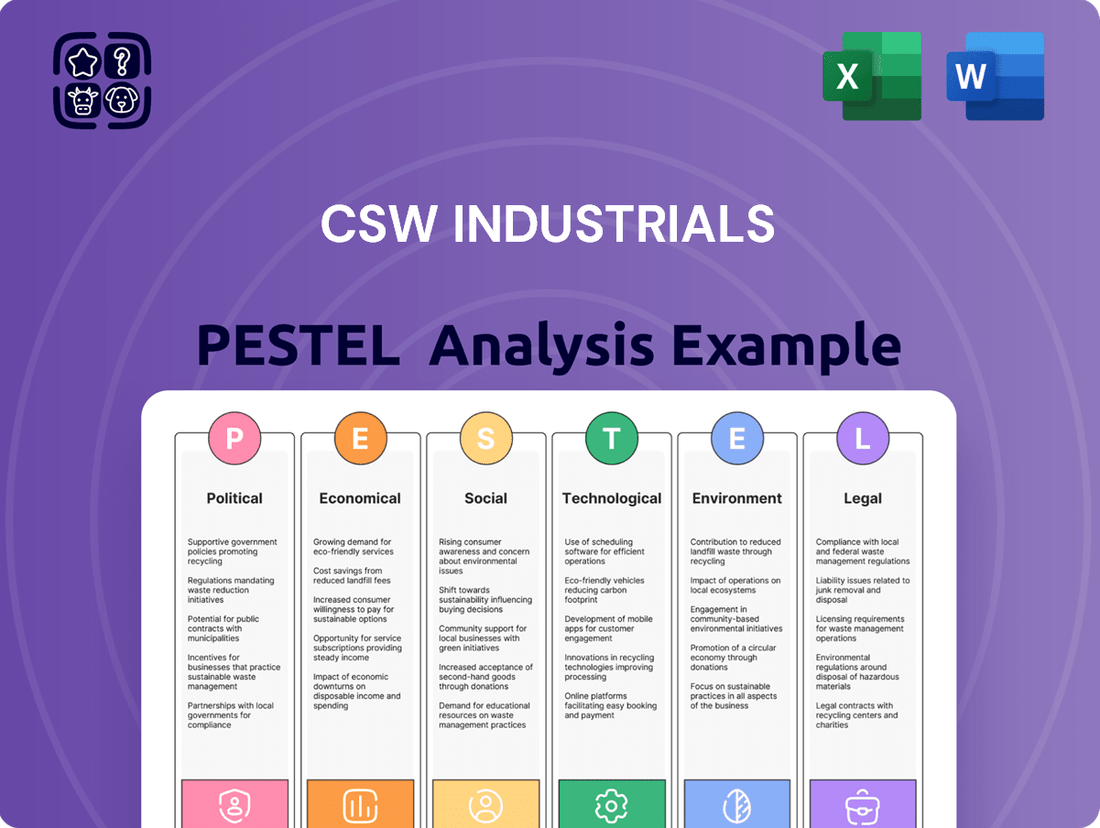

CSW Industrials PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSW Industrials Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping CSW Industrials's trajectory. This comprehensive PESTLE analysis offers a strategic roadmap to navigate external challenges and capitalize on emerging opportunities. Gain the foresight needed to make informed decisions and secure your competitive advantage. Download the full report now for actionable intelligence.

Political factors

Government investment in infrastructure, particularly through initiatives like the Bipartisan Infrastructure Law (BIL) in the United States, offers a direct boost to CSW Industrials' Engineered Building Solutions and Contractor Solutions segments. This sustained federal funding, projected to reach approximately $134 billion in 2025, is allocated across critical projects such as roads, bridges, public transit, broadband expansion, and energy infrastructure. Such substantial investment translates into a strong and consistent demand for the company's products and solutions essential for construction and ongoing maintenance activities.

Changes in international trade policies, such as new tariffs or trade agreements, directly affect CSW Industrials' operational costs and the efficiency of its supply chain. For instance, the Contractor Solutions segment has faced margin pressures due to tariff-related expenses. Staying informed about these evolving trade landscapes is essential for effective sourcing and pricing decisions.

Upcoming regulations, like the Draft Regulation on the Management of Industrial Emissions anticipated for 2025, are set to tighten controls on air, water, and soil pollution. These measures will compel industrial sites, including those CSW Industrials interacts with, to integrate more sustainable technologies and operational methods.

