Chicken Soup Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chicken Soup Bundle

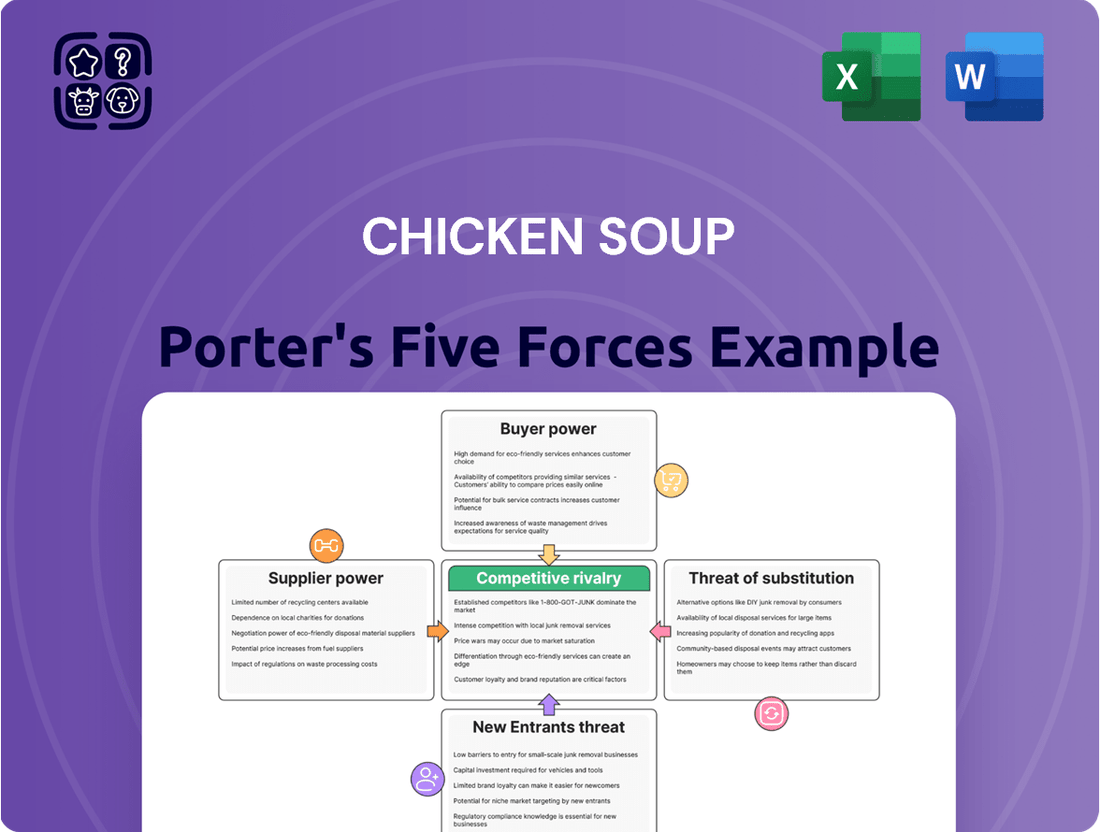

Our Chicken Soup Porter's Five Forces Analysis reveals the intense competition and strategic positioning within this beloved market. We've examined the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors to provide a clear picture of the industry's dynamics.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Chicken Soup’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Chicken Soup for the Soul Entertainment (CSSE) faces significant supplier bargaining power from content creators and studios. This is because these suppliers can easily license their valuable content to various streaming platforms or even develop their own direct-to-consumer offerings, limiting CSSE's exclusive access.

The intense competition for desirable content further amplifies this power. Global content spending is projected to hit $248 billion by 2025, with video-on-demand services alone increasing their investment by 6% to $95 billion. This robust spending environment means studios and creators can command higher licensing fees, directly impacting CSSE's profitability.

Advertising technology providers, including ad servers, demand-side platforms (DSPs), and measurement tools, wield considerable power over Chicken Soup Entertainment (CSSE). As an advertising-supported video-on-demand (AVOD) company, CSSE's financial health hinges directly on its ability to effectively monetize its content through advertising. The sophistication of these technology suppliers, particularly their advancements in AI-driven personalization and real-time analytics, directly impacts CSSE's ad targeting capabilities and overall profitability in the competitive digital video advertising landscape.

Data and analytics providers wield significant influence due to the unique and often proprietary nature of their insights into consumer behavior, content performance, and advertising efficacy. These companies offer specialized tools that are indispensable for navigating the complex media landscape.

