Cummins India Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cummins India Bundle

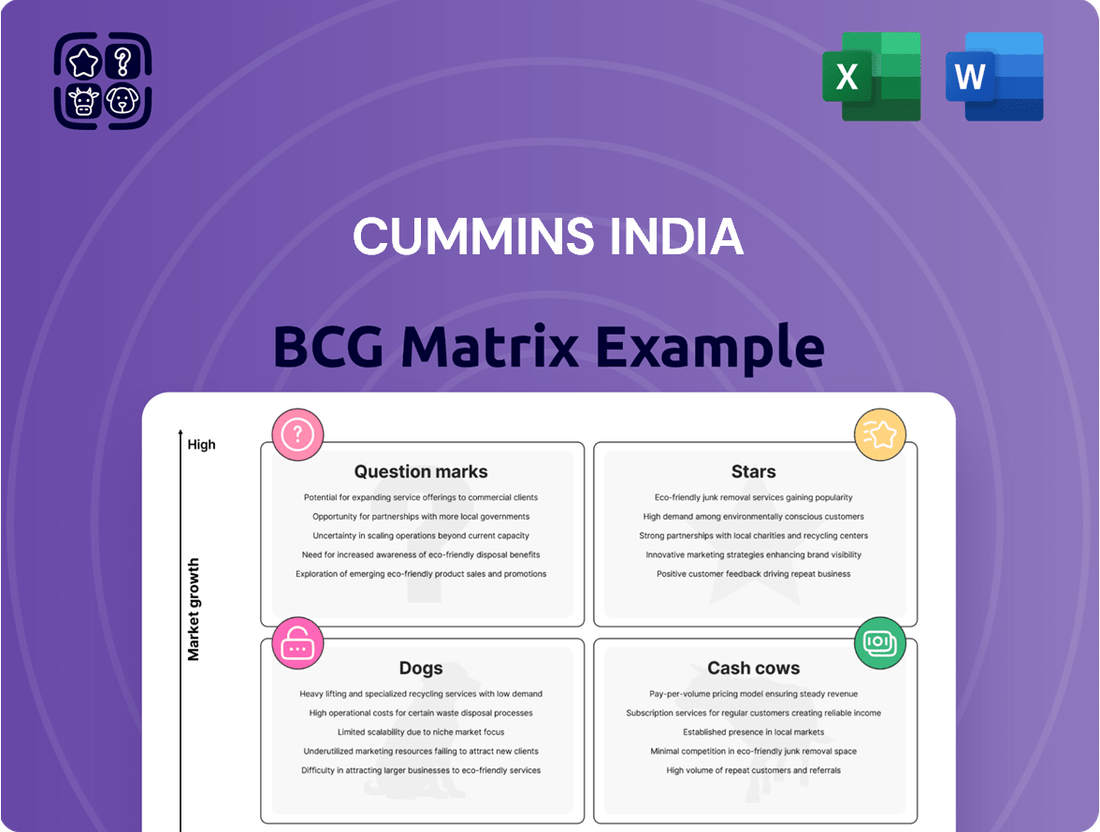

Curious about Cummins India's product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings stack up in the market, identifying potential Stars, Cash Cows, Dogs, and Question Marks.

Understanding these placements is crucial for strategic decision-making, from resource allocation to future investment. Don't miss out on the opportunity to grasp the full picture of Cummins India's competitive landscape.

Purchase the complete BCG Matrix for Cummins India and unlock detailed quadrant analysis, actionable insights, and a clear roadmap to optimize your business strategy.

Gain a competitive edge by understanding where to invest, divest, or nurture each product line. This comprehensive report is your key to unlocking Cummins India's strategic potential.

Elevate your understanding and make informed choices. Get the full Cummins India BCG Matrix report today and transform your strategic planning.

Stars

Cummins India's CPCB IV+ compliant generator sets are positioned as Stars in the BCG matrix. These advanced emission-compliant gensets meet the strictest new emission standards in India, offering better fuel economy and lower pollution levels. This product line directly addresses the rising need for eco-friendly power options, fueled by stricter environmental rules and ongoing infrastructure growth.

Hydrogen internal combustion engines (H2-ICE), specifically the B6.7H for Tata Motors, are a significant growth area for Cummins India. The company is positioned as a Star in this segment due to its first-mover advantage.

Production of these engines began in March 2024 at a new Jamshedpur facility. This strategic move into zero-carbon solutions for commercial vehicles underscores Cummins India’s commitment to innovation and a rapidly expanding market.

