Chicken Soup SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chicken Soup Bundle

Chicken soup boasts strong brand recognition and a comforting, universally appealing product, but faces intense competition and potential ingredient cost fluctuations. Understanding these dynamics is crucial for any player in the food industry.

Want the full story behind Chicken Soup's market position, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and competitive analysis.

Strengths

Chicken Soup for the Soul Entertainment boasts a robust and diverse content portfolio, a significant strength in the competitive media landscape. As of early 2024, the company held a substantial library featuring around 28,000 film titles and an impressive 40,000 television episodes. This vast collection, bolstered by subsidiaries like Screen Media and 1091 Pictures, provides a deep well of assets for its streaming services and lucrative licensing opportunities.

Chicken Soup for the Soul Entertainment (CSSE) leverages its established streaming platforms, including Crackle and Redbox, to reach a broad audience. These platforms operate across various models: ad-supported video-on-demand (AVOD), transactional video-on-demand (TVOD), and free ad-supported streaming TV (FAST). This multi-pronged approach ensures diverse revenue streams and direct consumer engagement.

In 2023, CSSE reported significant growth in its streaming segment, with Crackle alone reaching over 49 million registered users. The company's strategy of offering a mix of free and paid content across these platforms proved effective, with FAST channels contributing substantially to advertising revenue. This established presence in the streaming market provides a solid foundation for future expansion and monetization efforts.

The 'Chicken Soup for the Soul' brand name provides a powerful foundation, instantly recognizable and associated with inspirational content. This inherent brand equity allows for immediate differentiation in a crowded market, potentially attracting a loyal audience segment seeking uplifting stories.

This strong brand recognition facilitates significant cross-promotional opportunities across various media platforms, from books to television and digital content. In 2024, the brand continued its legacy, with new book releases and media projects aiming to leverage this established goodwill.

Hybrid Monetization Model

Chicken Soup for the Soul Entertainment's hybrid monetization model was a key strength, blending advertising-supported (AVOD/FAST) and subscription-based (SVOD) streaming with physical media rentals via Redbox kiosks. This multi-pronged strategy was designed to appeal to a broad audience and tap into diverse revenue opportunities, a strategy that showed promise as the streaming landscape continued to evolve. For instance, by the end of 2023, Redbox's physical locations continued to be a significant contributor to revenue, even as the company expanded its digital offerings.

The company's ability to generate income from multiple sources provided a degree of resilience against market fluctuations. This diversification was particularly relevant in 2024 as the streaming market saw increased competition and shifts in consumer viewing habits. The integration of Redbox's established footprint with growing digital platforms offered a unique competitive advantage, aiming to capture value across different consumer segments.

- Diversified Revenue Streams: The combination of AVOD, SVOD, and physical rentals reduced reliance on any single income source.

- Broad Market Reach: Catering to both digital-first viewers and those who still utilize physical media allowed for wider customer acquisition.

- Synergistic Opportunities: The model allowed for potential cross-promotion between digital content and the Redbox rental service.

- Adaptability: The hybrid approach positioned the company to adapt to evolving consumer preferences in media consumption.

Strategic Partnerships and Joint Ventures

Chicken Soup has actively pursued strategic partnerships, notably its early 2024 joint venture with FUEL TV. This collaboration focused on developing specialized streaming channels for action sports, a move designed to broaden its content library and tap into a new demographic. Such alliances demonstrate a forward-thinking strategy for market penetration and audience growth.

These collaborations are crucial for expanding reach and diversifying content. For instance, the FUEL TV venture aimed to leverage existing sports viewership, potentially increasing subscriber numbers and ad revenue. By teaming up with established entities, Chicken Soup can accelerate its market presence without the full cost of organic development.

Key benefits of these strategic alliances include:

- Expanded Content Portfolio: Access to new niche content like action sports.

- New Audience Acquisition: Reaching demographics associated with partner brands.

- Shared Development Costs: Mitigating financial risk in content creation and platform expansion.

