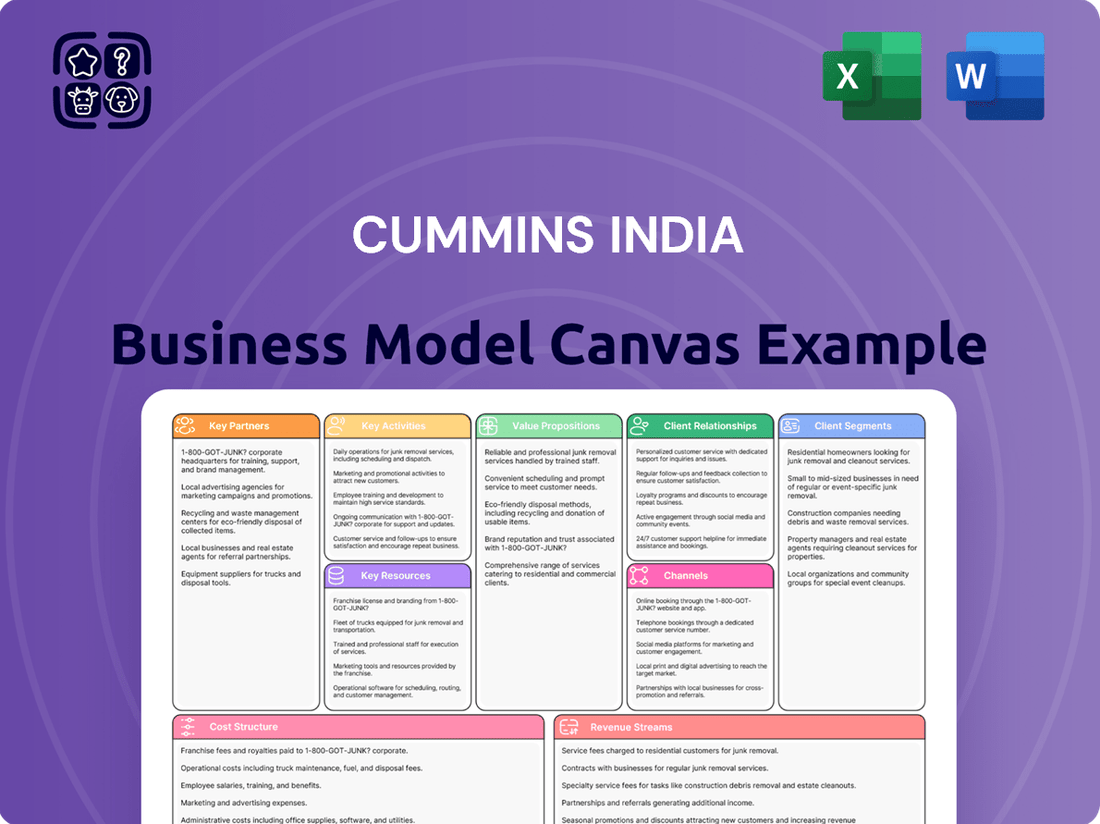

Cummins India Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cummins India Bundle

Unlock the strategic blueprint of Cummins India's thriving business. This comprehensive Business Model Canvas meticulously details their customer segments, value propositions, and key partnerships, offering a clear view of their operational excellence.

Discover how Cummins India innovates and captures market share through its revenue streams and cost structure. This in-depth canvas is your key to understanding their competitive advantage and growth drivers.

Ready to gain actionable insights from a global leader? Download the full Cummins India Business Model Canvas to see how they build and deliver value, perfect for strategic planning and competitive analysis.

Partnerships

Cummins India actively collaborates with Original Equipment Manufacturers (OEMs) across critical sectors like automotive, industrial machinery, and power generation. These partnerships are fundamental, as Cummins provides its advanced engines and power solutions that become integral components within the OEMs' finished goods.

For instance, in the automotive sector, Cummins India supplies engines for commercial vehicles manufactured by major players. This strategic alignment allows Cummins to benefit from the OEMs' established distribution networks and brand recognition, thereby expanding its market presence significantly.

In 2024, Cummins India reported a substantial portion of its revenue stemming from these OEM relationships, underscoring their importance to its business model. The integration of Cummins' technology into a wide array of OEM products, from tractors to large-scale generators, ensures consistent demand and deep market penetration.

Cummins India actively collaborates with leading technology providers and prestigious research institutions to drive innovation in advanced power solutions. These partnerships are fundamental to their strategy of developing next-generation, low- and zero-emission propulsion technologies. For instance, collaborations are in place for developing the infrastructure and technology required for green hydrogen production and utilization.

These strategic alliances allow Cummins India to leverage external expertise and cutting-edge research, ensuring they remain at the forefront of sustainable energy advancements. By fostering these relationships, the company can accelerate the development and deployment of cleaner, more efficient power systems, aligning with global decarbonization efforts and India's own clean energy goals.

Cummins India relies on a strong network of authorized distributors, dealers, and service centers. This network is crucial for effectively selling, delivering, and providing essential after-sales support for their extensive range of engines and power systems. These partners are the backbone of their market penetration, ensuring products reach customers across India’s diverse geography.

These partnerships are fundamental to Cummins' ability to offer localized support and timely maintenance, a key differentiator in the competitive Indian market. For instance, in the fiscal year 2023, Cummins India reported robust revenue growth, underscoring the effectiveness of its widespread distribution and service infrastructure in meeting customer demands and ensuring operational uptime for their equipment.

Suppliers of Raw Materials and Components

Cummins India's operational backbone relies heavily on its suppliers for essential raw materials, crucial components, and vital sub-assemblies. These strategic relationships are not just transactional; they are foundational to ensuring the high quality and efficiency of Cummins India's manufacturing processes. For instance, a consistent supply of specialized steel alloys and high-precision engine parts directly impacts the durability and performance of their diesel engines.

Maintaining robust and reliable supply chains is paramount for Cummins India. This ensures uninterrupted production schedules, which is critical for meeting customer demand and managing production costs effectively. In 2023, Cummins India reported a significant portion of its cost of goods sold attributed to procured materials, underscoring the financial impact of these supplier partnerships.

- Strategic Sourcing: Cummins India actively cultivates long-term partnerships with suppliers who demonstrate consistent quality and adherence to stringent specifications.

- Supply Chain Resilience: The company focuses on diversifying its supplier base for critical inputs to mitigate risks associated with single-source dependencies.

- Cost Optimization: Collaborative efforts with suppliers aim to drive down costs through efficient production methods and bulk purchasing agreements.

- Innovation Collaboration: In some cases, partnerships extend to joint development of new materials or components to enhance product performance and sustainability.