Their bargaining power is amplified in the current fragmented streaming environment, where deep understanding of audience preferences is paramount for subscriber retention and engagement. For instance, in 2024, companies heavily reliant on targeted advertising and content optimization, such as major streaming platforms, often allocate substantial budgets to data analytics services, demonstrating the critical dependency and thus the suppliers' leverage.

Infrastructure and Cloud Service Providers

The bargaining power of infrastructure and cloud service providers is a significant factor for companies like CSSE. These providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, are critical for delivering streaming content, storing vast libraries of media, and ensuring the smooth operation of the entire platform. Their power stems from the considerable investment and technical expertise required to build and maintain such sophisticated infrastructure, making it difficult and costly for streaming companies to switch providers.

For instance, the global cloud computing market was valued at an estimated $610 billion in 2023 and is projected to reach over $1.3 trillion by 2028, highlighting the dominance and scale of these major players. This market concentration means that a few key providers dictate terms and pricing. The essential nature of their services for content delivery, especially for high-demand video streaming, further amplifies their leverage.

- High Switching Costs: Migrating complex streaming infrastructure and data to a new cloud provider involves substantial time, resources, and potential service disruptions, giving existing providers significant leverage.

- Specialized Expertise: The technical know-how required to manage and optimize cloud-based streaming infrastructure is highly specialized, concentrating power in the hands of providers who possess this expertise.

- Market Concentration: A few dominant cloud providers control a large share of the market, limiting options for streaming companies and increasing the bargaining power of these major players.

- Critical Infrastructure Dependency: The absolute reliance on reliable and scalable cloud services for content delivery means that streaming companies are highly dependent on their providers, further strengthening supplier power.

Payment Processing and Royalty Management Services

Chicken Soup for the Soul Entertainment (CSSE) relies on specialized payment processing and royalty management services to handle its licensing content and advertising revenue. These suppliers are critical for managing intricate financial flows and ensuring accurate fund distribution to content creators and rights holders.

The bargaining power of these suppliers stems from the highly specialized nature of their services, which often involve complex financial transactions and adherence to stringent regulatory frameworks. Their expertise in areas like digital payment gateways and international royalty accounting makes them difficult to replace.

- Specialized Expertise: Suppliers offer niche skills in financial transaction processing and regulatory compliance, which are not easily replicated internally or by generalist service providers.

- High Switching Costs: Migrating complex financial systems and established payment workflows to a new provider can be time-consuming and expensive for CSSE, increasing supplier leverage.

- Market Concentration: In certain segments of payment processing and royalty management, the market might be dominated by a few key players, further concentrating bargaining power.

The bargaining power of suppliers is a key consideration for Chicken Soup for the Soul Entertainment (CSSE) as it navigates the competitive media landscape. Suppliers of content, advertising technology, cloud infrastructure, and financial services all hold significant leverage due to factors like specialization, high switching costs, and market concentration.

| Supplier Type | Source of Bargaining Power | Impact on CSSE |

|---|---|---|

| Content Creators/Studios | High demand for content, ability to license elsewhere | Increased licensing fees, potential loss of exclusive content |

| Ad Tech Providers | Sophistication of AI, data analytics, and targeting tools | Higher costs for ad services, reduced ad revenue if targeting is ineffective |

| Cloud Infrastructure Providers | High switching costs, specialized expertise, market concentration | Increased operational costs, potential service disruptions during migration |

| Payment/Royalty Processors | Specialized financial expertise, regulatory compliance, high switching costs | Higher transaction fees, complexity in managing financial flows |

What is included in the product

This analysis dissects the competitive forces impacting Chicken Soup, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the industry.

Effortlessly identify and mitigate competitive threats by visualizing the impact of each Porter's Five Forces on your business.

Customers Bargaining Power

Individual viewers, as customers of Chicken Soup for the Soul Entertainment's (CSSE) free ad-supported streaming services, wield considerable bargaining power. This is largely due to the vast array of free and paid streaming alternatives readily available to them. For instance, as of early 2024, the streaming market is saturated with options, making it easy for consumers to switch if they find CSSE's content or ad experience lacking.

The low switching costs associated with streaming services empower viewers. They can readily move to another platform if the content doesn't resonate or if the advertising is intrusive. This ease of migration means CSSE must constantly strive to offer compelling content and a positive user experience to retain its audience.