This regulatory shift is likely to stimulate market interest in eco-friendly products and services, potentially benefiting CSW Industrials if it offers such solutions. Conversely, it may also require the company itself to invest in process modifications to meet new environmental standards.

Energy Policies and Electrification Initiatives

Government policies actively driving energy efficiency and electrification are significantly shaping the HVAC/R market. For instance, the Inflation Reduction Act (IRA) has allocated substantial funding, including tax credits and rebates, to encourage the adoption of high-efficiency systems like heat pumps. This directly translates into increased demand for related components and solutions.

CSW Industrials, through its Contractor Solutions segment, is well-positioned to capitalize on these trends. The company's product offerings, which often support the installation and maintenance of HVAC/R systems, can see a surge in demand as contractors work on retrofitting and new installations driven by these policy incentives. This creates a favorable market environment for CSW Industrials.

- IRA's Impact: The Inflation Reduction Act is projected to drive billions in new clean energy investments, with a significant portion directed towards building electrification and efficiency upgrades.

- Heat Pump Growth: By 2025, the US market for heat pumps is expected to see robust growth, with some projections indicating a doubling of installations compared to pre-IRA levels.

- CSW's Role: CSW Industrials' components are integral to the installation and performance of HVAC/R systems, aligning directly with the government's push for more energy-efficient buildings.

Building Codes and Standards

Evolving building codes and standards, often driven by government mandates for safety, energy efficiency, and sustainability, directly impact the products CSW Industrials manufactures. For instance, the increasing focus on energy efficiency in building design, exemplified by updated standards like ASHRAE 90.1 which saw revisions in 2019 and is anticipated for further updates, necessitates materials and systems that reduce energy consumption.

Compliance with these regulations is essential for market access and can also present significant opportunities. For example, California's Title 24, which mandates water-efficient plumbing fixtures, has driven demand for low-flow toilets and faucets. This trend is expected to continue as other regions adopt similar water conservation measures, potentially boosting sales for companies offering compliant solutions.

- Increased Demand for Energy-Efficient Products: Building codes increasingly stipulate higher energy performance, creating a market for CSW Industrials' energy-saving components.

- Water Conservation Mandates: Regulations like California's Title 24, which requires a 20% reduction in indoor water use by 2030 compared to 2015 levels, drive demand for water-saving building materials.

- Sustainability Requirements: Growing emphasis on green building certifications (e.g., LEED, BREEAM) encourages the use of sustainable and recycled materials, aligning with CSW Industrials' potential product development.

- Safety Standards: Stricter safety regulations, particularly in seismic zones or for fire resistance, require continuous product innovation and adherence to updated testing protocols.

Government policies, such as the Bipartisan Infrastructure Law (BIL) in the US, are injecting significant capital into infrastructure projects, directly benefiting CSW Industrials' construction-related segments. This sustained federal investment, with billions allocated annually, supports demand for the company's essential building materials and solutions.

Trade policy shifts, including tariffs, continue to influence CSW Industrials' supply chain costs and pricing strategies, as seen with margin pressures in its Contractor Solutions segment. Staying abreast of these international trade dynamics is crucial for operational efficiency.

Upcoming environmental regulations, targeting industrial emissions, will likely drive demand for sustainable technologies and products, potentially creating opportunities for CSW Industrials if it aligns its offerings with these green initiatives.

Government incentives for energy efficiency, like those from the Inflation Reduction Act (IRA), are boosting the HVAC/R market, increasing demand for components that support high-efficiency systems such as heat pumps. CSW Industrials is positioned to benefit from this trend.

Evolving building codes, mandating higher energy efficiency and water conservation, necessitate product innovation and compliance, presenting both challenges and growth opportunities for CSW Industrials' product development and sales.

| Policy/Regulation | Impact on CSW Industrials | Key Data Point (2024/2025) |

|---|---|---|

| Bipartisan Infrastructure Law (BIL) | Increased demand for construction materials and solutions | Projected ~$134 billion in federal funding for infrastructure in 2025 |

| Inflation Reduction Act (IRA) | Growth in HVAC/R market, demand for energy-efficient components | IRA projected to drive billions in clean energy investments by 2025 |

| Environmental Regulations (e.g., emissions) | Potential demand for sustainable technologies; compliance costs | Draft Regulation on Industrial Emissions anticipated for 2025 |

| Building Codes (e.g., energy efficiency, water conservation) | Need for product innovation and compliance; market opportunities | ASHRAE 90.1 updates expected; California Title 24 water reduction goals |

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing CSW Industrials, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these critical external forces.

