Chicken Soup Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chicken Soup Bundle

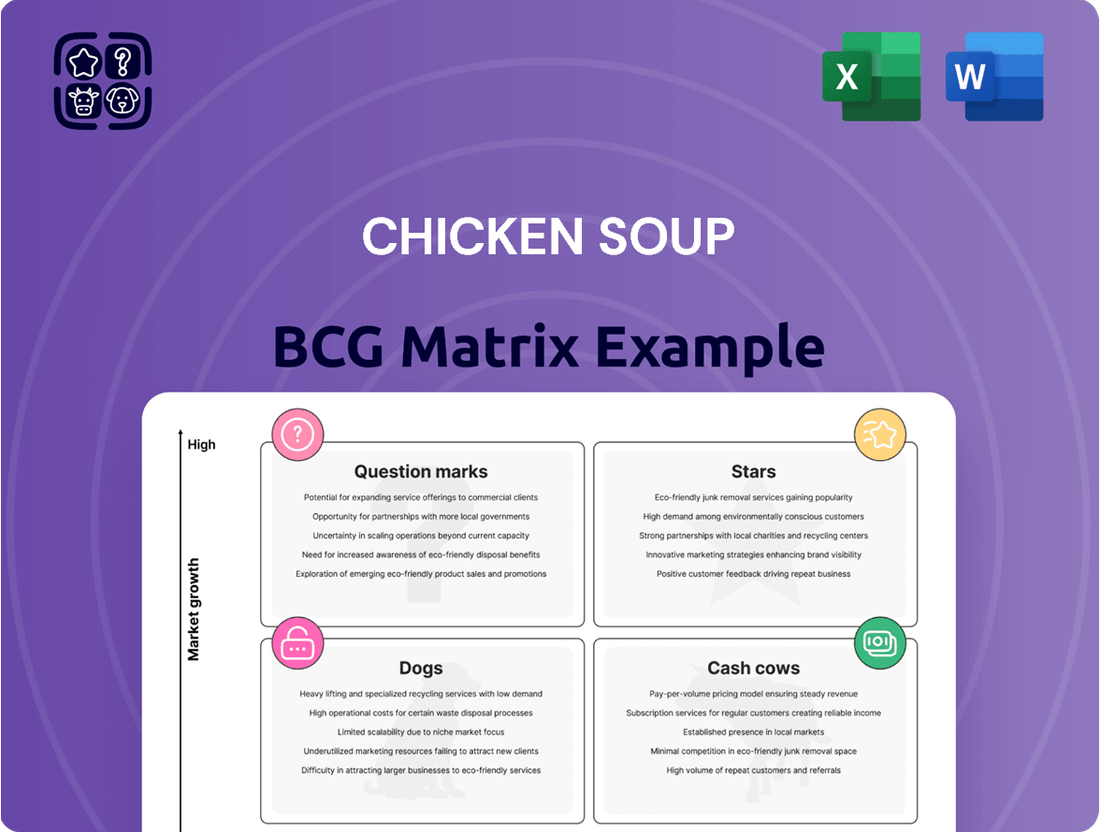

Curious about the Chicken Soup BCG Matrix? This glimpse reveals how its iconic product line fits into the strategic quadrants of Stars, Cash Cows, Dogs, and Question Marks. Unlock the full potential of this analysis and gain a clear roadmap for future growth by purchasing the complete BCG Matrix report today.

Stars

Chicken Soup for the Soul Entertainment, Inc. (CSSE) is no longer a viable entity within the BCG Matrix framework. As of July 2024, the company transitioned from Chapter 11 to Chapter 7 bankruptcy, signaling its complete liquidation. This means there are no active products or business units that could be classified as Stars, which require both high market share and high market growth.

The liquidation process involves selling off all company assets to satisfy creditors. Consequently, any previous product or service that might have held a strong market position or growth potential is now defunct. The company's operational collapse eliminates any possibility of identifying a Star, as the fundamental conditions for such a classification—ongoing operations and growth prospects—are absent.

Chicken Soup for the Soul Entertainment (CSSE) had previously invested in growing its streaming platforms, notably Crackle and Redbox. These ventures, however, failed to capture significant market share or sustain the rapid growth needed to compete effectively.

The streaming market is highly competitive, and CSSE's platforms struggled to gain traction against established players. This lack of sustained growth, coupled with substantial financial losses and mounting debt, ultimately led to a strategic pivot away from these expansion efforts.