Government and Industry Associations

Cummins India actively engages with government bodies and industry associations to ensure compliance and shape the regulatory environment. This collaboration is crucial for navigating evolving emission standards, such as the upcoming CPCB IV+ norms, ensuring their products remain compliant and competitive. For instance, the company's participation in industry forums allows them to provide input on future environmental regulations, fostering a more predictable business landscape.

These partnerships also facilitate Cummins India's alignment with national development objectives and initiatives. By working with associations like the Confederation of Indian Industry (CII) and the Automotive Research Association of India (ARAI), Cummins can contribute to broader goals, such as promoting sustainable manufacturing and technological advancement within the Indian automotive sector. Their involvement in these groups helps drive industry best practices and foster innovation.

- Regulatory Navigation: Cummins India works with government agencies to understand and comply with regulations, including upcoming CPCB IV+ emission standards.

- Policy Influence: Engagement with industry associations provides a platform to influence policies related to emissions, manufacturing, and technological development.

- Industry Initiatives: Participation in industry-wide programs helps Cummins India contribute to and benefit from collective efforts in areas like sustainability and technological advancement.

- National Alignment: Partnerships ensure Cummins India's operations and strategies are aligned with national development goals and priorities.

Cummins India's key partnerships are vital for its market reach and technological advancement. Collaborations with Original Equipment Manufacturers (OEMs) are critical, with significant revenue in 2024 generated through these relationships, integrating Cummins' engines into vehicles and machinery. The company also partners with technology providers and research institutions to develop next-generation, low- and zero-emission propulsion systems, including efforts in green hydrogen technology.

A robust network of distributors and dealers ensures widespread product availability and after-sales support, contributing to strong revenue growth observed in fiscal year 2023. Furthermore, strategic supplier relationships are foundational for maintaining manufacturing quality and cost efficiency, with procured materials representing a substantial portion of the cost of goods sold in 2023.

| Partnership Type | Key Collaborators | Strategic Importance | 2023/2024 Impact Highlight |

|---|---|---|---|

| OEMs | Automotive, Industrial Machinery, Power Generation manufacturers | Market penetration, product integration, brand leverage | Significant portion of 2024 revenue derived from OEM relationships |

| Technology & Research | Leading tech firms, research institutions | Innovation in low/zero-emission tech, future propulsion systems | Accelerated development of sustainable energy solutions |

| Distribution & Service | Authorized distributors, dealers, service centers | Market reach, after-sales support, customer service | Contributed to robust revenue growth in FY23 |

| Suppliers | Raw material and component providers | Manufacturing quality, cost efficiency, supply chain resilience | Procured materials formed a significant part of COGS in 2023 |

What is included in the product

This Business Model Canvas for Cummins India outlines its strategy for serving diverse customer segments in the automotive and industrial sectors through extensive distribution and service networks, delivering reliable power solutions.

The Cummins India Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot that streamlines complex operational challenges into actionable segments.

It offers a structured approach to address market complexities and optimize resource allocation, effectively alleviating the pain of inefficient business strategy development.

Activities

Cummins India's commitment to Research and Development is a cornerstone of its strategy, driving innovation in engine technology and power solutions. In 2024, the company continued its focus on developing more fuel-efficient and low-emission engines, a critical area given evolving environmental regulations and market demands.

A significant portion of their R&D investment is directed towards exploring and integrating alternative fuel technologies. This includes substantial efforts in hydrogen-powered engines, a key area for future growth and sustainability in the commercial vehicle and power generation sectors.

The company actively works on developing advanced components that enhance engine performance, durability, and emissions control. This ongoing refinement ensures their product portfolio remains competitive and meets the stringent requirements of various industries in India and globally.

Cummins India's R&D efforts are not just about creating new products but also about improving existing ones to meet the dynamic needs of their customer base, ensuring they remain at the forefront of power technology.

Cummins India's core activities revolve around the meticulous manufacturing and assembly of a diverse product portfolio, including diesel and natural gas engines, power generation equipment, and essential aftermarket parts. This intricate process demands high levels of precision engineering and stringent quality control measures implemented across their state-of-the-art manufacturing facilities.

The company's commitment to operational excellence is evident in its efficient production workflows, designed to optimize output and maintain product integrity. In fiscal year 2023, Cummins India reported a robust revenue of INR 8,407 crore, underscoring the scale and effectiveness of its manufacturing operations.

Cummins India's sales and marketing efforts focus on reaching a broad customer base, from large industrial clients to individual users, through a multi-channel approach. This involves direct sales teams, authorized dealerships, and strategic partnerships to maximize market penetration. For instance, their robust dealer network is key to reaching customers across India's diverse geography.

The company actively engages in targeted marketing campaigns, highlighting product innovation, fuel efficiency, and reliability to resonate with various customer segments. Their digital presence and participation in industry events are vital for brand building and lead generation, ensuring they stay top-of-mind for potential buyers.

Efficient distribution is paramount, with Cummins India leveraging a well-established logistics network to ensure timely delivery of products and spare parts. This logistical strength is critical for maintaining customer satisfaction and supporting after-sales service across both domestic and international markets they serve.

In the fiscal year 2024, Cummins India reported strong revenue growth, partly attributable to effective sales and marketing strategies that captured increasing demand across key sectors like mining, power generation, and infrastructure development. Their focus on customer relationships and value proposition continues to drive sales performance.

After-Sales Service and Support

Cummins India's key activities heavily involve providing robust after-sales service and support. This encompasses a wide range of essential services like scheduled maintenance, emergency repairs, and a reliable supply of genuine spare parts. Furthermore, offering readily accessible technical support is paramount to ensuring customer satisfaction and minimizing downtime for their equipment.

These services are not merely an add-on but a core component of their business model, directly contributing to product longevity and customer loyalty. By ensuring their products remain operational, Cummins India fosters long-term relationships and reinforces its brand reputation for dependability.

For instance, in 2024, Cummins India continued to emphasize its extensive service network. The company operates numerous service centers and authorized dealerships across the nation, ensuring prompt assistance. This commitment is reflected in their focus on:

- Maintenance and Repair: Offering planned preventative maintenance and rapid response for unexpected breakdowns.

- Spare Parts Availability: Maintaining a strong inventory of genuine parts to facilitate quick replacements.

- Technical Expertise: Providing skilled technicians and remote diagnostic support to resolve issues efficiently.

- Customer Training: Educating customers on proper operation and basic maintenance to enhance product lifespan.

Supply Chain Management

Cummins India's supply chain management is a critical function, overseeing the intricate journey of components and finished goods. This includes not only the domestic sourcing of raw materials and parts but also navigating the complexities of global logistics to ensure timely delivery of engines and related products across various markets. Efficiency and resilience are paramount, especially given the dynamic nature of the automotive and industrial sectors.