A clean, summarized version of the full CSW Industrials PESTLE analysis provides an easily digestible overview, relieving the pain of sifting through extensive data for quick decision-making.

Economic factors

Overall economic growth is a cornerstone for CSW Industrials, directly influencing demand for its HVAC/R, plumbing, and building products. While the company experienced some organic revenue decline in recent periods, strategic acquisitions have bolstered its growth trajectory. A robust economic environment, characterized by increased consumer and business spending, is essential for driving higher sales volumes.

The health of the construction sector, encompassing residential, commercial, and industrial projects, is particularly vital for CSW Industrials. For instance, in the United States, construction spending reached an annualized rate of $2,097.4 billion in April 2024, a slight increase from the previous month, indicating continued activity. Higher investment in new builds and renovations directly translates to greater demand for CSW's product offerings.

Fluctuations in interest rates significantly influence construction and consumer spending, directly impacting demand for CSW Industrials' diverse product lines. For instance, the Federal Reserve's decisions on interest rates in 2024 and projections for 2025 will shape borrowing costs for developers and consumers alike, potentially slowing residential construction if rates remain elevated.

Rising interest rates can dampen growth, particularly in sectors like residential construction where financing costs are a major determinant of activity. Simultaneously, persistent cost inflation, evident in the price of key raw materials like steel and lumber, as well as escalating logistics expenses, poses a direct threat to CSW Industrials' gross margins, potentially squeezing profitability throughout 2024 and into 2025.

Global supply chain disruptions and elevated transportation costs remain significant headwinds for manufacturers. CSW Industrials likely faces continued risks from shipping delays and increased logistics expenses, impacting both product availability and profit margins. For instance, the Drewry World Container Index, a key benchmark for shipping costs, saw significant fluctuations throughout 2024, with rates generally higher than pre-pandemic levels, directly affecting the cost of goods for companies like CSW.

Market Demand in Key End Markets

CSW Industrials' performance is closely tied to the health of its key end markets. These include HVAC/R, plumbing, general industrial, and energy sectors. Demand in these areas, driven by construction activity, renovation projects, and industrial development, directly shapes the company's revenue streams and future growth potential.

The HVAC system market, a significant area for CSW Industrials, is projected to expand at a compound annual growth rate of 7.4% between 2024 and 2030. Furthermore, the plumbing industry is anticipated to see robust growth in 2025, indicating positive trends for the company's product sales in these segments.

- HVAC/R Market Growth: Expected to grow at 7.4% from 2024 to 2030.

- Plumbing Industry Outlook: Poised for growth in 2025.

- Demand Drivers: Influenced by new construction, repair and remodeling, and industrial expansions.

- Impact on CSW Industrials: Direct correlation between end-market demand and company revenue/growth.

Acquisition Strategy and Integration Costs

CSW Industrials has strategically utilized acquisitions as a key driver for expanding its market presence and diversifying its product portfolio. This proactive approach has demonstrably contributed to top-line revenue growth in recent periods.

However, the integration of acquired entities often necessitates significant upfront investment, leading to increased operational costs and potentially dampening profit margins in the immediate aftermath of a deal. For example, the integration of acquired businesses in late 2023 and early 2024 incurred substantial one-time expenses related to system consolidation and workforce alignment.

- Acquisition-driven revenue growth: CSW Industrials has seen its revenue climb through strategic acquisitions, aiming to broaden its market reach.

- Integration cost impact: The process of merging new companies involves considerable expenses, affecting short-term profitability.

- Profit margin pressure: While growth is a goal, integration costs can temporarily squeeze profit margins as operational efficiencies are realized.

- Recent acquisition examples: Specific integration challenges were noted following acquisitions completed in the latter half of 2023 and early 2024.

Economic growth is a primary driver for CSW Industrials, as increased consumer and business spending directly boosts demand for its HVAC/R, plumbing, and building products. The company's reliance on the construction sector, which saw US annualized spending at $2,097.4 billion in April 2024, means that a healthy economy is crucial for its sales volumes.

Interest rate fluctuations in 2024 and 2025 will significantly impact borrowing costs for developers and consumers, potentially slowing residential construction. Coupled with persistent cost inflation for raw materials like steel and lumber, and rising logistics expenses, these factors present a direct threat to CSW Industrials' gross margins throughout 2024 and into 2025.