- Enhanced Brand Visibility: Cross-promotion opportunities with established partners.

Chicken Soup for the Soul Entertainment's extensive content library, encompassing roughly 28,000 films and 40,000 TV episodes as of early 2024, provides a deep well of assets for its streaming services and licensing. This vast collection, enhanced by subsidiaries like Screen Media and 1091 Pictures, offers significant value and monetization potential.

The company's established streaming platforms, including Crackle and Redbox, serve a broad audience through AVOD, TVOD, and FAST models, creating diverse revenue streams and direct consumer engagement. By the end of 2023, Crackle had amassed over 49 million registered users, demonstrating effective reach and audience building.

The iconic Chicken Soup for the Soul brand name offers immediate recognition and is associated with inspirational content, providing a distinct advantage in a crowded market. This strong brand equity fosters loyalty and differentiation, with ongoing media projects and book releases in 2024 continuing to leverage this goodwill.

CSSE's hybrid monetization strategy, combining ad-supported and subscription streaming with physical media rentals via Redbox, offers resilience and broad market appeal. By the close of 2023, Redbox's physical locations remained a notable revenue contributor, complementing the company's digital expansion efforts.

Strategic partnerships, such as the early 2024 joint venture with FUEL TV for action sports content, expand the company's library and reach new demographics. These collaborations reduce development costs and enhance brand visibility, demonstrating a proactive approach to market growth.

| Strength Area | Description | Key Data/Examples |

|---|---|---|

| Content Library | Vast and diverse library of film and television content. | ~28,000 film titles, ~40,000 TV episodes (early 2024). Subsidiaries: Screen Media, 1091 Pictures. |

| Streaming Platforms | Established and multi-modal streaming services. | Crackle, Redbox. Models: AVOD, TVOD, FAST. Crackle users: >49 million (end of 2023). |

| Brand Equity | Strong, recognizable brand associated with inspirational content. | Instant differentiation, fosters audience loyalty. Ongoing book and media projects (2024). |

| Monetization Strategy | Hybrid approach blending digital and physical revenue streams. | AVOD, SVOD, FAST, physical rentals (Redbox). Redbox kiosks significant revenue contributor (end of 2023). |

| Strategic Partnerships | Proactive engagement in collaborations to expand reach and content. | Joint venture with FUEL TV (early 2024) for action sports content. |

What is included in the product

This SWOT analysis provides a comprehensive overview of Chicken Soup's internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Offers a clear, actionable framework to identify and address key challenges, easing the burden of strategic planning.

Weaknesses

Chicken Soup for the Soul Entertainment's crippling debt load is a major concern, with the company carrying over $1 billion in liabilities. This substantial debt, significantly exacerbated by the Redbox acquisition, creates considerable financial fragility.

The sheer weight of this debt exposure makes the company highly susceptible to adverse market changes and operational setbacks, potentially hindering its ability to invest in growth or weather economic downturns.

Chicken Soup's acquisition of Redbox, a DVD rental kiosk operator, has proven to be a significant weakness. Redbox operates in a market fundamentally disrupted by streaming services, leading to a steady decline in its core business. The anticipated post-COVID resurgence in physical media rentals simply did not occur, failing to validate the financial logic behind the acquisition.

Chicken Soup faced significant financial headwinds, reporting a substantial $636.6 million loss in 2023. This deep deficit contributed to severe liquidity issues, evidenced by a sharp decline in the company's cash on hand. These financial strains directly impacted operations, leading to missed payments for both employees and crucial partners, signaling a critical cash flow crunch.

Inability to Secure Financing and Lender Disputes

Chicken Soup's inability to secure necessary financing proved to be a critical weakness. Despite attempts to raise capital and renegotiate existing debt, the company found itself unable to attract new funding. This financial constraint was compounded by reports that lenders were unwilling to cooperate on restructuring terms, effectively blocking any potential for a turnaround.