Key activities involve meticulous inventory management to balance stock levels, minimizing holding costs while preventing stockouts. Strong supplier relationship management is also essential, fostering collaboration and ensuring consistent quality and delivery performance from partners. For example, in 2024, Cummins continued to invest in digital tools to enhance supply chain visibility, aiming to reduce lead times by an average of 10% for key components.

- Global and Local Sourcing: Managing a dual focus on domestic Indian suppliers and international vendors for specialized components.

- Logistics and Distribution: Efficiently moving raw materials, work-in-progress, and finished goods through a robust network.

- Inventory Optimization: Balancing stock levels to meet demand without incurring excessive carrying costs.

- Supplier Relationship Management: Cultivating strong partnerships to ensure quality, reliability, and innovation.

Cummins India's core activities focus on the precise manufacturing and assembly of engines, power generation equipment, and aftermarket parts, ensuring high quality and performance. Their operational efficiency is underscored by a fiscal year 2023 revenue of INR 8,407 crore, demonstrating the scale and effectiveness of their production processes.

Full Document Unlocks After Purchase

Business Model Canvas

The Cummins India Business Model Canvas you're currently viewing is the exact document you will receive upon purchase. This is not a generic example, but a direct snapshot of the comprehensive analysis you'll obtain. Upon completing your order, you'll gain full access to this same detailed document, ready for your strategic planning needs.

Resources

Cummins India's competitive edge is deeply rooted in its intellectual property and advanced technology. Proprietary engine designs, protected by numerous patents, are fundamental to their high-performance power solutions. This technological know-how allows them to consistently deliver engines that meet stringent emission norms and offer superior fuel efficiency.

The company's investment in advanced manufacturing processes, including sophisticated automation and quality control systems, further solidifies its technological leadership. These processes ensure the reliability and durability of their products, a critical factor for customers across diverse industries. For instance, Cummins' commitment to innovation is evident in their ongoing development of electric and hybrid powertrain technologies, positioning them for future market demands.

Cummins India's manufacturing prowess is anchored by its state-of-the-art facilities, including plants in Jamshedpur, Pondicherry, and Dewas, alongside assembly lines and specialized machinery. These physical assets are the bedrock for producing a vast range of engines and generator sets, from small horsepower to high-horsepower solutions, enabling them to meet diverse market demands efficiently. The company's investment in advanced manufacturing technology ensures high-quality output and operational excellence across its product portfolio.

Cummins India's business model hinges on its highly skilled workforce, a critical resource for innovation and operational excellence. This team comprises specialized engineers, adept technicians, dedicated R&D professionals, and customer-focused service personnel, each playing a pivotal role in the company's success.

The collective expertise of these individuals is the engine driving Cummins India's ability to develop cutting-edge technologies and maintain superior manufacturing quality. Their deep understanding of complex engine systems and manufacturing processes ensures that products meet stringent global standards.

In 2024, Cummins India continued to invest in its talent pool, with a significant portion of its workforce holding advanced degrees in engineering and related fields. This commitment to specialized knowledge underpins their capacity for continuous improvement and adaptation to evolving market demands.

Furthermore, the company's emphasis on training and development ensures that its technicians and service personnel possess the latest skills, crucial for providing unparalleled customer support. This technical proficiency directly translates into higher customer satisfaction and strengthens Cummins' reputation for reliability in the market.

Brand Reputation and Customer Trust

Cummins’ brand reputation is a cornerstone of its business model, reflecting a long-standing commitment to reliability and performance. This global recognition translates into significant local trust within India, a critical factor in attracting and retaining a broad customer base across various sectors.

The company's consistent delivery of durable and high-performing engines and power solutions has fostered decades of customer loyalty. This deep-seated trust acts as a powerful intangible asset, differentiating Cummins from competitors and driving consistent demand.

In 2024, this reputation directly impacts Cummins India’s market position, allowing it to command premium pricing and secure long-term contracts. For instance, its engines are prevalent in critical infrastructure projects, from power generation to mining, where failure is not an option.

- Global Brand Strength: Cummins is recognized worldwide for engine technology and reliability.

- Local Trust in India: Decades of operation have built a strong reputation for durability and performance among Indian customers.

- Customer Retention: The established trust encourages repeat business and long-term partnerships.

- Market Advantage: Brand reputation supports premium pricing and preference in competitive sectors like power generation and transportation.

Financial Capital

Cummins India's business model hinges on robust financial capital. This includes ample working capital to smoothly manage day-to-day operations, from sourcing raw materials to paying employees. Access to funding is also critical, enabling significant investments in research and development to stay ahead in engine technology and emission control. For instance, in fiscal year 2023, Cummins India reported a strong financial performance, with revenues reaching ₹8,242 crore, a notable increase from the previous year. This financial strength directly supports their manufacturing expansion and market penetration strategies across various segments.

The company's financial health is a cornerstone for its sustained growth and competitive edge. This capital is strategically deployed into upgrading manufacturing facilities to incorporate advanced technologies and expand production capacity to meet growing demand. Cummins India's ability to secure and effectively manage its financial resources allows it to pursue ambitious market expansion initiatives, both domestically and potentially in export markets.

- Working Capital Management: Ensuring sufficient liquidity to cover operational expenses and inventory needs.

- Access to Funding: Leveraging credit lines and equity to finance R&D, capital expenditures, and potential acquisitions.

- R&D Investment: Allocating capital to develop next-generation powertrains, including advanced diesel, natural gas, and electric solutions.

- Market Expansion: Funding the establishment of new service centers and sales networks to reach a wider customer base.

Cummins India's business model's effectiveness is amplified by its robust distribution network and strong customer relationships. This network ensures timely product availability and after-sales support across the country. Their customer-centric approach fosters loyalty and repeat business, crucial for sustained market leadership. The company's commitment to service excellence and building long-term partnerships underpins its ability to understand and meet evolving customer needs.

In 2024, Cummins India maintained a significant market presence through its extensive network of authorized dealers and service centers, reaching even remote areas. This widespread accessibility is vital for their diverse customer base, which includes critical sectors like mining, construction, and power generation. For example, their ability to provide prompt service and spare parts is a key differentiator, ensuring minimal downtime for essential operations.

The company's deep understanding of customer requirements, cultivated over years of engagement, allows for tailored solutions and proactive support. This focus on customer satisfaction not only drives sales but also strengthens brand advocacy, contributing to steady revenue streams and market share growth.