Cummins India is a major player in supplying critical backup power for India's booming data center market. The nation's digital transformation is fueling massive growth in data center infrastructure. This surge in demand, particularly for reliable, high-horsepower generator sets and integrated power systems, places Cummins India's data center solutions firmly in the Star quadrant of the BCG matrix.

Engines for Rapid Infrastructure Development

Engines for rapid infrastructure development are a significant growth area for Cummins India, aligning perfectly with the Star quadrant of the BCG matrix. India's commitment to massive infrastructure projects, such as the Bharatmala Pariyojana for highways and dedicated freight corridors for railways, fuels a robust demand for construction and mining equipment. Cummins India, with its advanced engine solutions tailored for these demanding applications, is well-positioned to capture a substantial market share in this booming segment.

The company's comprehensive range of high-horsepower engines are critical for powering excavators, loaders, and haul trucks essential for these large-scale developments. For instance, the Indian government's infrastructure spending target for FY2024 was projected to reach INR 10 lakh crore, a significant increase, directly translating into higher demand for the equipment Cummins engines power. This creates a high-growth, high-share scenario, characteristic of a Star.

- High Market Share: Cummins India commands a leading position in supplying engines for construction and mining equipment due to its established reputation for reliability and performance.

- Rapid Market Growth: Driven by massive government investments in infrastructure, the market for construction and mining equipment engines is experiencing substantial year-on-year growth.

- Technological Advantage: Cummins' advanced engine technologies, focusing on fuel efficiency and emissions compliance, provide a competitive edge in meeting the evolving demands of the sector.

- Key Projects: Engines are vital for projects like the Delhi-Mumbai Industrial Corridor and the expansion of port infrastructure, all of which are experiencing significant investment.

Fuel-Agnostic Engine Platforms

Cummins' commitment to developing fuel-agnostic engine platforms is a significant strategic move, placing them firmly in the Star quadrant of the BCG Matrix for India's evolving clean energy sector. These innovative engines are designed to run on a variety of fuels, including natural gas, biogas, and crucially, hydrogen. This versatility offers Original Equipment Manufacturers (OEMs) unparalleled flexibility in adapting to diverse fuel availability and regulatory landscapes. The company's investment in this technology anticipates strong future growth as India aggressively pursues its decarbonization targets. In 2024, Cummins India reported a substantial revenue increase, driven in part by advanced powertrain solutions that align with these national environmental objectives.

The fuel-agnostic approach directly addresses the growing demand for sustainable transportation and industrial power solutions in India. By enabling engines to seamlessly switch between or utilize different fuel sources, Cummins is not only future-proofing its product line but also actively contributing to India's energy transition. This positions Cummins India as a market leader with high growth potential, as the country aims to reduce its reliance on traditional fossil fuels. The company's focus on hydrogen as a key alternative fuel aligns with global trends and India's own push towards a hydrogen economy.

- Fuel-Agnostic Technology: Cummins' engines can operate on hydrogen, natural gas, and other alternative fuels, offering versatility.

- Market Position: This innovation positions Cummins as a Star in India's clean energy market due to high growth potential.

- OEM Benefits: Provides flexibility for manufacturers to adapt to different fuel infrastructure and regulations.

- Decarbonization Goals: Supports India's national objectives for reducing carbon emissions and transitioning to cleaner energy sources.

Cummins India's CPCB IV+ compliant generator sets are positioned as Stars due to their advanced emission control and improved fuel economy, directly meeting India's stricter environmental regulations and growing demand for eco-friendly power. The company's first-mover advantage in hydrogen internal combustion engines (H2-ICE), with production starting in March 2024, further solidifies this Star positioning by targeting the rapidly expanding zero-carbon commercial vehicle market.

Cummins India's data center solutions are Stars, capitalizing on the nation's digital transformation, which drives massive demand for reliable, high-horsepower generator sets and integrated power systems. Similarly, engines for rapid infrastructure development are Stars, fueled by substantial government investments, such as the INR 10 lakh crore projected infrastructure spending for FY2024, which directly increases the need for construction and mining equipment powered by Cummins engines.