Furthermore, the trend of major players like Netflix and Disney+ introducing their own ad-supported tiers in 2022 and 2023 respectively, significantly amplifies customer choice. This competitive pressure means individual viewers have more options than ever to find content that meets their preferences and budget, directly impacting CSSE's ability to command viewer attention and advertiser revenue.

Advertisers, the lifeblood of Chicken Soup for the Soul Entertainment's (CSSE) advertising video-on-demand (AVOD) model, wield significant bargaining power. Their ability to shift ad spend to numerous competing digital video platforms, from social media giants to other Connected TV (CTV) services, means CSSE must constantly prove its value. Advertisers are also keenly focused on measurable results, demanding precise targeting, robust performance tracking, and a clear return on investment (ROI), which directly impacts their willingness to pay premium rates.

The digital video ad market is expanding, with global digital ad spending anticipated to reach over $740 billion in 2024. However, this growth doesn't automatically translate to higher ad rates for content providers like CSSE. Advertisers are increasingly sophisticated, leveraging data analytics to optimize their campaigns and negotiate favorable terms, effectively controlling pricing and targeting parameters across the digital landscape.

Chicken Soup for the Soul Entertainment (CSSE) relies on wholesale distribution partners such as Roku Channels and potentially internet service providers (ISPs). These partners wield significant bargaining power because they control access to viewers, enabling them to bundle streaming services or create curated content hubs. This aggregation strategy directly influences how consumers discover and consume CSSE's content.

As of early 2024, the streaming market continues to see a strong trend towards bundling and platform aggregation. For instance, major platforms are increasingly offering bundles of their own services or partnering with others to attract and retain subscribers. This dynamic suggests that CSSE's distribution partners will likely see their influence grow in 2025, potentially leading them to demand more favorable financial terms or content exclusivity in exchange for prominent placement.

Content Aggregators and Bundlers

Content aggregators and new bundling strategies significantly boost customer bargaining power. For instance, in 2024, major internet providers and streaming services continued to offer bundled packages, allowing consumers to access a vast library of content from multiple sources through a single subscription. This consolidation means customers can easily switch between or opt out of individual services, reducing their reliance on any single platform.

This trend directly impacts companies like Chicken Soup for the Soul Entertainment (CSSE). As viewers gravitate towards consolidated viewing experiences, platforms that remain standalone may experience diminished direct engagement. CSSE, therefore, faces pressure to participate in these bundles to maintain visibility and accessibility for its content, a strategic move driven by the amplified power of the customer to choose convenience and comprehensiveness.

The growing preference for bundled content is evident in market shifts. By mid-2024, the subscription video on demand (SVOD) market saw continued consolidation, with consumers actively seeking value through aggregated offerings. This environment compels content providers to adapt, either by integrating into larger bundles or by developing unique content that justifies standalone subscriptions against the backdrop of more convenient, all-encompassing alternatives.

- Increased Choice: Bundles offer customers a wider selection of content from various providers at a potentially lower combined price, enhancing their negotiating position.

- Reduced Switching Costs: It becomes easier for customers to shift their viewing habits to bundled services, making individual platforms less indispensable.

- Platform Dependence: Content aggregators gain leverage over individual content providers by controlling customer access and visibility.

Retail Partners for Redbox Kiosks

Chicken Soup for the Soul Entertainment's (CSSE) retail partners, such as Walmart and Walgreens, exert considerable bargaining power over its Redbox kiosk business. These partners control the prime real estate where kiosks are placed, directly impacting customer access and operational costs for CSSE. As of late 2023 and early 2024, reports indicated CSSE was facing challenges with rent payments to some of these locations, highlighting the retailers' leverage in negotiating terms.

The ability of these large retail chains to dictate placement, visibility, and even revenue-sharing agreements gives them significant sway. For instance, a retailer could easily choose to reduce the number of Redbox kiosks within their stores or demand more favorable terms if they perceive the kiosks as underperforming or taking up valuable retail space. This power dynamic is further amplified by the fact that these retailers have alternative options for utilizing their space.

- Location Control: Retail partners like Walmart and Walgreens determine the physical placement of Redbox kiosks, influencing customer reach.

- Operational Terms: These partners can negotiate terms related to kiosk maintenance, power supply, and operational hours.

- Financial Leverage: Delinquent rent payments by CSSE in late 2023 and early 2024 demonstrated the significant financial leverage held by retail partners.

