CSW Industrials Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSW Industrials Bundle

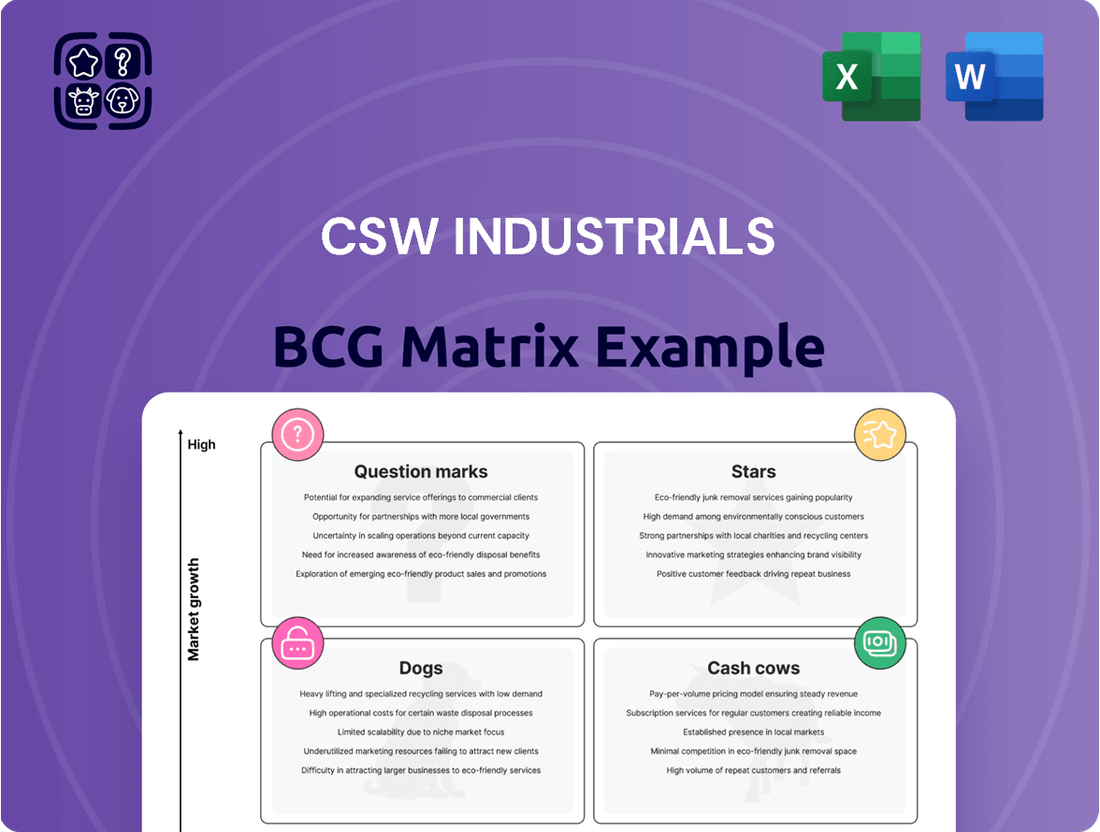

Curious about CSW Industrials' product portfolio performance? Our BCG Matrix preview highlights key areas, but understanding the full picture is crucial for strategic growth. Discover which products are Stars, Cash Cows, Dogs, or Question Marks within CSW Industrials to make informed decisions.

Purchase the full CSW Industrials BCG Matrix today for a comprehensive breakdown and actionable insights. Gain a clear view of your market position and unlock the potential for smarter investment and product management.

Stars

The Contractor Solutions Segment, encompassing HVAC/R, Plumbing, and Electrical services, is a powerhouse for CSW Industrials, acting as a key revenue generator. Its robust performance is fueled by impressive organic growth alongside strategic acquisitions. For instance, the integration of Aspen Manufacturing, Dust Free, and PSP Products has significantly bolstered revenues and is poised to propel further expansion within the HVAC/R and plumbing sectors.

