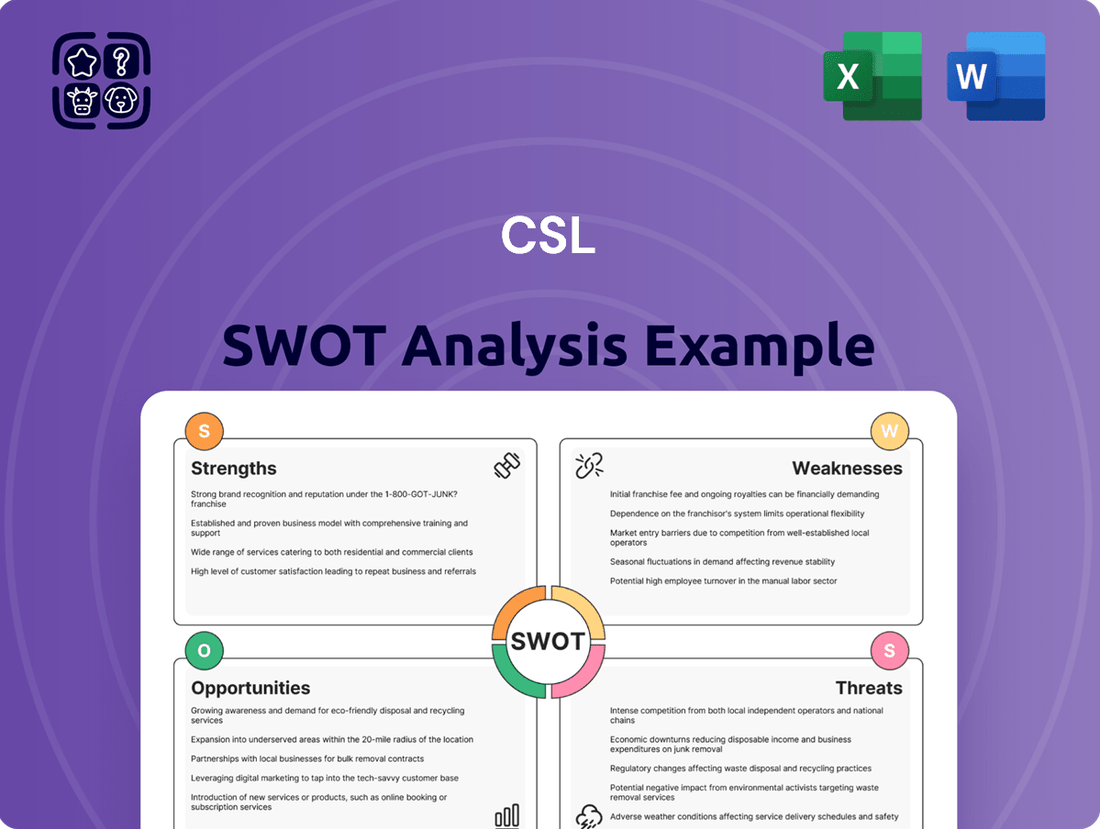

CSL SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSL Bundle

CSL's market position is defined by its significant strengths in innovative R&D and a global distribution network, but also faces challenges from intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for navigating the future.

Want the full story behind CSL's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CSL's position as a global leader in biotechnology is a significant strength, built on its continuous innovation in biotherapies. This leadership is evidenced by its broad reach, operating in over 100 countries with a dedicated team exceeding 32,000 individuals, showcasing its substantial operational capacity. The company's established name and sheer size offer a distinct edge in the highly competitive and intricate field of biotechnology.

CSL's strength lies in its remarkably diverse and essential product portfolio, addressing critical unmet medical needs across various therapeutic areas. This includes life-saving plasma-derived therapies for immune deficiencies and bleeding disorders, alongside recombinant products and influenza vaccines from its CSL Seqirus division. Furthermore, CSL Vifor contributes significantly with treatments for iron deficiency and nephrology, creating a robust and resilient revenue base.

CSL demonstrates exceptional strength through its robust research and development capabilities, consistently channeling substantial resources into innovation. In 2024 alone, the company allocated US$1.4 billion to R&D, underscoring a deep commitment to advancing its product pipeline.

Over the past five years, CSL's cumulative R&D investment has reached an impressive US$5.8 billion. This sustained financial commitment fuels a continuous stream of new products and life-saving treatments, solidifying CSL's position as a leader in biotechnological advancements.

