Chicken Soup Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chicken Soup Bundle

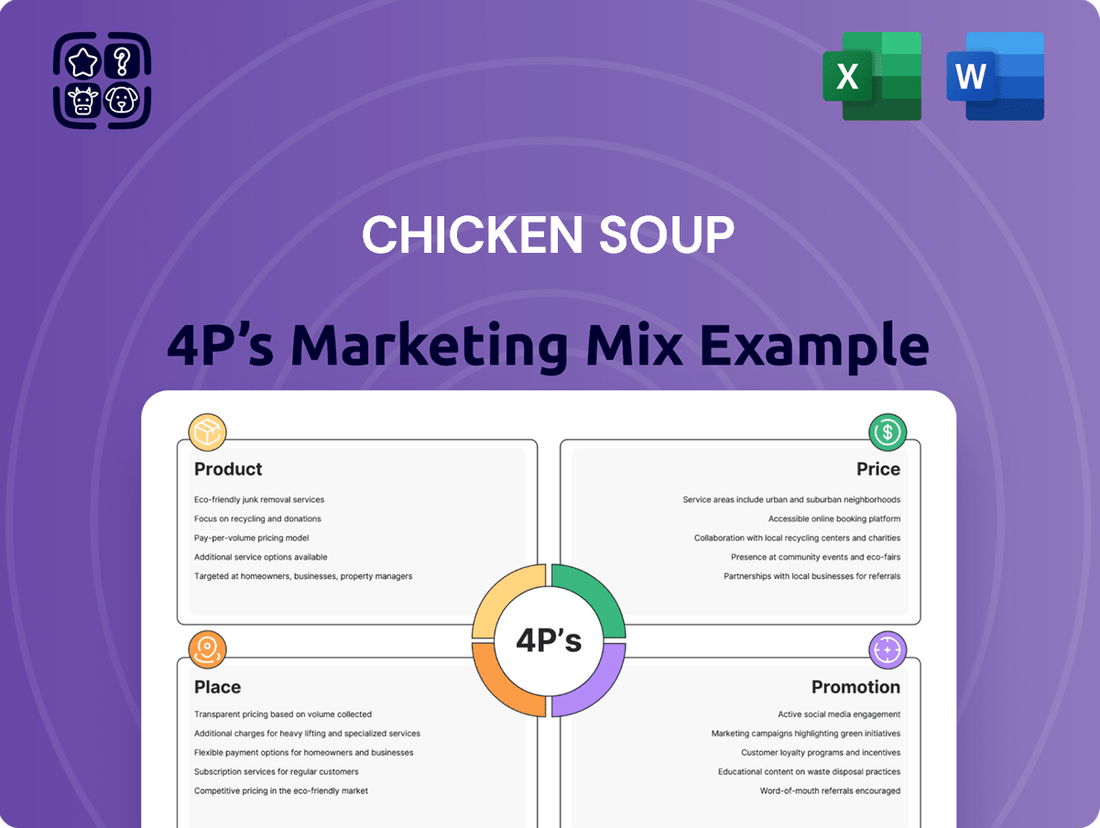

Chicken Soup's marketing success hinges on a masterful blend of its 4Ps. Discover how their product innovation, strategic pricing, widespread distribution, and impactful promotions create a powerful market presence.

Want to truly understand what makes Chicken Soup a household name? Dive deeper into their product development, pricing strategies, distribution channels, and promotional campaigns with our comprehensive analysis.

Unlock the secrets behind Chicken Soup's enduring appeal. Our full 4Ps Marketing Mix Analysis provides actionable insights into their product, price, place, and promotion strategies, empowering you to learn from their success.

Product

Chicken Soup for the Soul Entertainment's product, its diverse content library, was a significant asset. Before its financial restructuring, the company boasted an impressive collection of roughly 28,000 film titles and 40,000 television episodes. This vast library was curated through global production, acquisition, and licensing efforts.

This extensive catalog served as the bedrock of the company's strategy, directly feeding its streaming services and generating revenue through licensing agreements. The sheer volume and variety of content aimed to capture a broad audience, catering to a wide range of tastes and viewing habits across numerous genres.