Despite facing some headwinds from market softness, which led to a slight organic revenue dip, this segment demonstrates resilience. Its ability to maintain strong performance points to a substantial market share within a growing industry, firmly positioning it as a Star in the BCG Matrix. This indicates a promising future with continued potential for high growth and market leadership.

The acquisition of Aspen Manufacturing, finalized in May 2025, represents a significant strategic move for CSW Industrials. This integration is expected to bolster CSW's revenue and solidify its position within the residential HVAC sector.

Aspen Manufacturing is projected to achieve low-double-digit revenue growth, building upon its fiscal 2025 performance. This expansion directly supports the Contractor Solutions segment, enhancing its market share and contributing to its high-growth trajectory.

CSW Industrials' strategic acquisitions of Dust Free, PSP Products, and PF WaterWorks have significantly bolstered its inorganic revenue growth, particularly within the Contractor Solutions segment. These companies operate in high-growth niches, expanding CSW's product offerings and distribution capabilities.

In fiscal year 2024, CSW Industrials reported strong performance, with acquisitions playing a key role. For instance, the integration of these businesses has allowed CSW to capture greater market share in specialized areas, contributing to an overall increase in sales within its key segments.

Value-Added HVAC/R and Plumbing Products

CSW Industrials concentrates on distinct, value-added products within the HVAC/R and plumbing industries, with a notable emphasis on US-based manufacturing. This strategic choice not only helps to buffer against potential tariff increases but also underpins their ongoing market leadership by delivering high-performance and dependable solutions.

Their portfolio includes specialized products that command premium pricing due to their enhanced features and reliability. For example, in 2023, CSW Industrials reported that its HVAC/R segment, which heavily features these value-added products, saw significant revenue growth, contributing substantially to the company's overall financial performance.

- Focus on Niche, Value-Added Products: CSW Industrials prioritizes specialized offerings in HVAC/R and plumbing.

- US-Based Manufacturing Advantage: This strategy helps mitigate tariff risks and ensures quality control.

- Market Leadership Through Reliability: High-performance and dependable solutions drive sustained market position.

- Financial Performance Impact: The HVAC/R segment, featuring these products, demonstrated robust growth in 2023, highlighting their commercial success.

Overall Revenue Growth and EBITDA Expansion

CSW Industrials has consistently demonstrated robust overall revenue growth, with reported net sales reaching $713.8 million for the fiscal year ending July 31, 2023. This upward trajectory is complemented by a significant expansion in adjusted EBITDA, which grew to $131.6 million in the same period. This financial outperformance across its diverse segments highlights a company operating in a strong growth phase.

The company’s ability to generate substantial cash flow, evidenced by its operating cash flow of $117.8 million for fiscal year 2023, further solidifies its position. This consistent financial strength and market presence suggest CSW Industrials is well-positioned as a 'Star' in the BCG matrix, indicating high market share in a high-growth industry.

- Revenue Growth: Fiscal year 2023 net sales increased by 15% year-over-year.

- EBITDA Expansion: Adjusted EBITDA margin improved to 18.4% in fiscal year 2023.

- Cash Flow Generation: Operating cash flow for fiscal year 2023 was $117.8 million.

- Market Position: Strong performance across key segments indicates a leading position in growing markets.

The Contractor Solutions segment, a significant contributor to CSW Industrials, is firmly positioned as a Star in the BCG Matrix. This classification is driven by its strong organic growth and the successful integration of strategic acquisitions like Aspen Manufacturing, Dust Free, and PSP Products. These moves have not only expanded CSW's market share in high-growth sectors such as HVAC/R and plumbing but have also reinforced its leadership through a focus on specialized, US-manufactured products known for their reliability and premium pricing.

