CSW Industrials SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSW Industrials Bundle

CSW Industrials boasts strong brand recognition and a diversified product portfolio, positioning it well within its markets. However, understanding the full scope of its competitive advantages and potential vulnerabilities is crucial for informed decision-making.

Want the full story behind CSW Industrials' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CSW Industrials benefits significantly from its diversified product portfolio, spanning three key segments: Contractor Solutions, Engineered Building Solutions, and Specialty Chemicals. This strategic spread across different business areas inherently reduces the company's exposure to any single market's downturns, fostering greater stability.

The company's offerings serve a wide array of end markets, including HVAC/R, plumbing, general industrial, and energy sectors. This broad market penetration ensures a robust and varied revenue stream, as evidenced by their consistent performance across different economic cycles.

CSW Industrials possesses a robust history of strategic and disciplined acquisitions, a key strength that has fueled its expansion. Since 2015, the company has successfully integrated 17 acquisitions, investing approximately $1.0 billion in capital to broaden its capabilities.

Notable among these is the 2025 acquisition of Aspen Manufacturing, which significantly bolstered CSW Industrials' presence in the HVAC/R and plumbing sectors. This strategic move not only diversified its product portfolio but also extended its market reach, demonstrating a clear pattern of value-enhancing growth.

This consistent acquisition strategy directly contributes to the company's top-line growth and is instrumental in building long-term shareholder value. It highlights CSW Industrials' ability to identify and execute opportunities that strategically align with its business objectives.

CSW Industrials demonstrates robust financial health and ample liquidity, a key strength allowing it to pursue strategic growth opportunities, including acquisitions. This financial resilience is crucial for navigating market dynamics and investing in future expansion.

The company's solid financial footing is underscored by its low net leverage ratio. Following its Q1 fiscal 2026 acquisition financing, CSW Industrials reported a net leverage of just 0.2x, indicating a conservative and well-managed debt structure.

This strong balance sheet and high liquidity provide CSW Industrials with significant flexibility. It can readily fund strategic initiatives, manage operational needs, and allocate capital effectively to drive shareholder value.

Consistent Revenue and Profitability Growth

CSW Industrials has a strong track record of consistent revenue and profitability growth. This resilience is evident in their performance, even when facing some headwinds in organic revenue.

The company achieved a significant milestone, reporting record revenue of $263.6 million in the first quarter of fiscal year 2026. This represents a substantial 16.6% increase compared to the same period in the previous year, showcasing robust expansion.

This impressive growth is largely attributable to the company's adeptness at integrating acquired businesses and implementing effective operational efficiencies. These strategic moves consistently contribute to their expanding financial performance.

- Consistent Revenue Growth: Demonstrated overall revenue increases since inception.

- Profitability Expansion: Achieved consistent adjusted EBITDA growth.

- Record Q1 FY2026 Revenue: Reached $263.6 million, a 16.6% year-over-year increase.

- Acquisition Integration: Leverages successful integration of acquired businesses to fuel growth.

Experienced Leadership and Market Expertise

CSW Industrials benefits from a seasoned leadership team that has successfully managed public companies. This experience translates into astute strategic planning and a keen ability to navigate complex industrial markets. Their deep understanding of various sectors allows them to identify opportunities and mitigate risks effectively, ensuring the company remains competitive.

The company's leadership possesses significant domain expertise across diverse industrial segments. This specialized knowledge is crucial for developing products that meet specific end-market demands, focusing on performance, reliability, and customer value. For instance, their focus on engineered solutions in sectors like HVAC and infrastructure highlights this expertise.

CSW Industrials leverages its market knowledge to deliver products that offer tangible benefits to customers. Their strategy centers on providing solutions that enhance performance and reliability, thereby creating strong customer relationships. This customer-centric approach, backed by industry insights, has been a cornerstone of their growth, as evidenced by their consistent revenue generation.

- Proven Public Company Management: Leadership has a history of steering public entities through market cycles.

- Deep Sectoral Knowledge: Expertise spans critical industrial areas, enabling informed decision-making.

- Customer Value Focus: Products are designed to deliver performance and reliability, meeting specific end-market needs.

CSW Industrials' diversified product portfolio across Contractor Solutions, Engineered Building Solutions, and Specialty Chemicals provides a strong foundation against market volatility. This broad market penetration, serving sectors like HVAC/R and plumbing, ensures a stable and varied revenue base, a key advantage in the industrial landscape.

The company's disciplined acquisition strategy is a significant strength, evidenced by 17 acquisitions since 2015 totaling approximately $1.0 billion. The recent 2025 acquisition of Aspen Manufacturing further solidified its position in key growth markets.

