Cummins India Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cummins India Bundle

Cummins India navigates a complex landscape shaped by powerful buyer bargaining, particularly from large automotive and industrial clients. The threat of new entrants is moderated by high capital requirements and established brand loyalty. While the availability of substitute products exists, the specialized nature of Cummins' engines often limits direct replacements.

The bargaining power of suppliers is a significant factor, as specialized components and raw materials can influence production costs. Rivalry among existing competitors, including both global players and emerging domestic manufacturers, intensifies price pressures and demands for innovation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cummins India’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Cummins India heavily depends on specialized components and raw materials for its engine and genset production. A concentrated supplier base for these critical inputs grants suppliers substantial leverage. This means a few key suppliers can dictate terms, potentially driving up raw material costs for Cummins India.

In 2023, the global automotive components market saw significant price volatility, with some specialized material costs increasing by up to 15% due to supply chain constraints and demand surges. This situation directly impacts manufacturers like Cummins India, who source these essential parts. A limited number of suppliers for these specialized materials exacerbates this issue.

When suppliers are few and their products are essential, Cummins India's ability to negotiate favorable pricing or terms is diminished. This concentration can create vulnerabilities, making the company susceptible to supply chain disruptions and unexpected price increases, thereby affecting its overall profitability and operational efficiency.

The bargaining power of suppliers for Cummins India is significantly influenced by the high switching costs associated with specialized engine components. Re-tooling production lines and re-certifying new parts from alternative suppliers can represent a considerable financial and time investment. For instance, developing and validating a new fuel injection system might take over a year and cost upwards of several million dollars, a substantial barrier for Cummins India.

This complexity grants existing, trusted suppliers a stronger negotiating position. Cummins India faces a situation where the effort and expense required to onboard a new supplier for critical engine parts are substantial. This inherent inertia in changing its supply chain for specialized components directly enhances the leverage held by its current vendors, making supplier price increases or unfavorable terms harder to resist.

Suppliers offering unique or highly differentiated components, intellectual property, or advanced technologies critical to Cummins India's product performance hold greater bargaining power. For instance, if a supplier provides a proprietary engine control unit or a specialized emission after-treatment system that is integral to Cummins India meeting stringent BS VI emission norms, their leverage increases significantly. This is particularly relevant as Cummins India, a leader in engine technology, relies on cutting-edge solutions to maintain its competitive edge and comply with evolving environmental regulations.

If these specialized inputs are not easily replicable or offer demonstrably superior performance characteristics, Cummins India may find its alternatives limited, thereby amplifying supplier influence. The company's commitment to developing advanced and emission-compliant solutions necessitates access to these specialized inputs, making the differentiation of supplier offerings a key determinant of their bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into engine or power solution manufacturing significantly bolsters their bargaining power against Cummins India. If suppliers possess the capability and motivation to produce these core products themselves, they can dictate more stringent terms or even pose a direct competitive threat, forcing Cummins India to concede on pricing or other favorable contract conditions.

While the likelihood of suppliers integrating forward into the production of complete engines is relatively low due to the complexity and capital investment involved, the risk becomes more pertinent for specific sub-assemblies or critical components. This strategic leverage allows suppliers to negotiate better terms knowing Cummins India relies on their specialized inputs.

For instance, consider the market for advanced electronic control modules, a critical component in modern engines. If a key supplier of these modules were to develop the capacity and strategy to offer integrated power solutions directly to Cummins India's end customers, this would drastically alter the power dynamic. In 2024, the global market for engine control units saw significant consolidation, potentially increasing the forward integration capabilities of remaining key players.

- Supplier Capability: Suppliers' technical expertise and investment in manufacturing capabilities for engine components directly influence their potential for forward integration.

- Market Incentives: If suppliers perceive higher margins or greater market share by producing finished power solutions, their incentive to integrate forward increases.

- Component Criticality: The more critical a component is to Cummins India's product performance and differentiation, the greater the supplier's leverage if they can integrate forward.

- Competitive Landscape: The overall competitive intensity within the supplier base can either deter or encourage forward integration strategies.