- Alternative Space Utilization: Retailers can choose to reallocate kiosk space to other, potentially more profitable, ventures.

Individual viewers, as customers of Chicken Soup for the Soul Entertainment's (CSSE) streaming services, hold significant bargaining power. This stems from the abundance of content choices available, with numerous free and paid alternatives readily accessible. As of early 2024, the streaming landscape is highly competitive, allowing viewers to easily switch platforms if CSSE's offerings or ad experience falter.

The low switching costs for streaming services empower consumers. They can readily migrate to other platforms if the content doesn't appeal or if the advertising is disruptive. This ease of movement compels CSSE to consistently deliver compelling content and a positive user experience to maintain its audience base.

Major players like Netflix and Disney+ introducing ad-supported tiers in 2022 and 2023 respectively, further amplifies customer choice. This competitive pressure means individual viewers have more options than ever to find content that aligns with their preferences and budget, directly impacting CSSE's ability to capture viewer attention and advertiser revenue.

Advertisers, crucial to CSSE's advertising video-on-demand (AVOD) model, possess substantial bargaining power. Their ability to redirect ad spend to a multitude of competing digital video platforms, from social media giants to other Connected TV (CTV) services, necessitates that CSSE continually demonstrate its value. Advertisers also prioritize measurable outcomes, demanding precise targeting, robust performance tracking, and a clear return on investment (ROI), which directly influences their willingness to pay premium rates.

The global digital ad market is projected to exceed $740 billion in 2024. However, this growth does not automatically translate to higher ad rates for content providers like CSSE. Advertisers are increasingly sophisticated, utilizing data analytics to optimize campaigns and negotiate favorable terms, thereby controlling pricing and targeting parameters across the digital ecosystem.

CSSE's wholesale distribution partners, such as Roku Channels, wield considerable bargaining power as they control viewer access and can aggregate streaming services. This aggregation directly influences how consumers discover and consume CSSE's content. The trend towards bundling and platform aggregation, evident in early 2024, suggests that CSSE's distribution partners may gain further influence by 2025, potentially demanding more favorable financial terms or content exclusivity for prominent placement.

Content aggregators and new bundling strategies significantly enhance customer bargaining power. In 2024, major internet providers and streaming services continued to offer bundled packages, allowing consumers to access diverse content through a single subscription. This consolidation makes it easier for customers to switch or opt out of individual services, reducing reliance on any single platform.

This trend directly affects companies like CSSE. As viewers favor consolidated viewing experiences, standalone platforms may see diminished direct engagement. CSSE faces pressure to participate in these bundles to maintain visibility and accessibility, a strategic adaptation driven by the customer's amplified power to choose convenience and comprehensiveness.

The growing preference for bundled content is evident in market shifts. By mid-2024, the subscription video on demand (SVOD) market saw continued consolidation, with consumers actively seeking value through aggregated offerings. This environment compels content providers to adapt, either by integrating into larger bundles or by developing unique content that justifies standalone subscriptions against the backdrop of more convenient, all-encompassing alternatives.

CSSE's retail partners, such as Walmart and Walgreens, exert considerable bargaining power over its Redbox kiosk business. These partners control prime kiosk placement, directly impacting customer access and CSSE's operational costs. Reports from late 2023 and early 2024 indicated CSSE faced challenges with rent payments to some locations, underscoring the retailers' leverage in negotiations.

The ability of these large retail chains to dictate placement, visibility, and revenue-sharing agreements grants them significant leverage. For instance, a retailer could reduce kiosk numbers or demand better terms if kiosks are perceived as underperforming or occupying valuable space. Retailers also have alternative uses for their space, further amplifying this power dynamic.

| Customer Segment | Bargaining Power Drivers | Impact on CSSE | 2024 Data/Trends |

|---|---|---|---|

| Individual Viewers | High availability of alternatives, low switching costs, bundled offerings | Pressure on content engagement and ad revenue | Streaming market saturation, major platforms offering ad-tiers |

| Advertisers | Ability to shift ad spend, demand for ROI and targeting | Pressure on ad rates and platform value proposition | Global digital ad spending over $740 billion in 2024, data-driven negotiation |

| Distribution Partners (e.g., Roku) | Control over viewer access, aggregation capabilities | Leverage for favorable terms, potential content exclusivity demands | Continued trend towards bundling and platform aggregation |

| Retail Partners (e.g., Walmart) | Control over kiosk placement, alternative space utilization | Influence on operational costs and kiosk visibility | Reported rent payment challenges for CSSE in late 2023/early 2024 |

Preview the Actual Deliverable

Chicken Soup Porter's Five Forces Analysis

This preview shows the exact Chicken Soup Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual document, which details the competitive landscape of the chicken soup market. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning.