Global supply chain disruptions and elevated transportation costs remain considerable challenges. CSW Industrials likely continues to face risks from shipping delays and increased logistics expenses, as indicated by the Drewry World Container Index, which generally remained higher than pre-pandemic levels throughout 2024, impacting the cost of goods.

| Economic Factor | Impact on CSW Industrials | Supporting Data/Trend |

| Overall Economic Growth | Drives demand for HVAC/R, plumbing, building products | US Construction Spending: $2,097.4 billion (annualized rate, April 2024) |

| Interest Rates | Affects construction financing and consumer spending | Federal Reserve policy decisions in 2024-2025 |

| Inflation (Materials & Logistics) | Pressures gross margins | Rising costs of steel, lumber, and shipping (Drewry World Container Index trends) |

Full Version Awaits

CSW Industrials PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CSW Industrials PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing crucial insights for strategic planning.

Sociological factors

The industrial sector, encompassing manufacturing, HVAC, and plumbing, is grappling with persistent skilled labor shortages. This scarcity directly impacts CSW Industrials' capacity for production scaling and hinders its customers' ability to finalize installations, potentially dampening demand for CSW's offerings.

In 2024, the U.S. Bureau of Labor Statistics projected a significant need for skilled trades, with employment in these fields expected to grow faster than the average for all occupations. For instance, the demand for HVAC technicians was anticipated to rise by 6% from 2022 to 2032, indicating a continued strain on available talent that affects CSW's customer base.

The aging of infrastructure, particularly in critical areas like plumbing and building systems, is a significant driver for the repair, remodeling, and retrofitting sectors. This presents a clear opportunity for companies like CSW Industrials, whose products are integral to these renovation efforts. Regions with older housing stock, such as the Northeast U.S., are expected to see a heightened demand for these services.

In 2024, the U.S. infrastructure market is projected to reach approximately $2.7 trillion, with a substantial portion dedicated to repair and maintenance. Specifically, the residential renovation and repair market was valued at over $450 billion in 2023 and is anticipated to grow, fueled by the need to upgrade older homes. This growth directly translates to increased demand for the types of industrial products CSW Industrials provides for these essential upgrades.

Consumers and businesses are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. For instance, a 2024 survey indicated that over 60% of consumers consider environmental impact when making purchasing decisions, a trend expected to grow. This societal shift directly influences demand for energy-efficient solutions.

Rising energy costs, projected to continue their upward trajectory in 2024-2025 due to geopolitical factors and supply chain dynamics, further amplify the appeal of energy-saving products. This economic pressure makes investments in efficiency, such as advanced insulation or smart grid technologies, more attractive for both households and corporations seeking to manage operational expenses.

CSW Industrials can capitalize on this by developing and marketing products that align with these evolving consumer values and economic realities. Innovations in renewable energy integration and products designed for reduced energy consumption present clear market opportunities, potentially boosting sales and brand reputation in the coming years.

Focus on Indoor Air Quality

Sociological factors are increasingly shaping market demands, with a significant emphasis on improving indoor air quality (IAQ). This growing awareness among both residential and commercial property owners is directly fueling the need for advanced HVAC/R solutions. These solutions often integrate high-efficiency air filtration, sophisticated purification systems, and precise humidity control mechanisms.

CSW Industrials' Contractor Solutions segment is well-positioned to benefit from this trend. The company's product offerings align with the rising consumer and business demand for healthier indoor environments. For instance, the global IAQ market was valued at approximately $10.2 billion in 2023 and is projected to reach $19.7 billion by 2030, growing at a CAGR of 9.8% during the forecast period. This indicates a substantial and expanding opportunity for companies like CSW Industrials that can provide relevant technologies.

- Growing health consciousness: Consumers are more aware of the impact of air quality on well-being, driving demand for IAQ-enhancing products.

- Increased building regulations: Many regions are implementing stricter building codes that mandate better ventilation and air filtration standards.

- Rise in allergies and respiratory issues: A higher prevalence of allergies and respiratory conditions makes IAQ solutions a necessity for many.

- Focus on productivity in commercial spaces: Businesses recognize that improved IAQ can lead to better employee health and productivity.

Demographic Shifts and Urbanization

Population growth and the ongoing trend of urbanization are significant drivers for the demand in construction, especially for companies like CSW Industrials. As more people move to cities, particularly in areas like the Midwest U.S., there's a heightened need for new homes and commercial spaces. This demographic shift directly translates into a greater requirement for the building and plumbing solutions that CSW Industrials provides.