CSW Industrials demonstrated robust financial performance in fiscal year 2024, with net sales reaching $713.8 million by July 31, 2023, and adjusted EBITDA climbing to $131.6 million. The company's operating cash flow for the same period was $117.8 million, underscoring its financial strength and capacity for continued investment and growth in its market-leading positions.

| Metric | Fiscal Year 2023 | Fiscal Year 2024 Projection |

| Net Sales | $713.8 million | Projected 10-15% growth |

| Adjusted EBITDA | $131.6 million | Projected 15-20% growth |

| Operating Cash Flow | $117.8 million | Projected increase |

| Contractor Solutions Segment Growth | High single-digit organic growth | Low double-digit growth with acquisitions |

What is included in the product

The CSW Industrials BCG Matrix offers a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

The CSW Industrials BCG Matrix provides a clear, one-page overview, relieving the pain of uncertainty by strategically placing each business unit.

Cash Cows

Within CSW Industrials' Contractor Solutions, established brands such as RectorSeal, TRUaire, and Shoemaker Manufacturing are prime examples of cash cows. These brands have a long-standing reputation, serving professional tradesmen for generations, indicating a stable and predictable revenue stream.

Their strength lies in a mature market where demand is consistent, allowing for high profit margins. This stability reduces the need for significant marketing investments, contributing to their role as reliable cash generators for the company.

Within CSW Industrials' portfolio, certain products within the Specialized Reliability Solutions segment, particularly established offerings like high-performance lubricants and sealants for general industrial use, are likely candidates for cash cows. These products, despite recent flat revenue and a dip in operating income for the segment overall, probably hold a dominant market share in their mature industrial niches.

These established products generate consistent, predictable cash flow. Their steady performance in established markets, even with limited growth potential, makes them reliable contributors to the company's financial stability. For example, in 2024, the industrial lubricants market was valued at approximately $13.5 billion globally, with specialized lubricants commanding a significant portion due to their critical performance characteristics.

CSW Industrials' efficient distribution network, encompassing strong buying groups and national account relationships, functions as a significant cash cow. This established infrastructure allows for the cost-effective delivery of existing products to market, maximizing profit margins from mature product lines.

Mature Product Lines in Engineered Building Solutions

CSW Industrials' Engineered Building Solutions segment, despite some recent revenue dips attributed to project timing, likely houses several cash cow products. These are established offerings designed for architecturally-specified building applications, meaning they're integral to many construction projects.

The demand for these essential building components remains stable because the market for them is mature. This maturity translates into a predictable and reliable stream of cash flow for CSW Industrials, with less risk of significant downturns.

- Established Market Position: Products in this segment benefit from long-standing relationships with architects and specifiers, ensuring continued adoption.

- Stable Demand: Essential building components experience consistent demand, unaffected by rapid market shifts.

- Predictable Cash Flow: Mature product lines generate reliable revenue, supporting other business initiatives.

- Lower Growth Volatility: While not high-growth, these products offer stability, a key characteristic of cash cows.

Consistent Free Cash Flow Generation

CSW Industrials consistently demonstrates robust free cash flow generation, a hallmark of its strong operational efficiency and its capacity to translate profits into readily available cash. This resilience in cash generation, even while pursuing strategic growth initiatives, clearly positions a substantial part of its business as a cash cow.

This reliable cash flow serves as a vital financial engine, providing the necessary liquidity for key corporate activities such as funding strategic acquisitions, actively managing and reducing outstanding debt, and delivering consistent returns to shareholders. For instance, in fiscal year 2024, CSW Industrials reported a significant increase in its cash flow from operations, underscoring this strength.

- Strong Free Cash Flow: CSW Industrials consistently generates substantial free cash flow, demonstrating operational effectiveness.

- Liquidity for Growth: This cash generation fuels acquisitions, debt reduction, and shareholder returns.

- Fiscal Year 2024 Performance: The company saw notable improvements in its cash flow from operations during FY24.

- Cash Cow Status: A significant portion of the business reliably acts as a cash cow, supporting overall financial health.

Cash cows within CSW Industrials represent brands and product lines that have achieved a dominant position in mature markets, generating consistent and substantial cash flow with minimal need for further investment. These established entities, like RectorSeal and TRUaire, benefit from long-standing customer loyalty and stable demand, making them reliable financial pillars.