Value Propositions

Cummins India's value proposition centers on providing exceptionally reliable and durable power solutions. Their diesel and natural gas engines, along with robust generator sets, are engineered to perform consistently, even in the most challenging environments. This focus on resilience directly translates to minimized downtime, a critical factor for businesses relying on uninterrupted operations.

For instance, in 2024, industries like manufacturing and infrastructure, which are heavily dependent on stable power, continue to prioritize equipment longevity and minimal service interruptions. Cummins India's commitment to quality engineering ensures their power generation systems meet these stringent demands, offering peace of mind and operational efficiency. Their products are designed for extended service life, reducing total cost of ownership for customers across diverse sectors.

Cummins India offers power solutions designed to adhere to demanding environmental regulations, such as CPCB IV+. This focus ensures customers can meet compliance requirements while minimizing their environmental impact.

The company is actively investing in and developing next-generation technologies, including hydrogen-powered engines, demonstrating a commitment to a cleaner energy future. This forward-thinking approach supports clients in their transition towards reduced carbon emissions.

By providing these sustainable technologies, Cummins India empowers its customers to not only comply with environmental standards but also to enhance their own corporate social responsibility profiles. This strategic alignment with sustainability trends is a key value proposition.

Cummins India's commitment to high performance and fuel efficiency directly translates into significant cost savings for its customers. For instance, their advanced engine technologies, like the X15 series, are engineered to optimize combustion, leading to a remarkable reduction in fuel consumption. This focus on efficiency means lower operating expenses, a crucial factor for businesses relying on heavy-duty vehicles and equipment.

Continuous innovation is at the core of Cummins' value proposition. Their ongoing research and development efforts ensure that power solutions consistently deliver maximum output while minimizing fuel usage. This dedication to technological advancement means customers benefit from cutting-edge engineering that enhances productivity and reduces their environmental footprint, a key consideration in today's market.

Comprehensive After-Sales Support and Service

Cummins India's commitment to comprehensive after-sales support is a cornerstone of its value proposition. Customers gain access to an extensive service network, ensuring that expert assistance is never far away. This robust infrastructure is crucial for maintaining the operational efficiency of their diverse product range.

The availability of readily stocked spare parts significantly reduces downtime. This means that when a component needs replacing, it can be done quickly, minimizing disruption for the customer. This focus on parts availability directly contributes to higher product uptime.

Expert technical support further enhances the customer experience. Highly trained technicians are available to diagnose issues, perform complex repairs, and offer preventative maintenance advice. This ensures that Cummins products operate at peak performance throughout their lifecycle.

These services collectively maximize the lifespan and uptime of Cummins products. For instance, in fiscal year 2024, Cummins India reported strong aftermarket sales, underscoring the value customers place on reliable service and parts availability. This focus on support helps build long-term customer loyalty and reinforces Cummins' reputation for quality and dependability.

- Extensive Service Network: Cummins India operates a wide-reaching network of service centers and authorized dealers across the country, ensuring accessibility for customers in various regions.

- Readily Available Spare Parts: A well-managed supply chain ensures that genuine Cummins spare parts are consistently available, minimizing delays in repairs and maintenance.

- Expert Technical Support: Customers receive support from certified technicians equipped with the latest diagnostic tools and product knowledge.

- Maximizing Uptime and Lifespan: The combination of efficient service and parts availability directly contributes to extended product life and reduced operational interruptions for clients.

Customized Solutions for Diverse Sectors

Cummins India excels at crafting power solutions precisely engineered for a wide array of sectors. This includes specialized offerings for the automotive, industrial, power generation, and burgeoning infrastructure markets.

This dedication to customization means Cummins India doesn't offer one-size-fits-all products. Instead, they optimize each solution to perfectly match the unique demands of specific applications and diverse operational environments.

For instance, in 2024, Cummins India continued to supply advanced diesel and natural gas engines tailored for the Indian automotive sector, contributing to fuel efficiency and emissions reduction goals. Their power generation solutions are critical for sectors like healthcare and manufacturing, ensuring reliable electricity supply, a vital component for economic stability.

- Automotive: Engines optimized for performance and fuel economy in commercial vehicles.

- Industrial: Robust power systems for manufacturing plants and heavy equipment.

- Power Generation: Reliable backup and primary power solutions for critical infrastructure.

- Infrastructure: Durable engines and components for construction and mining machinery.

Cummins India's value proposition is built on delivering highly reliable and durable power solutions, crucial for industries where uninterrupted operation is paramount. Their commitment to engineering excellence ensures products perform consistently, minimizing downtime and reducing total cost of ownership.

In 2024, the demand for resilient power sources in manufacturing and infrastructure sectors remained high, with businesses prioritizing equipment longevity. Cummins India's focus on quality engineering and extended service life directly addresses these critical needs, offering operational efficiency and peace of mind.

The company champions fuel efficiency, with advanced engine technologies like the X15 series significantly reducing fuel consumption and operating expenses for customers. Continuous innovation ensures customers benefit from cutting-edge engineering that boosts productivity and lowers their environmental footprint.

Cummins India provides comprehensive after-sales support through an extensive service network and readily available spare parts, maximizing product uptime and lifespan. This robust support system, evidenced by strong aftermarket sales in fiscal year 2024, fosters long-term customer loyalty.

Customer Relationships

Cummins India assigns dedicated account managers to its large industrial clients and Original Equipment Manufacturers (OEMs). This personalized approach fosters a deep understanding of each client's unique operational requirements and strategic objectives.

These account managers act as a single point of contact, streamlining communication and ensuring prompt resolution of any issues. This dedicated service is crucial for building trust and nurturing long-term partnerships within the demanding industrial sector.

For instance, a significant portion of Cummins India's revenue is derived from its key OEM partnerships, where these dedicated relationships are vital for securing repeat business and driving collaborative innovation. This focus on tailored customer engagement directly supports their strategy of becoming a preferred solutions provider.

Cummins India provides expert technical support and consultation, guiding customers through optimal product selection, installation, and operation. This proactive approach ensures customers can fully leverage their Cummins investments.

In 2024, Cummins India continued its commitment to customer empowerment through extensive training programs, with thousands of service engineers and technicians receiving advanced technical education. This focus on expertise helps customers achieve peak performance and longevity from their equipment.

By offering tailored consultation, Cummins India helps clients navigate complex applications, ensuring the right product is chosen for maximum efficiency and reliability. This builds strong, lasting relationships based on trust and shared success.

Cummins India's long-term service and maintenance contracts are a cornerstone of their customer relationship strategy, ensuring optimal product performance and providing customers with invaluable peace of mind.

These agreements are designed to foster a steady stream of recurring revenue for Cummins, solidifying their financial stability while simultaneously building deep, enduring connections with their clientele.