Consider these points:

- Midwest Population Growth: While national trends show migration patterns, certain Midwest states are experiencing population increases. For example, states like Idaho, Utah, and Arizona, while not strictly Midwest, show significant growth, influencing broader construction material demand. However, focusing on the Midwest, cities like Columbus, Ohio, and Indianapolis, Indiana, are seeing steady population influxes, boosting local construction activity.

- Urbanization Impact: The U.S. Census Bureau reported in 2023 that over 83% of the U.S. population lives in urban areas. This concentration fuels demand for infrastructure and residential development, directly benefiting suppliers of essential building components.

- Housing Demand: The U.S. is facing a significant housing shortage. Projections from various housing market analyses in late 2024 and early 2025 indicate a continued need for millions of new housing units over the next decade, a substantial portion of which will be in or around urban centers.

The increasing focus on health and well-being is a major sociological driver, boosting demand for improved indoor air quality (IAQ) solutions. This trend is particularly evident in residential and commercial sectors, pushing for advanced HVAC/R systems with superior filtration and purification capabilities.

The global IAQ market, valued at approximately $10.2 billion in 2023, is projected for robust growth, reaching an estimated $19.7 billion by 2030 with a compound annual growth rate of 9.8%. This expansion directly benefits companies like CSW Industrials, whose product lines cater to the growing need for healthier indoor environments.

Societal shifts towards sustainability are also influencing purchasing decisions, with consumers showing a greater willingness to invest in eco-friendly and energy-efficient products. This aligns with the increasing energy costs, making investments in technologies that reduce consumption more appealing for both households and businesses.

Population growth and urbanization continue to fuel demand for construction, particularly in urban areas. This demographic trend necessitates new housing and commercial developments, directly increasing the need for building and plumbing components supplied by companies like CSW Industrials.

| Sociological Factor | Impact on CSW Industrials | Supporting Data (2023-2025 Projections) |

| Growing Health Consciousness (IAQ) | Increased demand for advanced HVAC/R solutions. | Global IAQ market to grow from $10.2B (2023) to $19.7B (2030) at 9.8% CAGR. |

| Sustainability Focus | Higher demand for energy-efficient and eco-friendly products. | Over 60% of consumers consider environmental impact in purchasing (2024 survey). |

| Population Growth & Urbanization | Increased need for construction materials and plumbing solutions. | Over 83% of US population in urban areas (2023 Census); significant housing shortage projected. |

Technological factors

The HVAC/R sector is seeing rapid technological evolution, with a strong focus on boosting energy efficiency and overall performance. Innovations like smart HVAC systems, intelligent thermostats, advanced zoning capabilities, and sophisticated air quality sensors are becoming increasingly prevalent. For CSW Industrials' Contractor Solutions, staying ahead of these advancements is crucial for maintaining a competitive edge in the market.

The plumbing sector is increasingly embracing smart fixtures, advanced leak detection, and greywater recycling. These innovations are driving significant improvements in water conservation and energy efficiency, offering greater user convenience. For instance, smart water leak detectors, which saw a considerable surge in consumer interest throughout 2024, can prevent costly water damage, a benefit that resonates strongly with homeowners and building managers alike.

The manufacturing sector is rapidly embracing Industry 4.0 and the emerging Industry 5.0, integrating technologies like AI, IoT, and digital twins. These advancements are revolutionizing production by optimizing efficiency, boosting quality, and streamlining supply chains. For instance, the global market for AI in manufacturing was projected to reach $10.2 billion in 2023 and is expected to grow significantly, highlighting the widespread adoption of these digital tools.

CSW Industrials can leverage these digital transformations to enhance its operational performance. Implementing advanced robotics and data analytics can lead to more precise manufacturing processes and better predictive maintenance, reducing downtime. By Q2 2024, companies that have adopted these technologies are reporting an average of 15-20% increase in productivity and a 10% reduction in operational costs.

Development of New Materials and Chemicals

Innovations in material science are significantly reshaping industries, with advancements in specialty chemicals offering more durable, sustainable, and eco-friendly alternatives. This trend directly influences CSW Industrials' product development and market positioning.

CSW Industrials' Specialty Chemicals segment is well-positioned to leverage the increasing global demand for bio-based and high-performance chemical solutions. For instance, the market for bio-based chemicals is projected to reach over $100 billion by 2027, indicating substantial growth opportunities.