Importance of Supplier's Input to Cummins India's Cost Structure

The significance of a supplier's input to Cummins India's cost structure directly correlates with their bargaining power. When a supplier's materials or components represent a substantial portion of Cummins India's production expenses, that supplier gains considerable leverage. For instance, in 2023, raw materials and components constituted a significant percentage of Cummins India's total cost of goods sold, making them highly sensitive to supplier pricing.

Fluctuations in the prices of essential inputs, such as specialized alloys or advanced electronic components, directly impact Cummins India's profitability. Suppliers of these critical materials, therefore, possess substantial power to influence pricing and terms. This leverage means Cummins India must carefully manage its procurement strategies to mitigate the financial impact of these price shifts.

Effectively managing these input costs is paramount for Cummins India's overall financial health and competitive positioning. The company's ability to negotiate favorable terms with suppliers of high-cost materials directly influences its margins and its capacity to offer competitive pricing to its customers.

- High Input Cost Dependency: Suppliers of critical components like engine blocks or fuel injection systems hold significant power due to their integral role in Cummins India's product manufacturing.

- Raw Material Price Volatility: Increases in prices for metals such as steel and aluminum, which are key inputs for engine manufacturing, directly enhance supplier bargaining power. For example, global commodity price surges in 2023 put upward pressure on these inputs for Cummins India.

- Impact on Profitability: A 1% increase in the cost of key raw materials could lead to a noticeable reduction in Cummins India's operating profit margin, underscoring the financial consequence of supplier pricing decisions.

- Strategic Sourcing Importance: Cummins India's financial performance hinges on its ability to secure these vital inputs at competitive prices, making supplier relationship management a critical strategic imperative.

Suppliers of specialized components for Cummins India's engines and gensets wield considerable power due to the concentrated nature of the market and the critical role of their products. This leverage is amplified by high switching costs, the uniqueness of their offerings, and the potential for forward integration, all of which can significantly impact Cummins India's operational costs and strategic flexibility. In 2023, the cost of specialized automotive components saw increases of up to 15% globally, a trend that directly affects manufacturers like Cummins India with limited alternative suppliers for essential inputs.

| Factor | Impact on Cummins India | 2023-2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Limited suppliers for critical inputs grant them pricing power. | Global automotive components market experienced supply chain constraints and demand surges. |

| Switching Costs | High costs for re-tooling and re-certifying new suppliers for specialized parts. | Developing new fuel injection systems can take over a year and cost millions. |

| Product Differentiation | Proprietary or advanced technology components increase supplier leverage. | Cummins India relies on specialized inputs for BS VI emission compliance. |

| Forward Integration Threat | Suppliers producing finished power solutions pose a competitive risk. | Consolidation in engine control unit market in 2024 could increase this threat. |

| Input Cost Significance | Suppliers of high-cost materials significantly influence Cummins India's margins. | Raw materials constituted a significant portion of Cummins India's cost of goods sold in 2023. |