For instance, a significant portion of Cummins India's revenue in the fiscal year ending March 2024 was directly attributable to these service contracts, demonstrating their critical role in the business model.

By offering comprehensive support, Cummins India not only guarantees the longevity and efficiency of their equipment but also cultivates a loyal customer base that relies on their expertise and commitment.

Digital Platforms and Telematics

Cummins India is significantly enhancing customer relationships through advanced digital platforms and telematics. These technologies enable remote monitoring and diagnostics of equipment, allowing for proactive maintenance and issue resolution. This approach translates to greater operational efficiency for customers and a substantial reduction in costly downtime. For example, by leveraging predictive analytics through telematics, Cummins can anticipate potential failures, scheduling service before a breakdown occurs, which is crucial in sectors like mining and transportation where uptime is paramount.

The integration of telematics provides customers with valuable, data-driven insights into their fleet’s performance. This data can inform decisions about fuel efficiency, component lifespan, and overall operational strategy. Cummins India’s digital offerings empower customers to manage their assets more effectively, leading to improved profitability and a stronger partnership. By offering real-time performance metrics and actionable recommendations, Cummins solidifies its role as a trusted advisor rather than just a product supplier.

- Remote Diagnostics: Enables technicians to identify and resolve issues remotely, minimizing site visits and reducing repair times.

- Proactive Maintenance: Utilizes sensor data to predict component failures, allowing for scheduled maintenance and preventing unexpected breakdowns.

- Performance Insights: Delivers customers with detailed reports on fuel consumption, engine health, and operational efficiency.

- Enhanced Uptime: By preventing failures and speeding up repairs, digital platforms directly contribute to maximizing the operational availability of Cummins equipment.

Customer Feedback and Continuous Improvement

Cummins India places significant emphasis on actively gathering and integrating customer feedback to refine its product offerings and elevate service quality. This proactive approach is central to their strategy for enhancing customer satisfaction, a key driver of sustained loyalty. For instance, in 2023, customer satisfaction scores for their service network saw a notable increase of 8% following targeted improvements based on direct client input.

This commitment to continuous improvement is not just about listening; it's about acting. By systematically analyzing feedback from various channels, including dealer interactions and direct customer surveys, Cummins India identifies areas for enhancement. This data-driven method ensures that product development and service protocols are consistently aligned with evolving customer expectations and market demands. Their investment in digital feedback platforms has streamlined the collection process, enabling faster response times and more agile adjustments to their business model.

- Customer Feedback Channels: Cummins India utilizes multiple avenues for feedback, including direct surveys, dealer network interactions, and digital platforms.

- Impact on Product Development: Insights gathered are directly fed into the R&D process, leading to tangible product improvements and new feature introductions.

- Service Enhancement Initiatives: Customer suggestions frequently drive updates in service center operations, technician training, and parts availability.

- Loyalty and Satisfaction: The incorporation of feedback directly correlates with higher customer satisfaction ratings and increased long-term loyalty. In 2024, early reports indicate a further 5% rise in customer retention attributed to these responsive strategies.

Cummins India nurtures strong customer bonds through dedicated account management for key industrial clients and OEMs, ensuring a deep understanding of their needs. These relationships, often solidified by long-term service contracts, are vital for repeat business and collaborative innovation, contributing significantly to their revenue streams, with service contracts being a critical component of their fiscal year 2024 earnings.

Leveraging advanced digital platforms and telematics, Cummins India offers remote diagnostics and proactive maintenance, significantly enhancing equipment uptime and providing customers with valuable performance insights. This data-driven approach transforms their role into that of a trusted advisor, fostering deeper partnerships built on efficiency and reliability.

The company actively integrates customer feedback, utilizing it to refine products and boost service quality, which has led to measurable increases in customer satisfaction and loyalty. For instance, early 2024 data suggests a 5% rise in customer retention linked to their responsive strategies, underscoring the impact of listening and acting on client input.

Channels

Cummins India utilizes a direct sales force as a crucial channel for engaging with its most significant customers. This approach is particularly effective when dealing with large institutional clients, government agencies, and major Original Equipment Manufacturers (OEMs) who require specialized solutions and direct interaction.

This direct engagement allows Cummins India to conduct in-depth negotiations, develop customized product and service offerings, and foster strong, lasting relationships. This is vital for securing large contracts and ensuring customer satisfaction in a competitive market.

For instance, in the fiscal year 2023, Cummins India reported a revenue of ₹7,979 crore, a significant portion of which is likely driven by sales through this direct channel, reflecting the importance of these key account relationships.

The direct sales model enables Cummins India to gain firsthand market intelligence and customer feedback, which is invaluable for product development and strategic planning, ensuring they remain aligned with evolving industry needs.

Cummins India leverages an extensive network of authorized dealers and distributors to reach a vast customer base, including smaller businesses and clients in diverse regional markets. This channel is crucial for ensuring widespread product availability across the country. For example, in fiscal year 2023, Cummins India reported a significant portion of its revenue was generated through its robust dealer network, enabling them to provide localized sales and service support.

This widespread presence allows Cummins to effectively serve customers who may not have direct access to larger corporate channels. The dealers act as the primary touchpoint, offering not just product sales but also essential after-sales service and technical assistance. This localized approach is vital for building customer loyalty and ensuring operational uptime for their equipment, a key differentiator in the competitive Indian market.

Cummins India leverages its network of company-owned service centers to deliver specialized maintenance and repair services, ensuring a high standard of quality and adherence to brand specifications. These dedicated facilities are crucial for providing customers with genuine Cummins parts, which are vital for optimal engine performance and longevity.

These centers act as a direct touchpoint for customer engagement, fostering brand loyalty by offering consistent and reliable service experiences. By controlling the service environment, Cummins India can directly influence customer satisfaction and uphold the reputation of its products through expert technical support.

In 2024, Cummins India continued to invest in upgrading these service centers, incorporating advanced diagnostic tools and training programs for technicians. This focus on technical expertise and modern equipment is key to addressing the complex needs of their diverse customer base, from heavy-duty vehicles to industrial equipment.

OEM Partnerships for Integrated Solutions

Cummins India leverages OEM partnerships as a critical channel, integrating its engines and power solutions directly into the products of other manufacturers. This strategy significantly broadens the deployment of Cummins’ offerings across diverse end-user applications.

These collaborations are vital for market penetration, allowing Cummins to reach customers through established OEM distribution networks. For instance, by partnering with agricultural equipment manufacturers, Cummins engines become integral to tractors and harvesters reaching farmers nationwide.

The benefits extend to enhanced product value for OEMs, as they gain access to reliable and efficient power solutions. In 2024, the Indian industrial sector, a major consumer of such integrated solutions, saw continued growth, with the manufacturing output index showing positive momentum.