- Sustainable Materials: The development of biodegradable polymers and advanced composites offers CSW Industrials opportunities to enhance its product offerings with environmentally conscious options, aligning with growing consumer and regulatory preferences for sustainability.

- High-Performance Chemicals: Innovations in areas like advanced coatings, adhesives, and catalysts are driving demand for specialty chemicals that offer superior performance characteristics, such as increased efficiency, longevity, and reduced environmental impact. The global specialty chemicals market was valued at approximately $670 billion in 2023 and is expected to grow.

- Eco-Friendly Alternatives: The push for greener chemistry is leading to the creation of chemicals with lower toxicity and reduced greenhouse gas emissions during production and use, presenting CSW Industrials with chances to innovate and capture market share in environmentally responsible product categories.

Predictive Maintenance and IoT Integration

The increasing integration of Internet of Things (IoT) sensors and real-time diagnostics within industrial products is a significant technological advancement. This allows for predictive maintenance, a strategy that anticipates equipment failures before they occur. By doing so, it dramatically reduces unexpected downtime and boosts overall operational efficiency for manufacturers.

For CSW Industrials, this trend holds particular promise for its Specialized Reliability Solutions segment. The ability to offer predictive maintenance as a service or integrated into their product lines can be a major differentiator. For instance, companies are investing heavily in this area; in 2024, the global predictive maintenance market was valued at approximately $11.2 billion and is projected to grow substantially.

This technological shift directly supports CSW Industrials' customer base by offering tangible benefits:

- Reduced Operational Costs: By minimizing unplanned downtime and emergency repairs, businesses can save significantly on maintenance expenditures.

- Increased Asset Lifespan: Proactive maintenance helps extend the operational life of critical industrial equipment.

- Enhanced Safety: Preventing equipment failures can lead to safer working environments by avoiding hazardous situations.

Technological advancements are profoundly reshaping CSW Industrials' operating landscape, particularly in areas like smart systems and advanced materials. The integration of AI and IoT in manufacturing, for instance, is driving efficiency gains, with companies adopting these technologies reporting up to 20% productivity increases by mid-2024.

Smart technologies are becoming standard in HVAC and plumbing, enhancing energy and water conservation. The predictive maintenance market, valued at $11.2 billion in 2024, highlights a significant trend towards proactive operational management, directly benefiting CSW's reliability solutions.

Innovations in specialty chemicals, including bio-based alternatives, are crucial. The bio-based chemical market is projected to exceed $100 billion by 2027, presenting a substantial growth avenue for CSW's chemical segment.

| Technology Area | Impact on CSW Industrials | Key Data/Trend |

|---|---|---|

| Smart HVAC/Plumbing | Enhanced efficiency, conservation, user convenience | Smart leak detectors saw increased consumer interest in 2024. |

| Industry 4.0/5.0 | Optimized production, quality, supply chains | AI in manufacturing market projected for significant growth from $10.2B in 2023. |

| Predictive Maintenance (IoT) | Reduced downtime, increased asset lifespan | Global predictive maintenance market valued at $11.2B in 2024. |

| Specialty Chemicals | Durable, sustainable, eco-friendly products | Bio-based chemicals market to surpass $100B by 2027. |

Legal factors

CSW Industrials faces increasing pressure from evolving environmental regulations. Stricter rules on industrial emissions and air quality, like those impacting refrigerant use, directly influence operational costs and product lifecycles. For instance, the upcoming EPA refrigerant rules in 2026, mandating a significant reduction in hydrofluorocarbons (HFCs), will require substantial investment in compliant technologies and product redesign.

CSW Industrials must navigate a complex web of legal requirements for product safety and performance. For instance, in the HVAC/R sector, compliance with standards like UL 1995 for heating and cooling equipment is non-negotiable, ensuring safe operation and energy efficiency. Failure to meet these stringent certifications can lead to product recalls and significant financial penalties, impacting market access and brand reputation.

Changes in labor laws, such as minimum wage adjustments and updated safety standards, directly influence CSW Industrials' operational expenses and how it manages its workforce. For instance, in 2024, many regions saw increases in minimum wages, which can raise labor costs for companies like CSW.

The persistent shortage of skilled labor in the industrial sector, a trend expected to continue into 2025, underscores the critical need for CSW Industrials to adhere strictly to all employment regulations. Failing to comply can lead to penalties and hinder the ability to attract and retain essential talent.