What is included in the product

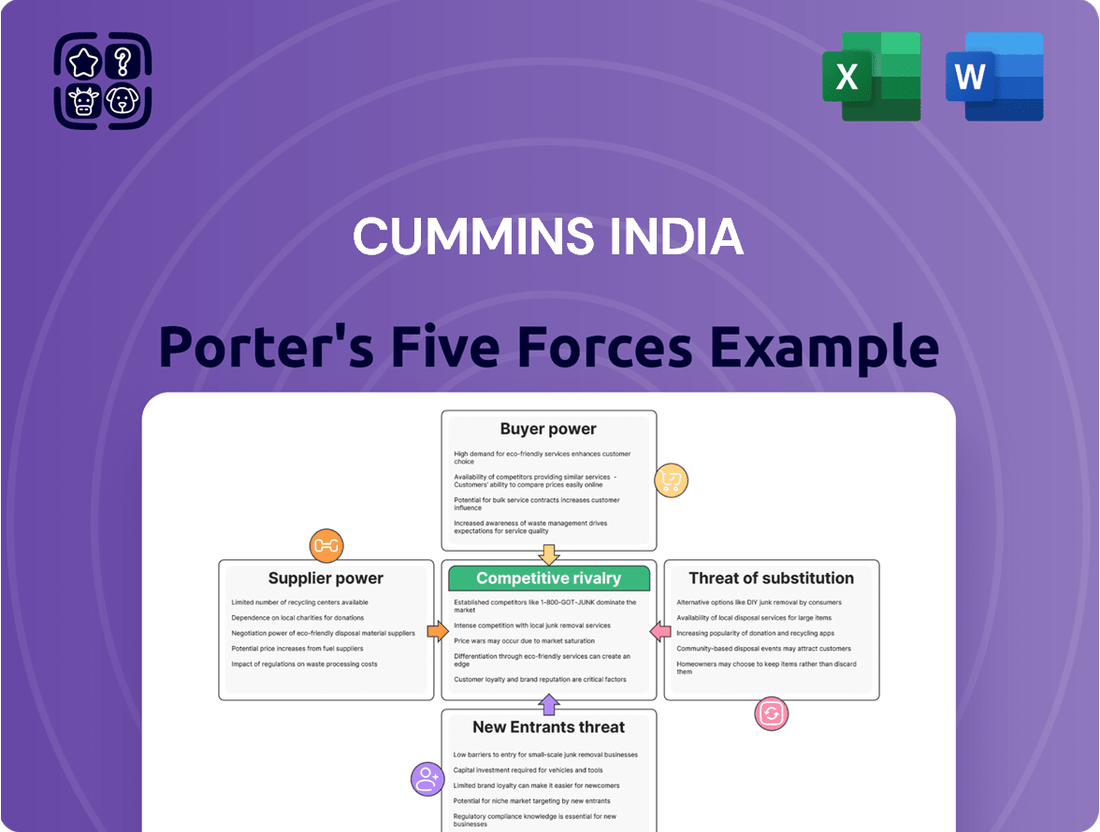

This Porter's Five Forces analysis specifically examines the competitive landscape for Cummins India, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

A simplified framework to identify and mitigate competitive threats, allowing Cummins India to proactively address market pressures.

Customers Bargaining Power

Cummins India's diverse customer base, spanning automotive, industrial, power generation, and infrastructure sectors, contributes to market fragmentation. This means no single customer segment dominates, diluting individual customer bargaining power.

However, significant players within these sectors, such as large fleet operators in the automotive industry or major developers in infrastructure projects, can wield considerable influence. For instance, a large fleet operator purchasing hundreds of engines at once can negotiate more favorable terms than a small, one-off buyer.

In 2023, Cummins India reported strong revenue growth, driven by demand across multiple segments. While specific customer volume data isn't publicly detailed, the broad distribution of their sales across various industries underscores the varied bargaining power dynamics at play.

Customer price sensitivity is a significant factor for Cummins India, particularly in competitive segments. When customers have many choices for engines and gensets, or when these products represent a large portion of their overall project expenses, they tend to focus more on price. This is especially true for standardized offerings where differentiation is minimal.

Cummins India's pricing power is directly linked to the unique value it offers. Customers are willing to pay more if they perceive Cummins' engines and gensets as superior in terms of reliability, fuel efficiency, and advanced technology. In 2023, the Indian genset market saw robust growth, with demand driven by infrastructure development and the need for reliable power backup, providing Cummins opportunities to leverage its brand reputation.

The availability of alternative engine manufacturers and burgeoning electric or hybrid power solutions significantly amplifies customer bargaining power in India's commercial vehicle and power generation sectors. For instance, the growing market for electric buses, with players like Tata Motors and Olectra Green Tech, offers fleet operators an alternative to traditional diesel engines, directly impacting Cummins India's pricing flexibility. Customers can readily switch to these greener or potentially lower-cost alternatives if Cummins India's product offerings and pricing are not perceived as competitive in the evolving market landscape.

Customer's Ability to Integrate Backward

The bargaining power of customers is influenced by their ability to integrate backward, meaning they could potentially produce the goods or services themselves. While for a complex business like engine manufacturing, it's highly improbable for most clients to undertake full-scale backward integration, very substantial customers might explore this for simpler, routine maintenance or specific less intricate components. This strategic consideration, even if theoretical, grants them leverage during price and service negotiations with Cummins India, as it presents an alternative, albeit costly, path to fulfilling their needs.