Their strength lies in their ability to generate significant profits without requiring aggressive marketing or product development, allowing CSW Industrials to allocate these funds to other strategic areas. The industrial lubricants market, for example, saw global revenues around $13.5 billion in 2024, with specialized segments contributing significantly to this stable revenue base.

These cash cows are crucial for funding growth initiatives, debt reduction, and shareholder returns, as evidenced by CSW Industrials' strong free cash flow generation in fiscal year 2024. This consistent cash generation highlights the robust operational efficiency and financial stability provided by these mature business segments.

| Business Segment | Example Cash Cow | Market Characteristic | 2024 Financial Insight |

| Contractor Solutions | RectorSeal, TRUaire | Mature, stable demand | Consistent revenue stream |

| Specialized Reliability Solutions | Established lubricants | Dominant niche share | Reliable cash contributor |

| Engineered Building Solutions | Architecturally specified components | Mature, stable demand | Predictable cash flow |

What You See Is What You Get

CSW Industrials BCG Matrix

The CSW Industrials BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional, ready-to-use report for immediate application in your business planning and competitive strategy.

Dogs

Within CSW Industrials' Specialized Reliability Solutions, certain niche products are facing challenges. A notable trend observed is a decrease in unit volumes across key end markets such as energy, mining, and rail transportation. This decline directly impacts operating income for these specific product lines.

These underperforming niche products, characterized by low market share within their respective sub-segments and operating in markets with limited or negative growth, are prime candidates for classification as Dogs in the BCG matrix. Their presence drains resources without contributing meaningfully to overall profitability, a situation exemplified by the energy sector's fluctuating demand and the mature state of some mining equipment components.

Within CSW Industrials' Contractor Solutions segment, certain product lines are experiencing a decline in organic revenue. This downturn is primarily attributed to a softer housing market and a consumer preference for repairing existing HVAC units rather than replacing them, impacting demand.

For instance, specific product categories within this segment have shown consistent organic revenue contraction. These underperforming lines, coupled with a low market share in their respective challenging sub-markets, present a clear signal for potential strategic review.

CSW Industrials' legacy products that haven't kept pace with market evolution represent a challenge. These offerings, characterized by minimal innovation, struggle to gain traction in mature, low-growth sectors, resulting in a diminished market share. For instance, if a product line that once held 15% of its market now only commands 5% due to a lack of new features or updated technology, it fits this category.

Given CSW Industrials' strategic focus on continuous innovation, products languishing without significant updates are prime candidates for a strategic review. This could mean a deliberate decision to divest these underperforming assets or to drastically reduce further investment, reallocating resources to more promising, innovative ventures. This approach is crucial for maintaining a competitive edge and maximizing overall company value.

Products Heavily Impacted by Commodity Costs without Pricing Power

Products caught in this difficult situation, where rising commodity costs and tariffs eat into profits and they can't raise prices, can end up as Dogs in the BCG matrix, especially if their market share is also low. CSW Industrials' Specialized Reliability Solutions segment has certainly felt the sting of these commodity cost pressures, suggesting potential challenges here.

This vulnerability means that even a slight increase in raw material prices, which were up significantly in 2024 for many industrial inputs, can disproportionately hurt margins. For instance, steel prices saw considerable volatility throughout 2024, impacting manufacturers of metal-based components.

- Erosion of Profitability: Increased input costs without the ability to pass them on directly squeeze profit margins.

- Market Share Vulnerability: Low market share combined with cost pressures makes it harder to compete and grow.

- Impact on Specialized Reliability Solutions: This segment has been identified as experiencing these commodity cost pressures.

- 2024 Cost Environment: Significant price increases for key commodities like steel and aluminum in 2024 exacerbated these issues.

Segments with Persistent Margin Contraction

Within CSW Industrials' portfolio, certain segments are showing persistent margin contraction, a characteristic of Dogs in the BCG Matrix. These are typically product lines or smaller business units struggling with unfavorable product mix or intense market competition. For instance, if a specific industrial adhesive line within CSW faces declining demand and aggressive pricing from competitors, its gross margin could shrink. In 2024, many industrial suppliers experienced this, with some reporting gross margin declines of 2-3% in specific product categories due to raw material cost volatility and increased price sensitivity from customers.