The lack of financial support meant that Chicken Soup could not implement recovery strategies or meet its operational obligations. For instance, without access to working capital, the company would struggle to purchase inventory, pay employees, or cover essential operating expenses. This inability to secure essential funds directly sealed its fate, leaving no viable path forward.

- Lack of New Investment: Failed to secure new equity or debt financing in a challenging market.

- Lender Non-Cooperation: Existing lenders reportedly refused to agree to debt restructuring or further credit lines.

- Operational Halt: Inability to fund ongoing operations, leading to a standstill.

- Missed Opportunities: Could not capitalize on market opportunities due to financial constraints.

Operational Mismanagement Allegations

Allegations of operational mismanagement, particularly concerning the CEO and board members, emerged prominently during the company's bankruptcy proceedings. These included serious accusations of misused business funds, which directly impacted the company's ability to meet its financial obligations.

The failure to pay employees and provide essential support for healthcare further exacerbated these internal issues. This not only created significant hardship for the workforce but also severely eroded trust among stakeholders and hampered operational effectiveness.

- Mismanagement Allegations: CEO and board members faced accusations of financial impropriety.

- Fund Misuse: Concerns were raised about business funds being improperly allocated.

- Employee Impact: Non-payment of wages and lack of healthcare support affected staff morale and retention.

- Trust Erosion: Internal governance failures significantly damaged confidence in leadership and operations.

Chicken Soup for the Soul Entertainment's significant debt burden, exceeding $1 billion, coupled with the underperforming Redbox acquisition, created a precarious financial situation. The company's inability to secure new financing or gain lender cooperation for debt restructuring proved fatal. This financial paralysis prevented any operational recovery or strategic adjustments.

The company's substantial losses, including a $636.6 million deficit in 2023, led to critical liquidity shortages. This cash crunch resulted in missed payments to employees and partners, highlighting severe operational disruptions. Furthermore, allegations of mismanagement and fund misuse by leadership eroded stakeholder trust and exacerbated the company's financial woes.

| Financial Metric | 2023 (Millions USD) | Impact |

|---|---|---|

| Total Liabilities | ~$1,000+ | Crippling debt load, financial fragility |

| Net Loss | $636.6 | Severe liquidity issues, operational strain |

| Cash on Hand | Significantly declined | Inability to meet obligations, cash flow crunch |

| Financing Secured | None | Inability to fund operations or recovery strategies |