For instance, a major fleet operator, if facing persistently high service costs from Cummins India, might investigate establishing its own in-house repair workshops for basic engine upkeep or sourcing generic replacement parts from third parties. Such a move, while not replacing the need for Cummins India's advanced engine technology, could chip away at their service revenue streams. This potential threat of customers taking some operations in-house, even for a small portion of their needs, acts as a check on Cummins India’s pricing power and service level agreements.

The financial implications for Cummins India are significant. If a large customer were to successfully implement even partial backward integration, it would directly reduce the revenue generated from that customer, impacting overall sales figures. For example, if a major client were to handle 15% of its maintenance needs internally, that would represent a direct loss of service revenue for Cummins India, which typically relies on a substantial portion of its income from aftermarket services and parts. This scenario underscores the importance of competitive pricing and superior service to deter such customer actions.

- Customer Leverage: Large customers may consider in-house maintenance for simpler components, reducing reliance on Cummins India's full service.

- Strategic Consideration: The possibility of backward integration, however remote, influences customer negotiation power.

- Revenue Impact: Even partial in-house operations by major clients can lead to direct losses in service and parts revenue for Cummins India.

- Competitive Pressure: This potential threat necessitates competitive pricing and high-quality service from Cummins India to retain customers.

Importance of Cummins India's Product to Customer's Business

Cummins India’s products are critical for many of its customers' operations. For instance, in sectors demanding uninterrupted power, like data centers and vital infrastructure projects, the need for reliability outweighs price considerations. This dependency significantly limits customers' ability to negotiate lower prices, as product performance and uptime are paramount.

Cummins India's strong brand reputation for dependable engines and power solutions in these critical applications further solidifies its position. Customers in these segments prioritize a proven track record of minimal downtime, making them less sensitive to price fluctuations and thus reducing their bargaining power.

- Critical Applications Drive Low Price Sensitivity: For data centers and essential services, the cost of a power outage far exceeds the cost of reliable equipment, diminishing customer price leverage.

- Reputation as a Bargaining Deterrent: Cummins India's established reliability reduces the perceived risk for customers, making them less likely to switch suppliers based on price alone.

- Focus on Total Cost of Ownership: Customers in critical sectors often evaluate suppliers based on the total cost of ownership, including maintenance, fuel efficiency, and uptime, rather than just the initial purchase price.

The bargaining power of customers for Cummins India is a mixed bag, influenced by customer size, price sensitivity, and the criticality of Cummins' products to their operations. While fragmentation across sectors limits individual power, large buyers can negotiate better terms. Customer price sensitivity increases when alternatives are readily available, such as in the growing electric vehicle market, which directly impacts Cummins India's pricing flexibility. Conversely, in critical applications like data centers, where reliability is paramount, customers have significantly less price leverage, relying more on total cost of ownership and Cummins' strong reputation.

| Factor | Impact on Cummins India | Supporting Data/Example |

| Customer Size & Fragmentation | Dilutes individual power, but large buyers have leverage. | Large fleet operators can negotiate better terms than small buyers. |

| Price Sensitivity | High when alternatives exist and products are standardized. | Growth of electric bus market offers alternatives to diesel engines. |

| Criticality of Product | Low price sensitivity when reliability is paramount. | Data centers and infrastructure projects prioritize uptime over initial cost. |

| Brand Reputation | Reduces bargaining power by offering perceived reliability. | Cummins' established track record minimizes perceived risk for customers. |

Full Version Awaits

Cummins India Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Cummins India's Porter's Five Forces Analysis, examining the intense rivalry among existing competitors, the significant threat of new entrants due to high capital requirements and established brand loyalty, and the substantial bargaining power of buyers, particularly large fleet operators. Furthermore, the analysis highlights the moderate threat of substitute products and the considerable bargaining power of suppliers, especially for specialized components and raw materials, all presented in a fully formatted and ready-to-use format.

Rivalry Among Competitors

Cummins India operates in a highly competitive Indian market for diesel and natural gas engines and power solutions. The presence of numerous domestic and international players intensifies this rivalry, demanding constant innovation and efficiency.