The company's track record of successful product launches, particularly in cutting-edge areas like gene therapies and innovative vaccines, highlights the effectiveness of its R&D strategy. These advancements not only address unmet medical needs but also reinforce CSL's competitive edge in the global biopharmaceutical market.

Dominant Plasma Collection Network

CSL Plasma, a key part of CSL Behring, stands as the global leader in plasma collection, boasting over 300 centers worldwide. This vast network is a significant strength, guaranteeing a steady supply of plasma, the essential ingredient for CSL's life-saving therapies. It also translates into better cost management. As of early 2024, CSL Plasma continues to expand its footprint, further solidifying its dominant position in the market.

- Global Leader: CSL Plasma operates the world's largest plasma collection network.

- Extensive Reach: Over 300 collection centers are strategically located globally.

- Supply Chain Security: Ensures a reliable and consistent supply of critical raw material.

- Cost Efficiency: The scale of operations contributes to favorable cost structures.

Strong Financial Performance and Margin Recovery

CSL has showcased robust financial performance, highlighted by a net profit after tax reaching $2.01 billion in the first half of Fiscal Year 2024/2025. This strong showing was primarily fueled by significant sales increases within its key immunoglobulin (Ig) business. The company is making good progress on its strategic goal to enhance gross margins, which are currently aligning with projections, suggesting a favorable trend for future profitability.

Key financial highlights contributing to this strength include:

- Net Profit After Tax (H1 FY2024/2025): $2.01 billion.

- Growth Driver: Strong sales performance in the immunoglobulin franchise.

- Margin Improvement: Gross margins are tracking according to plan, indicating effective cost management and pricing strategies.

- Profitability Outlook: Positive trends suggest continued improvement in earnings.

CSL's strong financial foundation is a key strength, evident in its $2.01 billion net profit after tax for the first half of FY2024/2025. This performance was significantly boosted by robust sales in its immunoglobulin business, and importantly, the company is on track with its gross margin enhancement goals, signaling effective operational and financial management.

| Financial Metric | Value (H1 FY2024/2025) | Commentary |

|---|---|---|

| Net Profit After Tax | $2.01 billion | Driven by strong Ig sales and margin progress. |

| Gross Margins | Tracking to plan | Indicates successful cost management and pricing. |

| R&D Investment (FY2024) | $1.4 billion | Underscores commitment to innovation and pipeline development. |

What is included in the product

Analyzes CSL’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential roadblocks into opportunities.

Weaknesses

CSL's reliance on human plasma for a substantial part of its product range presents a significant vulnerability. Disruptions in plasma collection, whether due to donor fatigue, adverse weather events, or evolving regulations, can directly constrain production capacity. For instance, in fiscal year 2023, CSL's plasma collections increased by 11% to 17.3 million liters, highlighting the sheer volume required, and any shortfall would have immediate repercussions on product availability and revenue streams.

While CSL has a global footprint, a significant portion of its manufacturing capacity is concentrated in Australia. This geographical concentration presents a notable weakness, as disruptions in this region, whether from natural disasters like bushfires or floods, or from changes in Australian regulatory policies, could disproportionately impact CSL's global supply chain and production output.

CSL is experiencing heightened competition, particularly in its haemophilia segment. Competitors like Roche, with its product Hemlibra, are introducing more convenient recombinant therapies, which are steadily capturing market share from CSL's offerings. This shift poses a significant challenge to CSL's established position in this crucial therapeutic area.

Furthermore, CSL's influenza vaccine division, Seqirus, is navigating a demanding market. The competitive landscape for flu vaccines remains intense, with multiple players vying for market dominance. These challenging market conditions and robust competition are acting as a drag on Seqirus's growth trajectory.

Integration Challenges from Acquisitions

CSL's significant acquisition of Vifor Pharma in 2022, though strategically sound for expanding its global footprint and product portfolio, has introduced considerable integration challenges. These complexities are directly impacting the company's financial performance metrics, particularly its return on invested capital (ROIC), which has seen a noticeable decline from its previously robust levels.

The integration process involves harmonizing diverse operational systems, corporate cultures, and supply chains, a task that is inherently complex and time-consuming. This has led to a period of adjustment as CSL works to realize the full synergies expected from the Vifor acquisition. For instance, reports from late 2023 and early 2024 indicate that the integration efforts have been a key factor in the temporary dilution of ROIC, highlighting the financial strain of such large-scale mergers.

- Integration Hurdles: Merging Vifor Pharma's operations has presented significant logistical and cultural integration challenges for CSL.

- ROIC Impact: The acquisition has reportedly caused a dip in CSL's return on invested capital, moving it away from its historical highs.