The company's fuel-agnostic engine platforms, designed to run on hydrogen, natural gas, and biogas, are Stars in India's clean energy sector, offering OEMs flexibility amidst evolving fuel infrastructure and regulations. This strategy aligns with India's decarbonization goals and the push for a hydrogen economy, with Cummins India reporting significant revenue growth in 2024 partly due to these advanced powertrain solutions.

| Product Segment | BCG Quadrant | Key Growth Drivers | Market Share Indicator |

| CPCB IV+ Gensets | Star | Stricter emission norms, infrastructure growth | High |

| H2-ICE Engines | Star | Zero-carbon commercial vehicles, innovation | Emerging/High (First-mover) |

| Data Center Power Solutions | Star | Digital transformation, infrastructure expansion | High |

| Infrastructure Engines | Star | Government infrastructure spending (FY24: INR 10 lakh crore), project scale | High |

| Fuel-Agnostic Platforms | Star | Decarbonization goals, energy transition, hydrogen economy | High Potential |

What is included in the product

This Cummins India BCG Matrix analysis identifies strategic opportunities for growth and resource allocation.

A clear Cummins India BCG Matrix provides a strategic roadmap, alleviating the pain of resource allocation uncertainty.

Cash Cows

Cummins India's traditional diesel generator sets, especially its established medium and large models, are firmly positioned as Cash Cows. The company commands a significant market share in this segment, a testament to their long-standing presence and product reliability.

While the global energy landscape is evolving, the Indian diesel genset market remains robust. In 2024, the market is projected to continue its growth trajectory, driven by the persistent need for reliable backup power due to grid instability and the ongoing expansion of industrial sectors across India.

This sustained demand ensures a steady and predictable stream of cash flow for Cummins India from these mature product lines. The company's ability to consistently meet market needs with these dependable solutions underpins their Cash Cow status.

Cummins India’s natural gas engines for commercial vehicles are a strong Cash Cow. These engines offer a dependable way to cut emissions, fitting perfectly with India's goal to boost natural gas usage in its energy mix by 2030, aiming for a 15% share.

Cummins has built significant trust and a solid market position in this area. This segment consistently brings in steady income, requiring minimal new investment to maintain its market share and promote its offerings.

In 2023, the commercial vehicle sector in India saw robust growth, with over 1 million units sold, indicating a strong demand for efficient and cleaner engine technologies like natural gas.

Cummins India's aftermarket services and components are a prime example of a Cash Cow within its BCG Matrix. The company boasts an extensive network of over 480 customer touchpoints across India, ensuring widespread accessibility for its services.

This robust infrastructure supports comprehensive aftermarket services for Cummins' existing engines and generator sets, generating a stable and high-margin revenue stream. The recurring nature of these services, coupled with the large installed base of Cummins products in the Indian market, solidifies its position as a Cash Cow.

For instance, in the fiscal year 2023, Cummins India reported strong revenue growth in its Aftermarket segment, driven by increased demand for genuine parts and maintenance services, reflecting the maturity and profitability of this business unit.

Engines for Mature Industrial Applications

Cummins' engines designed for mature industrial applications, like those found in established manufacturing sectors and certain agricultural machinery, act as the company's cash cows. These segments represent markets where demand is stable, though growth is minimal. Cummins' strong historical presence and technological expertise have secured a significant market share in these areas, allowing for consistent and predictable revenue streams.

These cash cow business units are crucial for funding other strategic initiatives within Cummins. For example, in the fiscal year 2023, Cummins reported strong performance in its Aftermarket segment, which often supports these mature engine applications, contributing significantly to overall profitability. The predictable cash flow from these established product lines allows Cummins to invest in research and development for newer technologies or expand into emerging markets without jeopardizing its financial stability.

- Cash Cows: Engines for mature industrial applications like manufacturing and agriculture.

- Market Position: High market share in stable, low-growth segments.

- Financial Contribution: Provide steady and predictable cash generation.

- Strategic Role: Fund investments in growth areas and new technologies.

Power Systems for Traditional Power Generation

While domestic power generation sales experienced a dip in Q1 FY25, Cummins' enduring strength in traditional power generation systems solidifies this segment as a Cash Cow. The company maintains a moderate revenue share in this established market, which, despite its maturity and slower growth trajectory compared to emerging areas, continues to generate reliable income streams.

This segment benefits from Cummins' long-standing reputation and deep customer relationships within the traditional power generation sector. The predictable demand for these systems, often driven by essential infrastructure and industrial backup power needs, ensures a consistent revenue base. For instance, Cummins India reported that its domestic power generation business faced headwinds in Q1 FY25, yet the foundational nature of these products supports its Cash Cow classification.