CSW Industrials boasts robust financial health, characterized by ample liquidity and a low net leverage ratio of 0.2x as of Q1 fiscal 2026. This strong balance sheet allows for strategic investments and capital allocation, supporting continued expansion and shareholder value creation.

The company demonstrates consistent revenue and profitability growth, achieving record revenue of $263.6 million in Q1 fiscal 2026, a 16.6% year-over-year increase. This growth is driven by effective acquisition integration and operational efficiencies.

CSW Industrials benefits from a seasoned leadership team with proven experience in managing public companies and deep domain expertise across industrial segments. This leadership fosters astute strategic planning and a customer-centric approach focused on delivering performance and reliability.

| Metric | Q1 FY2026 | Year-over-Year Change |

|---|---|---|

| Revenue | $263.6 million | +16.6% |

| Net Leverage Ratio | 0.2x | N/A |

What is included in the product

Delivers a strategic overview of CSW Industrials’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable SWOT breakdown to pinpoint and address critical operational challenges.

Weaknesses

CSW Industrials saw its organic revenue dip in the first quarter of fiscal year 2026. This decline was most noticeable in the Contractor Solutions segment. While acquisitions helped bolster overall revenue, this organic softness points to potential challenges in growing existing business lines.

CSW Industrials has experienced a notable gross margin contraction, dropping from 47.5% to 43.8% in the first quarter of fiscal year 2026. This downturn is largely due to the inclusion of acquired businesses that operate at lower profit margins, persistent tariff challenges, and rising costs for essential inputs.

The company faces a significant hurdle in its ability to sustain profitability given these combined pressures. The integration of new entities and the ongoing impact of external economic factors are directly affecting the company's core profitability metrics.

Integrating acquired companies like Aspen Manufacturing, acquired in late 2023, presents ongoing challenges. These integration efforts, while crucial for growth, can lead to substantial costs. For instance, consolidating IT systems and aligning diverse operational processes can drain resources, impacting the company's bottom line in the short term.

CSW Industrials faces risks in harmonizing different corporate cultures and optimizing complex supply chains post-acquisition. These hurdles can temporarily reduce operational efficiency and profitability, especially in newly acquired entities that may have historically operated with thinner profit margins, requiring dedicated efforts to improve their financial performance.

Sensitivity to End Market Fluctuations

CSW Industrials' performance is notably susceptible to shifts in its end markets. For instance, its Specialized Reliability Solutions segment experienced headwinds due to contractions in sectors such as energy, mining, and rail. This reliance on cyclical industries means that downturns in these areas can directly impact the company's revenue streams and profitability.

Furthermore, the Contractor Solutions segment is closely tied to the health of the housing market. A slowdown in construction or renovation activity, common during economic contractions, can significantly dampen demand for the products offered by this division. This sensitivity to broader economic cycles introduces a degree of earnings volatility for CSW Industrials.

- End Market Dependence: Performance in segments like Specialized Reliability Solutions is directly affected by contractions in energy, mining, and rail markets.

- Housing Market Impact: The Contractor Solutions segment's results are influenced by the cyclical nature of the housing market.

- Earnings Volatility: Sensitivity to these key sectors can lead to fluctuations in the company's financial performance.

Stock Underperformance

CSW Industrials has experienced significant stock underperformance. As of early 2024, the company's shares had declined approximately 23.8% year-to-date, starkly contrasting with the S&P 500's positive 8.2% return during the same period. This downturn has also seen the stock reach a recent 52-week low, signaling considerable investor apprehension.

The recent stock performance suggests underlying issues that are concerning investors. Potential drivers for this underperformance could include:

- Margin Pressures: Challenges in maintaining or expanding profit margins might be deterring investors.

- Organic Growth Struggles: Difficulties in achieving consistent, internally driven sales growth could be a key factor.

- Broader Market Sentiment: While the S&P 500 has seen gains, specific sector headwinds or general market caution could disproportionately affect CSW Industrials.

CSW Industrials faces challenges with organic revenue decline, particularly in its Contractor Solutions segment, indicating potential difficulties in growing existing business lines despite acquisition-driven overall revenue increases. Gross margin contraction, from 47.5% to 43.8% in Q1 FY2026, stems from lower-margin acquisitions, tariffs, and rising input costs, impacting overall profitability.

The company's profitability is further strained by integration costs associated with acquisitions like Aspen Manufacturing, which can drain resources and temporarily reduce efficiency. Additionally, CSW Industrials is susceptible to economic cycles, with its Specialized Reliability Solutions segment affected by downturns in energy, mining, and rail, and its Contractor Solutions segment tied to the volatile housing market, leading to earnings volatility.