- Optimization Period: CSL is currently in a phase of optimizing its newly expanded business structure to achieve long-term value creation.

High Valuation and Market Expectations

CSL's stock often commands a premium valuation, with its Price-to-Earnings (P/E) ratio frequently exceeding industry averages. For instance, as of early 2024, CSL's P/E ratio has been observed to be in the high 20s or even low 30s, indicating significant investor optimism. This premium valuation, while a testament to market confidence in its growth prospects, also translates to elevated expectations for consistent, strong financial performance. Consequently, any miss on analyst guidance or perceived slowdown in growth can lead to sharp negative reactions in the share price, making the stock vulnerable to market sentiment shifts.

The high market expectations mean CSL must continually deliver exceptional results to justify its valuation. This pressure can be a significant weakness, as even minor disappointments can be amplified.

- Premium Valuation: CSL's P/E ratio often trades at a premium compared to its peers, reflecting high investor expectations.

- Elevated Growth Expectations: The market anticipates continuous strong revenue and profit growth from CSL.

- Sensitivity to Guidance: Any shortfall in financial guidance relative to analyst expectations can trigger significant stock price declines.

- Market Sentiment Risk: The premium valuation makes the stock susceptible to negative sentiment and market volatility.

CSL's significant reliance on plasma-derived therapies means that any reduction in plasma supply, whether due to donor shortages or regulatory changes, directly impacts its production capabilities and revenue. The company collected 17.3 million liters of plasma in fiscal year 2023, underscoring the scale of this dependence.

Geographical concentration of manufacturing, particularly in Australia, creates vulnerability to regional disruptions. This can range from natural disasters to policy shifts, potentially affecting global supply chains. The company's operational structure necessitates robust contingency planning for these localized risks.

CSL faces intense competition, especially in the haemophilia market where recombinant therapies are gaining traction, challenging established product lines. Additionally, the influenza vaccine segment, Seqirus, operates in a highly competitive environment, limiting growth potential.

The substantial Vifor Pharma acquisition in 2022, while strategic, has introduced integration complexities that have temporarily impacted key financial metrics like return on invested capital (ROIC), which declined from previous highs in early 2024. This integration phase requires careful management to unlock expected synergies.

| Weakness | Description | Example/Data Point |

| Plasma Dependency | Reliance on human plasma for a core product range. | 17.3 million liters of plasma collected in FY23. |

| Geographic Concentration | Significant manufacturing capacity located in Australia. | Vulnerability to Australian-specific natural disasters or regulatory changes. |

| Competitive Pressures | Rising competition in key therapeutic areas. | Recombinant therapies gaining share in haemophilia; competitive flu vaccine market. |

| Acquisition Integration | Challenges in integrating the Vifor Pharma acquisition. | Temporary dilution of ROIC noted in early 2024 due to integration complexities. |

Same Document Delivered

CSL SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Get a look at the actual SWOT analysis file. The entire document will be available immediately after purchase.

Opportunities

The global biotechnology market is booming, projected to reach an estimated USD 2.4 trillion by 2030, a significant jump from its 2023 valuation. This growth is fueled by an escalating need for advanced therapies addressing complex health challenges like rare genetic disorders and chronic illnesses. CSL, with its robust pipeline and established leadership in plasma-derived therapies, including immunoglobulins, is strategically positioned to harness this expanding demand. The company’s commitment to innovation and its strong presence in key therapeutic areas offer a substantial opportunity to capture a larger share of this lucrative and rapidly growing global market.

The rapid evolution of gene and cell therapies presents a significant growth avenue for CSL. Continued breakthroughs in these areas allow for the development of novel treatments, potentially addressing conditions with high unmet medical needs. CSL's commitment to investing in these cutting-edge biotechnologies, exemplified by its haemophilia B gene therapy candidate HEMGENIX, positions it to capture substantial future revenue streams and solidify its leadership in regenerative medicine.

Expanding into emerging markets presents a substantial growth opportunity for CSL. These regions frequently exhibit a rising demand for advanced healthcare solutions and pharmaceuticals, enabling CSL to tap into new customer segments and enhance its global footprint.

For instance, CSL Behring's presence in Asia Pacific, a key emerging market, saw continued strategic investment in 2024. The company aims to leverage the increasing disposable incomes and growing awareness of specialty care in countries like India and Vietnam to drive sales of its immunoglobulin and plasma-derived therapies.

This strategic move allows CSL to diversify its revenue streams beyond mature markets, mitigating risks associated with economic slowdowns in established territories. By adapting its product offerings and distribution networks, CSL can capture market share in these rapidly developing economies.