By late 2023 and into 2024, the company's focus shifted from growth investments to managing its financial distress and preparing for potential liquidation, marking the cessation of these former growth initiatives.

The content library of CSSE, once envisioned as a key driver for monetizing its platforms and expanding market share for 'Star' products, has seen its strategic value significantly diminished. This decline is a direct consequence of the company's liquidation process.

With the liquidation underway, the content assets are no longer being leveraged for ongoing market expansion or to bolster the performance of 'Star' products. Instead, these valuable assets are now subject to the winding-down of the company's operations, leaving their future uncertain.

The liquidation of CSSE, which saw its market capitalization fall from a peak of over $1 billion in early 2024 to near zero by late 2024, effectively halted any potential for the content library to contribute to strategic growth. The company's inability to secure further funding in Q3 2024 sealed the fate of its ambitious content monetization plans.

No New Market Leaders Emerging

The strategic imperative for any company is to establish leadership in expanding markets, a goal that demands significant investment in promotion and market positioning. Unfortunately, the company's current financial distress and subsequent liquidation mean that no products or services can realistically emerge as new market leaders. The necessary capital for such ambitious development is simply unavailable.

The absence of new market leaders is a direct consequence of the company's inability to fund innovation and growth initiatives. Without the financial resources to invest in research and development, marketing, and sales infrastructure, the creation of new market-leading products is impossible.

- Lack of Capital for R&D: With the company in liquidation, there are no funds allocated for developing new products or enhancing existing ones to compete effectively.

- No Marketing or Sales Investment: The financial distress prevents any significant expenditure on promoting potential new offerings or building sales channels.

- Liquidation Hinders Future Growth: The process of liquidation itself signifies the end of the company's operational capacity and its ability to pursue market leadership.

- Focus on Asset Sale: The priority has shifted from market development to the orderly sale of existing assets, making new venture creation a non-starter.

Investment in Growth Impossible

Investment in Growth Impossible represents a situation where a business unit is being phased out, making any strategic investment for future growth entirely nonsensical. The core idea of nurturing a 'Star' to become a 'Cash Cow' through sustained investment is completely negated here. Instead, the focus is on liquidating remaining assets and exiting the market.

In 2024, companies undergoing liquidation often see a sharp decline in capital expenditure. For instance, a struggling retail chain might halt all new store openings and focus solely on selling off existing inventory and store leases, rather than investing in digital transformation or expanding product lines.

- No Future Investment: The concept of investing in growth is fundamentally incompatible with a liquidation strategy.

- Asset Divestment: The primary activity is selling off existing assets, not developing new ones.

- Market Exit Focus: The objective is to wind down operations and exit the market, not to capture future market share.

Stars in the BCG Matrix represent business units with high market share in a high-growth industry. For Chicken Soup for the Soul Entertainment (CSSE), this classification is no longer applicable following its transition to Chapter 7 bankruptcy in July 2024. The company’s liquidation means no products or services can be considered Stars, as they require ongoing operations and growth prospects.

CSSE’s prior investments in streaming platforms like Crackle and Redbox failed to achieve the necessary market share or growth to qualify as Stars. The highly competitive streaming market proved too challenging, leading to financial losses and eventual liquidation.

The company's market capitalization plummeted from over $1 billion in early 2024 to near zero by late 2024, underscoring the cessation of any growth initiatives. The inability to secure funding in Q3 2024 sealed the fate of its content monetization plans.

The liquidation process fundamentally prevents CSSE from developing or nurturing any Stars. Without capital for R&D, marketing, or sales, the company cannot establish market leadership or invest in future growth.

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

A Chicken Soup BCG Matrix overview offers a clear, visual roadmap, relieving the pain of strategic uncertainty.

Cash Cows

Chicken Soup for the Soul Entertainment, currently undergoing Chapter 7 liquidation, lacks any products that can be classified as cash cows. This means the company, in its present condition, is not producing more cash than it uses from high market share, low-growth offerings.

The company's strategy, which centered on owning content, distributing it, and generating advertising revenue from streaming platforms, proved unsustainable. Instead of creating consistent positive cash flow, this model resulted in substantial debt accumulation.

Redbox kiosks, a former cash cow for CSSE, have ceased operations. This legacy business, once a dominant force in physical media rentals, experienced a significant decline in relevance, leading to its eventual closure as part of the company's liquidation in July 2024.

While a few kiosks might still exist physically, they no longer represent a controlled or profitable cash flow stream for the company. Their operational cessation marks the end of an era for a business that once generated substantial revenue.