Rivalry Among Competitors

Chicken Soup for the Soul Entertainment (CSSE) operates in a highly competitive landscape dominated by large, diversified media conglomerates. Companies like Disney, Warner Bros. Discovery, and Paramount Global possess vast financial muscle, enabling substantial investments in original content and aggressive marketing campaigns. For instance, Disney's combined streaming services boasted over 220 million subscribers globally as of early 2024, showcasing their scale.

These giants leverage extensive content libraries and multiple streaming platforms, directly challenging CSSE's core business model. The increasing adoption of ad-supported tiers by these major players intensifies competition for advertising revenue, a critical component of CSSE's strategy. This broad market presence and significant capital allocation by competitors create a formidable barrier for smaller entities like CSSE.

Major tech companies like Amazon, Google, and Apple are fierce rivals in the streaming space. Amazon's Prime Video and Freevee, Google's YouTube, and Apple's Apple TV+ all benefit from vast existing user bases and deep pockets. For instance, Amazon reported over 200 million Prime members globally as of early 2024, providing a massive built-in audience for Prime Video.

These tech giants leverage their technological prowess and substantial capital to gain an edge. Their ability to integrate streaming services into broader ecosystems, offering cross-promotional benefits, intensifies the battle for viewer attention and advertising revenue. YouTube, in particular, continues to be a dominant force, with its Shorts feature seeing significant growth in 2024, directly competing for short-form video engagement.

Chicken Soup for the Soul Entertainment (CSSE) faces intense rivalry from other standalone AVOD and FAST services. Platforms like Tubi and Pluto TV are rapidly expanding their user bases by offering free content, making the ad-supported streaming market increasingly crowded. For instance, Tubi reported over 64 million active U.S. users in 2023, highlighting the significant competition for ad dollars and viewership.

Traditional Broadcasters and Cable Providers

Traditional broadcasters and cable providers are actively evolving, launching and expanding their own streaming services and ad-supported video on demand (AVOD) platforms. This strategic shift means Chicken Soup for the Soul Entertainment (CSSE) faces competition not only from digital-native streamers but also from these established media giants transitioning their business models. For instance, in 2024, many legacy media companies are investing heavily in their direct-to-consumer (DTC) strategies to capture a share of the growing streaming market, which by some estimates, saw advertising revenue in the US alone surpass $20 billion in 2023.

This intensified competition from traditional players adapting to the digital landscape presents a significant challenge for CSSE. Their existing brand recognition and subscriber bases provide a strong foundation for their streaming ventures.

- Adapting Business Models: Legacy broadcasters and cable companies are increasingly offering their content through their own streaming platforms and AVOD services.

- Increased Competition: CSSE must contend with both pure-play streamers and these transitioning traditional media companies.

- Market Evolution: The ongoing shift in media consumption necessitates continuous innovation and strategic adaptation for all players in the video content space.

- Revenue Diversification: Traditional broadcasters are also leveraging their extensive content libraries and advertising infrastructure to bolster their digital offerings.

Content Licensing and Acquisition Competition

The battle for captivating content is incredibly intense. Global spending on content is expected to climb significantly, reaching an estimated $300 billion in 2024. Chicken Soup for the Soul Entertainment (CSSE) finds itself in a constant struggle against deeply resourced competitors to secure licenses for popular movies, television shows, and, importantly, original series. These content assets are the lifeblood for drawing in and keeping audiences engaged.

This heightened competition directly inflates the cost of acquiring content. For CSSE, this means the escalating price tags for desirable intellectual property place considerable strain on its financial health and ability to invest in future growth.

- Content Spending Growth: Global content spending is projected to exceed $300 billion in 2024, highlighting the scale of investment in the industry.

- Rivalry Intensity: CSSE faces competition from major players with significantly larger budgets, making content acquisition a challenging endeavor.

- Cost Pressures: The increasing cost of licensing popular content directly impacts CSSE's profitability and operational capacity.