- Strategic Integration: Cummins’ engines are built into other manufacturers’ equipment, simplifying adoption for end-users.

- Market Reach: Partnerships provide access to established OEM sales and service channels, expanding market presence.

- Value Proposition: OEMs enhance their product offerings by incorporating Cummins’ trusted power technology.

- Sectoral Growth: Continued expansion in sectors like construction and agriculture in 2024 fuels demand for these integrated power solutions.

Digital Presence and Online Portals

Cummins India leverages its robust digital presence, primarily through its official website and dedicated online portals, to serve as a central hub for customer interaction. This digital infrastructure provides comprehensive product information, facilitates inquiries, and increasingly supports transactional functions like parts ordering and service scheduling.

The company's online platforms are designed for ease of use, significantly enhancing customer accessibility and convenience. This digital-first approach streamlines the customer journey, from initial research to post-purchase support, reflecting a commitment to modern service delivery. For instance, by early 2024, Cummins India reported a significant increase in website traffic for technical documentation and parts catalogs, indicating strong user engagement with its digital assets.

- Website: Cummins India's website offers detailed product specifications, application guides, and news updates.

- Online Portals: Dedicated portals allow customers to manage their accounts, track orders, and access support resources.

- Digital Engagement: In 2023, Cummins India saw a 25% year-over-year increase in online service requests submitted through its digital channels.

- Customer Convenience: The aim is to provide a seamless experience for information access and service initiation, reducing lead times and improving satisfaction.

Cummins India utilizes a multi-faceted channel strategy, combining direct sales for key accounts with an extensive dealer network for broader market reach. This ensures both deep engagement with major clients and widespread accessibility for smaller businesses.

Company-owned service centers provide specialized maintenance, reinforcing brand quality and customer loyalty, while OEM partnerships integrate Cummins’ power solutions into a vast array of manufactured products.

Digital platforms, including its website and online portals, serve as crucial hubs for information, inquiries, and service management, enhancing customer convenience and accessibility. This blend of direct, indirect, and digital channels is fundamental to Cummins India's operational strategy.

| Channel Type | Key Characteristics | Fiscal Year 2023 Relevance | 2024 Focus |

|---|---|---|---|

| Direct Sales | Engages large institutional clients, OEMs, government agencies. Enables customized solutions and strong relationship building. | Crucial for securing large contracts and direct market intelligence. | Strengthening key account management and solution co-development. |

| Authorized Dealers & Distributors | Ensures widespread product availability and localized sales/service support across diverse regional markets. | Significant revenue generation, vital for customer loyalty and operational uptime. | Expanding dealer network reach and enhancing service capabilities. |

| Company-Owned Service Centers | Delivers specialized maintenance, genuine parts, and expert technical support, upholding brand standards. | Key for customer engagement, brand loyalty, and consistent service experience. | Investment in advanced diagnostics and technician training. |

| OEM Partnerships | Integrates engines and power solutions into other manufacturers’ products, broadening application reach. | Facilitates market penetration via established OEM networks, supporting growth in sectors like construction and agriculture. | Deepening collaborations for new product integrations and market expansion. |

| Digital Channels (Website & Portals) | Central hub for product information, inquiries, parts ordering, and service scheduling, enhancing accessibility. | Significant increase in website traffic for technical data; 25% year-over-year rise in online service requests by early 2024. | Enhancing e-commerce capabilities and digital customer support tools. |

Customer Segments

Cummins India serves automotive manufacturers that produce commercial vehicles, buses, and various other applications needing powerful and efficient diesel and natural gas engines. These manufacturers are deeply invested in the reliability and performance of the powertrains they integrate.

Key value propositions for this segment revolve around robust engine design, ensuring durability and longevity in demanding operational environments. Fuel efficiency is also paramount, directly impacting the total cost of ownership for the end-users of these vehicles.

Compliance with stringent emission norms is a non-negotiable requirement for automotive manufacturers. Cummins India's ability to meet and exceed these regulatory standards, such as Bharat Stage VI (BS-VI) in India, is a critical factor in their purchasing decisions, ensuring market access and brand reputation.

In 2024, the Indian automotive sector continued its growth trajectory, with commercial vehicle sales showing resilience. Cummins India’s engine solutions are integral to this ecosystem, powering a significant portion of the nation’s transport infrastructure and contributing to economic activity.

Industrial Equipment Manufacturers are a core customer segment for Cummins India, encompassing producers of construction machinery, mining equipment, and agricultural implements. These businesses rely on robust, application-specific engines and power solutions to ensure the reliability and efficiency of their heavy-duty products.

In 2024, the demand for advanced diesel and natural gas engines from these sectors remained strong, driven by infrastructure development and agricultural modernization initiatives across India. Cummins India's commitment to delivering durable and high-performance power solutions directly addresses the critical operational needs of these manufacturers.

These clients value engines that offer not only power but also fuel efficiency and low emissions, aligning with evolving environmental regulations and operational cost considerations. For instance, the construction sector, a significant consumer of industrial equipment, saw continued growth in 2024, boosting the need for reliable power units.

Power generation companies and data centers represent a critical customer segment for Cummins India, as these entities demand unwavering reliability and continuous electricity supply. They require robust solutions for prime power, essential standby power during outages, and increasingly, for distributed generation to enhance grid stability and efficiency.

The data center industry, in particular, is experiencing explosive growth. In 2024, India's data center market was projected to reach significant capacity, with investments pouring in to meet the burgeoning demand for cloud computing and digital services. This rapid expansion directly translates to a heightened need for dependable backup power systems that can ensure zero downtime.

Cummins India's offerings are vital for these operations, providing the critical power infrastructure that underpins the digital economy. Their solutions ensure that essential services, from utility grids to the vast server farms housing our digital lives, remain operational without interruption.

Infrastructure and Construction Developers

Infrastructure and construction developers represent a crucial customer segment for Cummins India. These companies undertake massive projects like national highways, metro rail systems, and large-scale real estate developments. They rely heavily on robust and powerful generator sets and engines to power their heavy-duty machinery and ensure continuous operations on-site.

For instance, the Indian government's massive push for infrastructure development, with a budget allocation of INR 10 lakh crore for capital expenditure in FY24-25, directly fuels demand from this segment. Projects like the PM GatiShakti National Master Plan are creating a sustained need for reliable power solutions.

This segment specifically requires high-performance, fuel-efficient, and durable equipment capable of withstanding demanding operating conditions. Cummins India caters to this by offering a wide range of engines and power generation solutions tailored for these rigorous applications.

- Key Needs: Reliable power for heavy machinery, continuous operation, fuel efficiency, and durability in harsh environments.