CSW Industrials has experienced significant stock underperformance, with shares declining approximately 23.8% year-to-date in early 2024, while the S&P 500 rose 8.2%. This underperformance, reaching a 52-week low, suggests investor concerns regarding margin pressures, struggles with organic growth, and broader market sentiment impacting the company.

What You See Is What You Get

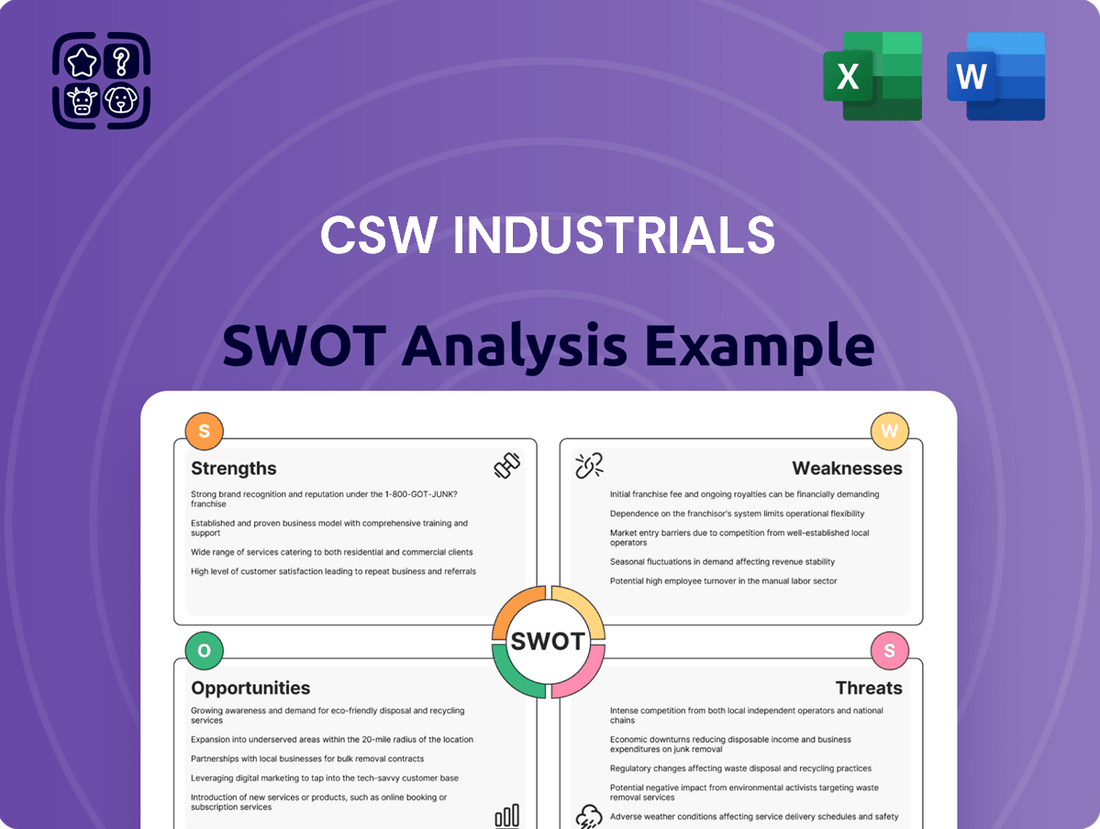

CSW Industrials SWOT Analysis

This is the actual CSW Industrials SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This detailed report is ready for immediate use.

Opportunities

CSW Industrials has a proven track record of expanding its business through strategic acquisitions. This approach allows them to quickly broaden their product lines and gain a larger slice of the market. For instance, the acquisition of Aspen Manufacturing significantly enhanced their HVAC/R offerings.

This inorganic growth strategy is a major engine for the company's development. The Aspen acquisition alone is projected to positively impact both EBITDA and EPS, demonstrating the financial benefits of these strategic moves. This focus on acquiring complementary businesses is expected to continue driving value.

CSW Industrials is well-positioned to benefit from the HVAC/R and plumbing sectors, which are experiencing substantial growth, especially in residential installations and ongoing maintenance. The company's strategic focus on these areas, coupled with an expanding product line, allows it to tap into strong consumer demand.

The company's capacity to support both existing and emerging refrigerant technologies is a key advantage. This adaptability is crucial as the industry navigates transitions, ensuring CSW Industrials remains relevant and competitive in a dynamic market landscape.

CSW Industrials is well-positioned to capitalize on innovation and new product development. By investing in research and development, the company can introduce novel solutions across its diverse markets, such as advanced fire and smoke protection systems. This strategic focus on creating commercially viable products is crucial for driving future revenue streams and solidifying its competitive standing.