Chicken Soup for the Soul Entertainment (CSSE) faces intense competitive rivalry from media giants like Disney, Warner Bros. Discovery, and Paramount Global, who possess substantial financial resources and extensive content libraries. These conglomerates, with subscriber bases in the hundreds of millions, directly challenge CSSE's streaming and content models. Furthermore, major tech players such as Amazon, Google, and Apple, leveraging vast user ecosystems and deep capital, intensify this rivalry, particularly in the digital content and advertising spaces.

| Competitor Type | Key Players | Relevant 2024 Data/Context |

|---|---|---|

| Diversified Media Conglomerates | Disney, Warner Bros. Discovery, Paramount Global | Disney's streaming services surpassed 220 million subscribers globally by early 2024. |

| Tech Giants | Amazon, Google (YouTube), Apple | Amazon reported over 200 million Prime members globally by early 2024; YouTube Shorts saw significant growth in 2024. |

| Standalone AVOD/FAST Services | Tubi, Pluto TV | Tubi had over 64 million active U.S. users in 2023. |

| Traditional Broadcasters/Cable Providers | Various legacy media companies | Significant investment in DTC strategies in 2024; US streaming advertising revenue exceeded $20 billion in 2023. |

SSubstitutes Threaten

User-Generated Content (UGC) platforms like YouTube and TikTok present a significant threat of substitutes, especially for younger demographics, by offering a massive library of free, varied, and often bite-sized video content. These platforms directly vie for consumer attention and advertising revenue that might otherwise go to traditional media or subscription services.

The competitive landscape is intensifying as streaming services increasingly collaborate with independent creators, blurring the lines between professionally produced and user-generated content. For instance, in 2024, TikTok continued its dominance in short-form video, with over 1 billion monthly active users globally, while YouTube saw its Shorts feature gain substantial traction, further fragmenting the video consumption market.

Social media platforms, far beyond just video-centric ones, present a significant threat of substitution for traditional streaming services. These platforms, like TikTok and Instagram, vie for consumer attention and leisure time, offering a constant stream of short-form video, live content, and interactive experiences. This diverts potential viewers away from dedicated platforms such as Crackle or Redbox, impacting their viewership and engagement metrics.

The wider digital entertainment sector, encompassing online gaming, podcasts, digital news, and immersive AR/VR experiences, poses a significant threat of substitution for traditional video streaming. With consumers facing finite leisure hours, the allure of these diverse digital offerings can divert attention away from streaming services. For instance, the global gaming market was projected to reach $229 billion in 2023, showcasing a substantial alternative for entertainment spending and time commitment.

Traditional Linear TV and Broadcast

Traditional linear TV and broadcast remain a significant substitute, especially for demographics less inclined towards digital platforms or for consuming live, unmissable events. Despite the rise of streaming, a considerable portion of the audience still tunes into scheduled programming, offering an alternative to CSSE's digital content delivery. For instance, in 2024, broadcast television still captured a notable share of viewership, particularly during major sporting events and breaking news cycles, demonstrating its persistent appeal.

While streaming services have indeed overtaken cable in many viewing metrics, the enduring habit of traditional TV consumption for specific content types cannot be overlooked. This segment of the population, often older, continues to rely on broadcast and cable for their entertainment and information needs, presenting a viable alternative to CSSE's digital-first approach. The continued reliance on these channels for live news and sports, in particular, highlights a persistent threat of substitution.

- Persistent viewership: In 2024, broadcast TV continued to command significant audience numbers, especially for live events.

- Demographic reliance: Older demographics often remain loyal to traditional TV, representing a key substitute audience.

- Live event appeal: The unmissable nature of live sports and news broadcasts keeps traditional TV relevant as a substitute.

- Alternative to digital: For those not fully embracing streaming, linear TV offers a complete alternative to CSSE's digital offerings.

Physical Media (DVD/Blu-ray Rentals/Sales)

The threat of substitutes for physical media, like DVD and Blu-ray rentals and sales, is generally low and declining, especially for companies like Chicken Soup for the Soul Entertainment (CSSE) that are heavily invested in this legacy business. While Redbox kiosks offer a physical rental option, they compete more directly with other physical media providers than with the burgeoning digital streaming market. The overall trend clearly indicates a shift away from physical media consumption.

This is underscored by the financial performance of companies operating in this space. For instance, Redbox, a significant player in physical rentals, has faced considerable financial challenges, leading to its bankruptcy filing. CSSE itself has also filed for bankruptcy, highlighting the difficulties in sustaining a business model reliant on physical media in the current entertainment landscape. The market for physical media rentals and sales has been in a consistent state of decline for years.