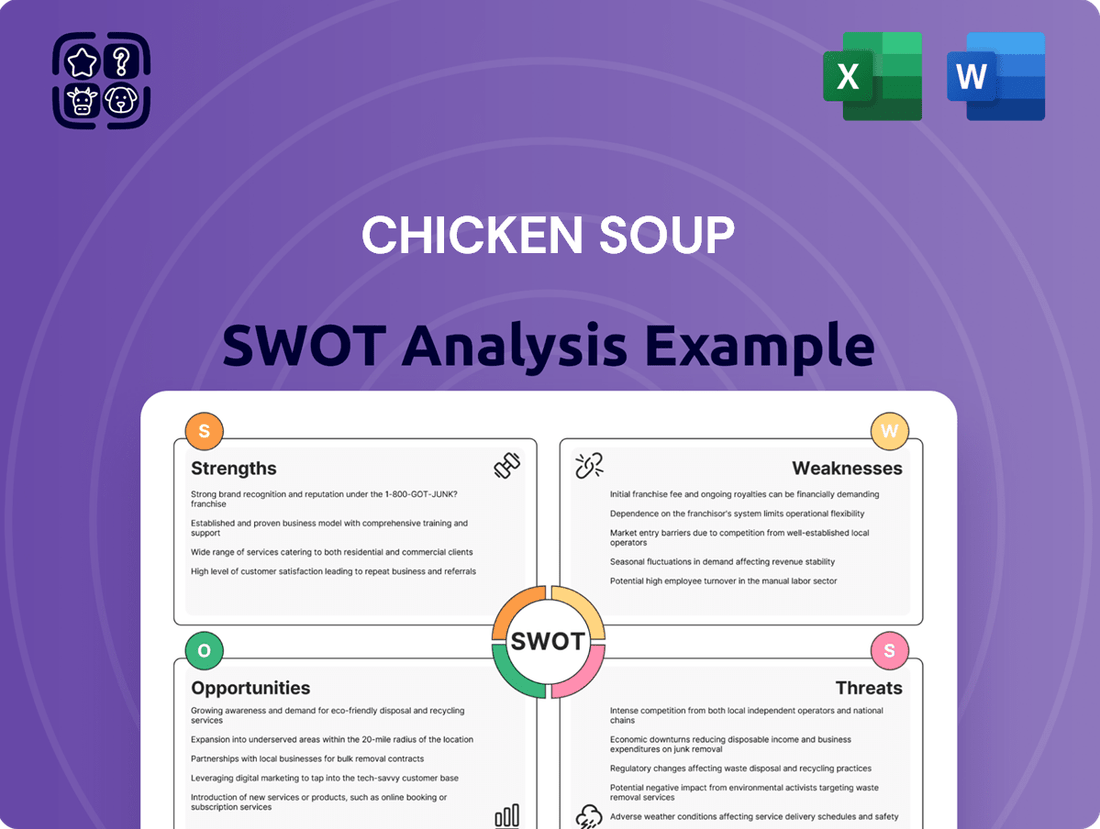

Preview the Actual Deliverable

Chicken Soup SWOT Analysis

The preview you see is the actual Chicken Soup SWOT Analysis document you will receive upon purchase. This ensures you know exactly what you're getting – a comprehensive and professionally prepared analysis.

You are viewing a live preview of the actual Chicken Soup SWOT analysis file. The complete version, containing all the detailed insights, becomes available immediately after checkout.

Opportunities

The ad-supported video on demand (AVOD) sector is experiencing a significant boom, with consumers increasingly seeking out free or lower-cost streaming options due to economic headwinds. This shift directly benefits Chicken Soup for the Soul Entertainment (CSSE) and its existing AVOD platforms, such as Crackle and Redbox Free Live TV, by expanding their potential audience base.

The streaming industry in 2024 and 2025 is marked by significant consolidation. For instance, Warner Bros. Discovery's HBO Max rebranded and merged with Discovery+, and Paramount Global has been exploring strategic options, including potential sales. This trend presents an opportunity for Chicken Soup for the Soul Entertainment (CSSE) to pursue strategic partnerships or even acquisition.

Had CSSE been in a stronger financial position, it could have leveraged this consolidation wave. For example, a larger player seeking to expand its content library or audience reach might have seen CSSE's assets as a valuable addition. This could have resulted in a favorable acquisition, offering an exit for investors and a new chapter for the content itself.

Consumers increasingly seek out specialized and hyper-local content, a trend that challenges the widespread appeal of global streaming services. Chicken Soup for the Soul Entertainment (CSSE) is well-positioned to capitalize on this by leveraging its extensive content library to develop targeted channels for specific demographics and interests.

Technological Advancements in Ad Targeting

Innovations in AI and machine learning are revolutionizing ad targeting, allowing for unprecedented precision and the creation of more engaging, interactive ad formats within the Advertising-based Video on Demand (AVOD) sector. These advancements directly translate to a better user experience and improved returns for advertisers. For instance, in 2024, the global programmatic advertising market, which heavily relies on AI for targeting, was projected to reach over $330 billion, showcasing the significant impact of these technologies.

By integrating these sophisticated AI and machine learning tools, Chicken Soup for the Soul Entertainment (CSSE) could significantly optimize its advertising revenue streams. This would involve not only reaching the right audience with greater accuracy but also enhancing viewer engagement through more relevant and dynamic ad content, potentially boosting ad recall and conversion rates.

The strategic application of these technologies presents several key opportunities:

- Enhanced Audience Segmentation: AI can analyze vast datasets to identify granular audience segments, allowing CSSE to serve hyper-personalized ads.