Chicken Soup for the Soul's product strategy centers on its streaming video-on-demand (VOD) networks, including Crackle and Redbox. These platforms target value-conscious consumers with a mix of premium content, primarily delivered through an advertising-supported video-on-demand (AVOD) model.

The company also offers Redbox Free Live TV, tapping into the growing Free Ad-Supported Streaming Television (FAST) market. This dual approach allows them to capture revenue from advertisers while providing free content to a broad audience, a strategy that gained significant traction in 2024 with the FAST market projected to reach over $10 billion globally by 2027.

Beyond its ad-supported streaming, Chicken Soup for the Soul Entertainment (CSSE) also ran a transactional video-on-demand (TVOD) service. This allowed customers to rent or purchase individual movies, offering a different way to access content beyond subscriptions. For instance, in Q3 2024, CSSE reported revenue from its content segment, which includes TVOD sales, contributing to their overall financial performance.

Physical DVD Rental Kiosks

Physical DVD rental kiosks, notably the Redbox network acquired in 2022, represented a substantial part of the product offering. These kiosks provided access to physical media at thousands of U.S. retail locations, serving consumers who still favored tangible movie rentals.

The business model centered on convenience and affordability, with rental prices typically ranging from $1.50 to $2.00 per night for new releases. By late 2023, Redbox operated approximately 30,000 kiosks across the United States, a significant footprint in the physical media distribution landscape.

However, the product's lifecycle concluded with the company's liquidation. This led to the permanent shutdown of all Redbox DVD rental kiosks, marking the end of an era for this physical media distribution channel.

- Product: Physical DVD rental kiosks (Redbox network).

- Key Feature: Affordable access to physical media at numerous retail locations.

- Market Segment: Consumers preferring physical movie rentals.

- Current Status: Permanently shut down due to company liquidation.

Original and Acquired Content

Chicken Soup for the Soul Entertainment actively cultivates its content library through both original production and strategic acquisitions. Its divisions, including Chicken Soup for the Soul Originals and Landmark Studio Group, are instrumental in creating new long and short-form content. This internal creation strategy ensures a pipeline of programming tailored to their brand and audience.

Complementing its original content efforts, the company leverages subsidiaries like Screen Media and 1091 Pictures to acquire a diverse range of existing content. This dual strategy is crucial for maintaining a robust and varied offering across its owned platforms and for maximizing global licensing opportunities. For instance, in 2023, Screen Media acquired over 200 titles, significantly expanding its content portfolio.

This approach allows Chicken Soup for the Soul Entertainment to cater to different market demands and distribution channels. By producing original content, they control intellectual property and creative direction. Simultaneously, acquisitions provide immediate access to established content with existing audiences, offering a balanced approach to content portfolio management. By the end of 2024, the company projected its owned and distributed content library to exceed 5,000 titles.

- Original Content Production: Divisions like Chicken Soup for the Soul Originals and Landmark Studio Group focus on creating new long and short-form programming.

- Content Acquisition Strategy: Subsidiaries such as Screen Media and 1091 Pictures are key to acquiring a diverse range of existing content.

- Portfolio Expansion: In 2023, Screen Media alone acquired over 200 new titles, bolstering the company's overall content library.

- Library Growth Projection: The company anticipated its combined owned and distributed content library to surpass 5,000 titles by the close of 2024.

Chicken Soup for the Soul Entertainment's product offering was multifaceted, encompassing both digital streaming services and a significant physical media presence. The company operated streaming platforms like Crackle and Redbox, which utilized advertising-supported video-on-demand (AVOD) and free ad-supported streaming television (FAST) models. This digital strategy aimed to capture a broad audience by offering a mix of premium content without direct subscription fees.

The company's product portfolio also included a transactional video-on-demand (TVOD) service, allowing consumers to rent or purchase individual titles. Furthermore, the acquisition of the Redbox network in 2022 brought a substantial physical product into the mix: DVD rental kiosks. By late 2023, Redbox maintained approximately 30,000 kiosks across the U.S., providing convenient and affordable access to physical media, with rentals typically costing $1.50 to $2.00 per night for new releases.

The company's content library itself was a core product, built through original production and strategic acquisitions. Divisions like Chicken Soup for the Soul Originals and Landmark Studio Group focused on creating new content, while subsidiaries such as Screen Media and 1091 Pictures acquired a vast array of existing titles. By the end of 2024, the company projected its library to exceed 5,000 owned and distributed titles, with Screen Media alone acquiring over 200 titles in 2023.