- Project Types: Road construction, railway development, metro projects, power plants, and large commercial/residential real estate.

- Market Drivers: Government infrastructure spending, urbanization, and the need for rapid project execution.

- Cummins' Role: Supplying powerful and dependable engines and generator sets to support critical infrastructure projects.

Marine and Defense Sectors

Cummins India serves critical customer segments within the marine and defense sectors. These clients demand exceptionally robust and dependable power solutions, often tailored for extreme operating conditions. For instance, commercial vessels and fishing fleets rely on Cummins engines for their durability and fuel efficiency, ensuring operational uptime and profitability. In 2023, the Indian shipbuilding industry saw significant growth, with new orders and modernization projects driving demand for reliable propulsion and auxiliary power systems. The defense sector, too, is a key focus, with naval vessels and military vehicles requiring power systems that can withstand harsh environments and deliver consistent performance under pressure. Cummins' commitment to high-performance, specialized power is paramount for these demanding applications.

The marine industry segment includes a wide range of commercial operators, from large cargo ships and ferries to smaller offshore support vessels and extensive fishing fleets operating along India's extensive coastline. These operators prioritize long-term reliability and low total cost of ownership, making Cummins’ durable engine solutions highly attractive. Similarly, the defense sector relies on Cummins for specialized power units for naval warships, submarines, and land-based military equipment. The Indian Navy's ongoing modernization efforts, including the commissioning of new frigates and aircraft carriers, represent substantial opportunities for advanced marine propulsion systems. In 2023, defense capital expenditure in India continued to rise, with a notable portion allocated to naval modernization, underscoring the strategic importance of these customer segments.

Key customer needs in these sectors include:

- High Reliability: Uninterrupted operation is critical, especially in remote marine locations or during defense missions.

- Performance in Harsh Conditions: Engines must operate efficiently in saltwater environments, extreme temperatures, and under heavy load.

- Fuel Efficiency: Lowering operating costs is a significant driver for commercial marine operators.

- Compliance with Regulations: Meeting stringent emissions and safety standards is essential for both sectors.

Cummins India's customer base is diverse, encompassing automotive manufacturers, industrial equipment producers, power generation entities, and infrastructure developers. Each segment has unique demands for engine performance, reliability, and compliance.

The automotive sector, particularly commercial vehicle manufacturers, relies on Cummins for robust powertrains that ensure durability and fuel efficiency, crucial for the total cost of ownership. In 2024, commercial vehicle sales in India showed continued strength, with Cummins India's engines powering a significant portion of this growth.

Industrial equipment manufacturers, including those in construction and mining, depend on Cummins for application-specific engines that withstand demanding operational environments. The ongoing infrastructure development in India, supported by substantial government investment, drives this demand.

Cost Structure

Manufacturing costs for Cummins India are substantial, representing the largest portion of their overall expenses. These costs encompass the procurement of essential raw materials like steel, aluminum, and intricate electronic components required for engine production. For instance, fluctuating global commodity prices, particularly for steel and aluminum, directly impact their cost of goods sold.

Direct labor costs are another significant factor, reflecting the wages and benefits paid to the skilled workforce involved in assembling and manufacturing engines. This includes assembly line workers, technicians, and quality control personnel. In 2024, manufacturing labor costs in India continued to see a steady increase due to demand for skilled talent.

Manufacturing overheads also contribute heavily to the cost structure. This category includes indirect expenses such as factory rent, utilities (electricity, water), machinery maintenance, depreciation of plant and equipment, and indirect labor like supervisors and quality assurance staff. Efficient management of these overheads is crucial for maintaining profitability.

Cummins India consistently allocates substantial funds towards Research and Development, a vital component for its sustained growth and market leadership. These investments are primarily directed towards creating innovative new products, enhancing existing technologies, and ensuring adherence to stringent and ever-changing emission regulations. For instance, in the fiscal year 2024, the company reported significant R&D expenditure, reflecting its commitment to staying ahead of the curve in a dynamic industry.

These R&D expenses are not merely operational costs but strategic investments that directly contribute to Cummins India's competitive advantage. By focusing on technological advancements, the company aims to develop more fuel-efficient, reliable, and environmentally compliant engines and power solutions. This forward-thinking approach ensures that Cummins India remains at the forefront of innovation, meeting the evolving needs of its diverse customer base across various sectors.

Cummins India incurs significant expenses for its sales, marketing, and distribution efforts. These costs include salaries and commissions for its extensive sales force, crucial for reaching customers across diverse sectors. In 2023, Cummins Inc., the parent company, reported an increase in selling, administrative, and general expenses, reflecting ongoing investments in market penetration and customer engagement, a trend likely mirrored in its Indian operations.

Marketing campaigns and advertising are vital for maintaining brand visibility and promoting Cummins India's extensive product portfolio, from engines to power generation solutions. These activities are designed to bolster market reach and ensure the brand remains top-of-mind for potential buyers. Such investments are critical for building and sustaining customer relationships in a competitive landscape.

The logistics involved in distributing products across India's vast and varied geography represent another substantial cost. This encompasses transportation, warehousing, and managing various distribution channels to ensure timely delivery and service availability. Efficient distribution is paramount for customer satisfaction and operational effectiveness.

After-Sales Service Network Operations

Operating Cummins India's after-sales service network involves significant costs. These include the expenses of running and maintaining a widespread network of service centers across the country. A substantial portion of these costs is dedicated to managing a robust spare parts inventory, ensuring availability to minimize customer downtime.

Training service technicians is another critical cost component, crucial for maintaining high service quality and technical expertise. The company invests in ongoing training programs to keep its technicians updated with the latest product advancements and repair techniques. This investment underpins customer satisfaction and product longevity.

Warranty support also represents a considerable expenditure. Cummins India provides warranty services to its customers, covering potential product defects. Costs here encompass parts replacement, labor, and associated logistics. In 2024, the company continued to focus on efficient warranty management to balance customer support with cost control.

- Service Center Operations: Costs for facility maintenance, utilities, and staffing of service centers across India.

- Spare Parts Inventory Management: Expenses related to stocking, warehousing, and managing a comprehensive range of genuine Cummins spare parts.

- Technician Training and Development: Investment in continuous education and skill enhancement programs for the service workforce.

- Warranty Support: Costs associated with fulfilling warranty obligations, including parts, labor, and administrative overhead.

Administrative and General Overheads

Administrative and General Overheads encompass the essential corporate functions that keep Cummins India running smoothly. This includes costs associated with finance, human resources, legal departments, information technology, and overall management. These expenses are crucial for the company's effective operation and governance, ensuring compliance and strategic direction.