- Declining Market Share: Physical media rentals and sales have seen a significant drop in market share as consumers increasingly opt for digital streaming services.

- Redbox's Financial Struggles: Redbox, a prominent name in physical rentals, has experienced substantial financial difficulties, culminating in a bankruptcy filing, signaling the unviability of the business model.

- CSSE's Bankruptcy Filing: Chicken Soup for the Soul Entertainment's own bankruptcy filing further emphasizes the severe challenges faced by companies heavily dependent on the physical media market.

- Shift to Digital: The overwhelming consumer preference for digital streaming platforms presents a powerful substitute that continues to erode the relevance of physical media.

The threat of substitutes for video streaming services is multifaceted, encompassing user-generated content platforms, social media, online gaming, podcasts, and traditional linear television. These alternatives vie for consumer attention and leisure time, offering diverse content formats and engagement models.

User-generated content platforms like YouTube and TikTok, with over 1 billion monthly active users for TikTok in 2024, provide a vast library of free, varied content. Social media platforms also divert attention with short-form video and live interactions. The global gaming market's projected $229 billion valuation in 2023 highlights another significant draw on consumer time and discretionary spending.

Traditional broadcast television, particularly for live events like sports and news, continues to hold a substantial audience share in 2024, especially among older demographics less inclined towards digital platforms. This persistent viewership represents a direct substitute for on-demand streaming content.

The decline of physical media, exemplified by Redbox's bankruptcy and CSSE's own filing, underscores the overwhelming shift towards digital substitutes. Consumers increasingly favor the convenience and accessibility of streaming over physical rentals or purchases.

| Substitute Category | Key Platforms/Examples | 2024 Relevance/Data Points |

|---|---|---|

| User-Generated Content | YouTube, TikTok | TikTok: 1B+ monthly active users globally. YouTube Shorts gaining traction. |

| Social Media | Instagram, Facebook | Constant stream of short-form video, live content, interactive experiences. |

| Online Gaming | Various PC, Console, Mobile Games | Global gaming market projected $229B in 2023. Significant time and spending competitor. |

| Podcasts & Digital Audio | Spotify, Apple Podcasts | Growing listenership for on-demand audio content. |

| Traditional TV/Broadcast | Network Broadcasts, Cable Channels | Significant viewership for live sports and news, especially among older demographics. |

| Physical Media | DVD/Blu-ray Rentals, Sales | Declining market share; Redbox bankruptcy filing. |

Entrants Threaten

The ease with which individuals can create and distribute content, particularly through user-friendly platforms, significantly lowers the barrier to entry. This means new players can emerge without substantial upfront investment, challenging established players.

Niche content creators, leveraging self-publishing tools and monetization options, can build dedicated audiences. For instance, by mid-2024, platforms like YouTube continued to see a surge in independent creators earning substantial revenue, with some channels surpassing traditional media viewership for specific demographics.

These specialized channels can siphon viewers away from broader advertising-supported video-on-demand (AVOD) services by offering highly targeted content. This fragmentation of viewership directly impacts the audience size and advertising revenue potential of larger platforms.

The threat of new entrants in the streaming market is amplified by large tech companies. These giants, possessing robust infrastructure and substantial capital, can readily establish or bolster their streaming services. For instance, in 2024, major tech players continued to invest billions in content and platform development, leveraging their existing ecosystems.

Companies like Walmart are demonstrating this trend by entering the streaming space. They aim to integrate streaming with their retail operations, using their extensive customer data to offer unique value propositions. This strategic move, seen with Walmart's continued exploration of entertainment offerings in 2024, signifies how established businesses can disrupt the streaming landscape.

Telecommunication and Internet Service Providers (ISPs) represent a significant threat of new entrants in the streaming market. Their established infrastructure and direct consumer relationships allow them to potentially bundle streaming services with internet packages, offering a compelling value proposition that could undermine existing standalone streaming platforms.

As of early 2024, major ISPs like Comcast (Xfinity) and Verizon are already active players in content distribution, further solidifying their potential to disrupt the streaming landscape. For instance, Comcast's Peacock streaming service demonstrates this integration strategy. This vertical integration provides ISPs with a powerful distribution advantage, potentially lowering customer acquisition costs and increasing subscriber loyalty.