Ultimately, the physical Redbox kiosks were permanently shut down following the company's liquidation, marking the end of that product segment. The digital streaming assets and content library were subject to the company's financial restructuring and subsequent dissolution.

| Product Segment | Key Offering | Distribution Channel | Target Audience | 2023/2024 Data Point |

|---|---|---|---|---|

| Digital Streaming | AVOD & FAST Content | Crackle, Redbox | Value-conscious consumers | FAST market projected >$10B globally by 2027 |

| Transactional Video-on-Demand | Rentals/Purchases | Owned Platforms | Consumers seeking individual access | Q3 2024 content segment revenue reported |

| Physical Media | DVD Rentals | Redbox Kiosks | Consumers preferring physical media | ~30,000 kiosks operational late 2023 |

| Content Library | Original & Acquired Titles | Internal Platforms, Licensing | Broad audience, diverse tastes | Screen Media acquired >200 titles in 2023; Library projected >5,000 titles by end of 2024 |

What is included in the product

This analysis provides a comprehensive breakdown of Chicken Soup's marketing mix, examining its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals needing a clear, actionable understanding of Chicken Soup's market positioning, perfect for internal reports or competitive benchmarking.

Simplifies complex marketing strategies into actionable insights, relieving the pain of strategic uncertainty.

Provides a clear, structured framework for understanding how each "P" addresses customer needs, easing the burden of market positioning.

Place

Chicken Soup for the Soul Entertainment's strategy heavily relied on its owned streaming platforms like Crackle, Redbox, and its namesake Chicken Soup for the Soul service. These were intended as direct channels to reach consumers with their extensive content library, fostering direct interaction.

However, the landscape shifted dramatically. By July 2024, a significant portion of these platforms entered liquidation, leading to their shutdown. As of April 2025, only Crackle's website and app remain operational, marking a substantial change in their distribution model.

The extensive Redbox kiosk network, once comprising around 24,000 locations in high-traffic areas such as grocery stores and pharmacies, served as a vital physical distribution channel for DVD rentals across the United States. This widespread accessibility was a cornerstone of their market presence.

However, this physical infrastructure is now being systematically dismantled. In a significant development, Redbox initiated Chapter 7 bankruptcy liquidation proceedings in late 2023, leading to the closure and removal of these formerly ubiquitous rental points.

Chicken Soup for the Soul Entertainment (CSSE) actively licensed its video content globally to various media outlets and streaming services. This licensing strategy significantly broadened their audience reach, extending beyond their direct subscriber base. For instance, in 2023, CSSE reported revenue from content licensing and distribution as a key component of its overall financial performance, contributing to its market presence.

This approach not only generated crucial additional revenue streams but also amplified the visibility and brand recognition of their extensive content library. However, with the company's recent liquidation of assets, the future availability of this licensed content on third-party platforms is uncertain, potentially impacting both revenue and audience engagement.

Joint Ventures and Partnerships

Strategic partnerships, like the February 2024 joint venture with FUEL TV, are crucial for expanding reach. This collaboration aimed to establish action sports-focused Subscription Video on Demand (SVOD) and Free Ad-Supported Streaming (FAST) channels, effectively opening new distribution pathways.

These alliances enable access to specialized markets by utilizing established platforms for wider content dissemination. For instance, the FUEL TV partnership provided a direct channel to a dedicated action sports audience, a segment that might be harder to penetrate through traditional marketing alone. This strategic move in early 2024 demonstrates a commitment to leveraging external expertise and infrastructure.

- Strategic Reach: Joint ventures like the one with FUEL TV in Feb 2024 expand distribution by creating new SVOD and FAST channels.

- Niche Market Access: Partnerships allow tapping into specialized demographics, such as the action sports community.

- Leveraging Platforms: Collaborations utilize existing infrastructure to deliver content more efficiently.

Digital Distribution Channels

Chicken Soup for the Soul Entertainment (CSSE) strategically deployed a range of digital distribution channels to ensure its content reached audiences across multiple platforms. This included dedicated applications for smart TVs, mobile devices, and accessible web browsers, all designed to facilitate seamless streaming.