- Segment Classification: Cash Cow within Cummins India's BCG Matrix.

- Market Characteristics: Mature market with steady, albeit lower, growth prospects.

- Revenue Contribution: Moderate revenue share, providing a stable income foundation.

- Key Strengths: Established presence, strong brand reputation, and deep customer loyalty in traditional power generation.

Cummins India's established diesel generator sets, particularly medium and large models, are strong Cash Cows. These products benefit from a significant market share due to their reliability and Cummins' long-standing presence in India. The demand for dependable backup power continues to be robust in 2024, driven by grid instability and industrial expansion, ensuring consistent cash flow from these mature product lines.

Cummins' natural gas engines for commercial vehicles also represent a Cash Cow. With India aiming for a 15% share of natural gas in its energy mix by 2030, these engines align with emission reduction goals. The commercial vehicle sector's strong performance in 2023, with over a million units sold, highlights the demand for cleaner engine technologies, providing Cummins with steady income requiring minimal new investment.

The company's aftermarket services and components are another key Cash Cow. Cummins' extensive network of over 480 customer touchpoints across India facilitates consistent, high-margin revenue from services and genuine parts. This segment's profitability is further boosted by a large installed base of Cummins products, as evidenced by strong aftermarket revenue growth in fiscal year 2023.

Cummins' engines catering to mature industrial sectors like manufacturing and agriculture are also Cash Cows. These segments offer stable demand with minimal growth, where Cummins' strong market share and expertise generate predictable revenue. This cash flow is vital for funding innovation and expansion into new markets, as demonstrated by the robust contribution of the Aftermarket segment to overall profitability in FY23.

| Product/Service Segment | BCG Classification | Market Share | Market Growth | Key Strengths |

|---|---|---|---|---|

| Diesel Generator Sets (Medium/Large) | Cash Cow | High | Moderate | Reliability, Brand Reputation, Established Network |

| Natural Gas Engines (Commercial Vehicles) | Cash Cow | High | Moderate | Emission Reduction, Growing Natural Gas Adoption |

| Aftermarket Services & Components | Cash Cow | High | Moderate | Extensive Network, High-Margin Revenue, Large Installed Base |

| Engines for Mature Industrial Applications | Cash Cow | High | Low | Stable Demand, Technological Expertise, Predictable Cash Flow |

Preview = Final Product

Cummins India BCG Matrix

The Cummins India BCG Matrix preview you are currently viewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive document showcases a detailed strategic analysis of Cummins India's product portfolio, categorized according to market share and growth rate, providing you with actionable insights for business planning.

Dogs

Legacy Diesel Engine Models (Non-Compliant) represent a category of products that are facing obsolescence for Cummins India. These are older diesel engines that do not meet the current CPCB IV+ emission standards, or are in the process of being phased out by the company.

The market for these non-compliant models is shrinking significantly as newer, cleaner technologies become mandatory. This decline in demand poses challenges for Cummins India, potentially leading to increased costs associated with managing existing inventory or the eventual disposal of these older units.

While specific financial data for these legacy models isn't publicly detailed, industry trends indicate a sharp downturn in demand for non-compliant diesel engines. For instance, as of early 2024, many vehicle manufacturers are actively phasing out older engine types to comply with evolving emission regulations across various sectors.

Highly niche or commoditized components within Cummins India's product portfolio can be seen as Dogs in the BCG Matrix. These are items where the company has a limited market share and faces aggressive price wars, leading to low profitability. For instance, certain specialized filters or older engine parts that have been largely superseded by newer technology might fall into this category. These products often require significant capital investment for their production or sourcing but yield minimal returns, effectively tying up valuable resources without substantial growth potential.

Cummins India's export markets are currently facing significant headwinds. Export sales experienced a substantial decline of 22% year-over-year in Q1 FY25, signaling a challenging international environment for the company's products.

Certain low-horsepower export segments are particularly affected, showing sustained weak demand. These segments might be consuming valuable resources and management attention without generating commensurate returns, posing a strategic challenge.

Outdated Power Generation Solutions

Power generation solutions relying on older, less efficient technologies, such as those not meeting CPCB IV+ emission standards, are increasingly being phased out. These products, often found in the Dogs quadrant of a BCG Matrix analysis, face declining demand as newer, more environmentally compliant, and fuel-efficient alternatives gain traction. For Cummins India, this segment likely represents a shrinking market share and minimal contribution to overall profitability, requiring strategic decisions regarding their future.