Media Companies Acquiring or Launching Streaming Arms

The media landscape is shifting, with traditional players increasingly entering the streaming arena. Companies that once supplied content to platforms like Netflix and Max are now launching their own direct-to-consumer (DTC) services or acquiring existing streaming entities. This strategy directly impacts companies like Chicken Soup for the Soul Entertainment (CSSE) by reducing the pool of content available for licensing and introducing formidable new competitors.

For instance, in 2024, we've seen continued consolidation and strategic moves by major media conglomerates to bolster their streaming presence. Warner Bros. Discovery, for example, has been actively refining its streaming strategy with Max. This trend of vertical integration means that content creators are increasingly keeping their valuable intellectual property in-house rather than licensing it out, thereby intensifying competition for CSSE.

- Vertical Integration by Media Giants: Traditional studios and broadcasters are launching or acquiring their own streaming services, keeping content exclusive.

- Reduced Content Licensing Pool: This strategy diminishes the availability of desirable content for licensing to third-party platforms like CSSE.

- Increased Competition: CSSE faces new, well-funded competitors with established brands and significant content libraries.

- Market Saturation: The proliferation of streaming services makes it harder for any single platform to capture and retain subscribers.

Advertiser-Backed Initiatives

Advertisers are increasingly looking for more bang for their buck and greater say in how their messages are delivered. This has sparked a potential threat where large advertisers or groups of them might decide to fund or even build their own content and distribution channels. Imagine major brands creating their own streaming services or exclusive content hubs.

This move could bypass existing platforms, offering highly tailored, ad-driven content experiences. For instance, a consortium of automotive brands might launch a dedicated automotive content channel, directly reaching enthusiasts without the overhead or competition of broader AVOD services. In 2024, the global advertising market saw significant shifts, with digital advertising spend projected to reach over $600 billion, highlighting the immense financial power advertisers wield and their growing desire for direct engagement.

- Advertiser Investment in Proprietary Platforms: Major brands could fund the creation of their own content and distribution networks.

- Targeted, Ad-Centric Content: This could lead to specialized content experiences directly controlled by advertisers.

- Bypassing Traditional AVOD Providers: Such initiatives may offer an alternative to existing ad-supported video-on-demand services.

- Increased Advertiser Control and ROI: Advertisers gain direct oversight of their campaigns and a clearer path to measuring return on investment.

The threat of new entrants in the streaming market remains significant, driven by several key factors. Low barriers to entry, particularly for content creation and distribution through user-friendly platforms, allow new players to emerge with minimal upfront investment. This is evident in the continued growth of independent content creators on platforms like YouTube, where some channels achieved viewership surpassing traditional media for specific demographics by mid-2024.

Large tech companies and telecommunication providers are also potent new entrants. Their existing infrastructure, substantial capital, and direct consumer relationships enable them to launch or bolster streaming services, often bundling them with other offerings. For instance, major ISPs continued to invest heavily in content and platform development throughout 2024, leveraging their vast customer bases.

Furthermore, traditional media companies are increasingly launching their own direct-to-consumer streaming services or acquiring existing ones. This vertical integration reduces the pool of content available for licensing to third parties and introduces formidable, well-funded competitors. By early 2024, companies like Warner Bros. Discovery were actively refining their streaming strategies, highlighting this trend.

Advertisers, too, pose a potential threat by exploring the creation of their own content and distribution channels to gain greater control and direct engagement. With global digital advertising spend projected to exceed $600 billion in 2024, advertisers possess the financial power to bypass existing platforms and create tailored, ad-driven content experiences.

| Factor | Impact on Streaming Market | Example (2024 Data/Trends) |

|---|---|---|

| Low Content Creation Barriers | Enables independent creators to challenge established players. | Surge in YouTube creators earning significant revenue. |

| Tech & Telecom Giants | Leverage infrastructure and customer bases for streaming services. | Continued billions invested in content and platform development by major tech firms. |

| Media Conglomerate DTC Moves | Reduces content licensing pool, increases competition. | Warner Bros. Discovery refining Max strategy; other studios launching own services. |

| Advertiser-Driven Platforms | Potential for bypassing AVOD providers with proprietary content. | Massive digital ad spend ($600B+ projected) indicates advertiser financial power for direct engagement. |

Porter's Five Forces Analysis Data Sources

Our Chicken Soup Porter's Five Forces analysis is built upon industry-specific market research reports, company financial statements, and consumer trend surveys. This blend of data provides a comprehensive view of competitive dynamics within the industry.