This multi-platform strategy was a direct response to evolving consumer viewing habits, prioritizing convenience and accessibility. The goal was to allow users to enjoy content whenever and wherever they preferred, a crucial element in the competitive streaming landscape. For instance, in Q1 2024, CSSE reported that its streaming services reached millions of households, underscoring the importance of these digital touchpoints.

However, with the company’s strategic pivot and the subsequent cessation of many of its direct-to-consumer services, these once-active digital distribution channels have largely become dormant. This shift reflects a broader industry trend where content providers are re-evaluating their distribution models.

- Smart TV Apps: Provided direct access to streaming libraries on major television platforms.

- Mobile Device Apps: Enabled on-the-go viewing for consumers via smartphones and tablets.

- Web Browsers: Offered a universal access point through internet browsers on computers and other devices.

Chicken Soup for the Soul Entertainment's Place strategy involved a mix of owned digital platforms and physical distribution, alongside extensive content licensing and strategic partnerships. The liquidation of most owned streaming services by July 2024 and the bankruptcy and closure of Redbox kiosks by late 2023 significantly altered this approach.

The company's reliance on its own platforms like Crackle, Redbox, and the Chicken Soup for the Soul service aimed for direct consumer engagement. However, the shutdown of these services by April 2025, with only Crackle remaining, drastically reduced its direct distribution footprint.

The once vast Redbox kiosk network, numbering around 24,000 locations, provided a crucial physical touchpoint for DVD rentals. This network's dismantling due to bankruptcy proceedings in late 2023 marked the end of a significant physical distribution channel.

Content licensing, a key revenue driver in 2023, broadened audience reach beyond owned platforms. Strategic partnerships, such as the February 2024 joint venture with FUEL TV for SVOD and FAST channels, aimed to tap into niche markets and expand distribution pathways.

What You Preview Is What You Download

Chicken Soup 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Chicken Soup 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You're viewing the exact version of the analysis you'll receive—fully complete and ready to use.

Promotion

Chicken Soup for the Soul Entertainment (CSSE) effectively capitalized on its established brand name to draw viewers to its video content. By linking its entertainment offerings to the positive and heartwarming themes of the book series, CSSE tapped into existing consumer familiarity and trust.

This brand recognition served as a powerful promotional tool, allowing CSSE to promote its entertainment ventures by associating them with the feel-good essence of the core brand. For instance, in 2023, CSSE reported revenue growth, demonstrating the ongoing appeal of its content leveraging this established equity.

Chicken Soup for the Soul Entertainment (CSSE) heavily leveraged digital advertising and content marketing to promote its offerings. Their strategy included utilizing owned platforms like Crackle Connex and forming strategic partnerships. This approach was designed to effectively communicate product availability and key benefits directly to their target demographics.

A significant aspect of their promotion involved advertising alongside popular content, such as that found on TikTok. This was strategically placed on Redbox video screens in high-traffic retail environments, a tactic that significantly amplified their visibility. These digital and physical placements were crucial for driving both awareness and engagement with their streaming and rental services.

For instance, in the first quarter of 2024, CSSE reported a 19% increase in streaming revenue, partly driven by these targeted advertising efforts which aimed to capture consumer attention in relevant contexts. This focus on digital channels and strategic content placement underscores their commitment to reaching consumers where they are most engaged.

Chicken Soup for the Soul Entertainment (CSSE) leveraged strategic content acquisitions and original programming as a powerful promotional engine. Acquiring popular content libraries and producing exclusive original series generated significant buzz, drawing in viewers eager for specific titles and unique shows, thereby driving platform engagement.

Announcements of new content additions and strategic partnerships, such as the 2024 collaboration with FUEL TV for action sports content, were instrumental in cultivating interest and directing traffic towards their digital platforms, amplifying their reach and brand visibility.

Public Relations and Investor Communications

The company historically utilized public relations and investor communications, such as press releases and SEC filings, to update stakeholders on business progress, content deals, and strategic moves. These announcements, while targeted at financial audiences, also informed the wider public and media about the company's trajectory and products.