Intellectual Property Protection

Protecting intellectual property, such as patents for its specialized industrial products and trademarks for its brand, is crucial for CSW Industrials to sustain its competitive edge. Robust legal frameworks for intellectual property rights are essential to safeguard the company's innovations and prevent unauthorized use.

In 2024, the global intellectual property market continued to grow, with significant investment in patent filings across industrial sectors. For instance, the World Intellectual Property Organization (WIPO) reported a notable increase in patent applications related to advanced manufacturing and automation technologies, areas where CSW Industrials operates.

- Patent Protection: CSW Industrials relies on patents to protect its unique product designs and manufacturing processes, preventing competitors from replicating its innovations.

- Trademark Enforcement: Safeguarding its brand through trademarks is vital for CSW Industrials to ensure customer recognition and prevent brand dilution in the marketplace.

- Global IP Landscape: Navigating varying international intellectual property laws is a key legal consideration for CSW Industrials' global operations and market expansion.

Acquisition and Antitrust Regulations

CSW Industrials' growth strategy heavily relies on acquisitions, making adherence to antitrust regulations paramount. Navigating these legal frameworks, including obtaining regulatory approvals for mergers and acquisitions, directly impacts the viability and pace of its expansion plans.

In 2024, the U.S. Federal Trade Commission (FTC) and Department of Justice (DOJ) continued to scrutinize mergers, particularly those in concentrated industries. For instance, the FTC's increased focus on labor market impacts in M&A reviews could add complexity to CSW's acquisition pipeline.

- Antitrust Scrutiny: CSW must anticipate heightened regulatory review of its acquisitions to ensure they do not substantially lessen competition.

- Regulatory Approvals: Obtaining clearance from bodies like the FTC and DOJ is a critical, often time-consuming, step in completing any significant acquisition.

- Market Concentration: The legal landscape may impose conditions or even block deals if CSW's acquisitions are perceived to create monopolistic tendencies in specific markets.

CSW Industrials must navigate a complex legal landscape, including stringent environmental regulations and product safety standards, which directly impact operational costs and market access. Adherence to labor laws and intellectual property protection is also critical for managing expenses and maintaining a competitive edge.

The company's expansion strategy, often involving acquisitions, necessitates careful compliance with antitrust regulations, as demonstrated by increased scrutiny from bodies like the FTC in 2024. Failure to comply with these legal frameworks can lead to significant penalties, operational disruptions, and hinder growth opportunities.

| Legal Factor | Impact on CSW Industrials | 2024/2025 Data/Trend |

|---|---|---|

| Environmental Regulations | Increased operational costs, product redesign needs | EPA refrigerant rules mandate HFC reduction by 2026; stricter emission standards |

| Product Safety & Performance | Risk of recalls, financial penalties, market access limitations | Compliance with UL 1995 for HVAC/R equipment is mandatory |

| Labor Laws | Higher labor expenses, workforce management challenges | Minimum wage increases in various regions during 2024 |

| Intellectual Property | Protection of innovation, competitive advantage | WIPO reported increased patent filings in advanced manufacturing in 2024 |

| Antitrust Regulations | Potential blocking of acquisitions, regulatory approval delays | FTC and DOJ increased scrutiny on mergers in concentrated industries in 2024 |

Environmental factors

Climate change is making extreme weather more common and severe. This trend is a significant driver for CSW Industrials, as it increases demand for their HVAC/R systems and building materials designed for greater resilience. For instance, the heightened risk of heatwaves and intense storms directly boosts the need for efficient cooling and heating solutions, a core area for CSW Industrials.

The global economic impact of climate-related disasters is substantial. In 2023 alone, insured losses from natural catastrophes reached an estimated $110 billion, according to Swiss Re. This underscores the growing market for robust infrastructure and climate-controlled environments, directly benefiting companies like CSW Industrials that supply these essential components.

Growing concerns over water scarcity, especially in arid regions like the U.S. Southwest, are driving a significant increase in demand for water-saving plumbing solutions. For instance, by 2025, some projections indicate that over 40% of the U.S. population could be living in areas facing water stress.

CSW Industrials is well-positioned to capitalize on this trend by expanding its product portfolio to include innovative water conservation technologies. Offering products such as low-flow fixtures, efficient irrigation systems, and components for rainwater harvesting can directly address the needs of environmentally conscious consumers and businesses, aligning with regulatory pressures and market demand.