These older power generation units are being superseded by more advanced models. In 2024, the demand for diesel generator sets that do not meet stricter emission norms has seen a significant dip. The push for cleaner energy sources and stricter environmental regulations means that older technologies are becoming obsolete, impacting their market position and revenue generation potential for manufacturers like Cummins India.

- Declining Market Share: Older generator sets struggle to compete with newer, CPCB IV+ compliant models.

- Low Profitability: These products contribute minimally to overall company profits due to low sales volume and potential price pressures.

- Regulatory Challenges: Increasingly stringent emission norms make it difficult for outdated solutions to remain viable in the market.

- Strategic Obsolescence: Continued investment in these products may not align with future market demands and technological advancements.

Products with High Maintenance Costs for Customers

Cummins India might categorize older engine models or those with less advanced emission control systems as products with high maintenance costs. These legacy products, while potentially still functional, could require more frequent servicing and parts replacement compared to their modern counterparts. For instance, engines designed before stricter emission norms might lack the sophisticated diagnostics and durable components found in newer generations, leading to increased customer expenditure on upkeep.

These less efficient or higher-maintenance products would likely face significant challenges in capturing market share. Consumers and businesses are increasingly prioritizing fuel economy and reduced operating costs, especially in a market influenced by environmental regulations and rising energy prices. As of the latest available data, the demand for advanced, fuel-efficient engines continues to grow, putting pressure on older technologies.

Consider these factors for such products:

- Higher service intervals: Older engine designs may necessitate more frequent visits to service centers, increasing labor costs for customers.

- Component wear and tear: Parts in older engines might have shorter lifespans, leading to more frequent replacements and associated expenses.

- Fuel inefficiency: Lower miles per gallon or liters per kilometer directly translates to higher fuel bills for the end-user, making them less attractive.

- Regulatory compliance: Products not meeting current or upcoming emission standards may face restrictions or become obsolete, limiting their market appeal.

Products categorized as Dogs in Cummins India's BCG Matrix represent areas with low market share and low growth potential. These are often legacy diesel engine models that are becoming obsolete due to stricter emission standards, such as CPCB IV+. The demand for these older, non-compliant engines is significantly declining as newer, cleaner technologies become mandatory, impacting their market viability and profitability.

For instance, certain low-horsepower export segments and older power generation solutions are experiencing sustained weak demand in 2024. These products may also include niche or commoditized components that face aggressive price competition. Cummins India's Q1 FY25 export sales saw a 22% year-over-year decline, highlighting challenges in international markets, particularly for products that do not meet evolving regulatory requirements.

These legacy products typically have high maintenance costs and are less fuel-efficient, making them less attractive to customers prioritizing operating expenses and environmental compliance. Consequently, these offerings contribute minimally to overall company profits and may require careful strategic decisions regarding their future, potentially involving phase-outs or limited resource allocation.

Cummins India's Dogs quadrant likely includes products such as:

| Product Category | Market Share | Growth Potential | Key Challenges |

|---|---|---|---|

| Legacy Diesel Engine Models (Non-Compliant) | Low | Declining | Obsolescence due to emission norms, shrinking demand |

| Older Power Generation Solutions | Low | Declining | Superseded by advanced models, regulatory non-compliance |

| Niche/Commoditized Components | Low | Low | Price wars, limited differentiation, low profitability |

Question Marks

Cummins India's Battery Electric Vehicle (BEV) systems, developed in partnership with Tata Motors, are positioned in a high-growth segment of the Indian automotive market. This venture aims to capitalize on the increasing demand for sustainable transportation solutions. The BEV market in India is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 45% from 2023 to 2030, reaching an estimated USD 15.6 billion by 2030, driven by government incentives and environmental concerns.

Despite the promising market outlook, BEV systems currently represent an emerging technology for commercial vehicles in India. Consequently, Cummins India's market share in this specific segment is likely to be relatively low at this stage. This places BEV systems in the "Question Mark" category of the BCG matrix, signifying a business unit with low market share in a high-growth industry. Such units require substantial investment to increase market share and achieve competitive positioning.

Hydrogen fuel cell systems represent a cutting-edge, zero-emission technology that Cummins India is actively developing, notably through its collaboration with Tata Motors. This market, while still in its early stages, exhibits significant potential for future expansion.