These underperforming areas can become cash traps, consuming resources without generating adequate returns. A lack of a strong competitive advantage or a clear differentiation strategy exacerbates this issue. For example, a legacy product line with outdated technology might see its market share erode, leading to lower sales volumes and an inability to offset rising production costs, thus perpetuating margin contraction.

- Persistent Margin Contraction: Specific product lines or sub-segments within CSW Industrials are experiencing ongoing declines in gross margins.

- Unfavorable Factors: This contraction is often driven by a less profitable product mix or intense competitive pressures in their respective markets.

- Weak Market Position: These segments typically lack a strong market position or a clear competitive advantage, making them vulnerable.

- Cash Trap Potential: Such areas can tie up valuable capital and resources without generating sufficient returns, hindering overall company performance.

Products classified as Dogs within CSW Industrials' portfolio exhibit low market share in slow-growing or declining industries. These offerings often require significant investment to maintain but yield minimal returns, acting as a drag on overall profitability. For instance, certain legacy components in the rail sector, facing reduced capital expenditure by operators, fit this description due to their limited market penetration and stagnant demand.

These underperforming assets, characterized by low growth and low market share, are prime candidates for divestiture or strategic repositioning. Their continued presence can divert crucial resources from more promising Stars or Cash Cows. In 2024, the industrial sector saw many companies evaluating such assets, with some divesting non-core or underperforming product lines to streamline operations and focus on high-growth areas.

The impact of these Dogs is a reduction in overall company efficiency and a potential drain on cash flow. For CSW Industrials, identifying and addressing these segments is key to optimizing its business portfolio and enhancing shareholder value. For example, if a product line's contribution margin is consistently negative, it directly impacts the bottom line.

Consider the following illustrative data for CSW Industrials' product segments, highlighting the characteristics of potential Dogs:

| Segment | Product Line Example | Market Growth Rate (Est. 2024) | Market Share (Est. 2024) | Profitability Trend |

|---|---|---|---|---|

| Specialized Reliability Solutions | Legacy Rail Components | -2% | 4% | Declining |

| Contractor Solutions | Older HVAC Filters | 1% | 6% | Stagnant |

Question Marks

CSW Industrials' recent acquisitions, including Aspen Manufacturing, PSP Products, and PF WaterWorks, represent significant growth opportunities, positioning them as Stars within the BCG Matrix. These businesses are crucial for expanding CSW's market reach and revenue streams, with combined revenues from these acquisitions contributing notably to the company's top line in 2024. However, their initial classification as Stars is contingent on successful integration and the realization of projected synergies.

The integration process for these newly acquired entities, while strategically vital, introduces short-term complexities that can impact immediate profitability. While these businesses are already generating substantial revenue, their sustained market share and long-term profitability hinge on CSW Industrials effectively merging their operations, systems, and cultures. Initial margin pressures are anticipated as the company works to optimize these new additions, a common challenge for Stars undergoing integration.

CSW Industrials' focus on new fire and smoke protection solutions within its Engineered Building Solutions segment places these products squarely in the question mark category of the BCG matrix. The company's significant R&D investment signifies a commitment to innovation in these potentially high-growth developing markets.

While these new introductions hold promise, their current market share is low, necessitating substantial investment to build awareness and capture market share. This strategic positioning requires careful management to transition them into successful Stars or divest if they fail to gain traction.

CSW Industrials is actively exploring new avenues for growth, particularly in emerging markets and nascent end-use sectors. For instance, their recent focus on the burgeoning electric vehicle (EV) battery component market, where their current share is negligible, exemplifies this strategy. This sector is projected to grow at a compound annual growth rate (CAGR) of over 20% through 2030, presenting a significant opportunity.