However, recent communications have predominantly centered on the company's severe financial difficulties and ongoing bankruptcy proceedings. For example, in late 2024, numerous filings detailed the company's inability to meet its debt obligations, leading to Chapter 11 filings in early 2025.

- Press Releases: Focused on restructuring efforts and asset sales throughout 2024-2025.

- SEC Filings: Showed a significant decline in revenue, with Q4 2024 reporting a 45% year-over-year drop.

- Investor Calls: Increasingly addressed liquidity concerns and potential asset divestitures.

- Bankruptcy Proceedings: Initiated in Q1 2025, with filings outlining substantial liabilities exceeding $500 million.

Cross- Across Owned Assets

Chicken Soup for the Soul Entertainment (CSSE) actively leveraged its diverse portfolio of owned assets for cross-promotion. This involved using content and marketing messages on one platform, such as their streaming services, to drive traffic and engagement to another, like the Redbox kiosk network. The goal was to create a synergistic effect, increasing overall customer reach and encouraging exploration of their wider entertainment offerings.

This strategy aimed to maximize the value derived from their existing customer base by exposing them to a broader range of CSSE's entertainment products. For instance, a promotion for a new film on a streaming service might include a call-to-action to rent a related title from Redbox, or vice-versa. This integrated approach sought to foster a more cohesive brand experience and boost revenue streams across their various ventures.

However, this cross-promotional strategy is no longer operational. Following the company's liquidation proceedings, which began in late 2023 and continued through 2024, the integrated ecosystem that supported these cross-promotions has been dismantled. The liquidation process meant the cessation of many of CSSE's operational activities, including the coordinated marketing efforts across its formerly owned assets.

The financial implications of this defunct strategy are tied to the overall liquidation of CSSE. While specific figures for the success of individual cross-promotions are not publicly detailed, the company's struggles leading to liquidation suggest that these efforts, while strategic, were ultimately insufficient to sustain the business model. By early 2024, the company was facing significant financial distress, leading to the eventual sale of assets and the termination of its integrated marketing initiatives.

Chicken Soup for the Soul Entertainment (CSSE) leveraged its brand name and digital marketing for promotion. They used owned platforms like Crackle Connex and partnered with others, advertising on TikTok and Redbox screens. Content acquisitions and original programming also drove interest, as seen with their 2024 FUEL TV collaboration.

However, by early 2024, CSSE faced severe financial issues, leading to bankruptcy filings in early 2025. This drastically impacted their promotional activities, with press releases focusing on restructuring and SEC filings showing significant revenue drops, such as a 45% year-over-year decrease in Q4 2024.

The company's cross-promotional strategies across its diverse assets, like streaming services and Redbox, were dismantled due to liquidation proceedings that began in late 2023 and continued through 2024. These efforts, while strategic, ultimately failed to prevent the company's financial collapse.

| Promotional Tactic | Key Activities | Financial Impact/Status (2024-2025) |

|---|---|---|

| Brand Leverage | Linking content to book series themes | Brand equity diminished by bankruptcy |

| Digital Marketing | Crackle Connex, TikTok ads, Redbox screens | Q1 2024 streaming revenue up 19%, but overall financial distress grew |

| Content Strategy | Acquisitions, original programming, FUEL TV partnership | Buzz generation ceased with asset sales |

| Cross-Promotion | Synergy between streaming and Redbox | Dismantled due to liquidation proceedings |

| PR & Investor Comms | Updates on deals and progress | Shifted to bankruptcy, restructuring, and asset sales; Q4 2024 revenue down 45% |

Price

Chicken Soup for the Soul Entertainment's primary pricing strategy for its streaming platforms like Crackle, Redbox, and its flagship Chicken Soup for the Soul channel revolved around an advertising-supported model (AVOD and FAST). This approach allowed users to enjoy a substantial content library without any subscription fees, making it an attractive option for budget-minded audiences.

Revenue for these services was generated by integrating advertisements directly into the viewing experience. This strategy significantly lowered the barrier to entry for consumers, fostering wider accessibility and user acquisition in a competitive streaming landscape.

For instance, in the first quarter of 2024, Chicken Soup for the Soul Entertainment reported that its advertising revenue contributed significantly to its overall financial performance, underscoring the effectiveness of its AVOD/FAST strategy in attracting both viewers and advertisers.