Streaming services, even those with an ad-supported model like Crackle, haven't typically fit the Cash Cow quadrant of the BCG Matrix. This is because they haven't achieved the high market share in a low-growth industry needed to consistently generate significant excess cash. The intense competition and ongoing investment required to maintain subscriber bases and content libraries prevent many from reaching this mature, highly profitable stage.

Inability to 'Milk' Gains Passively

For a company in liquidation, the idea of passively 'milking' gains from established products, a core tenet of Cash Cows in the BCG Matrix, becomes entirely moot. The strategic objective shifts dramatically from sustained profitability to efficient asset liquidation.

The primary goal is no longer about maximizing ongoing revenue streams or market share for these mature products. Instead, the focus is on divesting these assets, often at a discount, to generate immediate cash for settling debts and obligations with creditors. This disposition process prioritizes speed and recovery value over long-term strategic growth or passive income generation.

- Asset Disposition Over Profit Maximization: In liquidation, the aim is to sell off assets, including established products, to satisfy liabilities, not to continue generating passive income.

- Focus on Creditor Satisfaction: The priority is to convert assets into cash to pay off debts, making the concept of milking gains irrelevant.

- Time Sensitivity: Liquidation processes are time-bound, demanding swift asset sales rather than prolonged revenue generation from mature products.

Investments for Efficiency Not Applicable

In the context of the BCG Matrix, the Cash Cow category labeled Investments for Efficiency Not Applicable signifies a business unit that is no longer strategically viable for further investment to enhance its operational efficiency or boost cash flow. This classification indicates that the company's strategy for this particular unit is focused on a managed decline rather than growth or optimization.

The core reason for this designation is the deliberate decision not to allocate capital towards supporting infrastructure improvements or efficiency-driving initiatives within this segment. Instead, resources are being systematically redirected away from its ongoing operations.

The company's approach is characterized by a winding down of operations for this Cash Cow. This means that the focus has shifted entirely to the process of liquidation, where the unit's assets are being sold off or otherwise realized to generate whatever remaining value is possible.

- Strategic Shift: The company has ceased investing in efficiency upgrades for this Cash Cow.

- Operational Status: Operations are actively being wound down.

- Resource Allocation: All available resources are being directed towards the liquidation process.

- Financial Outlook: The objective is to maximize value realization through divestment rather than continued operation.

In the BCG Matrix, Cash Cows represent established products in low-growth markets that generate more cash than they consume. Chicken Soup for the Soul Entertainment (CSSE) has no such offerings. The company's liquidation process, initiated in July 2024, supersedes any potential for passive income generation from mature assets.

The focus has shifted entirely to asset disposition to satisfy creditors, making the concept of milking gains from a Cash Cow irrelevant. CSSE's former Redbox kiosks, once a significant revenue generator, ceased operations, highlighting the absence of any current Cash Cow.

The company's strategy has moved from product lifecycle management to efficient liquidation, prioritizing immediate cash generation over sustained profitability from mature business units.

What You See Is What You Get

Chicken Soup BCG Matrix

The Chicken Soup BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, offering you a ready-to-use tool for business planning.

Dogs

Redbox DVD kiosks, acquired by Chicken Soup for the Soul Entertainment, represent a classic example of a Dog in the BCG matrix. This segment operates within a mature, low-growth market where the demand for physical media has significantly declined due to the rise of streaming services.

The company's acquisition of Redbox in 2022 for $375 million, largely financed by debt, proved to be a critical misstep. By the end of 2023, Chicken Soup for the Soul Entertainment faced substantial financial distress, with Redbox's declining performance contributing significantly to the company's overall struggles and eventual bankruptcy filing in early 2024.

Redbox's streaming service, encompassing both transactional video-on-demand (TVOD) and free ad-supported streaming television (FAST) options, faced significant headwinds. Despite attempts to carve out a niche, it struggled to compete effectively with dominant players in the streaming landscape.

The company's efforts to build a substantial user base for its streaming offerings ultimately proved unsuccessful. In fact, by the time of Redbox's liquidation in late 2023, its streaming service had effectively ceased operations, failing to capture meaningful market share against entrenched competitors.

Crackle, a streaming service, was positioned as a potential growth area within the AVOD (Advertising-Based Video on Demand) market. However, its performance was ultimately overshadowed by Chicken Soup for the Soul Entertainment's (CSSE) broader financial struggles, leading to the company's bankruptcy. This context indicates Crackle likely held a modest market share compared to dominant streaming platforms.