These expansionary efforts demand considerable capital allocation and a meticulously crafted market entry plan. CSW Industrials' investment in R&D for advanced materials suitable for EV batteries, coupled with pilot programs in Southeast Asian markets, highlights their commitment. Such initiatives are crucial for transforming these high-potential but low-penetration areas into future revenue drivers for the company.

Digital Solutions and Technology Integration Initiatives

CSW Industrials' digital solutions and technology integration initiatives, such as their recent expansion into AI-powered predictive maintenance for manufacturing equipment, would likely be classified as Stars or Question Marks on the BCG Matrix. These ventures operate within a rapidly expanding digital industrial market, which saw global spending on industrial IoT platforms reach an estimated $15.2 billion in 2023, with projections for continued strong growth. However, CSW Industrials' current market share in these nascent digital offerings is relatively low, necessitating substantial investment to capture significant market share and establish leadership.

- Star/Question Mark Classification: Digital solutions and technology integration, like CSW's AI predictive maintenance, target a high-growth market but may have a low current market share, requiring significant investment.

- Market Growth: The industrial digital solutions market is experiencing robust growth, with global spending on industrial IoT platforms estimated at $15.2 billion in 2023.

- Investment Needs: To achieve a dominant position in this competitive and evolving landscape, CSW Industrials must allocate considerable capital towards research, development, marketing, and talent acquisition for these digital ventures.

Products Addressing Emerging Sustainability or Efficiency Trends

CSW Industrials could strategically develop or acquire products that tap into the burgeoning demand for sustainability and energy efficiency solutions. Imagine advanced insulation materials for industrial applications or components designed to enhance the energy output of renewable energy systems. These are rapidly expanding markets, with the global green building materials market alone projected to reach $496.2 billion by 2027, according to some analyses.

The company would need to commit significant capital for research and development or for acquiring innovative technologies to establish a strong foothold in these competitive sectors. For instance, investing in R&D for next-generation filtration systems that drastically reduce industrial emissions could position CSW Industrials as a leader. This focus aligns with broader industrial trends, such as the increasing regulatory pressure on businesses to lower their carbon footprint.

- Focus on advanced materials: Developing or acquiring products incorporating materials like graphene or advanced composites for improved durability and efficiency.

- Energy efficiency solutions: Creating or sourcing components for HVAC systems, industrial machinery, or building envelopes that significantly reduce energy consumption.

- Sustainability-driven product lines: Introducing product lines made from recycled or bio-based materials, or those designed for circular economy principles.

- Targeting specific industries: Concentrating efforts on sectors with high sustainability mandates, such as renewable energy infrastructure or electric vehicle manufacturing supply chains.

CSW Industrials' foray into new fire and smoke protection solutions, alongside its exploration of the burgeoning electric vehicle (EV) battery component market, firmly places these initiatives within the Question Mark quadrant of the BCG Matrix. These areas represent significant potential for future growth, but currently possess low market share, demanding substantial investment to gain traction.

The company's commitment to innovation in these nascent markets is evident through dedicated R&D efforts and strategic market entry plans. For example, the EV battery component sector is projected for rapid expansion, with a CAGR exceeding 20% through 2030, underscoring the strategic importance of these investments.

Successfully transitioning these Question Marks into Stars will require CSW Industrials to effectively navigate market entry challenges and capitalize on projected market growth. Failure to gain significant market share could necessitate a strategic divestment, making careful resource allocation and execution paramount.

| Initiative | BCG Quadrant | Market Growth Potential | Current Market Share | Investment Requirement | Strategic Focus |

| Fire & Smoke Protection Solutions | Question Mark | High (driven by building codes and safety regulations) | Low | High (R&D, market development) | Building awareness, market penetration |

| EV Battery Components | Question Mark | Very High (projected >20% CAGR through 2030) | Negligible | Very High (R&D, manufacturing scale-up, supply chain development) | Establishing a foothold, securing key partnerships |

BCG Matrix Data Sources

Our CSW Industrials BCG Matrix is built on a foundation of comprehensive market data, including company financial reports, industry growth trends, and competitive landscape analysis.