel cells and advanced battery systems. By aligning with national targets, like achieving 500 GW of non-fossil fuel energy capacity by 2030, the company can secure future revenue streams and market relevance.

Cummins India faces growing concerns regarding the scarcity of critical raw materials, such as rare earth elements vital for advanced engine components and emission control systems. This scarcity directly impacts their supply chain, necessitating a strategic shift towards sustainable sourcing practices to ensure long-term availability and price stability. The company is actively exploring alternative materials and strengthening relationships with suppliers committed to responsible mining and extraction methods.

Waste Management and Recycling

Cummins India faces increasing scrutiny regarding its waste management and recycling practices, driven by evolving environmental regulations and heightened societal expectations for product stewardship and circular economy principles. These factors directly influence operational decisions, from manufacturing processes to the handling of end-of-life products.

The company's commitment to robust waste reduction and recycling programs is paramount for maintaining environmental compliance and upholding its corporate social responsibility. This proactive approach not only mitigates risks associated with non-compliance but also enhances brand reputation among environmentally conscious stakeholders.

For instance, India's Central Pollution Control Board (CPCB) has been strengthening norms for industrial waste disposal and recycling, with a particular focus on hazardous waste. Cummins India's adherence to these evolving standards, including those related to e-waste management as per the E-Waste (Management) Rules, 2022, is critical. In the fiscal year 2023-24, the company continued to invest in technologies and processes aimed at improving resource efficiency and minimizing waste generation across its manufacturing facilities.

- Regulatory Compliance: Adherence to India's evolving waste management and recycling laws, including those from the CPCB.

- Operational Impact: Direct influence on manufacturing processes and end-of-life product handling procedures.

- Corporate Responsibility: Implementation of waste reduction and recycling programs to meet environmental standards and stakeholder expectations.

- Resource Efficiency: Continued investment in technologies to minimize waste and enhance the circularity of materials used in production.

Climate Change Impacts

Climate change presents significant challenges for Cummins India, potentially disrupting its supply chains and altering energy costs. For instance, increasing frequency of extreme weather events in India, such as the heavy monsoons experienced in 2023 that caused widespread flooding in various regions, can impact logistics and raw material availability. This necessitates a strategic focus on building resilience within its operations.

The evolving energy landscape driven by climate concerns also influences demand for Cummins India's products. As India aims to meet its renewable energy targets, there's a growing emphasis on cleaner power solutions. Cummins India's adaptation strategy must align with this shift, potentially by expanding its portfolio of alternative power technologies to meet market demands. For example, India's National Green Hydrogen Mission, launched in early 2023 with an outlay of ₹19,744 crore, signals a strong government push towards sustainable energy, creating opportunities for companies offering related technologies.

Developing climate-resilient products and operations is therefore paramount for Cummins India’s long-term sustainability and competitive edge. This includes investing in research and development for engines and power systems that can operate efficiently in diverse and potentially harsher environmental conditions. Furthermore, optimizing manufacturing processes to reduce their carbon footprint and water usage will be crucial. By 2024, many global manufacturing firms are reporting increased investments in ESG (Environmental, Social, and Governance) initiatives, with sustainability becoming a core business driver.

- Supply Chain Vulnerability: Extreme weather events can disrupt the flow of components and finished goods, impacting production schedules and delivery times for Cummins India.

- Energy Cost Volatility: Changes in energy policies and the transition to renewables can lead to fluctuating energy prices, affecting operational costs for manufacturing and product performance.

- Demand for Resilient Power: Growing concerns about grid stability and the impact of climate change on infrastructure are increasing the demand for reliable backup and distributed power solutions.

- Product Adaptation: Cummins India needs to innovate and adapt its product offerings to meet stricter emission standards and the growing market preference for lower-carbon and alternative fuel technologies.

Stricter environmental regulations, particularly India's BS-VI emission norms, mandate significant R&D investment in cleaner engine technologies for Cummins India. The nation's aggressive push towards renewable energy, targeting 500 GW of non-fossil fuel capacity by 2030, necessitates a strategic pivot towards alternative power solutions like hydrogen fuel cells.

Raw material scarcity, especially for rare earth elements used in emission controls, poses supply chain risks, prompting Cummins India to explore sustainable sourcing and alternative materials. The company also faces increasing scrutiny on waste management, requiring adherence to evolving CPCB norms and investment in resource efficiency, evidenced by continued efforts in FY 2023-24.

Climate change impacts supply chains through extreme weather events, such as the 2023 floods, requiring resilience-building. Simultaneously, the global shift to cleaner energy, supported by India's National Green Hydrogen Mission (₹19,744 crore outlay), drives demand for alternative power technologies, pushing companies like Cummins to innovate.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cummins India is built on a comprehensive review of official government publications, reputable industry association reports, and economic data from leading financial institutions. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.