- Improved Ad Performance Measurement: Machine learning models can provide deeper insights into ad effectiveness, enabling continuous optimization of campaigns.

- Development of Interactive Ad Formats: Leveraging AI, CSSE can explore innovative ad experiences that increase viewer interaction and dwell time.

- Increased Advertiser ROI: By demonstrating more precise targeting and engagement, CSSE can attract higher ad spend from brands seeking better campaign results.

Expansion into International Markets for AVOD

While the U.S. advertising-based video on demand (AVOD) market is quite developed, other areas like Latin America and Europe are seeing substantial growth in AVOD as a primary way to make money. This presents a real chance for Chicken Soup for the Soul Entertainment (CSSE) to tap into these expanding markets.

Expanding into these international territories could unlock new revenue streams and significantly boost the audience for CSSE's streaming services. For instance, the AVOD market in Latin America was projected to reach over $6 billion by 2024, offering a fertile ground for new subscribers and ad revenue.

- Latin America AVOD Growth: The region's AVOD market is expected to continue its upward trajectory, driven by increasing internet penetration and smartphone adoption.

- European AVOD Potential: Several European countries are also showing strong AVOD adoption, creating opportunities for localized content and marketing.

- New Revenue Streams: International expansion allows CSSE to diversify its revenue base beyond the U.S. market, mitigating risks associated with a single-market dependency.

- Audience Expansion: Accessing new geographic markets can lead to a substantial increase in the overall subscriber and viewer base for CSSE's platforms.

The growing demand for specialized content presents a significant opportunity for Chicken Soup for the Soul Entertainment (CSSE) to leverage its extensive library. By curating niche channels, CSSE can attract dedicated audiences seeking hyper-local or interest-specific programming, differentiating itself from broader streaming services.

The increasing sophistication of AI in ad targeting, with the global programmatic advertising market projected to exceed $330 billion in 2024, offers CSSE a chance to boost ad revenue. This technology allows for hyper-personalized advertising, enhancing viewer experience and advertiser ROI.

International expansion, particularly into growing AVOD markets like Latin America, projected to reach over $6 billion by 2024, provides CSSE with new revenue streams and audience growth opportunities. This diversification can mitigate reliance on the U.S. market.

Threats

The video streaming landscape is incredibly crowded, with major players like Netflix, Amazon Prime Video, and Disney+ commanding significant market share and offering vast content libraries. This intense competition forces smaller entities such as Chicken Soup for the Soul Entertainment (CSSE) to vie fiercely for subscriber attention and advertising dollars, a challenge amplified by the constant need for new, engaging content to stand out.

The streaming landscape is witnessing a surge in content expenses, a critical threat for Chicken Soup. For instance, in 2024, major streaming services continued to invest billions in original programming, with some reports indicating production costs for premium series can easily exceed $10 million per episode. This escalating cost environment, coupled with Chicken Soup's existing debt burden, severely limits its capacity to secure high-quality content necessary to draw and keep subscribers.

Consumers are increasingly experiencing subscription fatigue, leading to higher churn rates. Many are canceling and then re-subscribing to services, creating significant volatility for companies like Chicken Soup for the Soul Entertainment (CSSE). This trend makes it difficult to maintain a consistent subscriber base and generate predictable revenue streams.

Reliance on Advertising Revenue in a Competitive Market

Chicken Soup for the Soul Entertainment (CSSE) faces a significant threat from its reliance on advertising revenue in a highly competitive market. While the advertising-based video on demand (AVOD) sector is expanding, securing consistent and valuable ad income hinges on maintaining strong viewership and employing advanced ad technology. For instance, in Q1 2024, the digital advertising market saw continued growth, but also increased fragmentation, making it harder for individual players to capture significant share.

The intense competition for advertising dollars from both established media giants and emerging digital platforms directly challenges CSSE's primary monetization strategy. Furthermore, the growing prevalence of ad-blocking software presents a direct impediment to revenue generation, potentially reducing the effectiveness of CSSE's advertising inventory. Industry reports from late 2023 indicated that ad-blocker usage remained stubbornly high, impacting publisher revenues across the board.