The company's commitment to developing more efficient and consolidated product offerings presents a significant opportunity. For instance, in 2023, CSW Industrials reported a 7% increase in net sales for its Engineered Products segment, partly driven by new product introductions, demonstrating the tangible impact of this strategy on market performance and customer value.

Leverage Distribution Channels

CSW Industrials possesses significant strengths in its distribution networks, encompassing established buying groups and key national account relationships. By strategically maximizing these existing channels, the company can effectively introduce and market new products, thereby accelerating revenue growth and improving overall cost-efficiency in its go-to-market approach.

This robust distribution infrastructure provides a solid foundation for both organic expansion and the successful integration of any future inorganic growth opportunities. For instance, in fiscal year 2023, CSW Industrials reported net sales of $708.6 million, with a significant portion driven by these established channels.

- Expand reach within existing buying groups to introduce a wider product portfolio.

- Deepen national account relationships by offering tailored solutions and enhanced support.

- Utilize these channels to pilot new product launches, gathering crucial market feedback.

- Measure the cost-effectiveness of distribution by tracking incremental sales and associated marketing expenses.

Operational Efficiency and Margin Recovery

CSW Industrials has a significant opportunity to bolster its profitability by focusing on operational efficiency and margin recovery. Despite recent pressures, there's room to enhance gross and EBITDA margins through strategic adjustments in product mix, stringent cost controls, and the effective integration of recent acquisitions. Management’s commitment to a robust balance sheet and prudent capital deployment provides a solid foundation for these margin improvement initiatives.

Driving operational leverage is key to unlocking enhanced financial performance. For instance, a 1% increase in operational efficiency could translate to substantial bottom-line growth, especially considering the company's revenue base. The company's ability to manage its cost structure effectively, as demonstrated by its historical EBITDA margins which have often exceeded industry averages, positions it well to capitalize on these opportunities.

- Product Mix Optimization: Shifting focus towards higher-margin product lines can directly impact gross margins.

- Cost Control Initiatives: Implementing targeted cost-saving measures across manufacturing and administrative functions can improve EBITDA.

- Acquisition Synergies: Realizing cost and revenue synergies from acquired businesses is crucial for margin expansion.

- Operational Leverage: Increasing sales volume without a proportional rise in fixed costs will naturally boost profitability.

CSW Industrials is poised to leverage its strong market position in growing sectors like HVAC/R and plumbing. The company's strategic acquisitions, such as the one of Aspen Manufacturing, have significantly broadened its product portfolio and market reach, contributing to a projected positive impact on EBITDA and EPS.

The company's adaptability to evolving refrigerant technologies and its focus on innovation, including new product development in areas like fire and smoke protection, present further avenues for growth. In fiscal year 2023, CSW Industrials achieved net sales of $708.6 million, underscoring the potential of its expanding product lines and market penetration strategies.

Furthermore, CSW Industrials can enhance profitability by optimizing its product mix towards higher-margin offerings and implementing stringent cost controls. Realizing synergies from acquisitions and driving operational leverage are key to improving gross and EBITDA margins, building on a foundation of a robust balance sheet and prudent capital deployment.

| Opportunity Area | Description | Potential Impact | Supporting Data (FY23) |

|---|---|---|---|

| Market Expansion via Acquisitions | Acquiring complementary businesses to broaden product lines and market share. | Increased revenue, improved EBITDA and EPS. | Net Sales: $708.6 million |

| Product Innovation & Development | Introducing new, efficient, and consolidated products across diverse markets. | Enhanced competitive standing, new revenue streams. | 7% increase in Engineered Products net sales driven by new products. |

| Distribution Network Optimization | Maximizing existing buying groups and national account relationships for new product marketing. | Accelerated revenue growth, improved cost-efficiency. | Strong established channels contributing significantly to net sales. |

| Profitability Improvement | Focusing on operational efficiency, margin recovery, and cost controls. | Boosted gross and EBITDA margins, enhanced profitability. | Historical EBITDA margins often exceeding industry averages. |

Threats

CSW Industrials grapples with persistent inflation in raw material and component costs, a trend that has been particularly pronounced in 2024, impacting various industrial sectors. This upward pressure on input prices directly increases the cost of goods sold, potentially squeezing gross profit margins if these costs cannot be fully passed on to customers.

Furthermore, the imposition or continuation of tariffs on imported goods, a fluctuating geopolitical factor, adds another layer of cost uncertainty and can elevate the expense of sourcing essential materials. For instance, tariffs on steel or aluminum, key components for many industrial products, can significantly alter a company's cost structure.