Key competitors include Kirloskar Oil Engines, a significant domestic player with a strong presence in agricultural and industrial sectors. Ashok Leyland is another major rival, particularly in the automotive engine segment.

Globally recognized brands like Caterpillar and Volvo also vie for market share in India, especially in the industrial and construction equipment engine categories. This broad spectrum of competitors underscores the challenging landscape Cummins India navigates.

While India's economy is experiencing robust growth and significant infrastructure development, the traditional diesel engine market's overall growth rate may be experiencing a slowdown. This moderation is largely attributed to a growing emphasis on cleaner energy alternatives and stricter emission norms being implemented across various sectors. For instance, in 2023, the automotive sector, a major consumer of diesel engines, saw shifts driven by electric vehicle adoption, impacting traditional engine demand.

Cummins India stands out by offering technologically advanced products, including gensets that meet stringent CPCB IV+ emission norms. This focus on cleaner technology is a significant differentiator.

Their commitment to continuous innovation, particularly in areas like fuel efficiency and the exploration of alternative fuels, helps them maintain a competitive advantage. This innovation directly reduces the pressure for intense price-based competition.

A robust and widespread service network is another key differentiator, ensuring customer support and minimizing downtime. This strengthens their market position against rivals who may not have such extensive after-sales capabilities.

By investing in digital solutions and advanced engine technologies, Cummins India actively manages its competitive rivalry, moving beyond simple price wars to offer superior value and performance to its customers.

High Fixed Costs and Exit Barriers

The engine manufacturing sector, particularly for heavy-duty applications like those Cummins India serves, is inherently capital-intensive. Significant investments are required for research and development, sophisticated manufacturing plants, and extensive distribution and service networks. For instance, in 2023, the global capital expenditure in the automotive sector, which includes engine manufacturing, saw substantial investment as companies geared up for new technology adoption and capacity expansion.

These substantial upfront investments translate into high fixed costs. Once these facilities and R&D capabilities are established, companies face considerable challenges in exiting the market. The specialized nature of the equipment and the long-term commitments involved mean that selling off assets or redeploying capital elsewhere is often difficult and comes with significant losses. This creates high exit barriers.

Consequently, companies within the engine manufacturing industry, including players like Cummins India, are strongly incentivized to remain competitive and retain their market share. Rather than withdrawing, they are more inclined to engage in aggressive competition to secure revenue streams and cover their fixed costs. This dynamic directly intensifies the rivalry among existing players.

- High Capital Intensity: Engine manufacturing demands significant investment in R&D and advanced production facilities.

- Substantial Fixed Costs: Once established, operational fixed costs related to plants and networks are considerable.

- Elevated Exit Barriers: The specialized nature of assets makes it costly and difficult to leave the industry.

- Intensified Rivalry: Companies are compelled to compete fiercely to maintain market presence and cover fixed expenses.

Strategic Stakes and Global Parentage

Cummins India’s competitive rivalry is significantly shaped by its parent company, Cummins Inc. This global backing provides access to cutting-edge technology, robust research and development capabilities, and established global operational standards. These advantages position Cummins India favorably against competitors solely operating within the domestic market.

The strategic advantage derived from Cummins Inc. enables substantial investments in emerging technologies. For instance, Cummins Inc. is actively involved in developing solutions for hydrogen fuel cells and battery energy storage systems, areas where Cummins India can leverage this global expertise. In 2024, Cummins Inc. announced significant investments in electrification and hydrogen technologies, underscoring this commitment.

- Global R&D Leverage: Cummins India benefits from Cummins Inc.'s global R&D spending, which totaled approximately $1 billion in 2023, fueling innovation in areas like advanced diesel, natural gas, and new energy powertrains.

- Technological Transfer: The parent company facilitates the transfer of advanced technologies, including those related to emissions control and powertrain efficiency, enhancing Cummins India's product offerings.

- Strategic Investments: Cummins Inc.'s focus on future technologies, such as its commitment to investing over $500 million in battery electric and hydrogen fuel cell technologies through 2027, directly supports Cummins India's strategic positioning.

- Competitive Edge: This global technological and financial support creates a significant competitive moat, allowing Cummins India to compete effectively with both established and emerging players in the Indian automotive and power solutions market.