Enhanced Operational Efficiencies and Margin Recovery

CSL is making significant strides in boosting its operational performance, especially within its CSL Behring division. The company is focused on improving gross margins through strategic actions.

Key initiatives include a more thoughtful approach to managing the donor mix to optimize plasma acquisition costs and a concerted effort to streamline fixed costs associated with plasma operations. These measures are designed to lay the groundwork for substantial margin recovery and improved overall profitability.

The adoption of advanced technologies is also a critical component of this strategy. The introduction of the Rika Plasma Donation System, for instance, is anticipated to play a crucial role in enhancing both efficiency and yield from plasma donations.

- Donor Mix Management: Optimizing the blend of plasma donors to reduce acquisition costs.

- Plasma Fixed Cost Optimization: Streamlining operational expenses within the plasma collection network.

- Rika Plasma Donation System: Implementing advanced technology to improve donation efficiency and yield.

Strategic Partnerships and Further Acquisitions

CSL can bolster its competitive edge by continuing to forge strategic partnerships and explore further acquisitions. This strategy allows CSL to enrich its existing product pipeline, venture into novel therapeutic domains, and secure access to cutting-edge, complementary technologies. For instance, CSL's 2023 acquisition of Vita-Medica, a leading provider of autologous cell therapies, significantly expanded its regenerative medicine portfolio.

These alliances and takeovers are pivotal for CSL to maintain its market standing and expedite growth within its core therapeutic areas. By integrating external innovation, CSL can more efficiently bring new treatments to market and address unmet medical needs. The company's commitment to this strategy is evident in its consistent R&D investment, which reached approximately $1.1 billion in fiscal year 2024, underscoring its dedication to inorganic growth and product diversification.

Strategic opportunities for CSL include:

- Expanding into emerging markets through partnerships with local biotechnology firms.

- Acquiring companies with novel drug delivery systems to enhance existing therapies.

- Licensing agreements for early-stage research in rare diseases, complementing its existing rare disease portfolio.

CSL's robust investment in research and development, totaling approximately $1.1 billion in fiscal year 2024, positions it to capitalize on advancements in gene and cell therapies. The company's ongoing expansion into emerging markets, particularly in the Asia Pacific region, offers significant revenue diversification, with strategic investments in 2024 aimed at leveraging increased disposable incomes for its plasma-derived therapies.

Furthermore, CSL is actively enhancing its operational efficiencies, exemplified by its focus on optimizing donor mix and fixed costs within plasma operations, alongside the implementation of the Rika Plasma Donation System to boost yield and efficiency. Strategic partnerships and acquisitions, such as the 2023 acquisition of Vita-Medica, are crucial for expanding its regenerative medicine portfolio and securing access to complementary technologies.

| Opportunity Area | Specific Action/Focus | Expected Benefit |

| Biotechnology Market Growth | Leverage strong pipeline and leadership in plasma-derived therapies | Capture larger share of a growing global market |

| Gene & Cell Therapies | Invest in cutting-edge technologies (e.g., HEMGENIX) | Drive future revenue streams and leadership in regenerative medicine |

| Emerging Markets Expansion | Invest in Asia Pacific (e.g., India, Vietnam) | Diversify revenue, mitigate mature market risks |

| Operational Efficiency | Optimize donor mix, streamline plasma operations, implement Rika System | Improve gross margins and profitability |

| Strategic Partnerships & Acquisitions | Acquire complementary technologies (e.g., Vita-Medica) | Enhance product pipeline, access new therapeutic domains |

Threats

CSL is navigating an increasingly crowded marketplace, facing robust competition from large, established pharmaceutical companies with substantial resources and agile, innovative biotechnology firms. This dynamic environment presents a significant challenge, potentially impacting CSL's pricing power and market share, particularly in key therapeutic areas.

The intensified competition necessitates greater investment in research and development to maintain a competitive edge, as well as increased spending on marketing and sales to secure and grow market presence. For instance, in the plasma-derived therapies sector where CSL is a leader, competitors are also investing heavily in expanding their manufacturing capacities and exploring new product avenues.

This competitive pressure could lead to price erosion on existing products if rivals introduce comparable or superior treatments at lower costs. Furthermore, the need to constantly innovate and bring new products to market quickly adds to the financial burden and operational complexity for CSL. As of late 2024, the pharmaceutical industry continues to see significant M&A activity driven by the desire to acquire innovative pipelines, further highlighting the competitive threat.