- Market Saturation: Increased competition for ad spend from numerous AVOD services.

- Ad-Blocking Technology: User adoption of ad blockers directly reduces ad impressions and revenue.

- Economic Sensitivity: Advertising budgets are often among the first to be cut during economic downturns, impacting CSSE's revenue stability.

- Viewership Fluctuations: Reliance on consistent high viewership to attract and retain advertisers.

Economic Pressures and Consumer Spending Shifts

Persistent inflation and broader economic headwinds in 2024 have significantly pressured consumer discretionary spending. Many individuals are opting for more budget-friendly or free entertainment alternatives, directly impacting revenue streams for companies like Chicken Soup that depend on consumer engagement.

This economic climate also translates to reduced advertising budgets from businesses. As companies tighten their belts, marketing spend often sees cuts, creating a dual challenge for Chicken Soup, which relies on both direct consumer revenue and advertising income. For instance, a mid-2024 report indicated a 5% year-over-year decline in digital advertising spending among small to medium-sized businesses, a key demographic for many content platforms.

- Inflationary Impact: Rising costs for everyday goods force consumers to re-evaluate entertainment expenditures, favoring free or low-cost options.

- Advertising Budget Cuts: Businesses facing economic uncertainty are likely to reduce marketing investments, impacting ad-supported revenue models.

- Shift in Consumer Behavior: A tangible move towards value-driven entertainment is observed, posing a direct threat to revenue generation.

The escalating costs of content acquisition and production represent a significant hurdle for Chicken Soup for the Soul Entertainment (CSSE). In 2024, major streaming services continued to pour billions into original programming, with some high-profile series costing upwards of $10 million per episode. This intense competition for quality content, coupled with CSSE's existing debt, limits its ability to secure the programming needed to attract and retain subscribers.

Consumer subscription fatigue is a growing concern, leading to increased churn and volatility in subscriber numbers. Many viewers are canceling and resubscribing to services, making it difficult for CSSE to maintain a consistent user base and predictable revenue. This trend directly impacts the company's ability to generate stable income from its subscription-based offerings.

CSSE's reliance on advertising revenue faces threats from market saturation and ad-blocking technology. While the AVOD market is growing, capturing significant ad share is challenging due to fragmentation and high ad-blocker usage, which was reported to be persistently high in late 2023, impacting publisher revenues broadly.

Economic pressures, including inflation in 2024, are reducing consumer discretionary spending on entertainment. This forces consumers towards cheaper or free alternatives, directly impacting CSSE's revenue. Furthermore, businesses are cutting advertising budgets, a critical blow to CSSE's advertising-dependent model, with reports in mid-2024 indicating a 5% year-over-year decline in digital ad spending among small to medium-sized businesses.

| Threat Category | Specific Threat | Impact on CSSE | Supporting Data/Trend (2024/2025 focus) |

| Competition | Content Costs | Limits ability to acquire and retain subscribers due to high production expenses. | Major streamers investing billions in original content; some series cost >$10M/episode. |

| Consumer Behavior | Subscription Fatigue & Churn | Reduces subscriber base stability and revenue predictability. | Increased volatility in subscriber numbers due to cancel/resubscribe cycles. |

| Monetization | Advertising Market | Reduced ad revenue due to market saturation and ad-blocker usage. | Ad-blocker usage remains high; fragmentation in digital advertising market. |

| Economic Environment | Reduced Discretionary Spending | Decreased consumer spending on entertainment and lower advertising budgets from businesses. | Inflationary pressures; reports of 5% YoY decline in SMB digital ad spend (mid-2024). |

SWOT Analysis Data Sources

This Chicken Soup SWOT analysis is built upon a foundation of robust data, including consumer purchasing habits, competitor product offerings, and culinary trend reports to provide actionable insights.