Competitive rivalry within Cummins India's market is intense, driven by a mix of strong domestic players like Kirloskar Oil Engines and Ashok Leyland, alongside global giants such as Caterpillar and Volvo. This dynamic forces Cummins India to continually innovate and optimize its operations to maintain its market position.

The company differentiates itself through technologically advanced products, including gensets compliant with stringent CPCB IV+ emission standards, and a focus on fuel efficiency and alternative fuels. Furthermore, its extensive service network provides a crucial advantage, ensuring superior customer support and minimizing operational downtime.

Cummins India leverages its parent company, Cummins Inc.'s, global R&D, which saw investments of approximately $1 billion in 2023, to drive innovation in advanced powertrains and new energy solutions. This global technological and financial backing creates a significant competitive moat, enabling Cummins India to effectively compete.

The engine manufacturing sector is capital-intensive, with high fixed costs and elevated exit barriers. This compels companies like Cummins India to compete aggressively to retain market share and cover their substantial investments in R&D and manufacturing facilities.

SSubstitutes Threaten

The most substantial threat of substitution for Cummins India arises from the accelerating adoption of renewable energy solutions, particularly solar and wind power. These alternatives are increasingly viable for power generation, directly challenging the market for traditional diesel gensets.

India's ambitious goal to achieve 500 GW of renewable energy capacity by 2030 presents a significant headwind. This expansion in renewables directly reduces the reliance on and demand for conventional power generation equipment where Cummins India is a major player.

For instance, in the fiscal year 2023-24, India added over 16 GW of renewable energy capacity, showcasing the rapid shift. This trend implies a shrinking addressable market for Cummins India's traditional offerings in the long run.

The increasing sophistication and affordability of Battery Energy Storage Systems (BESS) present a significant threat of substitution for traditional diesel generator sets, a core product for Cummins India. As BESS technology matures, its capacity for reliable backup power and grid stabilization is improving, directly challenging the market share of generators. For instance, by the end of 2023, the global BESS market was projected to reach over $150 billion, with significant growth driven by declining battery costs.

Cummins India is actively addressing this threat by diversifying its portfolio to include its own BESS offerings, such as the recently launched distributed energy storage solutions. This strategic move acknowledges that BESS can serve as a viable alternative for applications ranging from industrial backup power to renewable energy integration, potentially impacting the demand for diesel-powered solutions. The ongoing advancements in energy density and charging speeds further enhance the attractiveness of BESS as a substitute.

The automotive and industrial sectors are witnessing a significant shift towards electric vehicles (EVs) and alternative fuels like hydrogen and natural gas. This trend directly challenges the dominance of traditional diesel engines, especially in on-highway and light-duty applications.

Cummins, recognizing this evolving landscape, is actively investing in hydrogen fuel cell technology. For instance, in 2023, the company announced a significant investment in its Fridley, Minnesota facility to produce fuel cell stacks and systems, underscoring its commitment to this alternative propulsion technology.

The increasing adoption of EVs and alternative fuels represents a substantial threat of substitution for Cummins, as these technologies can replace the internal combustion engine (ICE) products that have historically formed the core of its business.

Government Policies and Emission Regulations

Government policies significantly influence the threat of substitutes for Cummins India. Stricter emission norms, such as the Central Pollution Control Board (CPCB) Phase IV+ standards, directly push industries towards cleaner alternatives. For instance, by 2025, India aims to have 40% of its commercial vehicles equipped with advanced emission control systems, increasing the appeal of technologies that go beyond traditional diesel engines.

Government incentives also play a crucial role. Subsidies for electric vehicles (EVs) and renewable energy projects make substitutes like electric powertrains and hydrogen fuel cells more economically viable. India's National Green Hydrogen Mission, with an outlay of INR 19,744 crore, aims to make the country a global hub for green hydrogen production, directly impacting the demand for hydrogen-powered engines.

These policy shifts accelerate the adoption of alternatives to conventional fossil fuel engines.

- Emission Norms: CPCB IV+ standards mandate reduced particulate matter and NOx emissions, making advanced after-treatment systems a necessity for diesel engines, thus increasing the relative cost and complexity.