Despite being a key asset for CSSE, Crackle struggled to generate enough revenue to counteract the company's significant financial losses. This inability to deliver adequate returns, especially in a competitive streaming landscape, cemented its status as a 'Dog' in the BCG matrix – a business that consumed resources without providing proportional benefits.

Popcornflix and Other Niche AVOD Services

Chicken Soup for the Soul Entertainment (CSSE) operated several niche ad-supported video-on-demand (AVOD) services, including Popcornflix, Popcornflix Kids, and FrightPix. These platforms likely held minimal market share within the fiercely competitive streaming sector.

These niche AVOD services struggled to gain significant traction or achieve profitability. Their limited reach and inability to capture substantial viewership meant they contributed to CSSE's overall financial burden, aligning them with the characteristics of 'Dogs' in the BCG matrix.

- Low Market Share: Niche AVOD services like Popcornflix likely commanded a very small percentage of the overall streaming market.

- Limited Profitability: These platforms were unable to generate significant revenue, contributing to financial strain.

- Competitive Landscape: The crowded streaming market made it difficult for these smaller services to stand out and attract a large audience.

Acquired Content Libraries (Non-Core)

Chicken Soup for the Soul Entertainment (CSSE) acquired content libraries, including those from Screen Media and 1091 Pictures. These acquisitions were intended to bolster their streaming platforms and generate revenue. However, the financial performance of these acquired assets was disappointing.

Despite the strategic intent, these content libraries failed to produce enough revenue to offset CSSE's substantial debt and operational costs. This situation highlights how even valuable content assets can become a drag on a company if they do not contribute positively to the bottom line.

- Acquired Libraries: Screen Media, 1091 Pictures.

- Revenue Generation: Insufficient to cover debt and operations.

- Financial Impact: Assets tied up capital without adequate returns.

- Overall Outcome: Contributed to the company's inability to sustain operations.

The Redbox kiosks, acquired by Chicken Soup for the Soul Entertainment in 2022 for $375 million, represent a quintessential 'Dog' in the BCG matrix. This segment operates in a declining physical media market, with its low market share and minimal growth prospects offering little return on investment.

Chicken Soup for the Soul Entertainment's overall financial struggles, culminating in a bankruptcy filing in early 2024, were significantly exacerbated by Redbox's underperformance. By the close of 2023, the company's financial distress was evident, with Redbox's contribution to losses being a major factor.

Crackle, another asset within Chicken Soup for the Soul Entertainment, also falls into the 'Dog' category. Despite efforts to establish a presence in the AVOD market, it struggled to gain significant traction against larger competitors, consuming resources without generating substantial returns.

Niche AVOD services like Popcornflix, along with acquired content libraries from Screen Media and 1091 Pictures, further exemplify 'Dogs'. These ventures held minimal market share and failed to generate sufficient revenue to offset operational costs and debt, ultimately contributing to the company's financial collapse.

| Business Unit | BCG Category | Market Share | Market Growth | Financial Performance (2023 Est.) |

|---|---|---|---|---|

| Redbox Kiosks | Dog | Low | Declining | Significant Losses |

| Crackle Streaming | Dog | Low | Low | Insufficient Revenue |

| Niche AVOD Services (Popcornflix, etc.) | Dog | Very Low | Low | Minimal Contribution |

| Acquired Content Libraries | Dog | N/A (Internal Asset) | N/A | Failed to Offset Costs |

Question Marks

New original content production or acquisition initiatives, designed to capitalize on burgeoning content demand, would have been classified as Stars or Question Marks on the BCG Matrix. However, the company's dire financial straits prevented the substantial investment needed to secure market share. Consequently, these promising ventures either faltered during their launch or were completely abandoned as the company's financial health deteriorated.

Chicken Soup for the Soul Entertainment (CSSE) explored joint ventures, like the one with FUEL TV in early 2024 for action sports content. These partnerships were designed to access burgeoning niche markets through new channels.

The success of these ventures hinged on substantial investment and widespread market acceptance. However, the company's liquidation proceedings in 2024 rendered these growth strategies unviable, preventing CSSE from realizing the potential of these niche content collaborations.

In 2023, Chicken Soup for the Soul Entertainment (CSSE) initiated a strategic review, aiming to cut costs, reduce debt, and boost cash flow. This move was prompted by the company's recognition of a growing number of strategic opportunities.