The nascent nature of the hydrogen fuel cell market, coupled with its high growth trajectory, places these systems firmly in the "Question Marks" category of the BCG matrix. This classification indicates that substantial investment is required to nurture this segment and steer it towards becoming a "Star" performer for Cummins India.

Globally, the hydrogen fuel cell market is projected to reach USD 132.1 billion by 2030, with a compound annual growth rate of 22.3%, highlighting the immense opportunity. Cummins' investment in this area, particularly with partners like Tata Motors, is strategically positioned to capitalize on this burgeoning demand.

Cummins India is strategically investing in advanced digital solutions for power management, aligning with its sustainability goals. Offerings like the DATUM S fuel management system and telematics for gensets represent this push towards smarter, more efficient operations. These digital tools are designed to optimize fuel consumption and enhance performance monitoring, contributing to a greener operational footprint.

The market for these industrial digital solutions is experiencing robust growth, yet Cummins India's current market share in these nascent digital offerings might be relatively small. This positions these advanced digital solutions as potential Stars or Question Marks within the BCG framework. For instance, the burgeoning adoption of IoT in industrial settings indicates significant future potential for these services.

New Ventures in Renewable Energy Integration Solutions

New ventures focusing on renewable energy integration solutions for India's grid represent a Star segment for Cummins India. As the nation aims to achieve its ambitious renewable energy targets, there's a growing need for technologies that enhance grid stability and manage the intermittency of sources like solar and wind. Cummins India, with its established expertise in power generation and advanced systems, is well-positioned to capitalize on this expanding market.

These solutions, such as advanced energy storage systems and smart grid management technologies, are in a high-growth phase. India's renewable energy capacity has seen significant expansion, with solar and wind power contributing substantially to the energy mix. For instance, India's total installed renewable energy capacity reached over 180 GW by early 2024, a testament to the sector's rapid development.

However, entering this space means facing established players and the inherent complexities of grid-level integration. Cummins India would be entering a market with initially uncertain market share, requiring substantial investment in research and development, as well as strategic partnerships. The success of these ventures will depend on Cummins India’s ability to offer differentiated, reliable, and cost-effective solutions that meet the evolving demands of the Indian power sector.

- Grid Flexibility Solutions: Developing technologies to balance supply and demand with variable renewable sources.

- Energy Storage Systems: Offering battery storage and other solutions to store excess renewable energy and release it when needed.

- Smart Grid Technologies: Implementing digital solutions for better monitoring, control, and optimization of the power grid.

- Market Potential: Capitalizing on India's drive to integrate a higher percentage of renewables into its national grid, which is projected to grow significantly in the coming years.

Low-Emission Propulsion Technologies Beyond Core Offerings

Cummins India is actively exploring emerging low-to-zero emission propulsion technologies that fall outside its current established product lines, often categorized as question marks in a BCG matrix. These represent areas with high growth potential but currently low market share, demanding significant investment in research and development to establish viability and capture future market leadership.

One such area involves advanced hydrogen fuel cell solutions, particularly for heavy-duty truck applications. While Cummins globally is a leader in fuel cell technology, its widespread adoption in India for commercial vehicles is still nascent. The company is investing in pilot programs and partnerships to demonstrate the efficacy and economic feasibility of these systems in the Indian context, aiming to build a strong foundation for future market penetration. For instance, by 2024, Cummins aims to have its fuel cell modules powering a significant number of demonstration vehicles across various transport segments in India, showcasing their operational capabilities and emissions benefits.

- Hydrogen Fuel Cells: Focus on developing and validating hydrogen fuel cell systems for commercial vehicles, targeting a significant increase in demonstration fleet size by 2024.

- Advanced Battery Technologies: Exploring next-generation battery chemistries and integration solutions for electric powertrains that offer improved range and faster charging times.

- Synthetic Fuels Compatibility: Researching and testing the performance of Cummins engines with sustainable synthetic fuels, aiming to offer retrofitting solutions or new engine designs.

- Carbon Capture Integration: Investigating the potential for integrating carbon capture technologies with existing and future propulsion systems for specific industrial applications.

Cummins India's Battery Electric Vehicle (BEV) systems and hydrogen fuel cell solutions are both positioned as Question Marks. This means they operate in high-growth markets but currently hold a low market share, necessitating significant investment to gain traction.

BCG Matrix Data Sources

Our Cummins India BCG Matrix is built on comprehensive market data, encompassing financial disclosures, industry growth forecasts, competitor analysis, and internal sales performance reports to provide strategic clarity.