- EV Adoption: Government targets for EV penetration, such as the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) scheme, directly promote electric powertrains as substitutes.

- Green Hydrogen: Policies supporting green hydrogen infrastructure and applications create a viable alternative for heavy-duty transportation and industrial power.

- Renewable Energy Integration: Incentives for solar and wind power can indirectly reduce reliance on diesel generators for backup power, a segment where Cummins operates.

Customer Preference for Cleaner Technologies

Customer preference for cleaner technologies presents a significant threat of substitutes for traditional engine manufacturers like Cummins India. Growing environmental consciousness and stringent regulatory frameworks are accelerating the adoption of alternative power sources. For instance, by 2024, the global electric vehicle market is projected to reach over $800 billion, indicating a strong shift away from internal combustion engines.

This trend is further amplified by corporate sustainability mandates aiming for net-zero emissions. Even where traditional engines currently hold a cost advantage, the long-term operational and reputational benefits of cleaner alternatives are increasingly outweighing initial price differences. The demand for solutions aligning with these net-zero targets makes substitutes more appealing.

- Growing Demand for Electric and Hybrid Powertrains: As of early 2024, major automotive manufacturers are heavily investing in and launching a wider range of electric and hybrid vehicle models, directly impacting the market for diesel and gasoline engines.

- Government Incentives and Subsidies: Many governments worldwide, including India, are offering substantial incentives for the adoption of electric vehicles and renewable energy sources, making these substitutes more economically viable.

- Advancements in Battery Technology: Continuous improvements in battery energy density and charging infrastructure are reducing range anxiety and improving the practicality of electric power, further challenging traditional engine dominance.

- Hydrogen Fuel Cell Technology: While still in its nascent stages for many applications, hydrogen fuel cell technology is gaining traction as a zero-emission alternative, particularly for heavy-duty transportation and stationary power generation.

The escalating adoption of renewable energy sources like solar and wind power poses a significant threat, directly competing with Cummins India's core business of diesel generator sets. India's commitment to achieving 500 GW of renewable energy capacity by 2030 underscores this challenge, as it inherently reduces the need for conventional power generation equipment. For instance, the addition of over 16 GW of renewable energy capacity in fiscal year 2023-24 highlights the rapid transition away from fossil fuel-based solutions.

Battery Energy Storage Systems (BESS) are emerging as a strong substitute for diesel generators, especially for backup power and grid stabilization. The global BESS market, projected to exceed $150 billion by the end of 2023, is driven by decreasing battery costs. Cummins itself is investing in BESS solutions, acknowledging its potential to displace diesel-powered alternatives.

The automotive and industrial sectors are increasingly embracing electric vehicles (EVs) and alternative fuels like hydrogen and natural gas, directly challenging traditional diesel engines. Cummins' strategic investments in hydrogen fuel cell technology, such as its Fridley facility expansion in 2023, reflect its response to this disruptive trend.

Government policies, including stricter emission norms and incentives for EVs and green hydrogen, accelerate the shift towards cleaner substitutes. For example, India's National Green Hydrogen Mission, with an outlay of INR 19,744 crore, aims to foster hydrogen-based solutions, impacting the demand for conventional engines.

Entrants Threaten

Entering Cummins India's competitive landscape, particularly in engine manufacturing and power solutions, demands a formidable initial capital outlay. New entrants must secure significant funding for cutting-edge research and development, state-of-the-art manufacturing plants, and specialized, high-precision machinery. Establishing a robust distribution network and a comprehensive after-sales service infrastructure further inflates these entry costs.

Cummins India benefits significantly from its established brand reputation, cultivated over more than six decades of operation. This deep-seated trust, built on a foundation of reliability and superior performance, presents a substantial barrier to new entrants. Customers across various segments, from heavy-duty trucking to power generation, have come to rely on the Cummins name, making it difficult for newcomers to replicate this level of confidence and loyalty.

Cummins India, along with its parent company Cummins Inc., possesses a substantial portfolio of proprietary technology and patents. These intellectual assets cover critical areas such as advanced engine designs, sophisticated emission control systems, and innovative power generation solutions. This technological advantage acts as a significant barrier to entry for potential new competitors.