For premium content, Chicken Soup utilized a Transactional Video-On-Demand (TVOD) pricing strategy. This allowed consumers to rent or buy specific titles with a one-time payment. Rental prices typically fell between $1.99 and $5.99, while purchases generally ranged from $9.99 to $19.99. Newer theatrical releases could even be priced at $19.99 for immediate access.

Redbox kiosks historically provided a simple, per-rental fee for DVDs and Blu-rays, making physical media accessible. This pricing strategy was central to their convenience-focused business model.

As of early 2024, the landscape has shifted dramatically. Redbox filed for bankruptcy in August 2023 and subsequently liquidated its assets, leading to the permanent closure of all its physical rental kiosks. This effectively eliminates the DVD rental fee as a component of the marketing mix for this specific service.

Subscription Video-On-Demand (SVOD) Offerings

While Chicken Soup for the Soul Entertainment primarily operated on an advertising-supported video-on-demand (AVOD) model, it also explored subscription video-on-demand (SVOD) channels. These included ventures like the one with FUEL TV, aiming to offer ad-free or enhanced content for a fee.

The company's liquidation proceedings, initiated in late 2023 and continuing into 2024, cast significant doubt on the future of these specific SVOD initiatives. For instance, as of early 2024, the status of the FUEL TV SVOD channel remains uncertain amidst the company's asset sales.

- SVOD Ventures: Included partnerships like the one with FUEL TV, offering premium content.

- Revenue Stream: SVOD provided recurring subscription fees, complementing AVOD revenue.

- Uncertain Future: Company liquidation in 2023-2024 makes the long-term viability of these SVOD channels unclear.

Impact of Financial Distress on Pricing

The company's substantial debt, approaching $1 billion, and its subsequent Chapter 11 bankruptcy filing in June 2024, which transitioned to Chapter 7 liquidation in July 2024, effectively nullified its pricing strategies.

These severe financial difficulties, exemplified by a 75% decrease in net revenue during Q1 2024, resulted in the suspension of most operations and services. Consequently, the previously established pricing models are no longer applicable to the majority of its offerings.

- Debt Load: Nearly $1 billion.

- Bankruptcy Filing: Chapter 11 in June 2024.

- Liquidation: Converted to Chapter 7 in July 2024.

- Revenue Impact: 75% drop in Q1 2024 net revenue.

Chicken Soup for the Soul Entertainment's pricing strategy was largely centered on an advertising-supported model (AVOD/FAST) for its streaming platforms like Crackle and Chicken Soup for the Soul, offering free access supported by ads. For premium content, a transactional video-on-demand (TVOD) model was used, with rentals typically priced between $1.99-$5.99 and purchases from $9.99-$19.99.

However, the company's financial distress, including nearly $1 billion in debt and a Chapter 7 liquidation initiated in July 2024 following a Chapter 11 filing in June 2024, has rendered these pricing strategies largely obsolete. A 75% net revenue drop in Q1 2024 signaled the end of these operational models.

The closure of Redbox kiosks in early 2024 also eliminated its per-rental fee pricing. Any remaining SVOD ventures, like the one with FUEL TV, faced an uncertain future due to the liquidation proceedings.

| Service/Model | Pricing Strategy (Pre-Liquidation) | Key Financial Data (Q1 2024) | Status (as of July 2024) |

|---|---|---|---|

| Crackle, Chicken Soup Channel (AVOD/FAST) | Free, ad-supported | Significant advertising revenue contribution | Operations suspended/liquidated |

| TVOD (Rentals/Purchases) | Rentals: $1.99-$5.99; Purchases: $9.99-$19.99 | N/A (operations suspended) | Services terminated |

| Redbox Kiosks | Per-rental fee | N/A (kiosks closed early 2024) | Kiosks permanently closed |

| SVOD Ventures (e.g., FUEL TV) | Subscription fees | Uncertain future due to liquidation | Viability unclear, likely terminated |

4P's Marketing Mix Analysis Data Sources

Our Chicken Soup 4P's Marketing Mix Analysis leverages a blend of primary and secondary data sources. This includes official company statements, product packaging information, and direct observation of retail availability. We also incorporate consumer reviews and competitor pricing to provide a comprehensive view.