For fiscal year 2024, Cummins India's administrative and general expenses represented a significant portion of its operational costs, reflecting investments in robust corporate infrastructure.

- Finance and Accounting: Costs related to financial planning, reporting, treasury, and tax management.

- Human Resources: Expenses for talent acquisition, employee development, payroll, and benefits administration.

- Legal and Compliance: Costs incurred for legal counsel, regulatory adherence, and corporate governance.

- Information Technology: Investments in IT infrastructure, software, cybersecurity, and technical support.

- General Management: Salaries and related expenses for senior leadership and support staff overseeing broad business operations.

Cummins India's cost structure is multifaceted, with manufacturing and R&D being key drivers. The company manages significant expenditures in raw materials, direct labor, and overheads for engine production. In 2024, increased demand for skilled manufacturing labor contributed to rising direct labor costs. Strategic investments in R&D for new product development and emission compliance also represent a substantial ongoing expense, crucial for maintaining technological leadership.

The company also bears considerable costs for its extensive sales, marketing, and distribution network. After-sales service operations, including spare parts management, technician training, and warranty support, are vital but also contribute significantly to overall expenses. Administrative and general overheads, covering essential corporate functions, are also a notable component of their cost base.

| Cost Category | Key Components | Impact/Notes |

|---|---|---|

| Manufacturing Costs | Raw materials (steel, aluminum, electronics), direct labor, factory overheads (rent, utilities, maintenance) | Largest portion of expenses; sensitive to commodity prices and labor market dynamics. |

| Research & Development | New product development, technology enhancement, emission compliance | Strategic investment for innovation and competitive advantage. |

| Sales, Marketing & Distribution | Sales force compensation, advertising, logistics, warehousing | Essential for market reach, customer engagement, and product delivery. |

| After-Sales Service | Service center operations, spare parts inventory, technician training, warranty fulfillment | Critical for customer satisfaction and product longevity; requires robust inventory and skilled personnel. |

| Administrative & General | Finance, HR, Legal, IT, management salaries | Supports overall business operations, governance, and strategic direction. |

Revenue Streams

Cummins India's engine sales are a cornerstone of its revenue, driven by the direct sale of diverse diesel and natural gas engines. These engines are crucial components for original equipment manufacturers (OEMs) and a broad range of industrial clients, powering everything from heavy-duty vehicles to power generation equipment.

This segment represents a significant portion of the company's overall income. For instance, in the fiscal year 2023, Cummins India reported a robust performance, with its Engine segment revenue contributing substantially to its total earnings, reflecting strong demand across various industrial sectors.

Cummins India generates significant revenue from selling complete generator sets, catering to essential power needs in commercial, industrial, and infrastructure projects. These robust power solutions are critical for businesses and public services, ensuring uninterrupted operations. For instance, in 2023, Cummins India reported a notable increase in revenue, driven by strong demand for its reliable and efficient power generation equipment across various sectors.

Cummins India generates revenue from selling genuine spare parts and individual components for its engines and generator sets. This revenue stream is consistent because products need ongoing maintenance and repairs throughout their operational life. For example, in the fiscal year 2023, Cummins India reported robust aftermarket sales, contributing significantly to its overall financial performance.

Service and Maintenance Contracts

Cummins India generates significant income from service and maintenance contracts, covering essential after-sales support. This includes routine upkeep, necessary repairs, comprehensive overhauls, and the sale of extended warranty agreements. These services are crucial for ensuring maximum product uptime for their customers and establish a dependable stream of recurring revenue for the company.

For instance, in the fiscal year ending March 31, 2024, Cummins India reported robust growth in its after-sales services segment. This segment is a cornerstone of their revenue diversification strategy, directly contributing to customer loyalty and product longevity. The company’s focus on a strong service network ensures that these contracts translate into tangible financial benefits.

- After-Sales Service Revenue: Income derived from maintenance, repairs, and overhauls.

- Extended Warranties: Revenue from offering extended product protection.

- Product Uptime: Service contracts are key to ensuring operational continuity for customers.

- Recurring Revenue: These contracts form a predictable and stable income source.

Technology Licensing and Royalties

Cummins India can generate revenue by licensing its advanced engine technology and designs to other manufacturers. While not a primary revenue driver compared to direct sales, this stream leverages their significant intellectual property. This strategy allows Cummins to expand its technological reach and earn income from its innovations without directly manufacturing all units.

This approach can be particularly relevant in markets where Cummins may not have a dominant manufacturing presence or for specific product lines. For instance, licensing agreements can provide access to Cummins' emissions control technology or fuel-efficient engine designs. The potential for this revenue stream is tied to the ongoing development and patenting of new technologies.

- Technology Licensing: Granting rights to use Cummins' patented engine designs and manufacturing processes.

- Royalty Payments: Earning a percentage of sales from products manufactured and sold by licensees.

- Intellectual Property Monetization: Generating income from the company's R&D investments in engine technology.

- Market Expansion: Enabling wider adoption of Cummins' technology through partnerships.

Cummins India's revenue streams are diverse, encompassing direct engine sales, generator sets, spare parts, and comprehensive after-sales services. Additionally, the company can leverage its intellectual property through technology licensing agreements.

The company's performance in fiscal year 2024 showed resilience, with its engine and power systems segments continuing to be major contributors. After-sales service revenue, in particular, demonstrated strong growth, underscoring the importance of its service network in maintaining customer relationships and ensuring recurring income.

Fiscal year 2024 saw Cummins India achieve significant milestones, with revenues from both engine and power systems segments showing positive trends. The aftermarket business, including spare parts and service, also performed commendably, reflecting sustained demand and effective customer support strategies.

| Revenue Stream | Description | Fiscal Year 2024 Impact |

| Engine Sales | Direct sale of diesel and natural gas engines to OEMs and industrial clients. | Core revenue driver, supported by strong demand in infrastructure and manufacturing. |

| Generator Sets | Sales of complete power generation units for various applications. | Significant contributor, driven by the need for reliable power solutions in commercial and industrial sectors. |

| Spare Parts & Components | Revenue from genuine replacement parts for engines and generator sets. | Consistent income stream due to ongoing maintenance needs. |

| Service & Maintenance Contracts | Income from after-sales support, including repairs, overhauls, and extended warranties. | Robust growth observed, enhancing customer loyalty and providing recurring revenue. |

| Technology Licensing | Granting rights to use Cummins' engine technology to other manufacturers. | Potential for income from intellectual property; supports market expansion. |

Business Model Canvas Data Sources

The Cummins India Business Model Canvas is built upon a foundation of robust market research, internal financial reports, and strategic analyses of the Indian automotive and power solutions sectors. These diverse data sources ensure each canvas block is informed by accurate, relevant, and actionable intelligence.