Continued softness in critical sectors like housing presents a significant headwind for CSW Industrials. For instance, the U.S. housing market, a key driver for many of their product lines, experienced a slowdown in new home starts and existing home sales throughout 2023, with projections for 2024 indicating only a modest recovery. This directly impacts demand for products used in construction and renovation.

Furthermore, cyclical industries such as energy, mining, and rail are prone to volatility. A downturn in commodity prices or reduced capital expenditure in these sectors, as seen with some energy companies scaling back investment in late 2023 and early 2024, can lead to decreased demand for CSW Industrials' specialized components and solutions, thereby hindering organic revenue growth.

CSW Industrials faces significant rivalry across its diverse industrial product segments, with many established competitors vying for market share. For instance, in the HVAC sector, the company competes with giants like Johnson Controls and Carrier, both of whom have extensive product lines and global reach. This intense competition can exert downward pressure on pricing, potentially impacting CSW's profit margins.

The need to remain competitive necessitates substantial investment in research and development to foster innovation and maintain a technological edge. Furthermore, increased marketing and sales efforts are often required to differentiate CSW's offerings and capture consumer attention. For example, in the fiscal year ending June 30, 2023, CSW Industrials reported R&D expenses of $22.1 million, a figure that may need to increase to keep pace with industry advancements and competitor strategies.

Acquisition Integration Risks

Acquisitions are a key growth strategy for CSW Industrials, but they come with significant integration risks. Successfully merging new businesses is complex, and failure to do so can impact financial results. For instance, in 2023, the integration of a newly acquired manufacturing plant faced unexpected supply chain disruptions, delaying synergy realization by an estimated 6 months.

These integration challenges can manifest in several ways:

- Synergy Shortfalls: Failing to achieve projected cost savings or revenue enhancements from the acquisition.

- Cultural Clashes: Mismatched corporate cultures can lead to employee dissatisfaction and reduced productivity.

- Key Personnel Departures: The loss of critical talent from the acquired company can disrupt operations and knowledge transfer.

- Operational Hiccups: Unexpected issues with IT systems, processes, or regulatory compliance can arise post-acquisition.

For example, a major competitor in the industrial sector saw its stock price drop by 8% in early 2024 following a poorly managed acquisition integration, highlighting the financial consequences of these threats.

Economic Downturns and Interest Rate Fluctuations

CSW Industrials faces significant risks from economic downturns, which directly impact industrial production and construction demand. For instance, a projected slowdown in global GDP growth for 2024-2025 could translate into reduced orders for CSW's products.

Interest rate volatility is another major concern, particularly given CSW's reliance on debt financing for strategic acquisitions. An increase in interest rates, such as the Federal Reserve maintaining higher rates through 2024, would increase the cost of servicing this debt, potentially squeezing profit margins and limiting future investment capacity.

- Economic Sensitivity: Industrial companies like CSW are highly sensitive to macroeconomic cycles; a recessionary environment could significantly curb demand for their products.

- Debt Financing Costs: CSW's acquisition strategy makes it vulnerable to rising interest rates, which directly increase borrowing expenses and impact its bottom line.

- Interest Rate Impact: For example, if CSW has outstanding variable-rate debt, a 1% increase in interest rates could add millions to its annual interest expenses.

Persistent inflation in raw materials and components, seen throughout 2024, directly increases CSW Industrials' cost of goods sold, potentially reducing profit margins if these costs cannot be fully passed on. Geopolitical factors like tariffs on key materials such as steel or aluminum also introduce cost uncertainty and can elevate sourcing expenses.

A downturn in critical cyclical sectors like energy, mining, and rail, driven by volatile commodity prices or reduced capital expenditure as observed in late 2023 and early 2024, can lead to decreased demand for CSW's specialized products, hindering organic revenue growth.

Intense competition across its product segments, including HVAC where it faces giants like Johnson Controls and Carrier, can exert downward pressure on pricing, impacting CSW's profit margins. The need for continuous innovation also requires significant R&D investment, with CSW's fiscal year 2023 R&D expenses of $22.1 million potentially needing to increase.

CSW Industrials' reliance on debt financing for acquisitions makes it vulnerable to interest rate volatility; for instance, the Federal Reserve's stance on maintaining higher rates through 2024 increases borrowing costs. Furthermore, economic downturns directly impact industrial production and construction demand, with a projected global GDP slowdown for 2024-2025 potentially reducing orders.

SWOT Analysis Data Sources

This CSW Industrials SWOT analysis is built on a foundation of verified financial reports, in-depth market intelligence, and expert industry commentary, ensuring a comprehensive and accurate assessment.