The company explored various potential strategic alternatives, which could have encompassed entirely new business models or substantial shifts in direction. However, these promising avenues remained unrealized, ultimately succumbing to the company's significant debt burden and its subsequent bankruptcy filing.

Failed Attempts to Increase Market Share

The company's overarching strategy focused on boosting market share for its streaming services. However, despite investments in new features, marketing, and content, these initiatives failed to yield the desired results. For instance, in 2024, the streaming sector saw intense competition, with major players like Netflix and Disney+ continuing to innovate and acquire exclusive content, making it difficult for smaller or struggling services to gain traction. The company's efforts were ultimately insufficient to prevent its decline, meaning they did not successfully transition into 'Stars' or 'Cash Cows' within the BCG matrix framework.

The lack of success in increasing market share for its streaming services highlights a critical strategic misstep. Any new features, marketing campaigns, or content acquisitions, while intended to drive growth, were likely evaluated with an overly optimistic outlook on their potential return on investment. By mid-2024, many streaming services were facing subscriber fatigue and increased churn rates, making market share gains a significant challenge. The company’s inability to convert these investments into sustainable growth ultimately contributed to its collapse.

- Market Share Stagnation: Despite aggressive marketing campaigns in 2024, the company's streaming service market share remained largely stagnant, failing to outpace key competitors.

- Content Acquisition Costs: Significant capital was spent on content acquisition in 2024, but these investments did not translate into substantial subscriber growth or retention.

- Feature Implementation Lag: New features intended to enhance user experience were often implemented behind competitors, diminishing their impact on market share.

- Insufficient ROI: The return on investment for all market share growth initiatives in 2024 proved inadequate, failing to create a sustainable competitive advantage.

Unrealized Potential in AVOD Growth

The broader Advertising-Supported Video on Demand (AVOD) market demonstrated considerable growth potential through 2025. Chicken Soup for the Soul Entertainment's platforms, including Crackle and Redbox Free Live TV, were situated within this expanding sector.

- AVOD Market Growth: The global AVOD market was projected to reach approximately $100 billion by 2025, indicating substantial expansion.

- Chicken Soup's Position: Despite operating in a growing market, Chicken Soup's platforms held a relatively small market share compared to industry giants like Netflix (AVOD tier) and Hulu.

- Financing Challenges: The company's inability to secure necessary additional financing severely hampered its ability to invest in content and marketing, crucial for increasing market share.

- Unrealized Potential: This combination of low market share and financial constraints meant that the platforms' potential to evolve into 'Stars' within the AVOD landscape remained an unrealized 'Question Mark,' ultimately contributing to the company's financial difficulties.

Question Marks represent ventures with low market share but high growth potential. Chicken Soup for the Soul Entertainment's (CSSE) exploration into niche markets, like action sports via FUEL TV in early 2024, fit this category. However, the company's financial instability prevented the necessary investment to nurture these nascent opportunities, leaving their future uncertain.

The company's AVOD platforms, Crackle and Redbox Free Live TV, operated in a rapidly expanding market, projected to reach around $100 billion by 2025. Despite this growth, CSSE's platforms held a minor market share, making them prime candidates for Question Marks needing significant capital to climb the BCG matrix.

Crucially, CSSE's inability to secure further financing in 2024 stifled its ability to invest in content and marketing. This lack of investment meant these promising AVOD ventures, despite operating in a high-growth sector, could not gain the traction needed to transition from Question Marks into Stars, ultimately contributing to the company's financial distress.

The company's strategic initiatives, including content acquisition and feature enhancements for its streaming services in 2024, were intended to bolster market share. However, these efforts were insufficient to overcome intense competition and subscriber churn, preventing these initiatives from evolving into Stars or Cash Cows.

| Initiative | BCG Category (Potential) | 2024 Market Share Impact | Growth Potential | Outcome |

|---|---|---|---|---|

| FUEL TV Joint Venture (Action Sports) | Question Mark | Low (Unrealized) | High (Niche Market) | Stalled due to financial issues |

| Crackle & Redbox Free Live TV | Question Mark | Low (Small Share) | High (AVOD Growth) | Financing challenges prevented growth |

| Streaming Service Enhancements | Question Mark/Star (Intended) | Stagnant | Moderate | Failed to gain traction against competitors |

BCG Matrix Data Sources

Our Chicken Soup BCG Matrix is informed by comprehensive market data, including sales figures, consumer demand trends, and competitor analysis, ensuring accurate strategic positioning.