New entrants would face the daunting task of either replicating Cummins' extensive R&D investment or securing licenses for its established technologies. For instance, Cummins has been a leader in developing advanced diesel engine technologies that meet stringent emission norms. Their commitment to innovation is evident in their continued investment in R&D, which stood at approximately $855 million globally in 2023, underscoring the high cost and time required to develop comparable capabilities.

Access to Distribution Channels and Service Network

Cummins India's formidable distribution and aftermarket service network presents a significant barrier to new entrants. This established infrastructure, crucial for ensuring customer support and minimizing downtime, represents a substantial investment and operational hurdle for any competitor aiming to enter the Indian market. For instance, Cummins India has over 200 dealership locations across the country, offering sales, service, and genuine parts, a scale that is difficult and costly for newcomers to match quickly.

Replicating Cummins India's extensive reach and service capabilities would require immense capital outlay and a considerable timeframe. New entrants would struggle to build a comparable network of dealerships, service centers, and spare parts depots that can efficiently cover the vast geographical spread of India. This difficulty in establishing a reliable service footprint directly impacts customer confidence and the ability to compete effectively on after-sales support, a key differentiator in the heavy-duty equipment market.

- Extensive Network: Cummins India operates a widespread network of over 200 dealership locations nationwide.

- Aftermarket Service: This network is vital for providing comprehensive after-sales support, including service and genuine parts.

- High Entry Barrier: Replicating this established and efficient service infrastructure poses a significant challenge and cost for new market entrants.

- Customer Uptime: The network's effectiveness directly contributes to ensuring customer equipment uptime, a critical factor in the industry.

Regulatory Hurdles and Compliance Costs

The Indian engine manufacturing sector faces significant regulatory barriers for new entrants. For instance, the Central Pollution Control Board (CPCB) mandates increasingly stringent emission standards, with CPCB IV+ being a current benchmark for heavy-duty engines.

Meeting these complex and evolving regulations demands substantial investment in research and development, as well as advanced manufacturing processes. This directly increases the cost and complexity of market entry for any new player.

- Stringent Emission Standards: CPCB IV+ requirements necessitate advanced technology, adding to initial capital outlay.

- R&D Investment: New entrants must invest heavily in developing compliant engine technologies, potentially costing millions.

- Manufacturing Upgrades: Existing or new manufacturing facilities need substantial upgrades to meet production quality and emission control standards.

- Compliance Costs: Ongoing costs for testing, certification, and adherence to evolving regulations present a continuous financial burden.

The threat of new entrants in Cummins India's market, particularly in advanced engine and power solutions, is significantly mitigated by the substantial capital required. This includes massive investments in R&D, state-of-the-art manufacturing, and extensive distribution networks, making it a high-cost industry. For example, Cummins’ global R&D spending was approximately $855 million in 2023, illustrating the scale of investment needed to compete.

Cummins India's established brand loyalty, built over decades, acts as a powerful deterrent. Customers trust Cummins for reliability, a reputation difficult and time-consuming for newcomers to build. Furthermore, Cummins possesses a robust portfolio of proprietary technologies and patents in areas like emission control and engine design, creating a significant technological barrier.

The regulatory landscape, specifically stringent emission standards like CPCB IV+, imposes considerable costs on new entrants for R&D and manufacturing compliance. Replicating Cummins India's extensive aftermarket service network, with over 200 dealerships, also demands immense capital and time, further discouraging new competition.

| Barrier Type | Description | Estimated Cost/Impact for New Entrants |

|---|---|---|

| Capital Requirements | R&D, manufacturing facilities, machinery | Hundreds of millions USD |

| Brand Reputation | Customer trust and loyalty | Years to build, significant marketing investment |

| Proprietary Technology | Patents, advanced engine designs | Licensing fees or costly replication |

| Distribution & Service Network | Over 200 dealerships in India | Massive capital outlay and time investment |

| Regulatory Compliance | CPCB IV+ emission standards | Millions in R&D and manufacturing upgrades |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cummins India is built upon a foundation of publicly available data, including annual reports, investor presentations, and press releases from Cummins India and its key competitors. We also leverage industry-specific reports from reputable market research firms and economic data from government and financial databases to capture the broader market landscape.