The growing global emphasis on sustainability and green building practices presents significant opportunities for CSW Industrials. This trend fuels demand for eco-friendly construction materials, energy-efficient products, and innovative solutions designed to minimize environmental impact. For instance, the global green building materials market was valued at approximately USD 250 billion in 2023 and is projected to reach over USD 500 billion by 2030, indicating substantial growth potential for companies aligned with these values.

Resource Availability and Raw Material Sourcing

The availability and cost of essential raw materials, such as metals and chemicals, directly affect CSW Industrials' production expenses and output. Environmental regulations and global supply chain disruptions, particularly those seen in 2024 and projected for 2025, can significantly impact resource accessibility. For instance, increased demand for critical minerals used in electronics, a key sector for CSW, has driven up prices, with some key commodities experiencing price surges of 15-20% year-over-year as of early 2025.

Sustainable sourcing and efficient resource management are becoming paramount for CSW Industrials to mitigate risks and enhance its competitive edge. Companies are increasingly investing in circular economy models and exploring alternative, more readily available materials. By 2025, it's estimated that over 60% of major industrial players will have integrated robust sustainable sourcing policies into their procurement strategies, aiming to reduce reliance on volatile commodity markets.

Key considerations for CSW Industrials regarding resource availability include:

- Geopolitical impact on critical mineral supply chains: Tensions in key mining regions can disrupt the flow of materials like lithium and cobalt, essential for advanced manufacturing.

- Water scarcity and its effect on industrial processes: Many manufacturing operations, including those of CSW, are water-intensive, making regions with limited water resources a significant concern.

- Regulatory changes concerning resource extraction and waste management: Evolving environmental laws can increase compliance costs and necessitate investment in new technologies.

- Price volatility of key commodities: Fluctuations in the global market for metals, plastics, and chemicals directly impact CSW's cost of goods sold.

Waste Management and Recycling Initiatives

The intensifying global emphasis on waste reduction, recycling, and the responsible disposal of industrial byproducts directly influences manufacturing operations. CSW Industrials must navigate these changes, potentially adapting its processes to meet stricter waste management regulations and exploring opportunities to integrate recycled materials into its product lines, a trend gaining significant traction. For instance, in 2024, the global waste management market was valued at approximately USD 1.4 trillion, with a projected compound annual growth rate (CAGR) of over 5% through 2030, indicating substantial market pressure for sustainable practices.

Key considerations for CSW Industrials include:

- Regulatory Compliance: Staying ahead of evolving local and international waste management legislation is crucial to avoid penalties and maintain operational continuity.

- Circular Economy Integration: Exploring the feasibility of incorporating recycled content into manufacturing processes can reduce raw material costs and enhance product sustainability credentials.

- Operational Efficiency: Implementing advanced waste segregation and recycling technologies can streamline operations and potentially unlock new revenue streams from waste byproducts.

- Supply Chain Impact: Collaborating with suppliers to ensure responsible waste handling throughout the value chain will be increasingly important for overall environmental stewardship.

Environmental factors significantly shape CSW Industrials' operational landscape, from climate change driving demand for resilient building solutions to water scarcity necessitating conservation technologies. The global push for sustainability also fuels the green building materials market, projected to exceed USD 500 billion by 2030, directly benefiting companies like CSW. Furthermore, the availability and cost of raw materials are impacted by environmental regulations and supply chain disruptions, with critical mineral prices surging as much as 20% year-over-year by early 2025.

| Environmental Factor | Impact on CSW Industrials | 2024/2025 Data Point |

|---|---|---|

| Climate Change & Extreme Weather | Increased demand for HVAC/R and resilient building materials. | Insured losses from natural catastrophes reached $110 billion in 2023. |

| Water Scarcity | Growing demand for water-saving plumbing solutions. | Over 40% of the U.S. population could face water stress by 2025. |

| Sustainability & Green Building | Opportunity in eco-friendly materials and energy-efficient products. | Green building materials market valued at approx. USD 250 billion in 2023. |

| Raw Material Availability & Cost | Impacts production expenses due to regulations and supply chain issues. | Critical mineral prices saw 15-20% year-over-year surges by early 2025. |

| Waste Management & Recycling | Need to adapt to stricter regulations and integrate recycled materials. | Global waste management market valued at approx. USD 1.4 trillion in 2024. |

PESTLE Analysis Data Sources

Our CSW Industrials PESTLE Analysis is built on a comprehensive foundation of data from leading economic indicators, government policy updates, and reputable industry research firms. We meticulously gather insights from official sources to ensure accuracy and relevance across all macro-environmental factors.