The healthcare sector, including CSL, faces a constantly shifting regulatory environment. Changes in drug pricing, approval processes, and market access regulations can significantly impact revenue streams and operational costs. For instance, ongoing discussions around healthcare reform in major markets like the United States could introduce new compliance burdens or alter reimbursement landscapes.

Furthermore, CSL’s global footprint makes it susceptible to evolving trade policies. Potential new tariffs, especially on imported raw materials or finished goods in key markets such as the U.S., could inflate CSL's cost of goods sold. Similarly, retaliatory trade measures from other nations could disrupt CSL's established supply chains, leading to increased logistical expenses and operational uncertainty.

CSL's intricate global supply chain, a critical component of its operations, faces significant threats from geopolitical instability and logistical hurdles. These vulnerabilities were highlighted in 2023 when disruptions, such as port congestion and trade disputes, led to increased lead times for key raw materials, impacting production schedules.

The company's reliance on a vast network of suppliers across different continents exposes it to risks from natural disasters, like the flooding events in Southeast Asia in late 2024 that affected several of CSL's component manufacturers. Such events can directly impede the flow of essential materials, potentially causing production halts and affecting product availability for customers.

Geopolitical tensions, including trade sanctions and regional conflicts, pose a continuous threat to CSL's supply chain resilience. For instance, heightened tensions in the Indo-Pacific region in early 2025 could disrupt shipping routes and increase transportation costs, directly impacting CSL's ability to distribute its finished products efficiently and potentially leading to revenue shortfalls.

Technological Disruption from Novel Therapies

The swift evolution of biotechnology presents a significant challenge to CSL's established plasma-derived products. Innovations like mRNA technology, exemplified by its rapid deployment in COVID-19 vaccines, signal a potential paradigm shift in therapeutic approaches. CSL's significant investment in R&D, including its 2022 acquisition of Vifor Pharma for $11.7 billion, aims to diversify its portfolio, but the speed of these technological advancements could outpace the adoption of its newer offerings.

A faster-than-expected transition by healthcare providers and patients towards novel therapies, such as advanced recombinant proteins or gene therapies, could diminish the market share and competitive edge of CSL's core plasma-based treatments. This could impact its revenue streams, particularly if its existing plasma fractionation infrastructure becomes less economically viable compared to more agile, bio-engineered production methods.

- Market Shift: An accelerated move towards non-plasma based therapies could disrupt CSL's revenue from its traditional plasma-derived medicines.

- Competitive Landscape: Emerging biotechnologies may offer more targeted or efficient treatments, challenging CSL's market position.

- Infrastructure Risk: Significant capital invested in plasma fractionation facilities could face obsolescence if treatment modalities change rapidly.

- R&D Investment: While CSL is investing in new technologies, the pace of disruption may necessitate even greater or faster strategic pivots.

Uncertainty and High Risk in R&D Pipeline

CSL's extensive investment in research and development, while crucial for future growth, carries inherent uncertainty. Despite allocating significant resources, the success of clinical trials and the ultimate market acceptance of new therapies remain unpredictable. For instance, in fiscal year 2023, CSL reported R&D expenses of approximately $1.4 billion, a substantial commitment that underscores the high stakes involved in bringing new products to market. This variability means that considerable spending may not always yield commercially viable products, potentially hindering anticipated revenue streams and profitability.

The R&D pipeline is characterized by a wide spectrum of potential outcomes, making it challenging to forecast future performance with certainty. A single failed late-stage trial can represent a substantial financial loss, impacting CSL's ability to meet growth targets. This inherent risk means that even with robust scientific innovation, market dynamics, regulatory hurdles, and competitor actions can derail even the most promising candidates.

- High R&D Investment: CSL's R&D expenditure for FY23 was around $1.4 billion, highlighting the significant capital commitment.

- Clinical Trial Uncertainty: The success rate of drug development through clinical trials is historically low, posing a constant threat to pipeline value.

- Commercialization Risk: Even successful trial outcomes do not guarantee market adoption or profitability due to factors like pricing, competition, and physician acceptance.

The evolving regulatory landscape presents significant challenges, with potential changes in drug pricing and approval processes impacting CSL's revenue. For example, ongoing healthcare reform discussions in the US could alter reimbursement structures. Furthermore, shifts in global trade policies, such as increased tariffs on imported materials, could inflate CSL's cost of goods sold and disrupt established supply chains.

SWOT Analysis Data Sources

This CSL SWOT analysis is built upon a comprehensive review of CSL's financial statements, internal operational data, and extensive market research reports. These sources provide a robust foundation for understanding CSL's current standing and future potential.